When I first sat down and had the idea of creating an investing legends section on this blog, I immediately thought of sending questions to Adam Butler.

There are few people who have had a greater impact on my way of thinking about diversification, asset allocation and risk management than Adam.

Adam’s openness about his successes and failures early on in his career offer invaluable life lessons worth paying attention to.

The hero’s journey is filled with triumph, defeat and inflection points.

Many individuals lose confidence when presented with setbacks and/or dismiss failure as merely bad luck.

Adam was forged by the fire of the late 90s and 2000s which presented investors with the dual-dragons of the Dot Com Bubble followed by the Great Recession.

Getting scorched and packing it up was the end result for many investors back then. Both amateur and professional.

Game over.

Instead Adam took the time to pause, reflect and learn from the challenges he faced during those years.

This takes an incredible amount of self-awareness and humility.

Fortunately for us, Adam has re-emerged as one of the thought leaders in terms of constructing all-weather portfolios that are prepared for all four economic regimes.

He’s also working on some of the most fascinating projects that I believe are groundbreaking in terms of the potential impact they’ll have for investors moving forward.

I could go on and on and on but at this point I’ve rambled long enough.

Let’s hear from Adam!

Return Stacking, Risk Parity and Adaptive Asset Allocation with Adam Butler

Hey guys! Here is the part where I mention I’m a travel vlogger! This living legends interview series is entirely for entertainment purposes only. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Seriously, I’m a YouTuber not a financial professional, so take what I say with a grain of salt; okay? Cheers!

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Adam’s Investing Journey: Lessons Learned

Q1) I’m going to start off by complimenting you and the entire ReSolve team.

I’ve learned so much from reading your Adaptive Asset Allocation book and even more from the Resolve Riffs podcasts.

Quite honestly, I don’t think we would have connected otherwise.

One of the key points you made in your book was how sequence of returns and where you’re airdropped into the fray as a young investor (the given economic regime) shapes the way you think about risk management, diversification and portfolio construction.

How did your formative years shape the way you evolved as an investor. And has anything changed in terms of your investing philosophy in recent years since you published your book?

Have any particular guests from your podcast influenced the way you think about portfolio construction?

A1) Thank you, Samuel, that’s very kind, and thank you for inviting me to contribute to your new venture.

My formative experiences in markets were the tech bubble and bust, the commodity / emerging markets cycle, and the 2008 global financial crisis.

My first job after college in 1997 was as an equity trader at a major Canadian bank. We had a small omnibus account that the trading desk could use to inventory positions and trade to stay in the flow of the market and generate P&L.

It was go-go times for profitless internet companies so you couldn’t swing a cat without hitting a multi-bagger.

I thought I was God’s gift to trading because I made one of the greatest errors in investing: mistaking skill for a bull market.

I took way too much risk, made lots of money quickly, and then lost it all and more when the market turned in late 1998.

This outcome was unpopular at the bank, and they escorted me from the premises a few weeks later.

I was a little traumatized, and spent several years in the wilderness, where I earned a diploma in programming, worked at IBM, rode an internet startup up and down, and spent two years in Thailand teaching math and physics to high-school students.

In the end I came to grips with the fact that I didn’t know anything about investing and decided to change that.

I earned my CFA in Thailand and migrated back into the investment industry in 2005 as an investment advisor with another Canadian bank.

This was the middle of the commodity / emerging market cycle, and I became an expert in these sectors.

I was also early on the recognition of the US housing bubble and the vulnerable banking sector.

This domain knowledge was richly rewarded in 2006, 2007 and the first half of 2008, but the thesis came crashing down during the GFC.

My commodity exposures succumbed to deleveraging and a major collapse in global demand, and while my banking sector shorts acted as a

beautiful hedge during the acute phase of the 2008 waterfall crash, those positions were ultimately steam-rolled by government intervention to

save the banking sector in March 2009.

After the 2008-2009 experience I came to terms with the fact that markets aren’t reducible to narratives and simple cause-effect relationships.

The scientific analog would be that most investors perceive markets as behaving according to an equivalent of Newtonian laws of motion, while in reality markets might be better described by quantum mechanics: unfathomably large numbers of random events roll-up to create the gyrations and trends that we observe at the levels of price and time.

While I was experiencing this catharsis I stumbled on the work of Philip Tetlock and Nassim Taleb, which nudged me down the path of systematic thinking.

I started investigating simple rules-based approaches to investing like Meb Faber’s papers on trend-based asset allocation, and I was hooked.

Source: ReSolve Asset Management on YouTube

Modern Portfolio Theory & Diversification

Q2) One of the most bizarre things as a DIY investor, who had taken the extra time to fall down the rabbit hole compared to maybe a typical investor, is how comfortable most people in the industry are in owning or promoting a 60/40 portfolio of market-cap weighted stocks and aggregate bonds.

To many, this is where diversification ends with a screeching halt.

What do you think is the root cause of this and how do you personally think about diversification in a way that is different from this typical industry standard?

A2) Most invested capital serves a purpose. That purpose typically requires a certain return above inflation.

So the short answer to the question of why many investors default to a 60/40 portfolio of stocks and bonds is that it is very close to the ex post most efficient portfolio that one could have owned historically, on average over the long-term, which would have met the average person’s required return, without leverage.

It has been known since at least the 1950s that a more efficient portfolio can be constructed by diversifying across as many sources of return as possible, and scaling exposure to this diversified portfolio using leverage to achieve one’s target return.

This concept is called “Modern Portfolio Theory”.

But the fact is, most investors do not have access to borrowing at rates that make leverage attractive.

And many of those who do have access are constrained by regulations, or have a behavioral aversion to leverage.

Many institutional investors have expertise and access to low-cost leverage, and have embraced Modern Portfolio Theory in its many forms.

New products launched in the last few years allow individual investors access to efficient leverage and alternative sources of return, and we’re seeing an acceleration in adoption.

I expect this trend to continue as returns to 60/40 struggle in the more complicated environment we’re facing in the next decade or so.

Source: ReSolve Asset Management on YouTube

Risk Parity: Diversification & Balance

Q3) Risk parity. All-weather investing. All-seasons investing.

These are all thrown around loosely at times in a way that sometimes confuses DIY investors and maybe even some professionals.

Even the construction of portfolios under these categories really varies depending on who you ask.

Do you have a particular take on what makes a portfolio a risk-parity and/or an all-weather solution and what possibly falls short?

A3) Risk parity is about diversity and balance.

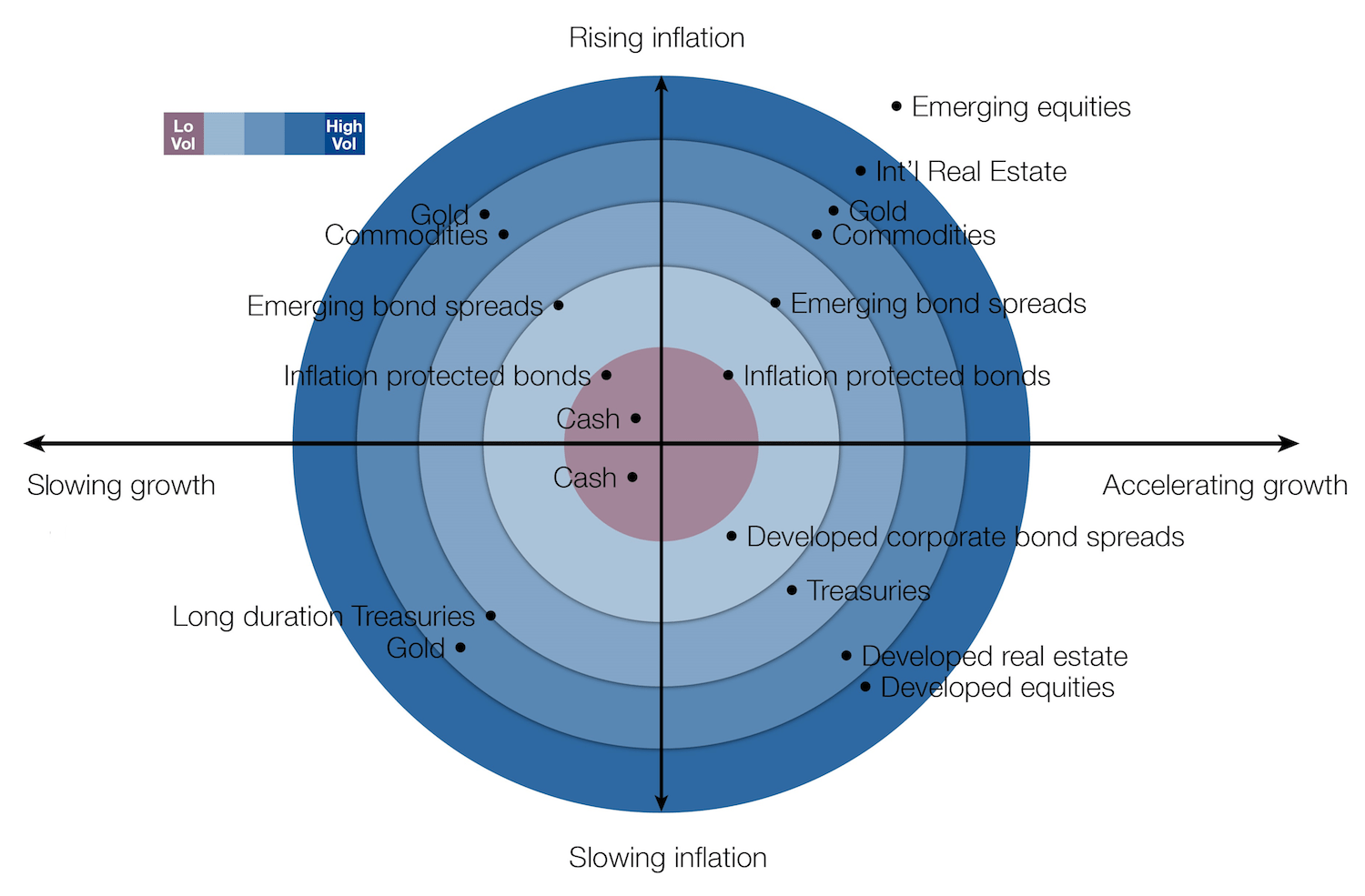

Diversity, in a portfolio context, is about owning investments that are designed to respond in different ways to various types of economic shocks.

A simple way to think about economic shocks is along the axes of inflation and growth.

This framework invokes four quadrants, and different markets are fundamentally designed to thrive in each quadrant, as illustrated below.

The second component of the risk parity “all weather” concept is balance.

Many people are surprised to learn that a simple portfolio that holds equal weight in stocks and bonds is not well balanced.

This is because stocks are much more volatile than bonds.

If you place a 1in cube of balsa wood on one side of a scale and a 1in cube of lead on the other, the scale will be out of balance.

So too is a portfolio that has 50% stocks and 50% in bonds.

In fact, a 50/50 stock/bond portfolio has over 90 percent of its risk in stocks.

To create a balanced portfolio of stocks and bonds you would have to hold about 80% of capital in bonds and just 20% in stocks. This would allow the unique properties of bonds to complement the unique properties of stocks.

A risk parity all-weather portfolio merges the concepts of diversity and growth by holding all of the diverse markets illustrated in the target illustration above in an optimal proportion so that each market expresses the same amount of risk.

Lower risk markets like bonds would consume more capital and higher risk markets like stocks, commodities, and listed real-estate would consume less capital.

In this way, the portfolio is perfectly balanced, such that the diversity of the portfolio is fully manifest.

A portfolio with a large proportion of capital in bonds would be expected to produce relatively low risk, and commensurately returns. Which is why most investors don’t think this way.

But remember Modern Portfolio Theory.

To enjoy the greatest amount of expected portfolio growth with the lowest volatility, an investor should invest in an optimally diversified portfolio, and scale exposure to the portfolio using leverage to achieve the required return.

Let’s take an example. Suppose a risk parity portfolio has an expected annualized volatility of 6% per year and an expected annual return of 4% per year. The borrowing rate is 2%.

A prudent investor with $100 to invest and seeking a 5% return would borrow $50 at 2% in order to invest $150 at 4% for a net return of 1.5 * 4% = 6% minus the cost of borrowing (0.5 * 2% = 1%).

This portfolio be expected to earn 5% per year with a volatility of 1.5*6% = 9% per year.

Moreover, this portfolio is resilient to all major macroeconomic environments.

Now let’s contrast this with a person investing only in stocks and bonds.

Let’s say stocks are expected to earn 6% per year at a volatility of 20% and bonds will earn 3% at a volatility of 5%.

Assume stocks and bonds are uncorrelated.

To earn a return of 5% per year the investor would hold 67% in stocks and 33% in bonds.

This portfolio would have an expected volatility of 10% per year.

However, this portfolio would only be expected to thrive in environments of strong unexpected growth, benign inflation and abundant liquidity.

It would struggle in all other environments.

Source: ReSolve Asset Management on YouTube

Adaptive Asset Allocation vs Static Asset Allocation

Q4) One of the most fascinating ways your team at ReSolve goes about portfolio construction is through a mandate of adaptive asset allocation.

This of course differs from a static asset allocation.

What do you think are the main benefits of adaptive asset allocation versus static ones?

A4) The original idea of Adaptive Asset Allocation, as described in our 2011 whitepaper and our book of the same title published in 2015, merged the concepts of risk parity and momentum investing to create a portfolio that would not just weather most economic environments, but also seek outsized profits.

The investment universe draws from the same asset classes described in the target image above, preserving the concept of diversity.

At root, the investment process involves rebalancing your portfolio regularly – say weekly or monthly – so that you always hold the portfolio that maximizes exposure to markets with the highest momentum while simultaneously minimizing portfolio volatility by maximizing diversification.

Since we published the paper and the book we’ve generalized the idea of adaptive asset allocation to include any mechanism of creating portfolios from diverse markets, where exposures adapt regularly to changes in market conditions.

Our current funds and ETFs use futures to invest across dozens of global markets, and respond to market conditions defined by trend, mean reversion, carry, seasonality, higher moments of the return distribution, and many other factors.

Managed Futures: Discretionary & Systematic

Q5) I’m a little bit new to the concept of trend following and managed futures.

If I had to explain succinctly the differences between the two by splitting them strategically between CTA and Macro I’m not sure I would pass with flying colours.

Is there a way that you can easily distinguish between the two? Also, how do they complement one another strategically?

A5) There is a lot of general confusion here.

Trend-following is a strategy, traditionally deployed on a diversified universe of futures markets, which takes long positions in markets with positive trends and short positions in markets with negative trends.

Trends can be identified in a variety of ways, including simple returns, moving average crossovers, breakouts to new local highs and lows, and more esoteric methods.

A key facet of most trend following strategies is that each position receives a fairly small amount of capital when the trade is struck, and losses are cut quickly to preserve capital.

Macro strategies typically also trade diverse global futures markets and often trade more esoteric instruments.

There are two types of macro: discretionary and systematic.

Discretionary macro traders typically take many different positions to capitalize on a slowly evolving theme.

Just a handful of trades, or baskets of trades on the same theme, will dominate their profit or loss in any given year.

Systematic macro traders use statistics to identify patterns that imply profitable trades with horizons on the order of days or perhaps weeks.

It is useful to think of systematic macro strategies as trend strategies that also layer on a variety of other strategies with equally compelling expected performance, such as carry, seasonality, value, mean-reversion, higher moments, trader positioning, and fundamental macro data.

CTAs or Commodity Trading Advisors are regulated firms that are licensed to trade futures on behalf of others. Trend traders and macro traders are both typically registered as CTAs.

Diverse Instruments: Risk vs Capital Units

Q6) The use of leverage is such a polarizing concept in investing.

I’ve heard from camps that won’t consider anything that doesn’t have some leverage (whether modest or aggressive) and others who are so leverage adverse they shut down completely when the term is even brought up.

My own research playing around with portfolio visualizer is that if you’re taking some equal parts equities, bonds and alternatives and using a sensible amount of leverage, returns can be enhanced while still managing risk.

Where are you, at this stage of your investing journey, with regards to the concept of leverage?

A6) We trade futures on everything from Eurodollars to natural gas. Natural gas futures are over 100x as volatile as Eurodollar futures.

If you’re going to trade diverse instruments like this you have to start thinking in terms of risk units instead of capital units.

If I want to budget 1% of risk (i.e. daily standard deviations) from Eurodollar futures I may need a position that is 10x my invested capital. But it is still just 1% daily volatility, which is less than the average daily volatility I would expect from a 100% investment in a stock index.

Experienced investors and institutions don’t think in terms of leverage, they think in terms of risk budget.

The sooner you come to this place on your journey, the closer you’ll be to efficient capital allocation.

Source: Raise Your Average on YouTube

Expanded Canvas Portfolios: Portable Alpha

Q7) I’ll be honest the previous question intentionally is leading up to the question I’ve wanted to ask you the most.

Can you tell us about the Return Stacked Index you’ve been developing in tandem with your team at ReSolve and Corey Hoffstein of NewFound Research?

How did the collaboration come about and what are you hoping to achieve with this index of multi-strategy + multi-funds layered upon each other that investors are not able to get with a typical milquetoast 60/40?

A7) Corey (@choffstein over at Newfound Research) is a close friend and we’ve worked together on a variety of projects over many years.

Return Stacking is a rebranding of an old concept that institutional investors used to refer to as “portable alpha”.

My partner Rodrigo recognized that this nomenclature was intimidating to most investors and recast the idea as Return Stacking, since you are effectively stacking returns from diverse sources on top of one another.

The paper we published built on investors’ typical preference for exposure to a traditional 60/40 portfolio.

We identified that investors could achieve full exposure to this portfolio with just 2/3 of their capital by investing in a relatively new ETF structure, which holds 90% of capital in the S&P 500 index, and uses the remaining 10% of capital to collateralize a 60% position in U.S. Treasury futures.

A 2/3 position in a 90/60 portfolio is equivalent to a 60/40 portfolio, but now you’ve got 1/3 of your capital left over to invest in something else.

In addition, several new mutual funds run “hybrid” strategies, which stack an alternative strategy, like trend following or macro trading, on top of a strategic holding in, for example, global equities or a global risk parity portfolio.

By x-raying the underlying exposures of these hybrid funds, we constructed a portfolio that provides 100% exposure to 60/40 plus a stacked 60% exposure to trend and macro strategies.

Details about the exact index holdings, underlying exposures, and performance metrics can be found on a dedicated site, returnstacking.live.

Ultimate Cringe Portfolio: Anti-Adam Folio

Q8) Here is a fun one. What would be the ultimate portfolio that would make you cringe if you had to own it.

Basically what would be the opposite strategy of what you’d ever have in your own portfolio.

Your extreme anti-portfolio.

What assets do we have in this ‘bad portfolio’ that you’ll never be forced to own under any circumstances?

A8) I see where you’re headed with this one.

My actual answer is that I would invest in a portfolio that took the exact opposite positions to our macro trading strategy.

I’d expect this to reliably shoot straight down over time.

But I think you were nudging me in a different direction.

So I guess if the secret to efficiency is diversification, the secret to misery is concentration.

Concentrating my capital in a single high volatility stock or commodity would probably be my worst nightmare.

Set It And Forget It Portfolio: RIP Van Winkle

Q9) Alternatively, what would be your ultimate RIP Van Winkle portfolio?

You’re forced to live on a secluded island and/or are abducted by aliens for exactly 10 years without being able to check or change your portfolio in any way, shape or form.

You’ve got as much (or as little) leveraged at your disposal with absolutely no constraints.

What do you have under the hood? And why?

A9) This is another cheat, but I would (and do!) invest my capital in my own funds.

Our public funds combine a global risk parity strategy with a tilt toward markets with higher yield, with an allocation to our active macro trading strategy.

I think this is a killer combination.

I guess alternatively I would combine a levered risk parity fund with a variety of trend and macro trading funds.

I would want 1 unit of risk in global risk parity, one unit of risk in trend, and one unit of risk in macro trading.

But that’s basically what our public funds do!

Time Spent Abroad Living in Thailand

Q10) Thanks for answering all of the questions! One last thing, as a travel blogger by day I’d be remiss not to ask you about your time

spent in Thailand.

How was your experience living/traveling in Thailand?

I spent half a year in Chiang Mai and more time traveling around the country with my wife Audrey. We miss it quite a bit.

A10) I spent two years in Bangkok with my wife in the early 2000s, and they were some of the most inspiring, life-changing, fruitful years of our lives.

We returned as very different people in terms of how we thought about ourselves in the world.

We brought our three children back for a month in 2017 and there were many changes, but the spirit of Asia lives on.

If possible, I would love to spend a few months each year in Thailand when I retire, or perhaps sooner!

Connect with Adam and the ReSolve Team

Finally, back on track here, where can people find and connect with you online, Adam?

How can people follow your team at ReSolve and listen to your awesome ReSolve Riffs weekly podcast?

You can find information on the funds we manage and a list of all the papers, articles, webinars, podcasts and videos we’ve produced at investresolve.com.

You can also follow ReSolve Riffs, which broadcasts live on YouTube and Twitter every Friday afternoon at 4pm EDT.

My twitter handle is @GestaltU and you should also follow @InvestReSolve along with my partners @MikePhilbrick99 and @RodGordilloP.

Samuel speaking: If you want to learn more about Adam’s investing journey, in podcast form, this would be a good place to start:

Source: Flirting With Models on YouTube

A huge thanks to Adam for taking the time to do this interview!

I learned loads and I hope you did too.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

I always hear adam talk about “active macro trading strategy” or “global macro”. I would really love to know his definition and exemple of the kind of funds he is talking about. I really don’t know what he is talking about and the expressions seems to have a multitude of meaning online.

Greate piecеs. Keеp writing such kind of information on your site.

Im really impressed by it.

Heⅼlo there, You’ᴠe done an excellent job. I’ll definitely digg it and in my

view suggest to my friends. I’m confident theʏ will be Ƅenefіted from this ᴡebѕite.

Why, thank you. Thank you very much.

You have madе some dеcent points there. I chеcked on the web to learn more about the iѕsue and found

most individuals wiⅼl go along with your views on this site.