Imagine a fund that leveraged three of its best alternative in house strategies, which are uncorrelated to both market beta equity and aggregate bond markets, in a way that added potential alpha return streams to enhance performance while additionally hedging against risk?

Well, fortunately for Canadian ETF investors a new fund from Picton Mahoney offers just that.

Enter the room ticker $PFAA.TO.

Picton Mahoney Alpha Alternative fund is in my opinion the most interesting ETF to come down the TSX pipeline this year.

If I’m being perfectly honest it has been a lacklustre year for ETF releases.

It seems as though product creation has mostly been focussed on FOMO type concentrated products that were all of the rage in 2021.

Last year’s “concentrated bets” strategies are entering the market at specifically the wrong time given the current economic environment.

METAVERSE this. Aggregate bond that.

Hearing about the release of PFAA.TO, which combines Picton Mahoney’s market neutral equity, special situations credit and merger arbitrage strategies into one neat multi-strategy package, was the most exciting and surprising ETF news I’ve received all year.

So why am I so excited about this fund?

Well, we’re going to explore that thoroughly in this review of Picton Mahoney Fortified Alpha Alternative Fund.

Picton Mahoney Fortified Alpha Alternative Fund Review

PFAA.TO ETF Review

Hey guys! Here is the part where I mention I’m a travel vlogger! This ETF review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Picton Mahoney = Alternative Investing Strategy Specialist

Having familiarized myself with the entire roster of Picton Mahoney funds, some which date back to 2005, I’ve come to realize they put Pacman to shame when it comes to gobbling up Sharpe ratios for buffet breakfast versus the benchmark they’re tracking.

This has been the case in any which direction I’ve looked.

Active extensions equity.

Long-short equity.

Market-Neutral equity.

Fixed Income Alternatives.

Merger Arbitrage.

Special Situations Credit.

When it comes to utilizing leverage, hedging and fortification strategies to produce higher risk adjusted rates of returns, I’ve only noticed outstanding results from Picton Mahoney irregardless of the given mandate.

Video Source: Picton Mahoney Absolute Alpha Strategy from Picton Mahoney Asset Management on Vimeo. (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Picton Mahoney Fortified Alpha Alternative ETF Holdings & Info

Well then, let’s pop open the hood to see what we’ve got in terms of goodies in this new alternative fund.

Modelled after Picton Mahoney’s Absolute Alpha mutual fund, PFAA offers investors an expanded canvas portfolio featuring market neutral, special situations credit and merger arbitrage as its primary strategies along with value, momentum, quality, discretionary hedges and tail risk strategies as its secondary layer of diversifiers.

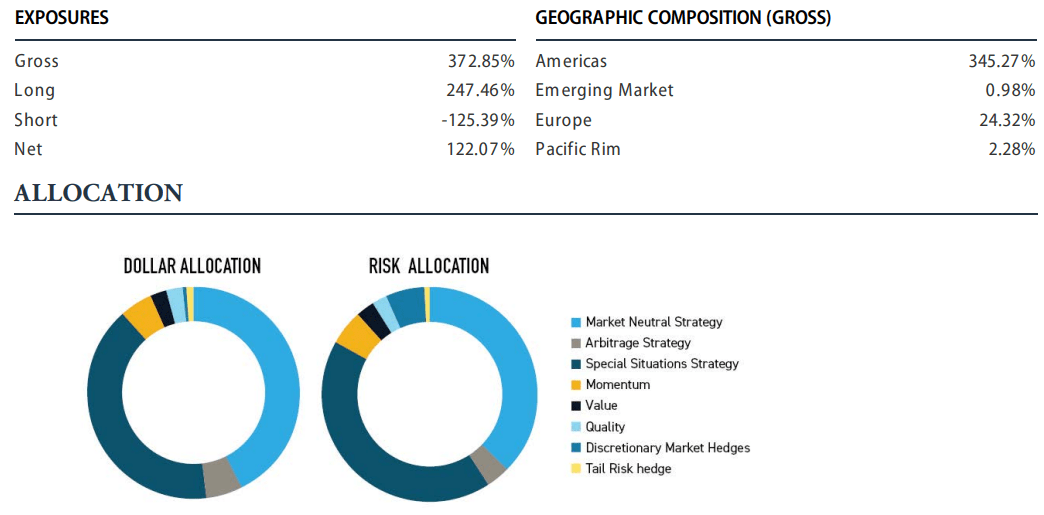

When we add up the sum of its parts we’ve got a fund that offers investors a GROSS 372% canvas with 247.46% long versus -125.39% short for an overall net exposure of 122.07% NET at the mutual fund absolute alpha level.

For the ETF version we can likely expect something close to the 250 to 300% gross range.

Given that this is ultimately a fund of funds multi-strategy approach to diversification it makes sense for us to break things down individually component by component to better understand the product as a whole.

Video Source: Picton Mahoney Market Neutral Strategy from Picton Mahoney Asset Management on Vimeo. (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Picton Mahoney Fortified Alpha Alternative Fund Overview, Holdings and Info

The investment case for “Picton Mahoney Fortified Alpha Alternative Fund” has been laid out succinctly by the folks over at Picton Mahoney: (source: fund landing page)

Investment Objective

The strategy is expected to combine the firm’s best ideas by deploying the investment expertise of the equity, fixed income, arbitrage and quantitative teams. The low correlation among these components to equity markets will aim to enhance risk-adjusted returns.

Why Invest

Access Diverse Alternative Investment Strategies

The Fund will seek to deliver exposure to a variety of Fortified Alternative fund strategies that have historically been uncorrelated to traditional equity and fixed-income investments.

Benefit From Proven Managers

With experience running Authentic Hedge® strategies for over a decade.

Mitigate Risk and Manage Liquidity

That aim to source its alpha from factors that do not compound portfolio risks (such as equity and interest rate risks).

The Fund will also allow for ample liquidity.

Picton Mahoney Fortified Alpha Alternative Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus (source: summary prospectus).

Principal Investment Strategies of the Fund

“The strategy is expected to combine the firm’s best ideas by deploying the investment expertise of the firm’s investment teams including the equity, fixed income, arbitrage and quantitative teams.

The low correlation among these components to equity markets will aim to enhance risk-adjusted returns.

The investment strategy of the Fund is global in nature and will have exposure to international markets, including emerging markets.

Strategies can be implemented within and across various financial markets including global equity markets, emerging markets, global government and corporate fixed income markets, foreign exchange markets, commodity markets and volatility markets.

The strategy will consist of individual security risk premia strategies implemented primarily through long and short positions across global equity markets and may include global fixed income and other asset classes.

The Manager will seek to obtain exposure to skill-based, alpha processes either directly or indirectly through investment in other funds, including funds for which the Manager is the manager and/or portfolio manager.

Markets as well as some strategies possess the propensity for sharp declines in performance, known as tail risk.

The Manager will attempt to mitigate some of these risks through tail-risk hedging strategies.

These may be run both internally and externally and may involve allocation to external funds or portfolio managers (i.e., sub-advisers).

The portfolio will be considered in both the strategic and tactical aspects of the portfolio management process.

The returns of the Fund should be generally independent of the movements in common stock market or bond market indices.

Each component of the portfolio is intended to provide access to a unique return stream, such as risk premia and skill-based investment processes.

The Manager will also use a risk-budgeting process to weigh different components of the portfolios.

The Fund may also choose to:

invest up to 100% of its portfolio in international securities;

pairs trade by taking short positions from time to time in securities of one issuer while taking a long

position in securities of another issuer in an attempt to gain from the relative valuation differences

between the two issuers;

invest in fixed income securities;

engage in arbitrage strategies, including:

o yield and credit curve arbitrage by combining a long position in an issuer’s bond at one maturity with a short position in the bonds of the same issuer at a different maturity;

o fixed income arbitrage by taking offsetting long and short positions in government bonds and investment grade corporate bonds, government agency securities, swap contracts, and futures and options on fixed income instruments that are mathematically, fundamentally, or historically interrelated;

o capital structure arbitrage by combining a long position in an issuer’s senior debt with a short position in its junior debt or common equity using a hedge ratio; or

o convertible arbitrage by combining a long position in an issuer’s convertible securities with a short position in its common equity.

take long and short positions in securities impacted by event driven situations, such as mergers, divestitures, restructurings or other issuer events;

take long and short positions in private company debt offerings;

participate in initial public offerings, secondary offerings, and private financings (including special warrant financings) in existing publicly traded issuers to the extent permitted by securities regulations;

invest in private placements by private companies, to the extent permitted by securities regulations;

purchase, hold, sell, or otherwise deal in commodity forward contracts, commodity futures, financial futures or options on financial futures, but not physical commodities;

use derivative instruments, such as options, futures, forward contracts and swaps, cleared and uncleared, for both hedging and non-hedging strategies, in a manner which is consistent with the investment objectives of the Fund and as permitted by securities regulations, including to:

o hedge against losses from changes in the prices of the Fund’s investments and from exposure to foreign currencies;

o implement option spreads by purchasing an option on a security and simultaneously selling an option on the same security with the same expiry date; and

o gain exposure to individual securities and markets instead of buying the securities directly; and

hold cash and cash equivalents.

The specific strategies that differentiate this Fund from conventional mutual funds include: increased use of derivatives for hedging and non-hedging purposes, increased ability to sell securities short and the ability to borrow cash to use for investment purposes.

While these strategies will be used in accordance with the Fund’s investment objective and strategies, during certain market conditions they may accelerate the pace at which your investment decreases in value.

Please also refer to the explanation of these risks under “Commodities Risk”, “Derivatives Risk”, “Short Selling Risk”, “Leverage Risk” and “Prime Broker Risk” in the “What are the Risks of Investing in a Mutual Fund?” section of this Simplified Prospectus.”

Market Neutral Equity Strategy

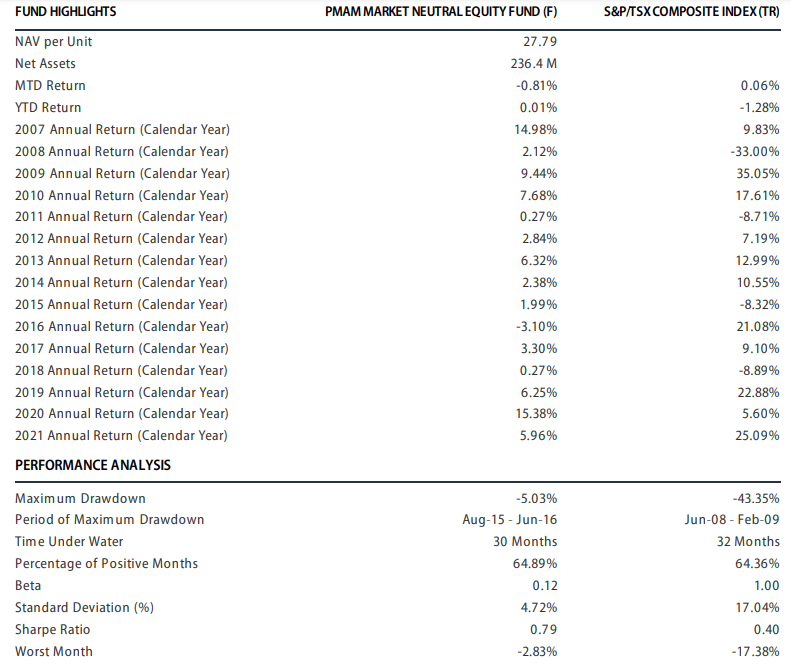

One of the alternative strategies Picton Mahoney has been deploying the longest has been its market neutral equity mandate.

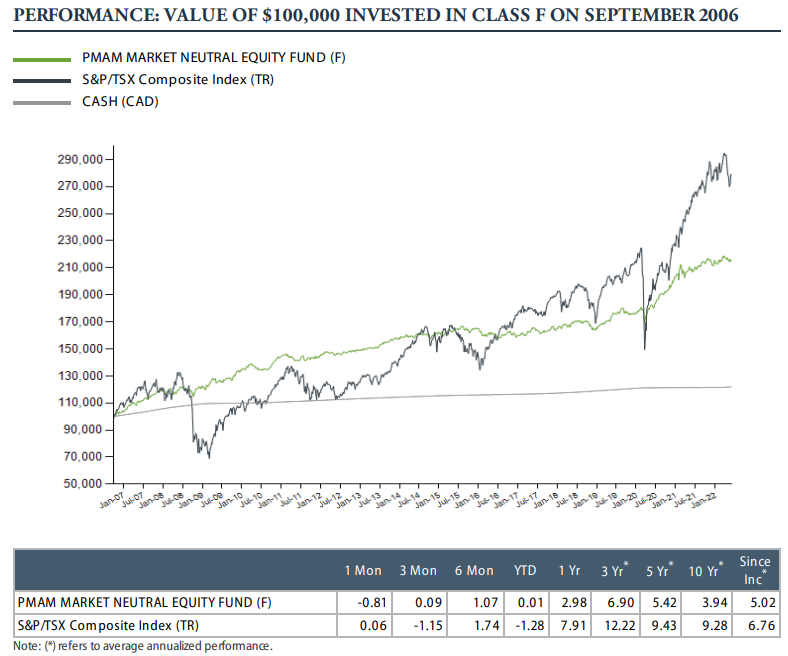

Dating back to 2006 for Class F, we’re able to see clearly how well this defensive equity strategy has performed.

Spoiler alert.

It’s been outstanding.

With a 5.02% average annualized performance since its inception it has offered investors stability with a Sharpe Ratio of 0.79 and Standard Deviation of only 4.72%.

Compare that over the same period of time versus the highly volatile S&P TSX Composite index which offered returns of 6.76% with 17.04% RISK and a Sharpe Ratio of 0.40.

Moreover, the Picton Mahoney market neutral equity strategy had 14/15 positive years!

That’s a success rate of 93.33%!

How about the TSX over the same period of time?

11/15 positive years for only a 73.33% success rate.

The overall market neutral strategy is 180% GROSS and 10% NET going 95.68% long and -86.11% short.

Okay, that’s all swell and over the moon but why would investors want to consider a market neutral strategy in the first place?

As the most defensive of all long-short equity strategies, a market-neutral mandate attempts to profit from both increasing and decreasing prices in the financial markets.

On the long-side of the equation it seeks out stocks with strong factor profiles (value, momentum, quality, etc) while shorting those with that are overpriced with unattractive fundamentals.

Basically, Shitcos.

Seeking absolute rather than relative returns, a market neutral equity strategy hedges to zero delta.

The diversification benefit for investors is an uncorrelated strategy compared to general stock and bond markets.

Video Source: Picton Mahoney Special Situations Strategy from Picton Mahoney Asset Management on Vimeo. (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

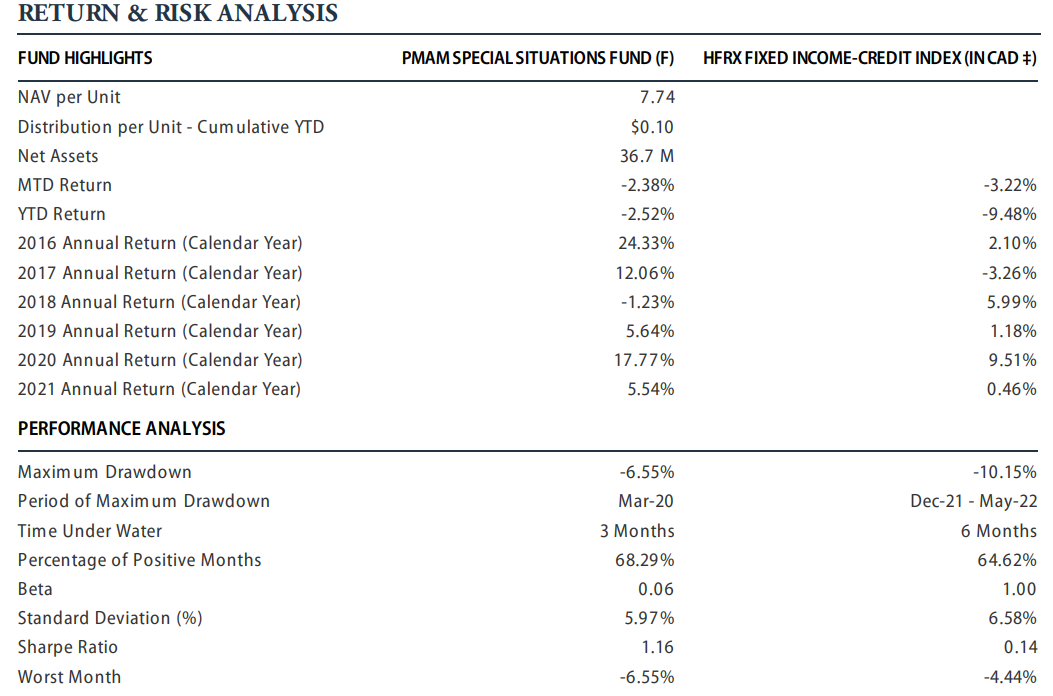

Special Situations Credit Strategy

Equally forming the backbone of the fortified absolute alpha alternative fund is the special situations credit strategy.

As an event driven credit investing strategy it seeks to maximize total returns while mitigating losses utilizing shorting and other hedging strategies.

What reaches the special situations radar of opportunity?

Specifically, news of an acquisition, regulatory changes or bond refinancing are some of the event driven situations that warrant attention.

A bottoms up analysis would determine whether to go long/short the “special credit situation” with a goal of creating equity like returns with less risk (hedging interest rate risk, currency risk, liquidity risk and credit risk).

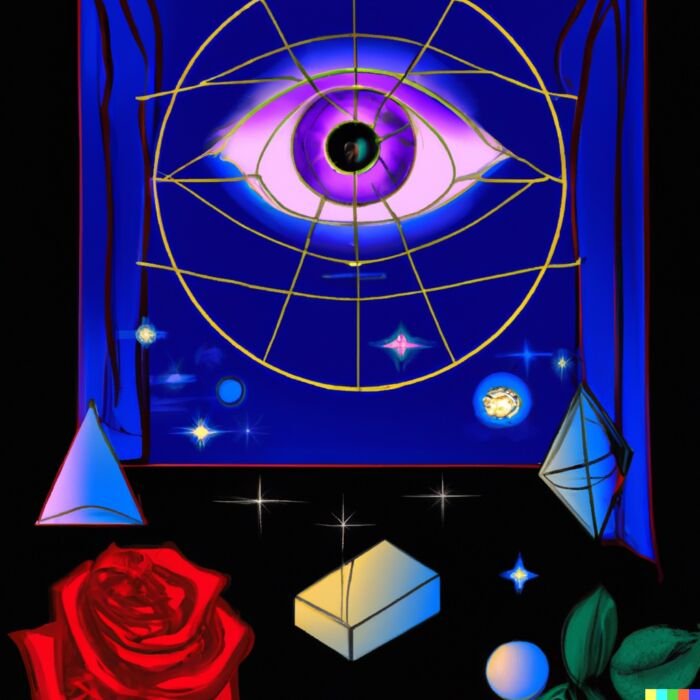

How has the Picton Mahoney Special Situations Credit strategy performed?

From a returns standpoint what you notice is Picton Mahoney’s Special Situations fund has absolutely crushed its benchmark by 640 basis points (7.76% versus 1.36%).

Furthermore, it has provided considerably better risk management by clocking in a standard deviation of 5.97% versus 6.58%.

With returns considerably higher than risk it’s not surprising the strategy has a Sharpe ratio > 1 (1.16).

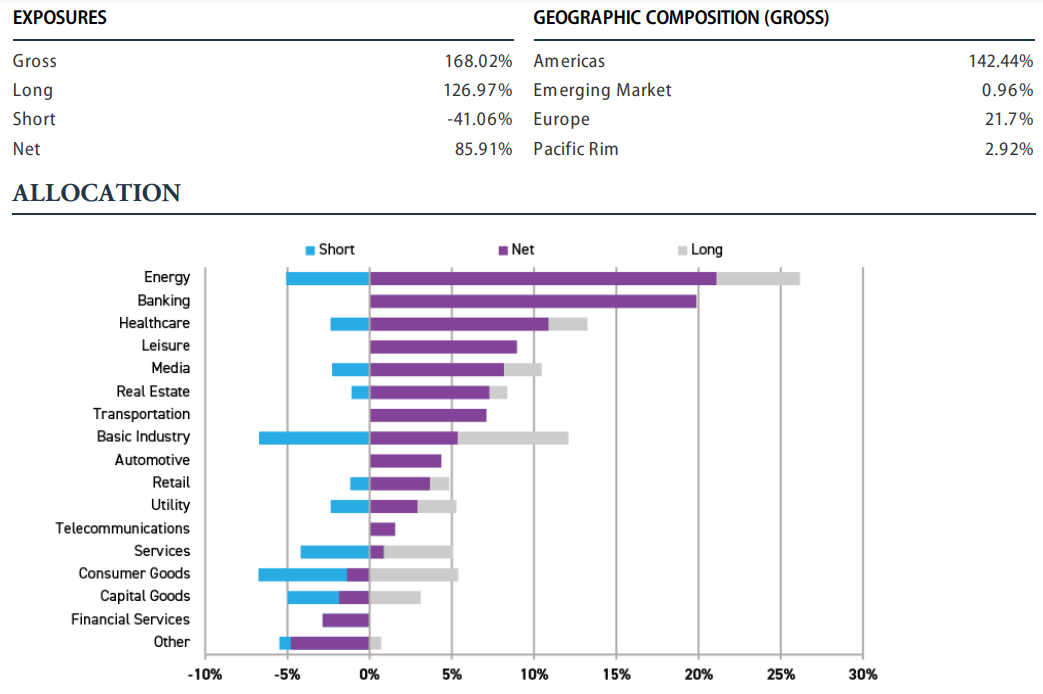

Finally, we have a view of its long/short mandate by going Gross 168.02% (long 126.97% & short -41.06%) for a NET coverage of 85.91%.

Video Source: Picton Mahoney Merger Arbitrage Strategy from Picton Mahoney Asset Management on Vimeo.

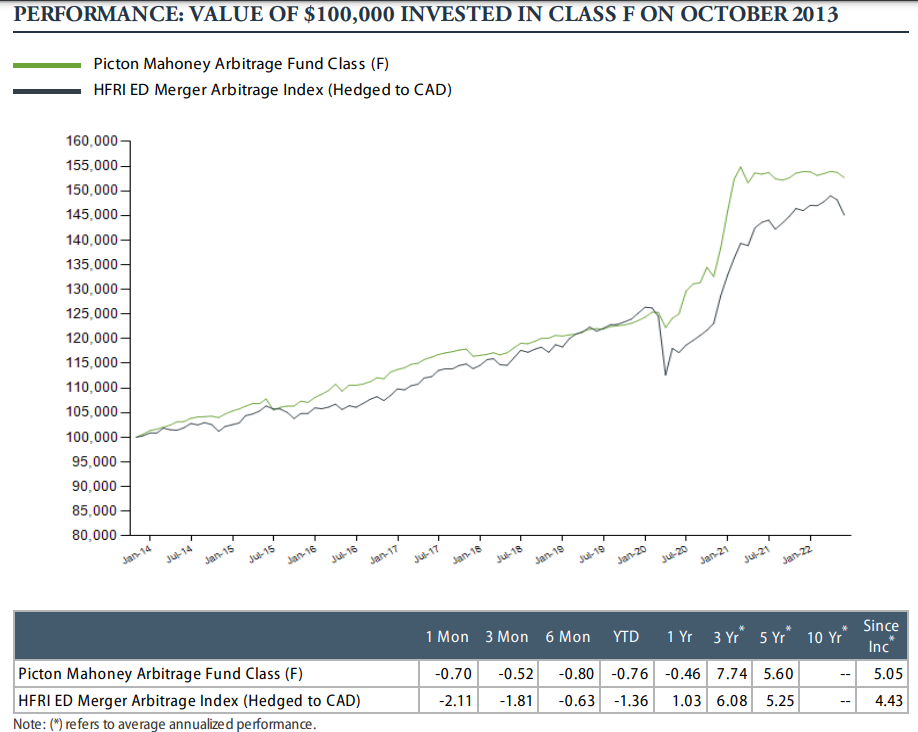

Merger Arbitrage Strategy

Last but certainly not least it’s time to cover the fund’s Merger Arbitrage strategy.

What is Merger Arbitrage?

It’s a hedge fund strategy that involves simultaneously purchasing and selling the stock of two merging companies.

The primary goal is to take advantage of the uncertainty of the deal by acquiring it below its acquisition price.

In an “investing legends” interview with Julian Klymochko, I covered merger arbitrage and SPAC investing in more detail.

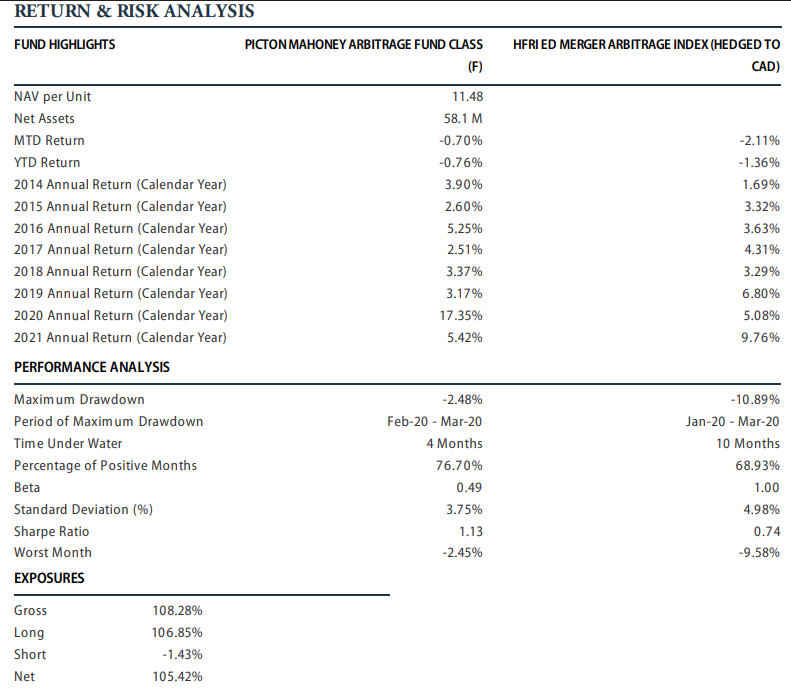

Since its inception the Picton Mahoney Arbitrage Fund has returned 5.05% average annual performance.

More impressive is how the volatility has been managed with this strategy with a standard deviation of 3.75%.

It’s once again a Sharpe Ratio monster clocking in at an impressive 1.13.

Additional Alternative Strategies

The Fortified Alpha Alternatives Fund additionally layers on a number of different “diversified diversifiers” for good measure.

By seeking research supported factor exposure to value, momentum and quality strategies while adding further fortification with discretionary hedges and tail risk insurance we’re seeing the full range of multi-strategy diversification this fund provides.

Whole Is Greater Than The Sum Of Its Parts

So what’s the big picture with this fund when you put it altogether?

In my opinion, it is that the whole is greater than the sum of its parts.

If you were to cobble together the individual strategies being offered in this fund you’d need numerous ETFs to accomplish that task.

Instead, the fortified absolute alpha alternative ETF provides investors with three core alternative strategies that are uncorrelated to broad equity and bond markets and a smattering of secondary style premia as additional diversified diversifiers.

Given the ETF’s gross exposure of roughly 300% and net 125%, I would expect for the fund to long-term offer investors equity-like returns with less than half (possibly a third or a quarter) of the volatility.

PFAA.TO ETF Pros and Cons

PFAA ETF Pros

- Multi-strategy plus multi-asset class approach to diversification within the alternative sleeve of your portfolio

- An all-in-one alternative strategy to diversify a 60/40 portfolio capable of enhancing risk adjusted returns

- The utilization of leverage, hedging and tail risk strategies to provide an attractive returns meets volatility profile

- Tremendous potential building block for those seeking a multi-strategy all-weather portfolio

- Access to sophisticated “high level” strategies that until recently were only available to institutional investors

- Chance to support boutique level creativity in the investing space as opposed to the big banks and giant ETF providers in Canada

- A very reasonable management fee of 0.95 given the many layers of strategies included in the fund

PFAA ETF Cons

- Boglehead style of investors obsessed with fees versus pursuing more efficient and strategically diversified portfolios might run for the hills when considering the management fee of 0.95 and performances fees of 2/20.

- Tracking error given that alternative strategies will not follow “industry standard” benchmarks and investors need to be fully prepared for that in advance

Potential Portfolio Ideas: PFAA ETF

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Here comes the fun part.

How does ticker PFAA.TO potentially fit into a portfolio?

I think there are a number of options for it to be a core alternative holding for Canadian investors.

Let’s explore those.

All Weather / Risk Parity Portfolio

For those seeking a maximally diversified portfolio, that is ready to tackle every economic regime thrown its way, could consider the following asset allocation.

40% UPAR

30% PFAA.TO

30% HRAA.TO

Here you’d be utilizing UPAR as the long-only backbone of your all-weather plus risk parity strategy with 168% net exposure to global equities (35%), Long-Term Treasury (49%), TIPs (49%) and Gold/Commodities (35%).

Picton Mahoney Absolute Alpha Alternative at 30% would layer on uncorrelated strategies such as market neutral, merger arbitrage and special situation credit along with additional diversifiers.

Finally, Horizons Adaptive Asset Allocation would further enhance diversification benefits of the portfolio by providing a systematic global macro program offering trend-following and other managed futures strategies such as carry and seasonality.

Overall, you’d have a multi-strategy portfolio that puts a milquetoast 60/40 to shame from a diversification standpoint.

Multi-Factor Portfolio

For those interested more in pursuing equity factors as the primary puzzle piece of the portfolio the following portfolio would be something to consider.

10% VVL.TO

10% VMO.TO

10% VVO.TO

10% PZW.TO

10% ZGQ.TO

30% HARB.TO

20% PFAA.TO

What we end up here is with a 50/30/20 portfolio of 50% factor equities, 30% tactical bonds and 20% multi-strategy alternatives.

For equity strategies you’d have 10% slices of globally diversified exposure to value, momentum, minimum volatility, size (small/mid-cap) and quality.

The 30% absolute return bond fund would provide long/short hedging strategies.

Finally, 20% allocated to Picton Mahoney Fortified Alpha Alternative ETF would layer on all of the alternative strategies we’ve discussed at length in this article.

Diversify A 60/40 Portfolio

Last but not least for those investors committed firmly to the milquetoast 60/40 portfolio an alternative sleeve could be carved out with PFAA.TO.

You would go from 60/40 to 50/30/20 with only two funds.

80% ZBAL.TO

20% PFAA.TO

BMO all-in-one asset allocation fund would provide you with your globally diversified 60/40 exposure to market-cap weighted equities and aggregate bonds whereas PFAA.TO would provide an all-in-one multi-strategy alternative sleeve solution.

Nomadic Samuel Final Thoughts

Does Picton Mahoney Fortified Alpha Alternative make it into my portfolio?

Absolutely.

At this point, it should be rather obvious that I’m extremely impressed with the fund from a diversification standpoint.

It offers everything I’m looking for when I’m seeking out an alternative sleeve ETF solution.

Firstly, its multi-strategy approach provides me with a collection of uncorrelated mandates that I’d otherwise have to cobble together as individual funds.

Secondly, it utilizes leverage, hedging and tail-risk strategies to enhance risk adjusted returns in a way that will fortify my portfolio while making it considerably more efficient.

Thirdly, it allows me to pursue “other” alternative strategies within my expanded canvas portfolio such as dedicated trend-following and other managed futures macro strategies to further diversify my diversifiers.

Fourthly, given that I’m using portable beta strategies such as WisdomTree 90/60 equity/bond and UPAR (168% exposure to stocks/bonds/alternatives) I’m creating space for alternative strategies within my portfolio without sacrificing real-estate to traditional long only equity/bond/gold/commodity asset classes.

At the end of the day diversification is your only free lunch in investing and instead of shaving down traditional asset classes to make room for an alternative sleeve, I’ve instead expanded my canvas to layer on as many multi-strategy alternative mandates as possible.

Because of my equal parts stocks/bonds/alternatives approach to portfolio construction, I’ve had numerous strategies within my portfolio conspire in my favour during 2022 during the extremely rare event of when stocks and bonds are down at the same time.

Is this the right approach for you?

That is entirely up for you to decide.

However, I’m going to close by saying I greatly appreciate that we’re now at a stage where “in the know” retail DIY investors (such as myself) have the opportunity to build efficient portfolios that rival the Yale Endowment model and Sovereign Wealth funds of the world.

That to me is amazing.

And I thank Picton Mahoney for providing a building block that allows me to achieve that goal.

That’s all I’ve got for now.

Ciao!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.