When it comes to equity optimization and factor strategies, one that I don’t think gets nearly enough of the spotlight is “Growth at a Reasonable Price” better known for its acronym GARP.

One of my favourite amateur investors to follow on Twitter @SoloProsperity specializes in Quality Growth at a Reasonable Price investing (QGaRP) where he screens a broad universe of securities keying in on Profitability, Financial Strength, Growth & Stability and Valuation boiling things down to 100 names and then confidently selecting a roster of roughly 20-25 stocks.

That’s just a teaser of his overall process and methodology as you’ll discover far more as we take a deep-dive later on in the article.

I think you’ll find this to be one of the most fascinating “How I Invest” interviews to date and with that in mind let’s get crackin’ over here.

QGaRP: Quality Growth at a Reasonable Price Investing Strategy

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Solo Prosperity: A DIY Investor

My name is Solo Prosperity =).

I work in consulting, married to a badass, and a Dad to a couple young and crazy kids.

Those activities alone take up most of my time.

But I have found a passion for investing and everything that comes with it (Markets, Psychology, History, etc.).

And one day, I will be more committed to writing about it all on my blog, I promise.

I grew up (and still live) on the west coast of the U.S. Financial discussions, including investing, were never a topic in my household growing up.

As a kid, most “discussions” with my folks were about doing well in school and sports.

So I am not one of those people who had some early aha moment with this stuff.

Even in college, when I was finally introduced to stocks in a few courses, it never really stuck.

I liked those courses, but my head was always somewhere else.

I got my real start with investing after grad school.

In 2014 I got a “corporate” job and was told I will get access to a 401k and that is where the journey starts (More on that below).

With what limited free-time I have after work/kids/investing related activities, I enjoy being with friends, reading fiction, playing and watching sports with my son, and a nice gin & tonic.

Oh and spending too much time on Twitter so if you ever have any questions, just let me know =).

From Boglehead -> Macro/Factors -> QGaRP Stocks + Trend

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Realizing I had no idea what investing meant back in 2014, I went to the Google machine.

I was lucky enough to somehow stumble upon Rick Ferri and The Bogleheads forum.

So for about a year, all I did was read those forums and save up to the company match and put everything into a few low cost mutual funds in the 401k plan.

Then sometime in 2015, I stumbled on a Boglehead thread that linked to and brought-up trend following.

More specifically, it was about Meb Faber’s QTAA white paper.

And this was the first of two moments that “clicked” with me.

Not only did I fall in love with trend following, but it opened up the entire investing world to me.

For the next few years I consumed as much as I possibly could.

Factors, Systematic, Macro, Asset Allocation, etc. I LOVED this stuff.

I got on Twitter (Solo is my 3rd account I think), started a couple now defunct blogs, created countless spreadsheets/backtests, wrote lengthy Boglehead posts, read books and white papers, listened to podcasts and interviews, etc.

I couldn’t get enough.

I found a topic I really loved.

Then a few years ago (2019) I stumbled on Terry Smith via Fundsmith’s Owners Manual.

Someone posted it on Twitter.

This then led me to the Fundsmith annual shareholder meeting videos.

And within that same week, someone else posted Anthony Deden’s Real Vision interview on Twitter.

And this was my second “aha” moment.

Not sure why it was this.

I had read about discretionary/fundamental/quality investors prior to then (Buffett, Munger, Fischer, Lynch, etc.), but something about those two made me realize quality investing was for me.

It just stuck and that feeling has only strengthened in the last few years.

In no order, here are a bunch of folks who have influenced me.

As always, I have stolen bits and pieces from a lot of people, but I don’t agree with everything anyone says.

Melding them all together into my “own” is a wonderful (and critical) part of the journey:

Rick Ferri, Jack Bogle, Meb Faber, Tobias Carlise, Wes Gray, Cliff Asness, Jerry Parker, Tony Deden, Terry Smith, John Huber, Buffett/Munger, Lou Simpson, Geoff Gannon, Chuck Akre, Jesse Livermore (anon), Gary Antonacii, the O’Shaugnessey’s, Nick Train, Lawrence Hamtil…

The list could be 10x.

Tons of Twitter accounts have provided learning lessons to me over the years as well.

My 8+ year evolution has gone from Boglehead -> Macro/Factors (Bit of a journey through the wilderness here) -> QGaRP Stocks + Trend … But I have carried on aspects from each phase.

My QGaRP approach today, although “discretionary”, still has a ton of factor/systematic influence.

I will always have Bogle represented in terms of minimizing (all) costs where possible, regret minimization, and sticking with my strategy / ignoring the noise.

A ton of the fundamentals I use today are from learning about factoring investing and deconstructing/learning about what factors are trying to measure. Etc.

Books: All About Factor Investing, What Works on Wallstreet

Videos: Fundsmith Annual Meetings, Anthony Deden Real Vision Interview

White Papers: AQR Library, Meb Faber QTAA, Fundsmith Owner’s Manual

Podcasts: Invest Like the Best/Business Breakdowns, Focused Compounding

Got plenty more suggestions if anyone wants them.

It’s All On Me as a DIY Investor: Need To Feel Comfortable With What I Own

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

Most of this comes down to personality for me.

I cannot think of too many “life-events” with money that have shaped who I am as an investor.

It’s more about general life events, personality traits and relationships.

What I do know is that I desperately need to feel comfortable with what I own.

As a DIY investor, it’s all on me.

Here is what I mean.

Whenever I look at a fund for the first time, I skip over the fee, the issuer, the AUM, the performance, etc. and I go straight to the underlying holdings.

I want to see the names, the sectors and the allocations before I look at anything else.

I have a desperate need to like what I own.

And I want to choose it.

And this was a big issue for me when I started to invest in DIY deep value/macro/momentum etc.

I never really liked what I owned, and this created a very stressful relationship between myself, my portfolio(s) and markets.

I slowly learned that underlying holdings trumped factors for me.

I *think* it comes down to just wanting to take ownership for it.

The idea of something not working out, because of someone else, is a fear of mine.

I call it responsibility, but Freud might call it “trust issues”.

On a smaller note, I do tend to lean more conservative/defensive when it comes to money.

Again, not sure why, as I was fortunate growing up that I didn’t have to worry about money all that often and it was never a topic in my household (At least with us kids).

So given that preference, I do not short, I do not use leverage (Except our mortgage), etc.

My equity holdings tilt towards Quality and my other strategies are Trend, Investment Grade Bonds, and Cash.

Everyone Pays An Investing Tuition At Some Point

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

DIY as early as possible, explore all types of strategies, do it with real $ (It doesn’t have to be a lot), and ignore the mistakes as much as possible.

Everyone pays an investing tuition at some point.

Better to do it when you’re young and don’t have all that much $ or responsibility.

I am a big believer that the most critical component to investing is aligning your personality/goals with the allocation/portfolio/strategies.

Nothing else comes close.

And nothing lets you feel those emotions like using real $.

It’s helpful to read and research but you cannot truly understand how a strategy feels (tracking error, volatility, costs, time, etc.) until you really do it.

Once you find that match, it’s incredible how much less stressful investing becomes (Even when things are going against you return wise).

Getting there is the #1 goal of investing.

How I Pick Stocks: Quality Growth at a Reasonable Price (QGaRP)

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

I have 2 buckets. 401k and IRA/Brokerage.

The IRAs and Brokerage have been fully allocated to my discretionary stocks now.

I currently own 23 stocks across all of those accounts.

I try to employ a Quality Growth at a Reasonable Price approach.

It’s a mouthful, I know.

But I will go through it quickly.

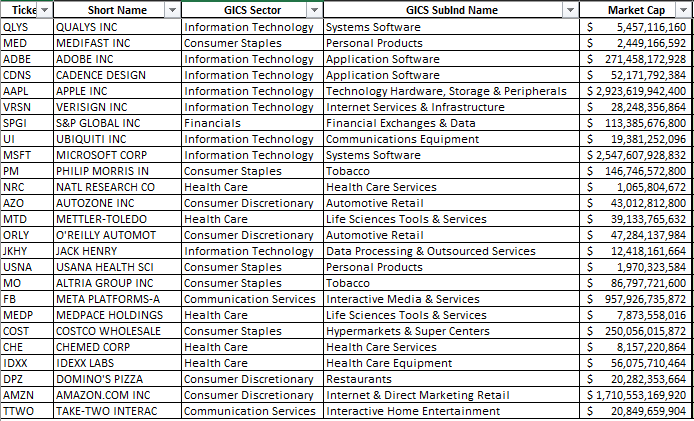

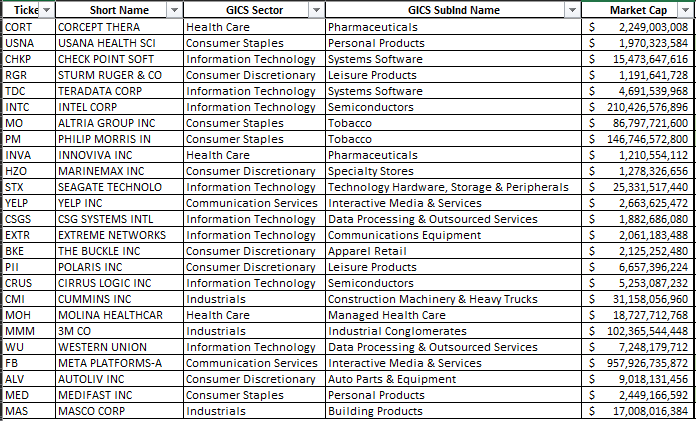

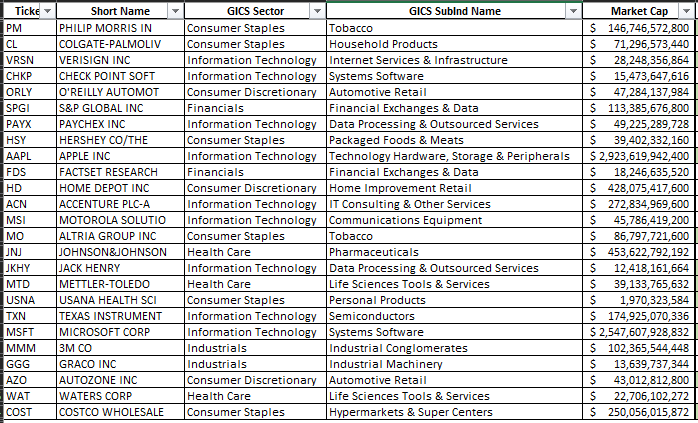

I take an initial screen of the largest 2,000 stocks that trade here in the U.S. (I would love to be able to own businesses on local exchanges but that is a whole different topic) including ADRs.

I exclude Financials and Energy Sectors.

I then instantly remove any business that has lost money in any of the last 4 years.

From there I take a look at traditional quant/factor approach and rank each stock according to Profitability, Financial Strength, Growth & Stability, Valuation, Income/Yield, Volatility and Momentum.

I use 4 years of data for the fundamental measures to try and dampen cyclicality/noise.

I also use multiple measures for each section.

The main screens I use to do homework are an equal-weight rank of Profitability, Financial Strength and Growth & Stability OR Profitability, Financial Strength and Valuation.

I tend to use Yield/Income, Volatility and Momentum as negative screens (ST Avoids).

From there, I simply go through the top 100 names or so on each list and pick out names that look interesting from an industry perspective OR names where the Growth and Valuation combo look interesting.

FYI. I try to regularly post the screen results on my Twitter (With a few variations) every quarter or so.

WFH sometimes delays this though =/

Stable Growth Top 100 and Top 25 Quant Screen

Value Top 100 and Top 25 Quant Screen

Defensive Top 100 and Top 25 Quant Screen

To me, every range of potential *positive* growth outcomes has a fair price OR every valuation has a potential *positive* growth outcome where it makes sense.

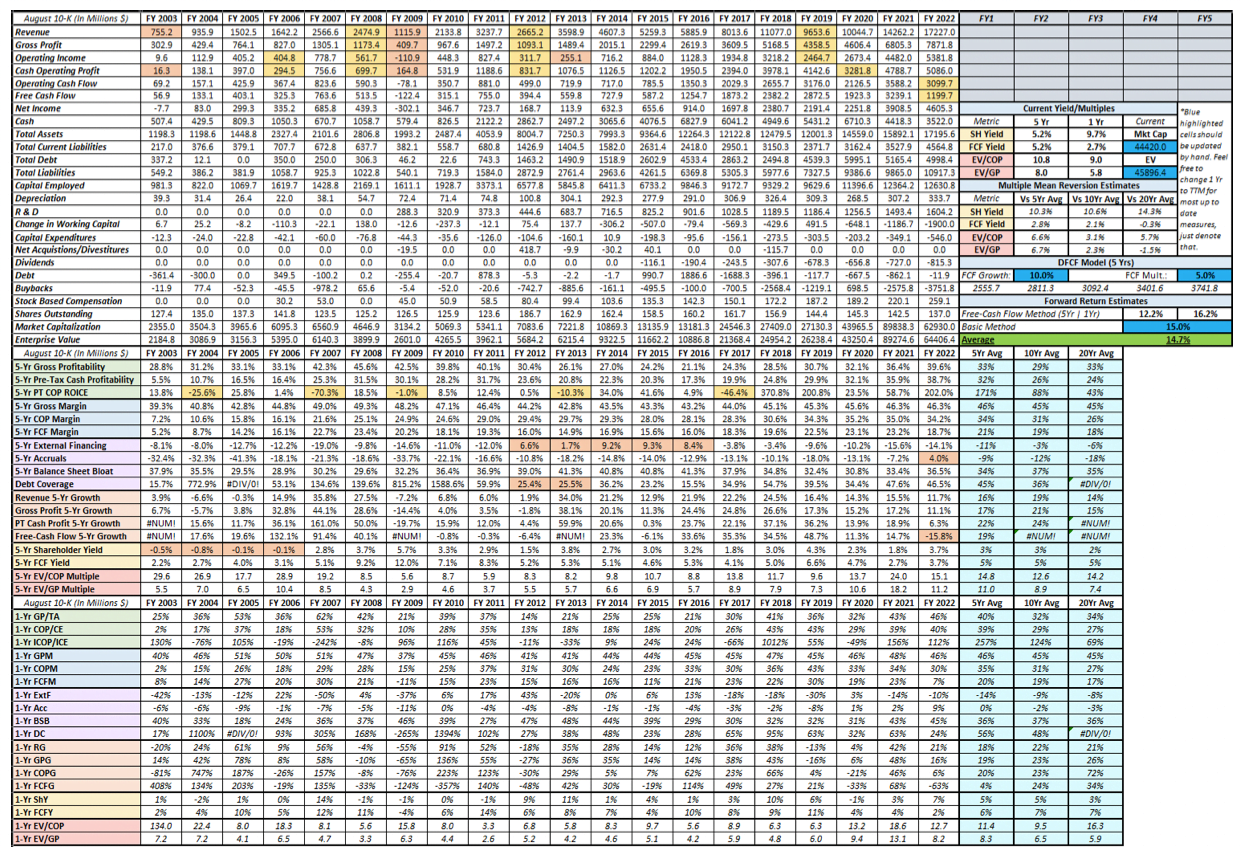

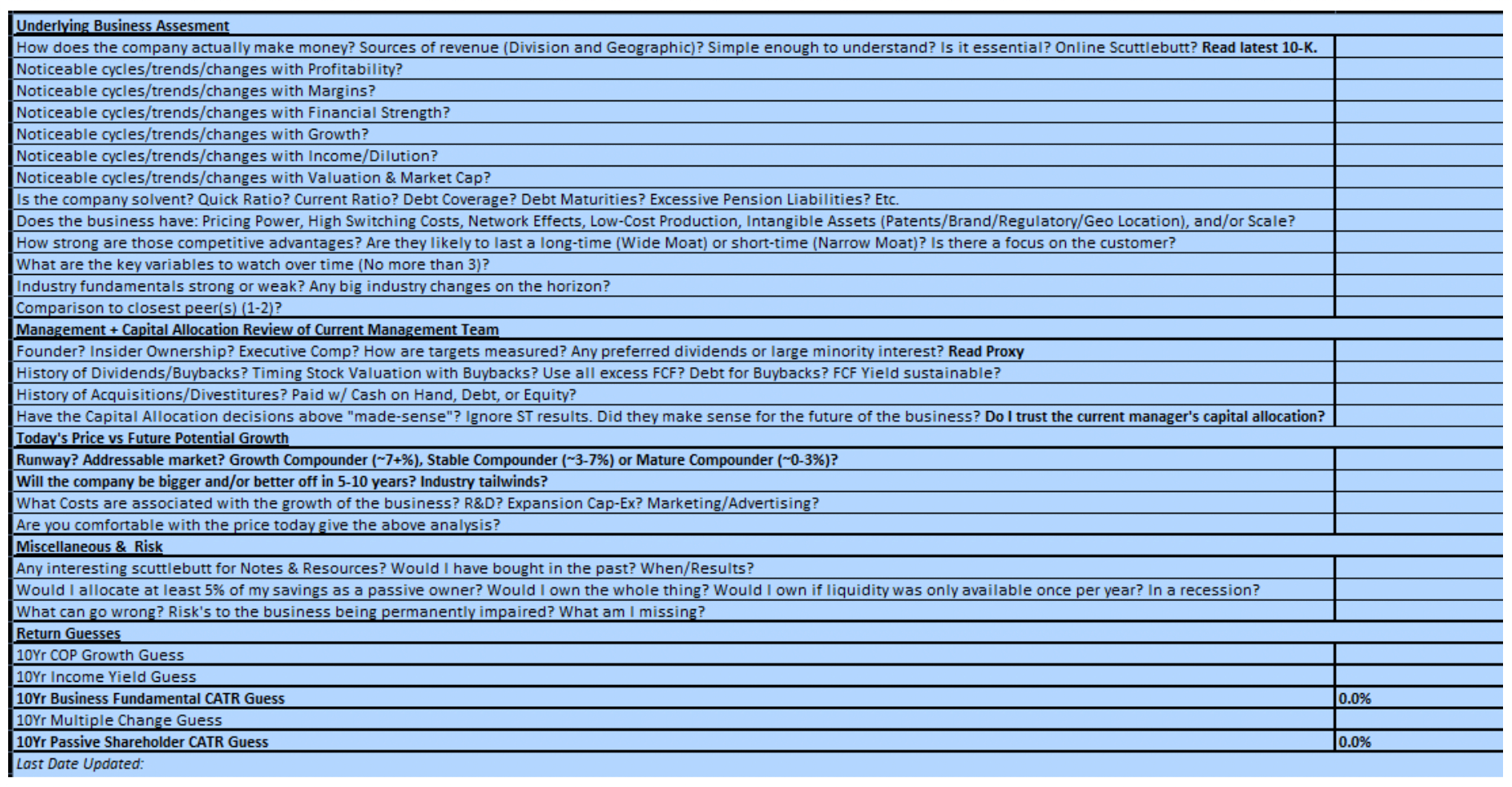

From this “what looks interesting watchlist”, I then create a spreadsheet for any stock I want to take a serious look at.

I outline the last 20 years of financials/ratios, go through a checklist of questions to help me think about the business, and then make some generic forward growth assumptions based on everything I have read/think.

Here are the $LRCX financials as an example:

I am not trying to be perfect at this.

I just want to build confidence in the industry, business, and use what I think are realistic growth assumptions.

If everything clicks, great.

If not, it stays on the watchlist or gets kicked to the curb.

Remember, Growth + Yield +/- Multiple = Total Return.

I’m just trying to guesstimate that equation.

I am not married to growth or value.

I own $AMZN and $MO.

I own $GOOGL and $CCU, etc.

In fact, it’s not an explicit goal of mine, but all else equal, I would prefer to own a roughly equal amount of “growth” and “value” (Although I really don’t like those descriptions).

You might see me ranting on Twitter from time to time about how Growth IS NOT the opposite of Value.

I do implement a few PM rules like not having any stock OR industry exposure larger than 10% (with appreciation; typical holding would 4-5% at cost).

I tend to own 20-25 stocks, but one of my goals is to get more comfortable in the 15ish range as confidence is further built in my process.

My 5 largest holdings right now are: $GOOGL $MO $SMWAY (Particularly due to the acquisition announcement earlier this year) $OMAB and $AMZN (They represent about 30% of the portfolio).

The 401k is where I implement the other stuff.

I run a monthly re-balanced Trend approach similar to Dual Momentum. US Equities, Ex-US Equities, Bonds.

Ideally this allocation will become true Trend one day (Via DIY and Funds), but for now, it’s the best I can do with the options available.

I also keep some cash laying around in the brokerage account and a static 10% allocation to IG bonds in the 401k.

FOMO Is Always Around: You Need Patience And Trust

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

A whole lot of patience and trust.

In an ideal world, any stock I buy, I would own for a long-time.

Now I’m not on team #neversell and have sold a few positions after some pretty extreme run-ups in the multiple, but my dream is to own businesses like an Autozone or Sherwin Williams or Altria, etc. for many many years.

It won’t always happen, but based on my entry in something like $OMAB, I could see myself holding those initial few lots for decades.

That is my dream scenario.

To do that requires extreme patience and trust in the fundamental analysis.

It also requires two other things.

An interest and capability in accounting/algebra/stats.

Nothing that complex.

And also, some outside hobbies.

Patience is harder to employ if all you do is watch markets all day long.

FOMO is always around.

I have found having a balance of things away from investing helps my actual investing decisions/analysis.

More Aggressive and More Conservative QGaRP Portfolio

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

Two ways to tone it down.

Add more names on the equity side (particularly to get sector neutral) OR lower the equity allocation and increase the Trend/Bonds/Cash allocation.

Two ways to ramp it up would be even more concentration (This is a goal of mine) and to lower the Trend/Bonds/Cash allocation.

Pretty simple.

I guess you could lever it up too, but as discussed earlier, that is not something I would do or be comfortable with.

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

Knowing Who I Am: Being At Peace With How I Invest

My strength is knowing who I am. It took me awhile, but I have really been at peace these last few years with how I invest.

Despite 2020 and 2022 madness, I have not felt any extra stress about increasing activity, changing styles, performance, etc. It’s really nice and it’s why I think marrying personality/persona to the right investment style is the most important thing in investing.

Also, it may not be fully applicable to investing but trying to view the world in absolute measures versus relative measures is another strength.

It helps frame expectations in terms of returns, helps me ignore benchmark/index FOMO, etc.

I still struggle with sell discipline.

I wrote a tweet about it a few days in terms of my $LRCX position.

I so desperately want that buy and hold portfolio that I sometimes get cute with holding names, even if they are trading at what I know are some expensive levels.

I hear so often about how it is never good to sell great companies, but I think it’s warranted on occasion.

I still need to get better at doing that despite my bias to want to buy and hold forever.

Ignoring my gut and being wrong hurts more (mentally) than listening to my gut and being wrong.

Value And Growth Are Not Opposites: Great Businesses Show Up In The Financials

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

Value and Growth are not opposites.

There are times (i.e prices) where you can sell a great company and not regret it.

Slow investing works, I.e. Just following fundamentals can work.

You don’t need some grand qualitative insight to identify great businesses.

Great businesses show up in the financials in my opinion.

Less is more, especially in long-only quality investing.

Just think of them as private businesses and you get a sense that diversification comes quickly in terms of # of holdings.

Customized stock/bond allocation based on risk tolerances (outside of specific liability matching) are useless.

Everyone wants the most returns with the least risk.

Matching the style of the investments/portfolio (Know what you own) to the personality is how you control for “behavioral risk”, not your stock/bond allocation.

Keen To Learn More About REITs and Farmland

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

Specialty Real Estate/REITs.

I know RE as a whole has some pedestrian ROCE figures (Which goes against my investment beliefs).

I.e. Most of the returns are achieved by leverage, but I would like to add more Real Estate over my life into the Trend/Bond/Cash side and there are areas of Real Estate that achieve durability and decent ROCE.

Timberlands is one example I have looked at ($PCH).

Farmland is another. Etc.

Accounting is always interesting to me and coming with up interesting ways to measure things. i.e. My profitability yield measure (ROCE / P/CE Multiple).

I think there are a lot of ways to identify good investments just by measuring things a bit different depending on the company/industry.

Forget About Gold and Unprofitable Businesses

What would be the ultimate anti-Solo Prosperity portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Gold and unprofitable businesses lol.

So maybe 50% ARK and 50% Gold?

Kidding…kind of.

Basically anything that has a large long-only allocation to non-cash flowing assets.

If it doesn’t have cash-flow, it’s trend or bust.

Going long-only speculative assets is madness to me.

I think people are drawn to those strategies because they like to gamble OR in the case of gold, believe the government is corrupt, debt spirals, disaster scenario, etc and gold will somehow save them?

It’s clearly psychological.

At least with Gold, it has worked in the past (At times).

I personally think part of that is generational.

Boomers were gold folks.

I think as assets pass on to younger generations, Gold will be a less reliable instability/inflation hedge.

But I think a good way to end it would to simply say, do your own homework.

Maybe 50% unprofitable business and 50% Gold will be the best portfolio over the next 10 yrs?

Who knows?

But unless the portfolio matches your personality, it won’t matter.

Everything comes back to that.

Connect With Solo Prosperity

My Twitter is probably the best place.

Feel free to check out the blog I rarely post on too.

Nomadic Samuel Final Thoughts

I want to personally thank Solo Prosperity for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to take part in the “How I Invest” interview series feel free to reach out to nomadicsamuel at gmail dot com.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.