I was so blown away by the success, engagement and high retention time from the Investing Legends contributions on Picture Perfect Portfolios that I’ve decided to expand the genre by creating a new interview series entitled “How I Invest.”

The idea, quite honestly, came from a couple of books by Tim Ferris that I enjoyed immensely:

Tools Of Titans

Tribe Of Mentors

Tim interviewed various experts, celebrities, and successful entrepreneurs using a template of thought provoking questions that really brought forth fascinating and diverse answers on a wide variety of subjects.

Instead of just serving up softballs and pandering towards the obvious strengths of the guests, the questions likely forced each participant to ponder and consider the journey they’ve been on including the highs and lows with lessons learned in between.

The goal I have for this series is to really unpack the “raison d’être” behind the specific investing strategies that certain investors pursue while trying to tease out the following:

- What’s under the hood of the portfolio

- The potential pros and cons of that particular asset allocation/strategy

- How others can adopt that particular strategy and/or gain the necessary experience to become skilled at it

- What makes the investor tick (life experience, influences and lessons learned along the way)

- Strengths and weaknesses of the investor and how they’ve attempted to either overcome them and/or double down on their strengths

- How they’ve changed (or not changed) as an investor over the years

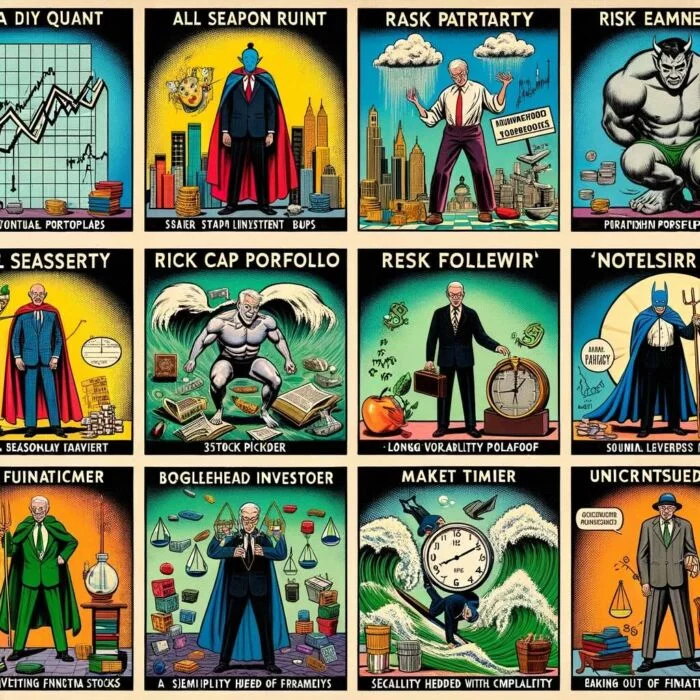

How I Invest as/with a….

DIY Quant

All Seasons Portfolio

Risk Parity Portfolio

Micro Cap Stock Picker

Long Volatility Trader

Trend Follower

Seasonality Investor

60/40 Boglehead

Market Timer

Risk On Risk Off Portfolio

Unconstrained Investor

Simplicity Hedged with Complexity

ETC…

I’ll try my best to have guests who pursue a wide variety of investing styles and strategies.

The goal with this site is to continue to grow and expand our knowledge in pursuit of the subjectively “picture perfect” portfolio.

That’s the only reason it exists.

So I’m excited to see what we can learn from these interviews.

Oddly, I’m going to start off by interviewing myself.

Yes.

That’s kinda freakin’ weird.

I know.

But it’ll serve as a template for when I reach out to others.

The goal will be to create a 10 question template that I can easily send out via email.

I’ll ask participants to create a short biography and also a section where we can connect with them on social media and/or any platforms they run (blogs, podcasts, YouTube channels, etc).

If you’re reading this and would like to participate in the series please send me an email to nomadicsamuel at gmail dot com.

I’m honestly seeking investors of all pedigrees and experience levels; both amateurs and pros.

Anyhow, time to interview myself.

LOL.

Here it goes!

How Nomadic Samuel Invests: Contrarian Expanded Canvas Portfolio

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Investing Influences and Resources

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

The first book I ever read about investing many years ago was the “Wealthy Barber” by David Chilton.

What was fascinating about that particular book was its use of fictional characters to convey a story about financial advice.

Roy, the Barber, became wealthy by simply saving and investing sensibly over a long period of time despite not having what many would consider a financially lucrative career.

It introduced to me the concept of compound interest as a miracle that manifests itself with a long enough runway.

When I became an overnight basement dweller during the pandemic, I devoured numerous books on the subject of investing.

The ones that really stand out in no particular order are as follows:

My Favourite Investing Books

- Your Complete Guide to Factor-Based Investing: The Way Smart Money Invests Today by Larry Swedroe and Andrew Berkin

- Reducing the Risk of Black Swans: Using the Science of Investing to Capture Returns with Less Volatility by Larry Swedroe and Kevin Grogan

- The Four Pillars of Investing: Lessons for Building a Winning Portfolio by William Bernstein

- Your Money and Your Brain by Jason Zweig

- Risk Parity: How to Invest for All Market Environments by Alex Shahidi

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times – and Bad by Adam Butler, Rodrigo Gordillo and Mike Philbrick

- Trend Following: How to Make a Fortune in Bull, Bear, and Black Swan Markets by Michael Covel

- Mastering The Market Cycle: Getting the Odds on Your Side by Howard Marks

- Predicting the Markets: A Professional Autobiography by Edward Yardeni

- Expected Returns on Major Asset Classes by Antti Ilmanen

It would be impossible to cover everything I learned in those 10 books without writing one myself.

Hence, if I can summarize briefly these would be the most important lessons

My Five Most Important Investing Lessons

- Diversification is your only free lunch (take it)

- No sensible investing plan survives impatience

- Leverage is a tool you can utilize to enhance your portfolio by managing risk and returns, or aid in blowing it up entirely via concentrated bets

- Zooming out and seeing the big picture is an advantage you can have as an investor compared to just about everyone else

- Being contrarian allows you to shake the shackles of benchmarks, orthodoxy and herding to create a portfolio that suits your needs, personality and investing goals

Given that I do a lot of video editing and SEO work from my computer at home, I have the unique privilege of listening to investing podcasts while I’m working on certain projects.

My favourite Investing Podcasts are as follows:

My Favourite Investing Podcasts

If you can figure out a way to listen to these shows while you’re multi-tasking (working, cooking, exercising, etc) it is amazing the amount of information you can absorb without necessarily needing to carve out additional space in your weekly schedule.

Events That Have Shaped You As An Investor

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I grew up in a tiny resource based community on Vancouver Island, British Columbia, Canada.

I remember winning a colouring contest in grade three with the prize of getting to fly over the town in a helicopter.

I was in awe of the surrounding mountains and forest sprawling in all directions.

The village of Gold River was just a spec carved out in the woods with a high enough vantage point.

At ground level it was a booming resource based community with one of the highest per capita incomes of any small-town in Canada during the mid 80s and early 90s.

Source: Town of Gold River Struggling on YouTube via CTV News

Yet, that all changed overnight when both the pulp and paper mill shutdown permanently.

The amount of lives ruined by that event was unfathomable.

Divorce.

Suicide.

Financial ruin.

Some folks pivoted and actually started lucrative new careers and/or businesses but for many individuals the shock of the situation and the lack of a back-up plan was devastating.

The town these days looks dilapidated.

I, along with my parents, moved away many years ago but I recently had a chance to return with my wife Audrey for the first time in decades while working on a campaign on the island.

I made a video about the one day visit we had here.

Source: Uchuck III to FRIENDLY COVE Nootka Sound + Visiting GOLD RIVER on Vancouver Island, British Columbia on YouTube via Samuel and Audrey

It’s an in your face reminder, at least to me, that many good things eventually come to an end.

Seeing where you grew up become a shadow of its former self does impact the way you view the world at large and also how you invest.

I’m probably more attuned to risk than most other investors given those circumstances.

Conversation With Your Younger Self

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

I would inform my younger self that you don’t necessarily have to choose risk over reward or vice versa.

I’ve learned through research that a modest amount of leverage applied to a portfolio with enough uncorrelated asset classes and strategies allows for returns to collide with risk management in a way where you can have your cake and eat it too.

I used to just think it was one over the other.

More equities if you’re keen on returns.

More bonds if you’re risk adverse.

That’s it.

Yet, when you realize you can construct a portfolio that moves beyond merely stocks and bonds, you have all kinds of diversified opportunities to utilize leverage to enhance returns while managing volatility.

Here is the most basic example.

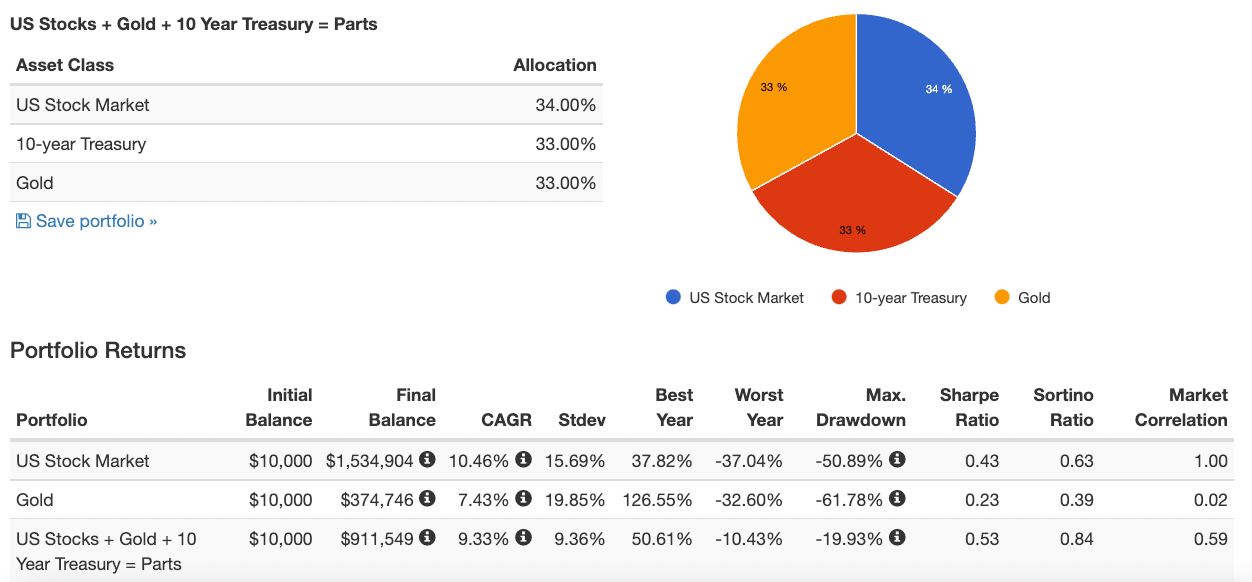

We’ll only use US equities, 10 Year Treasury and Gold to illustrate the point.

Individually, they’re all incredibly flawed line items in the portfolio.

Lost decades for US equities in the 70s and 2000s.

A brutal 26 year underwater period for Gold lasting from the early 80s until the mid 2000s.

Anemic relative returns from the 10 year treasury even though it offered a smoother journey.

Yet when you combine them together magic happens.

Why?

Because they’re uncorrelated asset classes.

They zig and zag and zig and zag some more all at different times.

And because of this you’re not caught with your pants down the same way you’d be if you only had exposure to one asset class.

Overall: US Stock Market vs Gold vs Equal Parts

Let’s feast our eyes upon the Portfolio Returns of US Stocks, Gold and Equal Parts US Stocks, Gold and 10 Year Treasury since 1972.

For US Stock Market or Gold only investors what a ride it has been!

Worst years of -37.04% and -32.60% respectively.

Max drawdowns of -50.89% and -61.78%.

How many investors pursuing that type of strategy held on tight when it got that volatile?

Not many.

How about the equal parts portfolio?

It crushed the single line items in terms of standard deviation, worst year, maximum drawdown, Sharpe ratio and Sortino ratio while offering returns close to US equities.

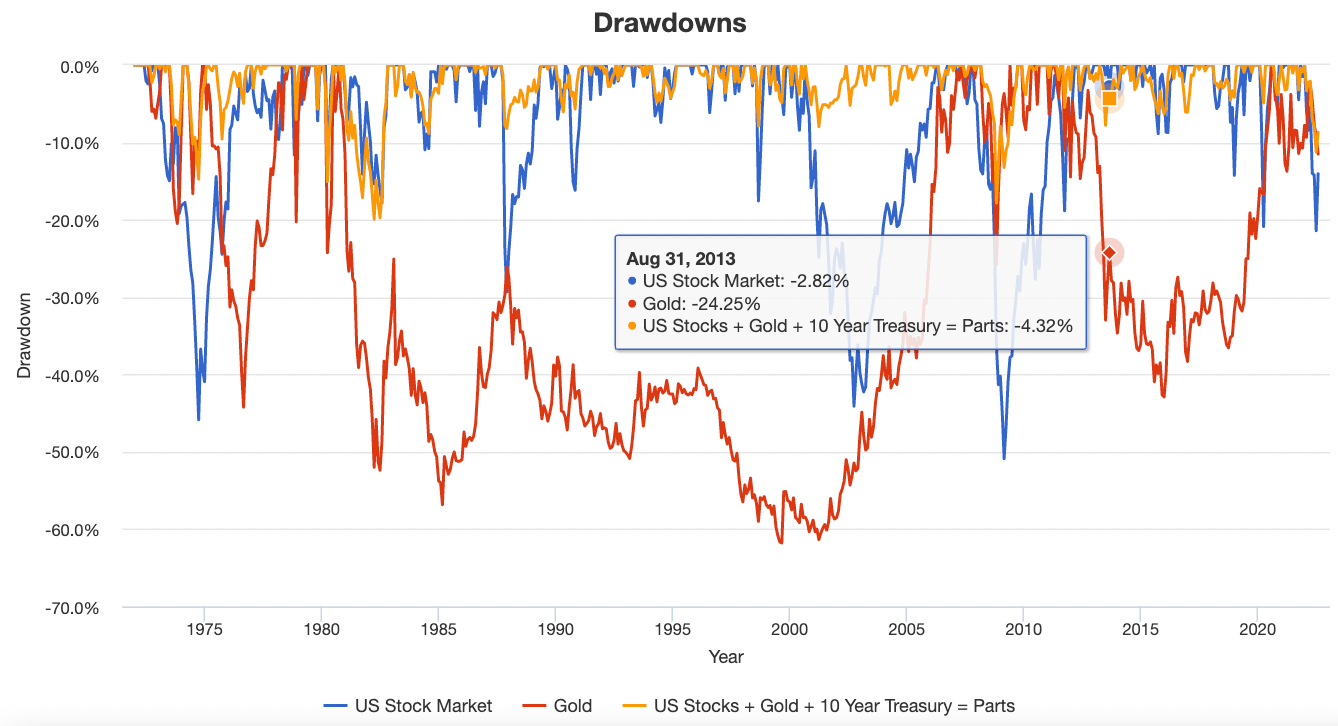

Drawdowns: US Stock Market vs Gold vs Equal Parts

My oh my the drawdowns for US Stocks and Gold as single line items in the portfolio are scarier than a wicked roller coaster ride.

Whereas the equal parts diversified portfolio offers a silky smooth ride in comparison.

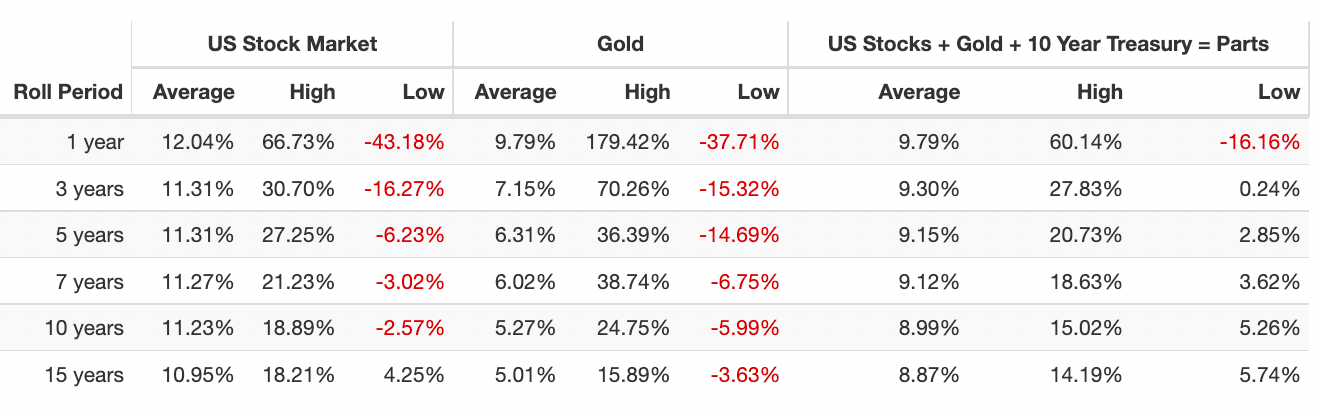

Rolling Returns: US Stock Market vs Gold vs Equal Parts

US Stock Market investors would have had to endure a roll period with negative 10 year returns at -2.57%!

Indeed, a lost decade!

Gold only investors would have faired worse.

15 years of pain and then some!

Equal parts investors had a sequence of returns risk roll period of only one negative year.

If that’s not a convincing enough argument to diversify your portfolio, I don’t know what is!

But what if you’re interested in returns that are better than equities but without the jaw dropping risk?

Too good to be true?

Let’s find out what happens when we add a modest amount of leverage to the equation at 60%.

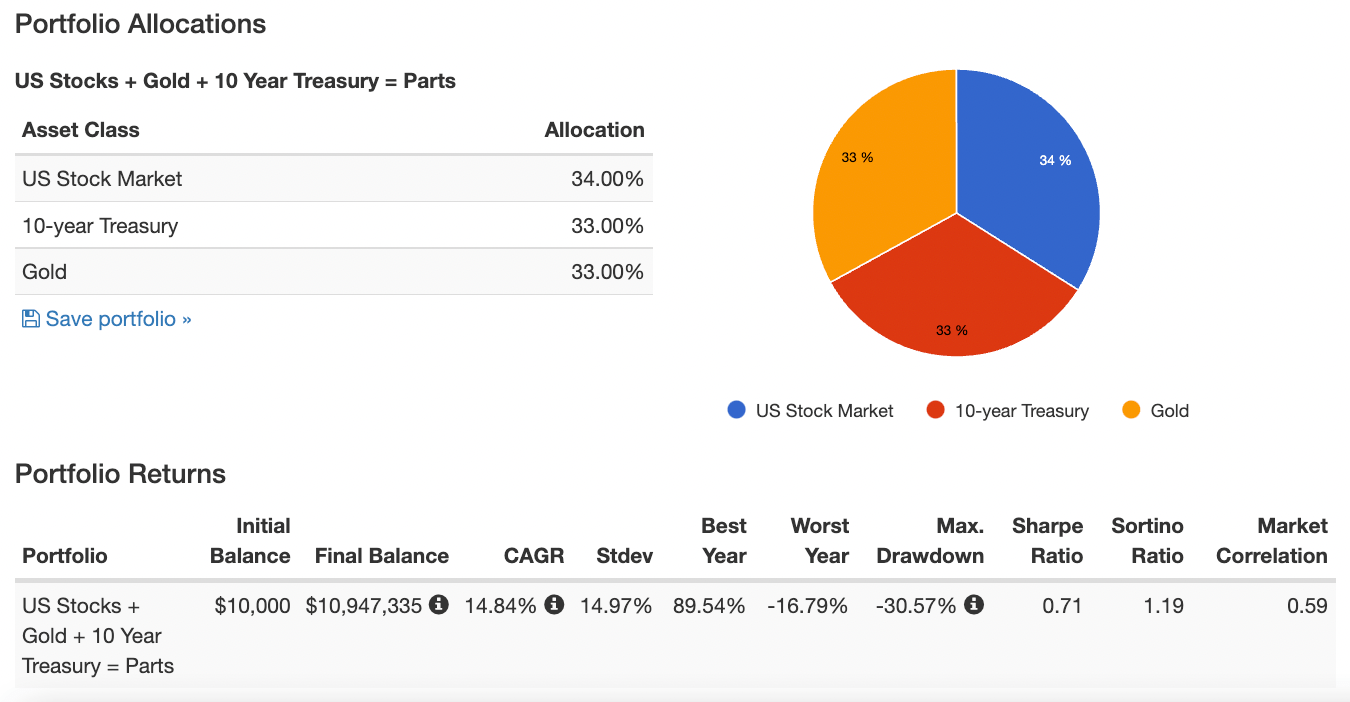

Overall: Equal Parts US Stocks, Gold and 10-year Treasury with 60% Leverage

With a 160% canvas portfolio of equal parts US stocks, 10 year Treasury and Gold we’re able to convincingly exceed the returns of US only equities with a 14.84% CAGR versus 10.46% CAGR.

More importantly, we’re able to control volatility across the board including standard deviation, worst year, maximum drawdown, Sharpe Ratio and Sortino Ratio as the whipping cream and cherry on top.

For instance, a -37.04% worst year for US stocks versus -16.79% worst year for the equal parts US stocks, gold and 10 year treasury portfolio with modest 60% leverage.

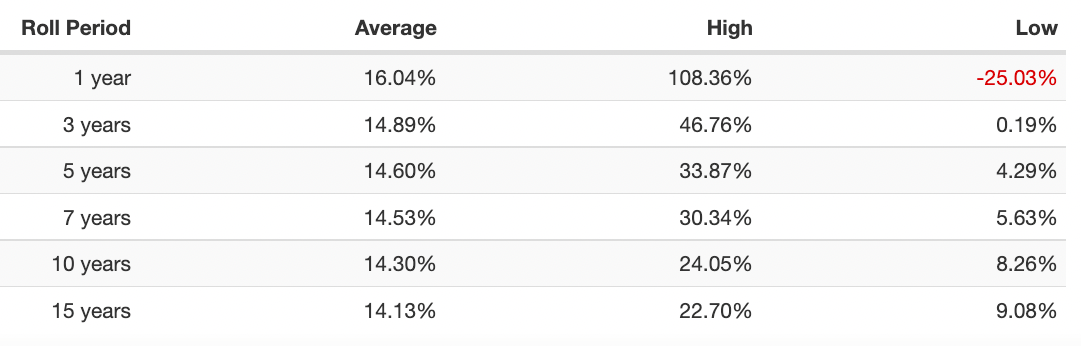

Roll Period: Equal Parts US Stocks, Gold and 10-year Treasury with 60% Leverage

And the knockout blow is that the roll period doesn’t change the results even when leverage is applied.

The equal parts portfolio with a 160% canvas still only has a negative low roll period of 1 year versus 10 years for US equities.

Now, I don’t recommend this portfolio as this is just the peanut butter, strawberry jam and wonder bread example of how uncorrelated asset classes back-test over 6 decades.

There are numerous ways to further diversify your portfolio that I’ll explore more in detail when I reveal what I have under the hood of my portfolio.

But it should give equity only investors a chance to pause and reflect when it comes to the risk/reward profile of their portfolios.

I used to be one of you guys.

But not anymore.

Contrarian Expanded Canvas Portfolio: Pop Open The Hood!

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

And at its worst?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Recently, I wrote an entire article going over my expanded canvas DIY quantitive portfolio.

Thus, instead of rehashing that entirely here, I’ll elect to go with the quadrant approach of explaining what I’ve got under the hood in quadrants as opposed to individual line items.

| UPAR | 15.00% | ULTRA RISK PARITY ETF |

| HRAA.TO | 15.00% | HORIZONS RESOLVE ADAPTIVE ASSET FUND |

| ONEC.TO | 10.00% | ACCELERATE ONECHOICE ALTERNATIVE PORTFOLIO |

| PFAA.TO | 10.00% | PICTON MAHONEY FORTIFIED ABSOLUTE ALPHA ALTERNATIVE |

| NTSE | 7.50% | WISDOMTREE EMERGING EFFICIENT CORE FUND |

| GDE | 7.50% | WISDOMTREE EFFICIENT GOLD PLUS EQUITY |

| NTSI | 5.00% | WISDOMTREE INTERNATIONAL EFFICIENT CORE FUND |

| FIG | 5.00% | SIMPLIFY MACRO STRATEGY ETF |

| KMLM | 5.00% | KFA MOUNT LUCAS INDEX STRATEGY |

| DBMF | 5.00% | IMGP DBI MANAGED FUTURES STRATEGY ETF |

| ATSX.TO | 5.00% | ACCELERATE ENHANCED CANADIAN BENCHMARK ETF |

| PFAE.TO | 5.00% | PICTON MAHONEY FORTIFIED ACTIVE EXTENSIONS |

| HDGE.TO | 5.00% | ACCELERATE ABSOLUTE RETURN HEDGE FUND |

My goal as an investor is to utilize an expanded canvas portfolio to stretch the limits beyond 100%.

I specifically am seeking to add uncorrelated asset classes and strategies by efficiently creating space in my portfolio.

For instance, NTSE takes the 60/40 version of Emerging Markets and Treasuries and dials it up to 90/60.

This creates additional real estate in my portfolio to add alternative strategies such as trend following managed futures, global systematic macro, merger arbitrage, long-short equities, market neutral hedging, bitcoin and long volatility portfolio insurance.

I’m not using leverage to dial up the exposure and associated risk of any particular asset classes such as equities only.

Instead I’m attempting to add unique return streams to my portfolio while concertedly managing its risk profile overall.

When I’m adding/subtracting funds from my portfolio I try to ponder how does this improve the diversification of my portfolio, if at all?

Let’s explore what I’ve got in a bit more detail.

Risk Parity = 30%

I would describe the main backbone of my portfolio as a hybrid risk-parity allocation.

UPAR at 15% provides the static long-only 168% expanded canvas allocations to global equities (US, EAFE, EM), TIPs, Long-Term Treasury and Gold/Commodities whereas HRAA.TO at 15% is the adaptive version where I have long/short exposure to equity, bond, commodities and currency indexes utilizing a bespoke global systematic macro approach via trend-following, seasonality, carry, value and other strategies.

I love the ying-yang component of static versus adaptive here.

For those wondering about Risk Parity investing, it’s allocating based on risk and not returns.

For instance, TIPs and Long-Term Treasury have a much lower standard deviation than stocks and gold.

Hence, in a risk parity portfolio you’d allocate a greater percentage of resources to the less risky line items versus the more volatile ones.

Efficient Core = 20%

The efficient core of my portfolio consists of 90/90 and 90/60 funds.

I’ve got GDE at 7.5% providing 90/90 US equities and gold and NTSE at 7.5% and NTSI at 5% providing 90% exposure to Emerging Markets and International Developed Equities in tandem with 60% treasuries.

I love that these funds provide outsized exposure to help create space in my portfolio for additional alternative strategies.

Furthermore, they’re some of the cheapest in terms of management fees as well.

A win all around in my opinion.

Long/Short Equities = 15%

I get a bit more aggressive over in the wing of my long-short equities sleeve.

Here I’m utilizing mostly expanded canvas 140-40 funds to get exposure to multi-factor equities minus junk.

The goal is to have extended deep factor exposure to drive outsized returns while also capturing the other side of the equation by shorting shitcos.

I’ve got PFAE.TO at 5%, ATSX.TO at 5% and HDGE.TO at 5% filling out the roster spots.

Alternatives = 35%

The alternative sleeve is the secret sauce of my portfolio.

It’s where I most deviate from the pack in terms of asset allocation, seeking unique return streams and strategies.

The primary strategies I have exposure to are trend-following, merger arbitrage, market neutral equities, special situations credit and gold.

I have secondary exposure to other global systematic managed futures strategies, tail risk hedging (long volatility puts), covered calls, REITs, private loans and high yield bonds.

In order to capture all of this I have ONEC.TO at 10%, PFAA.TO at 10%, DBMF at 5%, KMLM at 5% and FIG at 5%.

Wishlist

I’m seeking more efficient core access to factor equity strategies such as global minimum volatility, momentum, value and size.

I’d love to see the 90/60 market-cap weighted funds offer the same (or similar) products with factor based strategies instead.

I’d also love to have exposure to strategies that are still difficult to access for retail investors such as reinsurance and private equity/credit.

Overall though, I’m thrilled with my portfolio as it is and I’m also highly cognizant that many of these funds/strategies were not available to DIY investors until recently.

For that I’m very grateful.

Investing Skills Required To Pull It Off

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

To arrive at the portfolio I’ve assemble takes a curious mind.

If your knowledge base and convictions are stuck at market-cap weighted equities and bonds is the only (and best) game in town, an expanded canvas portfolio is not for you.

Plain and simple.

Thus, the continuous desire to want to learn and to have a goal of integrating long-only traditional asset classes such as stocks, bonds, commodities and gold with more esoteric strategies in the managed futures and options space is when you end up with a portfolio like mine.

Believe you me I’m fully aware this type of portfolio isn’t for everyone.

It also requires tremendous patience in order to pull it off long-term as the results will not be anything like a 60/40.

If you’re addicted to comparing your portfolio to industry standard benchmarks please run for the hills if you’re thinking of test-driving the one I’m using.

Yet, I feel it’s the perfect fit for me.

Toned Down and More Aggressive Version Of My Portfolio

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

It would be really easy to tone down my portfolio by utilizing less leverage, tilting more towards bonds and replacing some of the aggressive long-short equity strategies with market neutral ones.

Here is what I’d do specifically:

UPAR to RPAR.

This switch takes you from a fund offering a 168% canvas to 125% canvas.

NTSI to ISWN.

From 90/60 International Developed Equities and Treasuries to 70/90.

PFAE.TO to PFMN.TO

Going from Picton Mahoney 140/40 to the market neutral mandate they offer.

ATSX.TO to PLV.TO

Going from 140-40 equities to an asset allocation fund of global low volatility equites and 30% corporate bonds.

HDGE.TO to QBTL.TO

A long-short combination of multi-factor equities minus junk being replaced by a fund offering market neutral anti-beta.

For US investors the fund BTAL is the same strategy.

That is enough to tilt this portfolio more conservative without losing its spirit.

This is what it looks like exactly.

Conservative Nomadic Samuel Portfolio

| RPAR | 15.00% | RISK PARITY ETF |

| HRAA.TO | 15.00% | HORIZONS RESOLVE ADAPTIVE ASSET FUND |

| ONEC.TO | 10.00% | ACCELERATE ONECHOICE ALTERNATIVE PORTFOLIO |

| PFAA.TO | 10.00% | PICTON MAHONEY FORTIFIED ABSOLUTE ALPHA ALTERNATIVE |

| NTSE | 7.50% | WISDOMTREE EMERGING EFFICIENT CORE FUND |

| GDE | 7.50% | WISDOMTREE EFFICIENT GOLD PLUS EQUITY |

| ISWN | 5.00% | AMPLIFY BLACKSWAN INTERNATIONAL ETF |

| FIG | 5.00% | SIMPLIFY MACRO STRATEGY ETF |

| KMLM | 5.00% | KFA MOUNT LUCAS INDEX STRATEGY |

| DBMF | 5.00% | IMGP DBI MANAGED FUTURES STRATEGY ETF |

| PFMN.TO | 5.00% | PICTON MAHONEY FORTIFIED MARKET NEUTRAL ALTERNATIVE |

| PLV.TO | 5.00% | INVESCO LOW VOLATILITY PORTFOLIO ETF |

| QBTL.TO | 5.00% | AGFiQ US MARKET NEUTRAL ANTI-BETA ETF |

The more aggressive version of my portfolio is a cinch to put together.

It involves no changes but further expanding the canvas.

You’d need a margin account and to borrow 50% to expand the expanded canvas portfolio to 150%.

Now keep in mind the funds I have already utilize leverage to begin with, so I’m not suggesting or recommending this at all.

But since the question was asked I feel the need to provide an answer.

Please notice the adjusted percentages below.

Aggressive Nomadic Samuel Portfolio

| UPAR | 20.00% | ULTRA RISK PARITY ETF |

| HRAA.TO | 20.00% | HORIZONS RESOLVE ADAPTIVE ASSET FUND |

| ONEC.TO | 15.00% | ACCELERATE ONECHOICE ALTERNATIVE PORTFOLIO |

| PFAA.TO | 15.00% | PICTON MAHONEY FORTIFIED ABSOLUTE ALPHA ALTERNATIVE |

| NTSE | 7.50% | WISDOMTREE EMERGING EFFICIENT CORE FUND |

| GDE | 7.50% | WISDOMTREE EFFICIENT GOLD PLUS EQUITY |

| NTSI | 5.00% | WISDOMTREE INTERNATIONAL EFFICIENT CORE FUND |

| FIG | 15.00% | SIMPLIFY MACRO STRATEGY ETF |

| KMLM | 15.00% | KFA MOUNT LUCAS INDEX STRATEGY |

| DBMF | 15.00% | IMGP DBI MANAGED FUTURES STRATEGY ETF |

| ATSX.TO | 5.00% | ACCELERATE ENHANCED CANADIAN BENCHMARK ETF |

| PFAE.TO | 5.00% | PICTON MAHONEY FORTIFIED ACTIVE EXTENSIONS |

| HDGE.TO | 5.00% | ACCELERATE ABSOLUTE RETURN HEDGE FUND |

You’ll notice the Risk Parity and Trend-Following strategies have been boosted the most so as to more effectively manage volatility as opposed to jacking up the portable beta and long-short equities.

My Greatest Strengths and Weaknesses as an Investor

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

Curiosity and keeping an open mind is my greatest strength as an investor.

I’m interested in forever being a sponge investor thrilled by soaking up new information while expelling junk.

My plan is to only keep inside of my sponge what makes sense to me as I learn, acquire, evolve, absorb, reject and disavow over time.

My greatest weakness fortunately for me doesn’t revolve around patience issues.

For some reason I firmly believe I’ve got firm grasp of the importance of staying the course with the strategies I’m pursuing.

I fully expect for each and every one of them to underperform for significant periods of time and I’m anticipating that with eyes wide open.

Thus, my greatest weakness is without a doubt being attracted to complex things.

If you notice, nothing in my portfolio involves a single strategy fund.

I have no long-only equity funds or long-only bond tickers or long-only commodities ETFs.

Instead, I have long-only equity plus treasury and/or gold funds.

Or multi-asset class and multi-strategy fund of funds.

In order for a fund to capture my attention it must offer more than one strategy.

And my biggest fear is that I’ll one day wake up with a portfolio that is maybe 100% alternatives or something along those lines.

LOL.

In order to prevent myself from doing that I plan on floating the current manifestation of my portfolio to a few trusted friends for a second opinion.

If those around me, who I admire the most and trust, feel as though I’ve lost the plot then I’m sure that I have.

Because I’m a curious investor (strength) I do plan for my portfolio to change and evolve as I learn more about different strategies and when new and potentially better products come to market.

However, I’m trying to firmly establish a rule where I’m not just adding funds for the sake of it because they’re new and alluring.

They truly need to enhance my portfolio from what I currently have on roster.

Thus, the tug-of-war between my curious mind and propensity for enjoying complexity will likely forever duke it out.

And I’m okay with that.

That’s just me.

I ain’t gonna change.

So warts and all I march forward.

Things You Agree and Disagree With As An Investor

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

The use of leverage is such a polarizing subject that it can cause two investors who generally agree about everything under the sun to suddenly look at each other as though they were aliens.

The fact that I believe modest applications of leverage can potentially enhance a portfolio by expanding its canvas to accommodate unique and uncorrelated asset classes/strategies is definitely anything but the norm.

Most investors think leverage equals annihilation.

And they’re not wrong.

When you hear the stories of investors blowing up it almost always involves leverage as part of the equation.

But what they may not realize is that this almost entirely involves applications of concentrated leverage.

Dialling up a single asset class that is already risky and volatile (such as equities) to levels way beyond 100%.

Worse, is when it is just a handful of stocks making the leverage and volatility even more concentrated.

However, if you consult the example I gave earlier in the article with equal parts US equites, Gold and the 10 Year Treasury it’s possible to use leverage to enhance returns and manage risk.

So my belief that leverage is not a four letter word definitely puts me into contrarian investor territory.

Whew.

That’s my favourite spot to be.

Not just in investing but in life too.

On the other hand, one thing I don’t agree with entirely that most people in the industry believe firmly is that fear causes panic selling.

I’m sure that fear plays a role in investors selling when markets are going down sharply.

However, I believe it is just plain old vanilla impatience that causes bad investor behaviour most of the time.

The kind of impatience that ticks you off when you’re waiting in line at the grocery store or the light turns red before you can make it through the intersection.

A better example might be the quarterback on TV from your favourite football team not being able to complete passes.

After a while you just can’t stand it anymore.

This guy sucks!

Get rid of ’em!

And this extends to the way most investors manage their portfolio.

They just get frustrated and impatient with the results of certain funds and underperforming benchmarks or having lost decades.

They’ll proclaim a strategy is dead and move on.

Thus, I feel it is being impatient rather than being afraid that drives most bad short-term decisions for investors.

I’ve never talked or written about this before, so I’d be curious to know if you agree with me or not.

Investing Subject Area To Further Explore

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

Oh, that’s an easy one.

I want to learn more about options based trading strategies.

I’d love to know how volatility strategies can better enhance the risk/reward profile of your portfolio.

I’ve just wrapped my head around trend-following and other managed futures strategies but I’m admittedly quite green when it comes to options based investing.

How do I plan to learn more about the subject?

The same way I have with everything else.

Books.

Podcasts.

White papers.

Pulling my hair out more than once.

The Anti-Nomadic Samuel Portfolio

What would be the ultimate anti-Nomadic Samuel portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

I’m tempted to be a little goofy and go with the 60/40 combination of TESLA and shitcoins but I’m going to just say the plain old 60/40.

Now if you duct-taped me to a chair and threatened my life I’d be okay owning this.

Just want to get that clear.

However, I do feel that that market-cap weighted 60/40 strategy represents everything that is mediocre, bland and insipid about the investing industry at large.

It’s repulsive to me because it lacks creativity and I feel constructing a portfolio should be equal parts art and science.

In terms of direct constructive criticism I feel as though it doesn’t prepare investors for every economic outcome (especially stagflation) and is lacking from a strategic diversification standpoint.

It’s easy for me to Steel Man this approach because its the McDonald’s of investing.

It’s the average portfolio for the average investor just as eating junk food is the average diet for the average person.

Far from optimal in my opinion but easily accessible.

And like junk food that lures you in with cheap prices and easy to pop open bags of sugary/salty poison, the 60/40 is the lowest cost portfolio you can slap together.

And if you believe fees are the most important thing to consider as an investor you’ll be happy to own it.

So I totally understand why most people do.

I’m just glad I’m not one of them.

Connect With Nomadic Samuel

Thanks so much for taking part in the “How I Invest” series! How can others connect with you on social media and other platforms that you run?

You can connect with me right here!

This is after all my blog.

I’m also on twitter @NomadicSamuel

Nomadic Samuel Final Thoughts

So that was me test-driving these questions for the “How I Invest” series.

Thanks to anyone who stuck around.

This is officially the longest blog post I’ve ever written coming in at over 5000 words.

So we’ll keep things brief to close.

I’m excited for the potential of this series and to interview as many investors as I possibly can.

If you’ve read this article and would enjoy participating in this series email me at nomadicsamuel at gmail dot com.

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.