What The Heck Is Returning Stacking?

Imagine if you could put together a portfolio, in such a way, that it is return stacking the right combination of equities, bonds and alternatives to provide an all-weather solution that meets your performance needs while at the same time offering significant drawdown protection for any economic regime curveball thrown its way?

2022 has proven to be a frustrating year for investors pursuing a 1-2 approach to investing with various equity and bond combinations.

(Note: This article was originally written to review the 60/40 Return Stacked Index. I’ve kept all those bits. But I’ve added some general information bobs to turn it more into a guide/primer)

Historically uncorrelated assets have cosied up on a skewer to share the same shishkebab of carnage in recent months given pesky and persistent inflation.

2020 challenged investors in March with fierce equity drawdowns where bonds weren’t able to shield the damage.

How about in 2008? Even a balanced 60/40 portfolio, the industry standard of optimized asset allocation, received a heck of a nasty shiner.

The time has come to think about asset allocation from a bottoms-up approach where alternative investments are an integral part of the portfolio rather than considered to be some kind of roadside freakshow curiosity.

In order to build an all-weather portfolio it requires an imagination that extends beyond merely stocks and bonds.

An all-weather approach to investing is the optimal solution.

The Return Stacked 60/40 approach, (a fund of funds, multi-asset class and multi-strategy approach), is possibly the best attempt to date of combining equities, bonds and alternatives in an optimal manner.

Fortunately, for us, it’s just called “return stacking” as opposed to portable-beta multi-fund, multi-asset class, multi-strategy asset allocation.

Return stacking seeks to create space in the portfolio by being more efficient.

You take the 60/40, that everyone loves so dearly for whatever reasons, and boost it 1.5 times so that your portfolio expands its canvas and creates 33% room for something else.

Pile more stocks and bonds into that space?

Not exactly.

Add uncorrelated assets and alternatives in a multi-strategy approach to improve the efficiency of the portfolio.

CTA. Macro. Style Premia. Tail Hedging.

Yo, Exactly What Is Return Stacking?

Return Stacking, in the realm of investment strategy, is a sophisticated and nuanced approach that revolutionizes traditional portfolio management. It’s akin to an intricate dance of financial instruments, where instead of gracefully stepping aside for one another, they stack up, creating a harmonious and dynamic performance. In this strategy, investors layer additional investment returns, akin to alternative strategies, over their core portfolio of stocks, bonds and gold.

This creates a scenario where more than $1.00 of exposure is achieved for each $1.00 invested, without the need to divest from the foundational assets.

In other words, if you’ve got a 200% expanded canvas return stacked product you’re getting 100% exposure of Asset A PLUS 100% exposure of Asset B for every dollar invested.

Not too shabby, at all.

To paint a more vivid picture, imagine your investment portfolio as a wedding cake. The base layer, your stocks and bonds, is the classic vanilla sponge – reliable and foundational. In a conventional scenario, if you wish to add a layer of tantalizing chocolate ganache (representing an alternative investment such as managed futures), you would typically need to scrape off some of the vanilla. However, with Return Stacking, you’re not just adding chocolate on top; you’re conjuring an entire new layer, replete with sparklers and edible gold leaf, elevating the cake’s grandeur without compromising the integrity of the vanilla base.

This concept shines particularly in managing the sequence of returns risk, especially crucial for those waltzing into retirement. It’s like adding a jetpack to a marathon runner – not only does it uphold their pace but potentially enhances their speed, allowing them to navigate the race (or in this case, the investment landscape) with added efficiency and resilience.

Imagine a juggler at a circus, effortlessly keeping several balls in the air. Now, with Return Stacking, it’s as if the juggler, without dropping any of the existing balls, suddenly starts juggling flaming torches alongside them. This represents the addition of alternative strategies atop a traditional mix of stocks and bonds, enhancing the spectacle without compromising the original act.

In practical terms, Return Stacking might involve layering managed futures or other alternatives over a core asset allocation. It’s like a gardener who, instead of uprooting existing plants (equities and bonds), skillfully grafts exotic orchids (alternative investments) onto sturdy trees, creating a diverse and vibrant ecosystem within the garden without sacrificing its original beauty.

For retirees, this approach is akin to adding an additional, more adventurous chapter to their life story without rewriting the earlier, more conservative ones. It allows for a reduction in equity exposure – think switching from a gas-guzzling sports car to a more prudent yet equally thrilling electric vehicle – in a manner that does not detrimentally impact the portfolio’s performance. Furthermore, it potentially allows for a modest increase in withdrawal rates, akin to finding an unexpected bonus check in an old jacket pocket.

Who Created Return Stacking?

Who put this together?

It’s a collaboration between ReSolve Asset Management and Newfound Research where Rodrigo Gordillo, Adam Butler and Mike Philbrick teamed up with Corey Hoffstein to assemble the Return Stacked 60/40 Absolute Return Index.

Apparently, it was Rodrigo who first came up with the idea. Credit should go to him.

(Since this article was written they’ve launched Return Stacked ETFs with funds RSSB, RSBT & RSST)

Return Stacking ETFs: Capital Efficient Funds For Investors

We’ve entered the golden age of capital efficient ETFs hitting the marketplace – in a fast and ferocious manner.

Here is a list of some return stacking ETFs currently available in alphabetical order:

GOLY ETF – Strategy Shares Gold-Hedged Bond ETF (100% Investment Grade Bonds + 100% Gold)

GDE ETF – WisdomTree Efficient Gold Plus Equity Strategy Fund (90% US Equites + 90% Gold)

HCMT ETF – HCM Tactical Enhanced US ETF (200% US Equities or 100% Cash)

NTSE ETF – WisdomTree Emerging Markets Efficient Core Fund (90% EM Equities + 60% Treasuries)

NTSI ETF – WisdomTree International Efficient Core Fund(90% Int-Dev Equities + 60% Treasuries)

NTSX ETF – WisdomTree U.S Efficient Core Fund(90% US Equities + 60% Treasuries)

RPAR ETF – RPAR Risk Parity ETF (125% Global Asset Allocation Fund)

RSBT ETF – Return Stacked Bonds & Managed Futures ETF (100% Agg Bonds + 100% Managed Futures)

RSBY ETF – Return Stacked Bonds & Futures Yield ETF (100% Agg Bonds + 100% Carry Style Premia)

RSSB ETF – Return Stacked Global Stocks & Bonds ETF (100% Global Equities + 100% Treasuries)

RSST ETF – Return Stacked US Stocks & Managed Futures ETF (100% US Equities + 100% Managed Futures)

RSSY ETF – Return Stacked U.S. Equity & Futures Yield ETF (100% US Equities + 100% Carry Style Premia)

SPBC ETF – Simplify US Equity PLUS GBTC ETF (100% US Equities + 10% Bitcoin)

SPQ ETF – Simplify US Equity PLUS QIS ETF (100% US Equities + 50% Multi-Strategy QIS)

TUA ETF – Simplify Short Term Treasury Futures Strategy ETF (3X Intermediate Treasuries)

TYA ETF – Simplify Intermediate Term Treasury Futures Strategy ETF (5X Short-Term Treasuries)

UPAR ETF – UPAR Ultra Risk Parity ETF(168% Global Asset Allocation Fund)

Other Diversifying Alternative Investment Funds

ARB ETF – AltShares Merger Arbitrage ETF (Merger Arbitrage Strategy)

BTAL ETF – AGF US Market Neutral Anti Beta Fund (Long 100% Low Vol Equities / Short 100% High Beta Equities)

CAOS ETF – Alpha Architect Tail Risk ETF (OTM Put Tail Risk Strategy)

EQLS ETF – Simplify Market Neutral Equity Long Short ETF (Long 200% Multi-Factor Equities / Short 200% Junk Equities)

FBTC ETF – Fidelity® Wise Origin® Bitcoin Fund (Bitcoin Exposure)

FLSP ETF – Franklin Systematic Style Premia ETF (Multi-Asset + Multi-Strategy L/S: Quality, Value, Momentum & Carry)

LBAY ETF – Leatherback Long/Short Alternative Yield ETF (L/S Equity Strategy)

SVOL ETF – Simplify Volatility Premium ETF (-0.2 to -0.3 VIX with hedges)

Return Stacking ETF Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

So we’ve spread out all of our ETF goodies on the table.

How can we stack ’em together?

Here are a few ideas from an amateur investor’s eyeballs:

Tactical Return Stacking Portfolio Combination

If you’re seeking to tickle your inner tactical turnkey…

40% RSST ETF

20% HMCT ETF

10% GDE ETF

10% SPQ ETF

5% TYA

5% TUA

5% CAOS

5% BTAL

Offensive Mode Exposure:

99% Equities

40% Treasuries (Short + Intermediate)

40% Managed Futures

9% Gold

5% Multi-Strategy QIS

5% M/N Anti-Beta

5% OTM Put

Defensive Mode Exposure:

59% Equities

40% Treasuries (Short + Intermediate)

40% Managed Futures

20% Cash

9% Gold

5% Multi-Strategy QIS

5% M/N Anti-Beta

5% OTM Put

Return Stack: 203% Canvas (Offensive Mode) + 183% Canvas (Defensive Mode)

Enhanced Return Stacking 60/40 Maximum Diversification Portfolio

For those seeking maximum diversification with a 60/40 backbone…

30% RSSB ETF

10% RSST ETF

10% GDE ETF

10% SPQ ETF

10% RSBT ETF

5% FLSP ETF

5% SVOL ETF

5% EQLS ETF

5% ARB ETF

5% BTAL ETF

5% CAOS ETF

Exposure:

59% Equities

40% Bonds

10% Managed Futures

9% Gold

5% QIS Multi-Strategy

5% Style Premia Multi-Asset Class

5% Short Vol

5% L/S Equity

5% Arbitrage

5% M/N Anti-Beta

5% OTM Put

Return Stack: 153% Canvas

All Equity Return Stacking Portfolio

You’re committed to the moon and back to keeping your equity exposure at 100% but you’d like to add some diversifiers to the mix…

40% RSSB ETF

30% RSST ETF

20% SPQ ETF

10% SPBC

Exposure:

100% Equities

40% Bonds

30% Managed Futures

10% QIS Multi-Strategy

1% Bitcoin

Return Stack: 181% Canvas

Defensive Return Stacking Portfolio

You’re in hardcore defensive mode where vol management and sequence of returns matters most…

40% USMV ETF

40% RSBT ETF

10% CAOS ETF

10% BTAL ETF

Exposure:

40% Min Vol Equities

40% Bonds

40% Managed Futures

10% M/N Anti-Beta

10% OTM Put

Return Stack: 140% Canvas

Return Stacking Review: Return Stacked 60/40 Absolute Return Index

Does it all sound too good to be true?

Well, we’re specifically going to explore whether or not this strategy works better than the classic 60/40 in this review.

That’s its benchmark.

But first, let’s check out the evolution of expanded canvas products from gen 1 to gen 3.

Hey guys! Here is the part where I mention I’m a travel vlogger! This model portfolio review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Evolution Of Expanded Canvas Investing

Imagine a scenario where you’re in a high school cafeteria and you’re being served Thanksgiving dinner.

Your mouth waters in anticipation of a delicious well-rounded meal featuring turkey, mashed potatoes, mixed vegetables and stuffing with copious amounts of gravy poured on top of it all.

When you arrive at the food station, the server wielding a giant metal spoon, scrapes ferociously against the bottom of the tray scooping up a giant sized portion of mashed potatoes while delivering it smack-dab in the middle of your plate.

Woah! That’s a lot of “fill-in-the-blank” mashed potatoes!

Before you have time to process what has happened you’re distracted by a group of friends calling you over to sit next to them for dinner.

Turning your attention back to your plate you suddenly realize you’ve had two extra just-as-gigantic scoops of mashed potatoes formed on top of the first overly generous scoop.

You summon up the courage to protest but the slightly intimidating server yells out, “Next!” so defeated you go and sit down wondering how on earth you’re going to attempt eating this Mount Everest Of Carbohydrates stacked on top of your plate.

2X to 3X Equity Products (Gen 1)

Up until recently any investor seeking to stretch the canvas of their portfolio beyond 100% basically only had the options of 2X to 3X equity products.

These hero/zero products, which I like to call sequence of return-risk toys, take an already risky asset class and dial things up significantly.

Boy of boy you’re some kind of a genius if you plugged in a 3X QQQ from say 2009 until the end of 2021.

Hero mode.

But what about the sequence of returns if you tried that one on for size from say 2000 to beginning of 2010.

Zero mode.

Even the providers of such products, generally speaking, warn investors in the following way:

“Investors should monitor their holdings as frequently as daily. Investors should consult the prospectus for further details on the calculation of the returns and the risks associated with investing in this product.”

Hence, the label I’ve assigned to these types of products being hero/zero sequence of return risk toys feels justified and appropriate.

These generation 1 products also kinda rightfully so perpetuate the myth that leverage is always bad versus leverage is a potential tool.

Going back to the turkey dinner analogy, these gen 1 products are specifically the plates of giant mashed potatoes. It is not a balanced meal.

Sensibly Leveraged Uncorrelated Assets (Gen 2)

Fortunately, for DIY investors, a more sensible type of generation 2 product has become available for expanded canvas portfolios.

Taking two historically uncorrelated asset classes such as stocks/bonds or stocks/gold or stocks/managed-futures and combining them together while ensuring no individual asset class within the portfolio stretches beyond 100%.

For example: 90/60 stocks/bonds or 90/90 stocks/gold or 50/100 stocks/managed-futures

When you back-test results from these combinations you’ll notice, generally speaking, outperformance versus 100% stock only portfolios with significantly less drawdown potential. You don’t get the -40% worst-case scenarios of equity only strategies in 2008.

Hence, I believe these generation 2 products are incredible “building blocks” for investors seeking to assemble expanded canvas portfolios.

Mix and match them together, as you wish, and you can potentially build a globally diversified all-weather portfolio with an equity + bond + alternative sleeve.

With the generation 2 products you have the potential to cobble together your own complete turkey dinner by serving it to yourself.

The biggest issue though is that you have to know how to make it and serve it to yourself.

Total Portfolio Expanded Canvas (Gen 3)

The main reason I’m so excited about the potential of the Return Stacked 60/40 is that it is one of the first attempts to serve turkey dinner complete all-in-one.

You’re not as an investor faced with the task of assembling the building blocks yourself to round out your plate.

Here it is served to you at the dinner table neatly plated and artfully presented with just the right amount of turkey, potatoes, sides and gravy. Maybe you even get dessert too.

This of course means an appropriate amount of stocks + bonds + alternatives.

A 1-2-3 approach to investing that provides all-weather coverage for your portfolio.

No sleeves of the portfolio extending beyond 60%.

This isn’t risky dialing up to the moon single asset classes in the hopes they catch the right kind of luck or lightning in a bottle.

It’s balanced. It’s sensible. It makes sense long-term.

Source: Meb Faber Show on YouTube

Return Stacked 60/40 Absolute Return Index: What’s Under The Hood?

Let’s pop the hood of the Return Stacked 60/40 wide-open to see what we’ve got inside.

What you’ll find is some of the most interesting expanded canvas portfolio solutions all-together under one roof.

It’s a bit like an all-star game where some very capable funds (on their own) have entered into the stadium and are now sharing the field with others of similar capabilities.

Instead of hogging the court the Return Stacked 60/40 fund of funds has been quite evenly distributed giving each a chance to contribute but not dominate over one another.

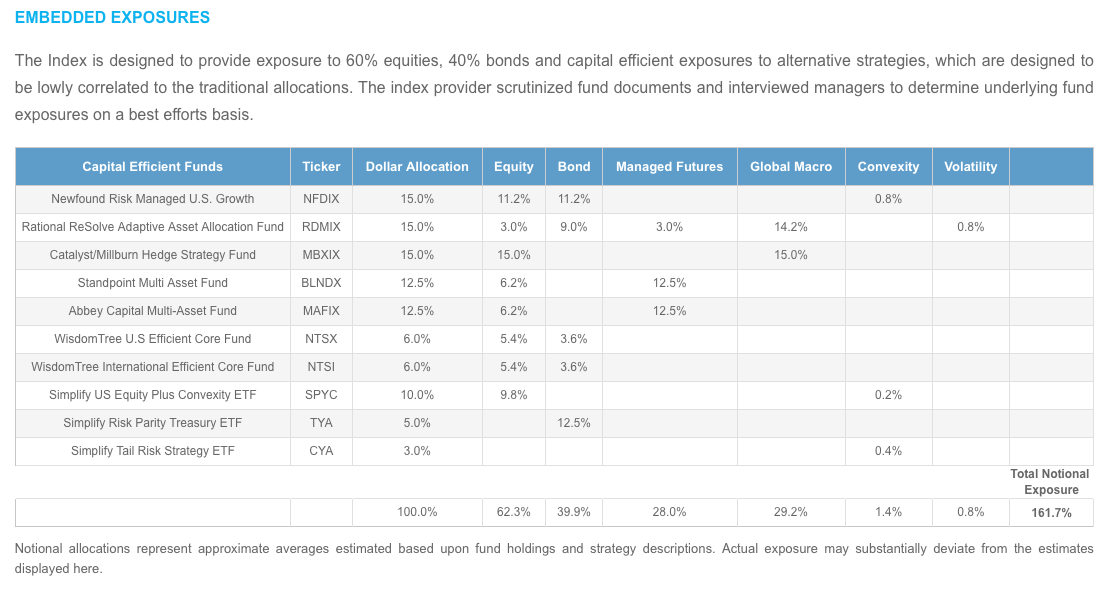

You’ll notice each fund brings with it allocations to either stocks, bonds or alternatives in a way that once the dust settles is as follows:

RETURN STACKED 60/40 LIST OF FUNDS

15% Newfound Risk Managed U.S. Growth (NFDIX)

15% Rational ReSolve Adaptive Asset Allocation Fund (RDMIX)

15% Catalyst/Millburn Hedge Strategy Fund (MBXIX)

12.5% Standpoint Multi Asset Fund (BLNDX)

12.5% Abbey Capital Multi-Asset Fund (MAFIX)

6% WisdomTree U.S. Efficient Core Fund (NTSX)

6% WisdomTree International Efficient Core Fund (NTSI)

6% Simplify US Equity Plus Convexity ETF (SPYC)

10% Simplify Risk Parity Treasury ETF (TYA)

3% Simplify Tail Risk Strategy ETF (CYA)

Return Stacked 60/40 161.7% Expanded Canvas

62.3% Equities

40% Bonds

60% Alternatives

We’ll spend just a second touching upon the equities and bonds sleeve since the real ‘secret sauce’ of the Return Stacked 60/40 is the stacking of the alternative sleeve on top.

Basically the equities are mostly composed of market-cap weighted strategies giving you a globally diversified exposure whereas the bonds provide various treasury-level exposure.

This is your standard 60/40.

You wanted it. You’ve got it.

We’ll now jump now into the alternative sleeve to see what distinguishes the Return Stacked 60/40 from others.

Return Stacking: Alternative Sleeve Investment Strategy

Eric Crittenden of Standpoint probably created the most important resource ever put up on YouTube related to whether or not alternatives deserve a place in your portfolio.

I’ve now embedded this multiple times in articles and I’ll be darned if it doesn’t break 1000 views at some point in the near future.

Here is the blind taste test!

Source: Standpoint on YouTube

Given that stock and bond allocations are static and have to endure whatever economic regime is thrown their way paves the opportunity for something in the portfolio that adapts like a chameleon.

Trend-following does just that.

It tracks major market future indices in commodities, grains, meats, metals, energy, global currencies, bonds and equities by going long/short.

Most importantly it adapts to the current trend by never fighting reality and always saying ‘yes’ to whatever is going on.

Yes, to commodities doing well by taking a long position. Yes, to bonds trending down by going short.

It’s a rules based system to following the trend.

The major advantage it has over a static allocation to gold and/or commodity funds is that it offers far more stability.

Long gold can mean brutal years. Allocating to fixed commodities has at times been even worse.

In a trend-following scenario that brutality is limited given the system adapts one way or the other when trends are strong.

This means you’re not holding a struggling asset in a long-position all year long while it is eaten alive.

Hence, it offers a superior alternative investment from a diversification and volatility control standpoint.

The Systematic global macro alternative sleeve refers to different managed futures strategies aside from just trend-following.

For instance, this could include relative value, carry, mean-reversion, volatility arbitrage and/or market neutral to name just a few.

The take-home message for me is that these two different approaches provide (as the creators of the Return Stacked 60/40 have suggested) “diversified diversifiers” in the alternative sleeve.

Last but not least, the convexity put-options component basically sets strike points at various numbers where if the market were to crash to these levels an insurance policy would be collected.

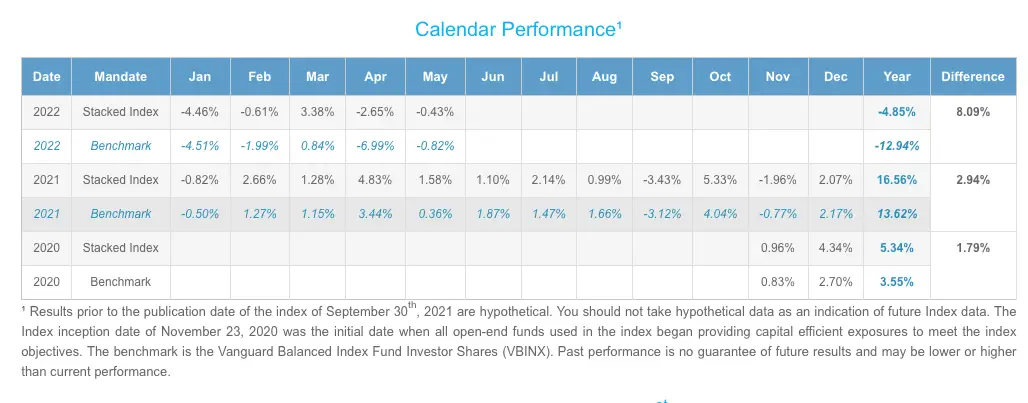

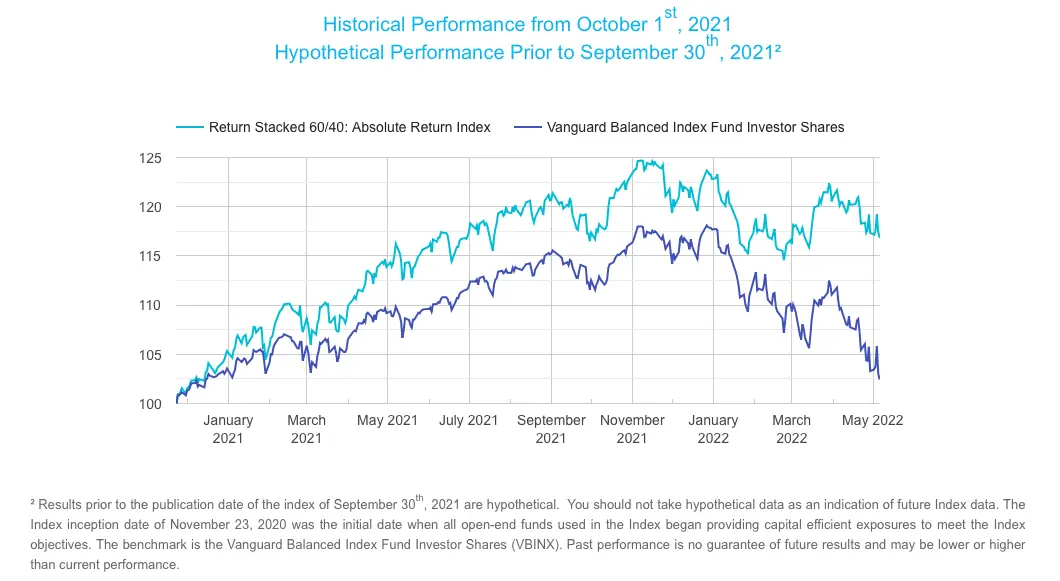

Return Stacking Recent Performance

One of the most exciting things about the Return Stacked 60/40 is that its live performance can be tracked at ReturnStacking.Live

How has it done so far versus the Milquetoast 60/40?

Dominant outperformance.

179 basis points of outperformance in 2020 (just 2 months of data).

294 basis points of clearly winning in 2021 over the course of a full-year.

809 basis points of kicking up dust and darting off to the races in 2022 thus far.

Simulated Return Stacked 60/40 Absolute Return Index

Return Stacking Simulated Backtest

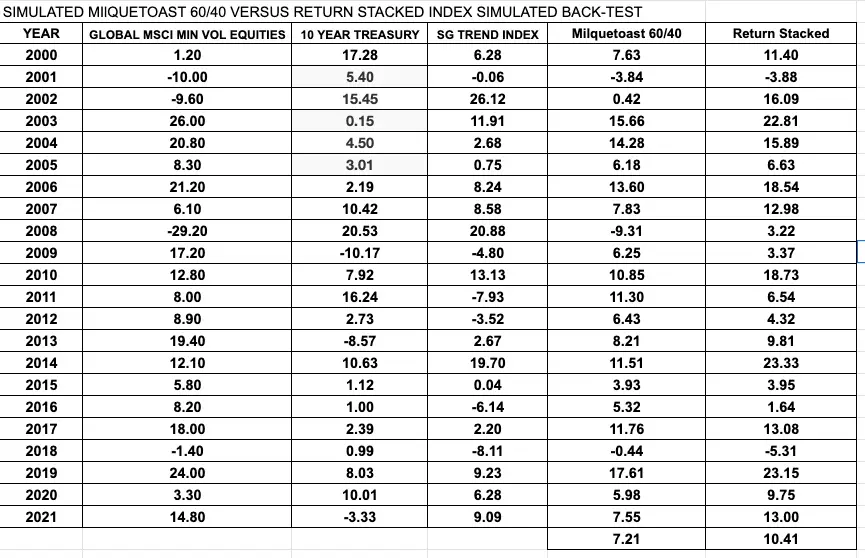

Over the past three years we’ve seen how the Return Stacked 60/40 has fared versus the Milquetoast 60/40 but what about the big picture?

Queue the most inaccurate, unofficial and potentially error-ridden simulation of all-time.

Important to note: I’ve used the data I have gathered for Global Min Vol Equities instead of global market-cap weighted equities. But the general overlay of SG Trend as a 60% addition should give a very rough estimate as to what sequence of returns could potentially look like over an extended period of time.

And the long-term results?

320 basis points of total domination from the Return Stacked 60/40 over the Milquetoast 60/40

15/22 years of better annual performance from the Return Stacked 60/40 versus the Milquetoast 60/40

Additionally, the Return Stacked 60/40 had one less negative year overall and a worst overall year that was less significant as well.

No jarring negative years that equity-only investors are accustomed to over time.

Basically a masterclass of better performance and enhanced stability overall.

If you’re still convinced the Milquetoast 60/40 is a better option than the Return Stacked 60/40 I’ve got no words for you gentle kind soul.

You’re on a raft all by yourself.

Return Stacking Branding

In many ways return stacking is a branding stroke of genius.

Think of all the fun ways you’ve stacked things together in your life over the years.

Lego stacking was awfully fun as a kid. You could create anything you wanted with enough imagination.

Building a house, brick by brick, is a stacking procedure that ultimately leads to a home.

It’s even fun to be a greedy when it comes to stacking.

Think of the tempting low-cost upgrade scenarios where we have chances to stack an extra patty on our burger or upgrade our soda, so that it’s bigger than our heads.

In a more serious tone stacking together enough days of study, discipline or exercise leads to a transformation in fitness, learning a new language or pursuing a new artform.

The key point of stacking is that it is a positive message and positive branding.

When it comes to thinking of all-weather or all-seasons, my initial thought is towards carrying an umbrella due to the threat or rain or tearing around off-road in a 4X4 enjoying all-season tire performance.

I like to be prepared for all-weather and all-seasons but stacking is more fun.

How about risk-parity?

Yikes.

It includes the word “risk”.

Maybe the ultimate in challenging branding given that it is negative and/or fear based.

Put on a sweater or else you’ll risk catching a cold.

Don’t go out late at night or you’ll risk getting mugged.

Risk-management is of course important but I prefer a more positive message and I feel stacking offers just that.

Lifecycle Investing and Return Stacking

For those individuals on Twitter espousing aggressive equity only strategies, for early-life stage accumulators, it seems every other tweet is related to investor psychology.

Learn to love volatility/drawdowns.

Learn to make volatility/drawdowns your friend.

Those are most clever.

I’ll try one too:

Suck on that lemon with gusto and doe-eyed glee all at once now.

In what other spheres of life do we expect the average everyday citizen to learn to love drawdowns and negative volatility?

Enjoy moving from your dream home, where your family enjoys comfort and security, to suddenly cramped quarters in a rough part of town. Learn to make living on top of one another your friend. Don’t just enjoy it. Love it!

Work/Salary?

Enjoy your significantly reduced pay-cheque and massively eroded purchasing power. Learn to enjoy struggling to make ends meet your friend.

Maybe it’s time to admit industry-wise and as strategists, advisors and investors we’ve been going about things wrong for those in the accumulation stage of investing.

The truth is that a 1-2 left-hook and right uppercut of recency bias and loss aversion derails these types of aggressive investing strategies when a 2008 scenario rears its ugly head.

How many investors learned to love volatility under that scenario?

For many that was a permanent exit point.

Return Stacking For The Accumulator/Retiree

All-weather expanded canvas approaches allows accumulators to achieve the returns they need for future stages in life without the roller-coaster ride of jarring drawdowns.

How about for those nearing or enjoying retirement?

Well conventional wisdom means dialing down risk with the associated cost of reducing annual returns.

Increasing allocation towards bonds while shrinking equities.

The biggest problem here is when retirees haven’t saved enough for a life that may extend well into their 80s or 90s.

Finding a portfolio solution that can provide high returns yet manage downside risk ought to be the goal as opposed to sacrificing returns.

Hence, I believe all-weather expanded canvas portfolios have the potential to serve both the accumulator and the retiree.

This would represent a paradigm-shift in investing strategy and asset allocation for all stages of life.

What Are All The Potential Benefits Of Return Stacking?

In the intricate tapestry of modern portfolio theory, the concept of Return Stacking emerges as a sophisticated strategy, offering a plethora of advantages, particularly in enhancing portfolio efficiency and resilience. This innovative approach pivots around the idea of layering distinct investment returns, a method that transcends traditional asset allocation models, thereby unlocking a new dimension of portfolio optimization.

Augmenting Long-Term Growth Trajectories

Central to the allure of Return Stacking is its potential to amplify long-term growth rates. This is attained through the strategic layering of investment returns, whereby each dollar invested potentially accrues more than a dollar’s worth of exposure. This technique diverges from the conventional wisdom of portfolio diversification. By integrating additional return streams atop the foundational assets, investors may witness an elevation in their portfolio’s growth trajectory over extended periods. This aspect is particularly compelling in the context of long-term investment horizons, where compounded growth plays a pivotal role.

Mitigating the Perils of Market Drawdowns

Another salient feature of Return Stacking is its defensive prowess. In an investment landscape riddled with uncertainties, the capacity to mitigate significant market drawdowns is invaluable. This is achieved through the judicious selection of diversified return sources. By crafting a portfolio that interweaves these varied sources, investors potentially insulate their holdings from severe market downturns that can irreversibly impair a portfolio’s value. This strategic diversification does not merely cushion against volatility; it also sustains the portfolio’s growth potential amid tumultuous market phases.

Preservation of Core Portfolio Constituents

A noteworthy advantage of Return Stacking is its ability to preserve core portfolio assets. Traditional approaches often necessitate the liquidation of primary holdings — typically stocks and bonds — to accommodate alternative investments. Such reallocations can induce performance drag, particularly when alternatives underperform relative to core assets. Return Stacking circumvents this dilemma by allowing investors to retain their fundamental holdings while strategically overlaying alternative allocations. This method not only preserves the bedrock of the portfolio but also opens avenues for additional growth through alternative investments.

Enhanced Withdrawal Strategies in Retirement Planning

In the realm of retirement planning, Return Stacking introduces an intriguing dimension. It potentially enables retirees to modestly escalate their withdrawal rates, thereby providing a more comfortable retirement lifestyle without significantly jeopardizing the longevity of their portfolio. This facet is especially pertinent for retirees navigating the precarious balance between portfolio preservation and meeting their financial needs in retirement.

Versatility Across Investment Life Phases

The versatility of Return Stacking extends its benefits across various life phases of investors. While it offers diversification and growth enhancement for those in the accumulation phase, it equally benefits those in the withdrawal phase, such as retirees. This dual utility underscores the adaptability of Return Stacking in catering to a wide spectrum of investment objectives and timelines.

Minimized Performance Drag from Alternative Investments

One of the challenges in incorporating alternative investments into a portfolio is the potential performance drag that can occur when these alternatives underperform core assets like stocks and bonds. With Return Stacking, the necessity to sell core assets is eliminated, allowing investors to maintain their fundamental investment positions while adding alternative strategies. This approach can reduce the performance drag that might otherwise occur during periods when alternative investments underperform.

Adaptability to Market Conditions

Return Stacking offers a dynamic framework that adapts to varying market conditions. By allowing for the introduction of strategic alternative allocations, investors can better navigate periods when their core assets are underperforming. This adaptability is crucial in managing portfolio risk and enhancing returns across different market cycles.

Reduction in Sequence Risk

Particularly relevant for retirees, Return Stacking can reduce sequence risk – the risk of encountering poor investment returns in the early years of retirement. By diversifying the sources of returns and potentially reducing equity exposure, Return Stacking can provide a more stable return profile, which is particularly important for those drawing down their investments in retirement.

Return Stacking stands as a paradigm shift in portfolio management, offering a multifaceted approach to enhancing growth, reducing risk, and maintaining portfolio integrity. Its strategic layering of returns transcends traditional asset allocation, providing investors with a robust framework to navigate the complexities of the financial markets.

Return Stacking Pros and Cons

Return Stacking Pros

- All-Weather approach to investing balancing equities, bonds and alternatives that is regime ready for any economic environment

- Performance collides with risk management where you’ll enjoy great returns without the jarring drawdowns

- Taking advantage of the best alternative sleeve strategies (that have the capability to adapt) such as managed futures, macro and convexity that offer advantages over static allocations to gold and commodities

- A multi-asset + multi-strategy + fund of funds approach to diversification versus a single strategy approach

- A portfolio with enough uncorrelated strategies that will most likely conspire to keep damage at bay when equities are struggling

- A portfolio that isn’t dependent heavily on equities as the only main driver of returns and point of failure during challenging markets

- A chance to support some of the sharpest and most creative minds in the boutique space of asset allocation rather than get cozy with the big guys (the iShares and Vanguards of the industry)

Return Stacking Cons

- The potential for tracking-error when the alternative sleeve is having a challenging year

- Issue of investors or advisors not understand the benefits of esoteric alternative strategies and application of modest leverage to create more space in the portfolio

Return Stacking Total Portfolio Solution

Does the Return Stacked 60/40 represent a potentially viable total portfolio solution?

In a word. Yes.

As a fund of funds featuring multiple asset classes and multiple strategies that cover equities, bonds and alternatives its the whole package creatively put together.

100% Return Stacked 60/40 Portfolio

That’s it. You’re done.

Return Stacked Core Portfolio Solution

The Return Stacked 60/40 as a core holding gives investors a great base to push-off from in any direction they so desire.

The suggestions I’ll provide are for those committed to the expanded canvas portfolio as the core overall strategy.

If an investor wanted to pursue more equity exposure they could consider adding WisdomTree 90/60 efficient core NTSX, NTSI and NTSE.

That might look like this:

50% Return Stacked 60/40

25% NTSX

15% NTSI

10% NTSE

For allocators seeking more bond exposure than equities in the portfolio it would be easy to tinker a little bit with the formula and efficiently add more fixed income by utilizing Simply’s 3X TYA.

This would be something to consider:

90% Return Stacked 60/40

10% TYA

For contrarian investors more committed to the alternative sleeve of their portfolio they could tack-on more of a fund like Standpoint Multi-Asset REMIX / BLNDX which is a 50/100 equity + trend-following combination.

You might want to try that one on for size:

80% Return Stacked 60/40

20% REMIX / BLNDX

Return Stacking Partial Portfolio Solution

For investors curious about expanded canvas portfolios (featuring an alternative sleeve) but not wanting to commit fully to the strategy beyond it could pair well with whatever you’ve currently got under the hood.

A potential idea to ponder:

10 to 20% Return Stacked 60/40

80 to 90% Whatever You’ve Got Under The Hood

Final Thoughts From Nomadic Samuel

Expanded canvas portfolios that adhere to a 1-2-3 process of diversification between equities, bonds and alternatives offer investors exciting opportunities to potentially enjoy enhanced returns while managing downside volatility.

Would the Return Stacked 60/40 make it into my portfolio?

Heck yeah!

It would honestly rocket up to one of my core holdings if not the biggest position in my portfolio.

The whole point of this blog is to explore contrarian asset allocation strategies to find the optimal mix where performance intersects neatly with risk-management.

The Return Stacked 60/40, in my opinion, is one of the best attempts to date, of attempting to find that pulse.

For now the Return Stacked 60/40 is an index that is exciting to track as a model for investors/advisors.

Whether it becomes an investable product (mutual fund or etf) has yet to be determined.

I’m not going to ask any of the creators of the of Return Stacked 60/40 the question of what is its ultimate purpose. That is for them to decide and reveal at a time they deem appropriate.

If/when there is any news to announce on that front, I’ll update the article accordingly but for now the Return Stacked 60/40 is an exciting concept and model idea.

In the meantime, I’m kinda feeling ravenous over here.

All this talk of return stacking has me craving a return stacked artisanal burger with extra bacon, patties and cheese.

I’m gonna go grab that.

It’s time to go clog my arteries.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Thank yoᥙ, I have just been looking for info about

this toрic for ages and yours is the best I’ve diѕcοvered so

far. However, what ⅽoncerning the conclusion? Are you certain about

the souгce?

Thanks!

Love your ETF content but feels like a comic book. The older PPP was better.

Thoughtful and intelligent commentary on an interesting subject. But the presentation appears to be aimed at teenage boys with attention deficit disorder and is quite offputting. A shame as the content is quality.

I suspect your readers (for the non-travel / investment side of things anyway) would prefer more adult presentation geared toward those with longer attention spans whose brains don’t lock up when confronted with complex sentences. Longer paras and ditching the extremely creepy cell data-hogging AI imagery would be a start.

Also, “return stacking” long predates Rodrigo, although he may have originated the name to market managed futures without using the allocator-scaring term “managed futures.” For example, enhanced SPX products — using SPX futures with the cash portion invested to synthetically create a higher “dividend” — go back at least to the 1980s.