Chaos. That’s what you can expect to find in any hotel room or AirBnB I’m staying in.

I travel for a living and if there’s one thing I can count on, it’s that as soon as I check in and my luggage hits the ground, its contents will inevitably explode across the room. Camera gear, electronics, clothing – you name it!

However, today we’re talking about a different type of chaos and how it relates to turbulent market conditions.

As investors, we’re often prepared for the good times loading up on offensive assets.

But what about tail risk strategies and hedging against severe drawdowns?

Enter the room CAOS ETF.

It’s better known as Alpha Architect Tail Risk ETF.

We’re fortunate enough to have Wes Gray with us to discuss the strategy behind this particular fund.

Without further ado, let’s turn things over to Wes to find out more!

Reviewing The Strategy Behind CAOS ETF (Alpha Architect Tail Risk ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Wes Gray of Alpha Architect

After serving as a Captain in the United States Marine Corps, Dr. Gray earned an MBA and a PhD in finance from the University of Chicago where he studied under Nobel Prize Winner Eugene Fama. Next, Wes took an academic job in his wife’s hometown of Philadelphia and worked as a finance professor at Drexel University.

Dr. Gray’s interest in bridging the research gap between academia and industry led him to found Alpha Architect, an asset management firm dedicated to an impact mission of empowering investors through education. He is a contributor to multiple industry publications and regularly speaks to professional investor groups across the country.

Wes has published multiple academic papers and four books, including Embedded (Naval Institute Press, 2009), Quantitative Value (Wiley, 2012), DIY Financial Advisor (Wiley, 2015), and Quantitative Momentum (Wiley, 2016). Dr. Gray currently resides in Palmas Del Mar Puerto Rico with his wife and three children.

I had been an investor in AVOLX, when it was mutual fund, for several years. The product provided a unique tail risk exposure that didn’t have the typical return drag tied to other tail risk funds. Unfortunately, the fund was in the mutual fund wrapper and wasn’t that tax efficient.

I eventually asked Arin Risk Advisors, the brains behind the operation, if they would consider letting us convert their mutual fund into an ETF. This would, selfishly, make the fund more tax-efficient for my personal needs, but this would also make the strategy more readily available for the broader market of ETF buyers.

What’s The Strategy Of CAOS ETF?

For those who aren’t necessarily familiar with a “tail risk hedging” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Tail risks are generally defined as 25%+ drawdowns in the market that happen in short order – call is less than a month.

The best and most recent example is March 2020 during the COVID pandemic scare when markets blew up intra-month.

Unique Features Of Alpha Architect Tail Risk Fund CAOS ETF

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

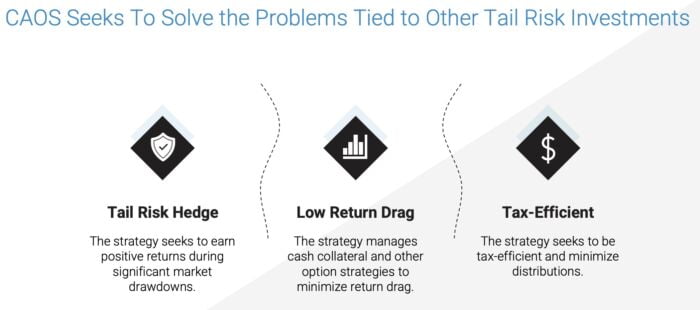

CAOS, which is almost 10 years old at this point (AVOLX was the prior ticker when it was a mutual fund before we did a tax-free conversion into an ETF), seeks to do 3 things: hedge tail-risk events, minimize return drag, and minimize tax drag.

The fund has delivered on the first 2 objectives by 1) providing positive returns during tail risk events and 2) having positive carry of the life of the fund. And now that the vehicle is delivered via the ETF wrapper, which has additional tools to minimize tax burdens, we are confident on a go-forward basis that we can accomplish all 3 objectives.

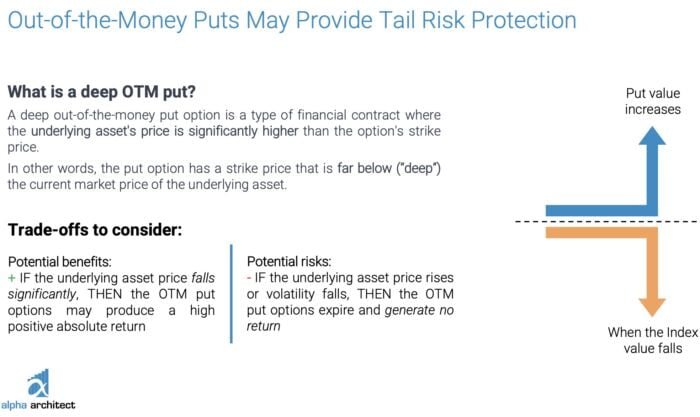

The strategy, at its foundation, owns out of the money puts to provide the tail risk protection. This is what any tail-risk fund has to do if they want to deliver a hedge against large market drawdowns. However, the trick is figuring out how to pay for these puts without burning all your money on fire along the way (which is common among all the tail risk strategies we see on the market).

This is done by actively buying and selling different option spread strategies and capturing ‘theta’ or time decay. These option strategies help pay for the tail risk hedges, on average, over time. Or at least that is our goal – figure out how to deliver tail risk hedging, while providing positive carry along the way.

The holy grail of ‘insurance’ in some sense. The objective is not easy but has been achieved over a long period of time thus far, which gives us confidence we can continue to be successful on a go-forward basis.

CAOS ETF from Wesley Gray on Vimeo.

What Sets CAOS ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other “tail risk hedging products” being offered in what is already a crowded marketplace?

What makes it unique?

As mentioned above, CAOS is almost 10 years old and delivered what amounts to the holy grail of tail risk hedging products: 1) tail risk protection during tail risk events and 2) positive carry.

The rest of the ETF marketplace, to our knowledge, cannot make these statements regarding their tail-risk products.

What Else Was Considered For CAOS ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

This was a MF conversion with a long-term track record of success. Many of the bugs had been worked out years prior to us converting this into an ETF via the CAOS ticker.

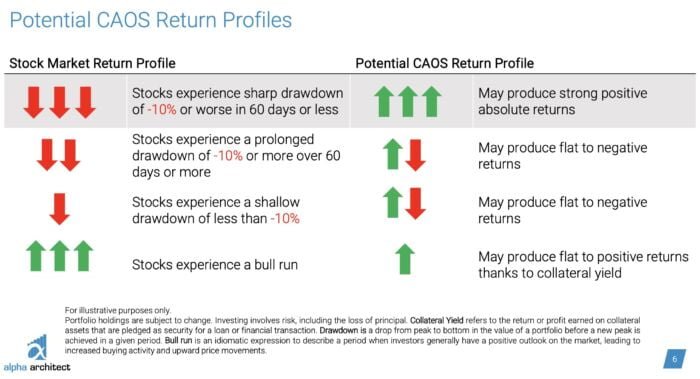

When Will CAOS ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

The strategy is designed to make money during violent and swift market corrections. So 25%+ drawdowns that happen within a month’s time period. And we want to deliver positive carry on the fund over the long-haul.

What the fund doesn’t do is make money all the time and protect against all losses. This would be unrealistic, obviously. So we knowingly structure the fund to have exposure to losses in the 0-20% range, especially if these are ‘bleeding bear’ market type losses that happen over an extended period. 2022 is a great example of the worst conditions for CAOS – a slow and steady bear market, but a bear market that isn’t that extreme.

In normal markets, we expect the fund to have positive returns and positive beta to the broad us stock market.

Why Should Investors Consider Alpha Architect Tail Risk Fund CAOS ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

The standard 60/40 stock/bond portfolio works okay when bonds go the opposite of stocks during a market panic. However, this relationship is precarious at best. A more robust portfolio needs to be better diversified and add strategies that minimize tail risk damage – this is what CAOS is designed to do.

We recommend it be used as a replacement for a portion of one’s fixed income portfolio and/or a substantial addition to a generic alternative/diversifier portfolio.

Advisors/individuals can reach out to our team to learn more about how to deploy the vehicle via https://advisors.alphaarchitect.com/

How Does CAOS ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

Let me explain how I use it, personally. I am essentially all-in on our core long-only global factor products – QVAL/QMOM/IVAL/IMOM. This exposes me to a lot of factor risk and a lot of beta risk. I offset this risk via 2 exposures: trend following managed futures and tail risk hedging. The managed futures are there to protect against long protracted drawdowns and the tail risk hedge, ie CAOS, is there to protect against quick/violent market drawdowns.

Now, how one sizes these positions will obviously depend on how much risk you want to hedge. I can’t answer that question without knowing a lot about the individual circumstances of the situation, but generically speaking, I think replacing a large portion of one’s no/low credit risk fixed income is a reasonable idea. High grade fixed income isn’t a great tail hedge and is generally tax-inefficient, so it strikes out on 2 fronts in my book.

The Cons of CAOS ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Mainly that we haven’t marketed it and/or explained it that well.

We are working on that and now have an overview deck and marketing materials related to the fund. Our firm has been exceptionally busy launching new products and our marketing/distribution capabilities are scarce…but we are in the long-game with all products under the Alpha Architect umbrella, which means marketing/distribution/etc can wait.

We are in no rush to grow, we are in a rush to build and deliver what we think are unique, affordable, exposures that solve a problem in one’s portfolio.

The Pros of CAOS ETF

On the other hand, what have others praised about your fund?

The historical performance track record, which has delivered on tail risk protection, without massive return drag (actually had positive returns!)

Learn More About CAOS ETF

Q10) We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

Nothing comes to mind. We launch funds very rarely and typically spend 3+yrs on product development. As of now, we have no new ideas on the horizon, but that could change.

Connect With Alpha Architect

Thanks so much for taking part in the “The Strategy Behind The Fund” series! How can others connect with you on social media and other platforms that you run?

Twitter: Twitter.com/alphaarchitect

Advisor Site: https://advisors.alphaarchitect.com/

ETF Site: https://etfsite.alphaarchitect.com/caos/

Video: https://vimeo.com/816988039

Nomadic Samuel Final Thoughts

I want to personally thank Wes Gray for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.