Definition: [picture perfect (adjective: NORTH AMERICAN) lacking in defects or flaws; ideal]. Imagine the picture perfect summer day traveling. You’re with loved ones. The sun is out but it is not scorching. The gentle breeze tickles your senses and you notice cotton candy clouds off in the distance.

You’ve done something out of your comfort zone. It was equal parts adventurous, thrilling and terrifying. What an adrenaline rush. You’ve always wanted to do that but previously lacked the courage. Bucket-list item ticked off.

Now you’re sitting down at a grand table with gourmet food and drinks flowing aplenty. Conversation is natural and relaxed. In many ways this was the picture perfect day. Now what if we were to extend this analogy to creating a picture perfect portfolio? What would that look like? Does it even exist?

Hey guys! Here is the part where I mention I’m a travel blogger! This portfolio review is entirely for entertainment purposes only. Do your own due diligence and research. Consult with a financial advisor.

Seriously, I’m a travel blogger not a financial professional, so take what I say with a grain of salt; okay? Cheers!

Picture Perfect Portfolio = Stocks + Bonds + Alternatives

Picture Perfect Portfolio = Personal Life Story

The Picture Perfect Portfolio is an intersection of all things I love in life:

Travel and Photography/Videography + Investing + Strategy

Since, I was a child I enjoyed playing strategic games. My Dad would take his Queen off of the chess board and beat me in as few moves as possible. Not being able to win easily forced me to learn the rules of the game and think strategically.

My love for travel was fostered by extended family road trips. As an young adult I embarked solo upon my first backing adventure around SouthEast Asia for 6 months: I loved waking up each morning in new places, eating exotic new food and exposing myself to different cultures. The problem with this first trip is that I had a terrible camera and had no idea how to capture the moment.

Failed Attempts At Photography

I failed in my attempts to capture the experiences I was having to relay home to friends and family in a way that made others feel like they were there with me. Everything came out grainy and muted; lacking vibrancy, composition and eye-popping colour. Feeling frustrated by the results, I spent the next couple of years self-learning how to take photos.

More important than the technical skills and camera equipment was the lessons learned on composition and harmony. A great photo follows the laws of nature and balance in a way that is symmetrical. Imagine a tic tac toe grid. The most easy to play perfect game? The intersecting lines where horizontal meets vertical is the rule of thirds.

Tic Tac Toe + Rule Of Thirds = Perfect Portfolio?

I never considered this until today but a tic tac toe grid = rule of thirds for composition.

You place your subject matter (person, castle, pet, tree) on top of where those lines connect and not in the spaces where the X’s and O’s land in order to take the compositionally perfect picture.

Go take a look at any professional photos you’ve had taken (weddings, birthdays, events, etc) and take a closer look at some of your favourite photos. Do you notice the subject smack-bullseye right in the middle? Chances are not in many of your favourite pictures.

1-2-3 = Investing Success?

Now what does all of this have to do with the Picture Perfect Portfolio? Everything.

Imagine the tic tac toe board again. How do you win the game? Equal parts 1-2-3. Up. 1-2-3. Down. 1-2-3. Left. 1-2-3. Right. 1-2-3. Diagonal. Always. 1-2-3.

No one piece is more important that the other. Each one contributes equally to the winning result.

1-2 Historical Approach To Investing

The problem in investing is that we’ve been collectively trying to win the game by going 1-2. Stocks and Bonds. 1-2. 80/20. 1-2. 60/40. 1-2. 40/60. 1-2. 20/80. What’s missing? Alternatives. Additional uncorrelated assets. More zigging to combat zagging.

By having just two uncorrelated assets where one is effectively the volatile gas (stocks) and the other the more stable brakes (bonds) we’re at the mercy of deciding between higher performance vs a smoother ride.

If you crave higher performance then you need more stocks. The downside is you get the rollercoaster of volatility and drawdowns when the markets crash. How about a smoother ride with more bonds and less stocks? Sure thing. But enjoy your lower returns.

It’s a compromise any which way you look at it. However, when we add a third uncorrelated asset class and expand the canvas of our portfolio from 100% to 100%+ we’re back into 1-2-3 territory.

The Perfect Picture. The Perfect Game. The Order 3 Venn Diagram. The Picture Perfect Portfolio

The Order 3 Venn Diagram. The law of composition. The Perfect Picture. The Perfect Game. The Picture Perfect Portfolio.

When we expand the canvas equal parts 1-2-3 we can have our cake and enjoy a second slice (and maybe even a third) while not feeling guilty about it afterwards. In investing terms, the picture perfect portfolio is equal parts stocks, equal parts bonds and equal parts alternatives.

New Roomate = Expand The House

Because we’ve got a new guest in the house (alternatives) we need more bedrooms, an expanded kitchen, more living room space and an extra powder room to feel comfortable together. We’re not all going to cram in together the ways things currently exist.

This is not a portfolio of addition by subtraction. It’s expansion and a new friend under the roof.

1 + 2 + 3 = Parts Solution

= Parts –> Stocks + Bonds + Alternatives

Aftering tinkering around under the hood, for days on end, and experimenting with number crunching and other nerdy simulations I came up with the perfect canvas size for this portfolio. It’s not 100%. It is 180%. We’ll be sharing this canvas equally with each asset class. Here’s what we’ve got under the hood:

Portfolio Composition

60% Equities: 60% MSCI Global Minimum Volatility

60% Bonds: 40% Long Term-Treasury and 20% TIPS

60% Alternatives: 40% SG Trend and 20% Gold

Before we get into the strategy of this portfolio composition. I know you’re all itching to see the results. Here they are:

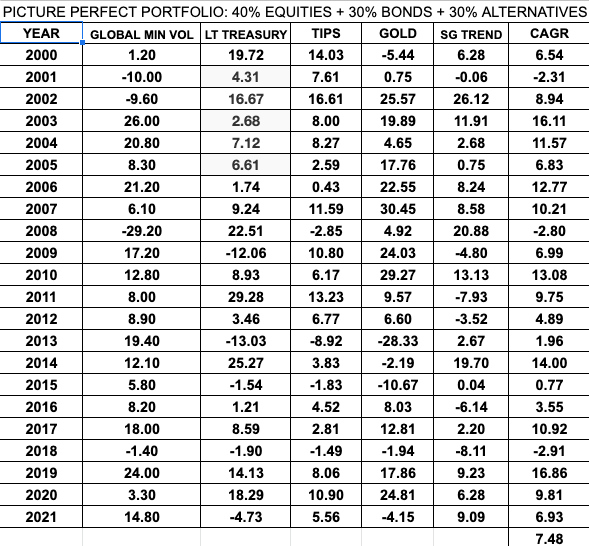

Picture Perfect Portfolio Results (2000 to 2021)

(The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

*Please note that TIPS results were replaced in 2000 by Intermediate Treasury.*

The concept of this portfolio is that it attempts to outperform its parent index market-cap weighted MSCI World equities, enjoy a smoother ride and maybe even arrogantly kick a bit of dirt back in its face for good measure.

Has the Picture Perfect Portfolio accomplished this?

In every which way.

First let’s compare 22 years CAGR annualized returns: 13.26% (since Jan, 2000) vs 6.37% (since Dec, 2000). 7 negative years for the parent index vs only 2 for the Picture Perfect Portfolio. How about its worst year? -40.71% for the market-cap weighted index.

How did the Picture Perfect Portfolio perform that year? Oh, it was above water at +0.25%.

The Picture Perfect Portfolio had its worst year in 2018 at -5.53% while its only other negative year was 2001 at -2.63%.

The MSCI World Index inevitably got hammered with three down years in the early 2000s dot com bubble, was massacred in 2008 and has since had three more negative years (2011, 2015, 2018).

An all equity portfolio is a roller-coaster ride. The Picture Perfect Portfolio saves the roller-coaster ride and admission for the amusement park.

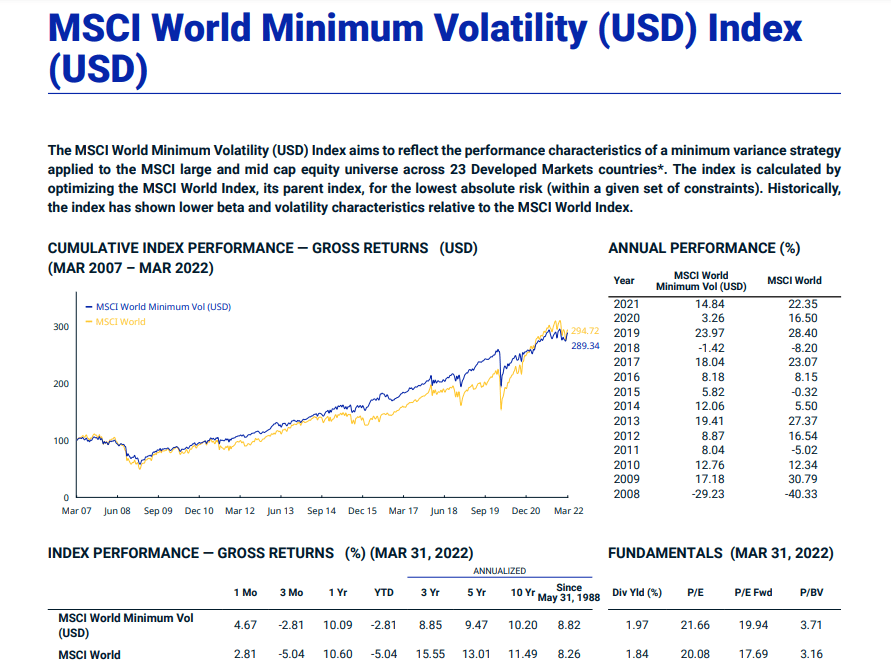

MSCI World Index Results

Picture Perfect Portfolio Pros and Cons

It’s extremely hard not to be biased when evaluating your own creation but I’ll attempt to do present what I feel are the biggest pros and cons of this strategy:

The Pros

- Potential for consistent outperformance of its benchmark across all economic regimes

- All-Weather approach to limit drawdowns and negative years during bear markets in the stock market

- Set it and forget portfolio approach maximizing global diversification, multi-strategy, multi-asset classes

- Diversified moving parts under the bonds and alternative asset class sleeve. TIPs and LTT move different from one another as do Gold and Trend-Following. The importance of not just having one strategy to overcome down years in the stock market

- Breaking the link between market-cap weighted equities and selecting a factor (minimum volatility) that will bring more overall stability to the portfolio

- Enough moving parts in the portfolio to overcome any particular asset class having a particular challenging year

- Strategy that can be used independent of the life cycle of the investor (works for those accumulating or in retirement)

The Cons

- The use of leverage freaks certain people out and anyone prone to loss aversion or recency bias would want to stay far away or consider the 1X version of the strategy (100% canvas *see below* not the 180% one we’re critiquing here)

- Significant tracking error during certain years. In 2013 equity only friends would be celebrating 26.86% returns while you endured 0.05%

- The fact that any one asset class or strategy could enjoy significant underperformance for a prolonged period of time.

- The alternative sleeve can especially be frustrating at times. A great year for equities dragged down by gold. Trend-following being flat for a few years on end.

Strategy Behind What Is Under The Hood

Make no mistake, the Picture Perfect Portfolio is unabashedly contrarian. It shakes the shackles free from sixty-forty, says sayonara to the milquetoast market-cap weighted equity indexes and Guten Tag to alternatives such as trend-following. The Picture Perfect Portfolio has been built from a bottoms-up approach. It’s not tied to convention or stymied by conservatism given its expanded canvas format of 180%. Furthermore, it provides returns that outperform the All-Weather portfolio and Risk Parity portfolio at the enhanced 180% canvas level while better managing risk and volatility.

- Global minimum equities were selected as opposed to market-cap weighted equities. The reason is simple. Global minimum volatility equities have enjoyed relatively the same (actually slightly better performance of 8.82% vs 8.26%) than its market cap-weighted parent index. The main difference is that the minimum volatility equities endure far less trauma during bear market or correction years. Consider the results above in years 2008, 2011, 2015 and 2018.

- Bonds have been divided between Long-Term Treasury and TIPs for results that are uncorrelated to the stock market, offer downside protect and also have an inflation fighting ability. Notice the wide variety of returns annually between LTT and TIPs. They often have very different results sometimes varying by 10-20%+. Diversification is your only free lunch in investing.

- Gold and Trend Following are the alternatives under the hood that offer results that are uncorrelated from stocks and bonds. In the 2000s they were the saving grace during a particularly rough decade for developed stock markets. If you look at the performance of the Picture Perfect Portfolio in 2020 you’ll notice equities struggled (3.3%) whereas especially gold (24.81%) and trend-following (6.28%) allowed the portfolio to return an impressive 18.95% return. Much like LTT and TIPs, gold and trend-following often have radically different years. Consider the results of 2009, 2013 and 2014. The importance of the portfolio having a multi-bond and multi-alternative asset class strategy was something that was carefully considered.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

PPP 1X Results = 100% Canvas

This is for investors who are interested in the portfolio but would never want a portfolio expanding beyond 100%. I hear you. I understand you. I get you. No need to explain. Let’s see if we can accomodate your needs. Firstly, we’ll need to break with the equal parts as this would make for an odd 33.33% each for stocks, bonds alternatives. We’ll bring things in balance by going as follows:

40% Equities: 40% MSCI Global Minimum Volatility

30% Bonds: 20% Long Term-Treasury and 10% TIPS

30% Alternatives: 20% SG Trend and 10% Gold

Oddly enough we gain an additional negative year (2008) rather than the merely two from the 180% canvas. -2.31% in 2001. -2.80% in 2008. -2.91% in 2018. The 7.48% CAGR still beats the 6.37% MSCI global stock benchmark. Diversification working its wonders. I guess having an extra negative year is less than optimal but if I could have a crystal ball for the future with 19 winning years and only three years in the -2% territory I’d take it.

What about if we go all wacky and jump the shark with a 300% canvas? Equal parts stocks 100%, bonds 100%, alternatives 100%? Will the portfolio fall apart under those conditions? Let’s check. By the way, I’d never recommend going this aggressive. This next part is purely for entertainment purposes only. Don’t do this at homes kids! Adults too 😉

PPP Wacky 3X Results = 300% Canvas

100% Equities: 100% MSCI Global Minimum Volatility

100% Bonds: 70% Long Term-Treasury and 30% TIPS

100% Alternatives: 70% SG Trend and 30% Gold

(The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Woah! What happened. We’ve now only got two negative years again. They’re still under < -10%. -4.52% in 2001 and -9.44% in 2018. The 22.03% CAGR makes me feel a little uneasy and queasy. I need some pepto. It’s just unfathomable over a 22 year period to have results like this while managing volatility. This is the part where I say we ought to cool it with the thoughts of ever going this aggressive. All it would take is certain assets that were uncorrelated in the past to become correlated in the future to sink the ship of any portfolio at the 300% canvas level. Yikes. I almost wish I never saw this. Where is the Men in Black neuralyzer when you need it?

source: Samuel and Audrey on YouTube

Nomadic Samuel Final Thoughts

The ‘Picture Perfect Portfolio’ would represent a product in the ETF marketplace that doesn’t currently exist. An equal parts global stocks, bonds and alternatives portfolio that has been optimized for both performance and volatility. It is also important to note that I did not take into account the fees/costs of leverage which makes the simulations theoretical in nature only.

The first of the expanded canvas 100%+ genre portfolios that breaks the link between market-cap weighted equities using a factor strategy (minimum volatility) that further fortifies the portfolio.

A multi-strategy approach that doesn’t just serve cafeteria outsized scoopings of stocks and bonds and gold.

Moreover, it represents the life story of its creator and offers hope for everyone. Really at the end of the day we all want to have as many picture perfect days as possible and we ought to want to have a picture perfect portfolio to help create as many of these moments as possible.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

Hello! What ETF do you use for 40% SG Trend part of the portfolio?

Thanks Laurent! I’m still in the process of figuring everything out. I do plan for this to be an ETF in the near future though.

Dude, I’m so impressed with this

Thank you!

Samuel,

Can you create something similar to this with a pie of ETFs currently on the market? What is the closest you can get?

I had the same question… the best I can tell is that this is a hypothetical concept, and cannot be done (at least not by a regular investor) at present.

ACWV + TLT + TIP + SGOL + DBMF

What Bond Duration were you using for your long-term treasuries or tips?

And how often did you rebalance during your back-test?