Multi-strategy plus multi-asset class alternative ETFs are rarer than a solar eclipse.

Traditionally, investors seeking exposure to these types of funds have had to go the route of high fee hedge funds and/or interval funds that required hurdles that only accredited investors could clear.

Fortunately, we’re now starting to see some of these types of strategies emerge, in a more accessible manner, in the ETF marketplace.

Enter the room QIS ETF.

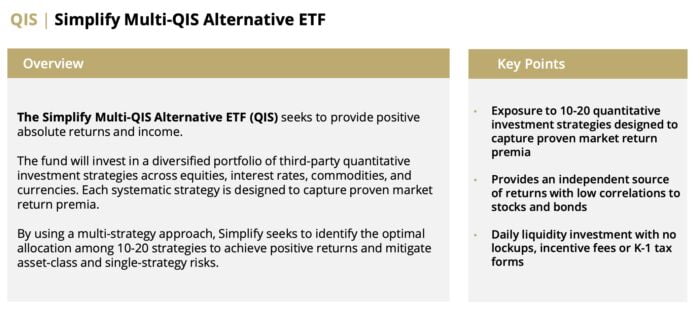

It’s better known as Simplify Multi-QIS Alternative ETF.

Its unique 10-20 QIS (quantitative investment strategies) approach seeks to provide an all-in-one alternative sleeve solution that slots neatly alongside your classic equity/bond asset allocation.

Without further ado, let’s find out more about this unique new fund!

Reviewing The Strategy Behind QIS ETF (Simplify Multi-QIS Alternative ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of QIS ETF?

For those who aren’t necessarily familiar with a “multi-strategy plus multi-asset class” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

QIS refers to “quantitative investing strategies”. Simplify Multi-QIS Alternative ETF (QIS) is an actively managed ETF that invests in a diversified portfolio of 10-20 QIS strategies run by leading investment banks.

Quantitative investment strategies use techniques and investment philosophies that may be very similar to traditional active managers. The key difference is that the essence of the strategies is encapsulated into quantitative algorithms that are systematically traded. This maintains the strategy discipline and makes it more repeatable.

Here’s an example of one of the strategies that might be found within QIS: Historically, the popular high yield ETF HYG has consistently exhibited higher implied volatility than realized volatility. Selling a put and a call with the same expiration date can reliably capture this differential in volatility by generating income. This type of strategy is an example of taking advantage of volatility within the credit asset class.

Unique Features Of Simplify Multi-QIS Alternative Fund QIS ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

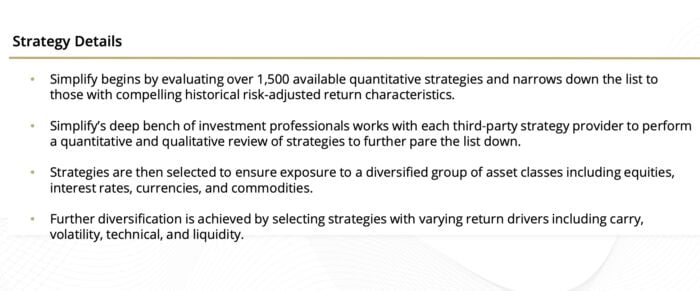

The fund begins with an analysis of approximately 2,000 strategies run by leading investment banks. The top 100 strategies are initially selected based on risk adjusted returns. From there, 10-20 strategies are selected to ensure diversification across asset classes and return drivers. The objective is to have positive absolute return with low correlations to stocks and bonds.

The fund will invest in strategies in each of the following asset classes: equities, commodities, interest rates, currencies and credit. Within these asset classes, the fund invests in strategies with different return drivers, including: carry, volatility, technicals and liquidity. QIS will target an investment in at least one strategy per asset class and one strategy per return driver. Each strategy is rules-based and actively managed. The discretionary component of the fund is Simplify management’s initial selection of the strategies, as well as ongoing monitoring and potential strategy replacements.

Some of the strategies within the fund will include leverage. However, many of the leveraged strategies also contain tail risk hedges. When combined with the fund’s extensive diversification, the goal remains to have a product with absolute returns with volatility in the 8-10% range. The expense ratio is 1.00%.

What Sets QIS ETF Apart From Other Diversified Alternative Funds?

How does your fund set itself apart from other “diversified alternative asset allocation funds” being offered in what is already a crowded marketplace? What makes it unique?

There are very few products in the multi-QIS space. One primary difference is the multi-strategist approach rather than constructing a portfolio from a single manager. The other key differential is the emphasis on diversification across not only asset classes, but return drivers.

source: Simplify Asset Management on YouTube

What Else Was Considered For QIS ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

One of the key discussion points during our research process was how much leverage/volatility the fund should target. A volatility target that’s too low would result in attractive correlation benefits, but with uninspiring returns. An equity-like volatility target could produce eyebrow-raising returns, but many allocators prefer lower volatility in their alternative sleeve. Ultimately, the 8-10 vol target was chosen as a sweet spot that could substantially improve a portfolio’s risk adjusted return while maintaining a reasonable level of volatility.

When Will QIS ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favorable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

Since the fund is broadly diversified across different asset classes and return drivers, there is no market condition or scenario where the fund would be expected to perform at its best or worst at an absolute level. On a relative performance level versus equities, the fund should exhibit its best performance during periods of equity drawdowns.

Why Should Investors Consider Simplify Multi-QIS Alternative Fund QIS ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

A low cost portfolio of equities and bonds is a good start, but we’ve seen how this two-legged stool can sometimes be unstable. This is especially true during inflationary periods like 2022 where stock and bond returns were highly correlated. Adding an alternative sleeve to a portfolio that has little correlation to both stocks and bonds adds a third leg that can improve a portfolio’s diversification when needed the most.

How Does QIS ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

QIS is a portfolio diversifier. It can be a part of a diversified alternatives sleeve or – due to its diversification – it could serve as an investor’s single alternative investment. A 10-20% allocation to the fund would add a significant amount of diversification benefits without introducing excessive tracking error.

The Cons of QIS ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Clients are definitely interested in learning more about the underlying strategies and managers employed, and we are working on ways to improve communication and transparency around this topic.

The Pros of QIS ETF

On the other hand, what have others praised about your fund?

It’s still early, but we have received interest in the fund, particularly from sophisticated investors who understand the benefits of a multi-QIS approach.

Learn More About QIS ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

It’s important to note that strategies similar to what are in QIS have historically only been available in the hedge fund space. As such, they were not accessible to most financial advisors and individual investors. QIS, on the other hand, is an ETF which means daily liquidity, no additional paperwork, no performance fees or redemption gates, and no K-1 tax forms.

As for Simplify, we’re really excited about our growing alternatives lineup, as well as the products in our high-yielding income suite.

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: QIS ETF

Nomadic Samuel Final Thoughts

I want to personally thank the team over at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.