As investors we’re well aware of what happens when you combine stocks and bonds in a portfolio, but what about the unlikely duo of stocks and gold?

Stocks and Gold?

Isn’t gold just meant to be a tiny sliver in your portfolio if you allocate anything to the asset class at all?

That’s what I used to think too.

I was anything but a Gold Bug.

It’s highly volatile.

Roll period lows that’ll send shivers down your spine.

All of that and then some.

But then I started to explore the asset class a little bit more.

Sprinkling in a bit of gold into a 60/40 portfolio helped improve returns, standard deviation, sequence of return risk and Sharpe/Sortino ratios.

Interesting.

Given that gold is uncorrelated with both stocks and bonds does it deserve a place in your portfolio?

I now firmly believe so.

We’re aware of the downsides of a 100% US Large Cap portfolio (basically the S&P 500) when it comes to lost decades.

The 1970s and 2000s were just that for aggressive equity only investors.

But what happens when you combine gold and stocks during those decades?

Does it protect your portfolio from disastrous roll periods?

And let’s flip the coin.

What happens when gold is causing pain in your portfolio?

Do stocks save the day in that scenario?

Furthermore, what happens when you combine leveraged stocks and gold in equal measures 50/50 over long periods of time?

We’re going to check all of that out.

We’ll explore the returns decade by decade of a 100% US Large Cap portfolio, 100% gold portfolio, 50/50 stocks/gold portfolio and leveraged 90/90 equities/gold to see how these asset classes perform individually and combined (with and without leverage).

Magic Happens When You Add Gold To Your Portfolio

Hey guys! Here is the part where I mention I’m a travel blogger! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. The leveraged 90/90 results in these backtests does not include borrowing costs. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Unremarkable Attributes of Individual Asset Classes vs Combined Asset Classes

Stocks and gold are most unremarkable when viewed as individual line-items in the portfolio.

Horrific worst years.

Frightening low roll periods.

Ferocious quarter century underwater periods.

Let’s explore all of the ugliness in detail.

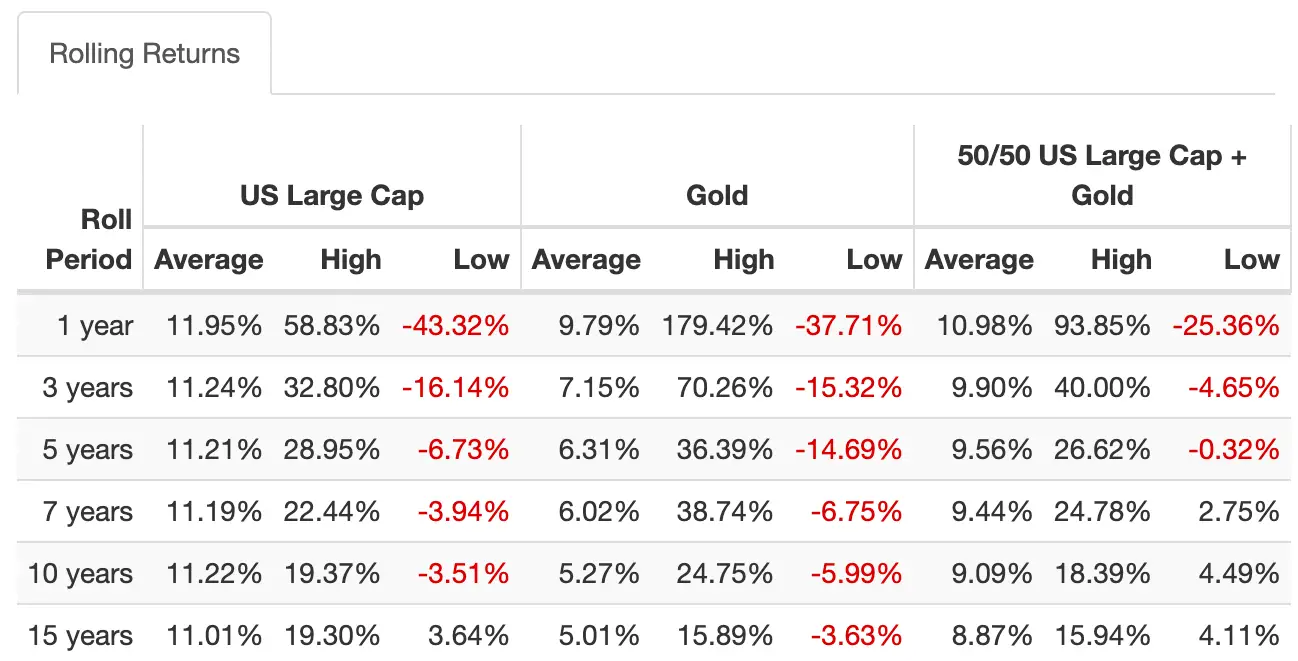

US Large Cap and Gold Rolling Returns Low Period

Ouch!

US Large Cap equities frustrated investors with a low roll period of -3.51% over 10 years.

Lost decade.

Gold one upped equities and provided investors with a low roll period of -3.63% over 15 years.

Lost decade +.

What about when they’re combined together 50/50?

A far more palatable -0.32% low roll period of 5 years.

The worst case scenario low roll period of 3 years for US Stocks, Gold and 50/50 Combo paints an interesting picture.

Us Large Cap = -16.4%. Gold = -15.32%. 50/50 Combo = -4.65%

Given the “impatience level” of an average investor, staying the course with a 100% equity or 100% gold portfolio when everything unravels would be nearly impossible.

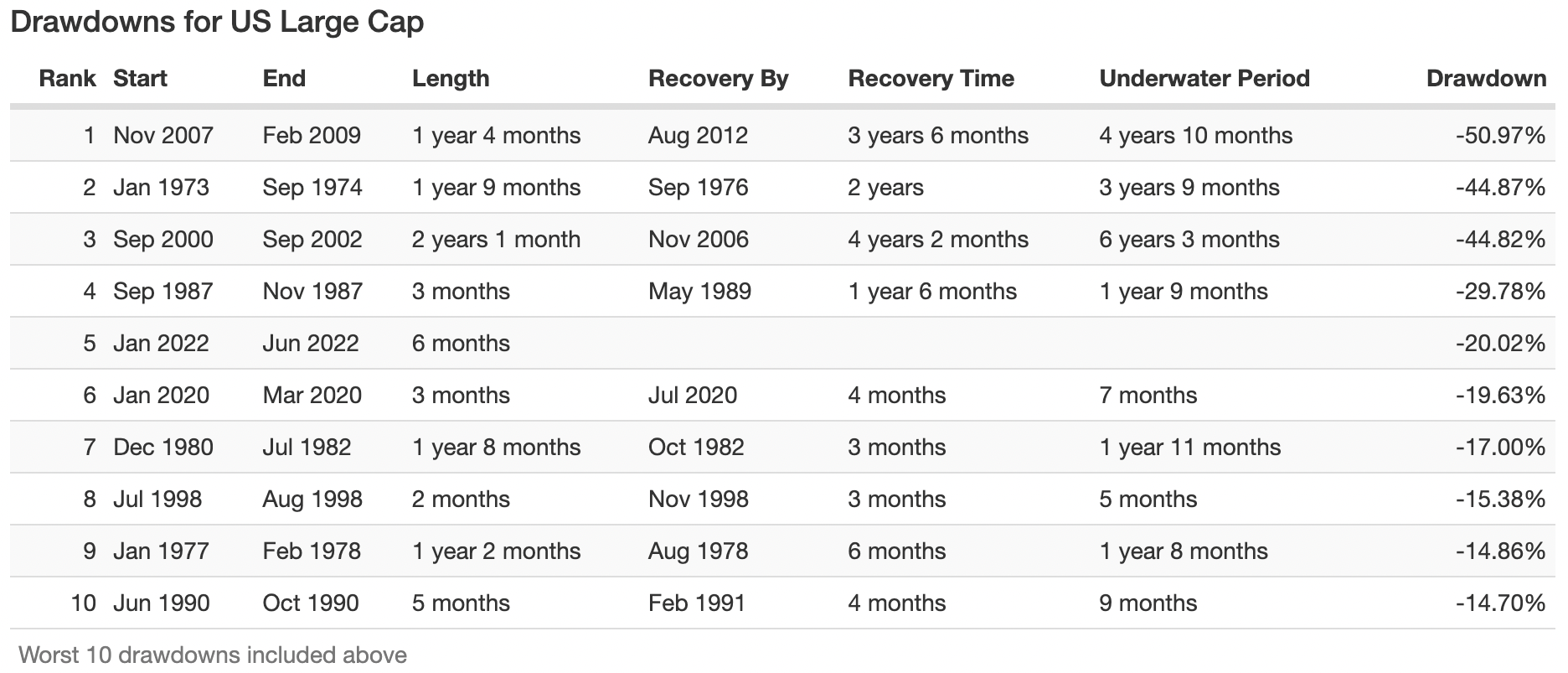

Drawdowns For US Large Cap

Let’s explore the worst Drawdown and Underwater Period for US Large Cap Equities since 1972.

From Nov 2007 until Feb 2009 US Large Cap stocks got sliced in half with a drawdown of -50.97%

The worst underwater period of 6 years and 3 months for US Large Cap equities was from the time period of Sep 2000 until Nov 2006.

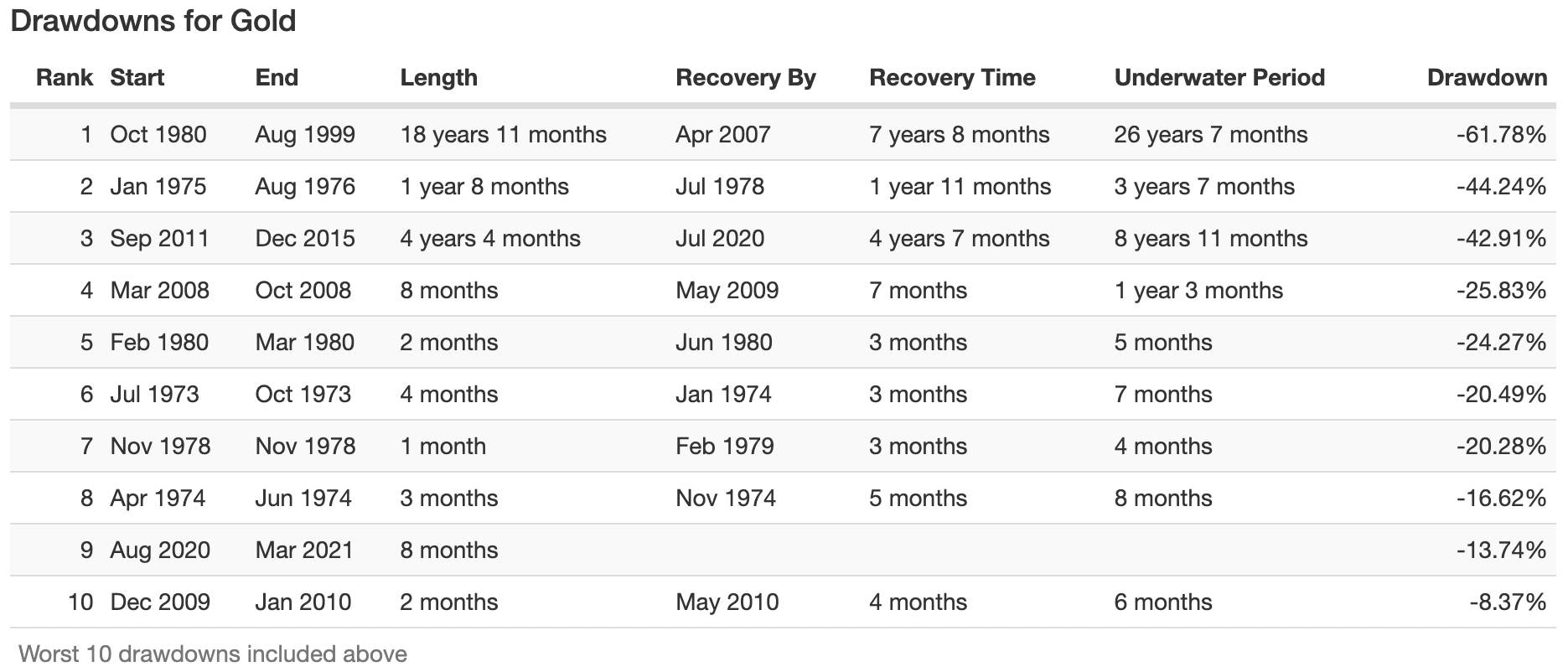

Drawdowns For Gold

Gold takes the cake and adds a triple layer of icing when it comes to the worst Drawdown and Underwater Periods.

From Oct 1980 until Aug 1999 Gold faced a maximum drawdown of -61.78%.

Even worse it featured a 26 years 7 months underwater period from Oct 1980 until April 2007.

Ouch!!!

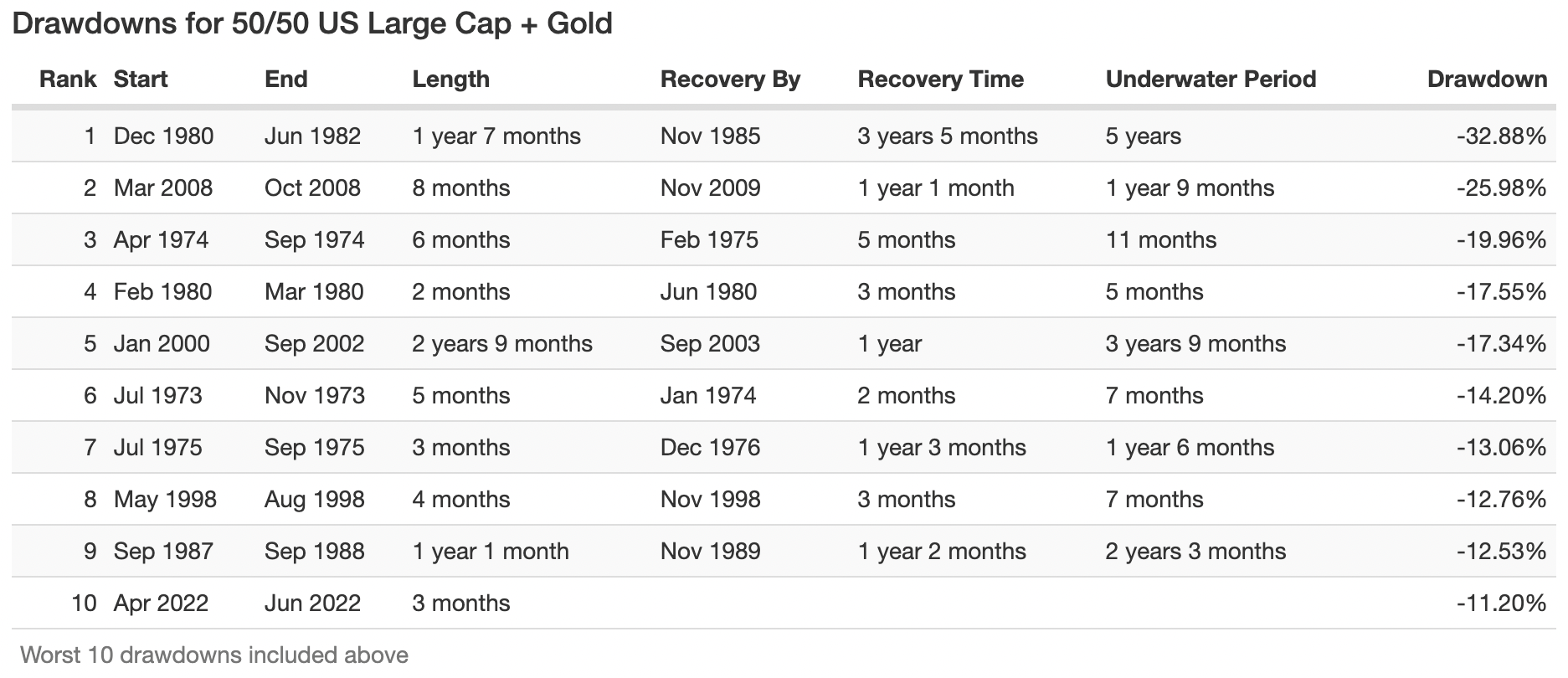

Drawdowns For 50/50 US Large Cap + Gold

What about when we combine the two uncorrelated asset classes for Drawdown and Underwater Periods?

From Dec 1980 until Jun 1982 a combined 50/50 stocks/gold faced its worse drawdown of -32.88%.

Extending that time period until Nov 1985 was the longest underwater period for the dynamic duo at 5 years.

Worst Case Scenario: Numbers at a Glance

US Large Cap Equities

Worst Year: -37.02%

Maximum Drawdown: -50.97%

Roll Period Low: 10 years at -3.51%

Underwater Period Low: 6 years 3 months

Risk (Standard Deviation): 15.34%

Gold

Worst Year: -32.60%

Maximum Drawdown: -61.78%

Roll Period Low: 15+ years at -3.63%

Underwater Period Low: 26 years 7 months

Risk (Standard Deviation): 19.85%

50/50 Combination

Worst Year: -18.90%

Maximum Drawdown: -32.88%

Roll Period Low: 5 years at -0.32%

Underwater Period Low: 5 Years

Risk (Standard Deviation): 12.77%

I don’t know about you but from analyzing every possible worst case scenario since 1972, the combination of stocks/gold sure seems to come out ahead of the asset classes individually.

Okay.

That’s all fine and dandy.

But what about the returns (CAGR) and what about the 50/50 combination of assets when leveraged?

You’ll have to be patient for the leveraged results.

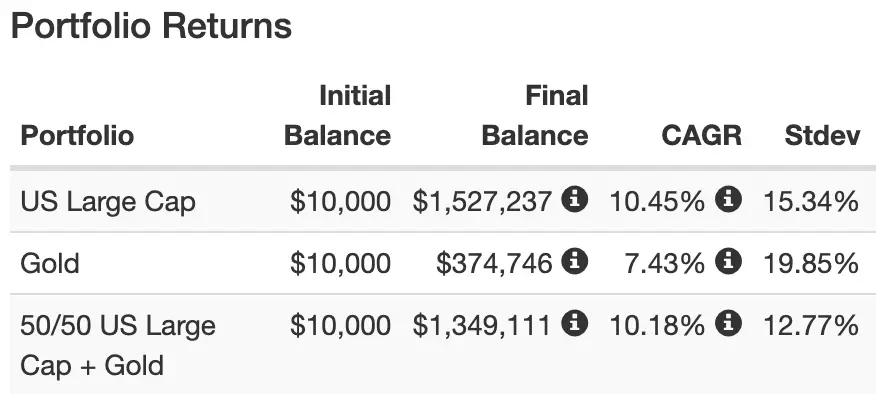

For the time being I’ll tease you with the CAGR of US Equites and Gold as individual asset classes.

US Large Cap Equities: 10.45%

Gold: 7.43%

Even with the brutal underwater periods both asset classes have served investors well over long periods of time.

What would you have guessed as the CAGR for the 50/50?

Single digits most likely, right?

Nope.

50/50 Combination: 10.18%

Merely 27 basis points below an equity only portfolio.

That kinda blew my mind!

What we’ve been able to establish up until this point is that a stocks/gold combination has crushed the individual asset classes from a “plethora of worst case scenarios” standpoint and provided equity like returns.

Clearly, the 50/50 duo can handle some leverage to seek dominant outperformance without being as risky as its individual components.

Given that GDE ETF WisdomTree Efficient Gold Plus Equity Strategy Fund exists as a 90/90 product we’ll backtest a 50/50 gold combination with a 180% canvas.

Let’s examine the results decade by decade.

*Before I begin the simulation I want to note that the cost of leverage is not included in the backtest results. Leverage would have been extremely expensive in the 70s and 80s especially. Now with institutions being able to get preferred rates and utilizing futures contracts to gold exposure (as with GDE) the cost of borrowing is extremely low. Thus, the results here are mostly just to showcase how the 90/90 combinations performs rather than anything else. Thus, the results need to be taken with a grain of salt.*

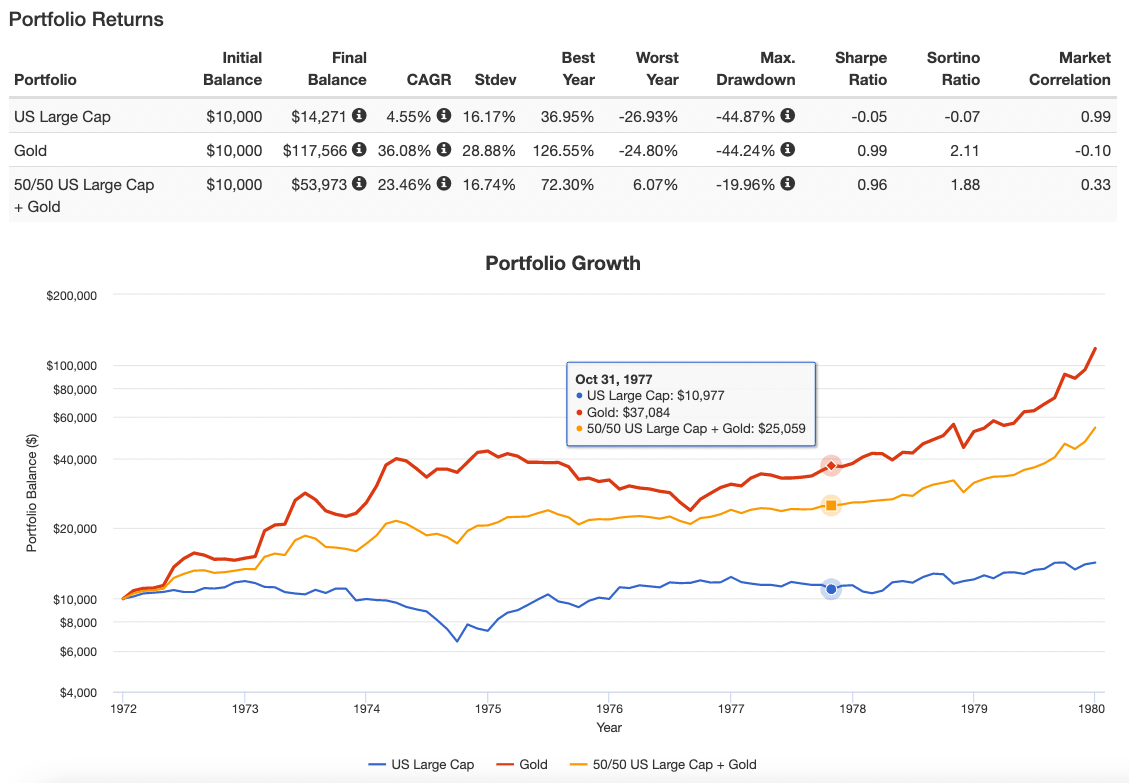

1970s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: 4.55%

RISK: 16.17%

WORST YEAR: -26.93

MAX DRAWDOWN: -44.87

GOLD

CAGR: 36.08%

RISK: 28.88%

WORST YEAR: -24.80%

MAX DRAWDOWN: -44.24%

50/50 US + GOLD

CAGR: 23.64%

RISK: 16.74%

WORST YEAR: 6.07%

MAX DRAWDOWN: -19.96

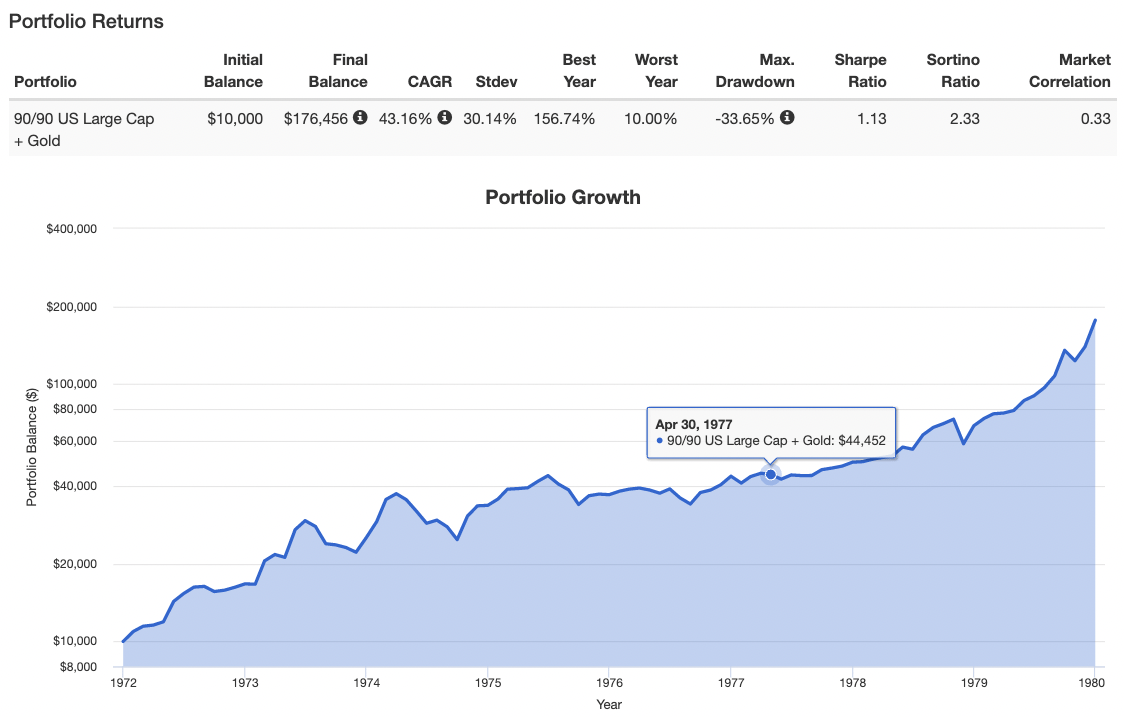

90/90 US + GOLD

CAGR: 43.16%

RISK: 30.14%

WORST YEAR: 10.00%

MAX DRAWDOWN: -33.65%

RELATIVE RESULTS

CAGR

90/90 US + GOLD: 43.16%

GOLD: 36.08%

50/50 US + GOLD: 23.64%

US LARGE CAP: 4.55%

RISK

90/90 US + GOLD: 30.14%

GOLD: 28.88%

50/50 US + GOLD: 16.74%

US LARGE CAP: 16.17%

WORST YEAR

50/50 US + GOLD: 6.07%

90/90 US + GOLD: 10.00%

GOLD: -24.80%

US LARGE CAP: -26.93

MAX DRAWDOWN

50/50 US + GOLD: -19.96

90/90 US + GOLD: -33.65%

GOLD: -44.24%

US LARGE CAP: -44.87

THOUGHTS

The 1970s were *fill-in-the-blank* crazy.

It’s easily one of the most fascinating decades to examine from a number of different angles.

Crazy high inflation (that reached double digits for certain years).

Bear markets.

A Gold Bugs dream come true.

90/90 combo, 50/50 combo and/or Gold only investors did fantastic.

Gold/Stocks combos did not have any negative years in the 1970s.

Equity only investors were in for a world of pain especially relative to inflation in real terms.

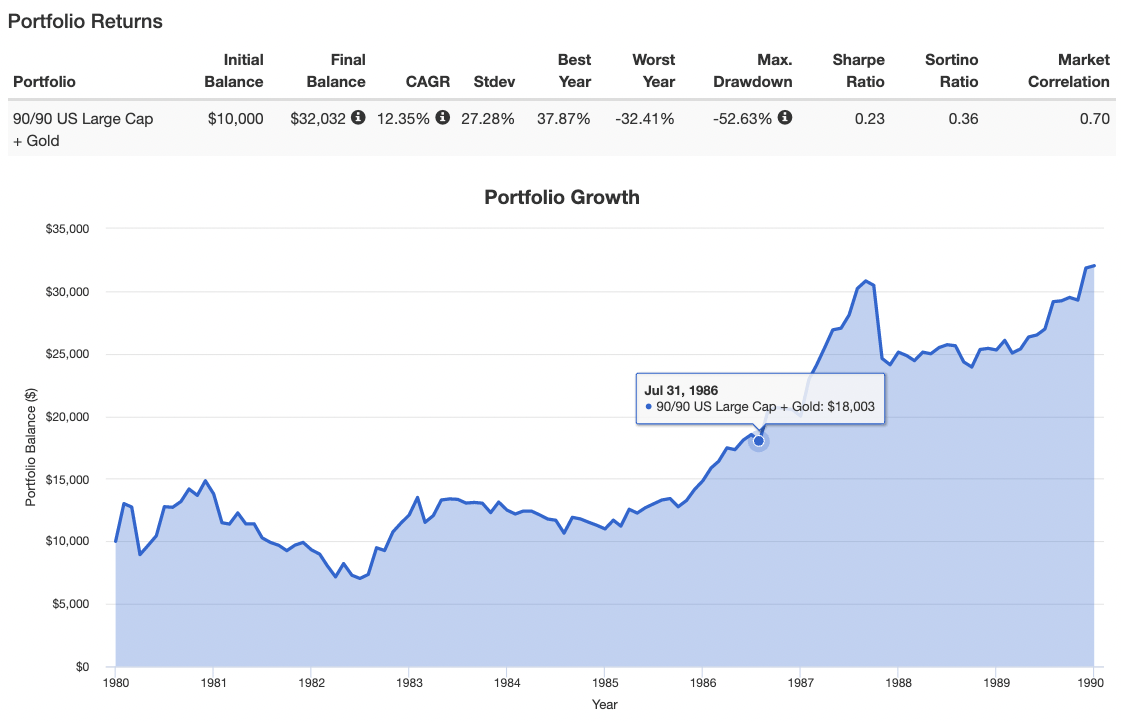

1980s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: 17.05%

RISK: 16.39%

WORST YEAR: -5.21%

MAX DRAWDOWN: -29.83%

GOLD

CAGR: -2.47%

RISK: 22.94%

WORST YEAR: -32.60%

MAX DRAWDOWN: -56.84%

50/50 US + GOLD

CAGR: 7.67%

RISK: 15.16%

WORST YEAR: -18.90%

MAX DRAWDOWN: -32.88%

90/90 US + GOLD

CAGR: 12.35%

RISK: 27.28%

WORST YEAR: -32.41%

MAX DRAWDOWN: -52.63%

RELATIVE RESULTS

CAGR

US LARGE CAP: 17.05%

90/90 US + GOLD: 12.35%

50/50 US + GOLD: 7.67%

GOLD: -2.47%

RISK

90/90 US + GOLD: 27.28%

GOLD: 22.94%

US LARGE CAP: 16.39%

50/50 US + GOLD: 15.16%

WORST YEAR

US LARGE CAP: -5.21%

50/50 US + GOLD: -18.90%

90/90 US + GOLD: -32.41%

GOLD: -32.60%

MAX DRAWDOWN

US LARGE CAP: -29.83%

50/50 US + GOLD: -32.88%

90/90 US + GOLD: -52.63%

GOLD: -56.84%

THOUGHTS

In many ways the 1980s cleaned up the extraordinary mess of the 70s.

Inflation was finally curtailed.

The US stock market recovered and made up for lost time.

The Gold Bugs party ended abruptly after enjoying otherworldly returns in the 70s.

US equity only investors were rewarded big-time after a lost decade, 90/90 enjoyed double digit CAGR returns (whereas 50/50 made out okay) and gold-only investors sucked on a super sour lemon.

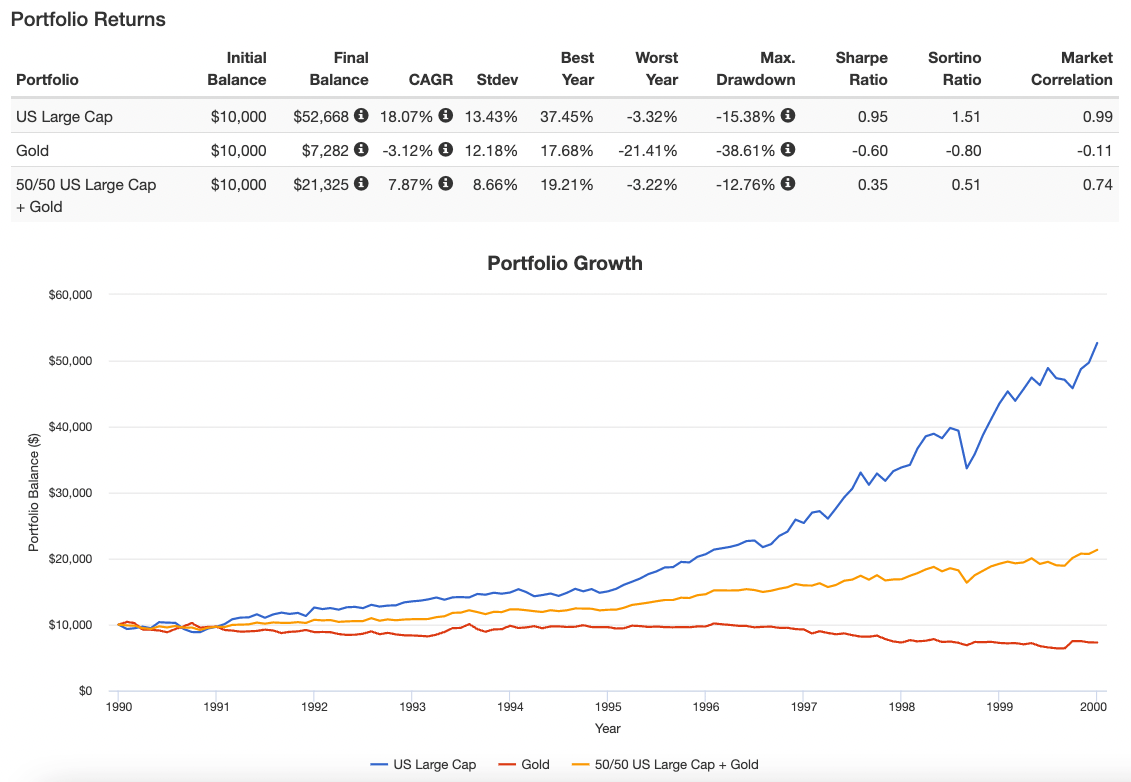

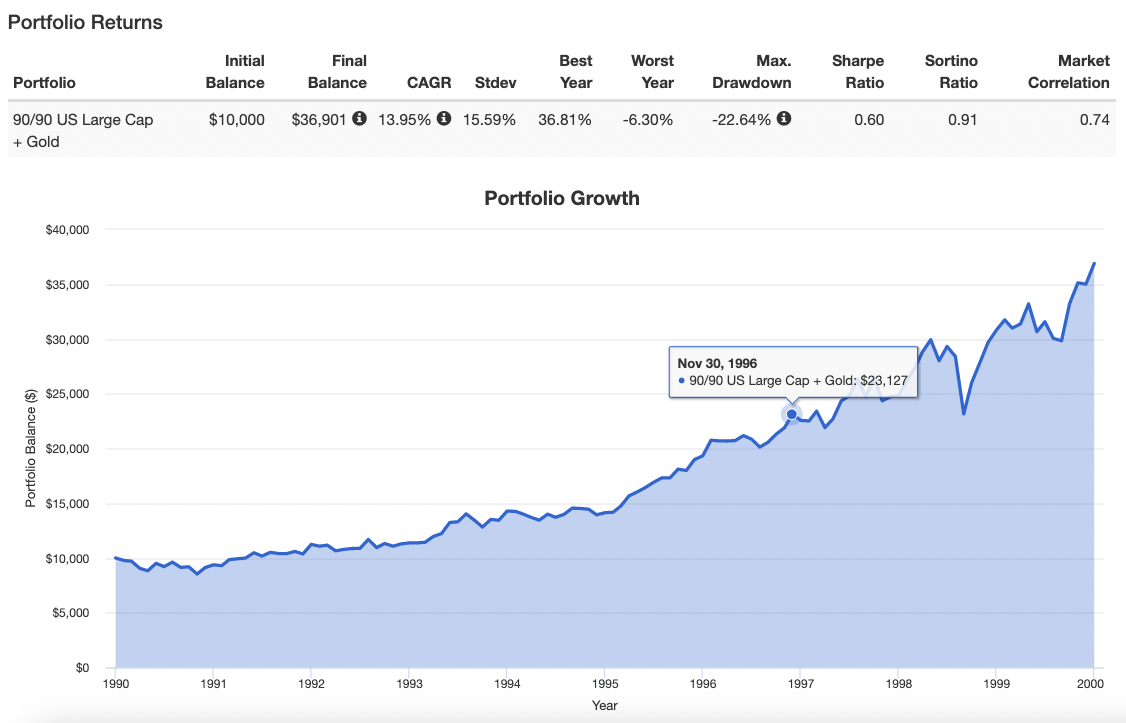

1990s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: 18.07%

RISK: 13.43%

WORST YEAR: -3.32%

MAX DRAWDOWN: -15.38%

GOLD

CAGR: -3.12%

RISK: 12.18%

WORST YEAR: -21.41%

MAX DRAWDOWN: -38.61%

50/50 US + GOLD

CAGR: 7.87%

RISK: 8.66%

WORST YEAR: -3.22%

MAX DRAWDOWN: -12.76%

90/90 US + GOLD

CAGR: 13.95%

RISK: 15.59%

WORST YEAR: -6.30%

MAX DRAWDOWN: -22.64%

RELATIVE RESULTS

CAGR

US LARGE CAP: 18.07%

90/90 US + GOLD: 13.95%

50/50 US + GOLD: 7.87%

GOLD: -3.12%

RISK

90/90 US + GOLD: 15.59%

US LARGE CAP: 13.43%

GOLD: 12.18%

50/50 US + GOLD: 8.66%

WORST YEAR

50/50 US + GOLD: -3.22%

US LARGE CAP: -3.32%

GOLD: -21.41%

90/90 US + GOLD: -22.64%

MAX DRAWDOWN

50/50 US + GOLD: -12.76%

US LARGE CAP: -15.38%

90/90 US + GOLD: -22.64%

GOLD: -38.61%

THOUGHTS

Let the good times roll.

In many ways the 1990s were a continuation and enhancement of the 1980s as the US Stock Market rolled with even less volatility and Gold floundered once again.

US only equity investors once again claimed the throne, 90/90 had its third decade in a row of double digit CAGR, 50/50 was once again high single digits and well we won’t even talk about Gold at this point.

Gold Bugs must have been beyond baffled and Equity only investors overconfident to the moon.

Hmmm…I wonder what happened next?

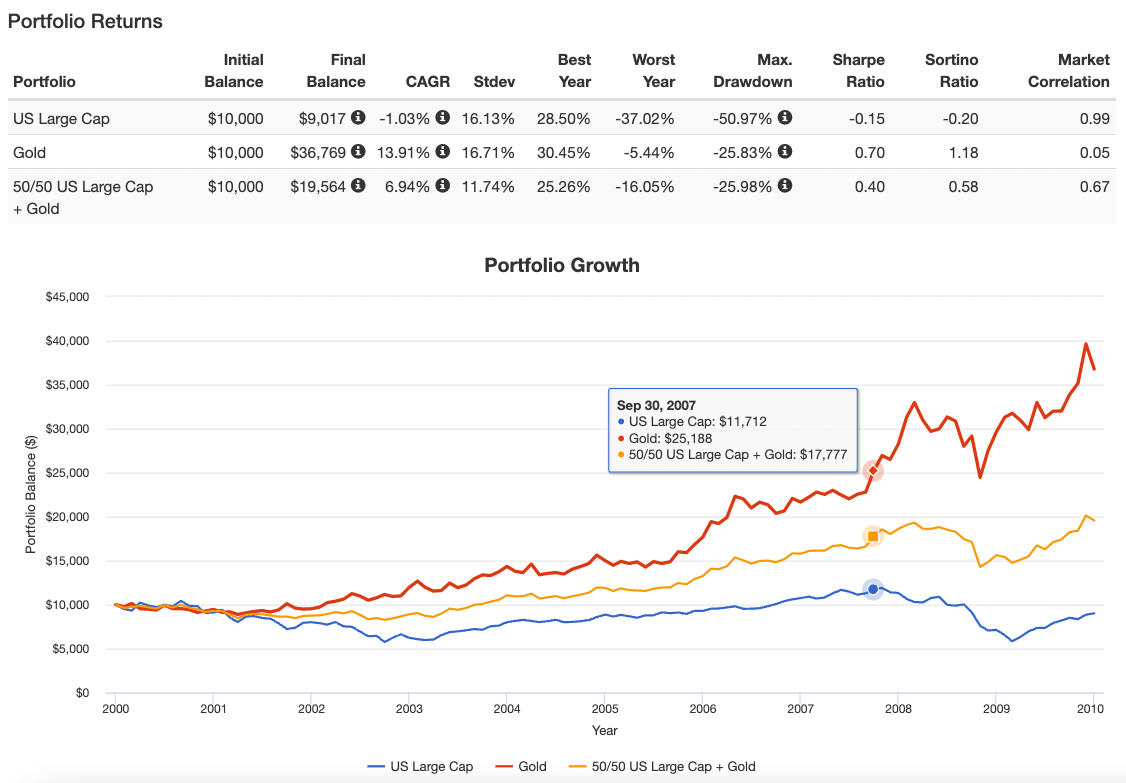

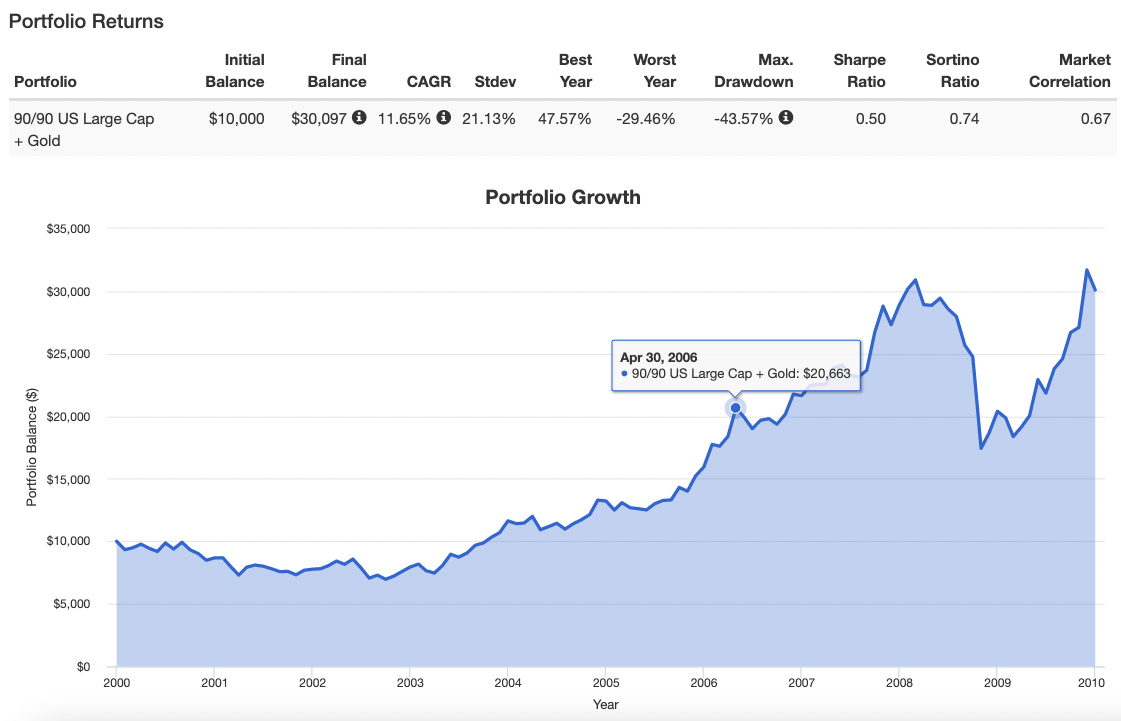

2000s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: -1.03%

RISK: 16.13%

WORST YEAR: -37.02%

MAX DRAWDOWN: -50.97%

GOLD

CAGR: 13.91%

RISK: 16.71%

WORST YEAR: -5.44%

MAX DRAWDOWN: -25.83

50/50 US + GOLD

CAGR: 6.94%

RISK: 11.74%

WORST YEAR: -16.05%

MAX DRAWDOWN: -25.98%

90/90 US + GOLD

CAGR: 11.65%

RISK: 21.13%

WORST YEAR: -29.46%

MAX DRAWDOWN: -43.57%

RELATIVE RESULTS

CAGR

GOLD: 13.91%

90/90 US + GOLD: 11.65%

50/50 US + GOLD: 6.94%

US LARGE CAP: -1.03%

RISK

50/50 US + GOLD: 11.74%

US LARGE CAP: 16.13%

GOLD: 16.71%

90/90 US + GOLD: 21.13%

WORST YEAR

GOLD: -5.44%

50/50 US + GOLD: -16.05%

90/90 US + GOLD: -29.46%

US LARGE CAP: -37.02%

MAX DRAWDOWN

GOLD: -25.83%

50/50 US + GOLD: -25.98%

90/90 US + GOLD: -43.57%

US LARGE CAP: -50.97%

THOUGHTS

The 2000s were the wall that the US equity corvette crashed into hard.

Bubbles burst.

Brutal bear markets reared not once but twice.

Gold awoke from what seemed like an eternal slumber.

Gold Bugs finished in first place, 90/90 collected its “now expected” double digit CAGR, 50/50 kept true to its single digit return ways and tears flowed aplenty for US equity only investors.

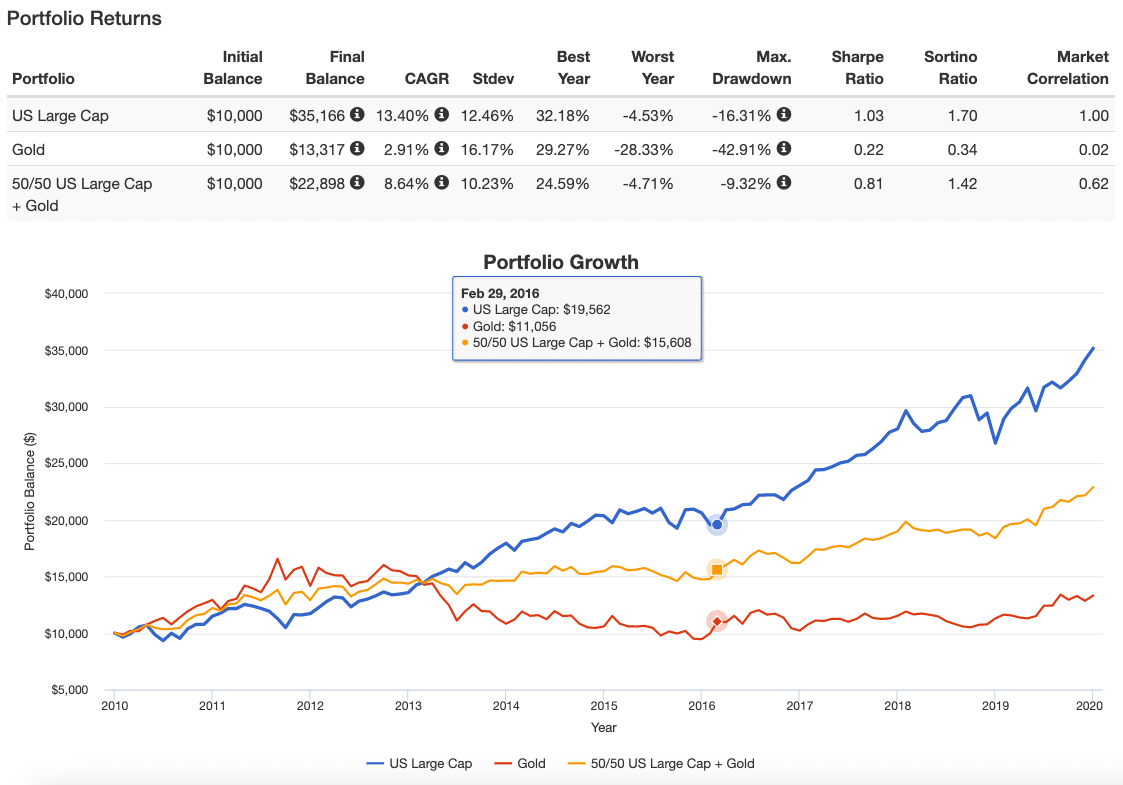

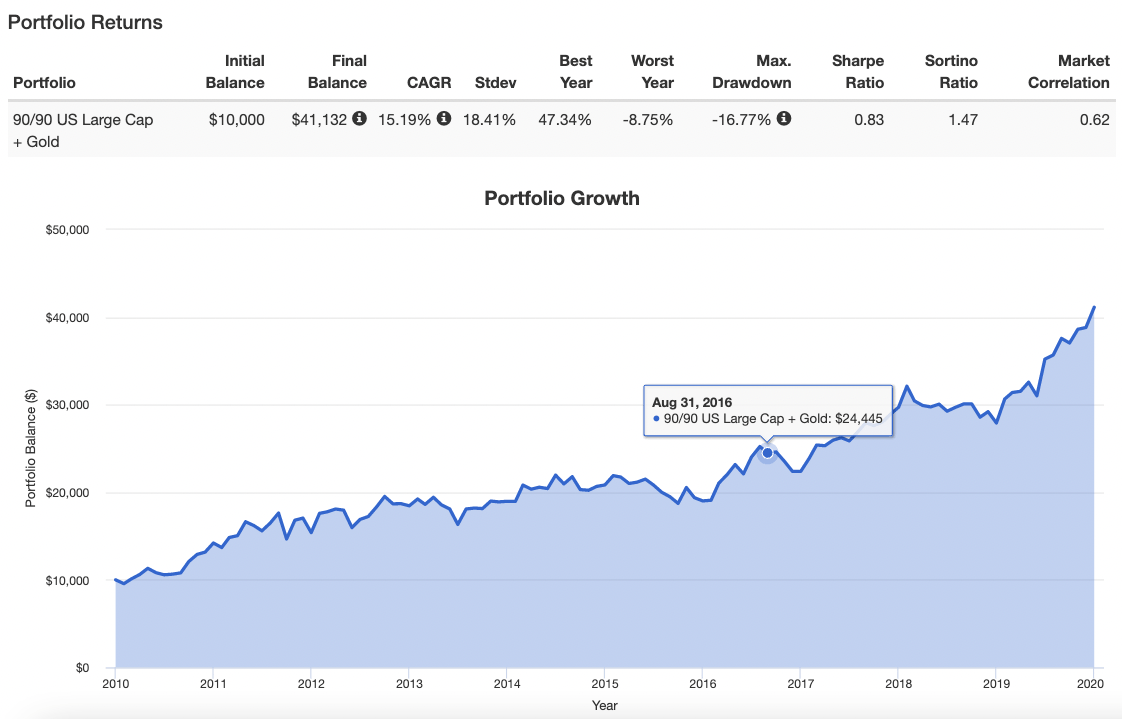

2010s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: 13.40%

RISK: 12.46%

WORST YEAR: -4.53%

MAX DRAWDOWN: -16.31%

GOLD

CAGR: 2.91%

RISK: 16.17%

WORST YEAR: -28.33%

MAX DRAWDOWN: -42.91%

50/50 US + GOLD

CAGR: 8.64%

RISK: 10.23%

WORST YEAR: -4.71%

MAX DRAWDOWN: -9.32%

90/90 US + GOLD

CAGR: 15.19%

RISK: 18.41%

WORST YEAR: -8.57%

MAX DRAWDOWN: -16.77%

RELATIVE RESULTS

CAGR

90/90 US + GOLD: 15.19%

US LARGE CAP: 13.40%

50/50 US + GOLD: 8.64%

GOLD: 2.91%

RISK

50/50 US + GOLD: 10.23%

US LARGE CAP: 12.46%

GOLD: 16.17%

90/90 US + GOLD: 18.41%

WORST YEAR

US LARGE CAP: -4.53%

GOLD: -28.33%

50/50 US + GOLD: -4.71%

90/90 US + GOLD: -8.57%

MAX DRAWDOWN

US LARGE CAP: -16.31%

GOLD: -42.91%

50/50 US + GOLD: -9.32%

90/90 US + GOLD: -16.77%

THOUGHTS

The turbulent 2000s paved the path for the silky smooth 2010s where stocks thrived once again and even gold was above water.

This time around 90/90 enjoyed first place while punching in yet another double digit CAGR, US Equities did extremely well, 50/50 collected its single digits CAGR yet again and Gold finished last but not negative.

Let’s flip the page to the unfinished decade we’re living through right now.

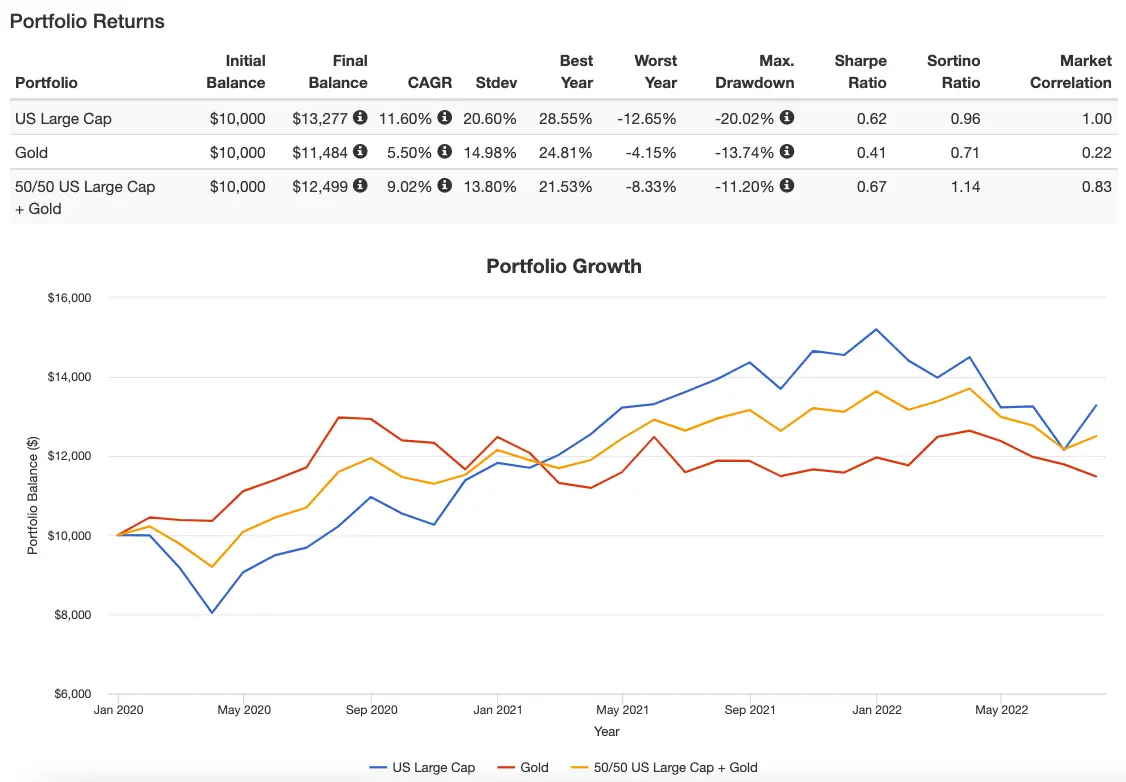

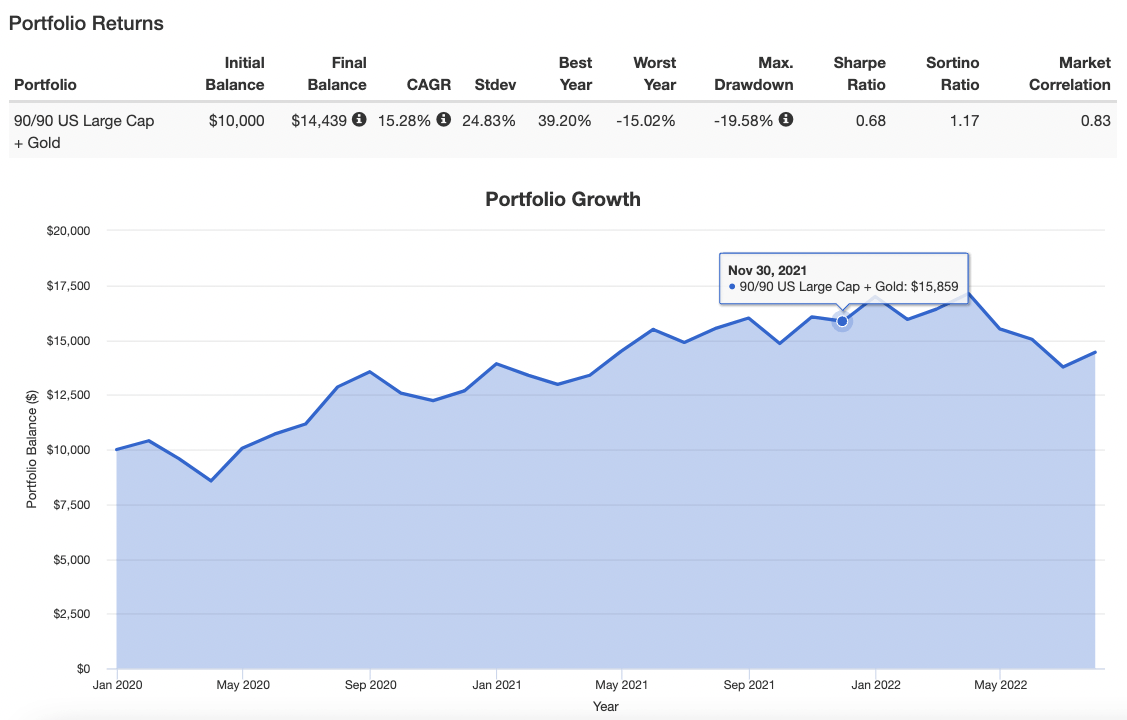

2020s Stocks + Gold + 50/50 Combo + 90/90 Combo

OVERALL RESULTS

US LARGE CAP

CAGR: 11.60%

RISK: 20.60%

WORST YEAR: -12.65%

MAX DRAWDOWN: -20.02%

GOLD

CAGR: 5.50%

RISK: 14.98%

WORST YEAR: -4.15%

MAX DRAWDOWN: -13.74%

50/50 US + GOLD

CAGR: 9.02%

RISK: 13.80%

WORST YEAR: -8.33%

MAX DRAWDOWN: -11.20

90/90 US + GOLD

CAGR: 15.28%

RISK: 24.83%

WORST YEAR: -15.02%

MAX DRAWDOWN: -19.58%

RELATIVE RESULTS

CAGR

90/90 US + GOLD: 15.28%

US LARGE CAP: 11.60%

50/50 US + GOLD: 9.02%

GOLD: 5.50%

RISK

90/90 US + GOLD: 24.83%

US LARGE CAP: 20.60%

GOLD: 14.98%

50/50 US + GOLD: 13.80%

WORST YEAR

GOLD: -4.15%

50/50 US + GOLD: -8.33%

90/90 US + GOLD: -15.02%

US LARGE CAP: -12.65%

MAX DRAWDOWN

50/50 US + GOLD: -11.20

GOLD: -13.74%

90/90 US + GOLD: -19.58%

US LARGE CAP: -20.02%

THOUGHTS

Well, well, well we’re living through history at this stage of the game.

Enter the room 2020s.

2022 has been especially challenging but overall we’re off to a decent start.

For the last time we get to announce 90/90 featuring a double digit CAGR, US Equities in second place, 50/50 loving those smooth single digit returns and Gold in last place.

*Note: It’s important to take into account that I did not include the simulated costs of borrowing for the 90/90 US equities + Gold combination for any of these simulations. Please account for that yourself.*

Nomadic Samuel Final Thoughts

Every single asset class and strategy under the sun goes through prolonged periods of underperformance that test the patience of even the most steadfast investors when viewed individually as a line item.

It is only when you combine uncorrelated asset classes and/or strategies that magic occurs.

Consider the pain US equity only investors had to endure in the 1970s and 2000s and then flip the card over to what seemed like a perpetual bear market for Gold Bugs in the 1980s and 1990s.

What happens when you combine them together at 50/50 or 90/90 is magic.

No lost decades.

A 50/50 portfolio with returns only 27 basis points behind a US Equity only mandate since 1972.

And what about the 90/90 combination?

Six consecutive decades of double digit CAGR performance.

Find me a portfolio that has that kind of track record!!!

Does it even exist?

When I learn about new strategies, such as applying sensible amounts of leverage to uncorrelated asset classes, I like to backtest the results before I become a believer.

I can honestly say that an equal parts US Stock Market and Gold portfolio leveraged sensibly is a winning combo.

Am I going all in with this particular strategy?

No.

There are plenty of other asset classes and strategies worth integrating into my portfolio to make it more efficient.

Yet, I’m thrilled to have a fund like GDE ETF in my portfolio as one its 12 building blocks.

source: Equitymaster on YouTube

Now over to you?

Did the results of this backtest surprise you in any way?

Do you allocate to gold in your portfolio?

I’d love to find out more in the comments below.

I’ve been henpecking away at this article indoors for too long.

It’s time to enjoy some golden sun rays.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Hi samuel! Thank you very much for your blog, it is very helpful.

What instruments do you use in portfoliovisualizer.com for Gold that has historical up to 1972?

Thank you very much in advance.

GDE sounds good conceptually but as with many of these funds it never got off the ground… can’t invest in something with this little AUM

Are you aware of any 100/100 Equity/Bond funds outside of Pimco’s StockPLUS? It would be much better if the bond portion was strictly passive UST long end rather than actively managed like Pimco’s with MBS, corporates, etc. They racked up huge losses in 2008 when UST should have offset SPX losses.

MAFIX, BLNDX, MBXIX are all not great once SPX is stripped out of their returns. In the managed futures space would much rather have ASFYX, EBSIX, AHLFX, PQTIX.