Is it possible to create an all-weather portfolio solution, which has the capacity to thrive given any economic curveball thrown its way, that doesn’t include a fixed long-only allocation to bonds?

That kind of sounds insane, no? Aren’t bonds a bastion of defensive fortitude when markets are clearly under siege?

Have you been paying attention to what is going on lately?

Stocks AND Bonds down together.

What if there was an alternative solution to all of this?

Enter Standpoint Multi-Asset Fund (Ticker: BLNDX – REMIX).

Standpoint thinks differently about diversification, asset allocation and all-weather investing than classic all-weather and/or risk-parity solutions.

Instead of being overweight bonds relative to stocks, it utilizes an active managed futures trend-following system of going long, short and/or flat 75 liquid markets including the following:

Domestic and International Equities

Grains, Meats, and Soft Commodities

Metals and Energy

Global Currencies

International Bonds and Interest Rates

U.S. Treasuries and Investment Grade Fixed Income

Interesting enough.

But does this style of investing provide investors with all-weather protection when markets are down and inflation is running rampant?

That’s what we’re going to explore in this REMIX – BLNDX review.

source: The Meb Faber Show on YouTube

Standpoint Multi-Asset Fund (REMIX) | BLNDX Mutual Fund Review

Hey guys! Here is the part where I mention I’m a travel vlogger! This Mutual Fund review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Standpoint Multi-Asset Fund Holdings & Info

Alrighty then, let’s pop open the hood of the Standpoint Multi-Asset Fund to see what kind of goodies we can find inside.

REMIX / BLNDX utilizes an expanded canvas format, to manage performance and volatility, stretching the portfolio from 100% while seeking roughly an exposure of 50% Global Developed Equities and 100% Trend-Following across commodities, currencies, fixed income and equities.

Its long Equity strategy consists specifically of market-cap weighted indexes composed of low cost ETF funds from the US and other International Developed countries (basically Canada + EAFE) for a globally diversified combination of stocks.

Utilizing Morningstar third party screener I notice funds such as the following: (to name just a few)

SPDR® Port S&P 1500 Comps Stk Mkt ETF

Vanguard Total Stock Market ETF

Vanguard FTSE Developed Markets ETF

Schwab International Equity ETF™

Avoiding home country bias by not having a US only equity strategy is clearly a bonus for investors seeking increased diversification.

The trend-following component of the fund is exposed to an expansive global investment universe of the following categories:

Agricultural Commodities

Industrial Commodities

Currencies

Fixed Income

Equities

Standpoint Multi-Asset Fund Overview, Holdings and Info

The investment case for “Standpoint Multi-Asset Fund” has been laid out succinctly by the folks over at Standpoint Funds: (source: fund landing page)

FUND OVERVIEW

“The Standpoint Multi-Asset Fund diversifies across geographic regions, asset classes, and investment styles, using an all-weather approach with the goal of improving portfolio performance by seeking uncorrelated returns, minimizing declines, and adding global diversification.”

FUND CHARACTERISTICS

- Capacity to invest in over 75 of the most liquid markets

- Ability to go long or short certain markets and assets

- Minimize taxes and trading costs

- Exposure to markets in over 25 different countries

DIVERSIFICATION ACROSS 10+ SECTORS

- Domestic and International Equities

- Grains, Meats, and Soft Commodities

- Metals and Energy

- Global Currencies

- International Bonds and Interest Rates

- U.S. Treasuries and Investment Grade Fixed Income

Standpoint Multi-Asset Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus. (source: summary prospectus)

The Adviser pursues these returns by allocating the Fund’s assets using an “All-Weather” strategy.”

All Weather Strategy:

“The All-Weather strategy is an asset allocation methodology that diversifies across geographic regions, asset classes, and investment styles.

The strategy holds long positions in equity ETFs such that exposures resemble those of a global market-cap weighted index of developed markets, such as the U.S., U.K., Germany, Japan, and Singapore.

The Adviser typically selects broad-based regional equity ETFs that the Adviser believes will produce positive absolute returns.

The strategy also invests in exchange traded futures contracts from seven sectors: equity indexes, currencies, interest rates, metals, grains, soft commodities, and energies.

The contracts are positioned either long or short.

The Fund not only may invest in this strategy directly, but may also invest indirectly through its Subsidiary (as described below).

The strategy is designed to participate in medium-term and long-term trends in global futures markets and to produce a reasonable return premium in exchange for assuming risk.

The Adviser identifies global futures contracts to be considered for the Fund’s portfolio on a daily basis through analysis of futures prices, volume, open interest, and term structure data.

The strategy emphasizes durability, scalability and diversification across sectors and countries.

Futures contracts are typically exchange traded contracts that call for the future delivery of an asset at a certain price and date, or cash settlement of the terms of the contract.

Generally, a “long” position in a futures contract is expected to provide a positive return if the price of the underlying instrument or reference obligation increases and a negative return if the price of the underlying instrument or reference obligation decreases.

Conversely, a “short” position in a futures contract is expected to provide a positive return when the price of the underlying instrument or obligation decreases and a negative return if the price of the underlying instrument or reference obligation increases.

If the Fund holds both long and short futures positions in the same underlying instrument or reference obligation, the Fund may experience an overall loss with respect to its investments in that instrument or obligation if losses on one position (long or short) exceed the gains on the other position (long or short).

The Fund will be required to use a portion of its assets as margin for the Fund’s futures positions.

Assets of the Fund not invested in ETFs or futures contracts (or used as margin) will generally be invested in liquid instruments, such as cash, money market instruments, and U.S. government securities including U.S. treasury bills or notes.

The Fund may hold liquid instruments during periods when the Fund is already invested in ETFs and futures positions to the extent dictated by its investment strategy or when the Fund is not invested in futures positions.

As a result, a substantial portion of the Fund’s portfolio may be invested in instruments other than ETFs or futures contracts.

The Fund may invest up to 25% of its total assets (measured at the time of purchase) in a wholly-owned and controlled Cayman Islands subsidiary (the “Subsidiary”).

The Subsidiary is advised by the Adviser, and has the same investment objective as the Fund. Unlike the Fund, however, the Subsidiary may invest to a greater extent in commodity-linked derivative instruments.

The Subsidiary’s investments in such instruments are subject to limits on leverage imposed by the Investment Company Act of 1940 (the “1940 Act”), when viewed on a consolidated basis with the Fund.

Additionally, the Subsidiary, when viewed on a consolidated basis with the Fund, complies with 1940 Act Sections 8 and 18 (regarding investment policies, capital structure and leverage), Section 15 (regarding investment advisory contracts) and Section 17 (regarding affiliated transactions and custody).

The Fund’s investment in the Subsidiary is expected to provide the Fund with an effective means of obtaining exposure to the investment returns of global commodities markets within the limitations of the federal tax requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund and the Subsidiary are “commodity pools” under the U.S. Commodity Exchange Act, and the Adviser is a “commodity pool operator” registered with and regulated by the Commodity Futures Trading Commission (“CFTC”).

As a result, additional CFTC-mandated disclosure, reporting and record keeping obligations apply with respect to the Fund and the Subsidiary.”

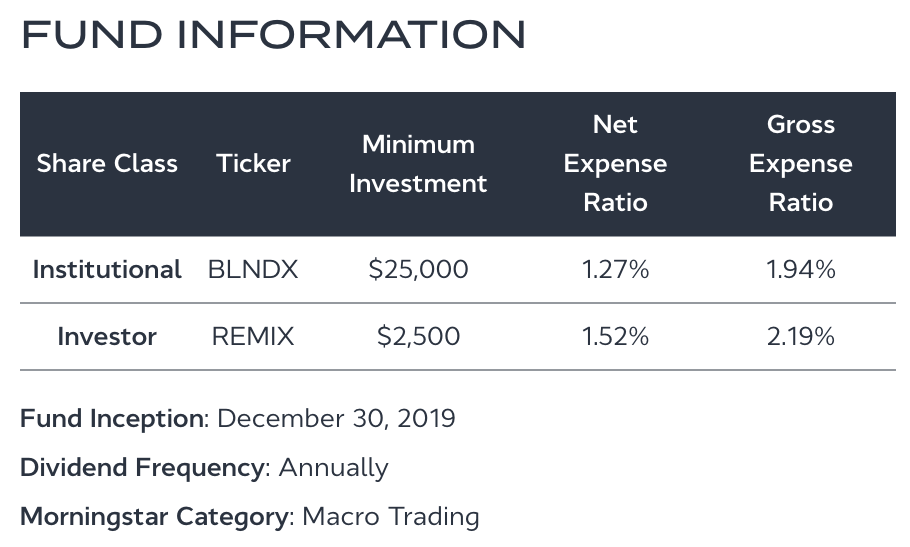

And now let’s look at differences between the tickers BLNDX and REMIX along with the associated Net Expense Ratios and Gross Expense Ratios.”

The funds inception date was on December 30th, 2019 which for me is exciting because we’ll have an opportunity to examine its performance during the brutal March 2020 pandemic drawdown for equities.

Standpoint Multi-Asset Fund is split clearly by code BLNDX for institutional share class investors committing a minimum of $25,000 to the fund versus investor share class REMIX which requires an initial commitment of $2,500.

You’ll notice the net expense ratio and gross expense ratio is lower for institutional class versus investor class at NER 1.52% vs 1.27% and GER 1.94% vs 2.19%.

BLNDX / REMIX Performance

Here is where things get really interesting.

Standpoint Multi-Asset Fund launched at the most auspicious moment to test its all-weather capabilities.

Firstly, it was just in time to receive the meltdown of the pandemic in March 2020 and a little over a year later the challenging start to 2022 where equities and bonds have been getting skewered together on the same shishkebab.

In order to examine things closely, we’ll compare how BLNDX / REMIX did relative to fellow expanded canvas fund SWAN and milquetoast 60/40 VBIAX.

I’ve chosen SWAN as it has been designed to weather storms while delivering enhanced performance given its 70/90 equities to bonds ratio.

And the milquetoast portfolio has been added into the mix just to compare an all-weather fund versus vanilla industry standard.

Big Picture Performance

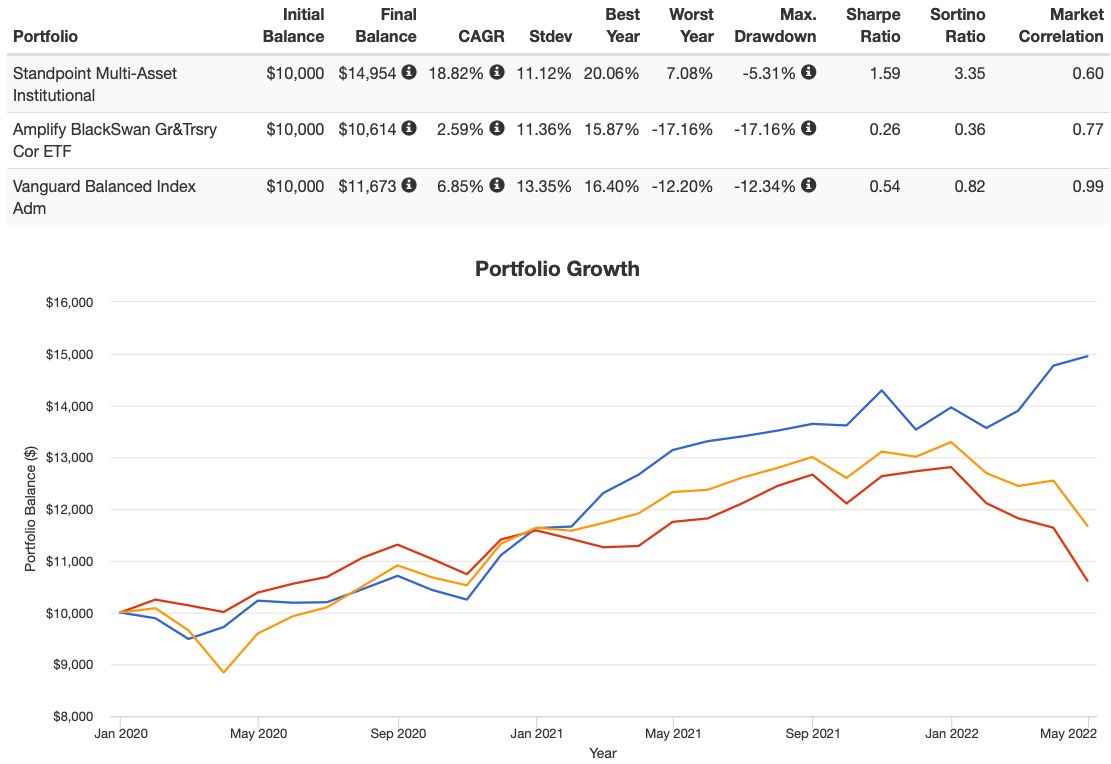

Let’s start with the biggest picture available to us.

How has Standpoint Multi-Asset performed relative to SWAN and Milquetoast 60/40?

Total blowout.

BLNDX / REMIX has crushed both SWAN and 60/40 in ways that really need to be more closely examined.

Firstly, a convincing CAGR flamethrower session of relative outperformance with results of 18.82% versus 2.59% for SWAN and 6.85% for 60/40.

Secondly, a Sharpe Ratio, Sortino Ratio, max drawdown and worst year triumph masterclass adding even greater insult to injury:

Ouch.

SWAN and VBIAX are indeed walking wounded.

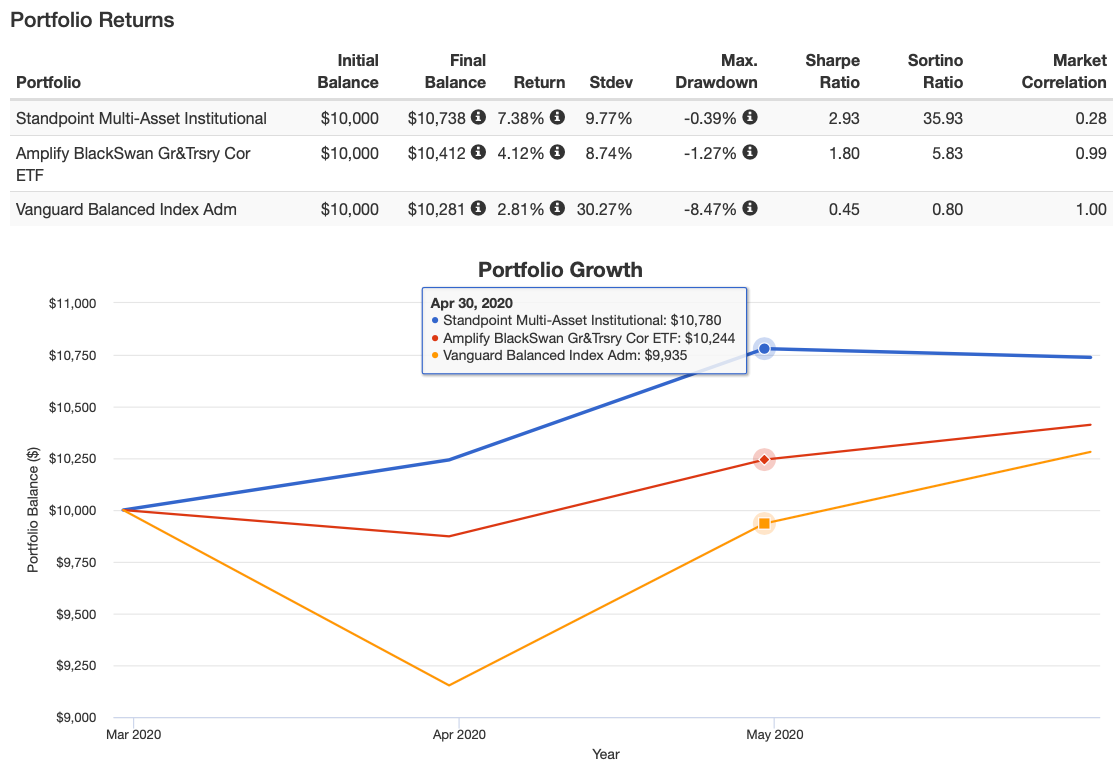

March 2020 Performance

Standpoint Multi-Asset was without a doubt the most all-weather of the three portfolios during the Pandemic market meltdown.

It actually had a positive March whereas Swan defended admirably (yet still negative) whereas Milquetoast 60/40 got caught with its pants down.

Consider the standard deviation and max drawdown between the three portfolios just to see how relatively bad 60/40 did compared to both Standpoint and SWAN.

Here you can clearly see a demonstration of Standpoint and SWAN providing all-weather defensive coverage during a time of market turbulence; however Standpoint kept you above water whereas SWAN did not.

A convincing win for Standpoint Multi-Asset fund.

A feather in its all-weather cap.

2022: The Good, The Bad and The Ugly

Did you know there was a remake of the Good the Bad and the Ugly in 2022?

The 1966 spaghetti western starring Clint Eastwood now has three new actors all in debuting roles.

The Good. Standpoint Multi-Asset Fund

The Bad. Milquetoast 60/40

The Ugly. SWAN.

If the results of early 2022 doesn’t make investors pause and carefully reconsider whether or not a 60/40 portfolio is adequately prepared to handle all economic regimes, I’m not sure what will.

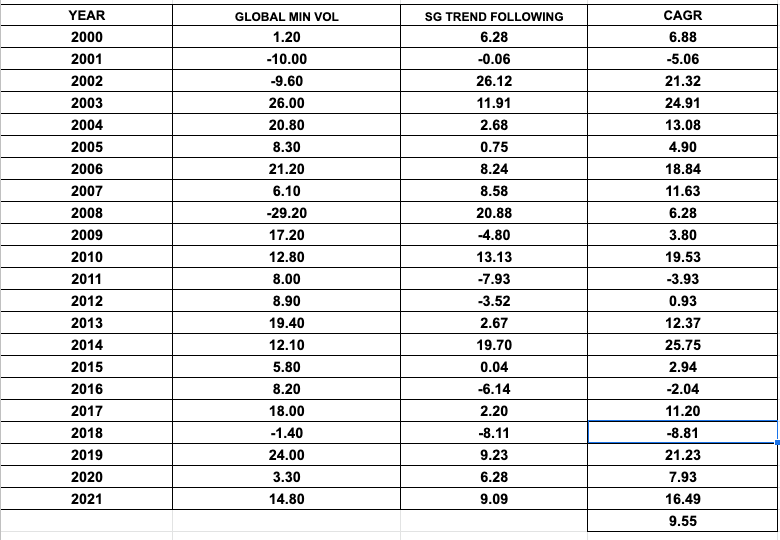

Potential BLNDX Long-Term Performance

I have readily available data for Global Minimum volatility equities and SG Trend. So just for fun I plugged those in and these are the results for 22 years with equities at 50% and Trend at 100%.

Not too shabby at all.

Not only does the strategy have the potential to deliver strong long-term results but it also delivers all-weather performance having 18/22 positive years and a worst year of only -8.81%.

The chances of having a potential 9-10% CAGR long-term performance and worst-case scenario of a negative single digit annual drawdown is something a 60/40 portfolio falls short of in both regards.

Trend-Following as Powerful Diversifier

Before you decide whether or not trend-following has a place in your portfolio I encourage you to watch the Blind Taste Test video.

Source: Standpoint on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Which which did you choose First? Second? Third?

I’m not going to spend too much time discussing the potential benefits of trend-following given this is a fund review; however, I will present an abbreviate case as to why this ‘alternative sleeve strategy’ might be worth considering.

Firstly, trend-following is uncorrelated with both stocks and bonds. It’s a potent diversifier.

Secondly, it (unlike long only strategies for stocks/bonds) has the ability to adapt given current market conditions.

It doesn’t fight reality. It instead welcomes it.

It’s a chameleon of sorts.

When there are clearly strong trends in the market, such as when stocks and bonds are tanking and commodities are thriving, a trend-following strategy will capture both the long/short of this scenario.

It’ll say ‘yes’ to stocks and bonds being down by going ‘short’ and ‘yes’ to commodities trending up by going ‘long’.

If you’ll afford me the opportunity to rant a little, I believe it is “insane in the membrane” that trend-following is considered an ‘alternative investing‘ style. I wrote an article recently about why trend-following isn’t more popular where I outline some of the potential reasons it hasn’t become more generally accepted.

Given the black or white option of stocks/bond versus stocks/trend-following, I’ll choose trend any day of the week.

REMIX / BLNDX Mutual Fund Review: Pros and Cons

Pros

- A unique alternative asset allocation approach combining equities and trend-following

- Having a portfolio solution that is more prepared for stagflation and economic downturns than a 60/40

- The potential to combine this strategy with other all-weather and risk-parity approaches

- Two completely uncorrelated strategies of stocks “being the best game in town” with the chameleon “adaptable long/short alternative“

- Globally diversified equities and trend-following strategy that eliminates home country bias as a risk factor

- Contrarian approach to investing that thinks about diversification and all-weather investing from a bottoms up approach

- Chance to support a boutique firm doing interesting and unique things as opposed to cozying up with the big guys – the iShares and the Vanguards of the industry

source: RCM Alternatives on YouTube

Cons

- Ultra low fee aficionados may not be thrilled with managements fees over 100 basis points when they’re used to single digit numbers (but trend-following strategies have costs that passive indexing does not have)

- The ability for trend-following to at times disappoint and stymy a decent year for equities in certain given years

- Mutual fund vs ETF format limits its availability to US only investors

BLNDX Total Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Does Standpoint Multi-Asset mutual fund have the potential to be a total portfolio solution?

Yes. I believe it does.

In its favour, as a total portfolio solution, it has proven its all-weather capabilities during both March 2020 and early 2022.

Furthermore, in simulated back-tests I found 18/22 positive years and a hypothetical worst year of <10%.

This matches the back-test success ratio of the Ray Dalio All-Weather Portfolio and Risk-Parity portfolio I wrote about recently.

This is very much a globally diversified all-weather approach to investing and it could be a one and done solution for your portfolio.

100% BLNDX – REMIX

Yeah. I could see the case for that.

source: Mutiny Funds on YouTube

REMIX Model Portfolio Core Holding Ideas

Standpoint Multi-Asset fund pairs really nicely with some other expanded canvas solutions.

If you wanted long bonds in your portfolio you could easily allocate a small amount to TYA to achieve 3X exposure. A 90/10 or 80/20 combination would be ideal:

80 or 90% BLNDX – REMIX

10 or 20% TYA

For those seeking more equity exposure and a bit of bonds could utilize the WisdomTree 90/60 suite of NTSX, NTSI, NTSE with BLNDX – REMIX.

A 50-50 mix would like this:

50% BLNDX – REMIX

25% NTSX

15% NTSI

10% NTSE

I think an even more interesting combination would be to handcuff the Standpoint Multi-Asset fund with UPAR Ultra Risk Parity.

The two funds couldn’t be more strategically different from an all-weather standpoint.

I believe this would present a fascinating ying-yang approach of an all-weather trend-following strategy meets treasury and tips heavy risk-parity.

For a 50-50 approach you’d allocate as follows:

50% BLNDX – REMIX

50% UPAR

source: Excess Returns on YouTube

Standpoint Multi-Asset Fund Partial Portfolio Ideas

For those who are interested in the fund but only as a part of their alternative sleeve a 10% or 20% allocation would pair nicely with a milquetoast 60/40:

80 to 90% 60/40

10 to 20% BLNDX – REMIX

Nomadic Samuel Final Thoughts

Does Standpoint Multi-Asset mutual fund make it into my portfolio?

No.

Wait. You’ve been kinda gushing over it big-time.

Yes. That’s true.

But, I’m “fill-in-the-blank” Canadian.

In other words, I’m not able to put it into my portfolio. US mutual funds are for US residents only.

For the time being, I’ll stare through the storefront window ‘wide-eyed’ and with drool-bucket firmly in hand.

In all seriousness, I’m a really big fan of this fund.

I feel given its unique trend-following and equity combination it makes for an incredible portfolio puzzle piece.

My own bias, as a self-proclaimed ‘Sponge Investor‘ is that I like to keep a rather messy room.

And by messy room I mean a complex portfolio.

I enjoy owning lots of funds that pursue as many uncorrelated strategies and asset classes as possible.

This is a major personal bias that is uniquely mine and I wouldn’t suggest owning more funds than you feel comfortable managing.

Honestly, I think most investors keep it under 10 at most but I’m happy with a roster of 30 or more.

Getting back on track, if I had access to REMIX / BLNDX it would move far up the totem pole of my core holdings.

For those of you more interested in the strategy behind the fund, I’d highly encourage you to check out the interview I did with fund founder Eric Crittenden where we discuss all-weather investing and trend-following.

If you haven’t been trendy in other areas of your life, maybe this is your chance.

Trend-following.

I’ll give Standpoint Multi-Strategy mutual fund a big double thumbs-up and green light recommendation overall.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Great commentary’s on that!…..I envy your ability to do the research . I’m a Vanguard

investor and mainly in 2 closed to new investors”. funds…Primecap, and Primecap Core,

and 40% in Vanguard Star….maybe i should just go with an advisor,…dilemma……

Best Mike..(73 yr old)

Hi Samuel, how can non-US residents buy these (or similar) funds? Thanks

Hi Alex,

I offer a very similar all weather asset management strategy including 30 % simple stock ETFs of all 4 world regions, 20 % REIT ETFs of 3 available regions, 30 % trend following oriented on the leading SG trend index (about 95 % correlation and 98 % beta) and 20 % long volatility oriented on the CBOE Eurekahedge Long Volatility Index. If interested take a look at http://www.democratic-alpha.com.

Best, Norbert

Norbert,

Norbert,

Love your site. I like BLNDX a lot, but the expense ratio does give me pause. Do you know of any trend-following ETFs that follow a similar strategy to BLNDX (combining trend with a healthy allocation to buy and hold equities)? Would be good to know if there are any cheaper options out there for those of us counting our pennies.

P.S. I appreciate that you write about investing as something to celebrate and have fun with rather than making it sound like a trip to the dentist or accountant. Bravo!