Is it actually possible for amateur DIY investors to have certain advantages over professional investors?

That’s the question that randomly popped into my head several days ago while enjoying a walk in the woods.

Indeed, I ought to have been more focused on the solitude and tranquility of being out in nature but sometimes new ideas for articles arise in the strangest of environments and circumstances.

Professional investors have the formal education, training, experience, licensing and network advantages of being professionals in the industry.

How the heck would a DIY investor, with none of the above, potentially have any advantages whatsoever?

How can they compete against that?

Well, that’s what we’re going to explore today.

Amateur Traveler to Professional Content Creator

I have intimate knowledge of what it is like to turn from amateur to pro as a travel content creator.

I went from being a galavanting backpacker without a care in the world to creating travel content for a living.

I feel extremely grateful to have been able to turn my passion into my job.

Yet, there have been all kinds of sacrifices I’ve had to make in order to turn this into a business.

Gone are the days where I can just show up somewhere, spontaneously explore my surroundings and handle whatever curveball is thrown my way with absolute ease.

Now I’ve got deadlines, deliverables, client expectations and self-imposed pressures to ensure I’m filming, photographing and firing on all cylinders at ground level.

Sure, I’m often smiling on camera and it looks like I have the most carefree job in the world; however, the behind the scenes story paints a different picture.

In the past, as an amateur, if it rained one afternoon I’d go find a cafe to sit and people watch while sipping on a coffee and leisurely enjoying a slice of cake being fully present and in the moment; now, I’m scrambling with my mind racing as I frantically try to figure out how we’re going to hit our target of 15 things to do for the city guide we’re filming as I try to recalibrate our plans to film indoor attractions.

It’s just an entirely different travel experience when you’re efficiently trying to create content on a tight schedule versus being fully immersed in your new destination as a backpacker with no time constraints whatsoever.

I do at times long for my amateur days when all I had to do was worry about myself and I wonder too if sometimes professional investors feels this way having to deal with challenging clients, emotional investors and volatile markets sometimes all at once.

Invaluable Role of Professional Investors in Finance

As a DIY investor I’ve learned almost everything I know from professional investors.

Those who generously create content in the form of books, articles, white papers, videos, podcasts and tweet storms.

I’m forever in debt for being able to airdrop in and sponge information that has taken years for professionals to acquire through study and research.

Thus, you have my full respect and there are many skills that I don’t have as a DIY investor given my lack of experience and formal training.

However, I do believe I have some advantages (as do other DIYers) over professionals given I’ve only got myself to worry about over here.

I can build a portfolio to suit my specific needs, personality and investing goals and I have the runway space to patiently see it through to the end-zone.

That’s a huge advantage to have as a DIY investor compared to professionals who are only one phone call, text message or email away from being fired by an impatient client.

I can’t even imagine what it must be like seeing clients throw in the towel, of a reasonable investing plan you helped construct for them, due to a couple years of underperformance or just plain old expected market volatility.

I can imagine it must be a challenging job with a lot of rewards but a lot of pressure as well.

I’ve got all the time in the world to see my investing mandate through thick and thin whereas pros are judged based on bad quarters, tracking error and human clients being all too human.

So hats off to all of you pros who help clients stay the course and reach their personal goals.

But the rest of this article is basically going to focus on ways us DIY investors have certain advantages over you.

DIY Investor Psychology Boom or Bust

Before we get started with the potential 10 advantages DIY investors have over professional investors, it’s paramount we address the elephant in the room.

Behavioural finance.

If as a DIY investor you’re not aware of your own personal biases and proclivities towards recency bias, loss aversion, home country bias and/or risk tolerance just forget about it.

You probably have no business managing your own money.

If you’re not able to stick with a sensible plan by creating an IPS (Investment Policy Statement) it doesn’t matter how incredible of a portfolio you’ve assembled when shit inevitably hits the fan.

If you’ve designed yourself a portfolio that looks different from a market-cap weighted portfolio and you’re growing impatient and frustrated by tracking error you’re toast my friend.

We can layer some butter on you and spread on some thick jam because you’re being served for breakfast.

So a DIYer it’s patience to the moon and back with the ability to see the portfolio through all of the economic curveballs thrown its way or you’re likely better off having your money managed by a professional.

That’s the bottom line in my opinion.

An Article Informed By Guest Contributions!

Firstly, I want to thank everyone who helped contribute to this article via tweets.

We had all walks of investors from various spheres (including fellow DIYers, advisors and asset managers) contribute to this article including many based outside of North America.

I can honestly say this is the first time an article I’ve written has been informed by generous contributions.

In the past, I’ve written the article and gathered tweets as a bonus segment at the end.

However, this time around the contributions have informed the article and literally many of these subheadings were created due to the suggestions of others.

I don’t think I would have hit 10 on my own, so I’m very appreciative of everyone who chimed in and had something to say.

Let’s finally kick things off!

Top 10 Advantages of being a DIY Investor

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

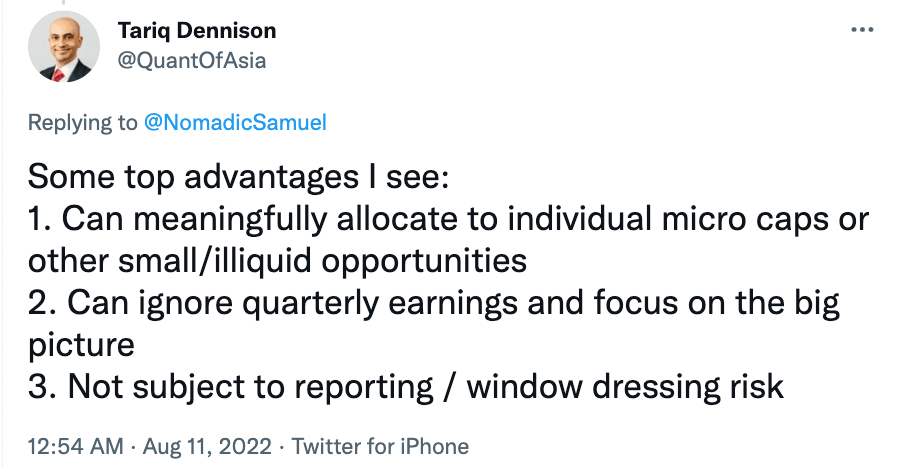

1) Illiquid, Small and/or Special Opportunities

Illiquid, small (as in size) and/or special opportunities is definitely one of the most significant hat tips towards DIY investors over professional investors.

I could write about some of them here but honestly the contributions in this section were so stellar we’re just going to hear from others on this particular subject.

Some top advantages I see:

- Can meaningfully allocate to individual micro caps or other small/illiquid

- Can ignore quarterly earnings and focus on the big picture

- Not subject to reporting / window dressing risk

– @QuantOfAsia of GFM Asset Management and author of Invest Outside the Box

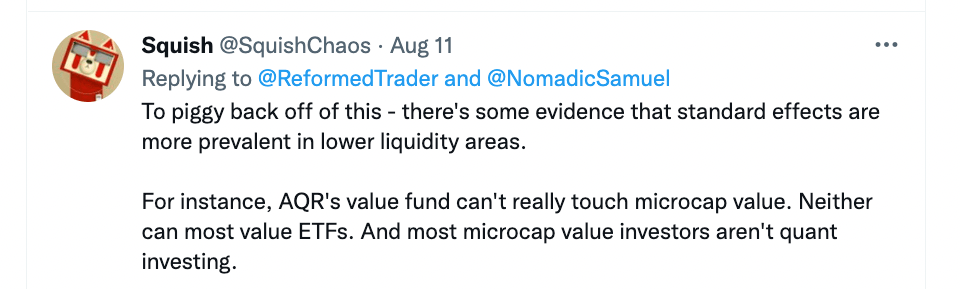

“To piggy back off of this – there’s some evidence that standard effects are more prevalent in lower liquidity areas.

For instance, AQR’s value fund can’t really touch microcap value. Neither can most value ETFS. And most microcap value investors aren’t quant investing.”

– @SquishChaos of Squish Chaos Investing Research

“Pinging @iancassel @EvanBleker and all the other microcap lovers.”

“Basically, the pool of securities increases enormously (~50x) because you can buy the tiniest companies the pros can’t.

Well read investors also face much weaker competition at those market cap levels, so can find much better bargains / buys than professionals can.”

– @EvanBleker of EvanBleker.com

“You might enjoy this article (I Hope This Inspires You) – wrote it as a foreword for Free Capital.”

– @iancassel of MicroCapClub

“Allowed to do crazy things like kelly size a position and withstand giant drawdowns.”

I found a retail CEF that issues badly mis priced warrants.

But you can’t perfectly arbitrage it, and opportunity is small.

But most years I make a few thousand dollars from the opportunity.

When capital is small, that’s pretty great for a small investor!

– @fowci

“size”

– @stellarallen of Allen Freeman

2) Lower Cost / Reduced Fees

The lowest hanging fruit advantage of them all for DIY investors is the potential to cobble together a portfolio with lower fees.

There are market-cap weighted products with single digit basis point fees now available for retail investors.

Long gone are the days of bad active management with an asset manager charging exorbitant fees, trading up a storm and underperforming the benchmark all at once.

I’m sure some of these legacy products still exist (and I feel sorry for those committed to them) but the truth is that it has never been easier to assemble a portfolio as a DIY investors while keeping costs down.

This also includes now having access to alternative investments and strategies such as trend-following, managed futures and hedge funds which used to cost a fortune in fees now being under 100 basis points all in.

If you’re a factor investor you’ve got reasonable cost ETFs to choose from.

Competition in the ETF space has meant both the giant providers and even boutique firms have had to get on board with shaving down fees for investors.

This presents a distinct advantage to the DIY investor who is now able to put together the portfolio of their dreams and do so at a low cost.

For pros who just build market portfolios, DIY investors have the advantage of being able to easily replicate the same strategy at a much lower cost.”

“1/ Management fee

2/ No need to balance a portfolio just for the sake of it

3/ High visibility

4/ Conviction in own thesis”

– @melbint04 of sahicoin

3) Unconstrained Go Anywhere Anytime

DIY investors are unconstrained and can go anywhere anytime!

Benchmarks schmenchmarks!

The shackles of 60/40 are not around your wrists/ankles.

Want more alternatives in your portfolio than bonds?

Go for it!

Wanna go off-road and seek opportunities in lower P/E zones such as mid-cap, small-cap and micro cap equities?

Oversized Emerging markets allocations that would make Rob Arnott smirk just a little?

You betcha!

You’ve got the green light.

Always.

To do whatever it is you want.

And if that is not an advantage, I don’t know what is!

“Mandates typically pro won’t invest in funds under $50m or a 3 year track record.”

– @Darin_T80 of Tuttle Ventures and Tuttle Ventures Newsletter

“DIY investors are largely unconstrained by compliance/benchmark adherence standards.”

– @EMcArdleInvest of Simplify

“DIYers don’t have to pay professional portfolio managers or worry about dishonest ones. They also have time to gain full knowledge of securities before having them handed over on a platter.

DIYers can maintain more advantageous accounts (e.g. TSP G Fund) without handling funds over to an advisor platform.

Disciplined DIYers can customize based on tolerance or reading of specific risk, e.g. political risk, interest rate risk. I’m out of China and underweight Taiwan.”

– @mokaThough of Garret O’Hare Linktree

4) Learn Specialized Knowledge and Skills

Instead of having to manage the emotions of clients you’re free as a DIY investor to spend time learning specialized skills and knowledge.

Over time you may become adept at mastering market cycles, learning about special opportunities and/or honing in on a certain asset class and becoming an expert in that field.

“I’ve been an RIA for over 18 years, was a trader many years before that.

Ritholtz Wealth posted a stat a while back that RIAs spend 70% of their time prospecting.

DIY-ers can spend that time learning instead if they want.

I have a nice small practice, spend no time prospecting.”

– @randomroger of Random Rogers Portfolio & Retirement Lab

“1/ Ability to time cash flows into/out of the portfolio as per lifecycle investing, with techniques like: a) value-average for accumulation phase, b) CAPE-based withdrawal strategies for decumulation phase

2/ Opportunistic rebalancing between asset classes (dynamic versus fixed).”

“I think individual investors can have niche knowledge that might give them an advantage over generic model portfolios, which tend to be fairly straightforward.

For instance, perhaps they have deep knowledge of commodity futures investing, which is a somewhat unusual asset class.”

– @Foulke_David of DIY Financial Advisor

5) Less Pressure: Patient with a Long Time Horizon

As a DIY investor you’ve got significantly less pressure on a short-term basis when it comes to your portfolio.

The contribution tweets are excellent so we’ll just dive in here.

“Diy investors can afford to be patient. We do not have to chase green quarters every time.

Pros have to show results every time, which causes them to trade more frequently –> mistakes will be made –> underperformance.”

– @jverzijl290 of Verzijl Capital Corporation

“Longer investment time horizon.

Pros have to take it a year or two or so at a time, to hold on to clients.”

– @rp_chronicles of Risk Parity Chronicles

“Not as likely to be over-confident (which has negatives of its own, i.e. lack of patience.)”

“Time horizons”

– @JasonMutiny of Mutiny Funds and Pirates of Finance and Mutiny Funds Podcast

6) Deviate From The Herd and Benchmarks

As a DIY investor you can deviate from the herd and say “sayonara” to the benchmarks that many pros feel pressure to follow.

You can build an all-seasons portfolio or have a risk parity backbone as opposed to the cookie cutter 60/40.

You’re able to pursue high conviction concentrated factor exposure instead of just tilting slightly away from the market-cap weighted benchmark.

Your portfolio can looks as similar or as different to what “most others” are doing in the industry as you want it to be.

That, in my opinion, is more refreshing than spearmint gum.

“Power to choose their own fate (investments) rather than what the advisor is comfortable with modeling.”

“Individual investors don’t have the perverse incentives that happen in professional asset management, such as the incentive to stay average.

The motivation of an asset manager is first and foremost to not lose assets.

So if a PM sticks his neck out and invests in something they think is going to go up a lot (i.e. real investing) their reward is only a bit more pay if it works.

If it doesn’t work, they get fired.”

– @andyflattery of Simple Wealth Planning Kansas City and The Reformed Financial Advisor Podcast

“No forced mandate. Most pros have to invest within the parameters of their funds.

An individual can invest how they see fit.”

– @mdeepe_cpa of Matt Deepe Linktree

“Individuals are:

Unconstrained by benchmarks and performance chasing.

Can shift sector/company allocations much more quickly.

Individuals can also hold lotto ticket stocks where it’s tough for pros to justify.”

7) No Career Risk: You Can Only Fire Yourself

Professionals have been fired over the most minuscule things under the sun.

Bad quarter. Gonzo.

Tracking error versus the industry standard. See ya later Charlie!

Clients exhibiting general impatience, freaking out and wanting to flip flop from one strategy to the next. That’s it for you.

All of the career risk associated with managing money probably makes most professionals and asset managers tilt more conservative than they’d like to.

I’ve noticed this clearly.

Certain strategies give clients this (what is industry standard) so that the asset manager can include that (what they really want to invest in) in a somewhat compromised toned down manner.

You as the DIY investor are your own boss.

You can only fire yourself if you decide you want to.

So long as you can stay patient with your strategy, you as the DIY investor can pursue anything you want while providing an ample enough runway to allow the strategy to underperform, outperform and everything in between.

No career risk is a big one (in the sense that nobody will fire you for periods of underperformance). Can concentrate as much as you believe you can handle.

Double edged sword though, if you get your risk tolerance wrong, the risk of behavioural error is high.”

“Not being judged every quarter on the current status of a long-term investment.”

– @HermosaAdvisors of Hermosa Advisors

Able to use longer-term trend following without career risk.

8) Airdrop in and Acquire Best Ideas From Others

One of my favourite aspects of being a DIY investor is having the ability to airdrop in, scoop up and absorb fantastic ideas and/or strategies, and then helicopter myself away to the next opportunity to rinse and repeat the process all over again.

I can grab a little small-cap value expertise over here and some trend-following over there.

As a DIY investor I feel like I’m at a gourmet all you can eat buffet where select chefs from around the world are offering up their best dishes.

As my knowledge expands as a DIY investor, I can now integrate these great uncorrelated strategies into my portfolio.

I love that.

9) Simple Portfolios vs Complex Portfolios

As a DIY investor you have the opportunity to build as simple of a portfolio or as complex of a portfolio as you want.

Want a one click and done portfolio put on DRIP autopilot?

It’s possible.

Want to manage a massive roster of ETFs that make a professional sports team (even including its prospects) seem tiny in comparison?

You can do that too.

It’s entirely up to you.

“Simple model portfolios for DIY investors are free everywhere on the internet.

Correct. But many advisors won’t use a simple portfolio because they are afraid clients will eventually decide to do it themselves.

Complexity is job security.

Correct. But many advisors won’t use a simple portfolio because they are afraid clients will eventually decide to do it themselves.

Complexity is job security.”

– @Rick_Ferri of Core-4 Free Portfolios and RickFerri.com

“Moreover, that additional complexity is a detriment to the investor putting their faith (and life savings) in the hands of the asset manager.

There’s a difference between the optimal portfolio *most likely* to provide the best results – a portfolio for marketing purposes.

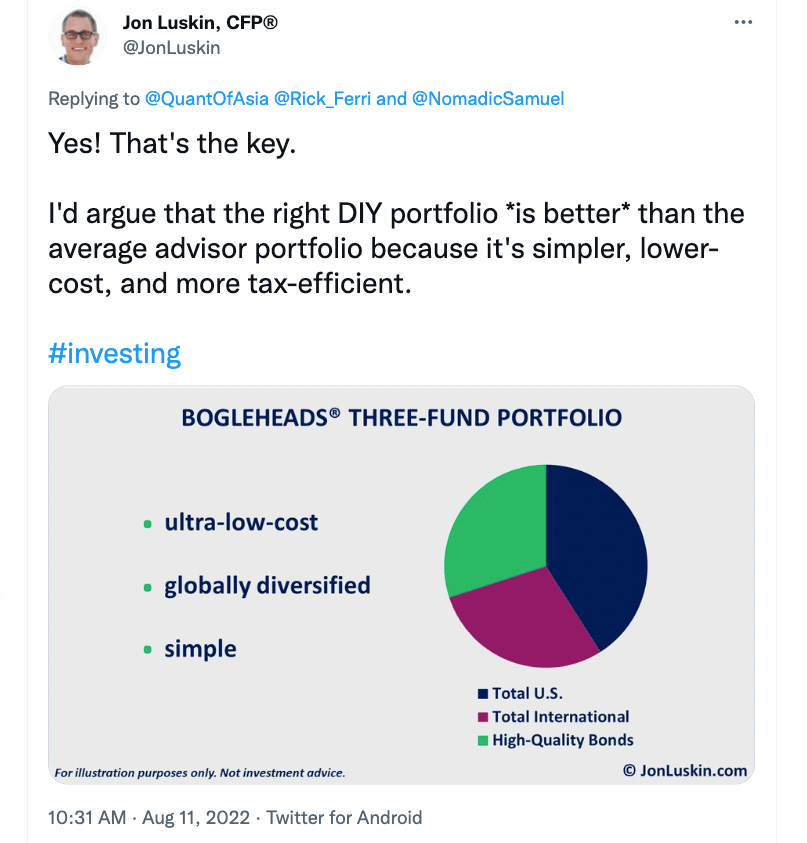

Yes! That’s the key.

I’d argue that the right DIY portfolio *is better* than the average advisor portfolio because it’s simpler, lower-cost, and more tax efficient.”

– @JonLuskin of JonLuskin.com

10) Know Thyself: Your Picture Perfect Portfolio

As you evolve as a person and progress through various life stages your portfolio has the opportunity to adapt and tag along with you.

You may find yourself more risk adverse as you get older or closer to distribution years.

Your ability to tilt your portfolio and customize it gives you all the optionality you could ever ask for.

Furthermore, you may expand your knowledge along the way and want to integrate new strategies into your portfolio.

Go for it.

All of this requires self-awareness and aside from just studying investing related subjects it would be worthwhile to turn inwards and study yourself.

What makes you tick.

What are your quirks.

Strengths. Weaknesses.

The opportunity to improve your portfolio by learning more about yourself is likely a lifelong endevour.

“Most ‘pros’ don’t build model portfolios for optimal compounding, but to be fair, most individual investors don’t do this, either.

1/ How do you maximize compound returns?

A. Don’t use too much risk.

B. Don’t rely on bounce-backs.

C. Appropriate risk depends on excepted Sharpe ratios.

D. Diversification increases Sharpes.

E. Hedge the (relevant) tails.

Rule #1: Never lose money.”

Bonus: Miscellaneous

“What? All the top multi-manager hedge funds make a ton of money calling quarters (forecasting earnings).

And there’s ton of even higher turnover strategies they successfully pursue too.

Having a short-term horizon isn’t always a bad thing – plenty of money to be made in trading.”

“Individual investors tend not to:

Have the tools to self assess:

– how are they performing relative to something

-how much of their performance is due to risk

-Understand their blind spots (eg ignoring countries/sectors through ignorance)

-Not able to identify implications of tax on their portfolio of the long term

However, these challenges are partially offset by not paying fees to advisors who have a natural incentive to use products they are connected to versus products that best suit the investor.”

“Hmmm…let me think about that for a second.

< >

Nope.

I got nuthin'”

Nomadic Samuel Final Thoughts

Firstly, before I share any final thoughts I want to once again thank everyone who generously contributed to this article!

Without you this blog post likely severely sucks .

I’m serious.

There were things I never would have thought of that came from your contributions.

As a DIY investor what I find most exciting is asset allocation.

Where that has lead me personally is to this current manifestation of a diversified DIY quant portfolio.

I’m not a trader or someone seeking to specialize in a certain area of the market.

I’m aspiring towards being a puppet-master worthy of managing my own funds in a way that I see fit.

I realize many other DIY investors are taking an entirely different approach.

Some become the top 1% of 1% of 1% experts in an uncrowded space such as micro-cap investing.

That’s a huge advantage versus the rest of us (both amateurs and pros) playing on a different field altogether.

However, in order to be a successful do it yourself investor, you have to resist the temptation to tinker with a well-thought out plan.

Unlike a client with an advisor, who will talk you out of doing something stupid, you’ve got all the tools at your disposal to entirely blow things up.

So with great privilege comes great responsibility.

As Warren Buffet famously said: “If you cannot manage your emotions, you cannot control your money.”

I’d say he nailed that one.

Your Biggest Enemy Is Yourself As A DIY Investor

Your biggest enemy as a DIY investor is staring back at you in the mirror.

And yet you’re also your greatest ally if you’re able to stay disciplined, constantly learn new things and make wise decisions to potentially enhance your portfolio instead of chasing performance.

The ball is in your court.

You’ve got plenty of advantages but you’ve also got obstacles along the way.

To both DIY investors and professional investors, I wish you the very best!

There is plenty of room for us both.

And I hope we both succeed.

Ciao for now.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.