All of the best things in life are worth waiting for.

With the tantalizing smell of pancake batter wafting through the air, the one hour I stood outside of Vidyarthi Bhavan waiting to get in was well worth it.

The dosas being served in Bangalore, India were nothing short of legendary!

For those who’ve never tried dosa before, they’re Indian pancakes made out of fermented batter of ground black lentils and rice.

The restaurant was a buzzing hive of activity with servers stacking plates of dosas to the heavens and above and somehow wielding them from one table to the next.

I counted one man carrying 16 at a time!

I’d never seen any kind of stack like that before in my life!

And with that in mind, today we’ll be reviewing a fund that I’ve been excited about ever since I first heard of the term “return stacking“.

It’s none other than Return Stacked Bonds & Managed Futures ETF.

Ticker RSBT.

It just launched today.

Normally, I’d allow a fund to drop into the frying pan and sizzle for a while (at least have a few months of returns under its belt) before considering a review.

But I’m making an exception this time around because it’s an ETF that immediately edges its way into my crowded DIY Quant portfolio.

It’s extremely rare for that to happen but the strategy of this fund is so intriguing that it just instantly bulldozes its way into the mix.

What Is Return Stacking?

Return Stacking was coined by Rodrigo Gordillo and Corey Hoffstein.

It’s the capital efficient process of combining two or more uncorrelated asset classes together into one fund without any compromises.

What exactly do I mean by that?

Normally, a fund is limited by a canvas size of 100%.

If you want to combine stocks and bonds you play within the boundaries of having to decide how much of this versus shaving down a bit of that.

For example, if you wanted 80% stocks you’d only have 20% room leftover for bonds.

Want to add more bonds to the mix?

You’ve gotta shave down your stocks.

However, return stacking flips that paradigm like a pancake in the air and stacks one on top of the other.

In other words, you get a gut busting portion of both stocks and bonds.

With a 200% canvas, it’s like having the dessert tray rolled over to your table and instead of choosing between carrot cake and cheesecake you say unabashedly, “I’ll take both!”

You expand the canvas of your portfolio to create space for both to exist whilst saying sayonara to the constraints of a 100% sandbox.

Why Would You Want To Return Stack?

Why would you want to return stack in the first place?

Isn’t diversifying your portfolio by adding alternatives a viable enough solution?

It is.

But it comes with the compromise of having to decide whether or not to create space by trimming your stocks and/or bonds.

When you return stack you’re layering alternatives on top (managed futures, gold, etc) of the backbone of an already sensible portfolio.

In most cases that’s the 60/40 portfolio.

You take the main ingredients of the sundae which is ice cream and banana (stocks and bonds) and add diversifying alternatives on top such as whipping cream, hot fudge, cherries and nuts (managed futures, global systematic macro, gold, market neutral, arbitrage, etc).

It clearly enhances the dessert.

Better yet you still get the same amount of ice cream and bananas!

In the case of return stacking you’re enhancing the returns of the portfolio plus managing risk better by adding diversifying alternatives.

It’s truly the best of both worlds.

Return Stacking Results In The Real World?

So you’ve waxed nostalgic about the wafting scent of stacked dosas and super duper sundaes.

Prove that return stacking works in the real world and not just inside of your overindulgent head?

Okay.

Let’s do just that.

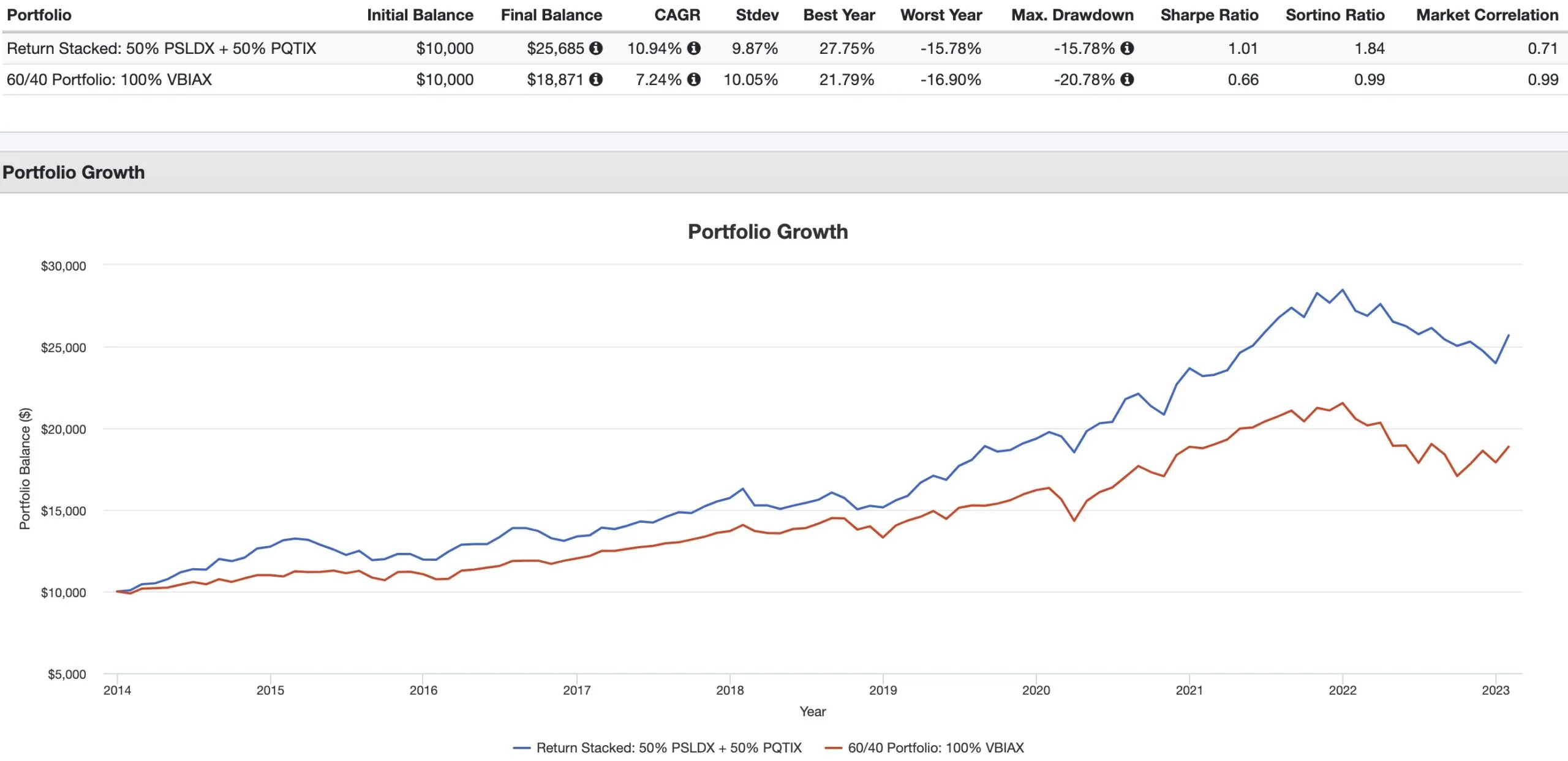

Let’s compare the results of a straight shooter 60/40 portfolio versus that of a return stacked portfolio.

In this instance we’ll be highlighting the results of the 60% equities and 40% bonds portfolio versus a return stacked portfolio featuring equal parts equities (50%), bonds (50%) and managed futures (50%).

The mandate is crystal clear.

Enhanced returns AND risk management.

Not one over the other.

Both.

And nothing less than both.

Return Stacked Portfolio versus 60/40 Portfolio

CAGR: 10.94% vs 7.24%

RISK: 9.87% vs 10.05%

BEST YEAR: 27.75% vs 21.79%

WORST YEAR: -15.78% vs -16.94%

MAX DRAWDOWN: -15.78% vs -16.90%

SHARPE RATIO: 1.01 vs 0.66

SORTINO RATIO: 1.84 vs 0.99

MARKET CORRELATION: 0.71 vs 0.99

The Return Stacked portfolio was able to achieve its capital efficient 50/50/50 configuration due to PSLDX offering 100% stocks and 100% fixed income with a 50% slice in the portfolio pie.

On the other hand, PQTIX was just a regular managed futures puzzle piece offering 50% Managed Futures exposure with a 50% allocation.

Notice something about the results of the Return Stacked 50/50/50 Portfolio versus the industry standard 60/40?

Something, ya say?

EVERYTHING is better!

Literally everything is better about the Return Stacked Portfolio where its enhanced returns and superior risk management collide.

The key point here being that managed futures have historically been uncorrelated with both stocks and bonds while typically providing crisis alpha along with consistent long-term positive returns.

Lethal Bonds Plus Managed Futures Return Stacked Combination

You really have to give it up to the folks over at Newfound Research and ReSolve Asset Management for having the vision to bring forth the first ever capital efficient managed futures ETF.

What do I mean by this exactly?

Well, up until now the only capital efficient managed futures plus long something else (usually stocks) were limited to just mutual funds.

This is the first ETF that provides you with 100% Bonds and 100% Managed Futures as a delectable stack-tastic combo!

This is exciting for a couple of unique reasons.

Firstly, it opens the door to investors who are able to purchase US-listed ETFs but not mutual funds to gain capital efficient access to managed futures for the very first time.

That’s me.

So I’m personally thrilled.

Secondly, it is the first capital efficient managed futures ETF (that I’m aware of) that combines managed futures and bonds.

Normally, it’s managed futures plus stocks as the expanded canvas equation.

This means as investors we’ve now got a unique puzzle piece to play around with as part of our overall return stacked portfolio.

Factor investors are likely over the moon excited.

As an example, for hardcore value enthusiasts, the capital efficient market cap weighted stocks plus bonds/managed futures/gold combinations were likely not enough to lure them in.

But with a 40% bonds/managed futures stack you can now plug 40% into your portfolio and then factor optimize your equities to your heart’s content with the remaining 60% space leftover.

The end result would be as follows:

60% Factor Equity Strategy + 40% Bonds + 40% Managed Futures = 140% Expanded Canvas Portfolio

source: ReSolve Asset Management on YouTube

Review of RSBT ETF : Reviewing Return Stacked Bonds & Managed Futures ETF

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

source: ReSolve Asset Management on YouTube

Newfound Research and ReSolve Asset Management

When the folks over at Newfound Research and ReSolve Asset Management collaborate on a project (fund, paper, research, etc) you know it’s going to be stellar.

This is no exception.

I’ve been following Corey Hoffstein of Newfound Research and the ReSolve crew (Adam Butler, Rodrigo Gordillo and Mike Philbrick) for over a year now, as they have generously shared research content via tweets, videos and podcasts.

Return stacking has been front and centre.

For a while, I was wondering whether or not “return stacking” was merely a concept they were coining for advisors and client centred model portfolios

Now the mystery is over.

It’s for everyone to enjoy.

With the launch of RSBT ETF and RSSB ETF (soon to be released) it’s a game changer for retail investors who are seeking capital efficient ETF puzzle pieces to build the return stacked portfolio of their dreams.

RSBT ETF Overview, Holdings and Info

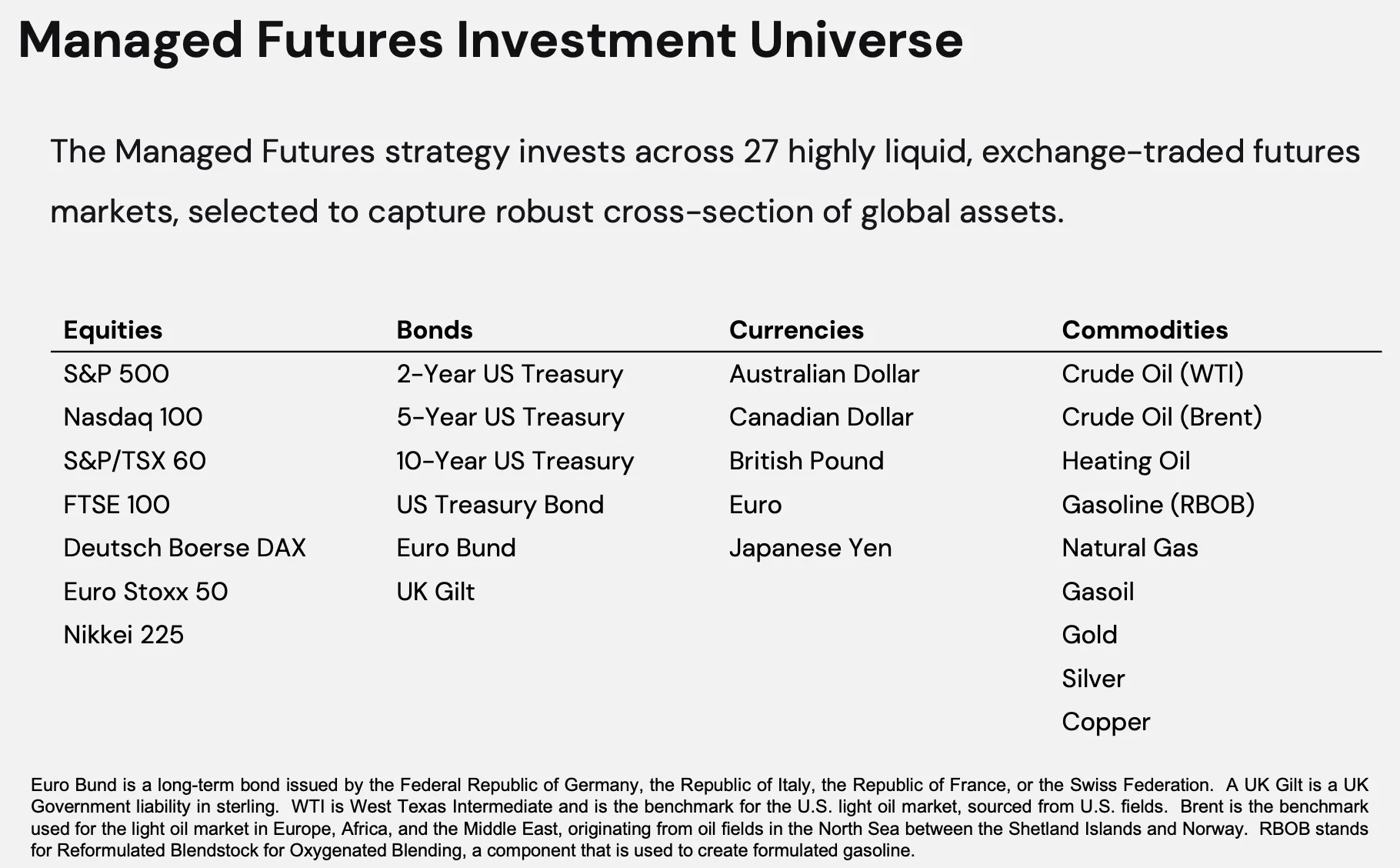

The investment case for “Return Stacked Bonds and Managed Futures” has been laid out succinctly by the folks over at Return Stacked ETFs: (source: fund landing page)

For your research and any discussions with the provider – do you think the 100% MF exposure in RSBT is equivalent from a risk/reward potneital perspective compared to 100% exposure to “vanilla” MF ETFs like KMLM, DBMF, CTA? E.g. you’ve said in the past KMLM has 200-300% “gross exposure”. I think this is another way of asking what volatility is RSBT targeting?

Hey Michael, thanks for the question. I reached out to make sure I’m giving correct information: “We are not targeting a specific volatility. We’re trying to track the SG Trend Index, so we’d expect volatility in the 10-12% range. As for the gross exposure, you can see the holdings on our website: https://www.returnstackedetfs.com/wp-content/fund_files/files/TidalETF_Services.40ZZ.STK_Holdings_RSBT.csv Currently, our gross exposure is around 350%.”

Any idea what equivalent bond duration exposure it would be ? Thinking it’s like 90% VGIT Or 50% TLT exposure ??

Hey J, thanks for the question. I reached out to make sure I’m giving correct information: “We are seeking to track the broad US fixed income market. AGG currently has an effective duration around 6.4 years.”

Dividend? Would this be a good piece for a fixed income portfolio?

Makes me want to do something like 50% RXL (2x healthcare) and 50% RBST.