Every single time I receive an email submission to the “Investing Legends” and “How I Invest” series it feels like an early Christmas present!

Hence, today I’m thrilled to welcome a highly skilled amateur investor to discuss his Tactical Asset Allocation investment strategy.

Welcome Tom Kasperski!

Tom’s systematic approach to investing evolved from a combination of his research (momentum / tactical asset allocation) and real life experiences (2008 bear market).

His Brave New World strategy is a comprehensive offensive and defensive tactical asset allocation system.

I’d love to highlight more of its unique features but at this point we’d all rather hear from Tom!

Tom Kasperski’s Tactical Asset Allocation Strategy: Brave New World Offensive and Defensive Systematic Investing

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Tom Kasperski: Systematic Approach To Investing

Who were your greatest influences as an investor when you first started to get passionate about the subject?

Early on (mid 1980s) I read everything I could get my hands on from Martin Zweig, Ned Davis, and Norman Fosback.

The whole idea of quantitative models and back-testing indicators really appealed to me.

Note, at this time virtually nobody had a PC.

By the mid 2000s I was reading the Meb Faber papers, Tim Hayes Research Driven Investor, and O’Shaughnessy’s What Works on Wallstreet.

This spurred my interest in factors, particularly the momentum factor.

How have your views evolved over the years to where you currently stand?

I suppose my views didn’t really change as much, I just gravitated to a systematic approach, and also realized trading over shorter term timeframes wasn’t really my thing.

I was never really interested in stock analysis/picking, day trading, options trading, etc.

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

- AllocateSmartly.com blog and all the papers and websites they link to.

- Antonacci’s Dual Momentum

- Alpha Architect’s blog

- Excess Returns and Meb Faber’s podcasts

- Cesar Alvarez’ blog

Tactical Asset Allocation Strategies = Breakthrough As An Investor

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

The 2008 bear market was pivotal for me.

I didn’t lose as much as many investors, but it made me a lot more risk averse (probably too risk averse).

I didn’t have and wasn’t using a systematic approach at the time.

My real breakthrough as an investor was reading about other tactical asset allocation strategies and my use of ETFreplay and Portfolio Visualizer to back test ideas.

People Who Make Predictions Are More Interested In Publicity Than Investment Performance

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

The challenge with giving this advice to my younger self is I didn’t have a computer, the Internet, or the programming knowledge and data to back test ideas.

The Jegadeesh and Titman research on momentum didn’t come out until 1993 and Faber’s paper (A Quantitative Approach to Tactical Asset Allocation) didn’t come out until 2006, about the same time as O’Shaughnessy’s book.

My general advice would be.

- Don’t try to predict markets or the economy. Nobody can do it consistently or with reliability. The people who make predictions are more interested in publicity than investment performance.

- Compartmentalize your time: Research, Design, Testing, and Execution. Focus on execution.

- Be systematic and don’t second guess your strategies and systems.

- Document your systems in detail and work on executing your systems exactly as written.

- Diversify your systems and understand the weaknesses of each system

Brave New World: Offensive and Defensive ETF Universes

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

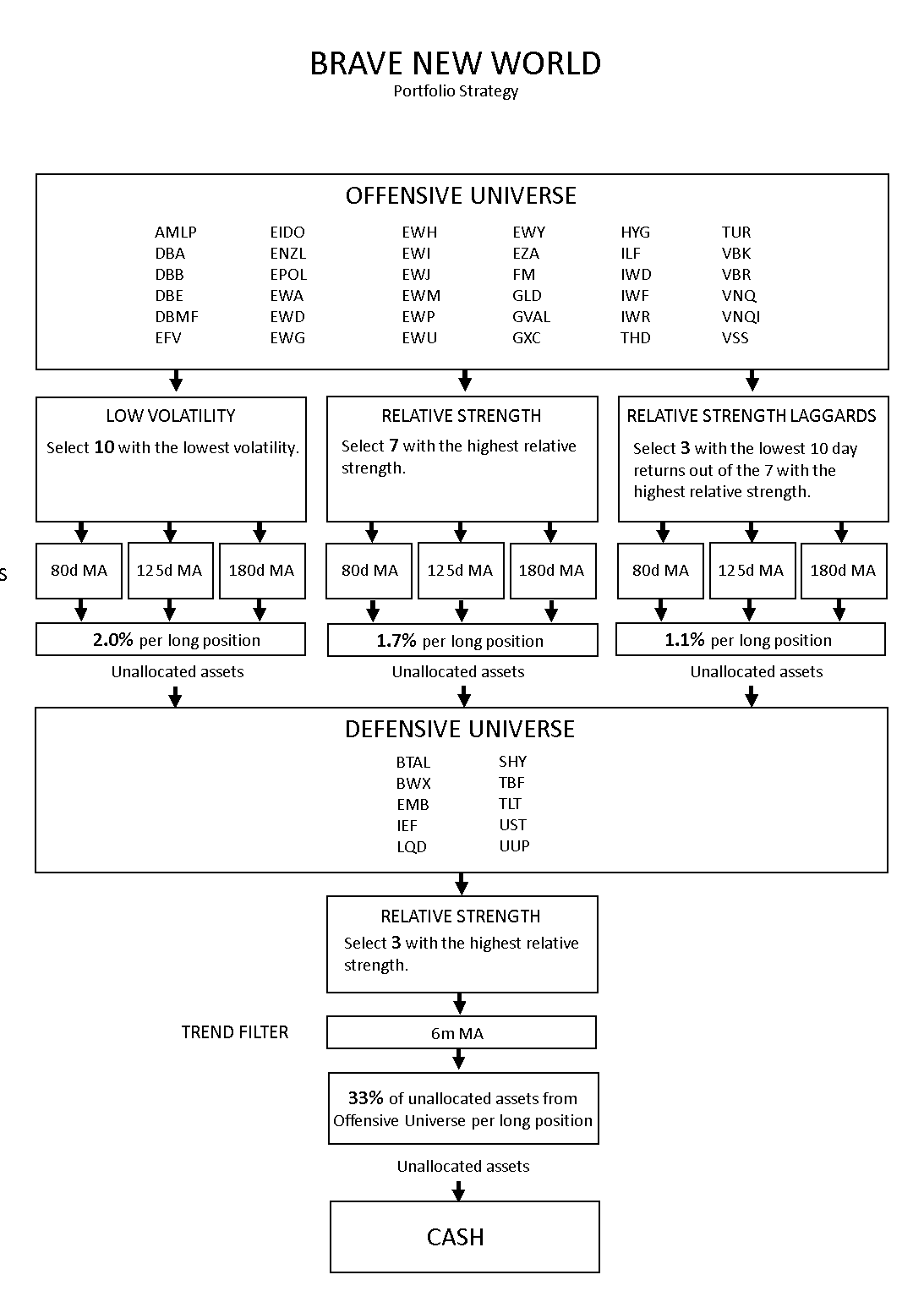

Brave New World is only one of three strategies I use. I believe the diagram is self-explanatory.

Brave New World: Portfolio Strategy

- There are two ETF Universes (Offensive and Defensive). The first universe includes a wide array of assets, mostly equities, but also commodities, REITs, MLPs, and managed futures.

- There are 4 systems within the strategy using one or more factors (cross-sectional momentum, trend following, and minimum momentum).

- The parameters are “loose pants”, so if you altered them (to a reasonable degree), it wouldn’t impact performance much. I try hard to stay away from curve-fitting or finding the best parameters. Tight pants are fragile.

- This system is used in two IRA accounts. Rebalancing occurs monthly in two tranches (the first day of the month and the 16th). This helps to mitigate timing luck and eases psychological stress.

- I use 3 different timeframes for the trend-following filters. In back testing the ETFs in the Offensive universe, I found wide performance differences for various timeframes, so I decided to use more than one timeframe.

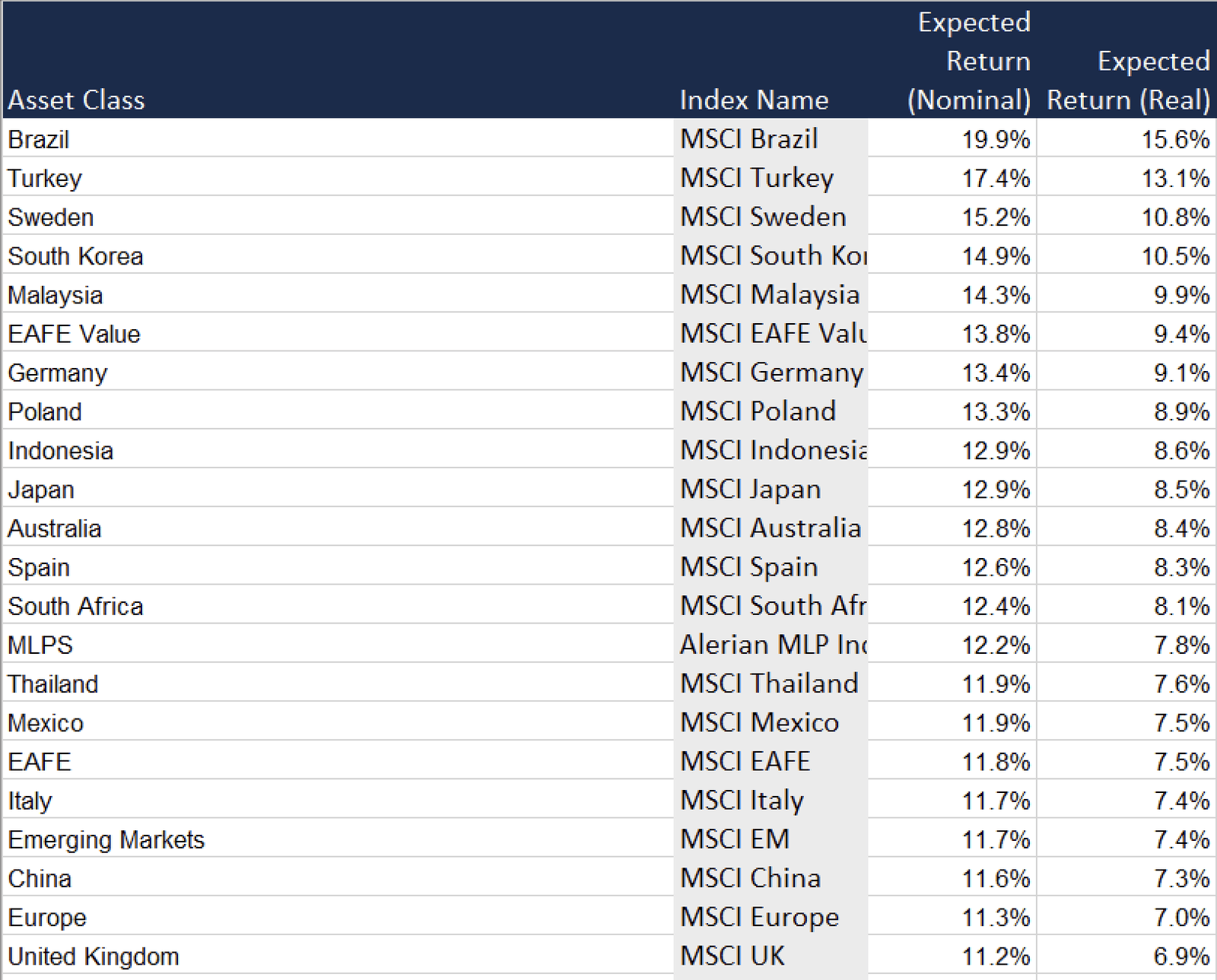

Asset Class Expected Returns (Nominal and Real)

The idea behind Brave New World was to use ETF Universes that include styles, caps, asset classes, and countries that are expected to outperform in the next 5 to 10 years based on research by following firms.

- Research Affiliates Expected Return Model

- Blackrock Capital Market Assumptions

- State Street Long-Term Asset Class Forecasts

- J.P. Morgan Long-Term Capital Market Assumptions

- BYN Mellon 10-Year Capital Market Assumptions

- Morgan Stanley Capital Market Assumptions

- AQR Capital Market Assumptions for Major Asset Classes

The expectation for the next 5-10 years is value will outperform growth, international equities will outperform the U.S., and there will be rising real rates and elevated inflation vs. what we’ve seen over the past couple decades.

Even if these expectations are completely wrong, the system should still perform well because I didn’t omit assets that are expected to perform poorly.

Traditionally, most tactical asset allocation strategies relied heavily on fixed income as a risk-off asset. I see this as an Achille’s heel to many systems, thus my Defensive Universe includes an inverse fixed income ETF and other assets that should perform well in a rising rate environment.

Here are the weaknesses of this strategy:

- There is no protection for rapid price shocks or black swan events. I want to do some research on using options as portfolio insurance to see if it makes sense.

- Trend-following and momentum strategies do not perform well in sideways/choppy markets, such as 2015-16 and 2018-2019. I’m still investigating if there are methods to mitigate this, such as using a mean reversion system as a diversifier.

- The performance of the momentum factor may fade due to wide-spread adoption. I believe investors who use momentum to select individual stocks are more vulnerable to this than those who use momentum to identify asset classes, countries, styles, etc.

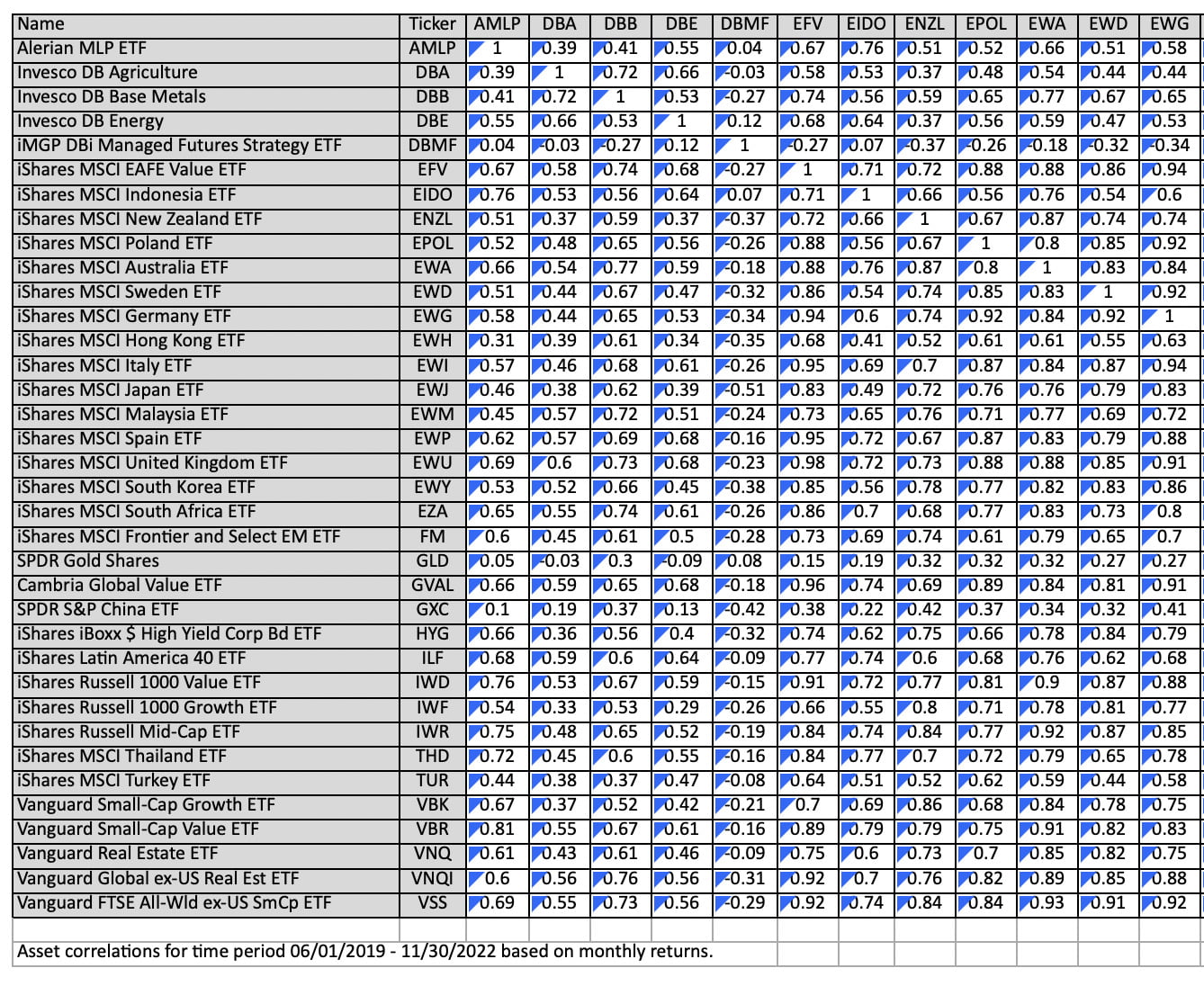

Asset Class Correlations

Discipline To Execute Rebalances On-Time

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

- Basic Excel skills

- Discipline to execute rebalances on-time, accurately, without second-guessing

- One hour per month/tranche to execute

- A sub to ETFreplay, Portfolio Visualizer, or similar system that doesn’t require programming skills is helpful, but not necessary. Access to price data is necessary.

Min Vol and Relative Strength to Dial Up or Down Risk

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

The strategy can be toned-down (risk adjusted) by

- allocating more to the min volatility system. I use 60% but one could adjust this.

- Use a cash position in addition to the defensive universe selections

The strategy can be amped up by

- allocating less to the min volatility system, and more the top relative strength systems

- Only allocating to the top 2-3 RS performers, or heavily weight position size based on RS rank

My Greatest Strength: Doubling Down On Skepticism

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

My greatest strength is skepticism and curiosity.

My greatest weakness is the lack of programming skills and knowledge of advanced math and statistics.

Given my age (61) and other interests, I would not pursue addressing my weaknesses.

I already double down on skepticism.

Buy And Hold Portfolios Will Not Perform As Well In The Future

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I don’t know what the investing community at large believes, but I believe the popular strategic/lazy/B&H portfolios (60/40, Permanent portfolio, All-Weather portfolio, etc.) will not perform nearly as well in the future as they have in past decades because most of them…

- Have insufficient allocation to international stocks, particularly emerging markets

- Have insufficient allocation to value stocks

- Have excessive allocation to U.S. bonds

- Have little to no allocations to commodities, managed futures, or MLPs

Desire To Learn More About Trend-Following and Return Stacking

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I’d like to learn more about…

- Stops

- Portfolio insurance

- Trade execution

- Trend-following – Research on adjusting timeframe by volatility

- Return stacking

Yes, if I knew more about a particular topic it probably would influence the way I’d construct a portfolio.

No Thanks To A U.S.-Centric 60/40 Portfolio

What would be the ultimate anti-Tom Kasperski portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

A U.S.-centric 60/40

What about this portfolio is repulsive to you?

I believe it will perform poorly in the future for the reasons I mentioned earlier. I believe the Sharpe ratio will trend south over the next 10 years.

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

- Super Simple

- Pretty solid historical performance. Per Portfolio Visualizer (starting in 1972); 10.43% CAGR, 0.59 Sharpe, 29% Max DD (too much for me, but others might not notice).

Connect With Tom Kasperski

You can follow Tom Kasperski on Twitter @TomKaz.

Nomadic Samuel Final Thoughts

I want to personally thank Tom for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

What has been the CAGR and Max Drawdown of Tom’s approach?

Seems good in theory. What are the actual results?