In a year where just about every long-only investment has been taken to the wood-chipper, one clear example of a fund that has shined brightly amidst the bloodbath is KFA Mount Lucas Index Strategy ETF (ticker KMLM).

As a managed futures trend-following product it has had the ability to transform during challenging market conditions by not fighting reality.

Instead of being positioned long-only across commodity, currency and fixed income markets it has the capacity to adapt and also go short depending on market trends.

This unique feature, in and of itself, makes it uncorrelated to both long-only equity and bond strategies.

Given its ability to adapt like a chameleon it has provided savvy investors (who are open to adding alternatives to their portfolio) a ballast that has shielded them in 2022, unlike bonds which have joined equities on the skewer of misery.

This type of alternative investment strategy used to only be available to institutional and high net worth individuals but in recent years has become accessible to retail investors in a cost efficient ETF wrapper.

Hallelujah!

And then some.

In this ETF review blog post we’ll attempt to unpack the managed futures trend-following strategy that KMLM brings to the table and how it can potentially integrate into a portfolio at large.

Without further ado let’s jump right in!

KMLM ETF Review | KFA Mount Lucas Index Strategy Managed Futures ETF

Hey guys! Here is the part where I mention I’m a travel content creator! This investing opinion blog post ETF Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

KFA Funds and Mount Lucas Partnership

KMLM ETF is a partnership between KFA Funds and Mount Lucas Management.

Mount Lucas Management, as the sub-advisor, has provided diversifying alternative investment solutions since the late 1980s to a clientele of mostly high net worth individuals and institutions.

With its recent partnership with KFA Funds these alternative systemic investments strategies are now available to everyone as ETFs.

Unlike other managed futures providers, Mount Lucas Management has a storied (and most impressive) track-record dating back to 1988 which we’ll unpack later on in the article.

These aren’t exactly the new kids on the block when it comes to alternative investing strategies.

The Case For Managed Futures Trend-Following

When it comes to investing we have two different spheres that rarely communicate with one another.

On the one side, we have the traditional long-only investments of equities, bonds and real estate and on the other we have managed futures and options based strategies.

What I’ve noticed, since I’ve started to take a deep-dive into the subject, is that it’s rare for investors to integrate the best of both worlds.

You have one camp that is militant about investing in stocks and bonds only (all the time in every scenario under the sun) and an equally committed side towards managed futures/options as the most sophisticated game in town.

The real magic, when I’ve backtested the results of combining these strategies, is when they all come together.

What managed futures trend-following can provide that long-only stocks and bonds cannot is an adaptive core feature to take both long and short positions depending on the current trends of the market.

When markets are trending strongly up or down this strategy captures the results sublimely.

Equity indexes are trending down strongly.

Short.

Certain commodities are rocketing to the moon.

Long.

Trend-Following thrives under these conditions (with robust upward and/or downward trends) which is why it has often provided what has been referred to as “crisis alpha” during markets such as this year and the Great Financial Crisis in 2008.

Aside from typically thriving in extreme market conditions, it’s a strategy that’s also proven to generate positive returns in years where equity markets are not down.

Consider 2005 and 2014 in particular when the KFA MLM Index offered 12.62% and 22.53% respectively.

However, more important than all of that is the fact that managed futures trend-following is uncorrelated with traditional-style portfolios consisting of long-only equities and bonds.

By adding an uncorrelated alternative sleeve to your mix you have the opportunity to build a more dynamic, robust and efficient portfolio that is better prepared to handle all economic regimes.

Few investors seize that opportunity as they’re mesmerized by orthodoxy and conservatism.

More sophisticated investors dig a little deeper and find a better way forward.

KMLM Index Overview and Implementation

A key strength of KMLM ETF is its overall transparency in reference to its index (underlying assets) and implementation (trend signal and overall execution).

Let’s first start by examining the KFA MLM Index by its overall underlying assets and target allocations.

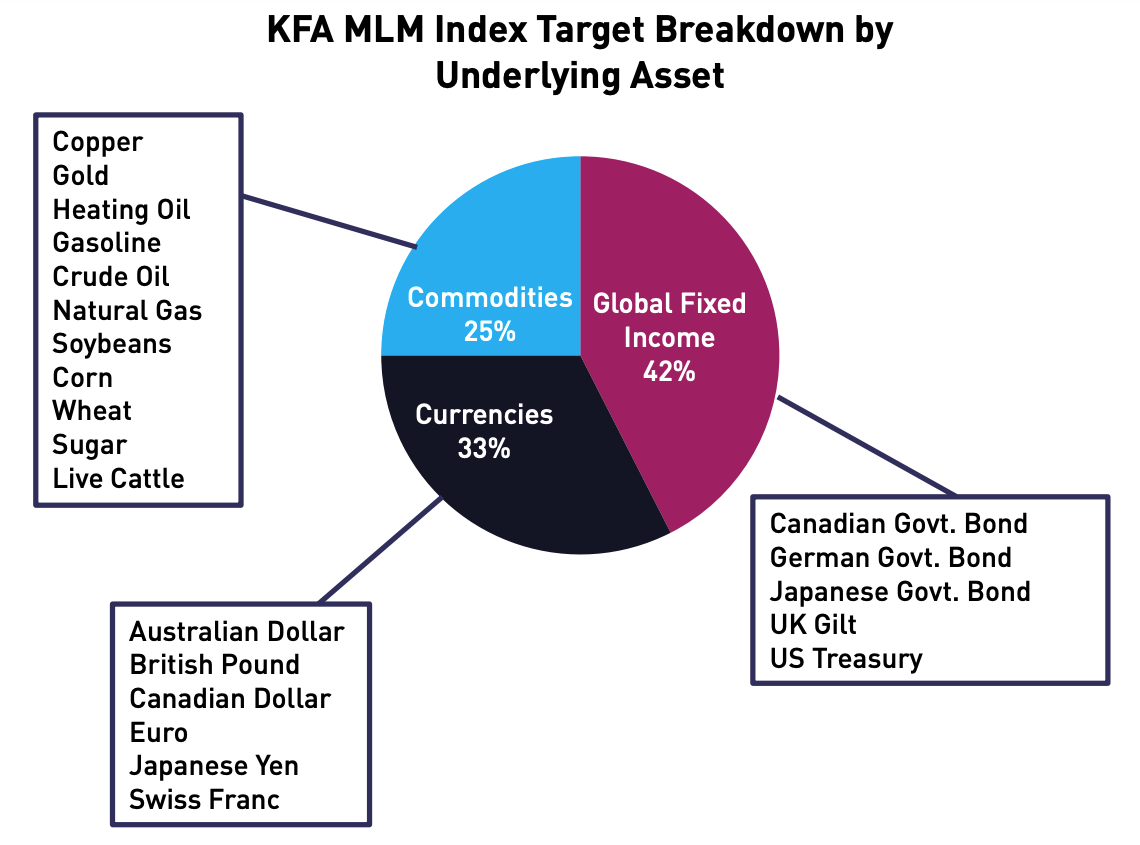

KFA MLM Index Target Breakdown by Underlying Asset

Overall, KMLM ETF provides global diversification by trading across 11 commodities, 6 currencies and 5 global bond markets.

What’ immediately apparent is how it distinguishes itself from other managed futures trend-following products by NOT allocating to equity market indexes.

Some would argue that this limits the diversification of the fund whereas others would suggest you obtain greater exposure to commodities and currencies (often lacking in most portfolios) with equity indexes not competing for valuable space.

Overall, I’m more than pleased with the level of diversification and exposure the fund has to offer which includes the following:

Commodities

- Copper

- Gold

- Heating Oil

- Gasoline

- Crude Oil

- Natural Gas

- Soybeans

- Corn

- Wheat

- Sugar

- Live Cattle

Currencies

- Australian Dollar

- British Pound

- Canadian Dollar

- Euro

- Japanese Yen

- Swiss Franc

Global Fixed Income

- Canadian Government Bond

- German Government Bond

- Japanese Government Bond

- UK Gilt

- US Treasury

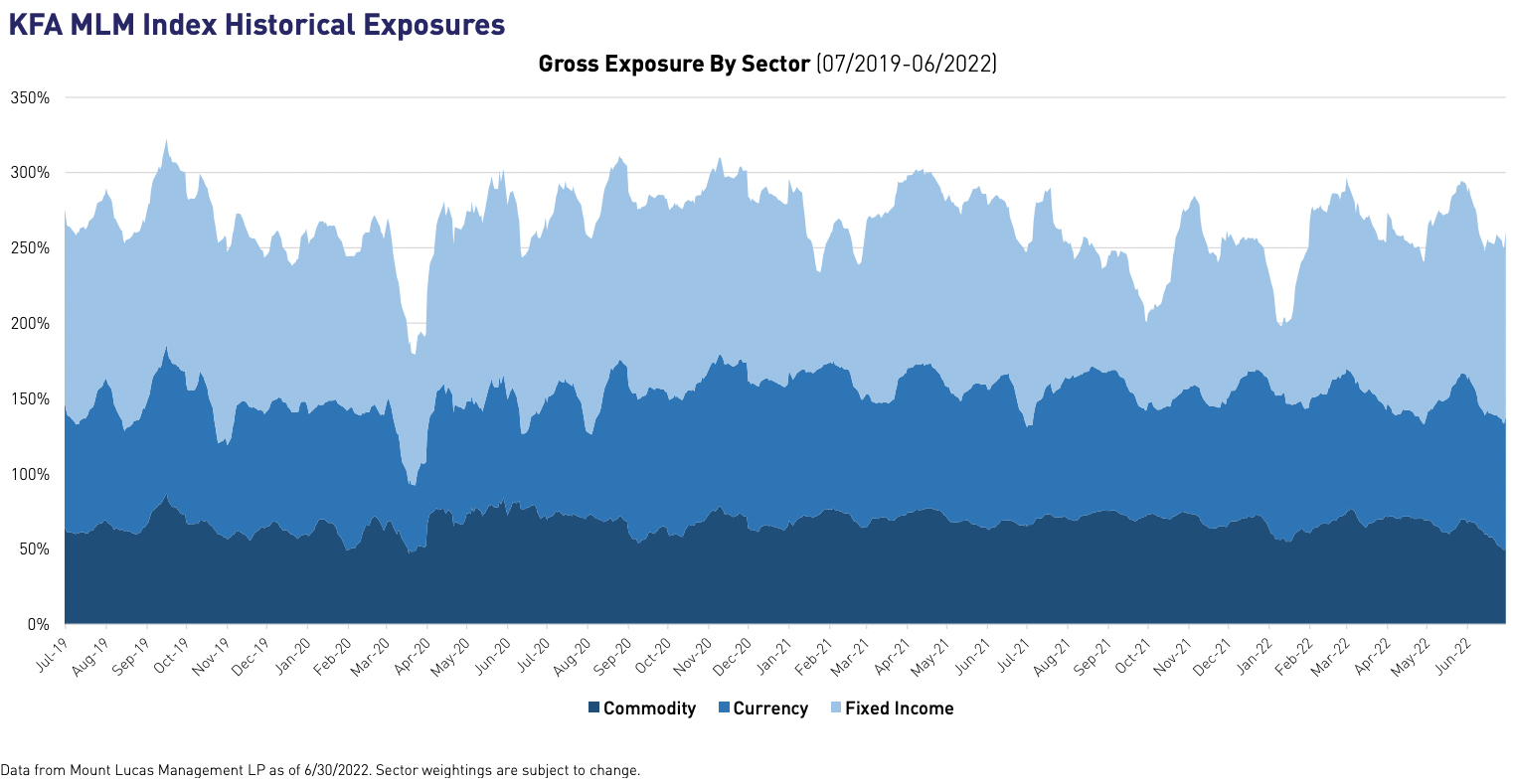

In terms of how the fund operates from a risk-return management perspective across markets and sectors is also clearly defined.

Every month rebalancing takes place so that each sector is in alignment with its historical volatility.

In terms of the long/short capacity of the fund, KMLM ETF evaluates market trading signals on a daily basis evaluating the price versus its long-term moving average.

As an example, if the long-term moving average for Corn is down-trending the fund would take a short position.

If/when that changes and the moving average for Corn is in an upward-trend it’ll change its position to long.

This systematic approach is dispassionate and completely removes human emotion and decision making from the equation.

The fund merely follows its trend-signals and adjusts its leveraged gross overall exposure (long/short) according to risk level and volatility (which is roughly 200% to 300%).

KFA Mount Lucas Managed Futures (KMLM ETF) Holdings and Info

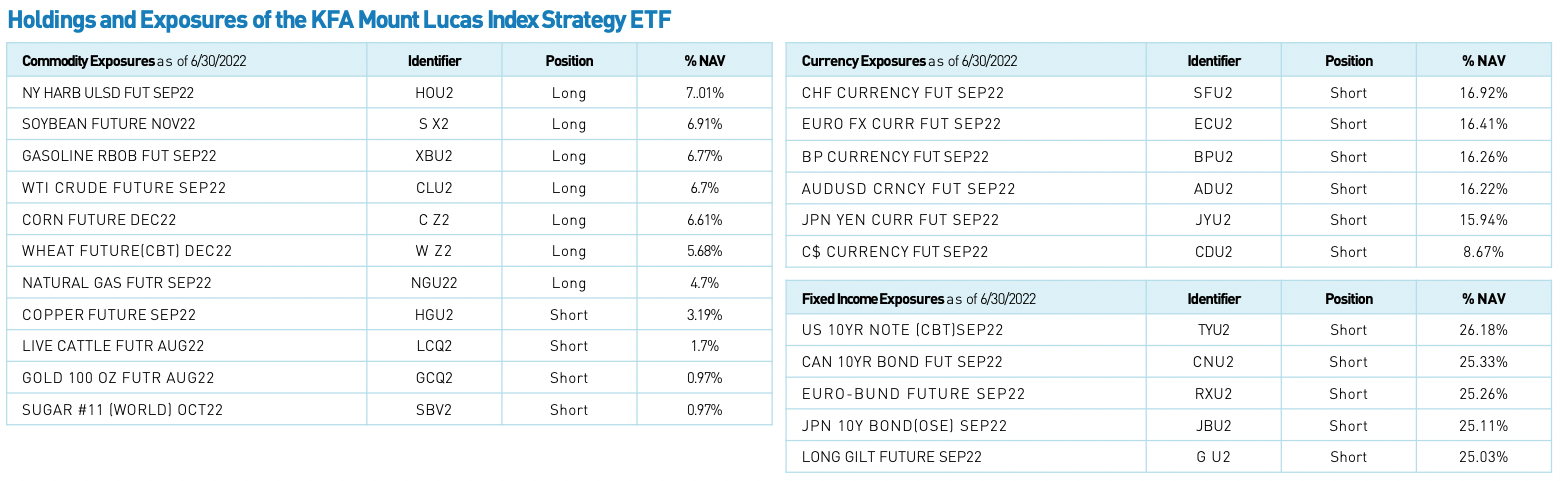

Now the holdings and exposures of the KFA Mount Lucas Managed Futures Index Strategy ETF have to be taken with a grain of salt given that this exact snapshot (as of 6/30/2022) is subject to change almost immediately.

KMLM ETF is a dynamic fund meaning that if you’re somehow reading this article in 2023 you’re going to notice a different configuration.

However, as an example of the timestamp of when this was published in 2022, the fund was capturing the downtrend in the fixed income markets by shorting across the board all of its bond and currency exposures.

Ticker: KMLM

Net Assets: $284,548,320

Expense Ratio: 0.92%

Inception Date: 12/2/2020

Distribution Frequency: Annual

Given that many alternative mandates involve fees north of 100 basis points (and performance fees tacked on top of that) I’m impressed with KMLM ETF having an expense ratio of only 0.92 and a solid AUM of 284 Million.

The fund is reasonably priced (for a strategy that involves trading) and also has no risk of being delisted given its well above the borderline 50 Million AUM threshold.

KFA Mount Lucas Managed Futures Index Strategy ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund seeks to achieve its goal by investing in commodity, currency, and global fixed income futures contracts traded on U.S. and foreign exchanges that are the same as or similar to those included in the Index.

The Index is a modified version of the MLM Index, which is an index that measures the performance of a portfolio of commodity, currency, and global fixed income futures contracts traded on U.S. and foreign exchanges using a trend following methodology.

The Index determines weightings of these three types of futures contracts by the relative historical volatility of each type of futures contract

as determined by the MLM Index Committee.

Within each type of futures contract, the underlying constituent markets are equal dollar weighted.

The Index will roll futures contracts forward on a market by market basis as each constituent market nears expiration.

The selection of the constituent markets occurs annually.

The constituent markets of the futures contracts for the Index currently consist of the following commodities (corn, crude oil, copper, gold, heating oil, cattle, natural gas, soybeans, sugar, wheat and gasoline), currencies (British pound, Canadian dollar, Australian dollar, Euro, Japanese Yen, and Swiss francs), and global bond markets (Canadian government bond, Euro bund, Japanese government bond, Long gilt and

Ten-year Treasuries).

Constituent markets are traded both long and short based on each market’s trading signals.

The Index evaluates market trading signals on a daily basis and rebalances on the first day of the month.

In addition, the Index has a target average annualized volatility of 15% over time.

The Fund will invest in futures contracts on commodities, currencies and global bond markets.

The Fund will utilize a subsidiary (the “Subsidiary”) for purposes of investing in futures contracts on commodities.

The Subsidiary is a corporation operating under Cayman Islands law that is wholly-owned and controlled by the Fund.

The Subsidiary is advised by the Fund’s investment adviser,

Krane Funds Advisors, LLC (“Krane” or “Adviser”) and is sub-advised by Mount Lucas Index Advisers LLC, the Fund’s sub-adviser (“MLIA” or “Sub-Adviser”).

The Fund’s investment in the Subsidiary may not exceed 25% of the value of its total assets (ignoring any subsequent market appreciation in the Subsidiary’s value), which limitation is imposed by the Internal Revenue Code of 1986, as amended, and is measured at the end of the quarter.

The Subsidiary has the same investment objective as the Fund and will follow the same investment policies and restrictions as the Fund.

Except as noted, for purposes of this Prospectus, references to the Fund’s investment strategies and risks include those of its Subsidiary, and references to the Fund include the Subsidiary.

While the Fund will generally seek to maintain exposure to the same futures contracts as those included in the Index, the Fund and Subsidiary may not replicate the Index.

For example, the Fund may invest in futures with different maturity dates, the Fund may weigh the futures differently than the Index, or the Fund may purchase futures on different dates than the rebalancing date for the Index.

Fund assets not invested in futures contracts or the Subsidiary generally will be invested in debt instruments, exchange-traded funds (“ETFs”), cash or cash equivalent instruments, or money market mutual funds.

The Fund may also invest directly and indirectly in certain debt instruments.

The debt instruments in which the Fund intends to invest include government securities and corporate or other non-government fixed-income securities with maturities of up to 12 months.

The Fund may invest in debt instruments indirectly through short-term bond funds and ETFs.

The Fund may also invest in cash and cash equivalents, including money market funds.

Currently, the Fund expects to invest in ETFs to gain exposure to debt instruments.

While the Fund will generally seek to maintain exposure to the same futures contracts as those included in the Index, the Fund and Subsidiary may not replicate the Index.

For example, the Fund may invest in futures with different maturity dates, the Fund may weight the futures differently than the Index, or the Fund may purchase futures on different dates than the rebalancing date for the Index.

The Commodities Futures Trading Commission (the “CFTC”) has adopted certain requirements that subject registered investment companies and their advisers to regulation by the CFTC if a registered investment company invests more than a prescribed level of its net assets in CFTC-regulated futures, options and swaps, or if a registered investment company markets itself as providing investment exposure to such instruments.

Due to the Fund’s use of CFTC-regulated futures and swaps above CFTC Rule 4.5 limits, the Fund is considered a “commodity pool” under the Commodity Exchange Act.

The Fund is non-diversified. To the extent the Index is concentrated in a particular industry, the Fund is expected to be concentrated in that industry.

As of May 31, 2022 the Index was invested in the futures contracts of the 11 commodities, 6 currencies, and 5 global bond markets listed above.

The Index is provided by Fuzzy Logix, Inc. (doing business as “FastINDX”) (“Index Provider”).”

Long-Term KFA Mount Lucas Index Performance

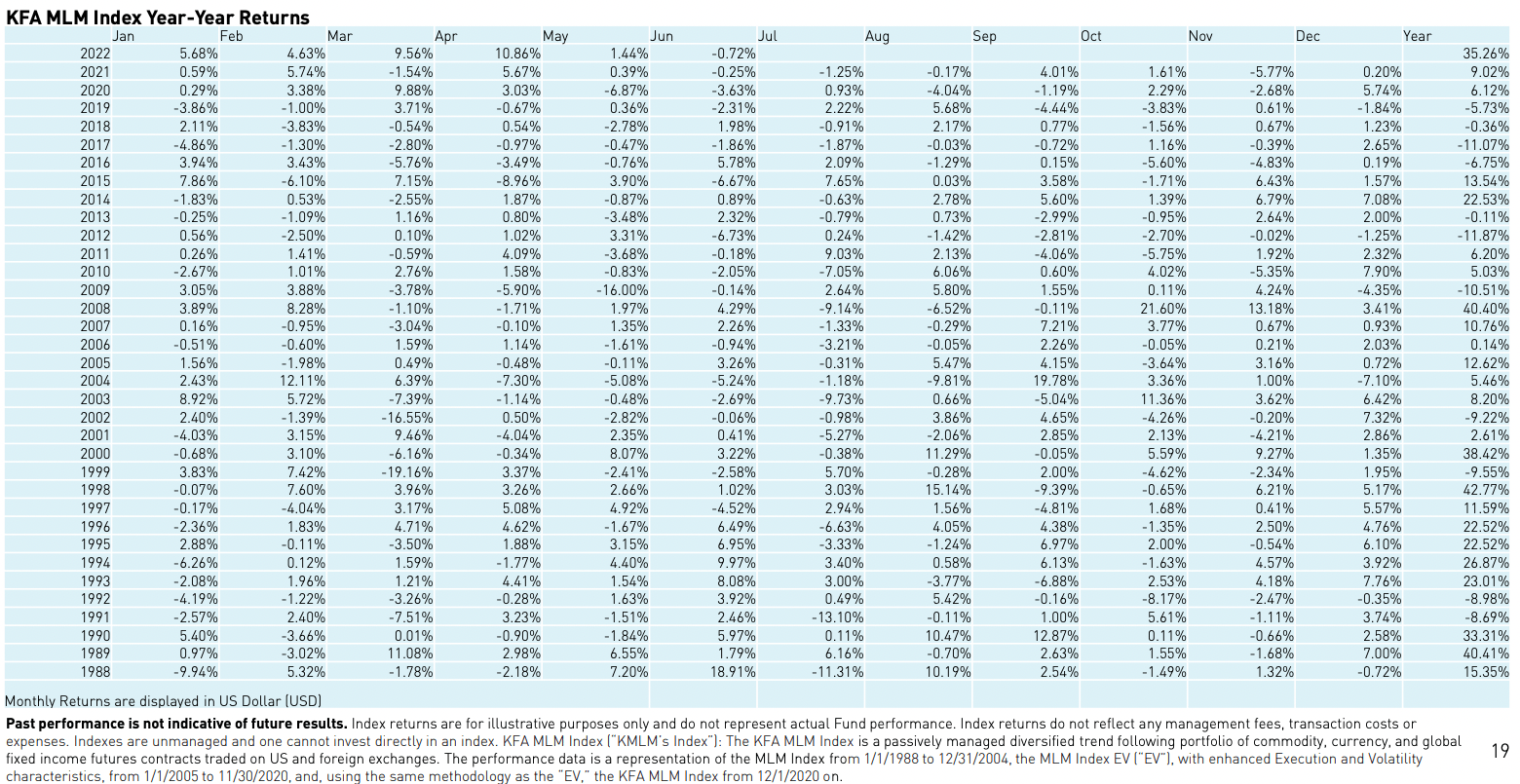

Fortunately, we’re blessed that Mount Lucas Management have been tracking monthly and annual results for the KFA MLM Index yearly since 1988.

We’re able to get a taste of how it has performed long-term and especially zero in on its returns during challenging years for the markets.

For instance, when markets were getting beatdown severely in 2000, 2001, 2002 and 2008 it offered returns of 38.42%, 2.61%, -9.22% and 40.40% respectively.

In March of 2020, when COVID impacted markets negatively the KFA MLM Index was up 9.88% for the month.

Not everything about managed futures trend-following is a free lunch though.

Consider the challenging period of the 2010s when the index had multiple negative years and struggled mightily along with most other managed futures strategies.

When trends aren’t strong in either direction this type of strategy can get whipsawed going back and forth and investors need to be aware that owning “alternative strategies” in your portfolio will test your patience just as much as anything else if you view them as an individual line-items only.

Recent KFA Mount Lucas Index Performance

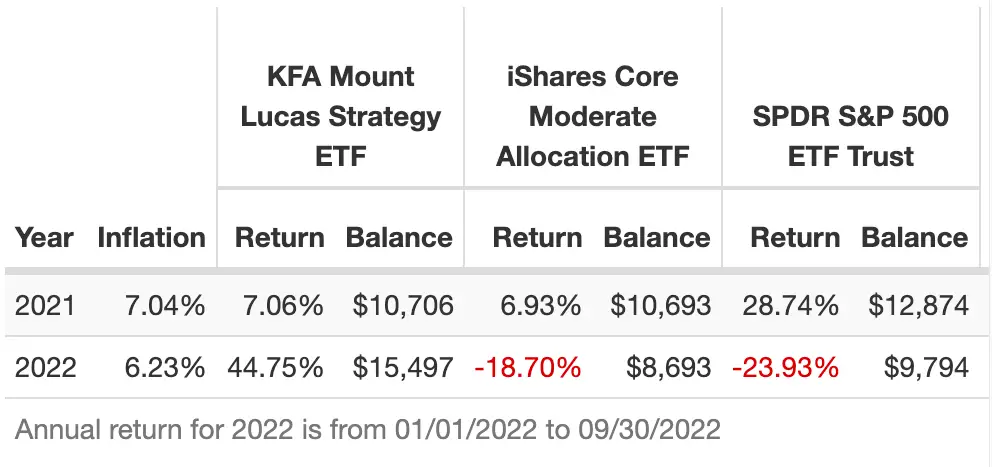

Few funds have had a more spectacular and auspicious debut than KMLM ETF.

It’s been out of the gate impressive positive returns in 2021 and unbelievable relative returns in 2022.

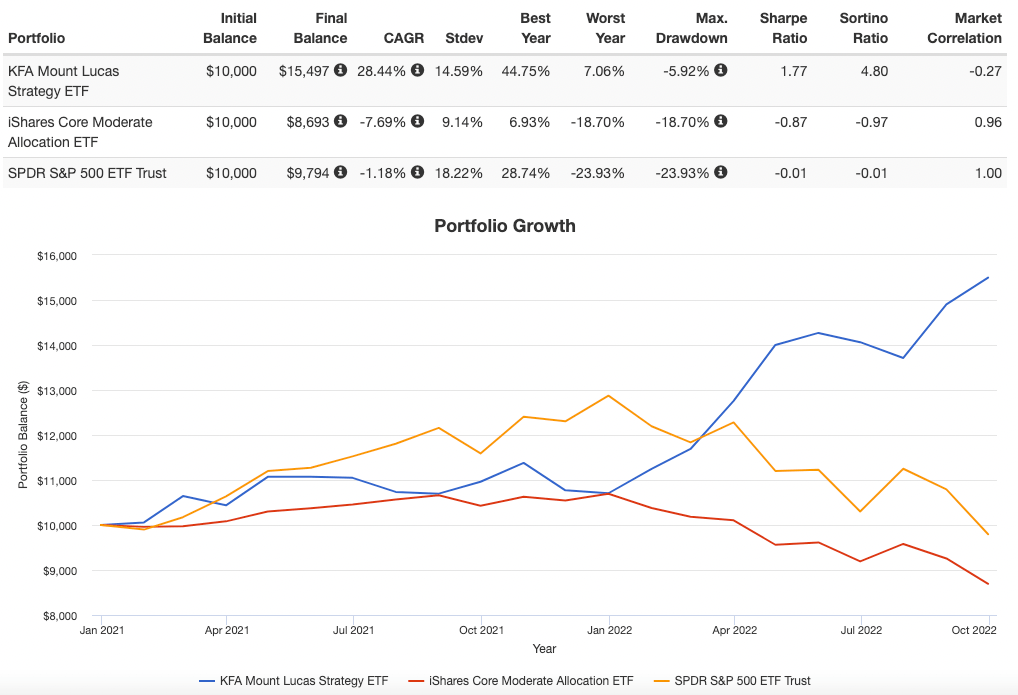

Notice that the market correlation for the fund is -0.27.

I’ve chosen the S&P 500 ($SPY) and a global 60/40 ($AOM) as reference points given how popular these allocations are with retail investors.

What you’ll notice is that the 60/40 globally diversified portfolio (-18.70%) and S&P 500 (-23.93%) has failed spectacularly this year (up until 09/30/2022) whereas KFA Mount Lucas Managed Futures Strategy ETF has been absolute gangbuster – kicking ass and taking names with returns of 44.75% YTD.

For those still insisting vehemently upon long-only portfolios I just don’t know what to say to you at this point.

If diversification is your only free lunch (not just globally but stylistically and by asset class) why aren’t you taking it?

KFA Mount Lucas Managed Futures Strategy (KMLM ETF) Pros and Cons

Let’s move on to the pros and cons of KMLM ETF.

KMLM ETF PROS

- Managed Futures Trend-Following offering uncorrelated returns to both stocks and bonds

- Dependable crisis alpha with proven results in the early 2000s, 2008, 2020 (March) and 2022 when you need them the most

- Exposure to global currency, commodity and fixed income indexes (note: no exposure to equity indexes)

- A track record and management team that have been deploying alternative strategies since in the late 1980s

- An “alternative” puzzle piece that integrates well with long stock and bond allocations

- Reasonable management fee and overall expense ratio of under 100 basis points (0.92) for a strategy that typically costs a lot more

- The opportunity for retail (and advisors) to have access to a strategy that has typically been available only to institutional and high net worth investors

- The chance to support an innovative fund provider (KFA) as opposed to the typical ones out there

KMLM ETF CONS

- A strategy that is doing “extremely well” right now but struggled in the 2010s means that investors need to be aware it’ll have its ups and downs just like any other part of their portfolio

- For those insisting upon single digit basis point fees you’re excluding yourself from this type of strategy (and many other ones out there) that involve some aspect of trading

KMLM Managed Futures Potential Portfolio Solutions

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

So we’ve arrived at my favourite part of every fund review which is figuring out how to integrate KMLM into a portfolio at large.

Factor Focused Quant Portfolio

For full on quants (such as myself) you’ll find integrating KMLM into a portfolio a cinch by utilizing a bit of capital efficiency to get exposure to other asset classes.

One potential solution looks like this:

40% $AVGE

20% $VMOT

30% $KMLM

10% $TYA

Here you’re taking advantage of the recently released $AVGE (Avantis All Equity Markets ETF) for your long-only global equity exposure and combining it with $VMOT for even deeper factor exposure to value and momentum with the capacity to hedge based on trend.

$TYA provides efficient capital exposure for a notional 30% long fixed income allocation.

You now have plenty of space to add $KMLM for its chameleon like capabilities to adapt to currency, commodity and fixed income indexes.

Overall you have 40% long equity, 20% long-short equity (when trend dictates otherwise its long), 30% managed futures trend following and 30% fixes income.

Capital Efficient Quant Portfolio

For quant investors seeking capital efficient exposure (across the board) you’ve got some fascinating puzzle pieces to put together these days.

Here is something to consider:

20% $GDE

10% $NTSI

10% $NTSE

10% $VAMO

30% $KMLM

10% $TYA

10% $CYA

You’ve got all the elements of a dragon portfolio (not in terms of specific allocation percentages) with this seven fund configuration offering you capital efficient exposure to gold, bonds and equities along with managed futures trend following, options based tail risk puts and trend dependent long-short factor focused equities.

What’s missing?

Not much in my opinion.

Standard Milquetoast Portfolio

Yes, I’ll even begrudgingly consider how you can diversify the boring 60/40 with KMLM ETF.

80% AOM

20% KMLM

Now you’ve got a 50/30/20 configuration between stocks, bonds and alternatives that should provide better risk adjusted returns from the classic 60/40 portfolio.

Nomadic Samuel Final Thoughts

I haven’t been able to hide my feelings towards KMLM ETF at any point in this article.

It’s painstakingly obvious that I love the fund and it is indeed a part of my DIY Globally Diversified Quant Portfolio.

I quite honestly feel blessed as a DIY investor these days to have the product selection that is now available.

I’m able to integrate what I’ve been learning over the past few years and apply it in real life scenarios with real-time consequences.

KMLM has conspired to keep my portfolio from getting beat up to a pulp in 2022.

source: KraneShares YouTube channel

It’s been one of several funds in my portfolio that has been above water in what has otherwise been a very challenging year for investors.

It’s allowed me to stay-the-course with some of the leveraged long-only funds I have such as NTSE that have struggled mightily given the challenging equity and fixed income market conditions.

Furthermore, it’ll allow me to rebalance what got hammered this year with what might be a generational buying opportunity for certain funds and strategies that normally don’t have all of their engines down at once.

Thus, I’m ecstatic to have KMLM ETF as part of my portfolio and I couldn’t imagine a scenario where trend-following wasn’t as vital a component of my overall investment strategy as is my equity and bond sleeves.

I think that’s where I’ll leave things today.

Have you heard of KMLM ETF before and is it a part of your portfolio?

Let me know in the comments below.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Hi Samuel,

Love your work on CTAs. What is your view on the under performance of KMLM in December 2021 (10%) compared to the MLM index? It is only month in the ETFs history where it differs from the MLM index, but the under performance that month is substantial. If the fund had a longer track record, it would be different but CTA ETFs have very limited history and it remains to be seen if they can deliver long term performance in the same way as established CTA funds can or if they “only” can deliver crisis alfa in the way they did in 2022. Your thoughts?