Few things excite me more than finding a fund that has beat the stuffing out of the S&P 500 since its inception.

You see I’m not particularly fond of market-cap weighted index strategies.

It’s what everyone else is doing.

In terms of evidence based investing, it’s suboptimal from a long-term returns standpoint.

And it’s the most crowded trade in the industry, hands down.

However, I’m also fully aware that “recency bias” and a fortunate sequence of returns can polish a turd and make it seem much better than it actually is.

Hence, I’m more focused on the strategy of a fund than I am on its recent performance.

With all that being said, I’m truly excited about both the performance and strategy of ALTL ETF.

Pacer Lunt Large Cap Alternator ETF seeks to alternate exposure between low volatility equities and high beta stocks in the S&P 500 universe.

Now why on earth would you want to do that?

Isn’t staying the course with your “equity optimization strategy of choice” the most prudent way to invest?

Maybe not.

It turns out being adaptable and flexible may provide the most opportunities for success.

As any factor investor knows their given strategy will go through prolonged periods of underperformance when there is an economic regime that favours other strategies.

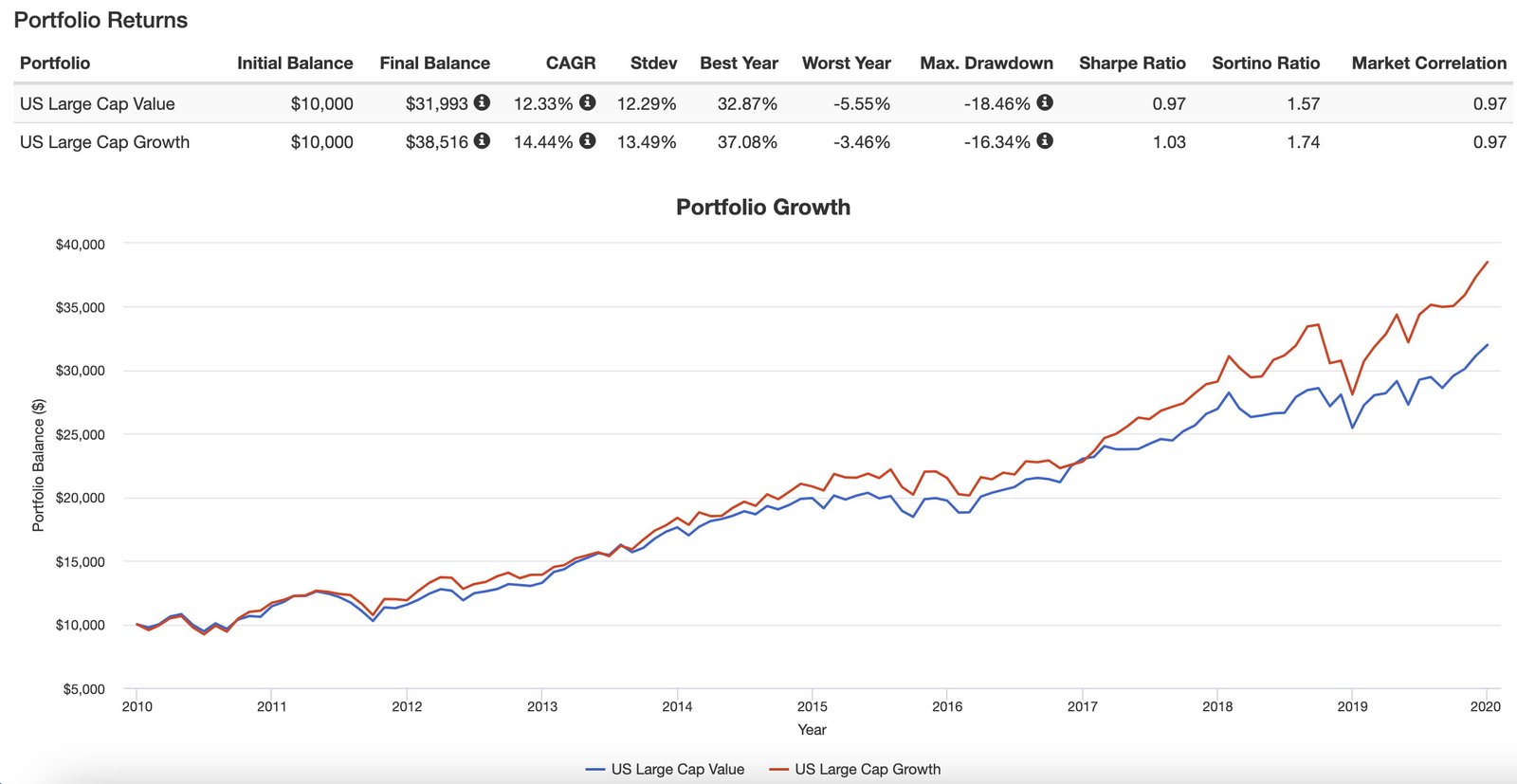

The most clear example of this recently was US Large Cap Growth stocks outperforming US Large Cap Value equities in the 2010s.

Us Large Cap Value vs US Large Cap Growth 2010s

Here we can see that US Large Cap Growth stocks enjoyed a decade of relative dominance over US Large Cap Value equities with a CAGR of 14.44% vs 12.33%.

However, what goes up often must come back down and the last couple of years have seen a clear regime change back to value stocks having the upper hand.

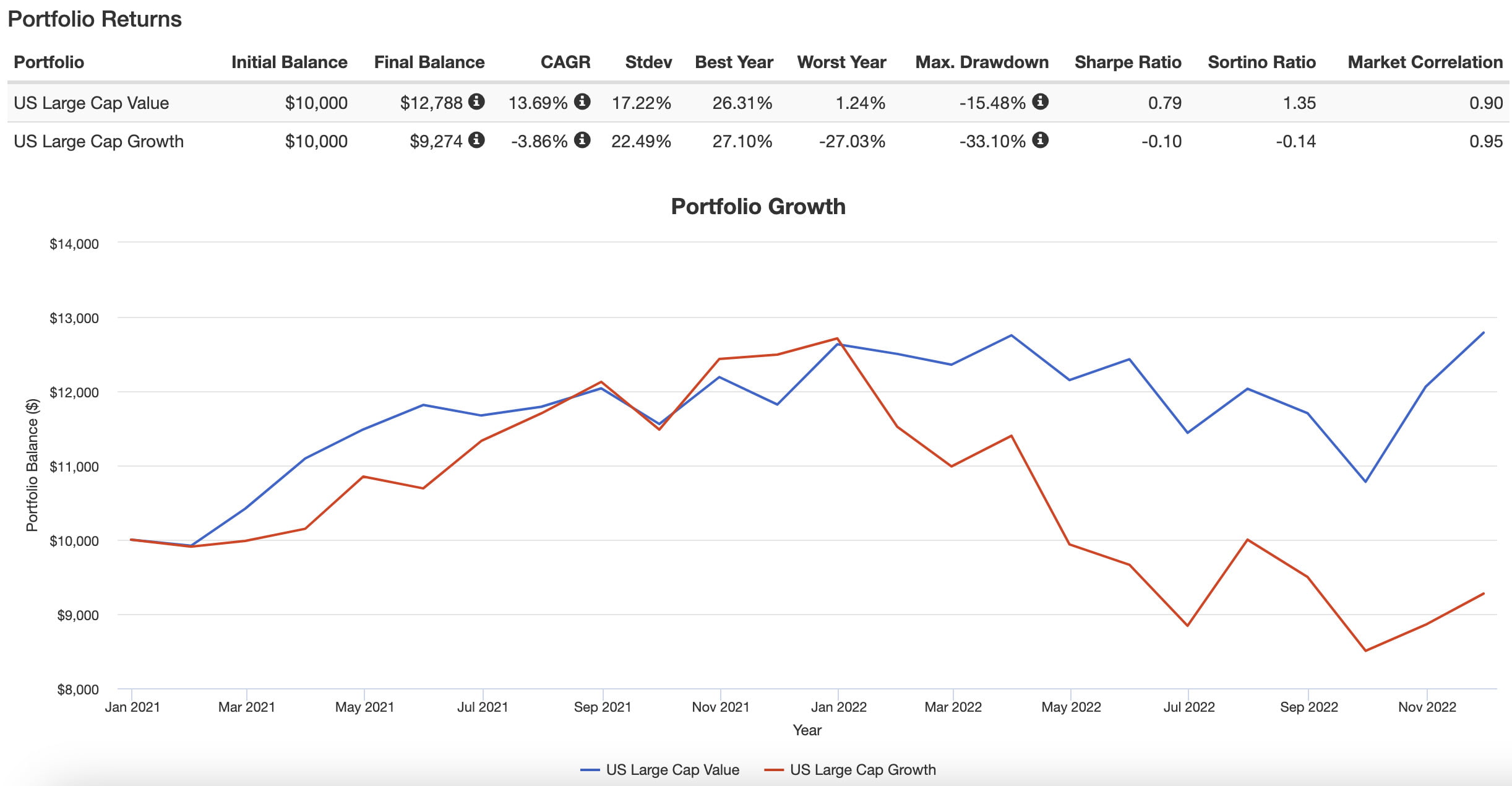

Us Large Cap Value vs US Large Cap Growth 2021-22

Oh my!

How the tables have turned.

The growth regime balloon that swelled throughout the 2010s and early 2020s has burst.

Value has provided above water returns of 13.69% vs Growth at -3.86%.

As investors we often like to hold tribal allegiances.

I’m a value investor.

You’re a growth investor.

But what if you were agnostic and more of a fair-weather factor friend?

Wouldn’t it be nice to be celebrating most of the time instead of waiting for your turn?

Pacer Lunt Large Cap Alternator Strategy potentially provides this type of solution.

It’ll jump on board the high-beta rocket ship to the moon when growth is trending and ditch that ship to join the slow train of low volatility equities when markets are turbulent or in drawdown.

With this type of strategy you get to be both a Jedi Knight and Sith Lord.

You don’t have to pick sides.

ALTL ETF Review | Pacer Lunt Large Cap Alternator ETF (Low Volatility vs High Beta)

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Pacer ETFS | Strategy Driven ETFs®

I’m quickly becoming a big fan of Pacer ETFs as a fund provider.

Recently, I reviewed their flagship cash cows product: US Pacer Cash Cows 100 ETF COWZ

And I’m hoping at some point to cover their TrendPilot series of funds.

The more I dig around the more I like what I see.

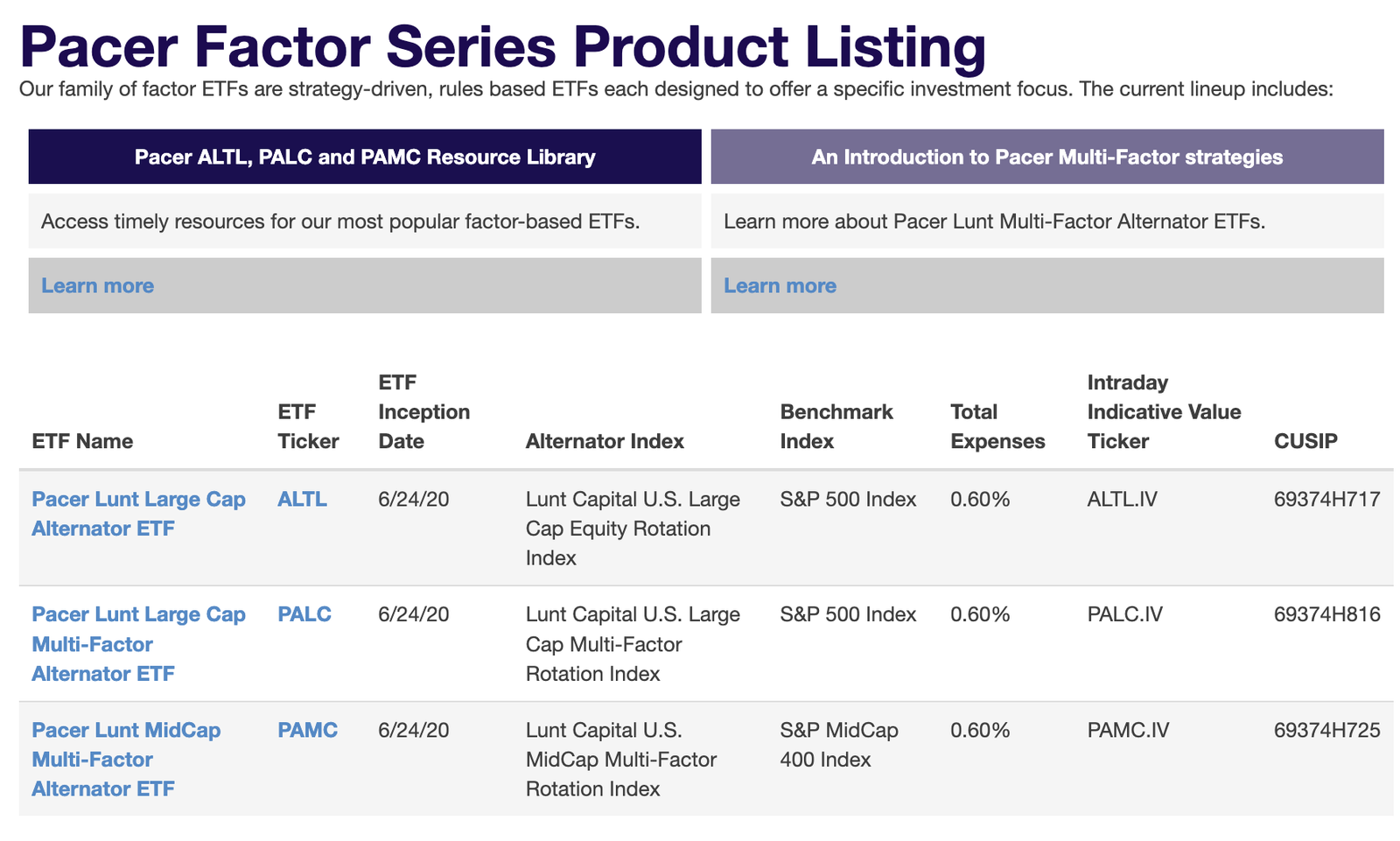

The Entire Pacer Factor ETF Series

Before we launch into a targeted review of Pacer Lunt Large Cap Alternator ETF, I thought I’d share the entire roster of funds available under the Pacer Factor ETF series.

At the moment there are just 3.

ALTL ETF – Pacer Lunt Large Cap Alternator ETF

PALC ETF – Pacer Lunt Large Cap Multi-Factor Alternator ETF

PAMC ETF – Pacer Lunt Mid Cap Multi-Factor Alternator ETF

I can honestly say I hope to see this roster double, triple or even quadruple as soon as possible.

source: Pacer ETFs on YouTube

The Case For Alternating Between High Beta and Low Volatility Stocks

The case for being able to adaptively alternate between High Beta and Low Volatility stocks is intuitively obvious.

Low Volatility stocks relatively shine during times of market turmoil and predictably tend to ride the coattails of other factor equity strategies during growth trends.

On the other hand, High Beta stocks enjoy more explosive growth during times of expansion and often get clobbered during downward trends.

The desire to capture the relative strengths of each strategy is tantalizing.

On the flip side, trying to avoid the shade and escape the downside is equally as appealing.

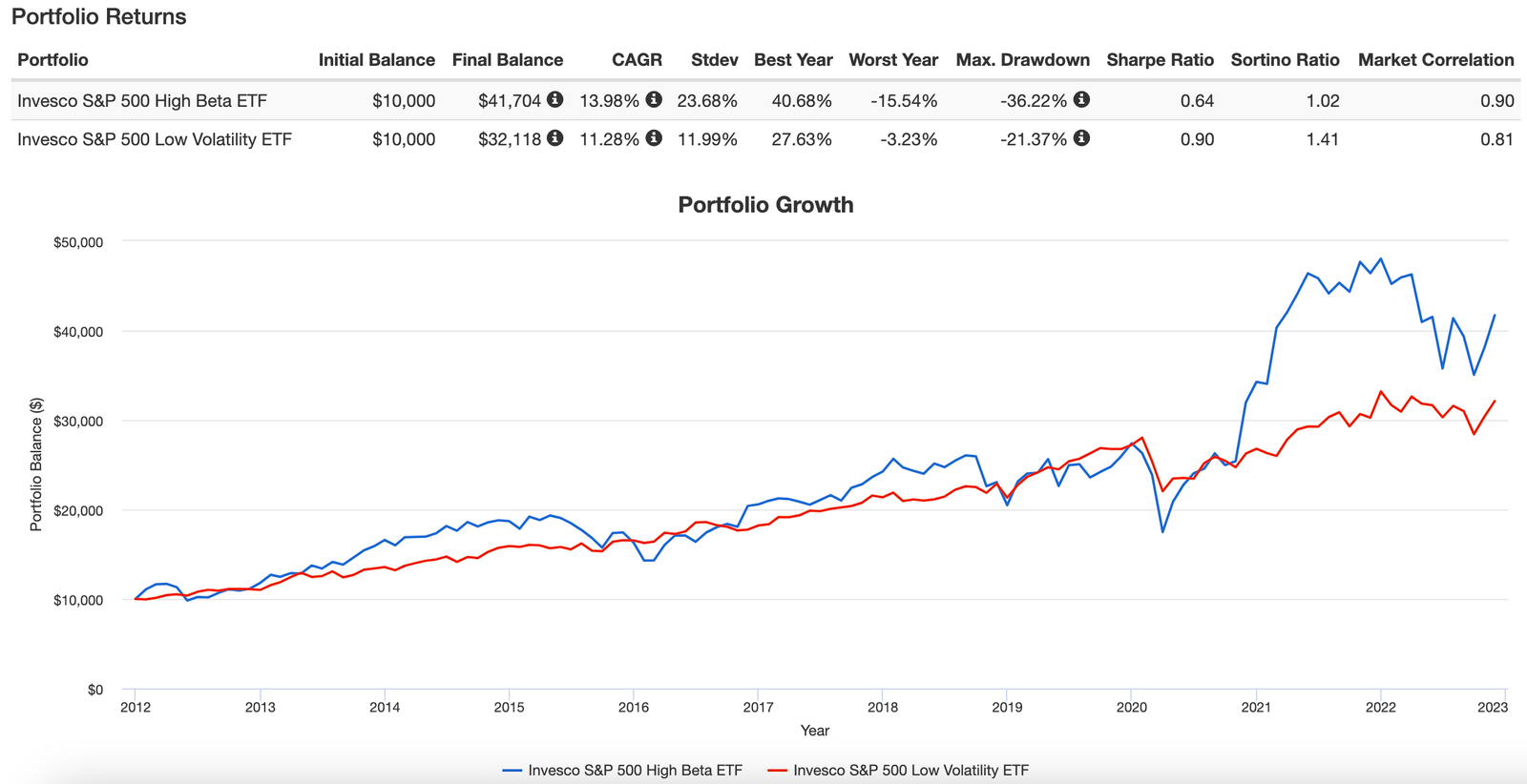

Fortunately, we can backtest to see when both strategies outperform and underperform by examining two specific ETFs.

SPHB ETF – Invesco S&P 500® High Beta ETF

SPLV ETF – Invesco S&P 500® Low Volatility ETF

S&P 500 High Beta vs S&P 500 Low Volatility Long-Term Performance

Oh my goodness gracious me!

The S&P 500 High Beta ETF is every bit the bucking bronco you may have imagined with a standard deviation of 23.68%.

Conversely, the S&P Low Volatility ETF is as defensive and stable as you’d figure with a standard deviation of 11.99%.

We’re well aware that Growth stocks have had quite the run over the past decade so it is no surprise the S&P 500 High Beta ETF comes out ahead with 13.98% vs 11.28%.

However, where we’re going to find the magic in all of this is to data mine each strategy’s moment in the sun and shade to see how the flip side of the coin responded.

Let’s examine from mid-2020 until the end of 2021 when high beta was flying sky high.

S&P 500 High Beta vs S&P 500 Low Volatility May 2020 until Dec 2021

So I’ve intentionally chosen May 2020 until the end of 2021 as our first point of examination between the two strategies.

After the initial months of the pandemic drawdown the recovery rally for equities was nothing short of incredible and no strategy could compete with high beta stocks.

Although a 23.16% CAGR for Low Volatility equities is nothing to sneeze at it sure doesn’t seem as terrific when compared with 64.99% CAGR for High Beta stocks.

Being able to ride that trend for an extended period of time would have been incredible.

And then it sure would have been nice to jump out before the massacre of 2022.

S&P 500 High Beta vs S&P 500 Low Volatility Performance in 2022

As you can see, clearly Low Volatility equities have been almost 1000 basis points more defensive in 2022 with less volatility.

Celebrating losing less is a greatly under appreciated skill in investing.

S&P 500 High Beta vs S&P 500 Low Volatility 2015 until mid-2016

And here is another distinct period of time where it would have been great to rotate out of high beta stocks and ride the trend with low volatility equities.

You’ll notice above water performance for the S&P 500 Low Volatility ETF with a 8.57% CAGR and over 1100+ basis points more defensive volatility management.

It’s clear that each strategy has its relative strengths and weaknesses but combining them together rotationally could create some sort of a juggernaut.

ALTL ETF Overview, Holdings and Info

The investment case for the “Alternator Strategy” has been laid out succinctly by the folks over at Pacer ETFs: (fund landing page)

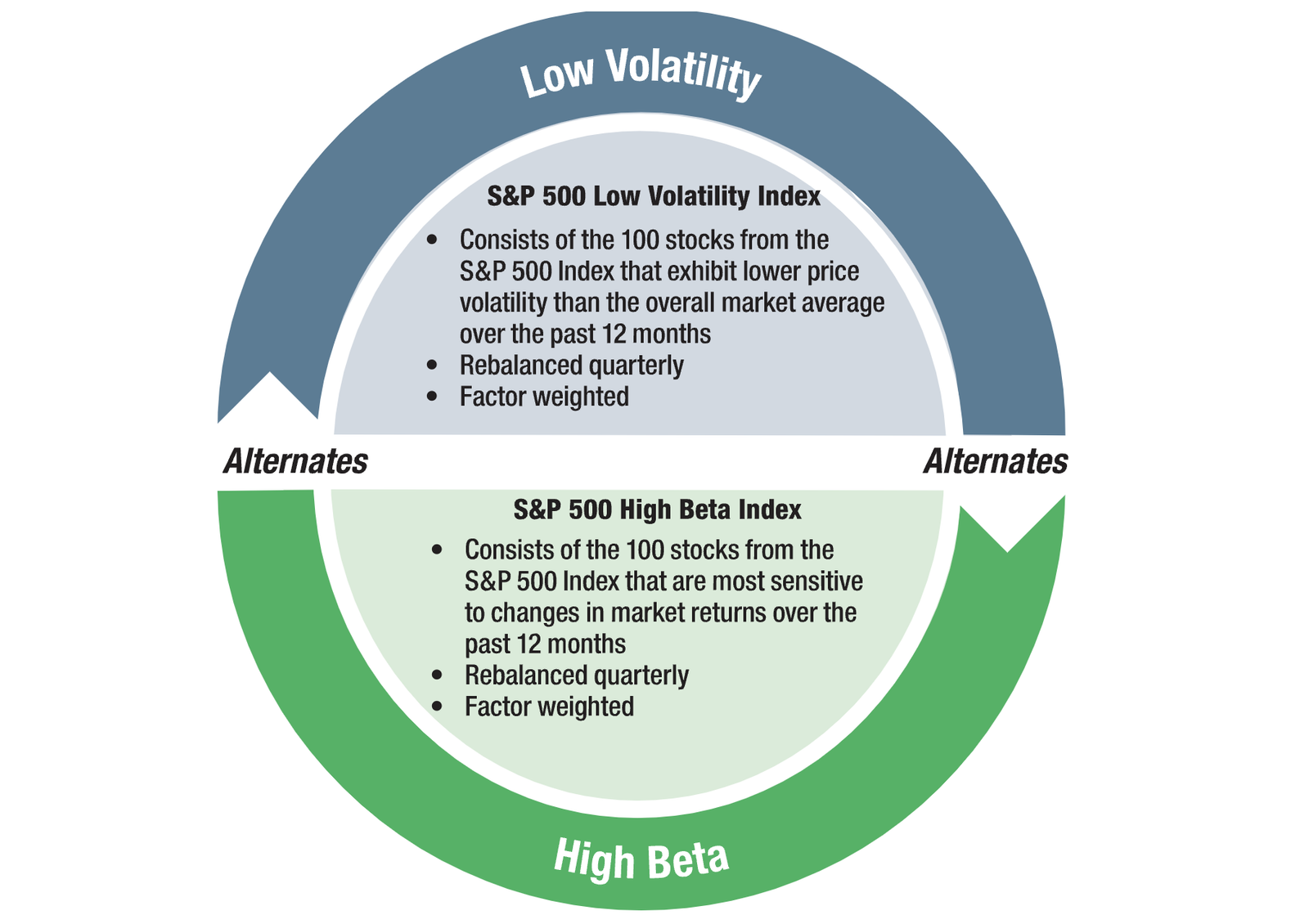

“A strategy-driven large cap exchange traded fund (ETF) that seeks to track the investment returns of an index that alternates exposure between low volatility and high beta stocks in the S&P 500 Index.

What is a high beta index?

The high beta index is an index comprised of stocks that are most sensitive to changes in market returns.

What is a low volatility index?

The low volatility index is an index comprised of stocks that exhibit lower price volatility than the overall market average.

What makes the Lunt approach unique?

Both Low Volatility and High Beta factors have historically exhibited periods of outperformance. The Lunt Capital U.S. Large Cap Equity Rotation Index is innovative because it uses a rules-based strategy to alternate between the High Beta and Low Volatility factors.

Strategy Overview

An objective, rules-based strategy that is re-evaluated monthly, and rotates between the S&P 500 Low Volatility Index and the S&P 500 High Beta Index based on a relative strength signal. The index is weighted by factor.”

Alternating Between Low Volatility to High Volatility

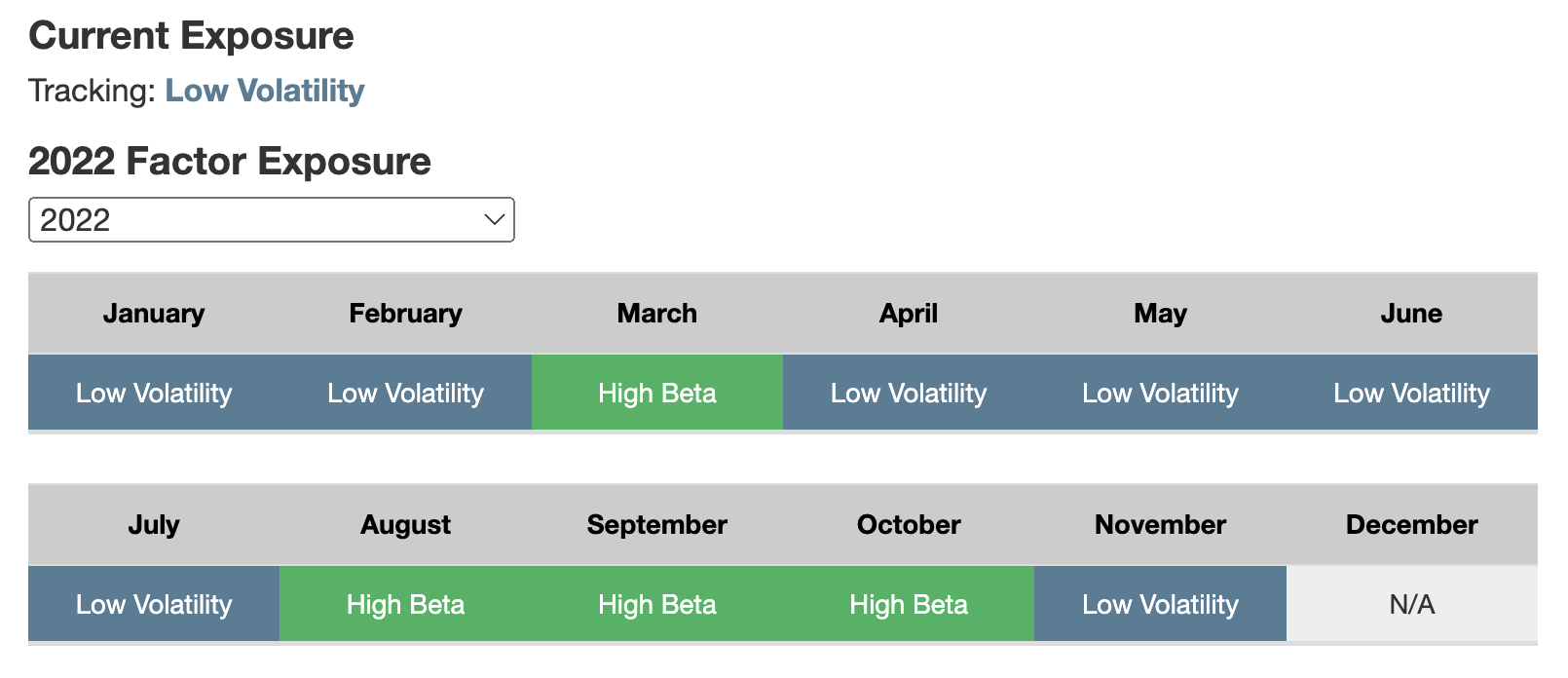

All of this begs the question of when does the strategy “alternate” between low beta and high beta and vice versa.

For that we’re able to find an answer in the summary prospectus:

“The Index utilizes Lunt Capital’s proprietary relative strength analysis in its attempt to determine which Sub-Index is likely to exhibit better price performance than the other Sub-Index. Pursuant to this methodology, the Index Provider calculates the “Risk Adjusted Score” for each Sub-Index. Each Sub-Index’s “Risk-Adjusted Score” is calculated using the Sub-Index’s standard deviation of returns over the prior 12 months. On the final trading day of each month, the Index Provider computes the relative strength of each Sub-Index by comparing each Sub-Index’s Risk-Adjusted Score. The Index Provider considers the Sub-Index with the higher Risk-Adjusted Score to have the higher relative strength. The Index is composed of the securities comprising the Sub-Index demonstrating the greater relative strength. The Index is reconstituted and rebalanced monthly, except when the Index methodology would not result in a change in the Sub-Index comprising the Index at such time.”

It appears on the final trading day of each month a comparison is made between the standard deviation of returns over the prior 12 months for both low volatility and high beta indexes and whichever one has a higher risk-adjusted score is chosen for that given month.

In other words, it would be the long-term 12 month relative trend that would determine which one is selected once a month.

Current Exposure: Low Volatility

Here we’re able to clearly see which factor is chosen for every given month.

Currently, it is Low Volatility but in October it was High Beta.

Moreover, there is a dropdown menu which allows you to select previous year’s monthly factor selection.

I love the transparency and ease of seeing what is going on month to month and year to year.

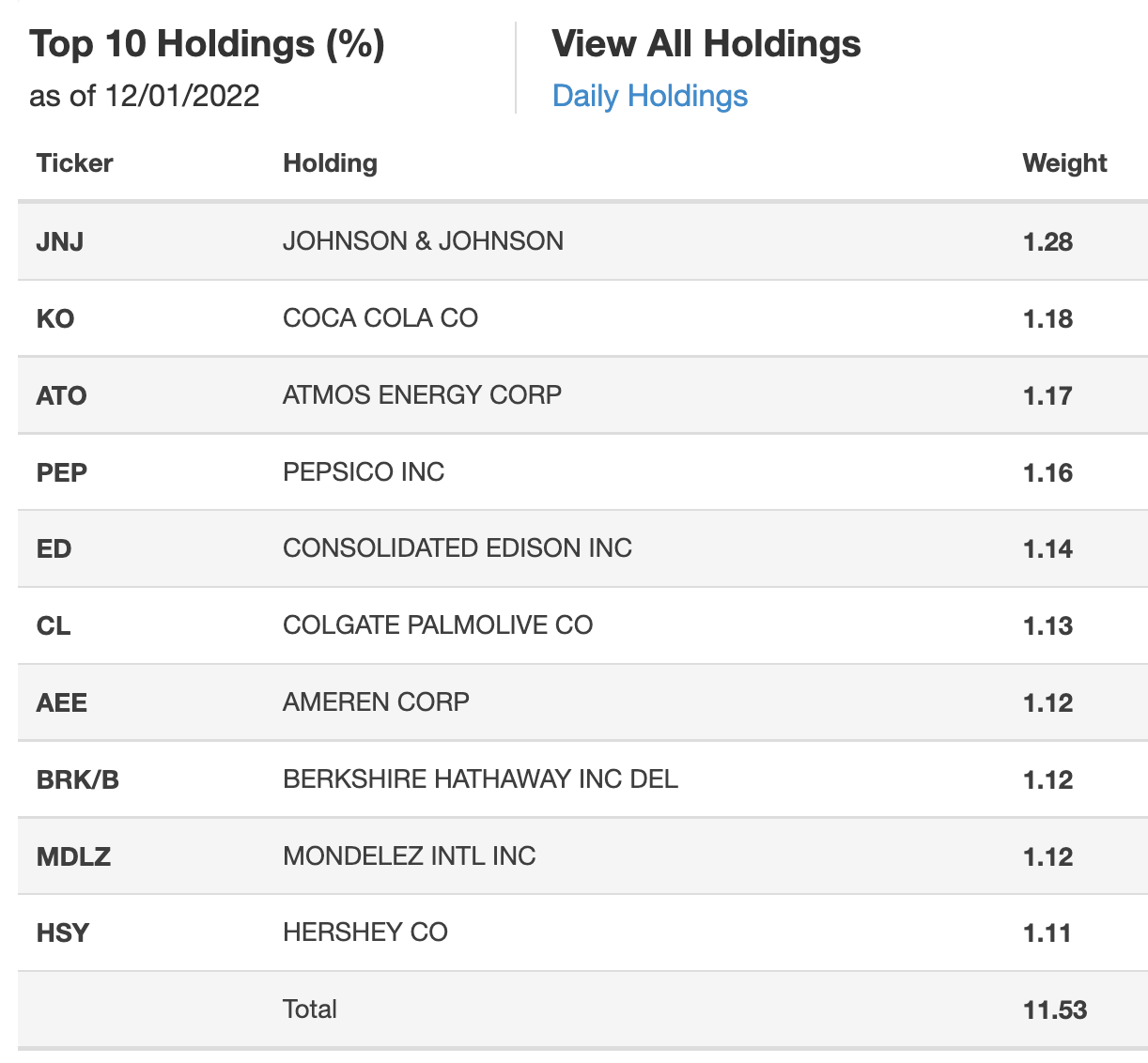

ALTL ETF: Holdings

Given the companies on display it’s pretty darn obvious the Low Volatility index has been selected.

You’ll find stable and steady companies that have been around forever such as Coke, Pepsi, Berkshire Hathaway and Johnson and Johnson.

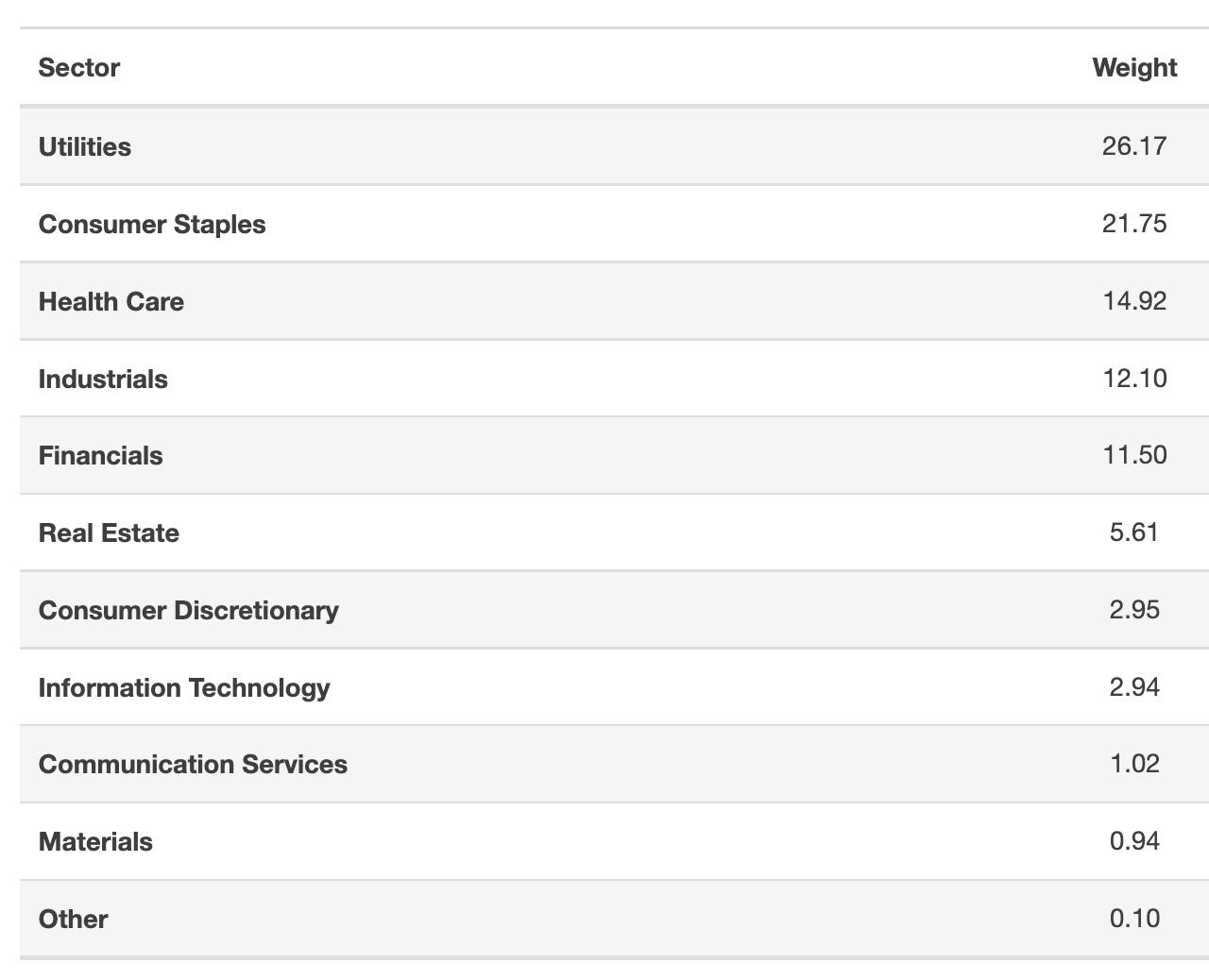

ALTL ETF: Sector Exposure

Notice how Utilities take up the top sector position with 26.17% while Technology is near the bottom at 2.94%.

I can imagine the tables are turned when High Beta is in vogue.

ALTL ETF Info

Ticker: ALTL

Net Expense Ratio: 0.60

AUM: 976.1 Million

Inception: 06/24/2020

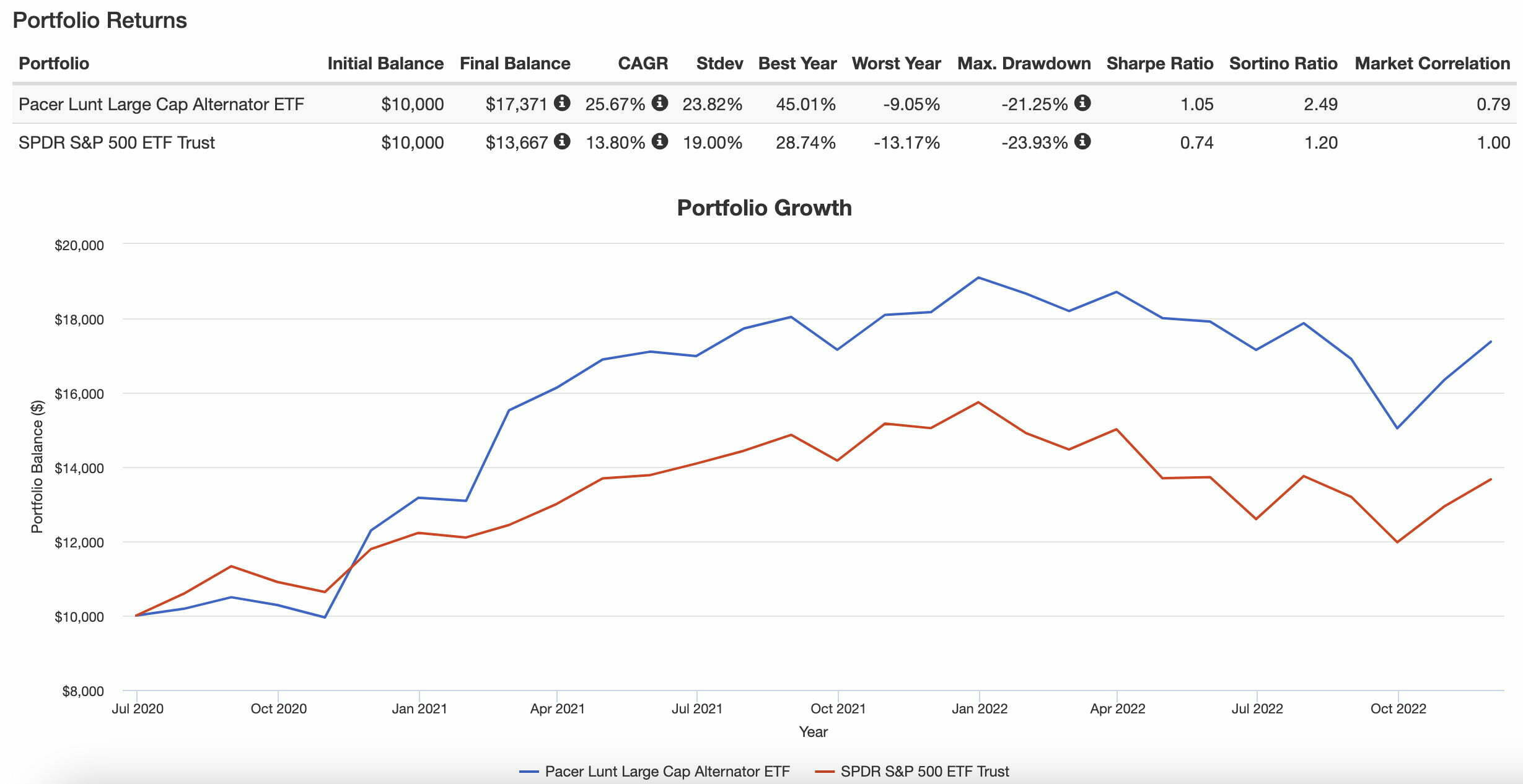

ALTL ETF Performance

Let’s move on to performance for ALTL ETF.

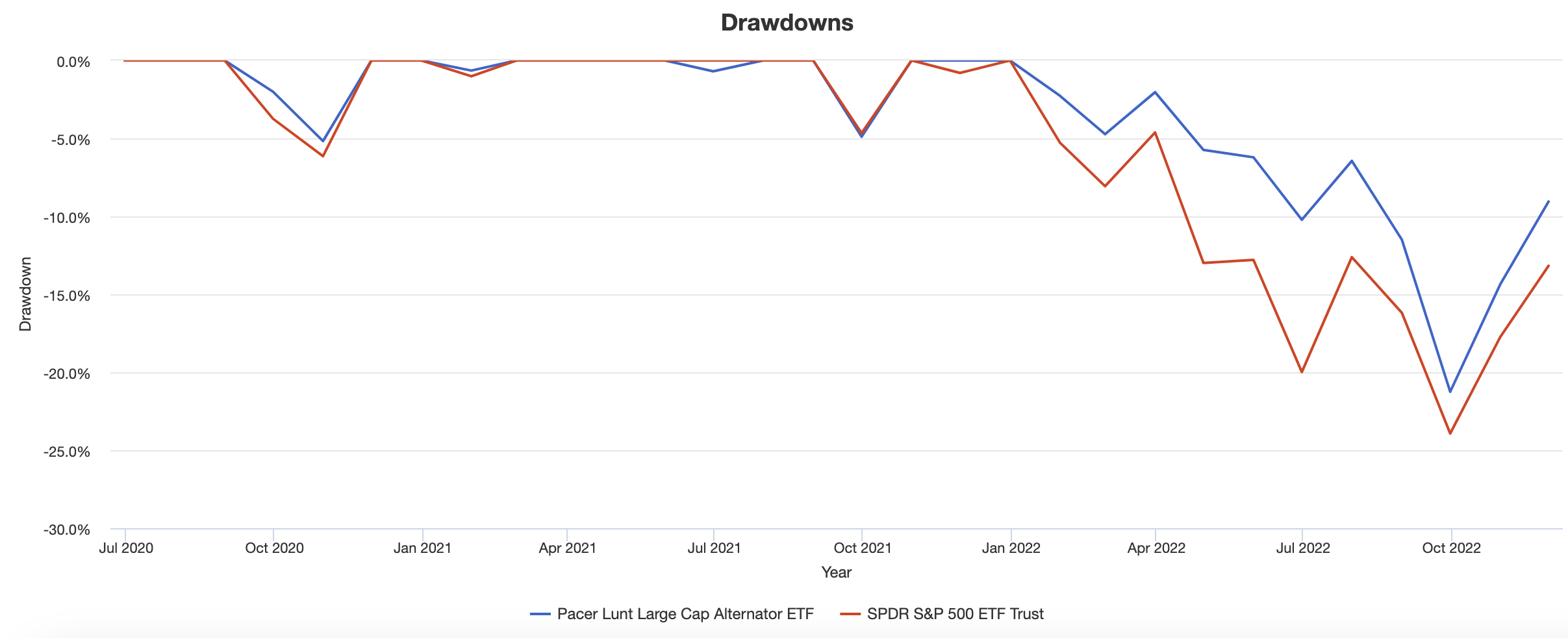

CAGR: 25.67% vs 13.80%

Stdev: 23.82% vs 19.00%

Worst Year: -9.05% vs -13.17%

Best Year: 45.01% vs 28.71%

Max Drawdown: -21.25% vs -23.93%

Sharpe Ratio: 1.05 vs 0.74

Sortino Ratio: 2.49 vs 1.20

Market Correlation: 0.79 vs 1.00

It’s a clear beatdown for ALTL ETF vs SPY since inception in terms of CAGR, Best/Worst Year, Max Drawdown, Sharpe Ratio and Sortino Ratio.

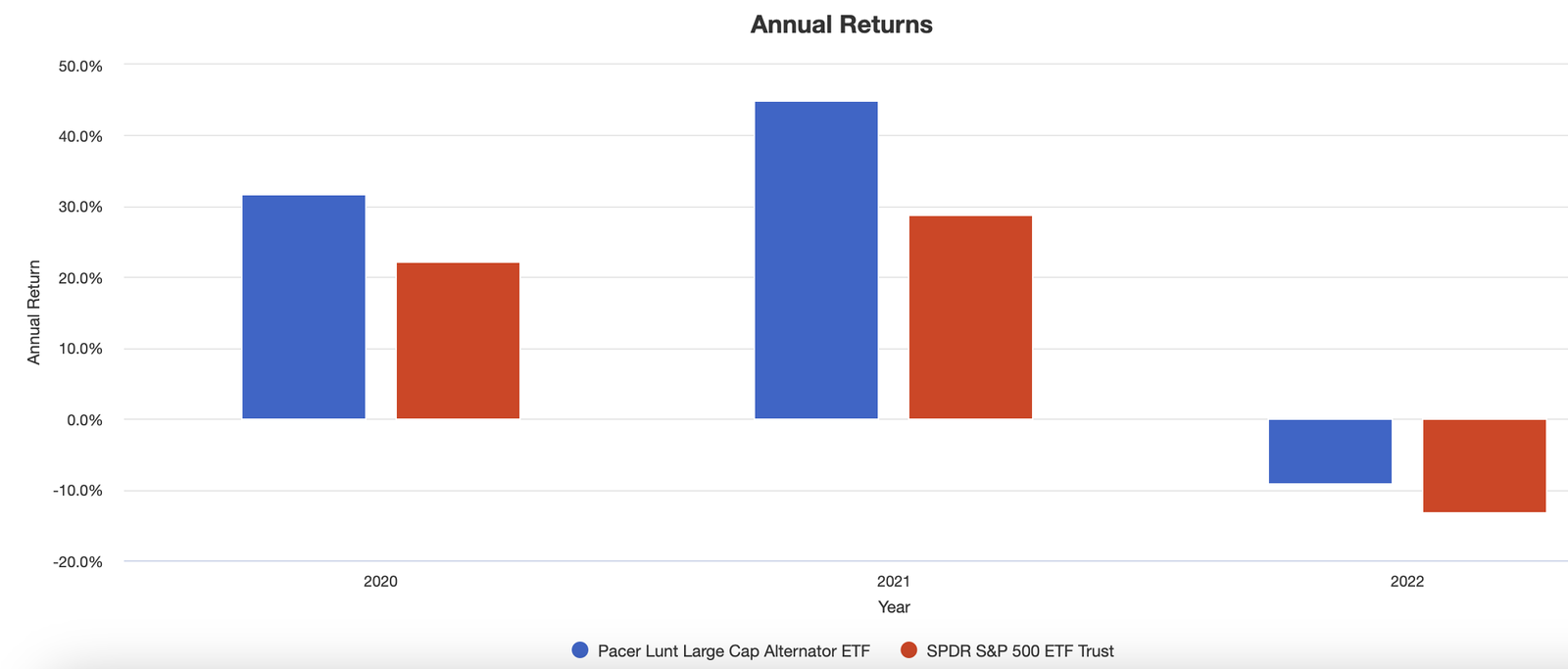

Here we’re able to see Pacer Lunt Large Cap Alternator ETF outperforming SPY each and every year.

The highs of 2020 and 2021 and the lows of 2022.

Relatively better across the board.

I think I’m most impressed with ALTL ETF in terms of its ability to manage drawdowns better than SPY ETF since inception.

That means it has been able to successfully transition from high beta stocks to low volatility equities in a timely enough manner to defend against drawdowns.

Pacer Lunt Large Cap Alternator ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index.

The Index is based on a proprietary methodology developed by Lunt Capital Management, Inc. (“Lunt Capital” or the “Index Provider”).

The Index The Index uses an objective, rules-based methodology to provide exposure to large-capitalization U.S. companies.

The Index uses Lunt Capital’s proprietary relative strength methodology to rotate between the holdings of one of two subindices, the S&P 500 Low Volatility Index and the S&P 500 High Beta Index (each, a “Sub-Index,” and together, the “Sub-Indices”), that seek to identify the 100 components of the S&P 500 Index that most strongly exhibit a particular trait (e.g., low volatility or high beta). Each Sub-Index is composed of the 100 securities comprising the S&P 500 Index that most strongly exhibit the characteristic screened for by the Sub-Index.

The S&P 500 is a free-float weighted index that measures the performance of the large-cap segment of the U.S. equity market.

The S&P 500 includes approximately 500 leading companies and captures approximately 80% of the U.S. market capitalization.

Accordingly, each Sub-Index is composed of large-capitalization equity securities. S&P Opco LLC (a subsidiary of S&P Dow Jones Indices, LLC) compiles, maintains, and calculates the S&P 500 Index and the Sub-Indices.

The S&P 500 Low Volatility Index is composed of the 100 securities comprising the S&P 500 Index that have exhibited the lowest realized volatility over the prior 12 months.

Each stock comprising the S&P 500 Low Volatility Index is weighted by the inverse of its volatility with the least volatile stocks receiving the highest weights.

Volatility is a statistical measurement of the magnitude of price fluctuations in a stock’s price over time.

The S&P 500 High Beta Index is composed of the 100 securities comprising the S&P 500 Index that have exhibited the highest sensitivity to market movements, or “beta,” over the prior 12 months.

The weight of each stock in the S&P 500 High Beta Index is proportionate to its beta, rather than to its market capitalization.

Beta is a measure of relative risk and is the rate of change of a security’s price.

The Index utilizes Lunt Capital’s proprietary relative strength analysis in its attempt to determine which Sub-Index is likely to exhibit better price performance than the other Sub-Index.

Pursuant to this methodology, the Index Provider calculates the “Risk Adjusted Score” for each Sub-Index.

Each Sub-Index’s “Risk-Adjusted Score” is calculated using the Sub-Index’s standard deviation of returns over the prior 12 months.

On the final trading day of each month, the Index Provider computes the relative strength of each Sub-Index by comparing each Sub-Index’s Risk-Adjusted Score.

The Index Provider considers the Sub-Index with the higher Risk-Adjusted Score to have the higher relative strength.

The Index is composed of the securities comprising the Sub-Index demonstrating the greater relative strength.

The Index is reconstituted and rebalanced monthly, except when the Index methodology would not result in a change in the Sub-Index comprising the Index at such time.

The Fund’s Investment Strategy Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of large cap companies.

The Fund considers a a company to be a “large cap company” at the time of purchase if it was included in the S&P 500 at any time within the prior 12 months.

The Fund’s investment adviser expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better.

The Fund will generally use a “replication” strategy to achieve its investment objective, meaning it will invest in all of the component securities of the Index.

The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund.”

ALTL ETF Pros and Cons

Let’s examine the pros and cons of Pacer Lunt Large Cap Alternator ETF.

ALTL ETF Pros

- Instead of being tribal and trying to pick sides ALTL tries to capture the best of both High Beta and Low Volatility strategies

- On the flip side it tries to eliminate the negative aspects of both High Beta and Low Volatility strategies by jumping ship (alternating) when necessary

- Performance since inception that indicates that strategy has the potential to effectively rotate between high beta and low volatility indexes expertly

- A rules based methodology of long-term trend signals (12 month look-back) to determine which factor to select for the current month based upon standard deviation of returns

- The potential to replace SPY entirely or have it as a diversifying wingman in your portfolio

- A strategy that could prevent FOMO based investing given the participation in high beta stocks when markets are roaring and low volatility equities when things are more tumultuous

- A very reasonable management fee of 0.60 for such a sophisticated strategy

- Chance to support an innovative fund provider in Pacer

ALTL ETF Cons

- The potential to be caught with the wrong factor during sharp market downward trends or upward movements (given that rotations are only made monthly)

- The potential for tracking error with the S&P 500 in the future if trends are not clear and the wrong strategy is being chosen (more often than not on a monthly basis) in hindsight

ALTL ETF Potential Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

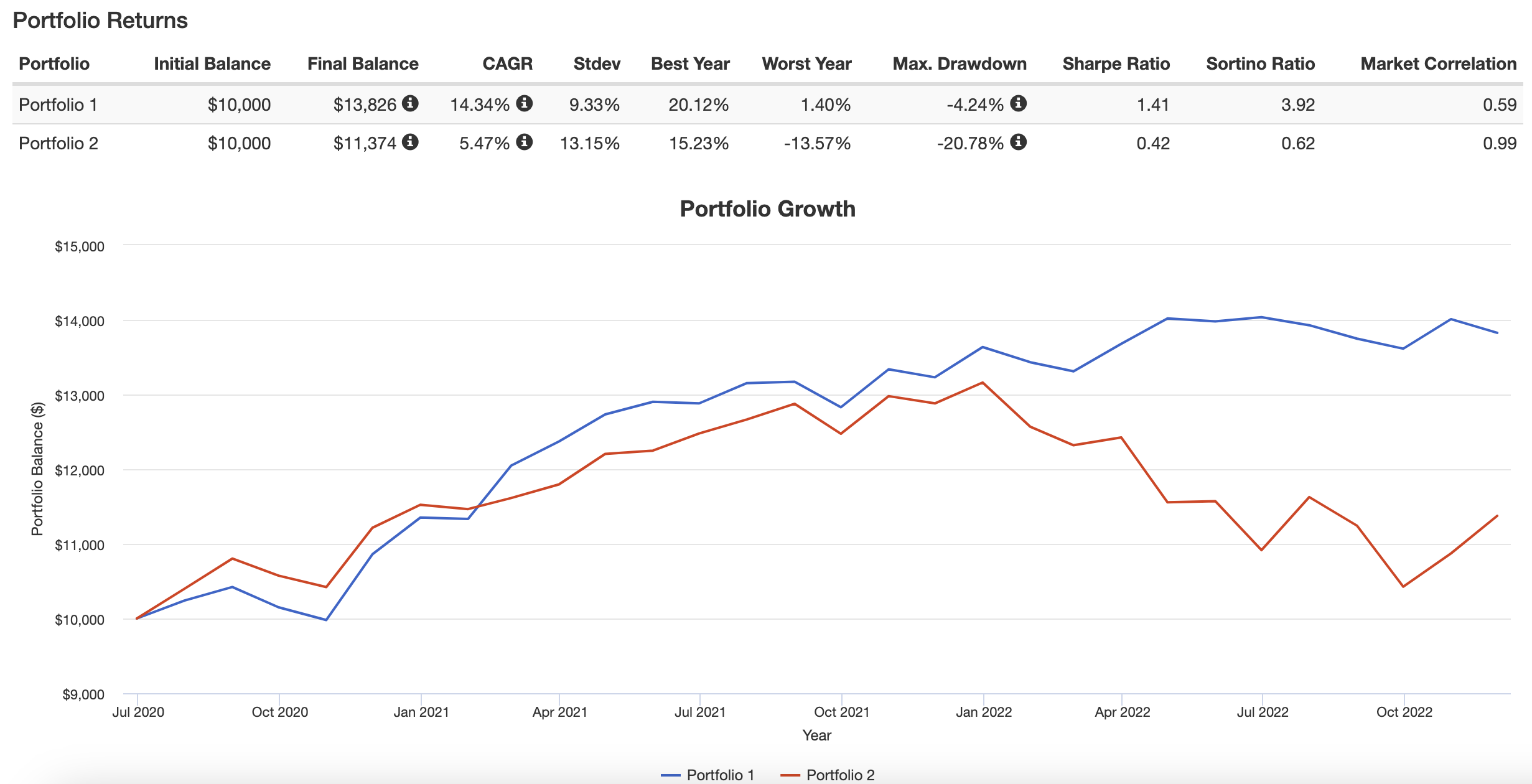

Since ALTL ETF has the ability to adapt it makes sense to build a portfolio around different adaptive strategies with moving parts that have low correlation with each other.

30% ALTL

30% TRND

30% DBMF

10% BTAL

Going back as far as we can our ALTL ETF and Friends Portfolio obliterates the 60/40 Portfolio in every regard.

CAGR.

Stdev.

Max Drawdown.

Sharpe Ratio.

It’s a convincing win over an admittedly small sample size.

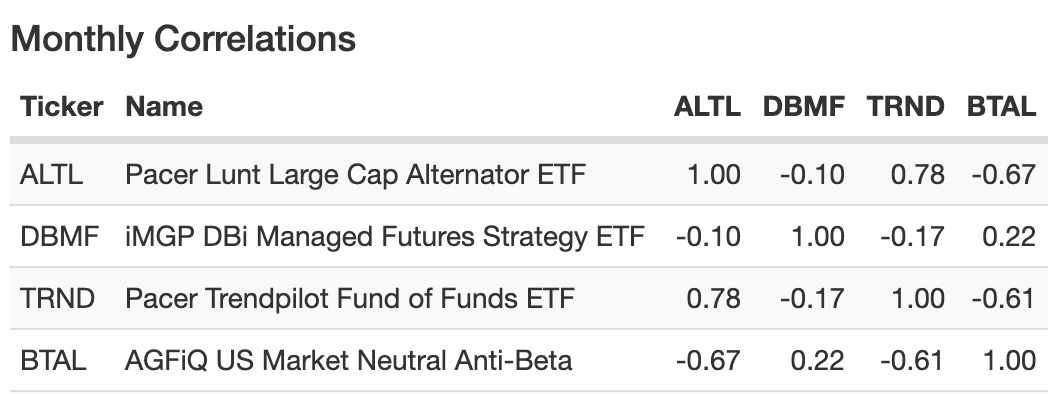

Monthly Correlations ALTL vs Other Strategies

Here we notice low correlations between the strategies which is exactly what we want at the end of the day.

Nomadic Samuel Final Thoughts

I’m left pondering whether or not ALTL ETF is a Juggernaut that has been designed to slay the S&P 500 index under every economic regime or if it is just a fortunate sequence of returns for the fund?

I suppose only time will tell.

But I have to admit I’m most impressed with the fund’s ability to outperform and defend during what has been turbulent market conditions.

Now over to you.

What do you think of ALTL ETF?

Is it on your radar?

Let me know in the comments below.

That’s all I’ve got.

Ciao for now.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.