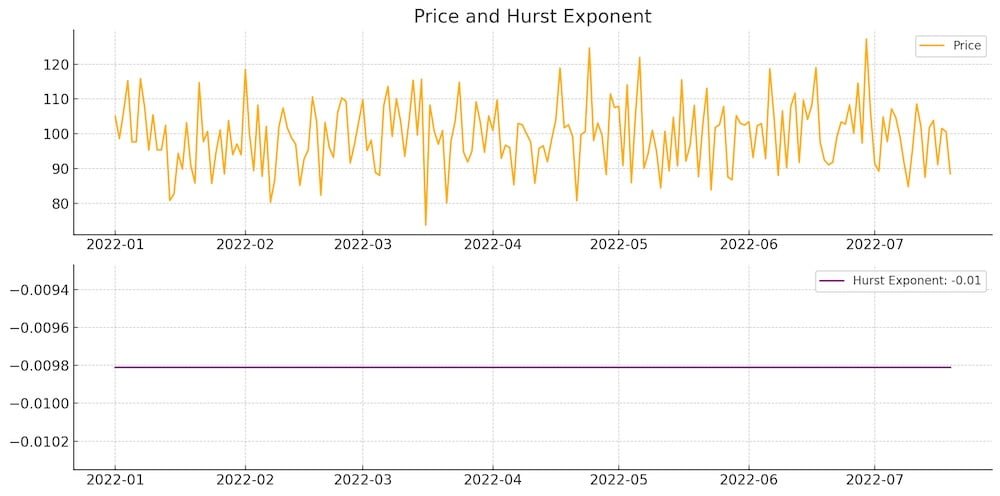

Merger arbitrage is an investing strategy that aims to profit from the price inefficiencies that can arise when companies announce mergers or acquisitions. This strategy involves buying shares of the target company, which is the company that is being acquired, and simultaneously shorting shares of the acquiring company. The goal is to capture the spread between the current market prices of the two companies and the expected value of the deal when it closes.

Merger arbitrage is a popular strategy among hedge funds and other sophisticated investors. It can be attractive because it has the potential to generate returns that are uncorrelated to the broader market. However, there are risks involved, including the possibility that the deal will fall through or that the market will react unfavourably to the announcement of the merger or acquisition.

What The Heck Is Merger Arbitrage?

Merger arbitrage is an investing strategy that involves buying shares of a company that is being acquired and simultaneously shorting shares of the acquiring company. The goal is to profit from the difference between the current market prices of the two companies and the expected value of the deal when it closes.

The concept of merger arbitrage dates back to the early 1900s when wealthy investors would buy up shares of companies that were about to be acquired and sell them for a profit when the deal closed. Today, merger arbitrage is a popular strategy among hedge funds and other sophisticated investors, who seek to generate returns that are uncorrelated to the broader market.

The process of merger arbitrage involves analyzing the details of the acquisition, including the terms of the deal, the financing structure, and the regulatory requirements. Investors also need to consider the likelihood of the deal being completed and any potential obstacles that may arise.

One of the key advantages of merger arbitrage is that it can provide consistent returns even in a volatile market. This is because the returns are based on the completion of the deal rather than the performance of the broader market. In addition, merger arbitrage can provide diversification benefits to a portfolio, as it is a strategy that is not directly tied to the performance of individual companies or sectors.

However, there are risks involved in merger arbitrage. One of the main risks is the possibility that the deal will fall through, which can result in significant losses for investors. This can happen if the regulatory approval process takes longer than expected, if the companies are unable to secure financing for the deal, or if one of the companies decides to back out of the acquisition.

Another risk of merger arbitrage is that the market may react unfavorably to the announcement of the merger or acquisition. This can result in a drop in share prices, which can impact the returns of the merger arbitrage strategy.

Despite the risks involved, merger arbitrage can be a profitable strategy for investors who are able to identify and act on the right opportunities. The strategy requires careful analysis and due diligence, but it can provide a way for investors to capitalize on market inefficiencies and generate returns that are uncorrelated to the broader market.

Furthermore, merger arbitrage is an investing strategy that involves buying shares of a company that is being acquired and simultaneously shorting shares of the acquiring company. The goal is to profit from the difference between the current market prices of the two companies and the expected value of the deal when it closes. While there are risks involved, merger arbitrage can provide consistent returns and diversification benefits to a portfolio, making it a strategy worth considering for investors looking to generate alpha in their portfolios.

source: Khan Academy on YouTube

Merger Arbitrage Real Life Examples?

Imagine that you’re at a dinner party, and your friend Bob starts bragging about his successful investing strategy. He starts going on about something called “merger arbitrage,” and you have no idea what he’s talking about. Well, let’s break it down for you, with some real-life examples and a little bit of humor.

First, let’s define what we mean by “merger arbitrage.” Essentially, it’s a strategy where you buy shares of a company that’s about to be acquired, and at the same time, you short (i.e. bet against) the shares of the company doing the acquiring. The idea is to make money from the difference between the current market price of the two companies, and the expected value of the deal when it closes.

So, let’s say that Company A is about to buy out Company B. The deal is set to close in six months, and the terms of the deal specify that Company A will pay $100 per share for Company B. However, right now, Company B is trading at $90 per share, and Company A is trading at $110 per share. This is where the merger arbitrage opportunity comes in. You would buy shares of Company B at $90, and simultaneously short shares of Company A at $110. When the deal closes in six months, Company B will be bought out for $100 per share, and you’ll make a $10 profit. Meanwhile, the value of Company A’s shares might drop because they’re taking on more debt to finance the acquisition.

Now, of course, there are risks involved in this strategy. What if the deal falls through? What if there are regulatory hurdles? What if the market doesn’t react the way you expected? These are all valid concerns. But if you do your research and pick the right opportunities, merger arbitrage can be a great way to make some money without having to rely on the broader market.

Here’s a real-life example to illustrate the point: in 2018, Disney announced that it was going to acquire most of 21st Century Fox’s assets. The deal was set to close in 12-18 months, and the terms of the deal specified that Fox shareholders would receive $38 per share. However, when the deal was first announced, Fox was trading at around $34 per share, and Disney was trading at around $105 per share. This presented a merger arbitrage opportunity. Investors could buy Fox shares at $34, and short Disney shares at $105. When the deal closed, Fox shareholders received $38 per share, and investors who took advantage of the merger arbitrage opportunity would have made a profit. It’s like finding money on the street, except you have to do a little bit of work to pick it up.

Now, let’s inject some humor into this discussion. Merger arbitrage can be thought of as a little bit like a heist movie, where you’re trying to outsmart the market and make a quick profit. You’re like Danny Ocean, but instead of stealing a casino vault, you’re taking advantage of market inefficiencies. It’s like Ocean’s Eleven, but with fewer high-speed car chases and more spreadsheets.

In all seriousness, though, merger arbitrage can be a great way to make some money in the market if you’re willing to put in the work. It requires careful analysis and research, but if you’re able to identify the right opportunities, you can potentially generate consistent returns that are uncorrelated to the broader market. So, if you’re feeling adventurous, consider giving merger arbitrage a try. Just remember to keep an eye out for any regulatory roadblocks or other scenarios.

The Advantages & Disadvantages Of Merger Arbitrage?

Merger arbitrage is a specialized investment strategy that involves profiting from price discrepancies between the stock prices of the acquiring and target companies during a corporate merger or acquisition. Merger arbitrage funds seek to generate returns by taking long or short positions in the stocks of the companies involved in a merger or acquisition. While this investment strategy has its advantages, it also comes with its fair share of risks. In this article, we will explore the pros and cons of merger arbitrage.

source: Learn to Invest – Investors Grow on YouTube

Pros of Merger Arbitrage:

- Low Market Correlation: Merger arbitrage funds typically have a low correlation with the broader stock market, making them a great option for investors who want to diversify their portfolios. This means that if the stock market experiences a downturn, the returns of merger arbitrage funds may not necessarily be affected.

- Lower Volatility: Merger arbitrage funds tend to have lower volatility than other investment strategies, such as growth or value investing. This can make them a more stable option for investors who prefer a more conservative approach to investing.

- Higher Returns: Merger arbitrage funds have the potential to generate higher returns than traditional investment strategies. This is because the investment strategy is designed to capture the spread between the stock prices of the acquiring and target companies during a merger or acquisition.

- Less Risky Than Other Hedge Fund Strategies: Merger arbitrage funds typically carry less risk than other hedge fund strategies, such as long/short equity or global macro funds. This is because the investment strategy is less dependent on market direction and more focused on the specifics of the merger or acquisition.

Cons of Merger Arbitrage:

- Time-Sensitive: Merger arbitrage funds rely on the successful completion of a merger or acquisition, and any delays or changes to the terms of the deal can significantly impact returns. Additionally, if the deal falls through, investors could potentially lose money.

- Not Always Profitable: While merger arbitrage has the potential to generate high returns, it is not a guaranteed investment strategy. Factors such as regulatory approval, antitrust concerns, and changes to the terms of the deal can impact the spread between the stock prices of the acquiring and target companies, reducing or even eliminating the potential profits.

- Complex Investment Strategy: Merger arbitrage is a complex investment strategy that requires a high degree of expertise to execute successfully. This can make it difficult for individual investors to implement on their own.

- Relies on Access to Capital: Merger arbitrage funds typically rely on access to capital to execute their investment strategy. This means that if credit markets tighten or the economy experiences a downturn, the fund may not be able to secure the necessary capital to execute its investment strategy.

Merger arbitrage can be a viable investment strategy for investors seeking diversification, lower volatility, and potentially higher returns. However, it is important to understand the risks and complexities involved and consult with a financial advisor before making any investment decisions.

source: Khan Academy on YouTube

How Much Should I Potentially Allocate To A Merger Arbitrage Strategy?

The allocation of a portfolio to merger arbitrage is a nuanced decision that requires careful consideration of various factors. Among these factors, investors must consider their investment goals, risk tolerance, and the diversification of their overall investment portfolio.

Merger arbitrage is an investment strategy that seeks to profit from price discrepancies between acquiring and target companies during a merger or acquisition. It is a specialized investment approach that carries unique risks and rewards that are different from traditional investments in stocks and bonds. Therefore, investors must approach it with caution and evaluate its place within a larger investment portfolio carefully.

When considering the percentage of a portfolio to allocate to merger arbitrage, most financial advisors recommend allocating no more than 5-10% of the portfolio to alternative investments, which includes merger arbitrage funds. This allocation is based on the higher risks and greater volatility associated with alternative investments.

However, the appropriate percentage of portfolio allocation will depend on the investor’s investment goals and risk tolerance. For example, an investor with a low risk tolerance and a focus on generating steady income may want to allocate a smaller percentage of their portfolio to more volatile investments like merger arbitrage.

Investors should also consider the overall diversification of their investment portfolio when determining the appropriate allocation to merger arbitrage. A well-diversified investment portfolio spreads risks across multiple asset classes and investment strategies, reducing the overall risk of the portfolio. Therefore, if an investor already has a diversified portfolio that includes other alternative investments, they may need to allocate a lower percentage to merger arbitrage to maintain proper diversification.

Thus, the allocation of a portfolio to merger arbitrage requires careful consideration of various factors, including investment goals, risk tolerance, and the overall diversification of the investment portfolio. Investors should consult with a financial advisor to determine the most appropriate allocation for their unique circumstances.

source: Patrick Boyle on YouTube

Merger Arbitrage Investing Strategy Final Thoughts

Merger arbitrage is an investment strategy that can potentially yield high returns for investors in a low-interest-rate environment. This approach involves taking advantage of price discrepancies that often arise during mergers and acquisitions, creating opportunities for profit.

The merger arbitrage process typically involves investing in a company that is the target of an acquisition, and simultaneously taking a short position in the acquiring company. This allows investors to profit from the difference in stock prices when the merger is completed.

However, merger arbitrage is a specialized investment strategy that carries its own unique risks and rewards. The success of the strategy is heavily dependent on the timing of the investment, the size of the deal, and the regulatory environment. Investors must have a keen understanding of these factors and how they can impact the success of their investment.

One of the advantages of merger arbitrage is that it can offer investors a low-risk way to generate returns. This is because the strategy is designed to profit from the spread between the current stock price and the price at which the stock is expected to be purchased during the merger. As a result, the potential for upside is significant, while the downside risk is relatively limited.

Investors considering merger arbitrage should approach the strategy with caution and carefully evaluate its place within a larger investment portfolio. As with any investment, diversification is key, and investors should consider the appropriate percentage of portfolio allocation to allocate to alternative investments like merger arbitrage.

Moreover, it’s important to note that merger arbitrage is not a foolproof investment strategy. There is always the risk that the deal may not go through as planned, resulting in losses for investors. Additionally, regulatory changes or unforeseen events can impact the success of the strategy, highlighting the importance of thorough research and analysis before investing.

Hence, merger arbitrage is a specialized investment strategy that can offer investors a potentially attractive source of returns in a low-interest-rate environment. However, it is important to approach the strategy with caution and to consult with a financial advisor to determine the most appropriate allocation for your unique circumstances. With careful consideration and thorough analysis, investors can potentially reap the rewards of this unique investment approach.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.