I’ve been focusing on ways to enhance returns, reduce risk and create more regime ready portfolios on this blog, but the truth of it all is that without discipline and a willingness to stay the course, it all falls apart.

That subjective picture perfect portfolio you’re pursuing is only as good as your discipline to stick with it through thick and thin.

Investor psychology is the most important ingredient of the cake.

The foundational base.

The portfolio strategy is merely the icing.

No portfolio, no matter how well it is designed, can survive the eject button.

The problem is that most investors fall hard off of the wagon when it comes to recency bias and loss aversion.

Especially when markets are down and have been for a while.

Capitulation instead of staying the course is often the ultimate result.

What if there was a way to be more disciplined and make it through the other side?

Fortunately, we’ve got Cullen Roche to consult on this very subject as part of our “Investing Legends” series.

Cullen is an expert when it comes to behavioural finance and has created an ETF, the Disciplined Fund, to help investors stay on track and not surrender.

We’ll wade back and forth between discussing ways investors can better prepare both mentally and structurally (with a portfolio appropriate for their given risk tolerance) while also exploring the DSCF ETF.

Let’s turn things over to Cullen.

Staying The Course: How To Become A More Disciplined Investor

Hey guys! Here is the part where I mention I’m a travel vlogger! This “Investing Legends” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What Prevents Investors From Staying the Course?

Thanks for joining us today Cullen.

When investors think of “factors” more often than not it is something along the lines of value, momentum, minimum volatility and/or yield.

However, you wrote a blog post on your website Pragmatic Capitalism entitled as follows:

The Most Important Investment Factor – Behaviour

“A suboptimal strategy that you can execute is better than an optimal strategy you can’t execute.”

What is it that you think prevents most investors, especially DIY or inexperienced ones, from being able to stick with a sensible plan?

Is it taking on too much risk?

A lack of knowledge of markets, economic cycles and never-ending volatility?

What at the end of the day prevents most investors from staying the course?

Great question.

My experience is that it tends to be a temporal problem.

We are impatient and the grass always looks greener somewhere else.

That’s the problem with diversification.

We know it’s the only free lunch, but we also know that diversification works because it’s a lunch that doesn’t always taste great.

In other words, diversification works because your portfolio isn’t always optimized.

Something in there should be uncorrelated and not working even when the rest of the portfolio is working.

People see this and struggle with staying the course because they constantly question the short-term performance of the assets that don’t perform as well as others.

A lot of investors don’t know their risk profile and don’t find it out until they’ve gone through a real bear market.

Unfortunately, that’s the worst time to learn your risk profile.

In my opinion most investors would be better off taking less risk, accepting less return and creating a more stable style of return that isn’t always “optimized”, but helps you stay the course and avoid big behavioural mistakes.

I think Ben Graham summed it up well when he said “the investor’s chief problem, and even his own worst enemy, is likely to be himself”.

What Derails A Sensible Investing Plan?

In my opinion, the Four Horsemen for potentially derailing a sensible investing plan are recency bias, loss aversion, narrative based investing and fear of missing out.

Recency bias being the tendency for investors to overweight recent events in the markets (whether good or bad) as continuing into the future.

Loss aversion for many investors is twice (or maybe three or four times) as painful on the way down as it is on the way up.

Narrative based investing lures in those who are seeking “big returns” while taking on concentrated bets.

And finally FOMO has many investors sniffing out the next “big thing” while often participating in the madness near the greater fool stage of the equation.

Do you agree with what I’ve designated as the Four Horsemen of inevitably doomed investing?

If so, can you expand upon each of those?

And if not, what are the some of the typical “grim reaper” scenarios that you feel investors encounter when it comes to veering off course from a sensible investing plan?

You nailed it.

Investors are impatient (recency bias), mistake potential risk for potential return (loss aversion), succumb to fear- based short-termism (narratives) and always think the grass is greener somewhere else (FOMO).

What is a Disciplined Investor?

Discipline is such an important thing to have in your life.

Without it you sleep in, eat trash, neglect your body, skip workouts and saunter throughout the day in a less than optimal state.

You’re not the “best version” of yourself without discipline.

Equally as an investor, if you don’t follow a disciplined rules based approach to managing your portfolio you’re most likely bringing in a myriad of bad habits (not too different from an underachieving version of your personal life) that over time erodes your wealth.

In your opinion, what does it mean to be a “disciplined investor” and how does that spill over into one’s personal life?

I define “Discipline Based Investing” as any asset allocation that is implemented using a systematic, evidence based and behaviorally robust strategy.

Investing is like dieting – we all know how it works and how to succeed at it, but staying disciplined to a diet is really hard.

I love the diet studies from Johnson and Gardner (2014 & 2018) which showed that it doesn’t even matter which diet you adhere to as long as you adhere to one.

Investing is so similar.

There are hundreds of evidence based investing strategies that will serve you fine if you just stick to it.

Find the one that works for you and then stay the course!

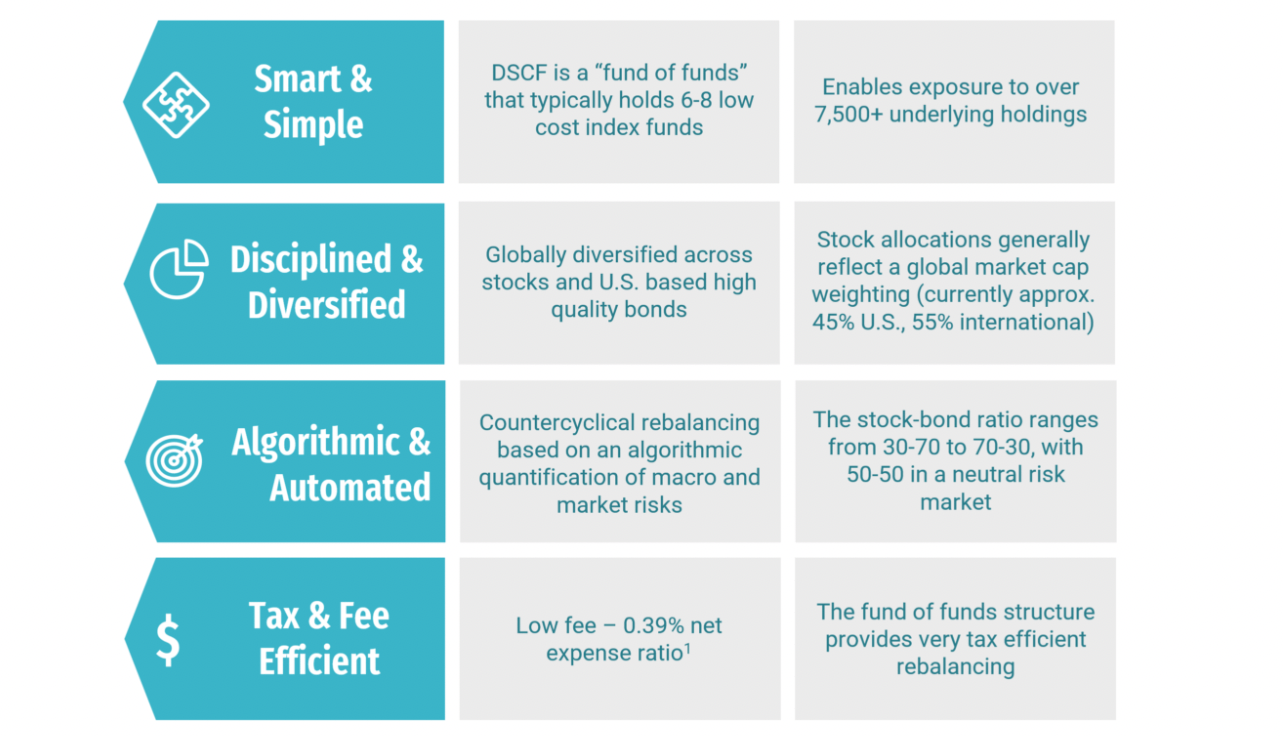

The Discipline Fund – DSCF ETF

Let’s explore your ETF DSCF.

The first ever countercyclical rebalancing fund.

I think a good place to start would be with the funds “countercyclical rebalancing” strategy which immediately sets it apart from other ETFs.

Can you explain exactly how this strategy works and how it differs from typical static asset allocation?

I’ve always loved low fee indexing strategies.

A 60/40 stock/bond portfolio, eg, has a lot of wonderful characteristics – it’s diverse, low fee and tax efficient.

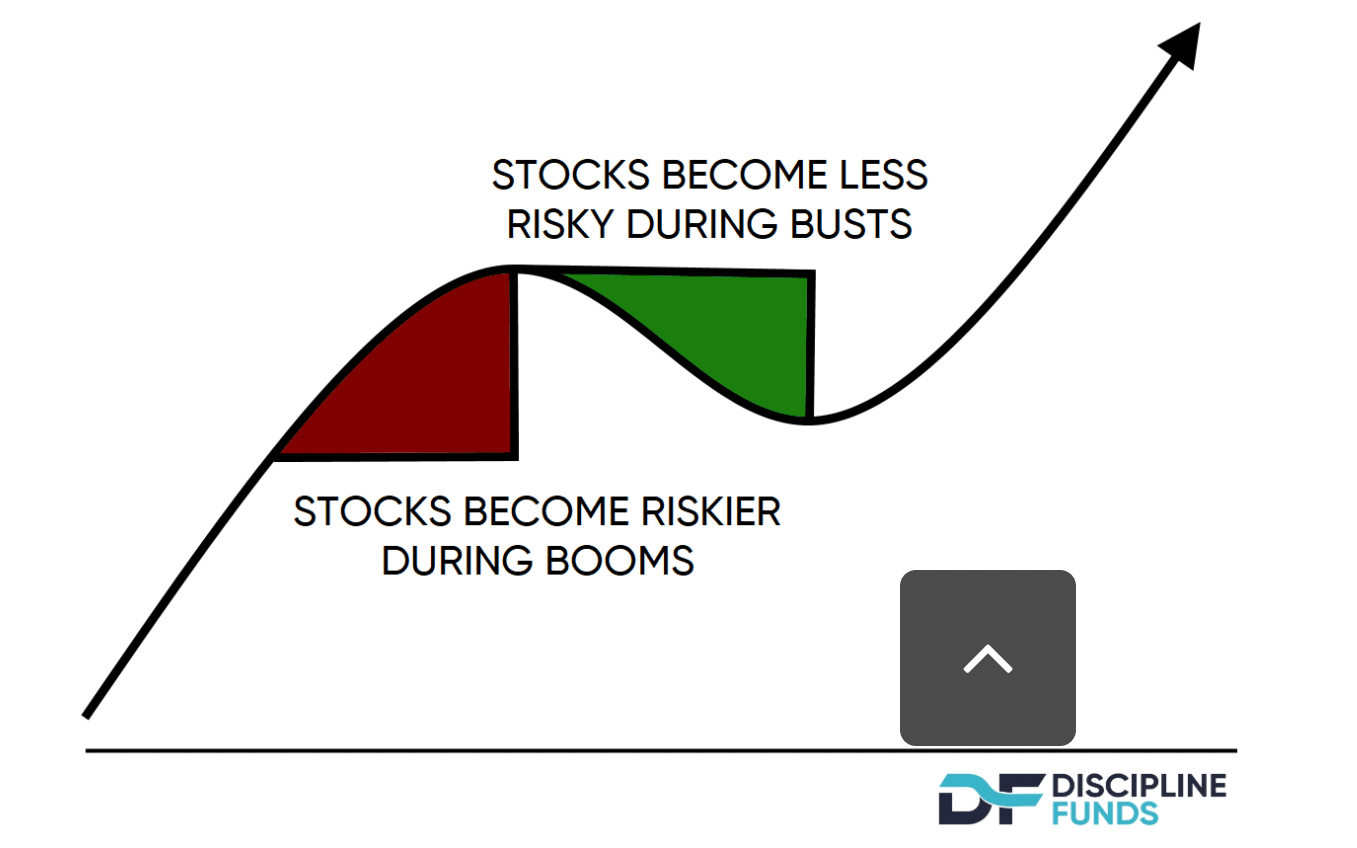

But we call this strategy a “balanced” index when, in fact, we know that 85% of the volatility in this portfolio comes from the 60% slice.

This isn’t balanced at all!

But the interesting thing about a 60/40 portfolio is that it’s somewhat countercyclical in the sense that, when stocks fall a lot, it overbalances back to 60% and when stocks rise it sheds exposure back to 60%.

It’s always reducing or increasing the cyclical risk in stocks relative to bonds.

But I would argue that it’s not countercyclical ENOUGH to create a truly balanced allocation because its initial starting weight in equities is so high.

This means that the investor in this portfolio is being whipsawed by the equity market even though they think they own a diversified and balanced portfolio.

The other interesting thing about the current indexing world is that there is no actual index that accurately tracks global market cap.

For instance, the actual market cap of stocks vs bonds is highly dynamic.

Stocks ebb and flow between 35-50% of global assets over time.

They were just 35% in the early 90s, boomed to 50% by the late 90s, crashed back to 25% by 2003, surged to 50% by 2007 and then crashed back to 35% by 2009 before recently surging back to 50%.

But no index fund actually tracks this.

Instead, almost all multi-asset index funds are fixed weight funds that don’t even track the actual changes in the market cap.

So, for instance, with 60/40 you end up rebalancing back to this fixed 60% weight even though the actual underlying market cap has surged on a relative basis.

Does this make sense?

I say absolutely not.

In fact, a truly “efficient” market theorist would say you should just track that relative market cap.

But this is also silly because then you’re always underweight after busts and overweight after booms.

And that’s where I think there’s a need for something more “countercyclical”.

The Discipline Fund establishes a benchmark with a lower starting equity weight (50%) and then rebalances against the dominant trend in the market cap changes of the stock/bond markets generally between 40/60 and 60/40.

So, it ends up trying to achieve more of a Risk Parity approach where the goal is to create greater parity between the portfolio’s underlying asset class risk so that the stock market isn’t driving all or most of the portfolio risk.

It’s very similar to what John Bogle said he did in his personal portfolio in which he described how, when valuations were crazy, he’d tilt his equity exposure to make himself more comfortable.

The Discipline Fund ETF: What’s Under The Hood

So let’s pop open the hood of The Disciplined Fund!

As a fund of funds, you’re targeting 6-8 index funds that are globally diversified and ranging from an asset allocation of 70/30 to 30/70 with a baseline of 50/50.

What kind of goodies are investors being offered with this fund?

And how important is it for the strategy of this fund to pursue a “diversification is your only free lunch” mandate by going global and avoiding home country bias?

I think all multi-asset index construction should start with the Global Financial Asset Portfolio because that’s the true “market” portfolio.

Everyone deviates from this portfolio actively and that’s fine, but it should always be your baseline.

Personally, I don’t like stock picking or even country picking.

We know that countries and economies rise and fall over time and I don’t spend my time trying to guess who the global economic superpower will be in 50 years.

But I know that equities are long-term instruments so I always like the Bogle approach of buy the haystack, ignore the needle.

But the real secret power of the Discipline Fund is its fund of fund structure.

The fund of funds space is very small for some odd reason.

But the beauty of a FOF is that it creates a tax shelter.

ETFs can rebalance in a very tax efficient way and when you structure your fund properly you can create a tax deferred rebalancing strategy that avoids the cap gain inefficiencies we see in portfolios where the assets are held individually or in a mutual fund structure.

This is a huge advantage and given the small size of the ETF FOF space seems to be one that is largely undiscovered.

Branding Of The Discipline Fund

The branding of the Discipline Fund receives a high grade in my books.

I’m a trained teacher after-all so I’m giving you an A for that.

To be honest we’re an industry that throws out “risk” and “all-weather” as part of fund/strategy names.

In my opinion this is negative “fear” based branding even if that was not its original intention.

Discipline on the other hand offers hope for a better future.

A disciplined approach to a healthy lifestyle can mean life changing results if pursued over a long-enough time period.

The same can be said for an investor willing to take a disciplined approach to managing their money.

How did you decide upon the name of your fund and how important is the branding/message as part of its overall strategy?

Discipline is an investing superpower.

People love to talk about how Warren Buffett is a great stock picker, but that only part of the story.

Buffett’s biggest strength is that he had an evidence based approach that he stayed disciplined to through thick and thin.

We can’t all be Buffett, but we can all be more disciplined.

That’s what we’re trying to do with Discipline Funds – help people build evidence based and systematic portfolios that help them stay the course by being more disciplined.

The Discipline Fund Model Portfolios

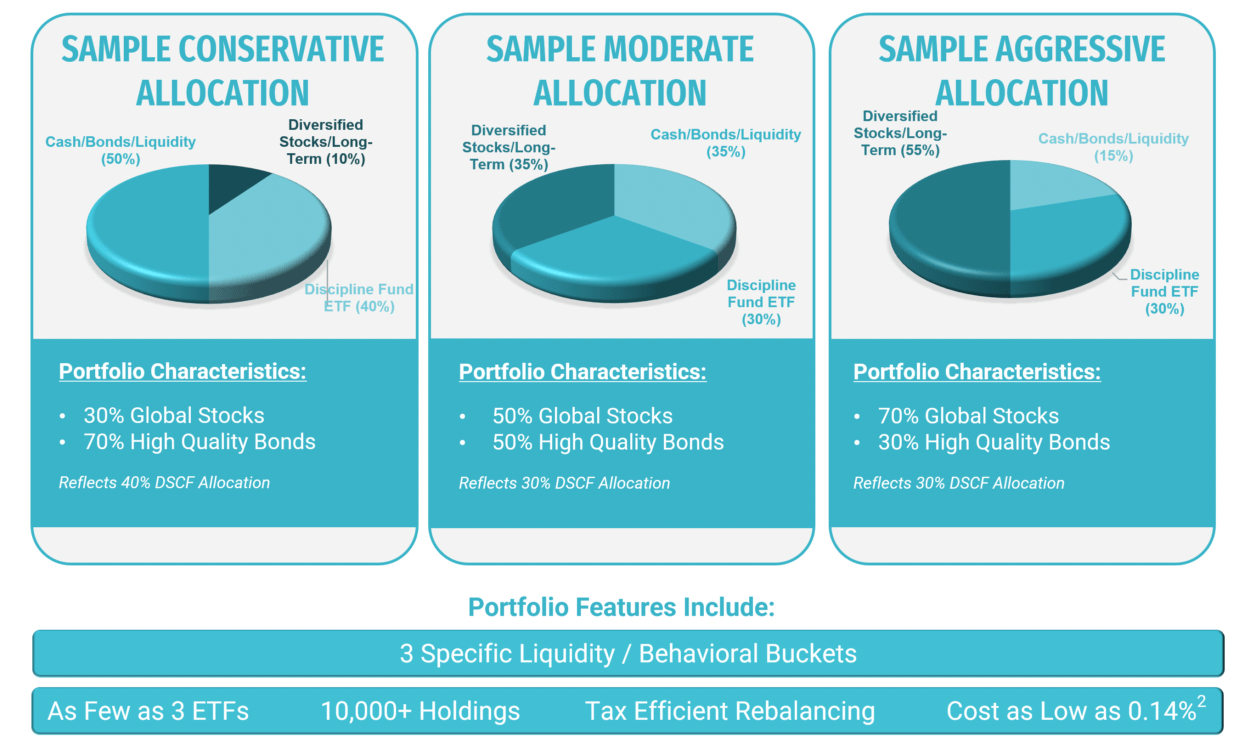

Let’s move on to how the Discipline Fund could potentially integrate into an overall portfolio.

Firstly, who is this fund for ideally speaking?

Secondly, you give some great sample portfolios for those with short, medium and long-term requirements.

Could you share some of those with us?

Anyone who needs more discipline in their portfolio!

But more specifically, it’s for anyone who wants a more diverse core holding in their portfolio.

I generally advocate for building many “buckets” out around a core holding like this.

Everyone needs to match their various assets with certain liabilities so it makes sense to hold some cash, some intermediate bonds, some stocks, etc.

The Discipline Fund is a super tax efficient core of this approach and you can tilt the other holdings to meet any risk profile.

In some cases this could be very simple (as few as three funds, for instance) or it could be much more sophisticated depending on the investor needs.

I tend to defer towards simple is better, but financial planning is messy and I know that simple isn’t always better.

The Discipline Fund: Alternative Model Portfolios

I’ll throw a curveball your way and give you three strategies that can be paired with your Discipline Fund for an overall portfolio that are not typical index funds.

A) Static Risk Parity Fund with allocation to global equities, long-term treasury, TIPs, gold/commodities

B) Trend Following Managed Futures Fund

C) Long-Short Equity Fund with strong factor exposure and an expensive junk/glamour stocks hedge

D) The Disciplined Fund

Given what’s on the table what might be an interesting asset allocation given those 4 building blocks?

There are a million ways to skin the cat there, but I would generally view The Discipline Fund and Risk Parity strategies as “core” holdings.

They’re asset class based indexing strategies that are just trying to create more balance in the underlying asset class risks.

It’s perfectly fine to use these sorts of approaches as a large core piece of the portfolio.

I tend to view managed futures, long/short and other “alternatives” as satellite pieces.

They’re strategies that will likely do worse, on average, than typical diversified long only portfolios, but have the potential to provide large asymmetric diversification in very specific environments.

So they’re almost like portfolio insurance in a sense.

In other words, I think investors should build their core around stocks and bonds and then add satellites around that to help you construct a sort of “all weather” portfolio.

So, for instance, if you were only using these 4 funds you might construct a 40/40 position in Disciple and RP and then add on a 10/10 satellite using Managed Futures and Long/Short.

But this totally depends on the investor’s specific profile and needs….

Cullen’s YouTube Channel: 3 Minute Money

You recently started a really cool new YouTube channel: 3 Minute Money

I’ve been watching it (and really enjoying the videos) but for those not familiar with the channel what can they expect to find in terms of content?

Thanks!

I do a lot of educational work on the financial system and that’s my main goal with the channel.

I think there are so many myths and behavioral biases that hurt investors.

Financial media and social media is so narrative driven and fear driven.

It’s counterproductive in a lot of ways.

I’ve always tried to establish a sort of first principles understanding of money and finance.

Let’s understand what stocks and bonds are, for instance, at an operational level so we can better understand what they do, how they do it and then we can better utilize those instruments because we are more comfortable with what they are.

I hope to do a lot of educational work with this channel.

I’ve always loved doing media and interviews so this is a fun new venture for me.

Cullen Roche Bucket-List Trip

Finally, I thought we could end things off with something travel related since that is my day job.

Where would you most like to visit and what would you most like to do as a bucket-list activity?

A super-fan who loves ticker DSCF ETF has offered to cover all costs associated with the trip.

So where are you off to and what do you plan on doing?

Tough question! I’ve still never been to New Zealand. When are we going? 🙂

Connect With Cullen Roche

Thanks for taking the time to do this Cullen!

How can people connect with you on online with all of your social media/content platforms?

The best place to find me is on twitter at @cullenroche and my blog pragcap.com.

Thanks for having me!

Sam over here. I so appreciate Cullen taking the time to do this. Be sure to check out his Discipline Funds ETF page as well.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.