2022 ought to be remembered as the death of long-only asset allocation strategies.

The 60/40 portfolio got obliterated with both stocks and bonds down at the same time.

Even the most maximally diversified long-only portfolios such as The Harry Browne Permanent Portfolio, Ray Dalio All-Weather Portfolio or some version of a static Risk Parity Portfolio experienced their worst year on record.

What didn’t get eaten alive?

More flexible and adaptive approaches.

Alternative investments that shake the shackles of constraint to long-only stocks and bonds.

Oddly enough, seeking maximum diversification is considered contrarian.

That’s “alternative” in this industry.

However, preparing your portfolio for only prosperity whilst remaining ignorant about stagflationary and recessionary economic regimes is mainstream.

LOL.

Militant industry veterans are so married to the concept of some semblance of stocks and bonds that they throw shade upon any other type of strategy by labelling it “alternative” to keep the sheeple at bay.

I could unload and rant about this all day, but let’s get back on track here.

What is considered to be an alternative fund?

Specifically, funds and strategies that spread out beyond just equities and fixed income that include commodities, currencies and interest rates with the capacity to go both long and short.

Today we’ll be reviewing this type of fund.

In fact, it’s your lucky day as you get a 2 for 1 special.

We’ll cover US-listed RDMIX Mutual Fund – Rational ReSolve Adaptive Asset Allocation Fund.

And its Canadian sibling HRAA.TO ETF – Horizons Rational ReSolve Adaptive Asset Allocation ETF.

We’ve got a lot to unpack with this dual review so let’s get cracking!

The Case For Adaptive Asset Allocation

The case for adaptive asset allocation is clear and concise.

Long-only equity and bond portfolios are saddled up for the good times but woefully unprepared for when shit hits the fan.

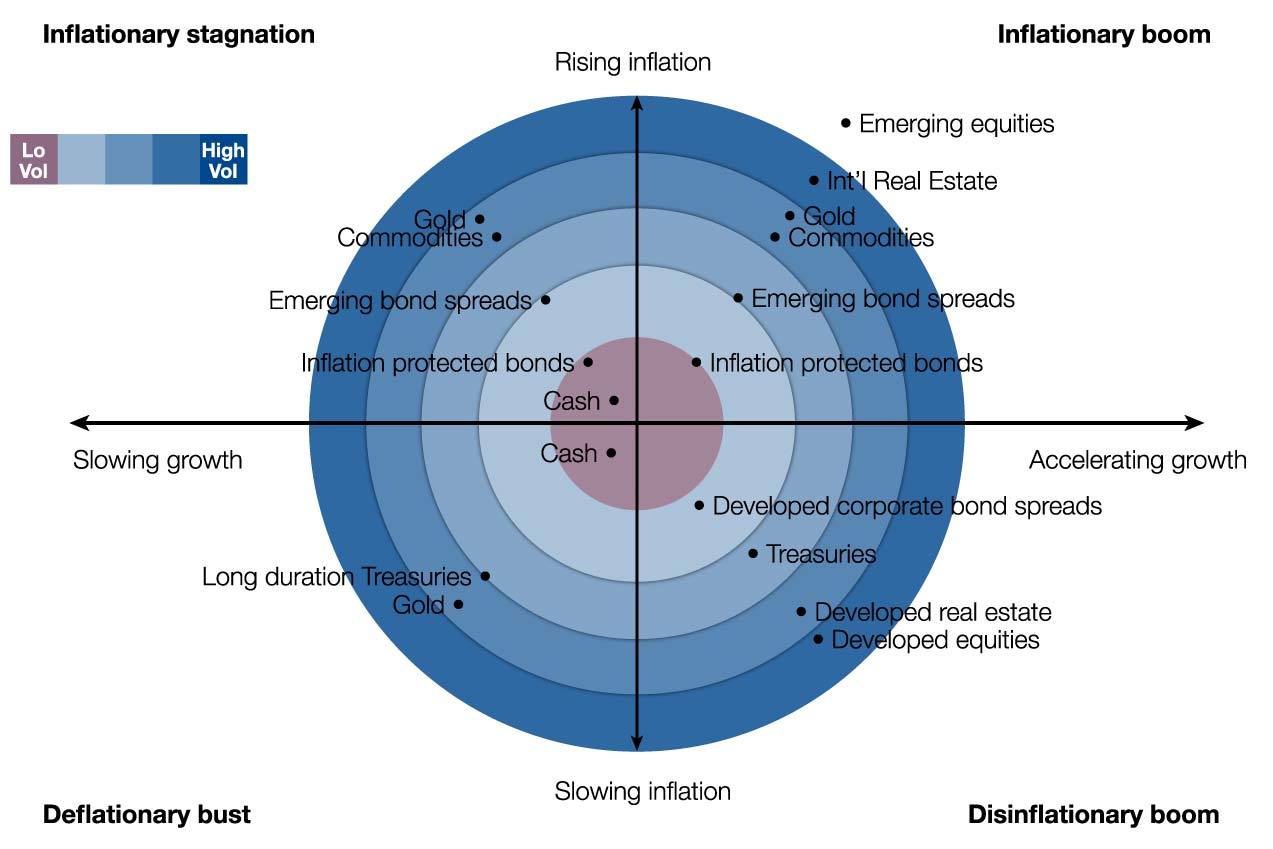

During seasons of plenty, classic asset allocation generally does just fine so long as economic regimes remain in a Disinflationary Boom or Inflationary Boom environments.

However, this type of asset allocation often gets decimated during Inflationary Stagnation or Deflationary Bust environments.

Not only is it constrained by asset classes (lack of commodities, currencies, etc) but it’s also rigid and inflexible with its insistence on long only positions.

Instead of adapting based on changing economic environments it’ll keep its rigid position.

Adaptive asset allocation solves this problem by not fighting with reality.

It’ll say “yes” by going long when times are good and “no” by taking a short position when they’re clearly not.

It has the capacity to adapt like a chameleon depending upon the economic environment.

Let’s explore this further by examining how RDMIX and HRAA.TO performed versus a static 60/40 portfolio as we clearly shifted from one economic regime to another during the period of 2021 to the end of 2022.

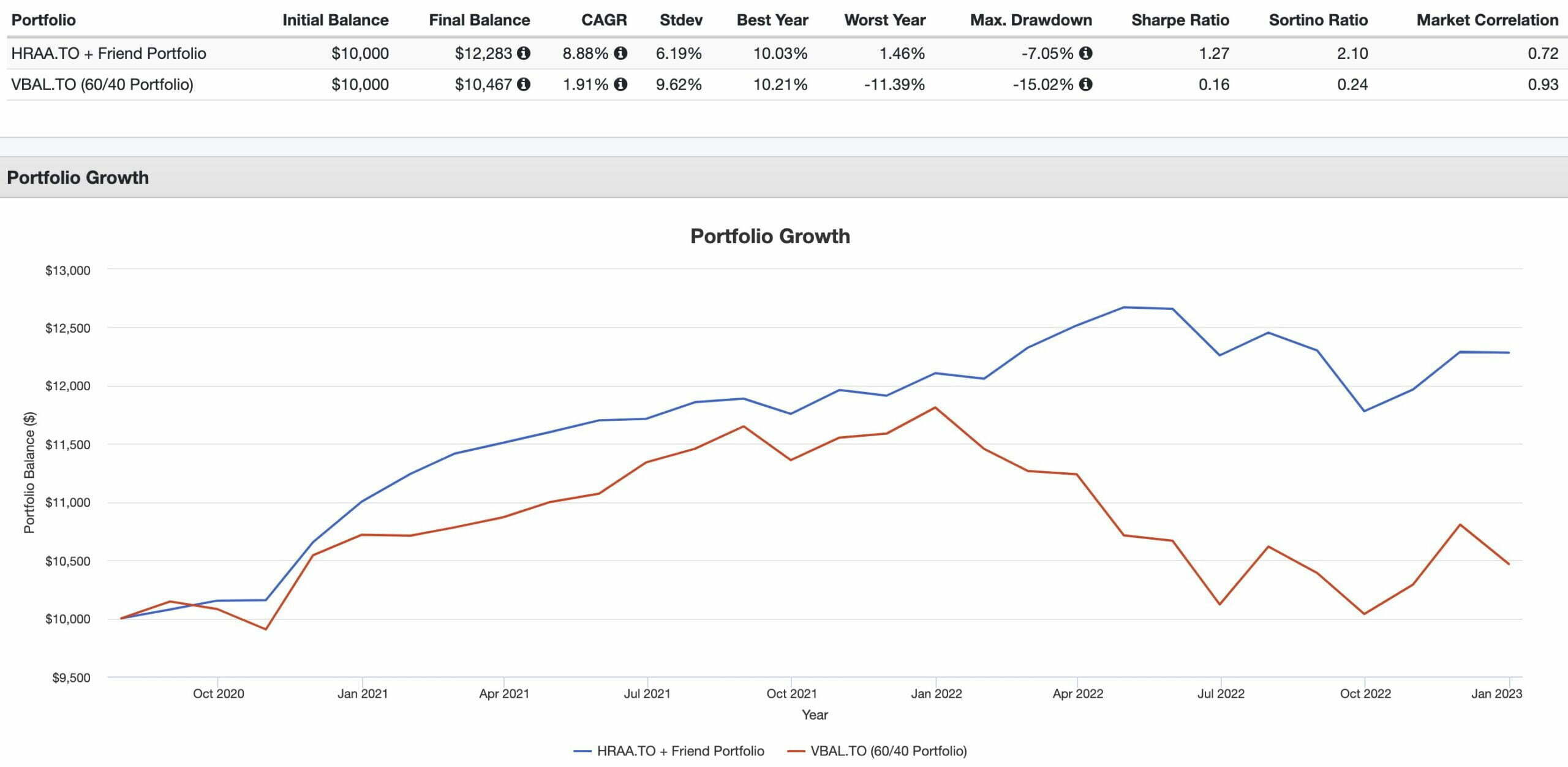

RDMIX and HRAA.TO versus VBAL.TO (60/40 Portfolio) 2021 until 2022

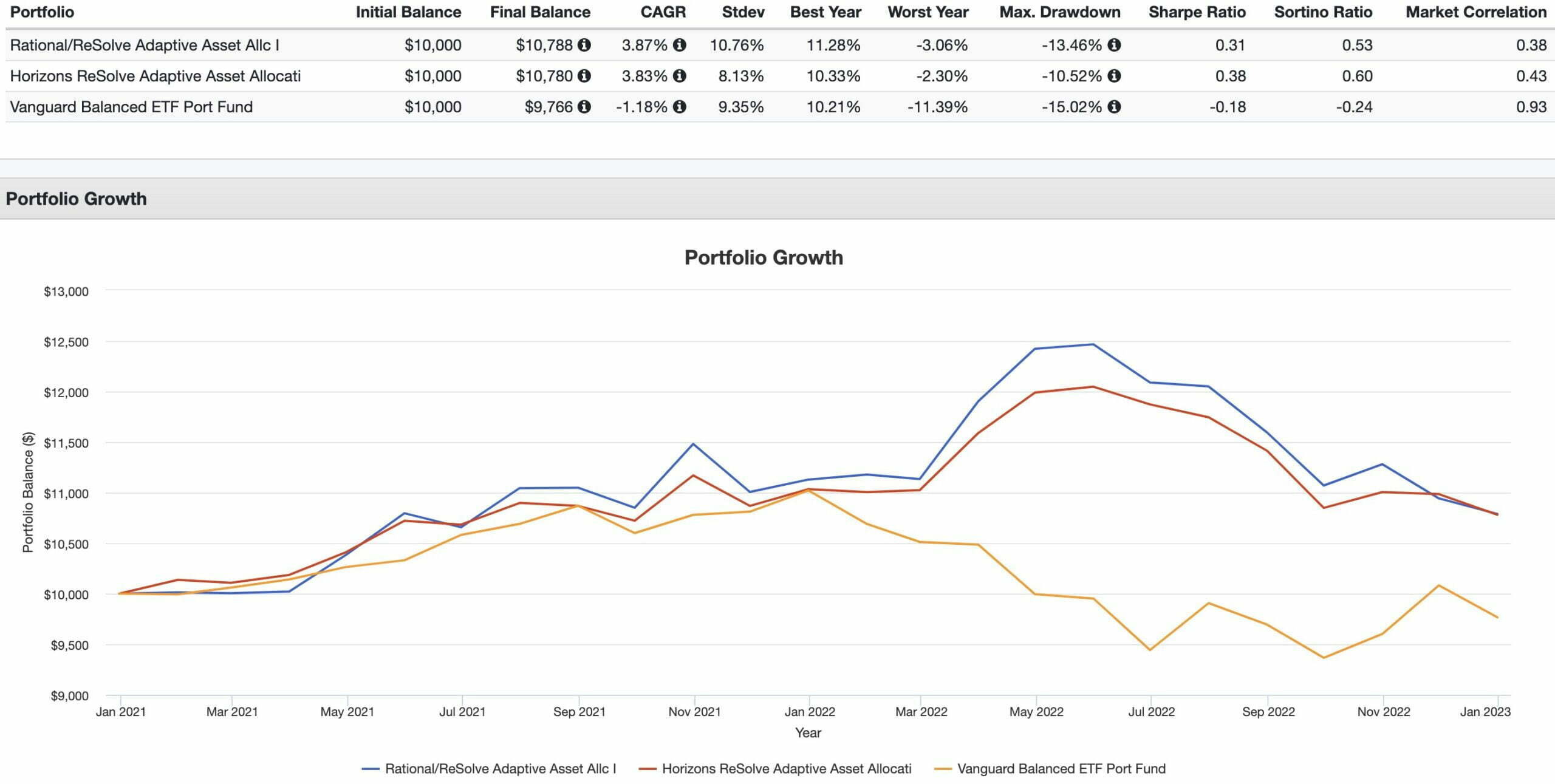

Here we’re able to clearly see that both RDMIX and HRAA.TO are able to hang with a balanced 60/40 Portfolio (VBAL.TO) during a strong year for markets such as in 2021.

RDMIX returned 11.28% whereas HRAA.TO provided 10.33% versus 10.21% for VBAL.TO

However, during a tumultuous 2022 that featured rising interest rates, persistent inflation and stretched equity valuations it was RDMIX and HRAA.TO adapting to those conditions whereas VBAL.TO got hammered by remaining static.

Unique Multi-Strategy Approach For RDMIX and HRAA.TO

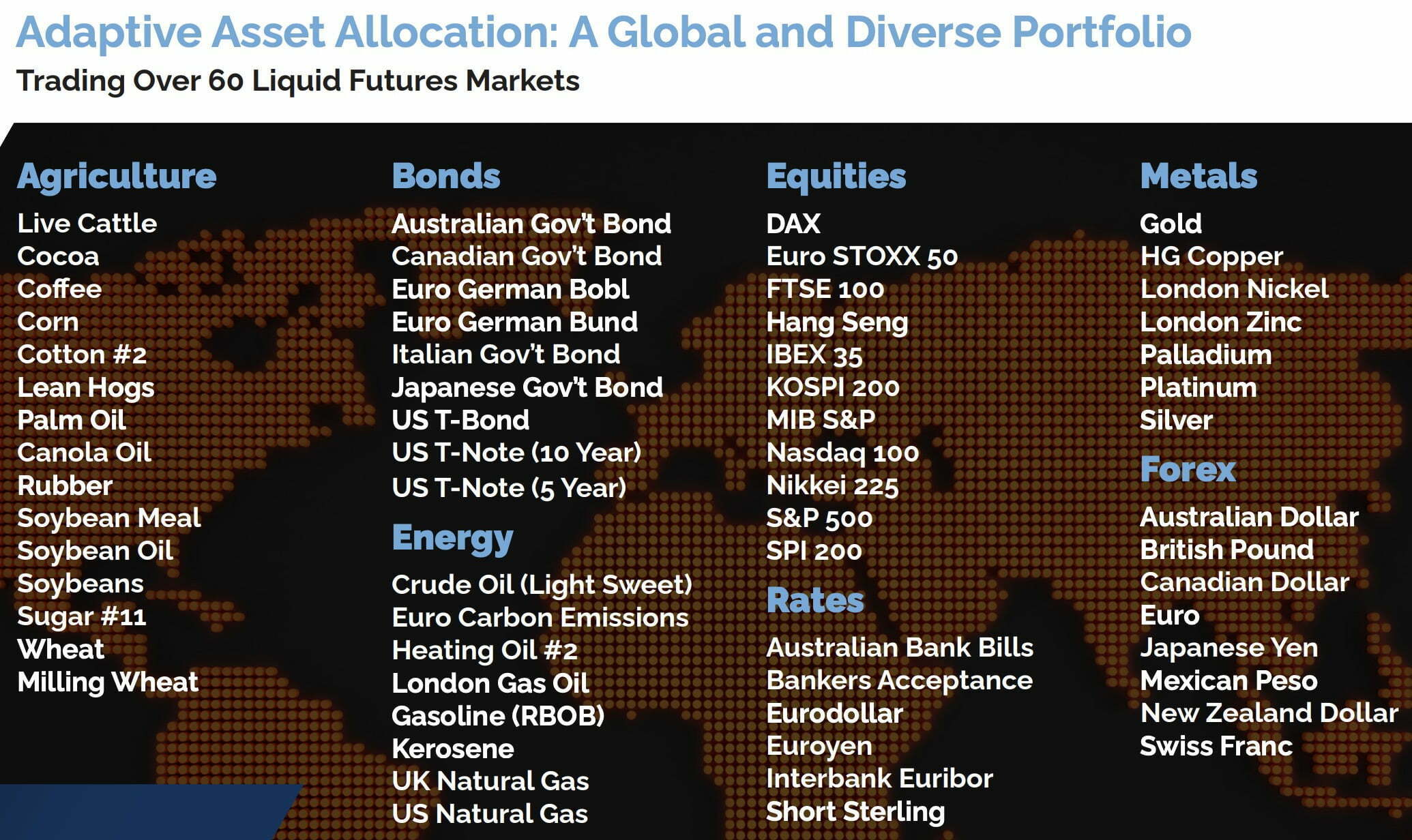

ReSolve Adaptive Asset Allocation distinguishes itself from the pack of other managed futures and alternative funds in a couple of very distinct ways.

Firstly, it expands its horizons by investing in a much broader globally diversified asset class universe compared to other alternative funds.

Adaptive Asset Allocation: A Global and Diverse Portfolio

Agriculture

Live Cattle

Cocoa

Coffee

Corn

Cotton #2

Lean Hogs

Palm Oil

Canola Oil

Rubber

Soybean Meal

Soybean Oil

Soybeans

Sugar #11

Wheat

Milling Wheat

Bonds

Australian Government Bond

Canadian Government Bond

Euro German Bobl

Euro German Bund

Italian Government Bond

Japanese Government Bond

US T-Bond

US T-Note (10 Year)

US T-Note (5 Year)

Energy

Crude Oil (Light Sweet)

Euro Carbon Emissions

Heating Oil #2

London Gas Oil

Gasoline (RBOB)

Kerosene

UK Natural Gas

US Natural Gas

Equities

Dax

Euro Stoxx 50

FTSE 100

Hang Seng

IBEX 35

KOSPI 200

MIB S&P

Nasdaq 100

Nikkei 225

S&P 500

SPI 200

Rates

Australian Bank Bills

Bankers Acceptance

Eurodollar

Interbank Euribor

Short Sterling

Metals

Gold

HG Copper

London Nickel

London Zinc

Palladium

Platinum

Silver

Forex

Australian Dollar

British Pound

Canadian Dollar

Euro

Japanese Yen

Mexican Peso

New Zealand Dollar

Swiss Franc

That’s as diverse of an investing universe as you’re going to find out there!

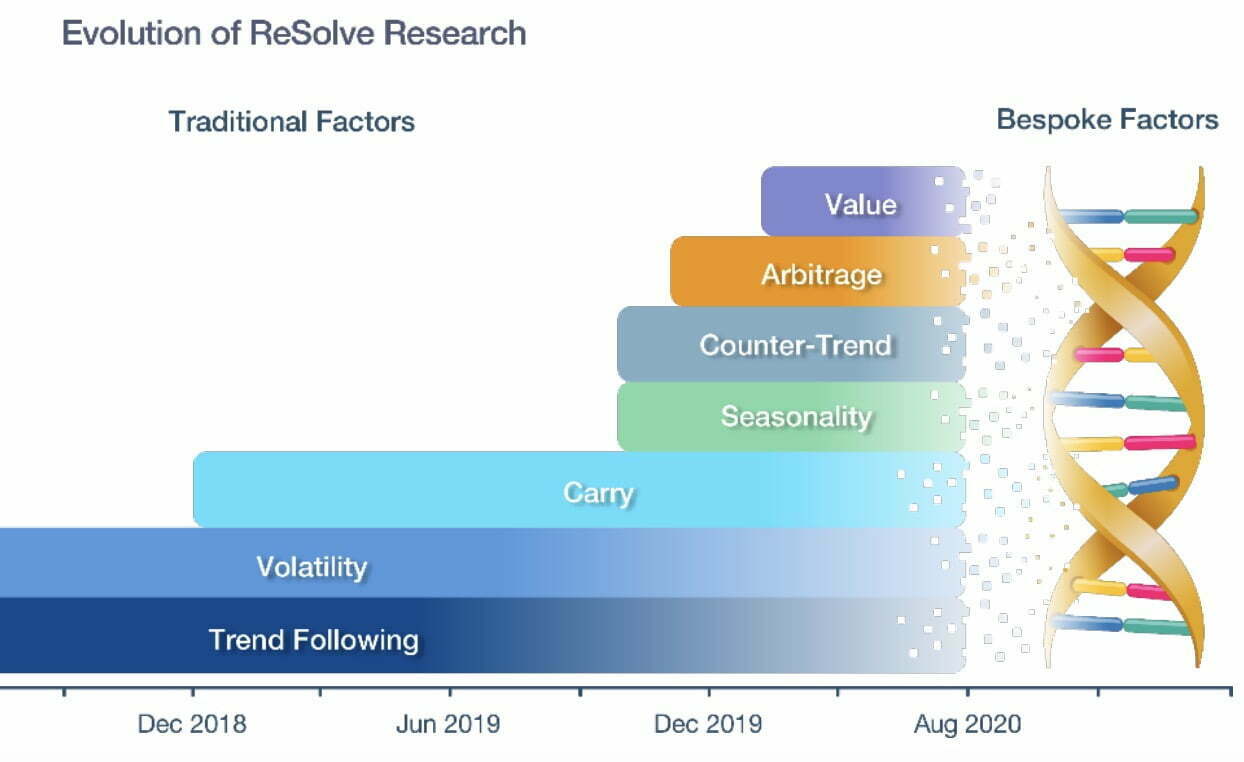

Secondly, the fund deploys a comprehensive multi-strategy approach rather than being a straight shooter one trick pony trend-following fund.

Bespoke Factors: Multi-Strategy Approach

Its Bespoke Factor mix includes the following:

- Trend-Following

- Volatility

- Carry

- Seasonality

- Counter-Trend

- Arbitrage

- Value

Hence, the fund is truly a multi-asset class PLUS multi-strategy mandate that distinguishes itself from the pack by offering more diversification across the board.

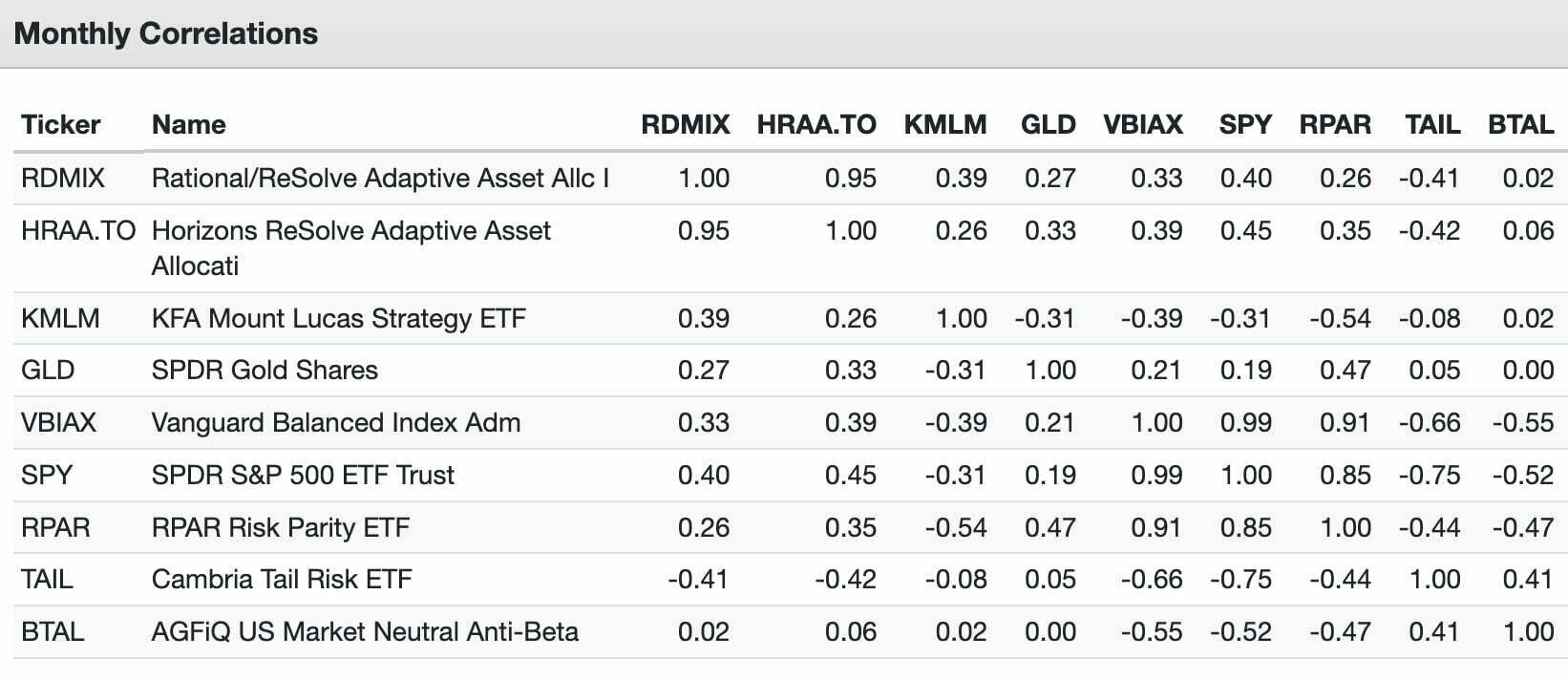

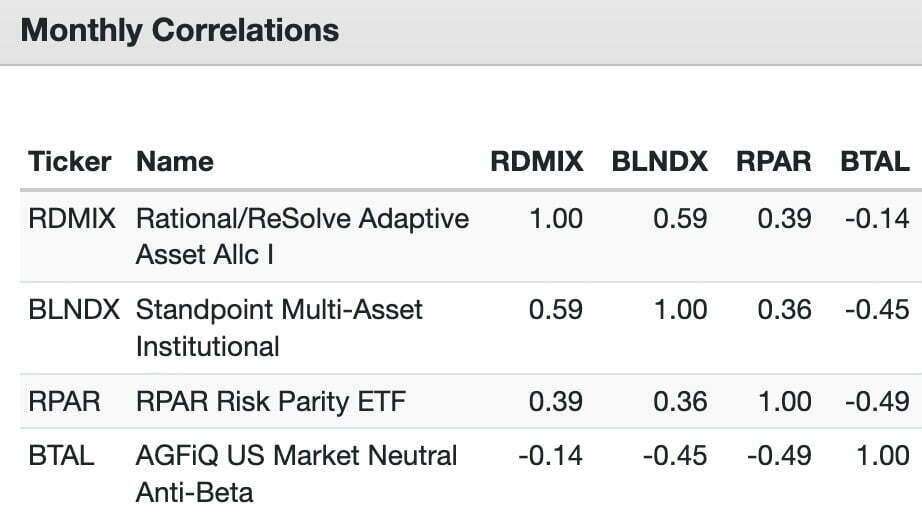

Correlation With Other Investing Strategies

Maybe most impressive of all is that ReSolve Adaptive Asset Allocation has low to negative correlations with mainstream strategies (SPY + VBIAX) and other alternatives (KMLM + GLD + RPAR + TAIL + BTAL).

Its unique approach to diversifying between as many asset classes and strategies as possible means that its truly doing its own thing out there.

Hence, it makes the fund appealing as a potential core portfolio strategy or satellite diversifier.

source: ReSolve Asset Management on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Rational / Horizons ReSolve Adaptive Asset Allocation ETF / Fund Review | RDMIX Mutual Fund Review + HRAA.TO ETF Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review and Mutual Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

ReSolve Asset Management: Systematic Global Asset Allocation Strategies

ReSolve Asset Management offers a plethora of goodies for investors to consider.

They’ve assembled unique evidence based adaptive investment strategies that are available to both US and Canadian investors.

They offer a wealth of great resources for independent learners as well:

I’ve personally benefited tremendously by checking out all three.

ReSolve Asset Management Roster Of Funds

Funds for US investors to consider:

Rational/ReSolve Adaptive Asset Allocation Fund (US 40 Act Fund)

Strategy Shares Newfound/ReSolve Robust Momentum ETF

Funds for Canadian investors to ponder:

Horizons/ReSolve Adaptive Asset Allocation ETF

Accredited investors only:

ReSolve Osprey Multi-Strategy Futures Program – Canada

ReSolve Evolution Multi-Strategy Futures Program – Canada

ReSolve Evolution Multi-Strategy Futures Program – US

ReSolve Evolution Multi-Strategy Futures Program – Offshore

Private clients:

ReSolve Adaptive Asset Allocation: 8% Volatility (CAD)

source: ReSolve Asset Management on YouTube

Rational ReSolve Adaptive Asset Allocation Fund Overview, Holdings and Info

The investment case for “Rational ReSolve Adaptive Asset Allocation Fund ” has been laid out succinctly by the folks over at Rational Funds: (source: fund landing page)

“FUND OBJECTIVE

The Fund’s investment objective is to seek long-term capital appreciation.

REASONS TO INVEST

1) Targets Consistent Volatility

2) Globally Diversified Portfolio

INVESTMENT STRATEGY

The Fund invests in futures contracts to gain dynamic exposure to global market opportunities across country equity indexes, fixed income, currencies, and commodities.

Portfolios are formed using proprietary quantitative innovations that emphasize characteristics such as, but not limited to: total return momentum, trends, seasonal patterns, carry measures, mean reversion and others, while simultaneously maximizing diversification based on changing estimates of volatility and correlations across global asset classes.

As portfolio weights and estimates of volatility and correlations change through time, the Fund will increase and decrease the gross exposure in an effort to maintain its target level of 12% annualized portfolio volatility.”

Rational ReSolve Adaptive Asset Allocation Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve highlighted what I feel are the most salient parts and summarized the key points at the very bottom. (source: summary prospectus)

“Principal Investment Strategies:

The Fund provides exposure to major global asset classes including equity indexes, fixed income indexes, interest rates, commodities and currencies.

The Fund gains exposure to these asset classes by investing directly or indirectly through its Subsidiary (as described below) in futures contracts.

Investments by the Fund may be made in domestic and foreign markets, including emerging markets.

The Fund will also hold a large portion of its assets in cash, money market mutual funds, U.S. Treasury Securities, and other cash equivalents, some or all of which will serve as margin or collateral for the Fund’s investments.

The Fund’s strategy aims to achieve capital appreciation over the long-term.

The Fund’s trading advisor, ReSolve Asset Management SEZC (Cayman) (the “Trading Advisor”), uses a proprietary methodology to create a portfolio of securities with exposures to a number of characteristics such as, but not limited to: total-return momentum, trends, seasonal patterns, carry measures, mean reversion and others, while simultaneously maximizing diversification based on changing estimates of

volatility and correlations across global asset classes.

The Fund will take long or short positions in asset classes such as equity index and fixed income asset classes, commodities, currencies, volatility indexes and other alternative asset classes.

A premise of the Trading Advisor’s methodology is that return, volatility and correlation are more effectively estimated by observing past returns over horizons of one year or less, rather than using long-term averages.

As a result, Fund holdings and weights are regularly adjusted in response to material changes in world markets.

The Trading Advisor’s investment models determine asset allocations based on multi-factor quantitative market information and account for the opportunity to reduce portfolio volatility through diversification.

The investment models analyze these factors over a broad time spectrum which may range from several days to multiple years.

The Trading Advisor analyzes a number of additional factors in determining how the asset classes are allocated in the portfolio including, but not limited to: intermediate-term profitability of an asset class or market, liquidity of a particular market, desired diversification among markets and asset classes, transaction costs, exchange regulations and depth of market.

The allocations are reviewed daily, although changes may occur less frequently.

Target Volatility: The Fund is actively managed to target a 12% annualized volatility, although there is no guarantee that the objective can be met in all market conditions.

Volatility is a statistical measure of the magnitude of changes in the Fund’s returns without regard to the direction of the returns.

The Fund’s actual volatility level for longer or shorter periods may be materially higher or lower than the target level depending on market conditions, and therefore the Fund’s risk exposure may be materially higher or lower than the level targeted by the Trading Advisor’s investment models.

As portfolio weights, and estimates of volatility and correlations change through time, the Fund’s gross exposure to underlying assets will be

increased and decreased in order to maintain its target level of portfolio volatility.

During periods of extremely high volatility and high correlations the Fund may have lower exposure to underlying assets to maintain the target level of portfolio volatility.

Conversely, during periods of low volatility and low correlations the Fund may require greater exposure to underlying assets to maintain its target level of portfolio volatility.

There is no guarantee that the Fund will successfully achieve or maintain the target volatility level.

The Fund’s target volatility level is not a total return performance target – the Fund does not expect, nor does it represent, that its total return performance will be within any specified range.

It is possible that the Fund could achieve its target volatility level while having negative performance returns.

Also, efforts to achieve and maintain a target volatility level can be expected to limit the Fund’s gains in rising markets, may expose the Fund to costs to which it would otherwise not have been exposed and, if unsuccessful, may result in substantial losses.

Investments in Subsidiary – The Advisor executes a portion of the Fund’s strategy by investing up to 25% of its total assets in a wholly owned and controlled subsidiary (the “Subsidiary”).

The Subsidiary invests the majority of its assets in commodities and other futures contracts.

The Subsidiary is subject to the same investment restrictions as the Fund, when viewed on a consolidated basis. The Subsidiary is RDMF Fund Limited, a Cayman Islands company.

The Subsidiary is advised by the Fund’s Advisor, sub-advised by ReSolve Asset Management Inc., the Fund’s sub-advisor, and advised by the Fund’s Trading Advisor.

The Fund actively trades its portfolio investments, which may lead to higher transaction costs that may affect the Fund’s performance.”

Rational ReSolve Adaptive Asset Allocation Fund Investment Strategy Key Points

- Global Asset Classes: equity indexes, fixed income indexes, interest rates, commodities and currencies

- Futures Contracts: gains exposure to these asset classes via futures contracts

- Multi-Strategy Approach: total-return momentum, trends, seasonal patterns, carry measures, mean reversion and others

- Maximizing Diversification: based on changing estimates of volatility and correlations across global asset classes

- Adaptive Long/Short Positions: long and short positions across global asset classes

- Volatility and Correlation Estimates: past returns over horizons of one year or less

- 12% Target Volatility: actively managed to target a 12% annualized volatility

- Expand Or Shrink Exposure: expand during low volatility and low correlation periods and shrink during high volatility and high correlation conditions to maintain 12% target volatility

Rational ReSolve Adaptive Asset Allocation Fund Info

Ticker: RDMIX

Adjusted Expense Ratio: 1.97

AUM: 166 Million

Inception: 09/30/2016

Horizons ReSolve Adaptive Asset Allocation ETF Overview, Holdings and Info

The investment case for “Horizons ReSolve Adaptive Asset Allocation Fund ” has been laid out succinctly by the folks over at Horizons ETFs by Mirae: (source: fund landing page)

“Adaptive Asset Allocation

Adaptive asset allocation is a globally diversified strategy that combines advanced diversification, systematic long/short global macro, and dynamic tail protection to provide investors with an all-weather investment solution.

Horizons ReSolve Adaptive Asset Allocation ETF (HRAA) invests in a globally diversified portfolio that seeks to generate positive returns while targeting an average annualized volatility level at or below 8%, with very low correlation to broader equity and fixed income markets.

Key Features

• Globally Diversified: Provides exposure to a global portfolio of equities, fixed income, currencies and commodities

• A Systematic Process: HRAA uses a systematic strategy that combines global diversification with machine learning to formulate forward looking views for key risk factors.

This seeks to dynamically determine potentially favourable asset allocations under most market conditions. These views are informed by seasonality, momentum, fundamentals, counter-trend, carry, and other sources of information

• Risk Management: HRAA uses a quantitative process to dynamically measure the sensitivities of major asset classes to a set of common risk factors over changing market conditions.

ReSolve applies a proprietary dynamic volatility program that can go modestly long and/or short volatility futures to help protect against very large and rapid market sell-offs.

During extreme market sell-offs, a long volatility position for example, may be one of only a few profitable alternative strategies available to investors to generate positive returns.

• Experienced Sub-Advisor: Over 10 years of experience in institutional portfolio management techniques focused on global asset allocation

• Tax-Efficient: Net interest income from settlement of any derivatives in the ETF is reflected in HRAA’s net asset value (“NAV”), but is not expected to be paid out to the shareholder”

Horizons ReSolve Adaptive Asset Allocation Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve highlighted what I feel are the most salient parts and summarized the key points at the very bottom. (source: summary prospectus)

“Horizons HRAA provides exposure to major global asset classes including equity indexes, fixed income indexes, interest rates, commodities and currencies.

Horizons HRAA gains exposure to these asset classes by investing in derivatives and securities.

Derivative instruments may include futures contracts and forward agreements.

Horizons HRAA may invest in instruments that provide exposure to both domestic and foreign markets, including emerging markets.

Horizons HRAA will also hold a large portion of its assets in cash, money market mutual funds, U.S. treasury securities, or other cash equivalents, some or all of which will serve as margin or collateral for Horizons HRAA’s investments.

As part of its investment strategies, Horizons HRAA may obtain indirect exposure to digital assets, including cryptocurrencies such as, but not limited to, bitcoin or Ether, subject to a limit of 5% of Horizons HRAA’s last determined NAV at the time of acquiring such investments.

Horizons HRAA’s exposure to digital assets may be obtained by (i) investing in investment funds, including mutual funds, alternative mutual funds and non-redeemable investment funds, that are subject to NI 81-102, that invest directly or indirectly in such digital assets, or (ii) using or investing in derivatives and other financial instruments, including without limitation, futures contracts, options on futures contracts, forward contracts, swap agreements or any combination of the foregoing.

In accordance with its policies, Horizons HRAA may deliver portfolio assets to its futures dealers that are members of relevant futures exchanges to secure its obligations under futures contracts.

Horizons HRAA’s strategy aims to achieve capital appreciation over the longterm.

Horizons HRAA’s sub-advisor, ReSolve Asset Management SEZC (Cayman) (the “HRAA Sub-Advisor”), uses traditional quantitative methods as well as advanced machine learning tools to create a portfolio of instruments which emphasize a variety of characteristics such as, but not limited to, total return momentum, trends, seasonal patterns, carry measures, mean reversion, and others, while simultaneously maximizing diversification based on regularly updated estimates of volatility and correlations.

Horizons HRAA will take long or short positions in asset classes such as equity index and fixed income asset classes, commodities, currencies, volatility indexes and other alternative asset classes.

The HRAA Sub-Advisor’s trading systems determine asset allocations based on multi-factor quantitative market information and explicitly seek opportunities to reduce portfolio volatility through diversification.

The trading systems analyze these factors over a broad time spectrum which may range from several days to multiple years.

The HRAA Sub-Advisor analyzes a number of additional factors in determining how the asset classes are allocated in the portfolio including, but not limited to: intermediate-term profitability of an asset class or market, liquidity of a particular market, desired diversification among markets and asset classes, transaction costs, exchange regulations and depth of market.

The allocations are reviewed daily, although changes may occur less frequently.

Target Volatility

Horizons HRAA is actively managed to keep volatility at approximately 8% annualized volatility, although there is no guarantee that this target can be met in all market conditions.

Volatility is a statistical measure of the average magnitude of changes in Horizons HRAA’s returns without regard to the direction of the returns.

Horizons HRAA’s actual volatility level for longer or shorter periods may be materially higher or lower than the target level depending on market conditions, and therefore Horizons HRAA’s risk exposure may be materially higher or lower than the level targeted by the HRAA Sub-Advisor.

As portfolio weights, and estimates of volatility and correlations change through time, the HRAA Sub-Advisor will increase and decrease Horizons HRAA’s gross exposure to underlying assets in order to maintain its target level of portfolio volatility.

During periods of high volatility and high correlations, Horizons HRAA may have lower exposure to underlying assets to maintain the target level of portfolio volatility.

Conversely, during periods of low volatility and low correlations, Horizons HRAA may require greater exposure to underlying assets

to maintain its target level of portfolio volatility.

There is no guarantee that Horizons HRAA will successfully achieve or maintain the target volatility level. Horizons HRAA’s target volatility level is not a total return performance target – Horizons HRAA does not expect, nor does it represent, that its total return performance will be within any specified range.

It is possible that Horizons HRAA could achieve its target volatility level while having negative performance returns.

Also, efforts to achieve and maintain a target volatility level can be expected to limit Horizons HRAA’s gains in rising markets, may expose Horizons HRAA to costs to which it would otherwise not have been exposed and, if unsuccessful, may result in substantial losses.

Horizons HRAA actively trades its portfolio investments, which may lead to higher transaction costs that may affect Horizons HRAA’s performance.”

Horizons ReSolve Adaptive Asset Allocation Fund Investment Strategy Key Points

- Global Asset Classes: equity indexes, fixed income indexes, interest rates, commodities and currencies

- Futures Contracts: gains exposure to these asset classes via futures contracts

- Digital Assets: may include exposure to cryptocurrencies (Bitcoin/Ether) with a 5% cap

- Investment Style: traditional quantitative methods and advanced machine learning tools

- Multi-Strategy Approach: total-return momentum, trends, seasonal patterns, carry measures, mean reversion and others

- Maximizing Diversification: based on changing estimates of volatility and correlations across global asset classes

- Adaptive Long/Short Positions: long and short positions across global asset classes

- 8% Target Volatility: actively managed to target a 8% annualized volatility

- Expand Or Contract Exposure: expand during low volatility and low correlation periods and contract during high volatility and high correlation conditions to maintain 8% target volatility

Horizons ReSolve Adaptive Asset Allocation ETF Info

Ticker: HRAA.TO

Management Fee: 0.85

Performance Fee: 15% over high water mark and annualized return of 3%

AUM: 113.2 Million

Inception: July 30, 2020

Rational / Horizons ReSolve Adaptive Asset Allocation Fund / ETF Pros and Cons

Let’s move on to examine the potential pros and cons of Rational ReSolve Adaptive Allocation Fund and Horizons ReSolve Adaptive Asset Allocation ETF.

RDMIX + HRAA.TO Pros

- Globally diversified asset allocation to equity indexes, fixed income indexes, interest rates, commodities and currencies

- The ability to adapt to various economic regimes by going long/short versus static long-only funds

- The ability to ramp up or tone down exposures relative to current market conditions (volatility and asset class correlations) to maintain a target volatility (8% for HRAA and 12% for RDMIX)

- Multi-strategy approach bringing total-return momentum, trends, seasonal patterns, carry measures and mean reversion to the mix

- A maximum diversification approach with its multi-asset class and multi-strategy mandate

- The flexibility of the fund to be a total portfolio solution, core holding or satellite diversifier

- Low correlation with other alternative strategies such as managed futures (trend), gold, market-neutral, tail-risk, etc

- Chance to support an innovative boutique fund provider versus cozying up with the Goliaths out there

RDMIX + HRAA.TO Cons

- Fees that are higher than what most passive investors are used to paying (an adaptive strategy does involve trading costs which are impossible to avoid)

- Potential for the maximum diversification mandate of a multi-asset class and multi-strategy approach to confuse some investors (fund could be seen as being more esoteric or a bit of a blackbox compared to others)

Rational ReSolve Adaptive Asset Allocation Fund Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Let’s explore a capital efficient expanded canvas four fund portfolio that has the potential to outperform a balanced 60/40 portfolio whilst managing risk better overall:

30% RDMIX

30% BLNDX

30% UPAR

10% BTAL

We’re adding a globally diversified 50/100 equity plus managed futures (trend) strategy with BLNDX .

UPAR is a globally diversified static risk parity fund, featuring a 168% expanded canvas, bringing TIPs, gold, emerging market equities and commodity producing equities into the mix.

Finally, BTAL is an anti-beta market neutral fund that is negatively correlated with markets.

In order to backtest this portfolio we’ll have to swap out UPAR with RPAR (more toned down original version) in order to rewind the clock back a few years.

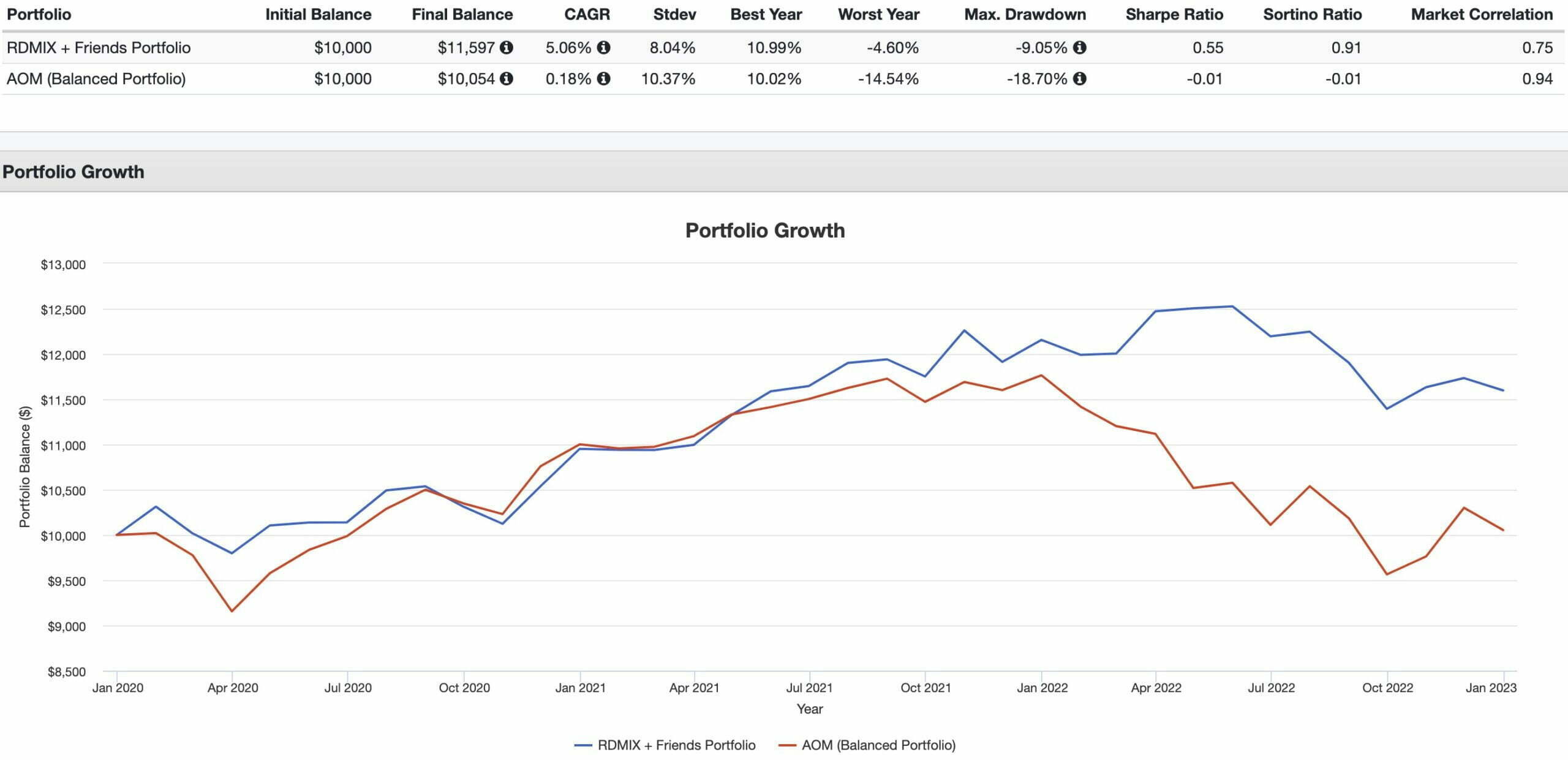

Rational ReSolve Adaptive Asset Allocation Fund + Friends Portfolio vs Balanced Portfolio (AOM)

CAGR: 5.06% vs 0.18%

RISK: 8.04% vs 10.37%

BEST YEAR: 10.99% vs 10.02%

WORST YEAR: -4.06% vs -14.54%

MAX DRAWDOWN: -9.05% vs -18.70%

SHARPE RATIO: 0.55 vs -0.01

SORTINO RATIO: 0.91 vs -0.01

MARKET CORRELATION: 0.75 vs 0.94

It’s a triumphant win across the board for the RDMIX plus Friends portfolio versus globally diversified balanced fund AOM ETF.

Notice the difference in drawdown management during the pandemic (March 2020) and overall superior returns in 2022.

We’re able to accomplish such impressive results due to the various funds having low and negative correlations with one another.

Horizons ReSolve Adaptive Asset Allocation ETF Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

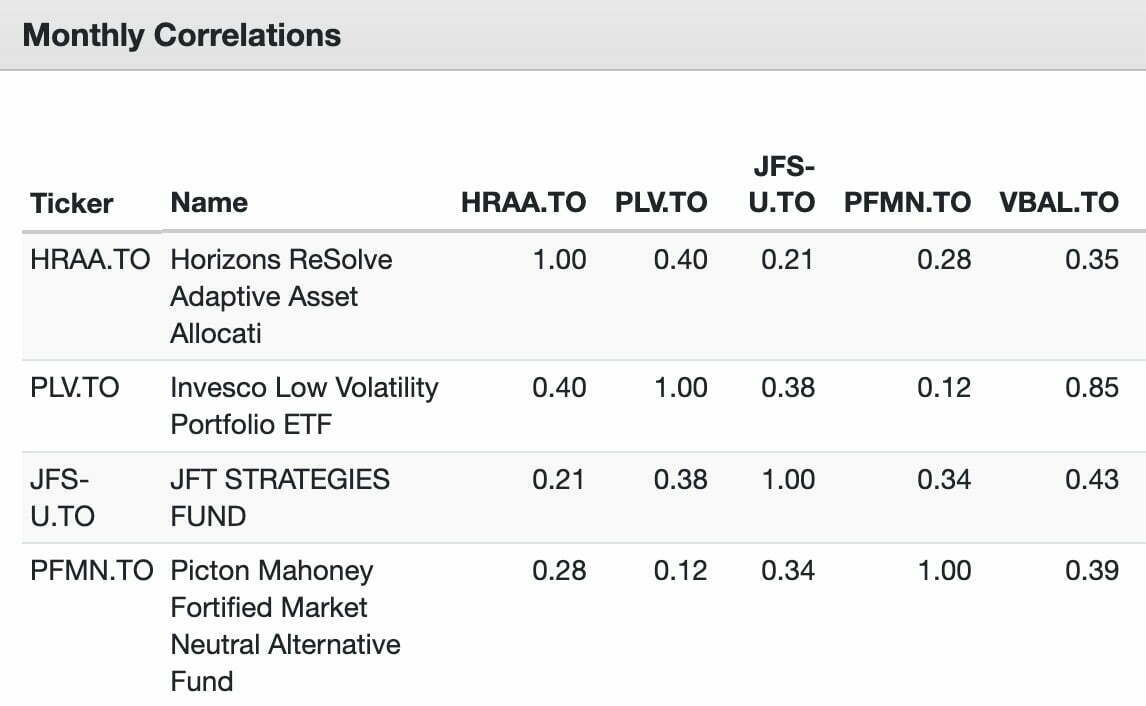

For Canadian investors seeking a maximally diversified portfolio this 4 fund combination could be a decent fit:

30% HRAA.TO

30% JFS.UN.TO

30% PLV.TO

10% PFMN.TO

We’re once again adopting a 30-30-30-10 model portfolio.

JFT Strategies is an absolute return fund with an excellent long-term track record for performance and low market correlations.

Horizons ReSolve Adaptive Asset Allocation ETF Stocks + Friends Portfolio vs 60/40 Portfolio (VBAL.TO)

CAGR: 8.88% vs 1.91%

RISK: 6.19% vs 9.62%

BEST YEAR: 10.03% vs 10.21%

WORST YEAR: 1.46% vs -11.39%

MAX DRAWDOWN: -7.05% vs -15.02%

SHARPE RATIO: 1.27 vs 0.16

SORTINO RATIO: 2.10 vs 0.24

MARKET CORRELATION: 0.72 vs 0.93

Our little Sharpe / Sortino Ratio Monster has absolutely crushed a globally diversified 60/40 portfolio as far back as we’re able to backtest it.

One of the primary reasons for such a convincing win is the low correlation between the various strategies of the HRAA.TO + Friends portfolio.

Nomadic Samuel hiking in Germany

Nomadic Samuel Final Thoughts

In many regards, there has never been a better time to be a retail investor than today.

Strategies that were once only available to institutions and high net worth individuals are now available to everyone.

The ReSolve Adaptive Asset Allocation strategy is one of them.

With its globally diversified multi-asset class and multi-strategy approach it can adapt to changing economic regimes and market conditions in a manner that leaves long-only asset allocation funds in the dust.

Hence, I’m thrilled to have the HRAA.TO as one of many funds in my highly diversified DIY quant portfolio.

It’s a shame that most retail investors have been blinded to the reality that there are more sophisticated ways to assemble a portfolio than just slapping together market cap weighted stocks and aggregate bonds.

Hopefully 2022 has revealed the downside of such an outdated and conservative approach.

However, only time will tell.

At this point in the fund review it’s time to turn things over to you.

What do you think of ReSolve Adaptive Allocation Funds RDMIX and HRAA?

Do you have a portfolio that features alternative strategies aside from just long-only stocks and bonds?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.