Earlier this week I listened to one of the most fascinating Investing Podcasts I’ve ever consumed since I became interested about the subject.

It was a comprehensive discussion between a Quant Legend, Autodidact Robotic Surgeon and a podcast host specializing in Futures and Options investing strategies.

No this isn’t a punchline to a joke.

This was an equal parts entertaining and serious conversation between a group of highly intelligent individuals at the apex of their respective careers.

Benn Eifert, the quant legend, is someone other professional quants admire in terms of his track-record, skill and overall knowledge of options and volatility focused strategies as a professional administering institutional mandates.

SurgiFi, a robotic surgeon by day and passionate investor on the side, is pursuing the best version of a portfolio he can possibly assemble to gain financial independence and build generational wealth by staying curious and acquiring new knowledge along his investing journey.

Jeff Malec, hosts one of the most popular podcasts “The Derivative by RCM Alternatives” on the subject of Futures and Options based strategies and is a successful professional with decades of experience under his belt.

The premise for the conversation taking place was to have a self-taught investor explore his recent learnings related to Options based investing strategies with a skilled professional that knows the ins and outs of that particular discipline like the back of his hand.

These kinds of investing conversations are refreshing, informative and anything but redundant.

We need more of them.

I referred earlier to the three gentlemen being at the apex of their given careers.

But what does it look like to be at the apex as a DIY investor?

It probably looks a lot like picking up the behemoth “Option Volatility and Pricing: Advanced Trading Strategies and Techniques” and reading this in your spare time while pursuing a demanding career.

That mammoth text could be used in a pinch as a self-defence weapon to knock someone out cold if dropped from a high enough vantage point.

The desire for a DIY investor to learn beyond basic market-cap weighted indexes and aggregate bonds is in short supply.

Most stop right there and are lured in by the low cost fees and simplicity of the products readily on display.

But the willingness to learn more about the derivative side of the investing equation with a goal of integrating easier to comprehend long-only investing strategies with more esoteric ones requires a rare level of curiosity as a DIY investor.

But here comes the ultimate dilemma.

After a certain amount of self-study you’ve reached a level of understanding and awareness of the potential benefits of managed futures and options based strategies but do you have to trade them yourself to unlock the magic?

That’s what we’re going to explore today.

The TL:DR version is likely a firm NO.

For the vast majority of us retail investors who are happy in our given careers it’s not likely feasible to trade on the side.

But being able to assemble the right puzzle pieces, that only recently have become available at the retail level, via a buy and hold asset allocation strategy is an entirely different story.

That’s a potential YES.

However, what exactly should a DIY retail investor know about options and managed futures before confidently being able to integrate them into an overall portfolio?

That’s what I believe needs to be unpacked thoroughly and is my primary goal with this article.

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Compelling Reasons Not To Trade Options and Futures As A DIY Investor

Unless you’re aspiring towards being a professional trader/quant as a career it’s most likely not a good idea to do this on the side while pursuing a regular day job.

The theory alone is daunting enough to grasp entirely and yet actually trying to put things into practice at ground level is another story altogether.

Fumbling your way to eventual success likely requires being on the costly wrong side of most trades for potentially months/years on end.

Remember who you’re competing against.

The ones on the other side of the trade.

Skilled Pros.

Who have been at this for a long time.

Take it from those who have been doing this for decades when they say trading is hard.

When they caution it takes years of experience to integrate all of the theory while developing the right ground-level skills, systems and disciplined approach to trade options/futures successfully they’re not joking.

Unless you’re willing to put in the requisite amount of time while taking brutal lickings along the way it’s not likely worth it.

Learning To Make Travel Videos/Photos

I now have an unusual career of creating travel videos and other forms of media as my day job.

I first started getting into photography when I started backpacking around the world after teaching overseas in South Korea.

I remember distinctly visiting Angkor Wat in Siem Reap, Cambodia with a Dutch traveler.

The photos he took with his dSLR and relayed back to friends and family were magnificent pieces of art.

My photos with a craptastic point and shoot Casio camera sucked severely.

Not so much because of the difference in camera gear, although that mattered, but mostly given his knowledge about composition, lighting, framing and technical skills to adjust the aperture, shutter speed and stabilize the camera with a tripod.

He knew what he was going.

I didn’t have a “fill-in-the-blank” clue.

With a desire to get better at taking pictures/videos, I first learned the theory about composition, framing, rule of thirds and lighting while simultaneously learning how to operate a cameras aperture, shutter speed, iso, white balance and exposure compensation.

I had learned so much from reading, watching video tutorials and other forms of self-study that I now was ready to take picture perfect photos.

I bought a more serious camera and with all of that theory recently acquired surely my photos/videos would now be better.

Nope.

They still sucked.

It took years of traveling and effort and practice and effing up big time before I finally was able to capture the moment in a way that was satisfying.

It turns out that it takes a while to acquire a steady hand, a creative eye and technical touch to capture the moment.

I’m pretty sure trading options and futures is kinda similar in that regard.

You’re unlikely to be an overnight superstar.

Flick A Switch To Enjoy Electricity In Your Home

You can flick a switch to enjoy electricity at home and light up an entire room with just a millisecond of effort.

If you want to continuously enjoy the miracle of electricity in your life what skills does it require?

- The ability to flick a switch on and off

- Being able to unscrew a lightbulb when it burns out and screw a new one in

- Paying your utility bill on time

- Calling an electrician when steps 1-3 aren’t getting the job done

You could otherwise be an ignoramus about the entire subject at large and yet have light in your home when the sun has gone down.

You may or may not realize that Thomas Edison patented the incandescent light bulb in 1879 and that only a handful of generations have enjoyed such modern amenities.

Whether or not you’re aware that an electrical charge goes through a high-voltage transmission line before reaching a substation (where the voltage is lowered) before continuing via smaller power lines to reach your neighbourhood and eventually your home doesn’t change your capacity to benefit from it in your life.

Don’t get me wrong here.

I’d rather know more about it than less.

Yet it doesn’t impact your ability to benefit from it whether or not you’re an expert in the subject area or a numbskull dunderhead.

You flick on that switch in most homes and light comes on.

It’s indeed a miracle.

What a DIY Needs to Know In Order To Benefit From Futures/Options Strategies

Hopefully I haven’t alienated all of you at this point by discussing the skills and experience it takes to be a competent trader and/or photographer versus the capacity to enjoy electricity at home by knowing a few basics because all of this collides right here and right now.

Let’s assume you’ve learned enough as a curious DIY investor about futures and options trading strategies to recognize the following:

- You’re not going to trade them yourself

- You’re aware they’re beneficial and want to integrate them into your portfolio

What options do you have given those circumstances?

More importantly, what should you know at the very least about managed futures and long-volatility strategies in order to patiently slot them into a buy and hold investing strategy.

Let’s start with Managed Futures.

Managed Futures: DIY Cheat-Sheet

The first thing you should realize about Managed Futures is that it has a plethora of different names and strategies you can potentially pursue and confuse yourself over.

Liquid Alts doesn’t refer to the pink stuff you keep in your fridge for when you’ve overindulged in spicy Mexican or Indian cuisine.

The most predominant Managed Futures strategy is Trend Following.

What exactly is trend-following?

It’s a rules based systematic way of going long/short futures equity, bond, commodity, metals and currency indexes depending on the direction of the particular line-items in question.

For instance, Gold is trending downward.

It goes short.

Bonds are trending upwards.

It goes long.

It’s a rules based system that doesn’t fight reality or get conflicted by human judgement by utilizing short, medium and long-term look-back periods.

It just says “yes” to reality.

It’s basically the equivalent of having a chameleon in your portfolio that is adaptive versus the long-only strategy of buy and hold equities and bonds.

It’s a brilliant diversifier given that it is uncorrelated to both buy and hold equity and bond strategies.

It’s adaptive characteristics handle the historically high commodity and metals volatility much better than long-only strategies.

Moreover, it’s referred to as crisis alpha given it tends to aid the classic line items in your portfolio when you need it the most.

When markets are down.

Why does it usually work so well when markets spiral downwards?

Because trends tend to be strongest under those circumstances.

Consider the initial months of 2022 as the ultimate example of the strategy thriving.

Equities clearly down.

Short.

Bonds deciding to join them on the skewer.

Short.

Commodities soaring.

Long.

By having a trend-following managed futures strategy in your portfolio you’re diversifying beyond merely buy and hold stocks and bonds by adding an alternative sleeve to your portfolio.

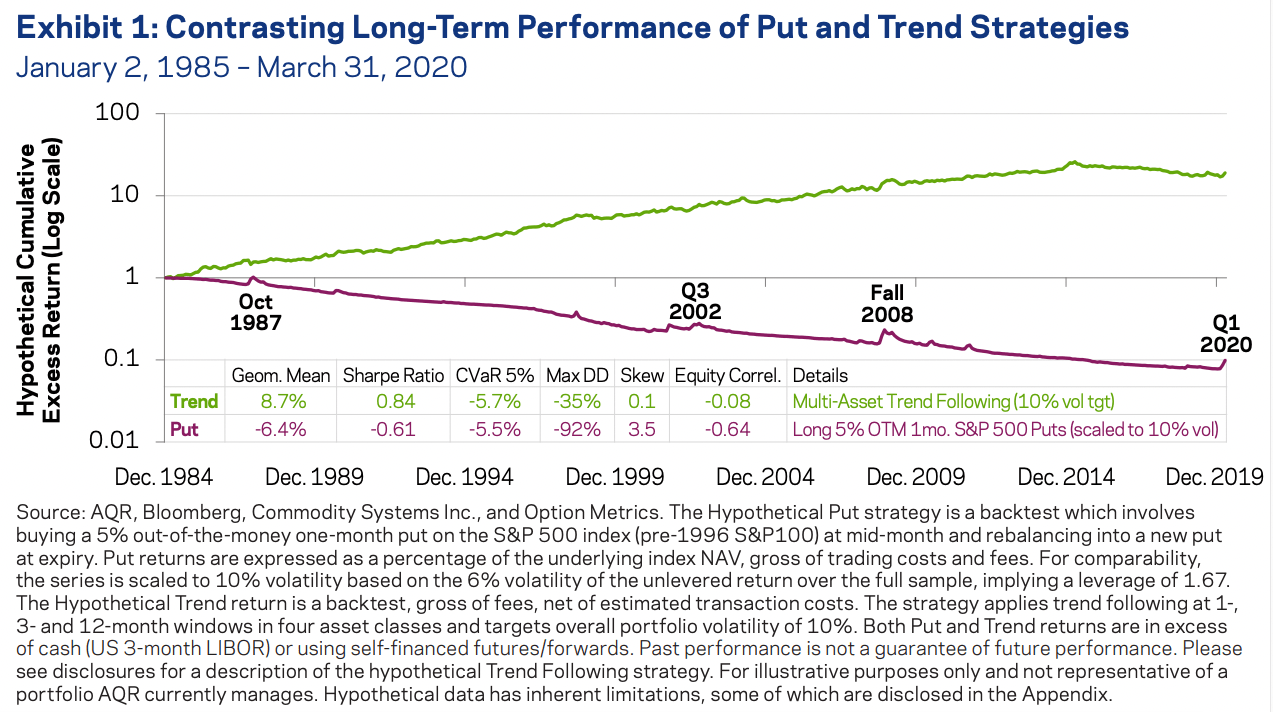

Overall, it has positive expected returns providing historically equity-like returns with only half the volatility.

But like any other investing strategy it struggles and underperforms too.

The 2010s were not kind in general for trend-followers.

When there are no clear trends, things tend to sway back and forth and get whipsawed.

That’s important to know.

Trend-Following Summary

- Positive Expected Returns (Equity-like with half the volatility)

- Uncorrelated to long-only stock and bond classic allocations (hence tremendous diversifier)

- Crisis Alpha dependable when you need it the most (when markets are clearly down)

- Ability to go Long/Short global equity, bond, commodity, metals, currency indexes

- It struggles just like any other investing strategy and will frustrate you at times (when trends are not strong or back and forth)

Options Long Volatility: DIY Cheat-Sheet

The easiest way to think about long-volatility options can be summarized in two words: “Portfolio Insurance”

It’s a strategy where you pay a premium for a policy that has a long-term negative expected return given that if it is not collected it goes to waste.

You’re basically betting against the market in order to hedge your losses should it actually go down.

And given how volatile markets have been in the 21st century it’s a prudent strategy worth integrating into a portfolio at large.

It typically involves buying out of the money PUT options at various strike points that expire at certain agreed upon contract date.

For instance you could buy a cheap out of the money PUT option for the S&P 500 at a strike price of 3000 that expires in December.

If the market goes down that much you’re protected.

If not it goes to waste.

This strategy works best when there are sudden violent marketplace downturns.

Think March 2020 or the fierce 1987 stock market crash.

Put strategies eat brutal rapid bear markets for breakfast.

Where they struggle is when it’s a slow grind down.

Where they’re a lost cause is when markets don’t go down at all.

Yet, you’re without a doubt thrilled in that scenario given that equity sleeve in your portfolio is likely reaching all-time highs.

Put Options Summary

- Portfolio Insurance

- Has a strike point and expiration date (ex: S&P 500 3000 expiring in December)

- Rapid brutal bear markets is when this strategy thrives

- Slow grinds down are a different story

- Should the market go up you get nothing and the seller of the Put collects the premium (just like in real life when your house doesn’t burn down)

Please Study More Than The See Spot Run Explanation I Provided

If you’re considering adding managed futures trend-following and/or options based long-volatility put please study more than the See Spot Run explanation I gave above.

That is just a Simple Simon qualitative explanation from a travel vlogger.

If you’re serious about learning more check out the following resources:

- Your Guide To Trend-Following from RCM Alternatives

- What Is A Put? – Put Definition – What Are Options? – How Does A Put Work from Investopedia

- Tail Risk Hedging – Contrasting Put and Trend Strategies by AQR

- The Derivative Podcast by RCM Alternatives

- Mutiny Fund Podcast featuring Jason Buck and Taylor Pearson

- Resolve Riffs featuring Adam Butler, Rodrigo Gordillo and Mike Philbrick

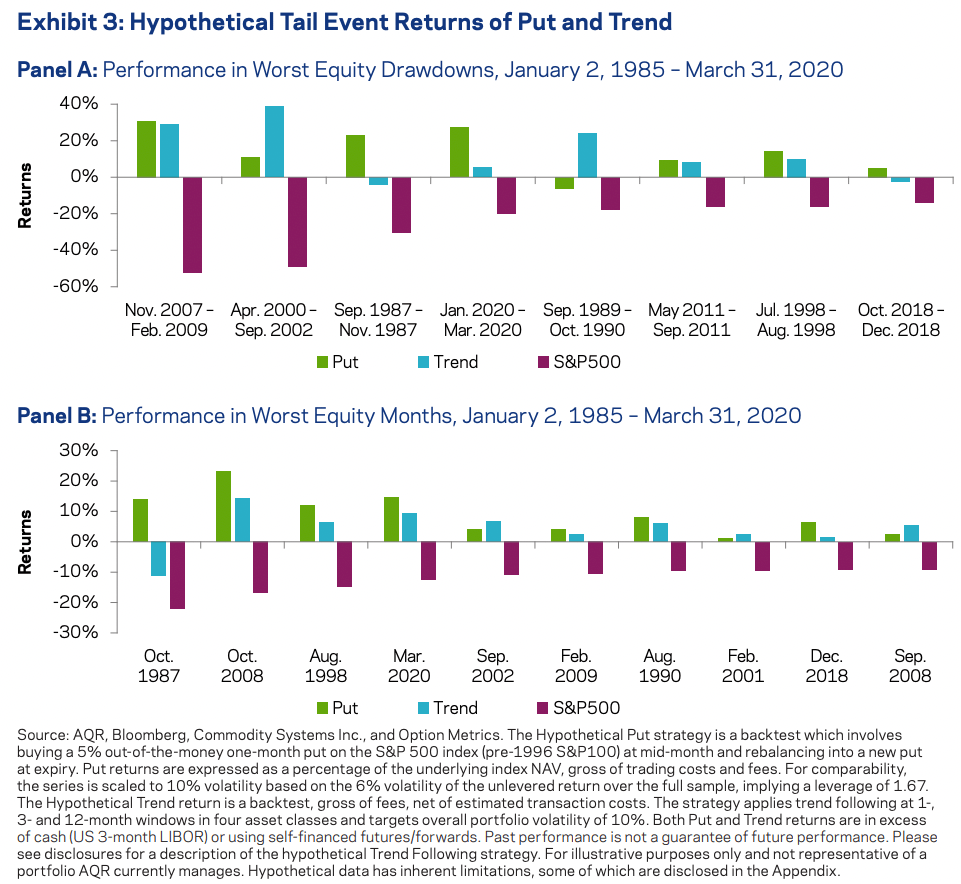

What’s Better: Trend vs Put

So you’re ready to integrate trend-following and/or put strategy into your portfolio but you can’t decide which one to choose.

Which is better?

In a word.

Both.

Both are better as you can clearly see from the example below.

In tandem they haven’t failed investors during market drawdowns with both shielding investors in 14 out of the 18 scenarios.

In three instances put strategies would have provided protection whereas trend didn’t.

And in one instance only trend came to the rescue.

A 2020 March-like fierce drawdown favours Put whereas the slower grind down in 2022 plays towards the Trend-Following wheelhouse.

If push came to shove I’d choose trend-following over put given its expected long-term positive returns in all market conditions.

Thus, I do allocate more to trend in my own portfolio.

But given the option to integrate both strategies into my portfolio I’m taking that free diversification lunch and doing what savvy quants refer to as diversifying my diversifiers.

Retail Products Now Available For Managed Futures and Options

As I’ve mentioned previously I’m not interested in trading managed futures or options myself.

Fortunately, in recent years ETFs and Mutual Funds offer these strategies for the DIY retail investor.

I’d much rather have the ReSolve team handle my managed futures mandate as part of HRAA.TO or Eric Crittenden trend-following for me over at REMIX.

I’m not going to strategically try and allocate Put strike points at various expiration dates when the Convexity Maven and Michael Green at Simplify can do it for me with CYA and/or FIG ETF.

Thus, what I have to decide as a DIY investor is how much of these strategies I want and how do I want them to coexist with my long-only equity and bond allocations.

That’s something you’ll want to figure out for yourself after preferably over 100s of hours of self-study.

Here is my DIY Portfolio (How Do I Invest My Money? Diversified DIY Quantitative Portfolio) in its current manifestation for those interested.

I further expand upon my strategy here: “Contrarian Expanded Canvas Portfolio | How I Invest”

I explain the funds I’ve selected (quadrant by quadrant) while examining my strengths and weaknesses as an investor and how life experiences have shaped my worldview.

Anyhow, I integrated trend-following into my portfolio before I came around to long volatility.

It wasn’t until I understood the rebalancing potential of having the put insurance kick in when equities are down the most that it started to make sense inside of my head.

Hence, the ability to buy equities when they’re scorched earth is what a put strategy offers investors from a strategic point of view.

Allowing you to stay the course when markets are down are the behavioural benefit of the strategy.

But you’ll have to come to those conclusions (or not) yourself as you learn more about managed futures and options strategies.

Managed Futures and Options ETFs and Mutual Funds

Here is a list of ETF and Mutuals that I’m aware of that offering access to managed futures and options based strategies.

Managed Futures

- $DBMF – Managed Futures Strategy ETF

- $KMLM – KFA Mount Lucas Index Strategy ETF

- $CTA – Simplify Managed Futures Strategy ETF

Options

- $CYA – Simplify Tail Risk Strategy ETF

- $TAIL – Cambria Tail Risk ETF

- $SVOL – SVOL Simplify Volatility Premium ETF

- $IVOL – Quadratic Interest Rate Volatility and Inflation Hedge ETF

Asset Allocation Funds (Futures + Options + More)

- $RDMIX – Rational/ReSolve Adaptive Asset Allocation Fund

- $FIG – Simplify Macro Strategy ETF

Nomadic Samuel Final Thoughts

To close things off I want to thank once again SurgiFi, Jeff and Benn for inspiring this post.

Discussions between experts and students are often more informative than between two pros.

It’s fascinating to think that a DIY investor now has the opportunity to integrate the best of both worlds into a portfolio.

Long-only equity and bond allocations with Managed Futures and Options based strategies.

Those two spheres used to only collide for high net worth individuals and institutions.

There has never been a better time to be a DIY investor than right now given the potential strategies at your disposal and the low costs to implement them.

Yet that involves a degree of humility and the responsibility to educate yourself on the various topics as you continue your investing journey.

You’ve got all of the building blocks at your disposal.

Now go out there and build your very own Picture Perfect Portfolio.

That’s all I’ve got.

Ciao.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.