Most asset allocation ETF funds follow a cookie cutter template of market-cap weighted equities and aggregate bonds.

I refer to these as milquetoast portfolios.

Why?

Because they’re not adequately diversified with only pure market beta exposure.

How is that working out for investors in 2022?

Yeah, we won’t go there.

Worse, is that these large-cap centric funds typically eschew research supported investing (lack of mid-cap, small-cap and factor equity exposure) and more often than not completely lack an alternative sleeve.

Most egregious of all is that they tend to exhibit extreme home country bias.

As a Canadian, the all-in-one funds available as ETFs, stuff a disproportionate amount of Canadian stocks into the equity sleeve.

US asset allocation funds tend to do the same.

Outsized exposure to US equities relative to their global weight of the overall marketplace.

Overall, classic home country bias hook, line and sinker.

What if there was a fund that addressed all of the flaws and biases that typically make asset allocation funds no more than two heaping scoops of vanilla ice cream?

Fortunately, such a fund exists.

It’s Meb Faber’s Cambria Global Asset Allocation fund GAA ETF.

We’ll take a deep-dive in this ETF review to showcase how ticker GAA differentiates itself from the pack of other asset allocation funds by offering investors global multi-factor equity exposure, diversified bonds and alternatives.

GAA ETF Review: Cambria Global Asset Fund

Hey guys! Here is the part where I mention I’m a travel vlogger! This ETF review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Meb Faber “School Of Thought” Towards Asset Allocation and Diversification

Before we pop open the hood of Cambria Global Asset Allocation ETF to see what kind of goodies we’ve got inside, let’s take a moment to shine the spotlight on its founder quant investor Meb Faber.

For those who have never heard of Meb, he’s a quant investor who has created an impressive roster of ETFs over at Cambria Funds.

Moreover, he’s one of the most prolific content creators in the quantitive investing space.

He hosts a podcast (The Meb Faber Show), tweets prolifically over @MebFaber, shares research supported articles from The Idea Farm, writes blog posts at MebFaber.com and publishes books (which are free to download) such as Global Asset Allocation and Shareholder Yield.

Having consumed a fair bit of his content over the past couple of years, I’m going to half-heartedly attempt to boil down some of the key ideas he espouses.

- Global Diversification (Avoiding home country bias at all costs by owning a portfolio that represents the global market)

- Multi-Factor Diversification (Owning equities that offer exposure to factors such as value, momentum, size, quality and most importantly shareholder yield)

- Breaking The Market-Cap Weighted link to Large-Cap Overexposure (Market-Cap weighted indexing concentrates equities towards “expensive” large caps while being underexposed to “value” mid-cap and small-cap stocks)

- Alternative Sleeve (Having exposure to commodities, gold and trend to name just a few as opposed to “just” stocks and bonds)

Given the way Meb views the world of investing, it should come as no surprise that his global asset allocation ETF GAA reflects the four key points I mentioned above.

Let’s now explore GAA ETF in detail.

Cambria Global Asset Allocation ETF Holdings & Info

Alrighty then, let’s pop open the hood of Cambria Global Asset Allocation GAA ETF to see what kind of goodies we’ve got inside.

To be perfectly blunt, with 29 ETFs under the hood, we’ve got a super fund of funds strategy!

Now critics such as Bogleheads investors might be quick to hurl the tired trope: “This is a Humpty Dumpty portfolio!”

More sophisticated investors are more likely intrigued by the quantity, quality and variety the fund offers considering that diversification is your only free lunch.

So what exactly do we have in total given the 29 funds that compose GAA ETF?

Global Asset Allocation (GAA) – Full Holdings

| PERCENTAGE OF NET ASSETS | NAME | IDENTIFIER | SHARES HELD | MARKET VALUE |

|---|---|---|---|---|

| 8.59% | Cambria Emerging Shareholder Yield ETF | EYLD | 144,276 | $3,875,758.33 |

| 7.52% | Cambria Shareholder Yield ETF | SYLD | 58,245 | $3,389,859.00 |

| 6.95% | Vanguard Total Bond Market ETF | BND | 41,250 | $3,135,000.00 |

| 6.71% | Cambria Global Real Estate ETF | BLDG | 108,900 | $3,028,672.35 |

| 6.62% | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | PDBC | 178,134 | $2,987,307.18 |

| 6.04% | VanEck J. P. Morgan EM Local Currency Bond ETF | EMLC | 112,134 | $2,725,977.54 |

| 5.24% | Vanguard Total International Bond ETF | BNDX | 46,398 | $2,364,906.06 |

| 5.12% | Cambria Global Value ETF | GVAL | 127,974 | $2,309,930.70 |

| 4.35% | Cambria Foreign Shareholder Yield ETF | FYLD | 82,863 | $1,960,107.69 |

| 4.19% | Vanguard Intermediate-Term Government Bond ETF | VGIT | 30,789 | $1,890,136.71 |

| 4.10% | Cambria Value and Momentum ETF | VAMO | 72,435 | $1,848,838.18 |

| 4.09% | Alpha Architect US Quantitative Momentum ETF | QMOM | 40,425 | $1,844,548.28 |

| 4.07% | Vanguard Long-Term Treasury Bond ETF | VGLT | 25,773 | $1,836,841.71 |

| 3.85% | VanEck Emerging Markets High Yield Bond ETF | HYEM | 97,812 | $1,736,163.00 |

| 3.14% | Vanguard Intermediate-Term Corporate Bond ETF | VCIT | 17,325 | $1,418,051.25 |

| 3.00% | Schwab US TIPS Bond ETF | SCHP | 23,991 | $1,354,052.04 |

| 2.97% | Graniteshares Gold Trust | BAR | 76,131 | $1,338,382.98 |

| 2.86% | SPDR FTSE International Government Inflation-Protected Bond ETF | WIP | 28,413 | $1,291,370.85 |

| 2.10% | Vanguard Short-Term Corporate Bond ETF | VCSH | 12,309 | $945,208.11 |

| 2.01% | Alpha Architect Value Momentum Trend ETF | VMOT | 38,148 | $906,762.70 |

| 1.99% | VanEck International High Yield Bond ETF | IHY | 45,474 | $898,111.50 |

| 1.96% | Alpha Architect International Quantitative Momentum ETF | IMOM | 34,320 | $885,788.90 |

| 1.73% | Cash Equivalent | 776,230 | $776,230.12 | |

| 0.80% | VanEck Gold Miners ETF/USA | GDX | 13,662 | $359,037.36 |

Whoa, Nelly!

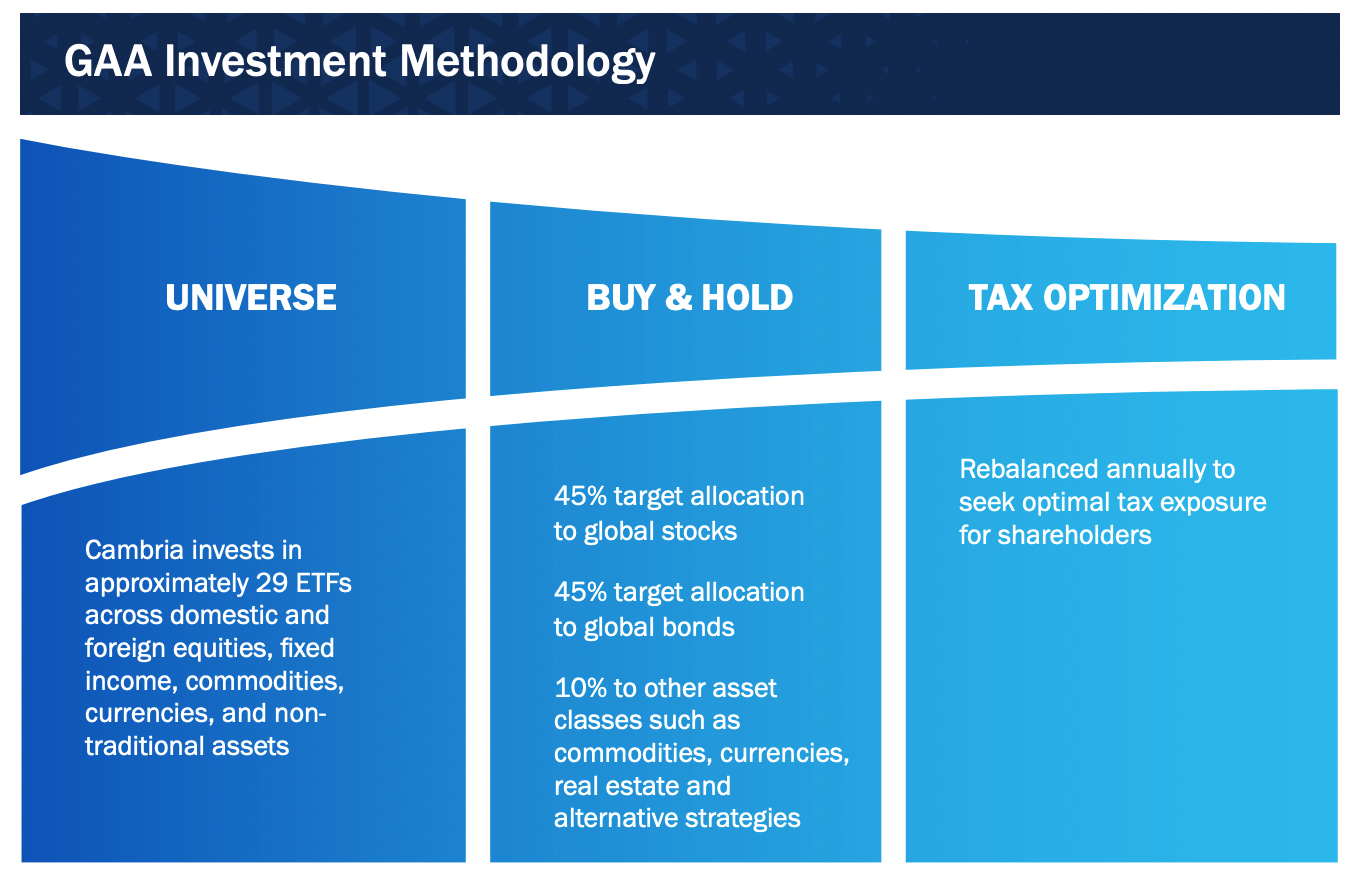

Overall, the 29 ETFs reflect a global universe of assets consisting of domestic and foreign stocks, bonds, real estate, commodities and currencies.

It primarily targets three spheres (global stocks, global bonds and real assets) in preparation for all four economic regimes (rising growth, declining growth, rising inflation and declining inflation.

From an investment methodology perspective, GAA ETF is a buy and hold strategy targeting 45% global stocks, 45% global bonds and 10% alternatives.

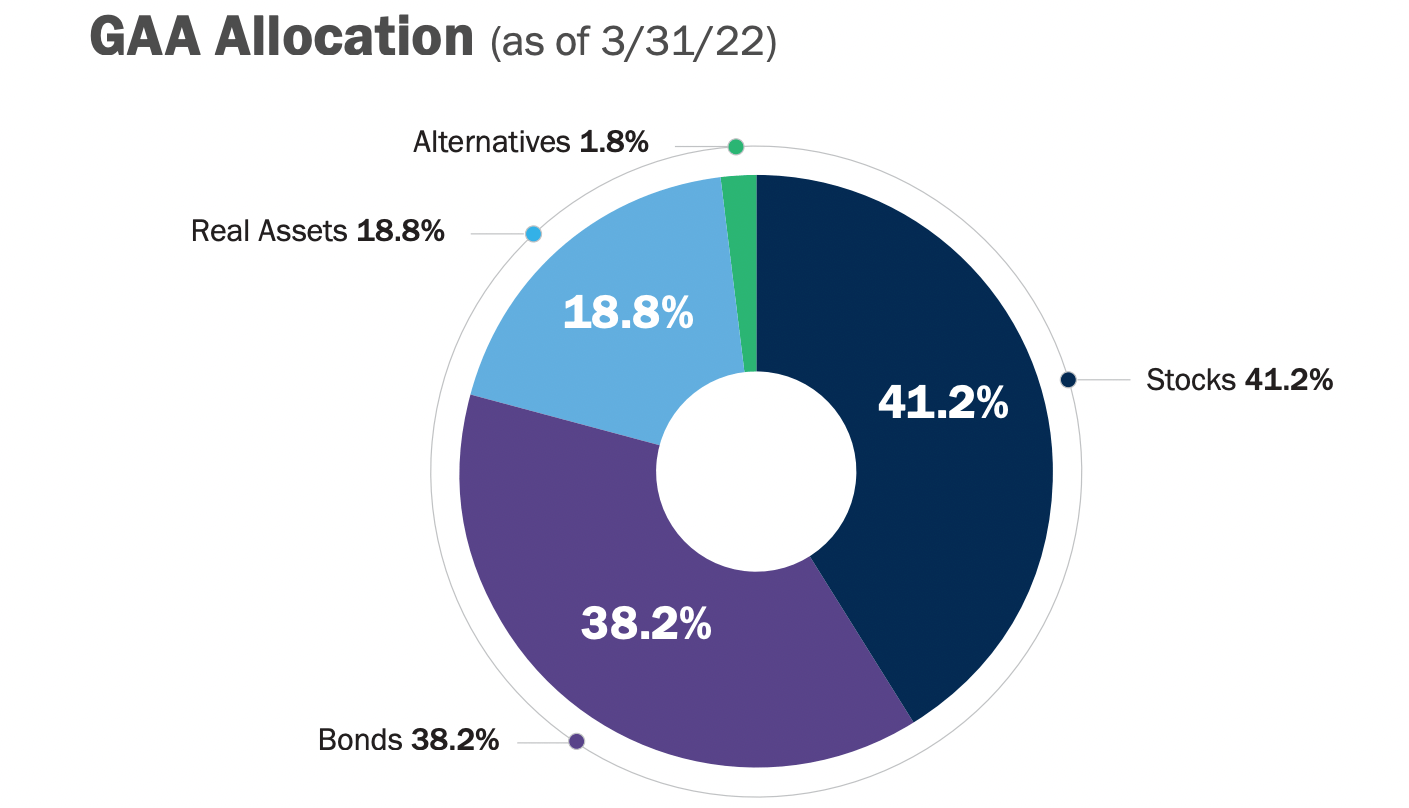

Its pie chart allocation as of March 2022 indicates 41.2% stocks, 38.2% bonds, 18.8% real assets and 1.8% alternatives.

Okay.

How am I going to best attempt to break this baby down?

Hmmm.

I’ve honestly never reviewed a fund quite like Global Asset Allocation ETF, so I think I’ll review its three main categories.

Stocks.

Bonds.

Alternatives.

And instead of going over every single line-item, which might make for a 10,000 word review, I’ll give an overall view of what is going on in each sleeve of the portfolio.

GAA ETF Equity Sleeve

The backbone of the equity sleeve consists primarily of Cambria Funds Shareholder Yield ETFs.

For those unaware, the Shareholder Yield ETFs are a suite of regional specific (Emerging Market, US, International Developed) funds (with usually 100 positions) offering deep multi-factor exposure.

Global Asset Allocation (GAA) – Equity Holdings

| PERCENTAGE OF NET ASSETS | NAME | IDENTIFIER | SHARES HELD | MARKET VALUE |

|---|---|---|---|---|

| 8.59% | Cambria Emerging Shareholder Yield ETF | EYLD | 144,276 | $3,875,758.33 |

| 7.52% | Cambria Shareholder Yield ETF | SYLD | 58,245 | $3,389,859.00 |

| 5.12% | Cambria Global Value ETF | GVAL | 127,974 | $2,309,930.70 |

| 4.35% | Cambria Foreign Shareholder Yield ETF | FYLD | 82,863 | $1,960,107.69 |

| 4.10% | Cambria Value and Momentum ETF | VAMO | 72,435 | $1,848,838.18 |

| 4.09% | Alpha Architect US Quantitative Momentum ETF | QMOM | 40,425 | $1,844,548.28 |

| 2.01% | Alpha Architect Value Momentum Trend ETF | VMOT | 38,148 | $906,762.70 |

| 1.96% | Alpha Architect International Quantitative Momentum ETF | IMOM | 34,320 | $885,788.90 |

To round out the equity sleeve Cambria Funds Global Value ETF and Cambria Value and Momentum ETF join the mix along with three Alpha Architect momentum/value funds QMOM, VMOT and IMOM.

The overall sum of the parts is a collection of global high conviction equity strategies that offer hard lever pulls on research supported factor exposure.

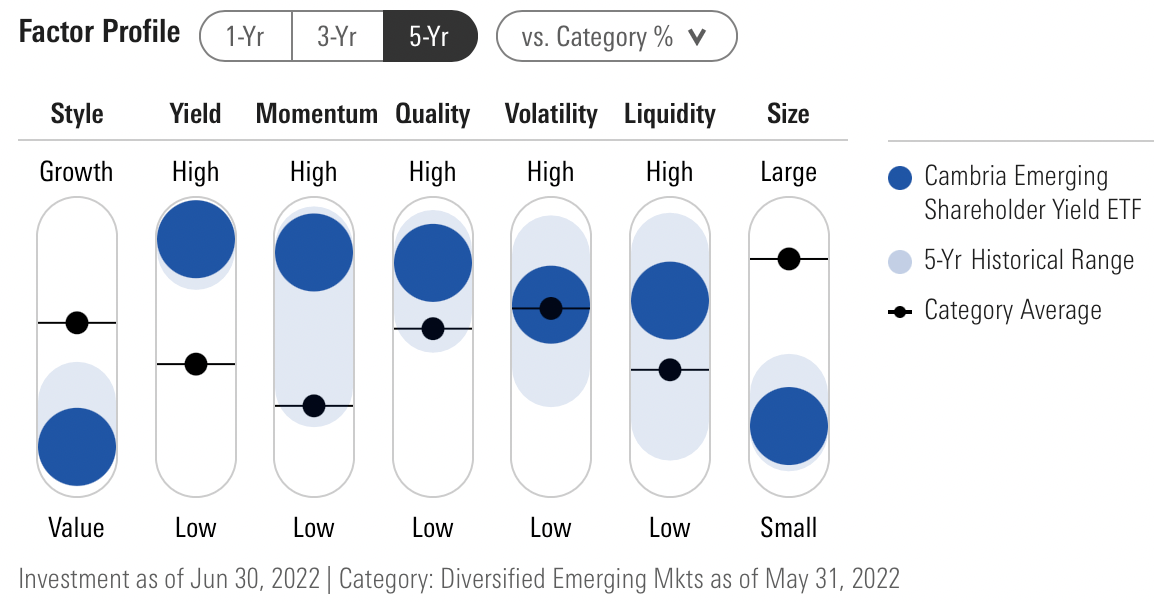

As an example, let’s examine Cambria Emerging Shareholder Yield ETF (the highest position fund in GAA ETF).

When I mentioned hard-lever factor pulls I wasn’t joking around!

This 95 position fund offers deep value, yield, momentum, quality and size (small) multi-factor exposure for factor thirsty investors.

So that’s just one of the many funds included in GAA ETF.

What about the big picture?

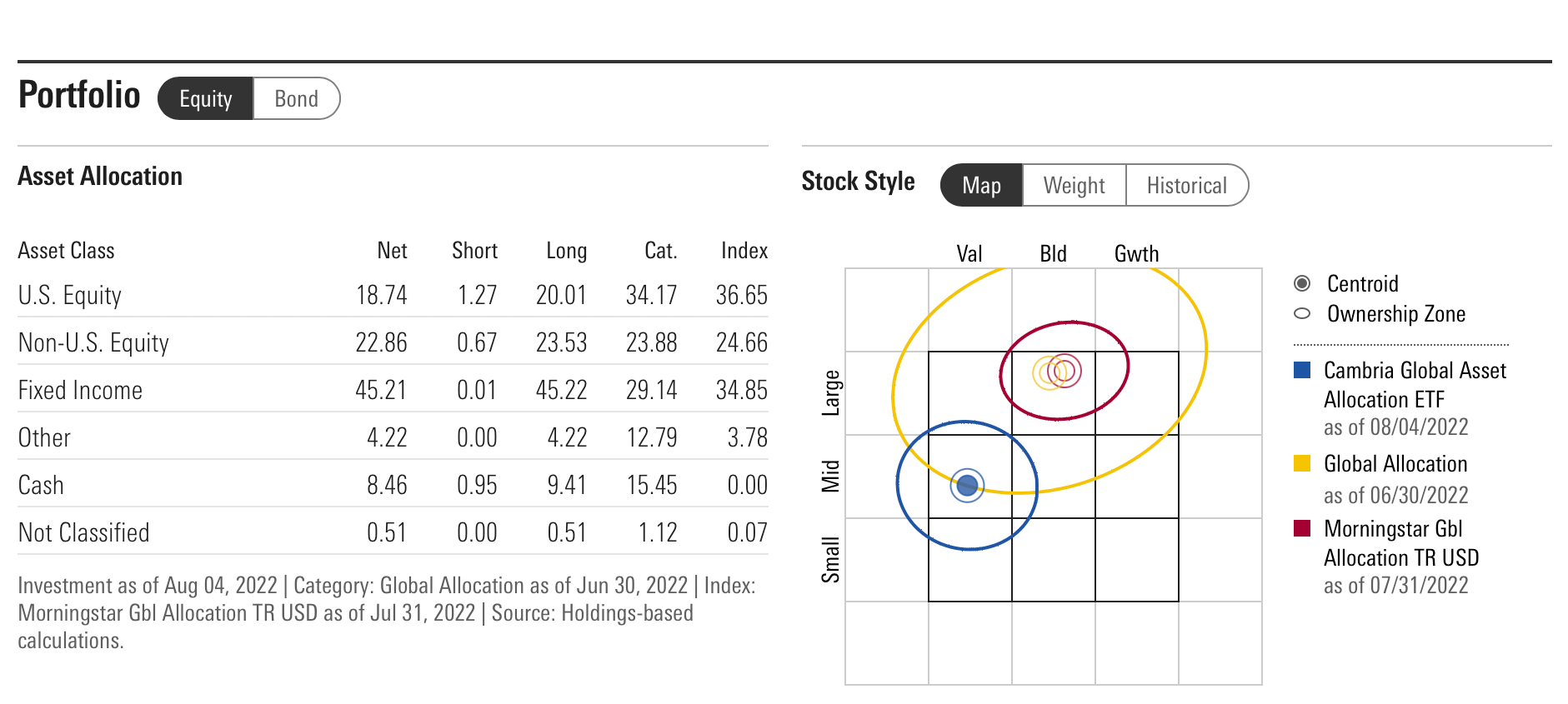

What immediately grabs my attention is the Non-US Equity allocation of 23.53% vs US equity 20.01%

Clearly, this fund is committed to global diversification and avoiding home country bias.

Moreover, it has a sweet mid-cap value bullseye whereas most asset allocation funds are hanging out in large cap blend/growth territory.

Mid-cap value may be the most underrated of all equity investing strategies.

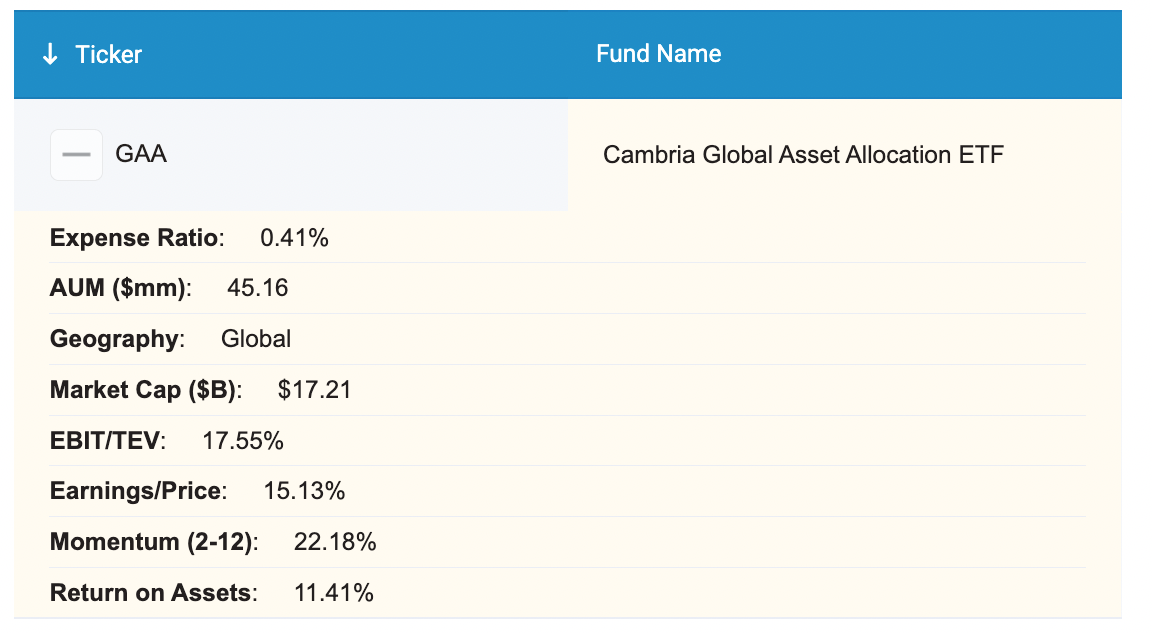

Heading over to the invaluable Alpha Architect fund screener reveals solid across the board scores ranging from EBIT/TEV to Return on Assets:

EBIT/TEV: 17.55%

Earnings/Price: 15.13%

Momentum (2-12): 22.18%

Return on Assets: 11.41%

AUM ($MM): 45.16

Expense Ratio: 0.41%

Additionally, there is no management fee with this fund (only acquired fund fees and expenses).

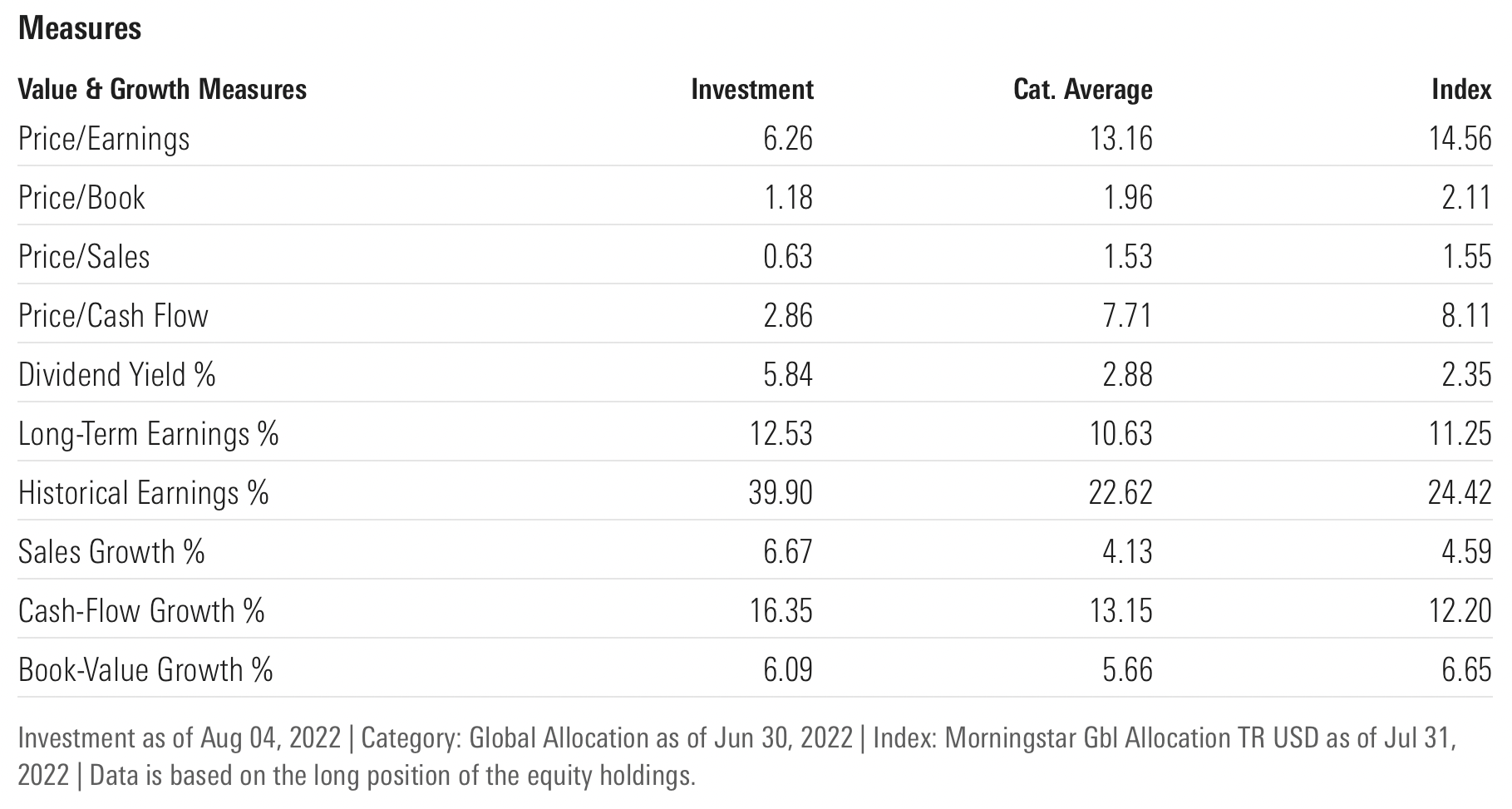

Analyzing measures what is immediately eye catching is the P/E single digit 6.26 versus index average 14.56.

Other measures that are noteworthy include price/sales of 0.63 vs 1.55, dividend yield % of 5.85 versus 2.35, price /cash flow of 2.86 vs 8.11 and historical earnings % of 39.90 versus 24.42.

Clearly, Cambria Global Asset Allocation ETF is hanging out in deep-value territory versus industry standard all in one funds.

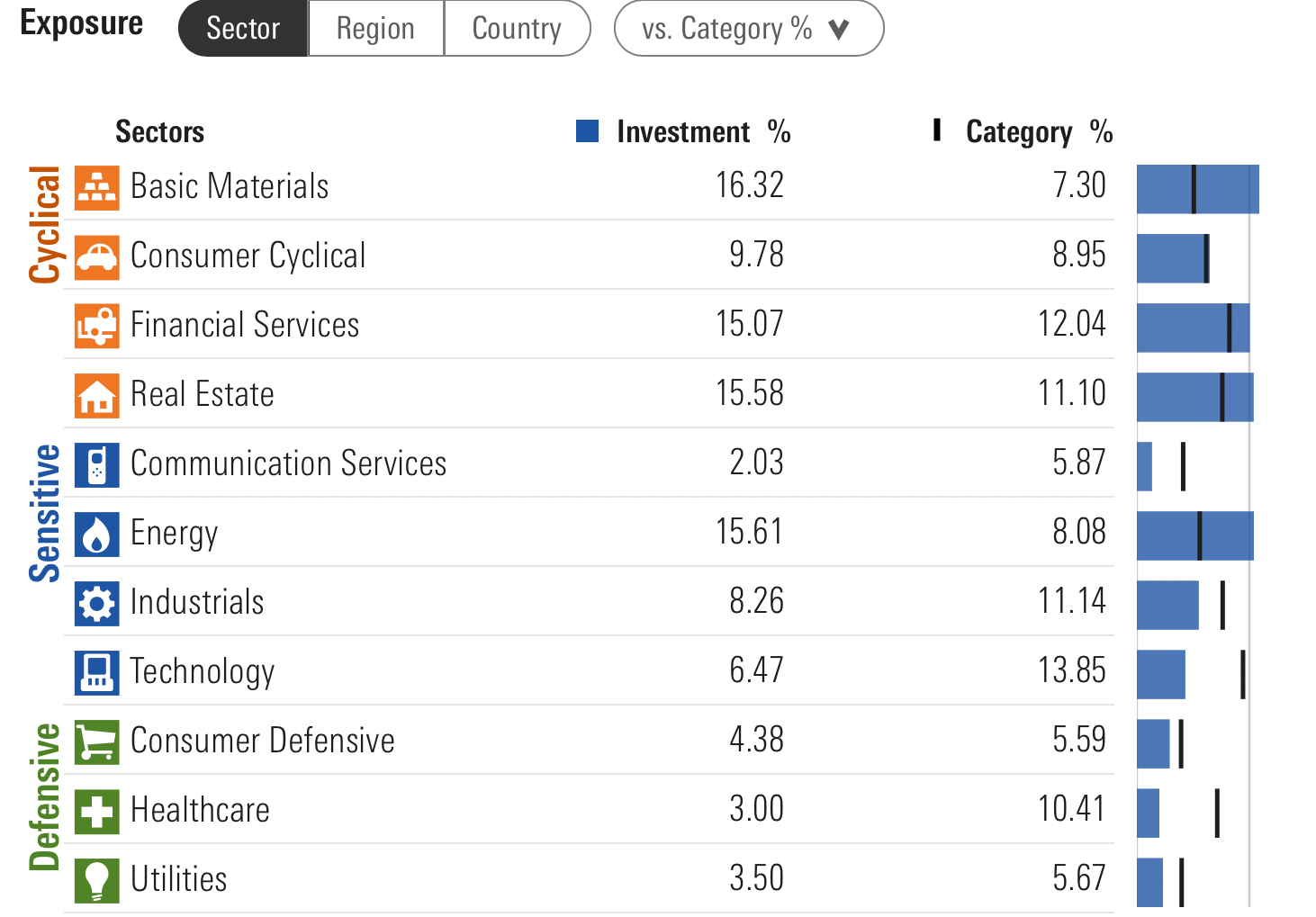

Last but not least we’ll examine sector exposure to see how GAA ETF stacks up versus its category average.

Basic Materials, Financial Services, Real Estate and Energy have outsized exposure versus Technology, Healthcare, Communication Services and Industrials receiving less than category average coverage.

GAA ETF Fixed Income Sleeve

Let’s check out the fixed income sleeve of GAA to see what bonds we’ve got as part of the fund.

Global Asset Allocation (GAA) – Bond Holdings

| PERCENTAGE OF NET ASSETS | NAME | IDENTIFIER | SHARES HELD | MARKET VALUE |

|---|---|---|---|---|

| 6.95% | Vanguard Total Bond Market ETF | BND | 41,250 | $3,135,000.00 |

| 6.04% | VanEck J. P. Morgan EM Local Currency Bond ETF | EMLC | 112,134 | $2,725,977.54 |

| 5.24% | Vanguard Total International Bond ETF | BNDX | 46,398 | $2,364,906.06 |

| 4.19% | Vanguard Intermediate-Term Government Bond ETF | VGIT | 30,789 | $1,890,136.71 |

| 4.07% | Vanguard Long-Term Treasury Bond ETF | VGLT | 25,773 | $1,836,841.71 |

| 3.85% | VanEck Emerging Markets High Yield Bond ETF | HYEM | 97,812 | $1,736,163.00 |

| 3.14% | Vanguard Intermediate-Term Corporate Bond ETF | VCIT | 17,325 | $1,418,051.25 |

| 3.00% | Schwab US TIPS Bond ETF | SCHP | 23,991 | $1,354,052.04 |

| 2.86% | SPDR FTSE International Government Inflation-Protected Bond ETF | WIP | 28,413 | $1,291,370.85 |

| 2.10% | Vanguard Short-Term Corporate Bond ETF | VCSH | 12,309 | $945,208.11 |

| 1.99% | VanEck International High Yield Bond ETF | IHY | 45,474 | $898,111.50 |

One of the easiest criticisms of many other asset allocation funds is just how lazy they get when it comes to fixed income.

It’s often just US Aggregate Bond index and done.

Or long-term treasury and out.

Allocations of this nature.

A real strength for Cambria Global Asset Allocation ETF is a diversified set of fixed income exposure that cover US, International Developed and Emerging markets.

Additionally, there is long-term, intermediate and short-term exposure as well.

Finally, TIPs, Corporate and High Yield bonds round things out.

Obviously, there has been considerable effort put in place to bring forth a globally diversified set of various fixed income ETFs under one hood.

GAA ETF Alternative Sleeve

Last but not least, let’s move on to the alternative sleeve of Cambria Global Asset Allocation ETF.

Global Asset Allocation (GAA) – Alternatives Holdings

| PERCENTAGE OF NET ASSETS | NAME | IDENTIFIER | SHARES HELD | MARKET VALUE |

|---|---|---|---|---|

| 6.71% | Cambria Global Real Estate ETF | BLDG | 108,900 | $3,028,672.35 |

| 6.62% | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | PDBC | 178,134 | $2,987,307.18 |

| 2.97% | Graniteshares Gold Trust | BAR | 76,131 | $1,338,382.98 |

| 2.01% | Alpha Architect Value Momentum Trend ETF | VMOT | 38,148 | $906,762.70 |

| 0.80% | VanEck Gold Miners ETF/USA | GDX | 13,662 | $359,037.36 |

Global Real Estate could slot into the equity sleeve or alternative sleeve depending who you ask.

The fund has alternative exposure to a diversified commodity strategy, gold trust and gold miners ETFs.

All of the above can be considered a bonus from a diversification standpoint compared to typical other all in one funds which receive none.

Cambria Global Asset Allocation ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund is designed to provide absolute positive returns with reduced downside volatility, manageable risk, and smaller drawdowns (i.e., peak-to-trough declines in performance) by identifying an investable portfolio of exchange-traded vehicles that provide diversified exposure to all of the major asset classes in the various regions, countries and sectors around the globe.

Under normal market conditions, the Fund invests at least 80% of its total assets in affiliated and unaffiliated exchange-traded funds (“ETFs”) and other exchange-traded products (“ETPs”) (collectively, “Underlying Vehicles”) that provide exposure to various (i) investment asset classes, including equity and fixed income securities, real estate, commodities, and currencies, and (ii) factors such as value, momentum, and trend investing.

The Fund invests in Underlying Vehicles that seek exposure to undervalued markets, according to various valuation metrics, such as the cyclically adjusted price-to-earnings ratio, commonly known as the “CAPE Shiller P/E ratio, while seeking to avoid overvalued markets through the use of systematic quantitative screens.

The Fund also invests in Underlying Vehicles with momentum and trend following strategies. Momentum and trend following strategies, both of which are based on quantitative and algorithmic models, attempt to (1) invest in assets when their prices are in an uptrend (i.e., prices are increasing over a specified time period) and/or increasing relative to the prices of other assets, and (2) sell assets when their prices are in a downtrend (i.e., prices are decreasing over a specified time period) and/or decreasing relative to the prices of other assets.

Under normal market conditions, the Fund’s investment adviser, Cambria Investment Management, L.P. (“Cambria” or the “Adviser”), selects Underlying Vehicles that provide exposures of approximately 45% to equity securities, 45% to fixed income securities and 10% to other asset classes, such as commodities and currencies.

Under normal market conditions, Cambria allocates approximately 40% of the Fund’s total assets to long positions in foreign companies’ equity or debt securities or foreign currencies.

The Fund defines foreign companies as those domiciled or principally traded outside of the U.S. The Fund defines equity exposures to include Underlying Vehicles that track the performance of stock indices, closed-end funds, real estate investment trusts (“REITs”), exchange-traded currency trusts, common stock, preferred stock and convertible securities of issuers of any market capitalization.

The Fund defines fixed income exposures to include Underlying Vehicles that track the performance of fixed income indices, exchange-traded notes, securities issued by the U.S. Government and its agencies, sovereign debt and corporate bonds of any credit quality, including high yield (or “junk”) bonds.

The Fund defines commodity and currency exposures to include Underlying Vehicles that track the performance of commodity and currency indices.

The Fund is considered a “fund of funds” that seeks to achieve its investment objective by primarily investing in Underlying Vehicles, including affiliated ETFs, that offer diversified exposure to all of the major asset classes in the various regions, countries, and sectors around the globe.

The Fund may invest up to 20% of its net assets in instruments that are not Underlying Vehicle, but which Cambria believes will help the Fund achieve its investment objective, including futures, options, swap contracts, cash and cash equivalents, and money market funds.

Cambria has discretion to actively manage the Fund’s portfolio in accordance with the Fund’s investment objective.

The Fund may sell a security when Cambria believes that the security is overvalued or better investment opportunities are available, to invest in cash and cash equivalents, or to meet redemptions.

Cambria expects to adjust the Fund’s holdings to meet target allocations at least annually.”

Whole Is Greater Than The Sum Of Its Parts

Cambria Global Asset Allocation ETF is definitely a fund where the whole is greater than the sum of its parts.

To cobble together this fund in its entirety you’d need 29 ETFs!

Instead, all of the thoughtful allocation towards multi-factor strategies, global diversification, fixed income and alternatives is rolled into one package and rebalanced on its own.

The strength of the fund is that it is clearly different from other vanilla all-in-ones.

It’s not overweight large cap equities, lazy with its fixed income sleeve or lacking in alternatives.

GAA ETF in many ways addresses the problems of these other asset allocation funds with more global diversification and research supported factor exposure.

GAA ETF Performance (Annual Returns)

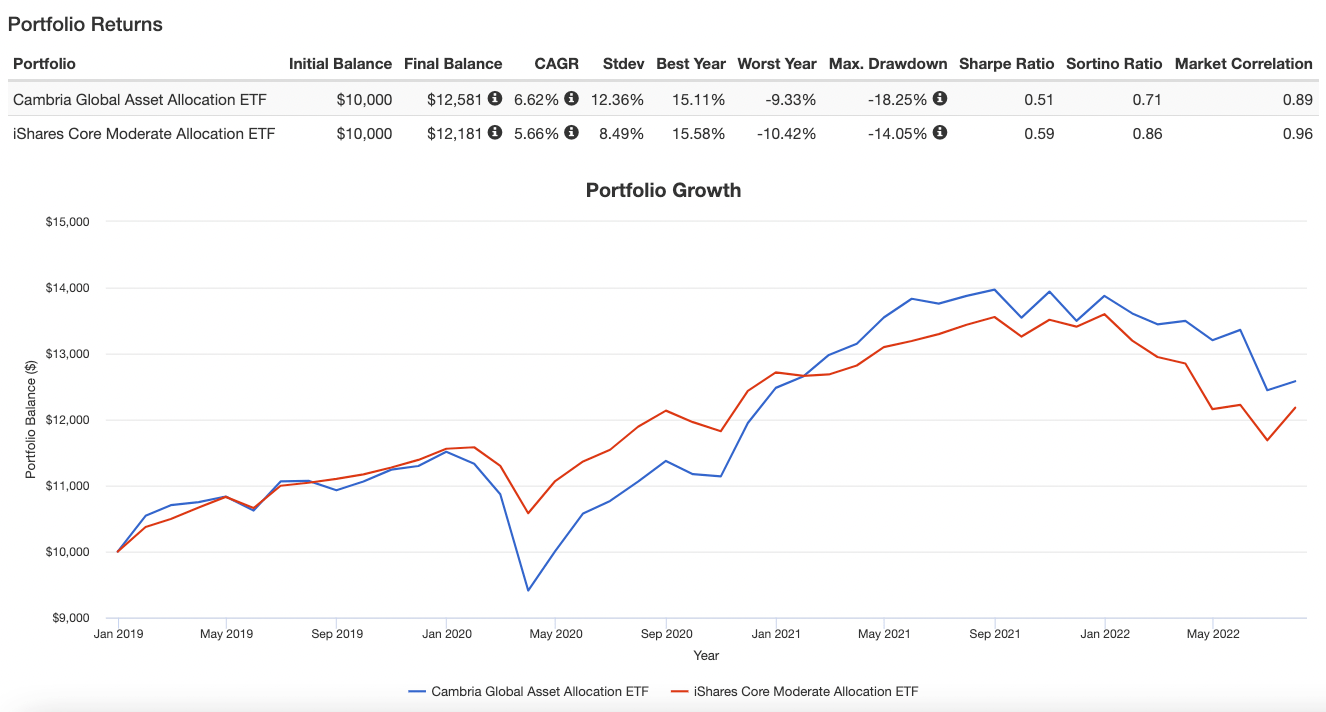

If we compare Cambria Global Asset Allocation ETF to iShares Core Moderate Allocation from January 2019 until July 2022 it outperforms by almost 100 basis points: 6.62% vs 5.66%

From a long-term perspective I would expect GAA to crush market-cap weighted all-in-one funds given its deep multi-factor exposure which has historically added 100s of basis points of returns over an extended period of time.

GAA ETF: Thumbs Up or Thumbs Down

GAA ETF Pros

- Globally diversified portfolio that clearly avoids “home country bias” with slightly more exposure to International Developed and Emerging Markets than US Markets

- 29 in 1 fund without any management fee and only the underlying costs of the funds coming in at a very reasonable 0.41 Expense Ratio

- Deep Multi-Factor exposure to research supported factors including value, yield, momentum, size (small) and quality

- An alternative sleeve consisting of REITs, diversified commodities, long-short factor focused equities and gold that are often lacking in all-in-one funds

- Sector exposure tilting away from typically high P/E Information Technology and Healthcare and more towards low P/E Basic Materials and Energy

- Single digit P/E of 6.26 versus the category average of 14.56 offers value versus blend/growth exposure

- Fixed income sleeve committed to diversifying globally to US, International Developed and Emerging markets bonds with government, corporate and high yield exposure

GAA ETF Cons

- Potential tracking-error versus market-cap weighted all in one funds means investors need to be patient during stretches of relative underperformance

- Even though the management fee is extremely reasonable at 0.41 certain hardcore low cost aficionados won’t go for it

Potential Portfolio Ideas – GAA ETF

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

We’re moving on to easily my favourite part of the review.

How does GAA ETF potentially fit into a portfolio?

Let’s explore a few different combinations.

GAA ETF Total Portfolio Solution

There is a case to be made for GAA ETF being a one and done fund for your portfolio.

It ticks off all of the boxes of global diversification, deep multi-factor exposure, multi-strategy bonds and alternatives to tickle your every fancy.

100% GAA ETF

Yeah.

That’s possible.

GAA ETF Core Portfolio Solution

For diversification is your only free lunch investors there are a plethora of interesting ways you could combine GAA ETF as the backbone of your strategy with other ETFs.

Something that comes to mind would be a simple to implement three fund solution:

40% GAA

40% RPAR

20% DBMF

Here we’ve got the dual backbone of a Risk Parity strategy and GAA forming the core holdings with DBMF managed futures trend-following providing further uncorrelated diversification.

GAA gives you deep factor equity exposure whereas RPAR provides global market-cap weighted equities and more outsized bonds and alternatives exposure.

The managed futures trend-following DBMF provides an uncorrelated strategy to both stocks and bonds as well as long-only alternatives.

GAA ETF Satellite Portfolio Solution

For investors interested in “factor” exposure but only wanting to sprinkle a little bit into the portfolio GAA could provide a satellite solution.

80% AOM

20% GAA

This would be your typical market-cap weighted all-in-one fund combined with GAA as a diversifier.

Nomadic Samuel Final Thoughts

Given the positive tone of this review it may come as a surprise that GAA ETF doesn’t make it into my Diversified DIY Quantitative Portfolio.

Why?

Only one reason.

I’m playing in an expanded portfolio sandbox these days and every single fund I own in my 12 fund portfolio stretches the canvas beyond 100%.

I absolutely love GAA over typical 60/40 investing strategies but adding a bit of portable beta leverage changes the equation.

Two unremarkable but uncorrelated assets classes (such as US Large Cap equities and Gold) with a plethora of flaws and sequence of return risk (as individual line-items) have double-digit CAGR returns when combined in 90/90 configuration for six consecutive decades.

It’s just not a fair fight when modest leverage is involved.

Apples and oranges.

However, I feel as though a GAA-type fund with a modest amount of leverage would be a game changer in the genre of expanded canvas portfolios.

There has yet to be a fund that combines globally diversified deep multi-factor equity exposure with bonds and alternatives that stretches the canvas beyond 100%.

If GAA had a 160% canvas I’d own it yesterday.

Putting my own biases and the way I personally invest aside, I think GAA is a great fund for those committed to a 100% canvas.

It’s the kind of asset allocation fund that differentiates itself from its insipid category crowd.

Deep multi-factor exposure with a sweet mid-cap bullseye and low single digit P/E.

Multi-strategy globally diversified bonds.

An alternative sleeve.

There is so much to like about GAA ETF.

Therefore, I think it makes an excellent backbone, core holding or puzzle piece in a 100% canvas portfolio.

I’ve had too much asado and wine today!

Over to you!

What do you think?

Please let me know in the comments below.

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.