When you think of the worst housing bubble of all-time Japan in the 1990s takes the cake and spreads a thick triple layer of icing for good measure.

Real estate in Japan was so outrageously overpriced in the 1990s that it still hasn’t recovered even in 2022.

Unrivaled for decades, as far as housing bubbles are concerned, there may be a new Sheriff in Town.

Hold your beer, Japan.

Canada has entered the room.

The perfect storm of overconfidence, lack of speculative foreign buyer regulations, impossibly low interest rates, generational ignorance, greedy guts investors and unabated soaring prices without any form of a correction (such as what happened in the US in 2008) has Canada teetering on the edge of THE mother of all-housing bubbles.

I’ll be the first to admit I’m no expert when it comes to real estate but I can share the experience of what it was like witnessing family sell a house in the Greater Toronto Area (Brampton) during the absolute peak of the housing bubble in Canada.

Canada Housing Bubble

How Overpriced Were Homes in the Toronto Area?

Just how overpriced were homes in the greater Toronto area during the peak of the housing bubble in Canada around March 2022?

Consider this.

The family house sold in Brampton (quite honestly an unremarkable suburban satellite city approximately 1 hour driving distance from downtown Toronto) was listed for 5.6 times the amount it was purchased for in the early 2000s.

Yeah.

You heard that correctly.

5.6 X!

And the amount overbid to secure the home from other prospective buyers was 1.75 times the price paid for the home in 2002.

I’ll say that again.

1.75 X overbid on the listing.

The real-life consequences of the house selling at the top of the top of the mother of all super-bubbles was that the family members who left Brampton were able to purchase a jaw-dropping dream retirement home with acreage in Alberta overlooking the Rocky Mountains with a considerable retirement nest-egg to go along with those views.

What has happened since?

With inflation soaring, markets down (stocks, bonds and crypto) and interest rates finally rising in Canada, houses that were listed at all-time highs in March are now selling at lower prices and closing hundreds of thousands of dollars below asking price.

It’s changed that much in just a few months.

And it’s likely only going to get worse.

All The Classic Signs of an Asset Bubble Were Present

Part of my financial education that I feel most grateful for was learning from legendary investors such as William Bernstein and Warren Buffet about what kind of specific behaviour is present during the top of any asset bubble.

source: One Minute Economics on YouTube

1) Extreme Overconfidence

Firstly, you’ll notice extreme overconfidence.

Family members, friends, acquaintances and random interactions with strangers in taxi cabs and barber shops revealed overconfidence and ignorance more than a peacock displaying its feathers.

“You just have to buy any property 1 or 2 hours away from Toronto and in less than 2-3 years it will double in price.”

The crazy thing is that they were right.

For many years investors and/or just regular folks with a family house were doing just that.

Yet, no one considered the other side of the coin.

source: Nolan Matthias on YouTube

2) Getting Angry When You Don’t Agree

“What if you overpaid for that house and it goes down in value?”

I remember saying that as a counterpoint, every once in a while, when I heard such extreme overconfidence.

“Nah. Dude. You just don’t get it. That’s impossible. Common man. It’s a unicorn riding a rainbow straight to the moon.”

Furthermore, you’re an idiot for not “seeing clearly” just how easy it is to make money flipping houses in Southern Ontario.

source: One Minute Economics on Youtube

3) Greater Fool Theory = Overbidding at the Supermarket

Warren Buffett classically pointed out just how ridiculous it is to overbid and overpay for an asset by using a supermarket analogy.

Imagine going to the grocery store and being thrilled that peanut butter is now triple the price of what it used to be just a few years ago.

Not only are you thrilled beyond belief you’re willing to pay even more.

That’s right.

You and a crowd of others are in the pit bidding for that jar of peanut butter auction style.

You want it so badly that you keep going higher and higher.

Screw buying it on sale.

It doesn’t matter what the price is as you’re determined to get it at all costs.

source: Global News on YouTube

That probably sounds ridiculous, no?

Indeed.

Yet this is the behaviour that was being displayed during the showing of the house sold in Brampton, Ontario.

20-30 viewings over just a few days.

Offers immediately being put in well above asking price.

Conditions waived to entice the owners – such as no home inspection necessary.

Yep.

All of that happened.

I think in total there were 4-5 bids that were well above asking price.

It was a game of who was going to pay the most while in tandem offering the owners the most favourable conditions.

Greater Fool Theory.

“In finance, the greater fool theory suggests that one can sometimes make money through the purchase of overvalued assets — items with a purchase price drastically exceeding the intrinsic value — if those assets can later be resold at an even higher price.” (source: Wikipedia).

Canada Housing Bubble = Worse Than Japan?

All of that anecdotal evidence was all fine and dandy but let’s see some data and charts to back it up.

Just how bad is the Canada Housing Bubble?

Is it worse than Japan in the 90s?

Let’s find out.

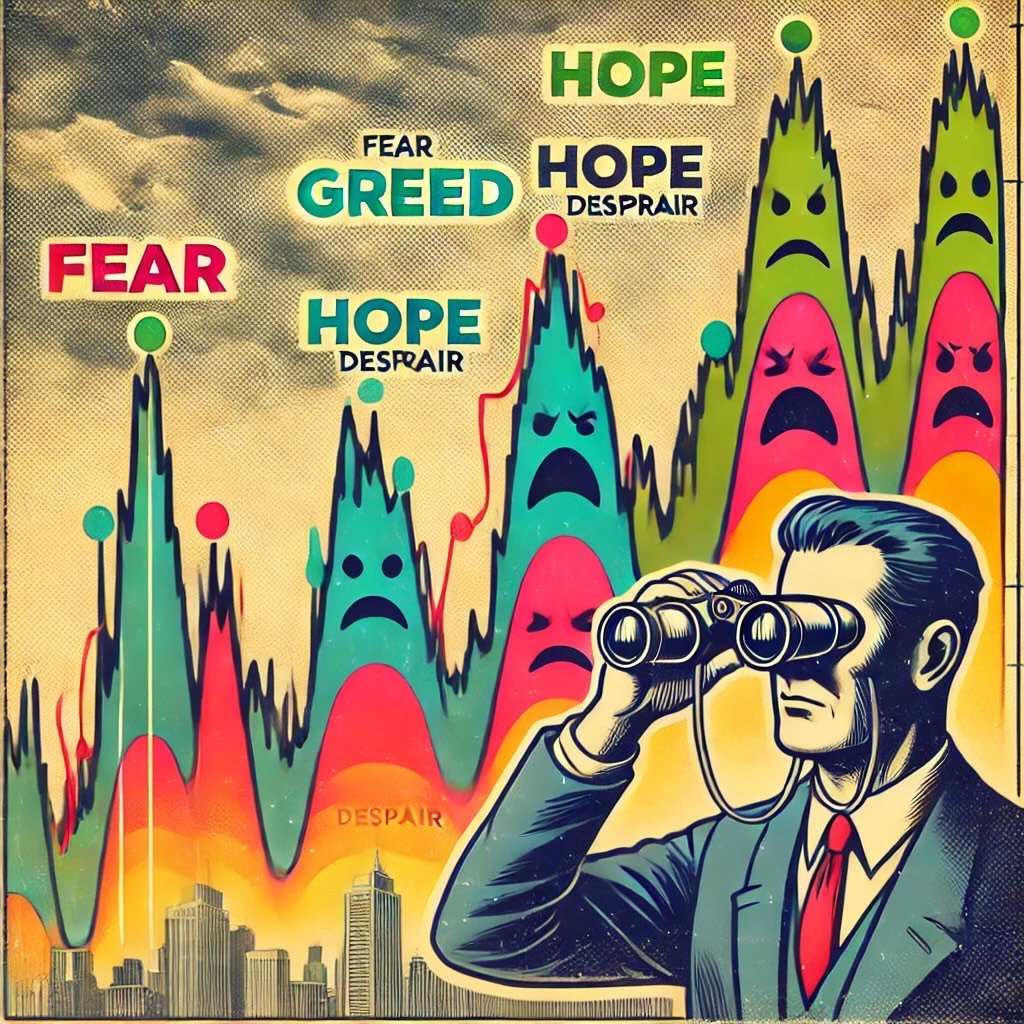

Bear markets are the slap in the face that is required every decade or so to remind investors of intrinsic asset value.

A good lick here and there is often necessary to prevent humans from being all too human.

FOMO.

source: VisualPolitik EN on YouTube

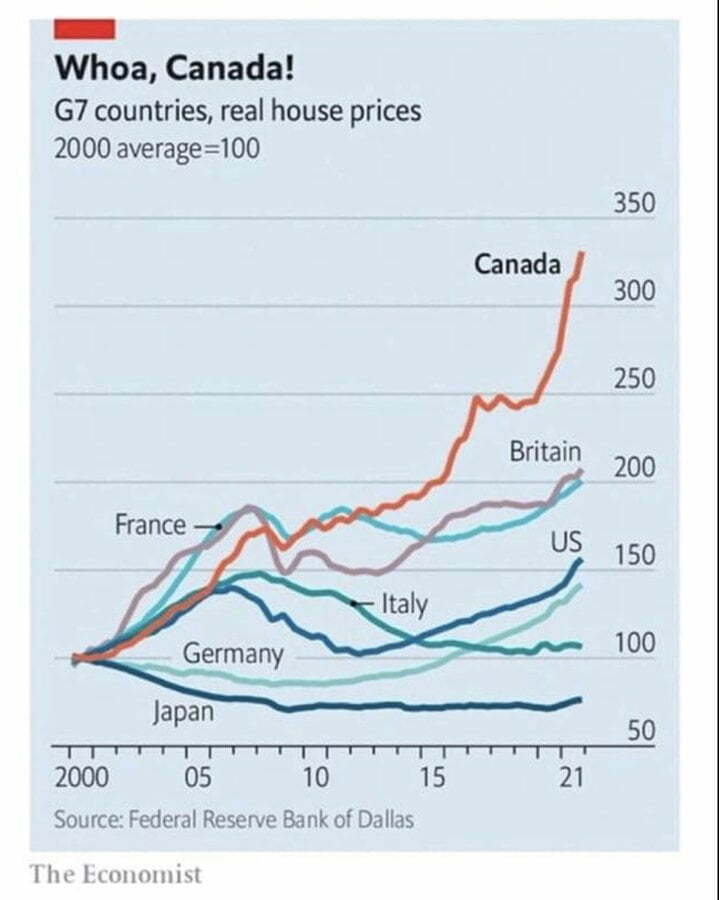

As you can see above, Canada did not experience the correction most other countries did around the world in 2008 when real-estate was becoming overpriced relative to fundamentals.

Housing in Canada was already more expensive than Japan, Germany, Italy and the US in 2008 with only Great Britain and France more overpriced.

What has happened since then is likely going to be studied by academics for years to come.

Like a rocket to the moon Canada surpassed all of these nations and then added a triple sundae of insanity to top it all off since 2020.

Canada vs Japan Housing Crisis

Let’s get back on track and compare the current housing crisis in Canada to that of Japan in the 1990s.

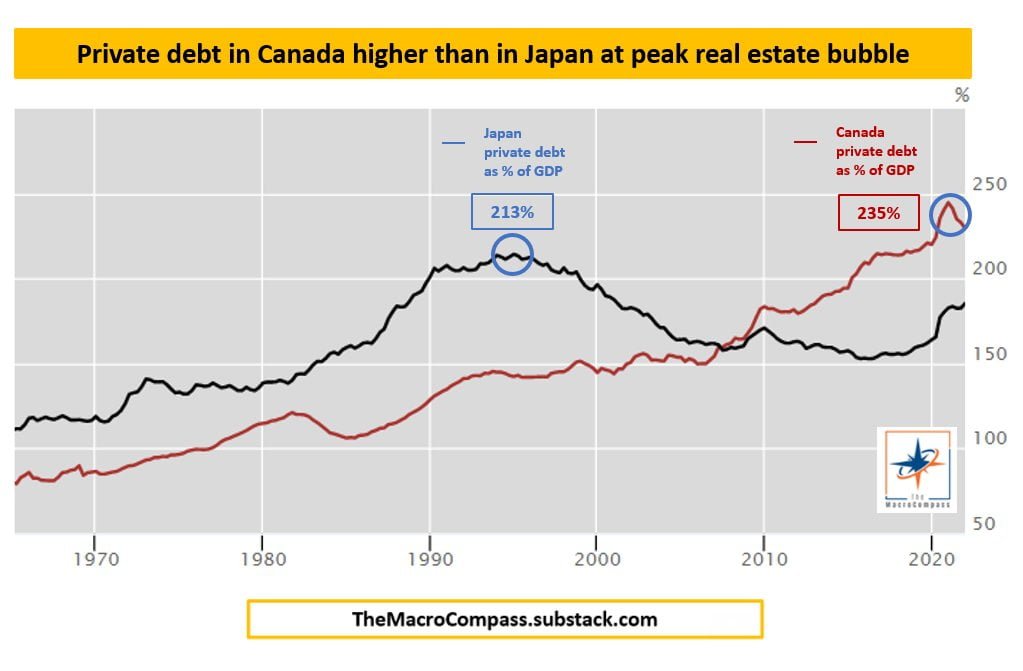

Regarded by many as the worst all-time housing bubble, Japan had private debt as a % of GDP of 213% during the peak of its crisis in the early 1990s.

Canada has now surpassed that amount with a private debt as % of GDP of 235% in the 2020s.

Bubblelicious?

Canada vs USA Housing Bubble

Many of my friends south of the border have been concerned about prices in the USA since 2020.

Indeed, there is reason for concern especially in larger urban centres where prices have soared.

Yet, compared to Canada it’s a walk in the park with regards to a potential correction.

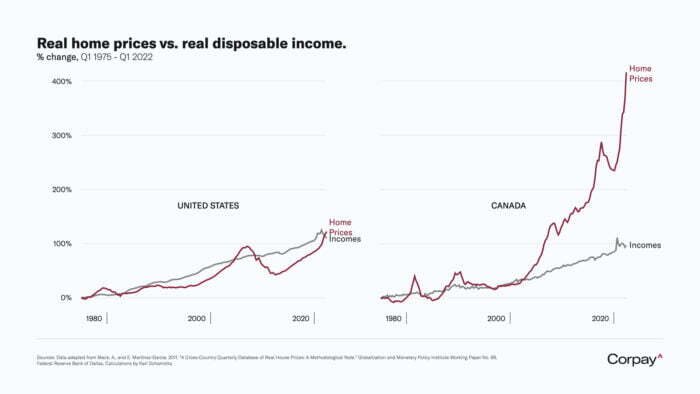

When home prices in the USA were starting to become untethered with incomes in the mid 2000s the crushing events of 2008 provided the necessary gravity to correct the madness.

source: CNBC International on YouTube

How about in Canada?

Completely and totally untethered since the early 2000s.

It was already bad in 2020.

The recent madness leading up to end-times in 2022 is nothing short of astonishing.

Real Home Prices vs Real Disposable Income is 4:1.

What kind of a bear market would be necessary to correct all of this?

Two back-to-back 50% bear markets.

What?

Yup.

Two back to back 50% bear markets would be what is required to bring housing prices to a 1:1 ratio of home listings vs disposable income here in Canada.

How Did Home Prices in Canada Become So Crazy?

How did home prices in Canada soar to such levels of insanity?

Well, this will be studied for generations.

Really, it’s a cocktail of many ugly ingredients.

- Lack of a necessary 2008 housing correction

- Lack of foreign investment regulations to prevent speculation

- Generational ignorance and FOMO

- Overconfidence = more investors than first time home buyers

- Ridiculously low borrowing rates

There are obviously other factors at play but the five I’ve listed above probably explain a great deal of the situation that has lead Canada down the path to its self-imposed housing bubble hell.

Is Housing Expensive Everywhere in Canada?

Is housing expensive everywhere in Canada?

Has the madness spread to all provinces and territories?

No.

But the radar of insanity has certainly expanded beyond just the Greater Toronto Area and the Vancouver/Victoria region of British Columbia.

Atlantic Canada, the most historically reasonable region to purchases homes in Canada (New Brunswick, Nova Scotia, PEI and Newfoundland), has seen prices increase dramatically since 2020.

However, it is not crazy like in Southern Ontario where a most unremarkable city such as Hamilton is now insanely expensive.

The Prairie Provinces of Canada (Alberta, Saskatchewan, Manitoba) have retained some level of affordability and did not get caught up in the madness of elsewhere.

For those seeking a laidback lifestyle out in nature a few places where you can still buy a home at a reasonable price remain available.

Cape Breton comes to mind.

As does northern British Columbia in communities near the Rockies such as Mackenzie.

For those seeking affordable city dwelling one could still consider Calgary, Edmonton, Winnipeg, Saskatoon, Quebec City and Fredericton.

Halifax?

Eh.

Maybe.

source: CTV News on YouTube

Generations Completely Shut-Out From Housing in Canada

Gen Z, Millenials and youngish Gen Xers have felt the brunt of the housing crisis in Canada the most.

Shut-out completely or carrying a boulder of a mortgage on their collective backs it has lead to record low fertility rates and delayed marriages.

It’s a total nightmare.

How can a young couple afford a house in Toronto and raise a family at the same time?

Not possible.

Even with great careers/salaries.

Most of Canada’s population is clustered between Montreal and Windsor where the madness is at its worst.

Getting on the housing ladder is a pipedream for many.

It’ll take a spectacular correction to bring affordability back to certain areas of Canada.

Most Embarrassing Part of the Housing Bubble in Canada?

Canada has officially six time zones:

Pacific, Mountain, Central, Eastern, Atlantic and Newfoundland.

Canada has a population of 38 million as of 2020.

We’re not a crowded nation.

Canada has a population density of 4 people per square kilometer.

We’re an enormous country with enough land to support a population exponentially greater than what currently exists.

Yet we’ve got an embarrassing affordability crisis when it comes to housing.

Unlike destinations such as Hong Kong and Singapore, where buildings rise to the heavens above and land is being reclaimed to deal with such insane population density, Canada has no shortage of land at it disposal.

It’s truly astonishing and quite frankly flat out embarrassing that things have gotten this bad.

Nomadic Samuel Final Thoughts?

This might sound harsh but I’m going to sit back with multiple bowls of popcorn and watch the housing bubble crash in Canada with glee.

Before I get into “why” I feel so strongly about wanting a reversal of this housing crisis, I first want to start off with a few specific considerations.

Firstly, I genuinely feel sorry for any new homebuyers or regular folks who becomes collateral damage when the Canadian housing bubble bursts.

It’s only just begun and many young couples and families are going to feel the brunt of the impact of having purchased a home well above its intrinsic value.

Secondly, I’m not taking any pleasure in the reduction or destruction of wealth that will happen to those who overpaid, held on too long or didn’t recognize how bad things were before shite hit the fan.

source: CTV News on YouTube

What I am going to personally enjoy is witnessing the “extreme greed” of certain folks who played the housing market like a Nintendo game on steroids for decade upon decade take a brutal licking.

Moreover, I’m rooting for the market to correct itself to a healthy level so that young people can aspire towards a middle-class lifestyle that once made Canada one of the most desirable places to live on this planet.

The housing bubble in Canada is finally bursting and it is about “fill-in-the-blank” time.

I’ve got my popcorn in hand and I’m here to binge watch every episode.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Japan never had the population growth or zoning and building restrictions that Canada has.

Japan has 338.2 people per square kilometer versus Canada at 4. And you think Canada has a population problem?

Has nothing to do with square kilometer. We are severely over populated with the highest immigration growth in the world! Shortage of Drs, some people are unable to receive cancer treatment because there are TOO MANY PEOPLE! Open your eyes!

people/ square km is a meaningless metric in Canada where only a fraction of the nation’s surface is livable territory with the necessary infrastructure. The article completely ignores that our housing crisis is driven by a severe shortage of construction over increasing rates of immigration. Japan or USA do not have these levels of population growth, a better comparison would be Australia and New Zealand.

Canada does find itself in significant trouble as far as real estate is concerned. However, I would never have imagined things getting as bad as they have.

And yet every news article says they don’t expect a major change in price with higher interest rates, and now is a good time to buy.

On a side note I wish I could have the satisfaction of watching these scumbags file for bankruptcy and/or driving by their tent on East Hastings

It has been a pleasure to read this article as this topic has affected me a lot in last 4 years. Every sentence of yours i completely agree with in this blog.

My background : Middle-aged Indian well settled in financial sector and working in Middle-east married to a canadian. Initially without having been to Canada myself, I had planned to leave my good job in ME and move after few years of marraige to Canada like millions of South Asians do and aspire for in search of a better lifestyle.

However, the more i visited Canada from 2018, every year for a month to visit my in-laws, the more dejected i felt in moving there permanently.

There are many reasons and I can honestly go on for very long on that topic in detail.

Medical service issues, basic education standards, overall safety and drug abuse getting worse, lack of many convenient services at affordable rates, very less salaries for professionals specially compared to other developed marktes, and the worst of all ofcourse, housing affordability as the income to home ratio of almost 20 (avg salary of 45K to 900K home values) in GTA and many other places is ridiculous.

Here, in ME and even in India, we have so many things to go for which are quite decent and that ratio is generally 10 times to income for similar homes.

As you said, even i had notice till last year the same insanity amongst many canadians where the only main topic of discussion everywhere is somehow related to housing and investing in housing and flipping them to earn millions. It’s like there’s just no other productive work or economic activity that i have seen in Canada other than housing as an industry. It really lacks depth as a mature economy of a developed country should be having in my opinion. The only thing that has been keeping this bonanza going is immigration. That is clearly the number one reason, which i think you have overlooked in your blog. Right from 2014 when the country made it more easier and invited people in larger numbers from all across the world, this real estate craze has just sky rocketed. A closer analysis of your own chart about real incomes vs disposable income proves that it just went berserk after 2015 and was still relatively OK compared to US till 2014. In short, although sad but true, its mainly te stupid South asians and mainly my countrymen who i think are the ones most responsible for this. Have seen and interacted with many India friends living there who told me how so many truck drivers in Brampton easily inflate their earnings with forged documents and keep on taking loans over loans to buy homes n flip thme for profits quickly. I think once a respectable person becomes Canadian PM (just hate Trudeau honestly) and puts a stop to the free immigration policies or atleast reduces the numbers, then it would surely trigger a domino effect on this keep on buying houses mentality amongst greedy asians who will get scrambling at the first sight.

Canada as a country is still attractive to millions of people and rightfully so for many of them. It still has many positives, but i feel it is no longer the country it used to be for immigrants before 2014.

To conclude, I have still not moved to Canada and have been delaying it with my wife as she is keen to be close to her family. However, for me, if i really had the choice I would never want to move there after seeing reality for last 5 years and the daily struggle that most of the middle class has to do to raise a family by working overtime or two jobs to pay off their high mortgages and other bills. I would rather enjoy my hard earned money in so many other better countries with amazing lifestyle and climate that offer real value for the buck.

This is the first time i have come across your website and would love to explore more and read your blogs.

Thanks for writing and sharing your experience and wisdom. Really appreciated!

Good analysis. The climate alone is very hard. It will take a long time for Canada to turn this real estate disaster around. I left in the early nineties. Tried to come back a few times, but just could not go through with it. Too many unknowns…plus add the politics…language issues…corruption…inflation…questionable health care.

Most the land in Canada is not suitable for residential construction, and even if you manage to get remote land at current bubble prices up north, you’ll be paying tens of thousands of dollars just to get the permits and pay lawyers to appeal and appeal the bureaucracy.

The grid is designed to keep Canadians close to the major cities and with the current government increasing immigration to 500,000 a year, demand for housing will increase due to artificial scarcity and urbanization.

It’s when the life savings of the newcomers are depleted that people eventually realize that Canadian real estate is overpriced.

Great blog. This blog is very informative and helpful. I really appreciate your work. Want to know more about real estate agent then visit realtors4you.ca

Hi guys love this editorial and incredible travel videos on YouTube .Keep up the great and inspiring content,love from Susan and Andrew in Vancouver!!

I’m ashamed to say our Housing Minister Sean Fraser told Bloomberg the Canadian Governments

“goal is not to decrease the value of their homes. Our goal is to build more units that are at a price that other people, who don’t currently have their needs met, can afford.”

Either he never heard of supply and demand or the Government will build cheap CMHC subsidized rentals for us wage slaves (Envision Chicken Coops or Plastic Capsule Hotels – shared toilet, shower and hotplate down the hall!) while maintaining Canada’s overpriced real estate for the year by year shrinking class of Fortunate Few.

Canada is the 2nd largest country in the world and sparsely populated, with resources to build affordable and liveable houses for all.

Thanks, Nomadic, for putting together so much valuable info in one place. Dr. Marc Faber is currently saying that the interest rates would go lower for the next six months. However, he points out that the interest rates would, afterwards, go higher for several decades. If so, a Canadian housing market crisis to come is ensured. How funny, for you, it’s like watching a train derail in slow motion, you’ve been saying it’s coming for so many years!!! The last time Canada had a housing market crisis, during the 1990’s, it was eventually saved by introducing large numbers of immigrant. What would save us from the next one, if any? Thank you again.

What countries would you consider moving to?