You’re probably wondering if I’ve run out of things to return stack!

I mean we’ve witnessed dosas piled up to the heavens above, triple burger feasts and a mountain of pancakes on this investing blog.

Do I have any other tricks up my sleeve?

It turns out I do!

A few years back, I visited Tokyo, Japan where I heard rumours of an 8 flavour ice cream cone.

Being the absolute glutton that I am, of course, I had to check it out.

So I went in search of this “return stacked” Japanese ice cream in some nondescript basement of a shopping mall in Tokyo.

And folks I eventually found it.

I can’t recommend a better way to expand your waistline and/or drift off into a pre-diabetic coma than trying to consume all 8 scoops but somehow I pulled it off.

But we’re not here today to discuss my lack of self-control when it comes to food.

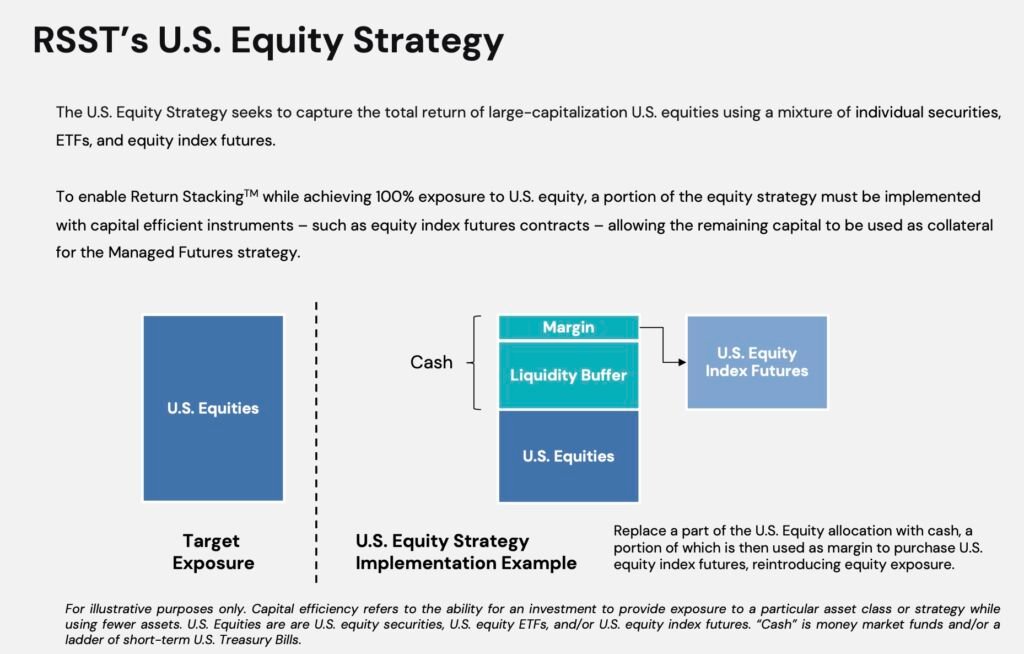

We’re here to unpack an exciting new “return stacking strategy” that manifested itself recently in the form of RSST ETF.

It’s better known as Return Stacked US Stocks & Managed Futures.

For every $1 spent you get 1$ exposure to US large-cap equities + $1 to a Managed Futures strategy.

2 for 1.

It’s easily one my favourite ETFs of the year and quite frankly a superstar when it comes to expanded canvas products in the marketplace.

In my opinion, it’s one of the most versatile capital efficient puzzle pieces out there.

So, without further ado, let’s review RSST ETF.

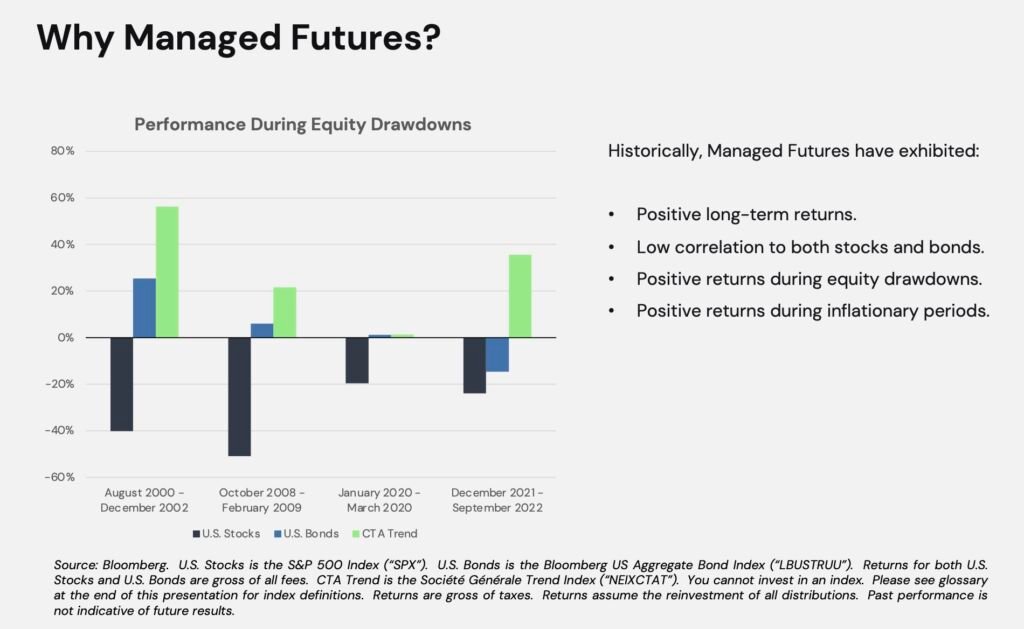

The Potential Benefits Of Managed Futures

Ladies and Gentlemen, Princes and Princesses, Knights in Shining Armor, and perhaps the occasional Pirate — gather around! Today, we shall embark on a whimsical journey to the magical realm of Managed Futures. Now, I understand that you might have been expecting dragons, unicorns, or perhaps a sprinkling of fairy dust, but bear with me. The world of Managed Futures is filled with its own breed of magic, especially for your investment portfolio.

- Diversification Delight: Managed futures are like the rainbow sprinkles on an investment sundae. Who wants a bland, one-flavor portfolio? Not I! And neither should you. With managed futures, you get to sprinkle some of that non-correlated asset goodness into your holdings. It’s like having both chocolate and vanilla. Or better yet, rocky road with a side of mint chip.

- Ride the Wave: Ever tried surfing? It’s all about catching the right wave. Managed futures strategies can go both long (ride the wave up) and short (ride the wave down). So, whether the market’s doing the cha-cha slide or the moonwalk, you’ve got some moves to groove with it.

- The Cool Under Pressure Award: When the financial markets are throwing tantrums like a toddler denied candy, managed futures are that cool kid in the corner, sipping a juice box with poise. They tend to exhibit low correlation with traditional asset classes, offering potential stability during market meltdowns. The kind of friend you want around when the proverbial investment ice cream hits the fan.

- Global Party: Why limit yourself to one playground? Managed futures party globally! They can access a broad range of global markets, from grains in Graceland to metals in Middle-earth. Okay, maybe not Middle-earth, but you get the picture.

- Flexibility Gymnastics: Managed futures funds can change their asset exposure on a dime. They’re more flexible than a contortionist at a circus. Whether it’s the shift from equities to commodities or from bonds to currencies, these funds can pirouette with grace.

In short, if you’re looking for a whimsical addition to your portfolio’s investment party, managed futures might just be the disco ball you’ve been waiting for. Dance on, savvy investor, dance on!

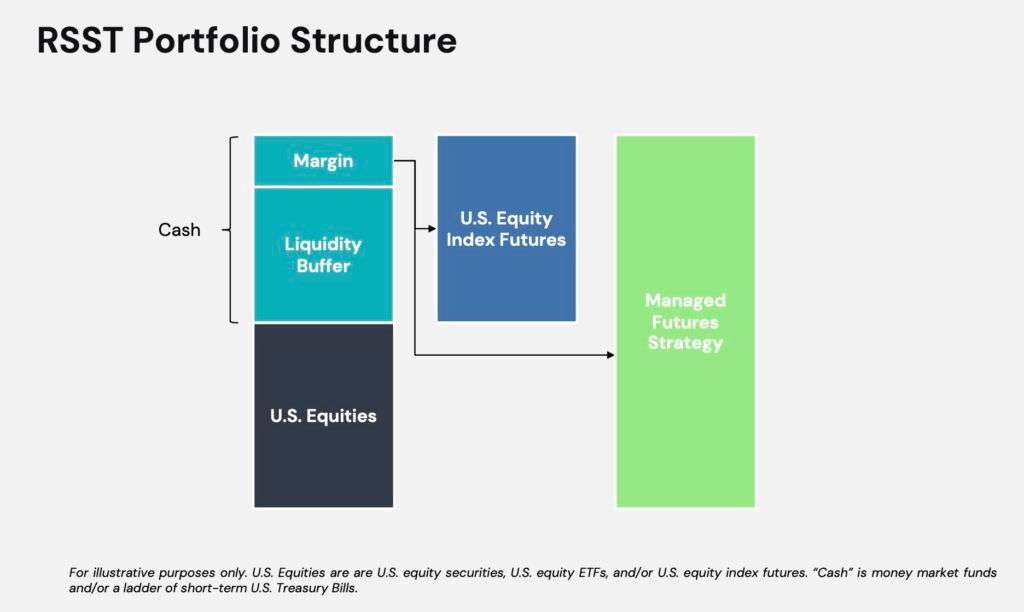

RSST Portfolio Structure

Why Return Stack US Equities With Managed Futures?

Picture this: US equities and managed futures decide to throw a soirée. What’s on the agenda? Nothing short of the grandest, most exhilarating investment shindig of the century! Let’s dive into why this is the duo you didn’t know you needed.

- The Peanut Butter & Jelly Principle: Just as these two sandwich superstars complement each other’s strengths, US equities provide the solid bread and butter (or, ahem, peanut butter) of growth and dividends. Managed futures, on the other hand, are the zesty jelly, adding flavor with their dynamic strategies. Alone, they’re delightful. Together? Culinary (and financial) bliss.

- Diversification’s Dashing Dance: In the ballroom of investments, US equities are the ever-popular waltz, while managed futures are the unexpected tango. When the stock market decides to have an off day (or month, or year…), managed futures might just sweep in, twirling and saving the dance. Their typically non-correlated performance means when equities dip, managed futures can cha-cha real smooth.

- The Bouncer at the Portfolio Club: Market volatility is like that one party crasher who wasn’t invited but shows up anyway. But don’t fret! Managed futures, with their global market strategies and long-short positions, act as the portfolio’s bouncer. They can handle market rowdiness, ensuring the party goes on.

- The Global Tour: If US equities are the home band playing your favorite familiar tunes, managed futures are the globetrotting DJ, bringing in beats from commodities in Cairo to currencies in Canberra. It’s a world tour right in your portfolio, ensuring you’re grooving to diverse investment rhythms.

- Fashion Forward: In the ever-trending world of investments, having both US equities and managed futures is akin to sporting both timeless classics and avant-garde haute couture. Equities? Your trusted tuxedo. Managed futures? That bold statement piece everyone’s raving about.

Aa blend of US equities and managed futures is like an epic gala with a fusion of timeless classics and electric new beats. You’ll have tales to tell, dances to relish, and perhaps, returns to cherish.

Cheers to a harmonious financial waltz! 🥂🕺💃

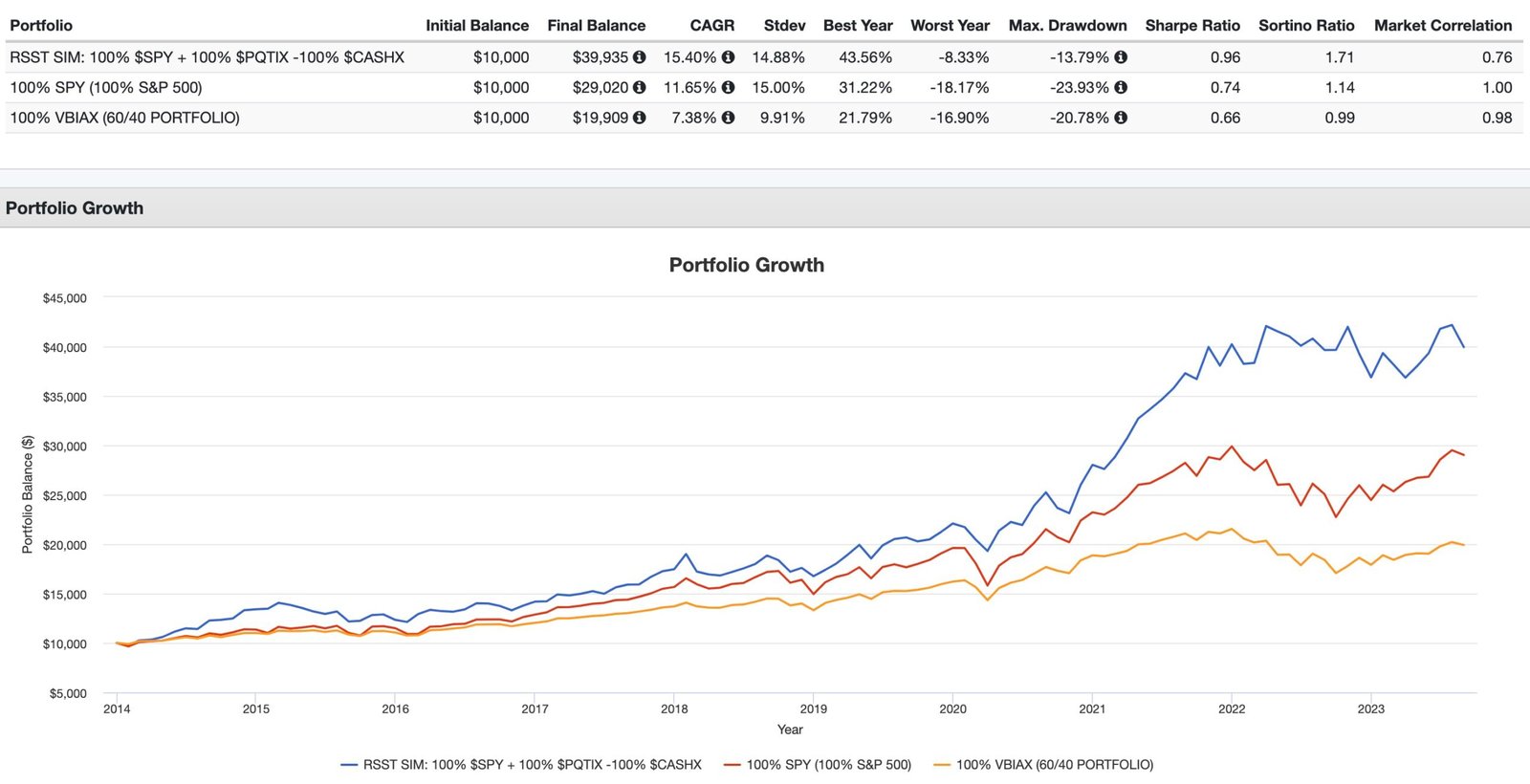

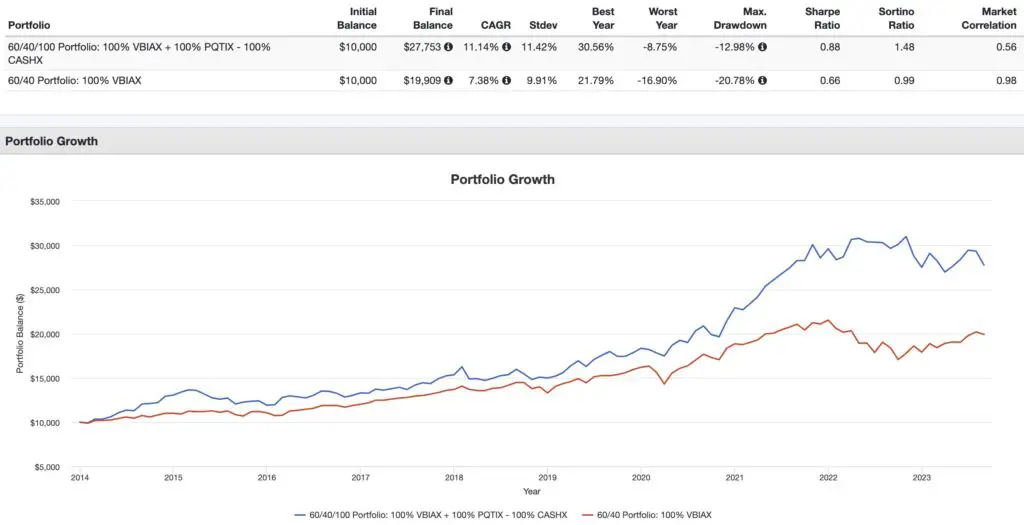

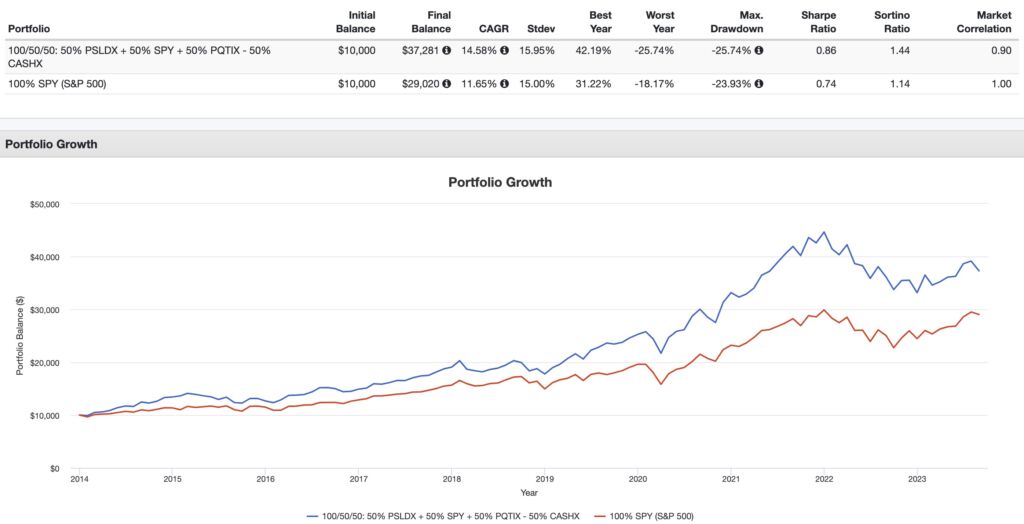

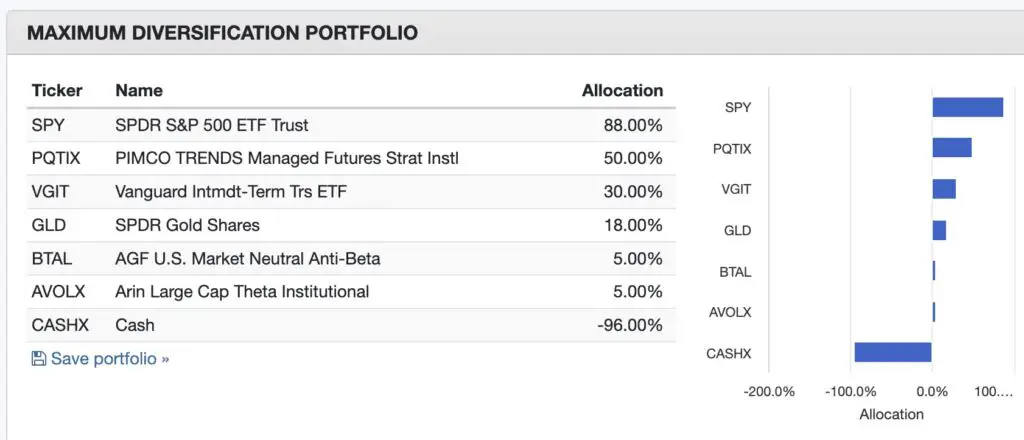

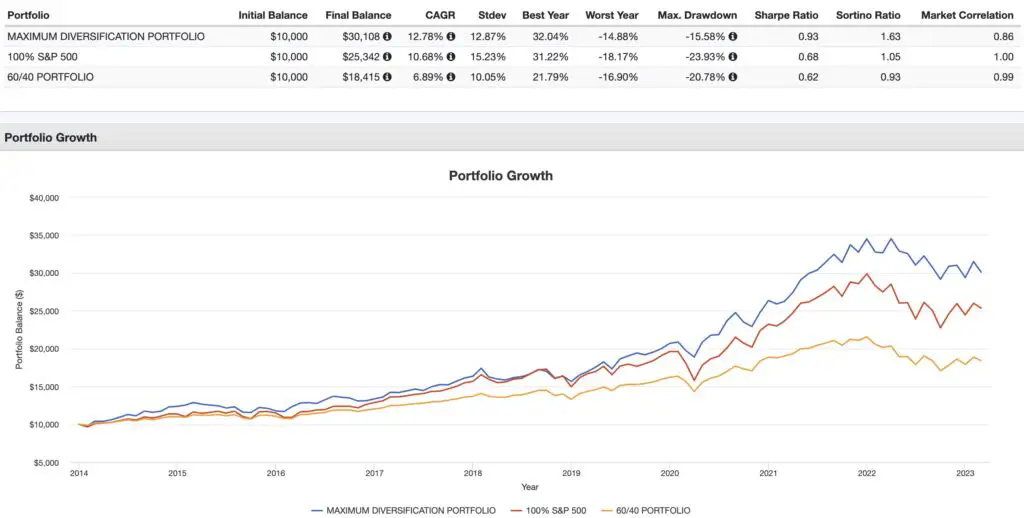

RSST ETF SIM vs 100% S&P 500 vs 100% 60/40 Portfolio Backtest

CAGR: 15.40% vs 11.65% vs 7.38%

RISK: 14.88% vs 15.00% vs 9.91%

BEST YEAR: 43.56% vs 31.22% vs 21.79%

WORST YEAR: -8.33% vs -18.17% vs -16.90%

MAX DRAWDOWN: -13.79% vs -23.93% vs -20.78%

SHARPE RATIO: 0.96 vs 0.74 vs 0.66

SORTINO RATIO: 1.71 vs 1.14 vs 0.99

MARKET CORRELATION: 0.76 vs 1.00 vs 0.98

Review of RSST ETF : Reviewing Return Stacked US Stocks & Managed Futures ETF

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

source: Return Stacked® Portfolio Solutions on YouTube

Newfound Research and ReSolve Asset Management

When Newfound Research and ReSolve Asset Management team up for a project, it’s bound to be top-notch.

This latest endeavor is no different.

For the past year, I’ve kept tabs on Corey Hoffstein from Newfound Research and the dynamic trio from ReSolve – Adam Butler, Rodrigo Gordillo, and Mike Philbrick.

They’ve consistently shared invaluable insights through tweets, videos, and podcasts.

The term “return stacking” frequently surfaced in their discussions.

Initially, I thought “return stacking” was just a buzzword they introduced for advisory purposes and specialized portfolio models.

But now, the fog has lifted.

It’s an offering meant for all.

With the introduction of RSST ETF, RSBT ETF, and the upcoming RSSB ETF, retail investors are now presented with innovative tools to craft their ideal return stacked portfolios.

RSST ETF Overview, Holdings and Info

The investment case for “Return Stacked US Stocks and Managed Futures” has been laid out succinctly by the folks over at Return Stacked ETFs: (source: fund landing page)

This is a red flag for me. RSST (and RSBT) has halted trading on 3/21.

False alarm.

https://www.globenewswire.com/news-release/2024/03/21/2850492/0/en/Return-Stacked-U-S-Stocks-Managed-Futures-ETF-RSST-Return-Stacked-Bonds-Managed-Futures-ETF-RSBT-Trading-halt-and-resumption-of-trading.html

Also explanation by Corey

https://twitter.com/choffstein/status/1770874280139452900