Many savvy investors are becoming informed of the importance of alternative investments as a way to efficiently diversify, stabilize and potentially enhance portfolio returns.

However, the issue of ‘exactly what’ alternative investments to pursue has long kept investors from picking a specific strategy and/or asset class towards committing to a dedicated alternative sleeve in the portfolio.

The Canadian ETF marketplace has been in the past sorely lacking a truly diversified alternative multi-strategy asset allocation ETF that provides Canadian investors reprieve from the typical milquetoast 80/20, 60/40, 40/60, 20/80 offerings (which are all too plentiful).

Enter the room ONEC.TO ETF.

Accelerate OneChoice Alternative Portfolio | ONEC.TO ETF Review

Accelerate OneChoice Alternative Portfolio ETF (ticker ONEC.TO) is an alternative fund of funds that attempts to turn the screws on ‘typical diversification’ and instead offers investors a multi-asset class and multi-strategy approach to alternatives such as global macro, merger arbitrage, bitcoin, gold and reits just to name a few.

Does this alternative asset class ETF provide the type of diversification needed to shake the shackles of a portfolio composed of merely market-cap weighted equities and aggregate bonds?

Let’s find out.

Hey guys! Here is the part where I mention I’m a travel blogger! This blog post (ETF review) is entirely for entertainment purposes only. Do your own due diligence and research. Consult with a financial advisor.

Seriously, I’m a travel blogger not a financial professional, so take what I say with a grain of salt; okay? Cheers!

Accelerate OneChoice ETF Overview, Holdings and Info

The investment case for “Accelerate OneChoice ETF” has been laid out succinctly by the folks over at AQR: (source: fund landing page)

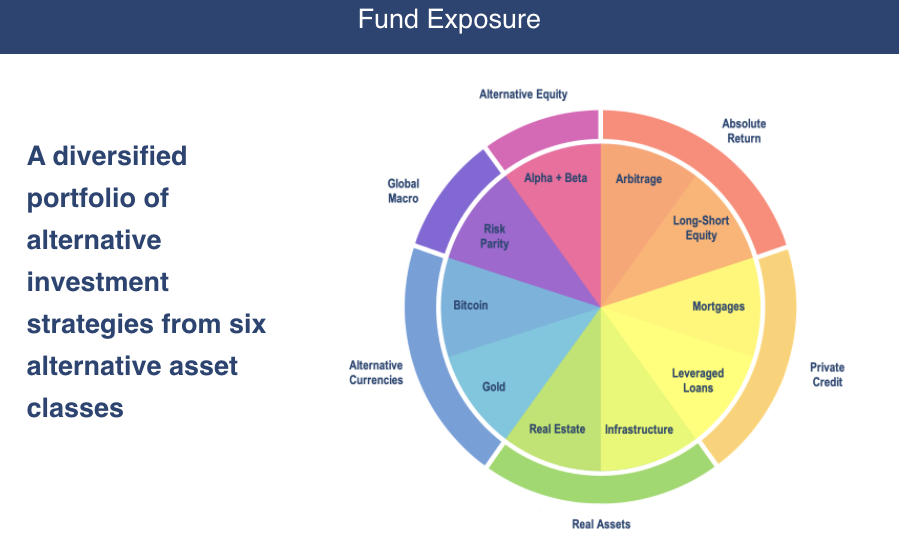

The Accelerate OneChoice Alternative Portfolio ETF (TSX: ONEC) provides investors with a diversified portfolio of uncorrelated assets from six alternative asset classes in one easy-to-use ETF with a management fee of just 0.20%.

OneChoice provides exposure to the following asset classes and alternative strategies:

- Absolute Return: Arbitrage and Long-Short Equity

- Private Credit: Mortgages and Leveraged Loans

- Real assets: Infrastructure and Real Estate

- Alternative Currencies: Gold and Commodities

- Global Macro: Risk Parity

- Alternative Equity: Alpha + Beta

Investment Objectives:

- Diversify client portfolio risk through increased diversification

- Increase efficiency through the automation of portfolio construction, due diligence and implementation

Increase Efficiency

Increase efficiency through the automation of portfolio construction, due diligence and implementation

Decrease Risk

Reduce client portfolio risk through increased diversification

Accelerate OneChoice ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“Accelerate OneChoice Alternative Portfolio ETF seeks to achieve long-term appreciation and a superior risk-adjusted return relative to the Scotiabank Canadian Hedge Fund Index Equal Weighted.

ONEC seeks to outperform the Scotiabank Canadian Hedge Fund Index Equal Weighted over the long term by investing in a diversified portfolio of listed alternative mutual funds, equity securities, derivative securities, and other securities in the alternative investments industry.

In order to achieve its investment objective, ONEC engages in a systematic, long alternative asset allocation investment strategy by investing primarily in long positions of alternative funds that are listed on an exchange or marketplace in Canada.

Security selection of the long portfolio is driven by an asset allocation approach, driven by a standard deviation target of 6-12%.

The Portfolio Manager applies its proprietary asset allocation model to the North American listed alternative fund market and selects the long portfolio to attain its target standard deviation of 6-12%.

ONEC is expected to have an approximately 100% exposure to the long portfolio.

While engaging in its investment strategy, ONEC may, at and from inception, invest directly in equity securities, derivative securities, and other securities in the alternative markets (collectively, “Permitted Investments”), also invest in long positions of funds managed by third-party managers, future funds managed by the Manager, if and when formed, and the following funds currently managed by the Manager: ARB, HDGE and ATSX.

See above for the investment strategies of ARB, HDGE and ATSX.

See “Fees and Expenses” for information regarding the additional management and/or performance fees of the Underlying Funds (as defined below).

ONEC may, in compliance with NI 81-102, lend securities to securities borrowers acceptable to it.

Currently, it is not expected that ONEC will engage in securities lending transactions.

ONEC may also hold cash and cash equivalents.

For purposes of a merger, termination or other transaction, ONEC may hold all or a portion of its assets in cash or money market.”

Alternative Investment Strategies

Let’s start off with a list of alternative strategies investors can potentially pursue:

List of Alternatives

- Private Equity

- Gold

- Commodities

- Managed Futures

- Crypto Currency

- Global Macro

- CTA

- Market Neutral Equities

- Active Extension Equities 130/30

- NFTs

- Art, Wine, Collectibles

- REITs

- Real Assets

- Merger Arbitrage

- Special Situations

- Hedge Funds

- Derivatives Contracts

- Long-Short Equities

- Private Debt

- Long-Short Bonds

Why Consider Alternative Investments?

Why even pursue alternative investments in the first place? Why not just be satisfied with being globally diversified in large-cap centric equity indexes?

Uncorrelated assets.

Uncorrelated assets are the ‘secret sauce’ for building a portfolio that is all-weather.

An all-weather portfolio is what is needed to sail through all the seasons (potential economic regimes) that you’ll experience as a long-term investor.

If you own the typical ‘diversified portfolio’ you’re concentrating all of your risk in only a few different ways.

A 60/40 portfolio composed of market-cap weighted stocks and aggregate bonds may be geographically diversified by owning US, Canadian, EAFE and Emerging markets stocks.

However, its entire equity strategy is large-cap centric and market-cap weighted.

You’re only pursuing one asset class (large cap) and only one equity strategy (market-cap weighted) amid a myriad of potential combinations.

Thinking Differently About Diversification

My research has included a deep-dive into the lost decade of the 2000s for those pursuing ONLY this type of strategy: holding a large percent of their portfolio in large cap stocks.

I’ve also highlighted how all of the equity factor strategies handily defeat market-cap weighted indexes over extended periods of time.

However, what changed my mind permanently about the importance of an alternative sleeve in the portfolio, was my research geared towards building my own Picture Perfect Portfolio.

In backtests, it was the uncorrelated alternatives I used in this creation (gold and trend-following) that smoothed out returns in the early 2000s, allowed for a positive 2008 and continued to provide support in the 2010s.

Without alternatives your only relationship between your portfolio is between traditionally uncorrelated stocks and bonds.

But what if one of those asset classes struggles for a decade or becomes more correlated over time?

The only solution is to diversify. And by diversification I don’t mean more stocks and bond optimization (although that is good place to start) but instead I’m talking about carving out an alternative sleeve in the portfolio.

Let’s Explore ONEC.TO ETF Review

Accelerate OneChoice Alternative Asset Allocation ETF attempts to provide investors with in demand uncorrelated asset classes and strategies to enhance overall portfolio diversification.

Its extended octopus approach (gaining 2 extra tentacles) keys in on ten different alternative investment strategies under the umbrella of six different alternative asset classes:

10 Alternative Strategies

1࣭: Absolute Return: Arbitrage and Long-Short Equity

2: Private Credit: Mortgages and Leveraged Loans ࣭

3: Real assets: Infrastructure and Real Estate ࣭

4: Alternative Currencies: Gold and Bitcoin ࣭

5: Global Macro: Risk Parity ࣭

6: Alternative Equity: Alpha + Beta

Here is a look at exactly what is under the hood in terms of underlying holdings: (as of March, 2022)

Fund Holdings

| Holdings | Weight |

| iShares Global Real Estate Index ETF | 10.2% |

| Accelerate Enhanced Canadian Benchmark Fund | 10.2% |

| Accelerate Carbon-Negative Bitcoin ETF | 10.1% |

| Accelerate Arbitrage Fund | 10.0% |

| SPDR® Gold Shares | 9.8% |

| SPDR® Blackstone / GSO Senior Loan ETF | 9.7% |

| Accelerate Absolute Return Hedge Fund | 9.7% |

| RPAR Risk Parity ETF | 9.5% |

| BMO Global Infrastructure Index ETF | 5.3% |

| FlexShares STOXX® Global Broad Infra Index Fund | 5.1% |

| BMO Canadian MBS Index ETF | 4.8% |

| iShares MBS ETF | 4.7% |

This is a true fund of funds. No particular holding is above the 10%+ level and the smallest averages out around the 5% mark.

40% of ONEC.TO is made up of underlying Accelerate funds including Accelerate Enhanced Canadian Benchmark Fund, Accelerate Carbon-Negative Bitcoin ETF, Accelerate Arbitrage Fund and Accelerate Absolute Return Hedge Fund.

The remaining 60% includes mostly global solutions from BMO, iShares, FlexShares, Evoke and SPDR.

Let’s now turn our attention towards analyzing the 10 different strategies in the fund.

10 Alternative Strategies of ONEC.TO

- Global Real Estate – Globally diversified Real Estate Investment Trusts which diversifies equity exposure and provides attractive long-term dividend and capital appreciation opportunities. REITs tend to perform optimally during periods of rising long-term interest rates. In terms of portfolio diversification, REITs are less correlated to the broad equity markets, and provided positive returns in the Dot Com Bubble era when many other equity asset classes were struggling.

- Global Infrastructure – Global infrastructure is a form of equity investment that keys in on ‘real assets’ such as energy, bridges, buildings, roads, highways, utilities and sewage systems. Investing in infrastructure stocks is a powerful way to diversify a portfolio, generate income and protect against inflation.

- Global Risk Parity – I thoroughly covered a risk parity ETF UPAR as one of my initial reviews. Risk parity is a strategy of diversifying between equities, bonds and alternatives in a way where allocation depends on the overall risk profile of the asset. For instance, equities and gold take up a smaller part of the portfolio than bonds and tips given they’re more volatile assets (have higher standard deviation). Risk parity investing is a powerful all-weather diversification tool that manages risk while offering alternatives such as gold and tips to protect against stagflation economic regimes.

- Gold -Gold is maybe the most well known and popular alternative investment. As an uncorrelated asset class to both stocks and bonds it has outperformed US large cap equities in the 21st century. Furthermore, gold has proven to be a safe haven during turbulent times in the stock market such as the 70s and 2000s.

- Cryptocurrency (Bitcoin) – For those curious about investing in cryptocurrency, but not yet willing to pull the trigger on a dedicated fund, a small allocation (roughly 10%) of this portfolio contains explose to CME bitcoin futures. Equally parts volatile and uncorrelated to traditional assets, exposure to bitcoin offers investors a true wildcard in the portfolio.

- Spac and Merger Arbitrage – Spac and Merger Arbitrage is a low volatility investment strategy that seeks to capitalize on the merger premium (spread between the acquisition price and the trading price of a stock). Spac arbitrage seeks specifically to acquire shares or units of a special purpose acquisition company at or below its net asset value. Merger Arbitrage strategy seeks the ‘merger premium’ of compensating an investor for the risk of an acquisition failing to close.

- Mortgage Backed Securities – As an alternative fixed income strategy, Mortgage Backed Securities are in essence a bundle of home loans bought from banks that issued them. As a diversification tool in the portfolio, this strategy historically offers higher yielding returns than treasuries with higher risk adjusted returns.

- Enhanced Long-Short Equity – A long/short equity strategy that seeks to outperform its benchmark by going 130/30 or 140/40. The long portion of the equity exposure keys in on attractive stocks from a fundamental and factor based lens. Meanwhile, it shorts stocks that offer relatively unattractive fundamentals and factor exposure.

- Absolute Return Hedge Fund Strategy – A hedge fund style of long/short equity that invests long in stocks with attractive multi-factor characteristics (quality, momentum, value) while shorting stocks that have unfavourable factor profiles. Hedging seeks to provide portfolios with an uncorrelated return stream that can perform in all market regimes.

- Leveraged Loans (GSO Senior Loan) – A senior loan is essentially a corporate loan repackaged into a bundle of corporate loans that are then sold to investors. These loans take priority over debt obligations offering payment before other creditors and preferred stockholders. Due to increased volatility and risk, Seniors loans typically offer higher yields than investment-grade corporate bonds. (source: Investopedia.com)

ONEC.TO ETF Pros and Cons

Pros

- Exposure to alternative investments in a multi-fund, multi-strategy and multi-asset class all in one fund format

- Providing diversified and unique alternative investment streams uncorrelated with both market-cap indexed stocks and aggregate bonds

- A potential single fund solution for an alternative sleeve in the portfolio vs a complicated mix and mash of funds

- Attractive management fee of 0.20% (typically lower than other alternative funds in Canada)

- Exposure to asset classes and strategies, such as cryptocurrency, in a small manner that attracts investors otherwise not willing to own a dedicated fund to that particular strategy

- Ability to enhance risk adjusted returns (Sharpe and Sortino ratios) in a portfolio by having stocks + bonds + alternatives

- Opportunity to turn a portfolio of merely stocks and bonds into an all-weather solution by including exposure to asset classes that can potentially perform well when markets are down

- Pull and drag of different elements performing well (or underperforming) with 10 different strategies ensures overall stability within the portfolio and limits highs/lows

Cons

- Orthodox investors or those with strong opinions about cryptocurrency may dismiss this fund even though it only has a 10% allocation to the strategy

- The potential for previously uncorrelated assets to become more correlated reducing the diversification benefit of the fund

- Tracking error. At times alternatives will underperform broad market stock and bond combinations. The temptation for investors to succumb to recency bias and want to chase what is recently performing well is forever an issue.

How Does ONEC.TO Fit Into A Portfolio?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Core Portfolio Holding?

Accelerate OneChoice Alternative Portfolio offers investors some unique mix and match opportunities with traditional investments. One particular strategy would be turning a 60/40 portfolio of market-cap weighted stocks and aggregate bonds into a 50/30/20 portfolio consisting of 50% stocks, 30% bonds and 20% alternatives. For Canadian investors interested in such a strategy a two fund solution would provide all of the diversification needed to pull it off.

80% ZBAL.TO (All-in-one stocks and bonds)

20% ONEC.TO (All-in one alternative investments)

Multi-Factor investors interested in optimized equities (value, momentum, quality, size and minimum volatility) and bonds could consider a 7 fund portfolio representing the same 50/30/20 configuration:

Equities:

10% VVL.TO (Global Value)

10% VMO.TO (Global Momentum)

10% ZGQ.TO (Global Quality)

10% PZW.TO (Global Small-Mid-Cap)

10% XMW.TO (Global Min Vol)

Bonds:

30% MGAB.TO (Global Multi-Fund + Multi-Strategy Bonds)

Alternatives:

20% ONEC.TO (All In One Alternatives)

However much an investor decides to allocate to ONEC.TO would depend on how strongly they believed in alternative investments.

There could be certain investors who would want to go well above 20% and others that would want allocation to be below 20%.

Partial Portfolio Holding?

Investors shy but curious about alternatives could consider a small 5 or 10% allocation. One idea would be to take an all-in-one fund 60/40 fund and pair it with a small allocation to ONEC.TO

90% All in One (ZBAL.TO) + 10% ONEC.TO

or

95% All in One (ZBAL.TO) + 5% ONEC.TO

Nomadic Samuel Final Thoughts

It should come as no surprise that I’m a huge fan of ONEC.TO.

As an investor who has studied the benefits of alternative investments, I am convinced in terms of their diversification benefit, risk management capabilities and overall ability to enhance portfolio returns.

ONEC.TO represents a low-cost all-in-one solution where I can gain access to 10 different alternative strategies to provide massive diversification to my optimized core equity and bond holdings.

Disclosure: I own a rather complicated portfolio but ONEC.TO represents one of my top 5 holdings.

If you’re interested in learning more about this particular strategy check out this video from its founder Julian Klymochko of Accelerate Shares below:

What do you think of alternative investments? Are they are part of your portfolio?

What are you opinions of the fund ONEC.TO?

Please let me know in the comments below.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.