Imagine being able to create your very own dream fund to add to your portfolio.

An ETF you’ve had on your wishlist that currently doesn’t exist.

You’ve got a Genie to grant you three ETF wishes.

Or even just one.

What strategy would you pursue as a DIY investor?

That’s what we’re going to explore today.

I believe we’ve entered the “golden age” of investing in terms of the potential building blocks available for DIY investors today.

There is everything under the sun available as an ETF right now.

Are you a factor investor?

Value. Momentum. Quality. Minimum Volatility. Yield. Multi-Factor.

All of these funds exist.

Prefer more concentrated strategies? Thematics?

You’ve got plenty of those funds as well.

How about alternatives?

Strategies that were once exclusively behind lock-and-key to institutions and high net worth individuals are now available to the retail DIY investor.

Absolute Return Bond Funds.

Global Systematic Managed Futures.

Multi-Asset Class Multi-Strategy Fund of Funds.

I could go on and on and on but the key point here is that the democratization of investing is in full swing.

There has never been a better time to be a DIY investor than right now.

Fees are low.

A plethora of puzzle pieces are at your disposal.

Yet that doesn’t mean there isn’t considerable room for improvement.

I’ve got some suggestions I’m itching to put forward.

But I also reached out on #FinTwit to ask friends within the investing community to share their thoughts and ideas as well.

I was blown away by the incredible suggestions shared by the community for potential ETF innovation.

Let’s explore all of these together.

DIY Investors ETF Wishlist: Funds You Want For Your Portfolio

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

DIY Four Quadrant Expanded Canvas Portfolio

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

As a DIY investor from Canada, I’ve cobbled together a 12 fund ETF portfolio that could best be described as a four quadrant quantitative expanded canvas solution.

For the deep-dive version of what I’ve got under the hood please check out the following post:

How Do I Invest My Money? Diversified DIY Quantitative Portfolio

| UPAR | 15.00% | ULTRA RISK PARITY ETF |

| HRAA.TO | 15.00% | HORIZONS RESOLVE ADAPTIVE ASSET FUND |

| ONEC.TO | 10.00% | ACCELERATE ONECHOICE ALTERNATIVE PORTFOLIO |

| PFAA.TO | 10.00% | PICTON MAHONEY FORTIFIED ABSOLUTE ALPHA ALTERNATIVE |

| NTSE | 7.50% | WISDOMTREE EMERGING EFFICIENT CORE FUND |

| GDE | 7.50% | WISDOMTREE EFFICIENT GOLD PLUS EQUITY |

| NTSI | 5.00% | WISDOMTREE INTERNATIONAL EFFICIENT CORE FUND |

| FIG | 5.00% | SIMPLIFY MACRO STRATEGY ETF |

| KMLM | 5.00% | KFA MOUNT LUCAS INDEX STRATEGY |

| DBMF | 5.00% | IMGP DBI MANAGED FUTURES STRATEGY ETF |

| ATSX.TO | 5.00% | ACCELERATE ENHANCED CANADIAN BENCHMARK ETF |

| PFAE.TO | 5.00% | PICTON MAHONEY FORTIFIED ACTIVE EXTENSIONS |

| HDGE.TO | 5.00% | ACCELERATE ABSOLUTE RETURN HEDGE FUND |

If I were to sort these funds into four quadrants (four different buckets) they would form the body of a creature with a backbone, arms/legs, torso/core and tail.

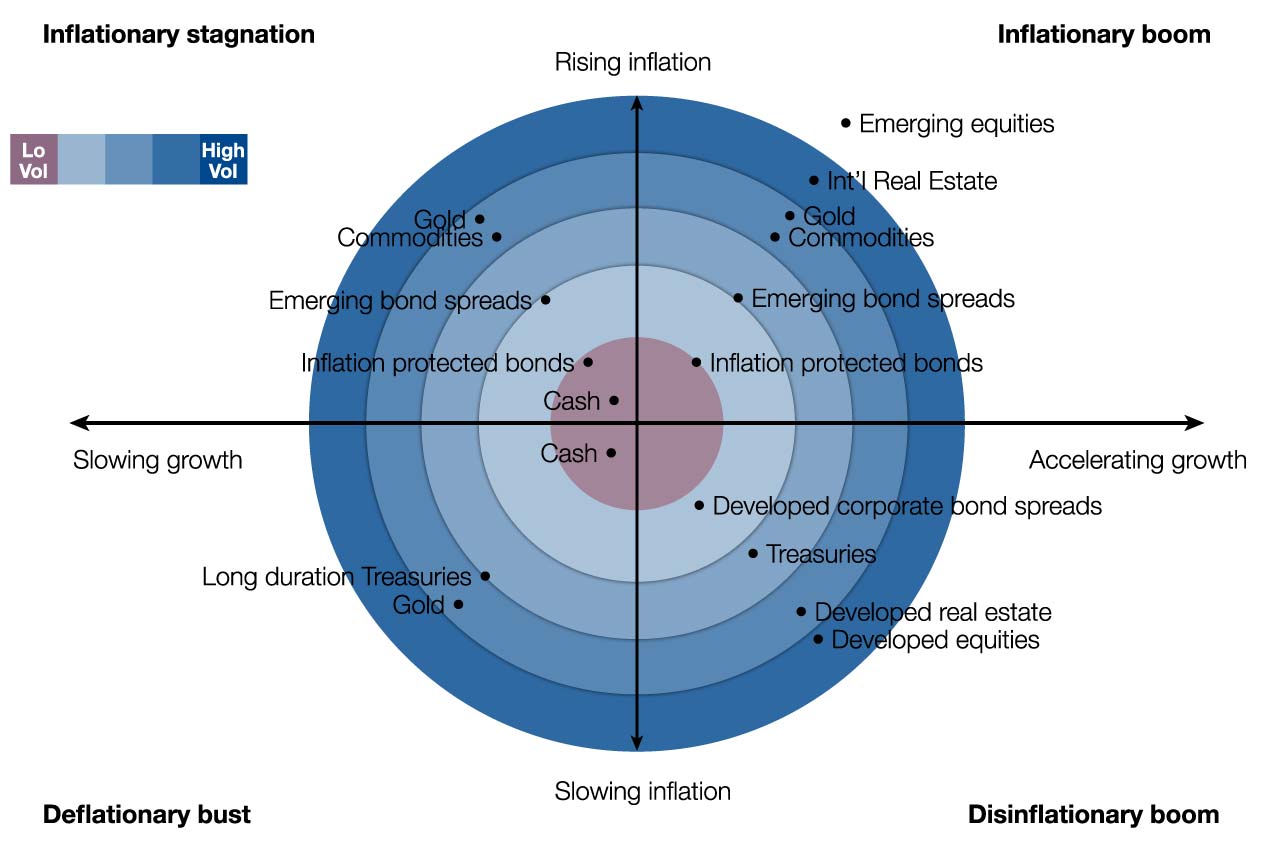

Four Economic Regimes

Risk Parity Backbone = 30%

UPAR at 15% and HRAA.TO at 15% make up the backbone of my risk parity strategy within my DIY ETF portfolio offering up “economic regime ready” asset class exposure.

Both ETFs utilize an expanded canvas format to provide a risk parity solution.

The difference between the funds is that UPAR is a long-only strategy whereas HRAA.TO is adaptive with the ability to go both long and short.

To be honest these funds, as they exist right now, are pretty close to being exactly what I want for the risk parity sleeve of my portfolio.

If I was to really nitpick I’d love to see global market-cap weighted equities get replaced by a factor strategy such as global minimum volatility.

But these funds already offer so much exposure to equities, bonds and alternatives (commodities, gold, currencies, etc) that I feel content with them as they are.

I’m also not looking to increase this sleeve beyond its current 30% weighting.

I’m basically a happy camper within this quadrant of my portfolio.

Efficient Core Portable Beta Arms/Legs = 20%

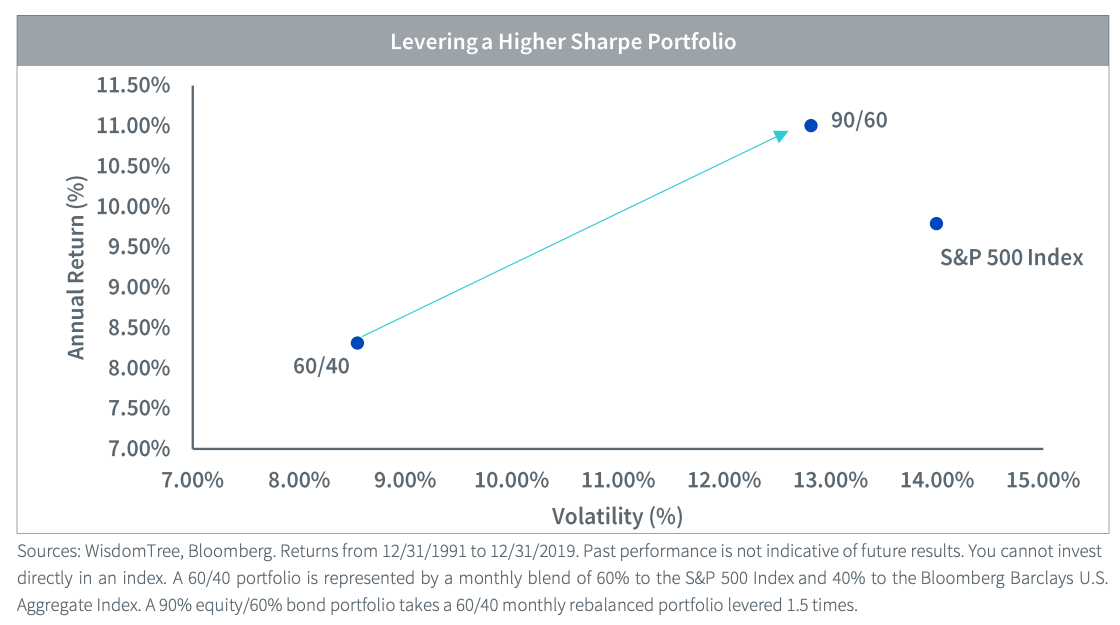

The efficient core (also known as portable beta) sleeve of my portfolio consists of two 90/60 equity/bond ETFs and one 90/90 equity/gold fund from WisdomTree.

Being able to stretch the canvas to gain efficient access to bonds/gold without shaving down my equity position below 90% creates efficient real-estate within my portfolio to pursue other investing strategies.

Furthermore, these funds are extremely cost effective in the sense they have some of the lowest management fees in my portfolio.

Yet, even with all of those positive attributes, I’m seeking potential upgrades in the future.

Let me explain.

I’m a reformed 100% equity only factor investor.

Although I’m thrilled to the moon and back to now have a more diversified portfolio, I’m less happy to have so much exposure to market-cap weighted equities.

I’d love for the 90/60 bond and 90/90 gold framework to be expanded to include different equity strategies.

I’ll certainly key in on some of the funds I think would be incredible at utilizing that specific format.

If innovation continues in the efficient core / portable beta space, I’d consider increasing my exposure from 20% to possibly 25% or 30% in the future.

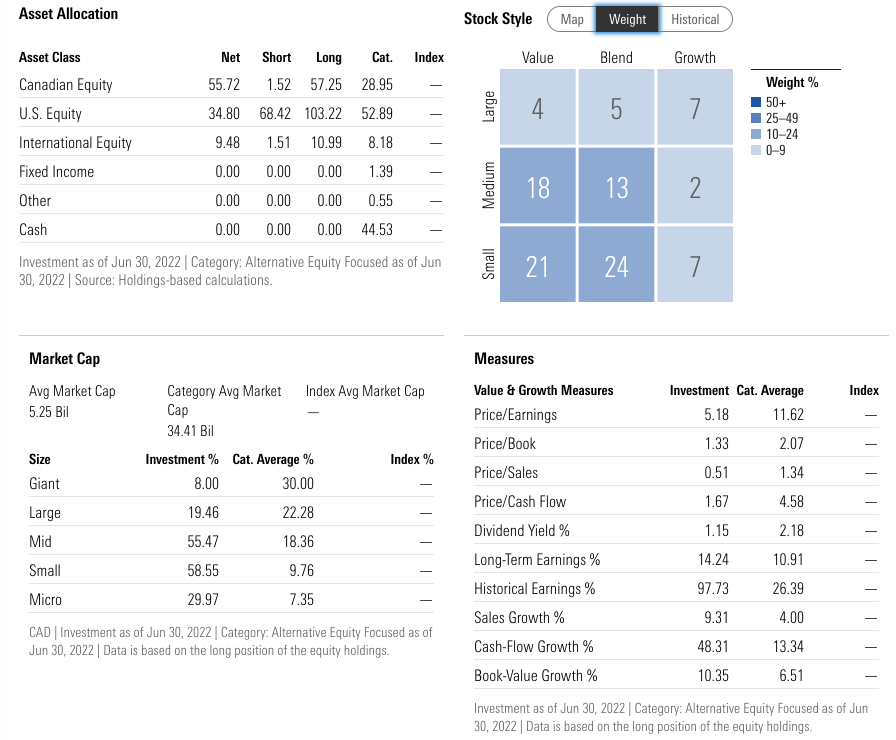

Active Extensions Long-Short Equity Tail = 15%

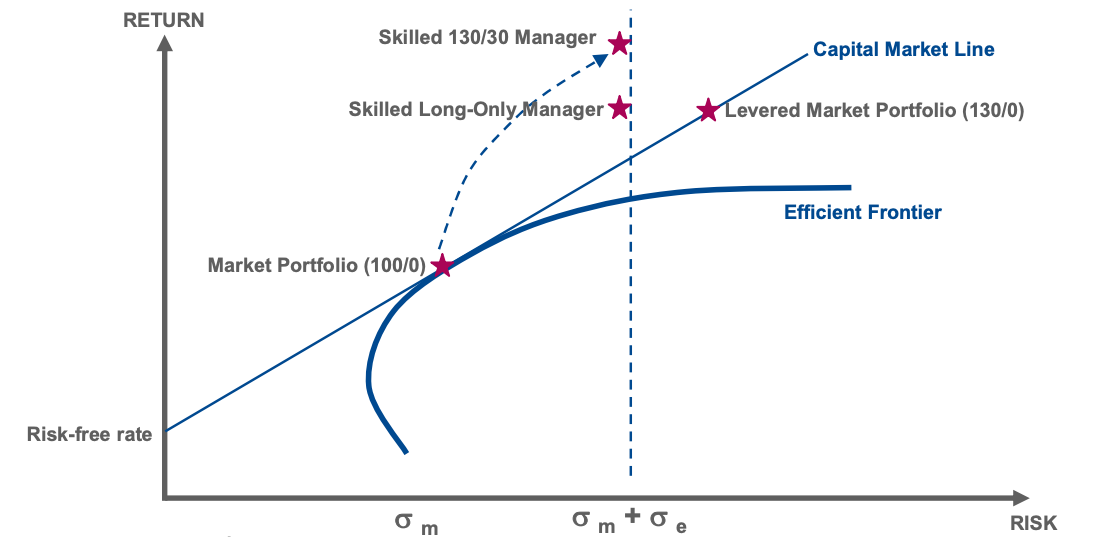

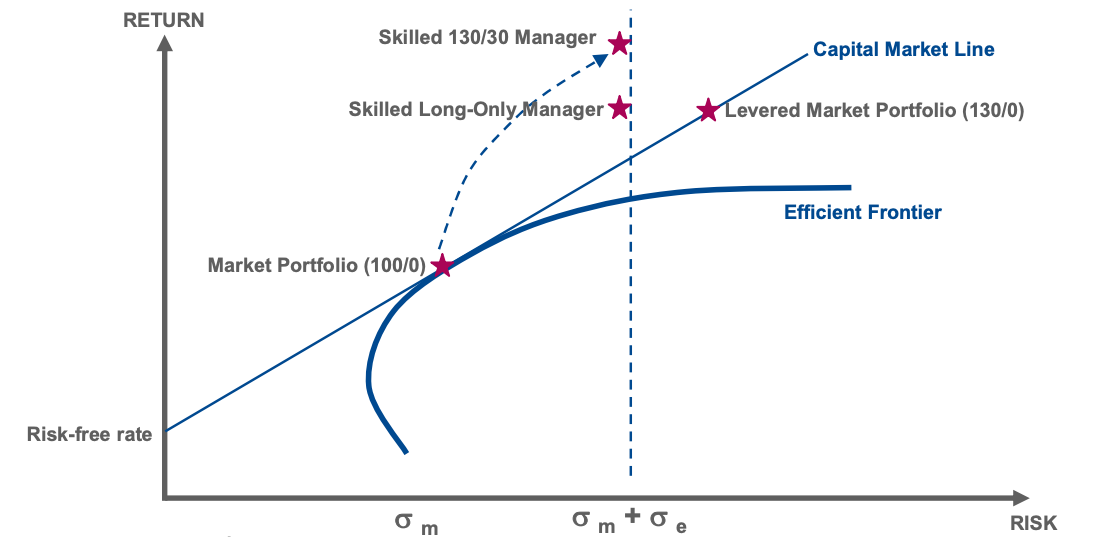

Active extensions long-short absolute return equity mandates are “high conviction” investing strategies that typically involve configurations such as 130-30, 140-40 or even 150-50.

They attempt to capture both sides of the coin by going extra-long equities with the most attractive factors and fundamentals while shorting a smaller slice of the opposite kinds of stocks (basically the shitcos).

It’s an alpha seeking strategy that historically has worked extremely well when pulled off by a skilled active manager able to identify a universe of attractive stocks while simultaneously shorting those that are not.

It is in this sleeve of the portfolio, what I like to refer to as the tail, that I’m pursuing long-short active alpha strategies with funds ATSX.TO, PFAE.TO and HDGE.TO

I’m able to gain equity “factor exposure” with each of these funds which I’m thrilled about.

However, I’d love to see more product development in this area with even more concentrated factor exposure minus junk.

Especially, globally diversified exposure to value and momentum strategies with a sweet mid-cap to small-cap bullseye.

I’d be willing to add another ETF at 5% to expand this sleeve of the portfolio to potentially 20% someday.

Alternatives: Diversified Diversifiers Torso/Core = 35%

Given the capital efficiency of the backbone, arms/legs and tail of my portfolio, I’ve carved out a nice 35% alternative sleeve where five funds reside.

I’ve got ONEC.TO at 10%, PFAA.TO at 10%, DBMF at 5%, FIG at 5% and KMLM at 5%.

Overall, I have primary exposure to long/short strategies within trend-following and global systematic managed futures (aside from trend) as the main layer.

The second layer offers significant exposure to market neutral, merger arbitrage, credit hedging, gold and tail risk strategies.

Finally, I have token exposure in the third layer to REITs, Global Infrastructure, Private Loans and Bitcoin.

Diversified Diversifiers.

Yup.

Check.

However, I’m still seeking innovation in this sleeve of my portfolio.

I’d love to have access to strategies not yet available in ETF form such as reinsurance.

And I also would love more exposure to managed futures strategies that extend beyond trend-following.

Last but not least, I’d love more long-volatility tail-risk protection in my portfolio.

I’ve only got a bit right now.

It’s hard to imagine me wanting to shrink this 35% allocation to alternative strategies but I’d be willing to if newer alternative funds provided more capital efficient usage of various strategies.

3 Fund Ideas From Nomadic Samuel

I could probably list at least 10 different fund ideas but I’m going to limit it to 3 so that we can hear from others.

Let’s dig in.

100/100 Global Min Vol Equities + Trend-Following

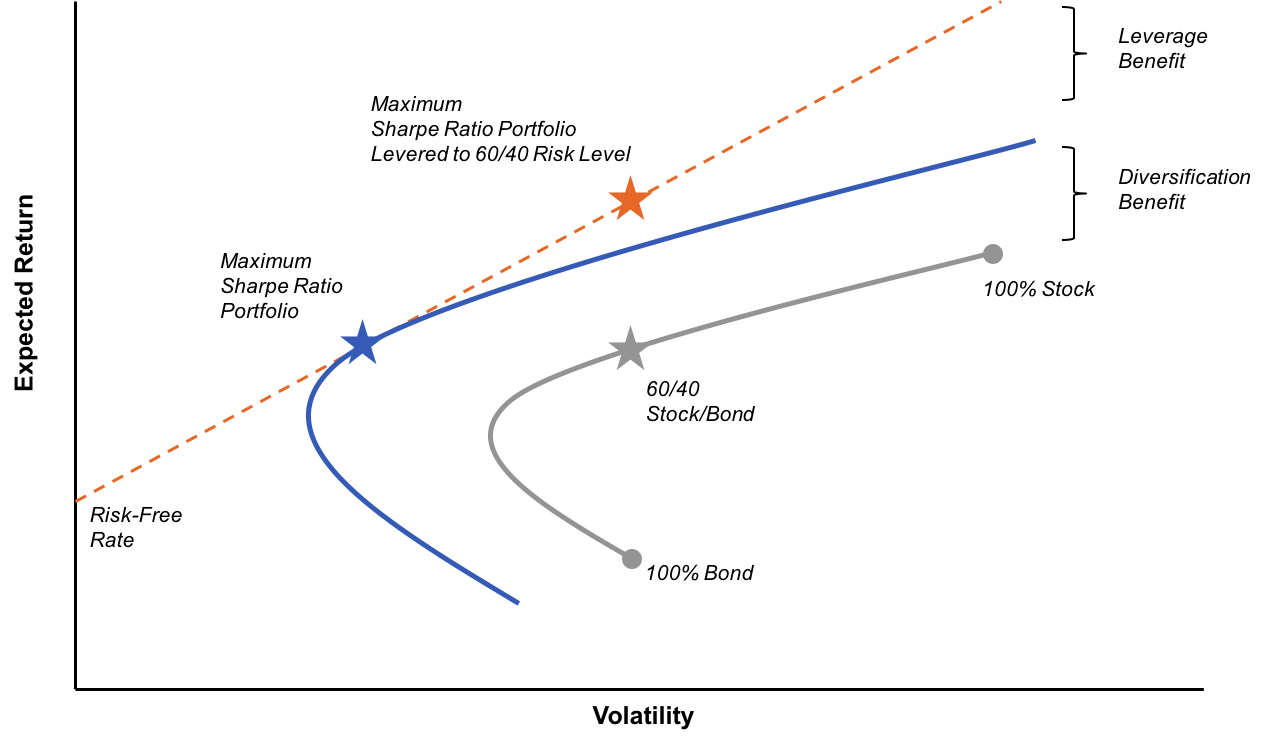

As DIY investors we’re blessed with ETFs that provide us with 90/60 stocks/bond, 90/90 stocks/gold but we’ve yet to see an ETF created that gives you expanded canvas exposure to an equities/managed futures combination.

In the mutual funds space we have some great options such as Standpoint Multi-Asset Fund BLNDX.

However, certain investors (such as myself as a Canadian) are not able to purchase mutual funds and then there is also a category of investors that only invest in ETFs.

Furthermore, I don’t believe there has been a fund that combines an expanded canvas factor equity strategy with managed futures.

So let’s be the first.

We’ll combine the most defensive equity factor “minimum volatility” in tandem with crisis alpha “trend-following” to provide a nice all-weather fund that should handle all four economic regimes better than the classic 60/40.

| YEAR | GLOBAL MIN VOL EQUITIES | SG TREND FOLLOWING | CAGR |

| 2000 | 1.20 | 6.28 | 7.48 |

| 2001 | -10.00 | -0.06 | -10.06 |

| 2002 | -9.60 | 26.12 | 16.52 |

| 2003 | 26.00 | 11.91 | 37.91 |

| 2004 | 20.80 | 2.68 | 23.48 |

| 2005 | 8.30 | 0.75 | 9.05 |

| 2006 | 21.20 | 8.24 | 29.44 |

| 2007 | 6.10 | 8.58 | 14.68 |

| 2008 | -29.20 | 20.88 | -8.32 |

| 2009 | 17.20 | -4.80 | 12.40 |

| 2010 | 12.80 | 13.13 | 25.93 |

| 2011 | 8.00 | -7.93 | 0.07 |

| 2012 | 8.90 | -3.52 | 5.38 |

| 2013 | 19.40 | 2.67 | 22.07 |

| 2014 | 12.10 | 19.70 | 31.80 |

| 2015 | 5.80 | 0.04 | 5.84 |

| 2016 | 8.20 | -6.14 | 2.06 |

| 2017 | 18.00 | 2.20 | 20.20 |

| 2018 | -1.40 | -8.11 | -9.51 |

| 2019 | 24.00 | 9.23 | 33.23 |

| 2020 | 3.30 | 6.28 | 9.58 |

| 2021 | 14.80 | 9.09 | 23.89 |

| 13.78 |

source: SG Trend and MSCI (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

The results of combining MSCI Global Minimum Volatility Equities with SG Trend Following produces results that are beyond impressive.

13.78 AAR (Average Annual Return).

19/22 Positive Returns Success Rate.

But how has it performed this year in 2022 when just about every asset class under the sun has been below water?

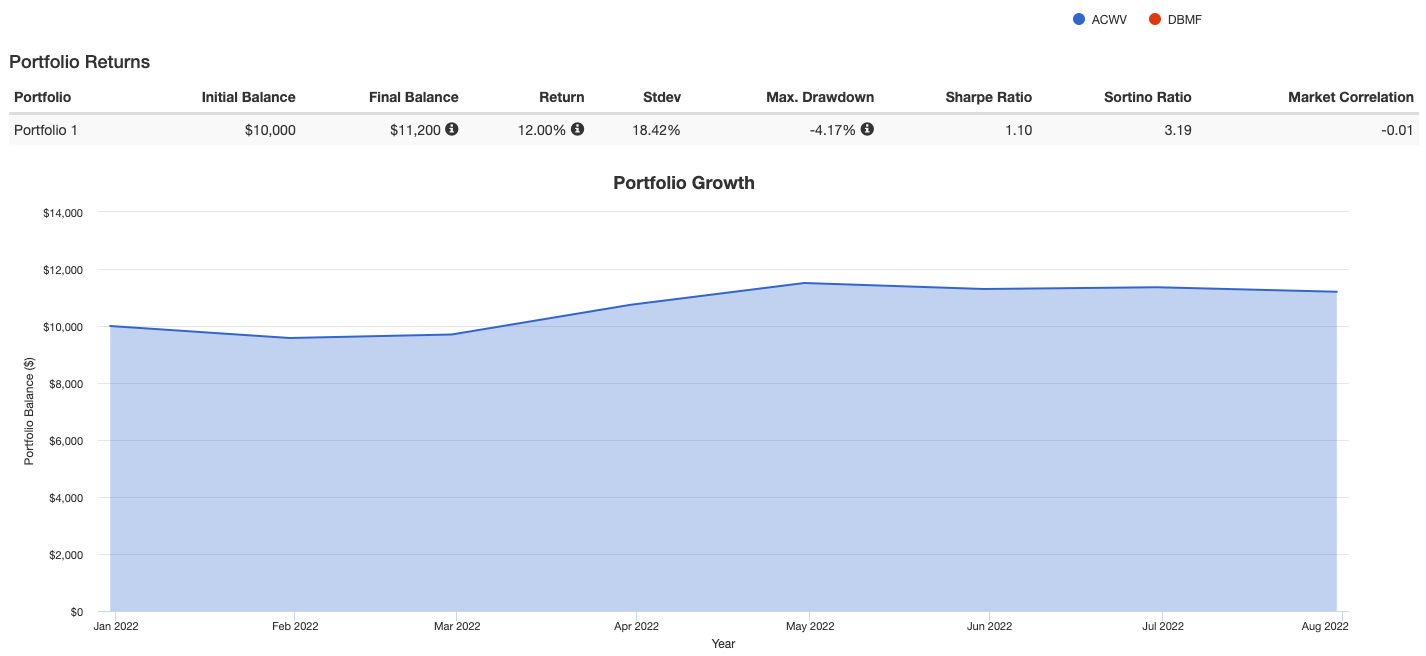

Let’s plug-in ACWV iShares MSCI Global Min Vol Factor ETF and DBMF iMGP DBi Managed Futures Strategy ETF at 2X leverage to find out.

A solid (and especially relatively spectacular) 12.00%.

Most funds/portfolios are below water this year and some are getting absolutely skewered.

If the results continue until the end of the year the success rate of this strategy would increase to 20/23 years which is an 86.9%.

That’s considerably better than most overall portfolios let alone what would here just merely be a single fund.

Factor Exposure: 90/60 Equity/Bond + 90/90 Equity/Gold

The 90/60 NTS(X,I,E) ETF suite of market-cap weighted equities offering US, Int-Dev and EM exposure and 90/90 GDE ETF offering US equities + Gold are easily some of my favourite funds that I own.

The portable beta strategy has historically proven to be successful on two fronts.

Firstly you can obtain full 60/40 exposure in your portfolio (should you desire it) by only utilizing 67% of your portfolio space.

Thus, you create 33% room for other strategies.

Secondly, the 90/60 when compared directly to a 60/40 or 100% equities has historically outperformed both while offering more desirable sequence of returns roll periods (and less jaw dropping negative annual years) when compared to 100% equity only mandates.

However, the problem I face personally as an investor is having WAY MORE market-beta equity exposure in my portfolio than I’d like.

I also know that other “factor equity” investors are tempted by the 90/60 funds but don’t ultimately pull the trigger on them because of the market-cap weighted equities.

The solution to this is painstakingly simple.

Expand the product range, which has been highly successful to date, by offering “factor” equity solutions as the 90% part of the equation.

Small-Cap Value.

Minimum Volatility.

Quality.

Multi-Factor.

Dividend.

Momentum.

Multi-Factor.

Fundamental (Rafi-style).

Anything but market-cap weighted.

Still utilizing a 90/60 cookie-cutter.

Please.

And thank you.

WisdomTree has an incredible product range of factor based equity strategies; hence, a mix and mash combination between some of their most successful factor funds would be a natural fit.

One out of the box idea as an ETF would be 45% Global REITs and 45% Small-Cap Emerging Markets for the 90% equity sleeve and then Gold for the additional 90% as a kind of portfolio completion fund:

90 Equities (45 REIT + 45 Small-Cap Emerging Markets) / 90 Gold

Active Extensions 140/40 Fund

I’ve already discussed (earlier in the article) how active extensions strategies (140-40) have the potential to offer outsized alpha-seeking returns versus long-only 100% canvas equity mandates.

As a factor thirsty investor, I think it would be amazing to see more of these high conviction equity strategies hit the ETF marketplace.

A natural fit might be a firm like Alpha Architect who offers Quantitative Value and Momentum strategies for both US and International Developed Markets.

An equal parts Value and Momentum 140-40 would look something like this:

LONG 140

QVAL = 35%

QMOM = 35%

IVAL = 35%

IMOM = 35%

SHORT 40

JUNK = 40%

LOL.

Junk isn’t a fund. At least not to the best of my knowledge.

However, given Alpha Architects research capabilities and quantitative tools at their disposal, creating an index of JUNK would seem like a natural fit.

It would basically utilize the rigorous process they utilize to identify attractive value/momentum in the opposite manner.

It would seek out the most unattractive stocks from a factor/fundamental perspective to short.

This would be such an awesome fund in my opinion, as it provides the highest conviction equity factor strategy of them all, capturing both the long/short side of the equation.

ETF Fund Ideas From #FinTwit

Although books and podcasts have been the primary sources I’ve used to expand my knowledge as a DIY investor, I’ve also benefited greatly from making new friends, networking and learning on Twitter.

Thus, I’m thrilled to share some of the suggestions by friends as tweets under a thread I recently created: https://x.com/NomadicSamuel/status/1553782925480509446

Global Factor Strategies

There is serious demand for “global” factor strategy ETF funds.

As an example, value investors are currently having to cobble together all three of US, International Developed and Emerging Markets small-cap value funds to allocate globally.

Thus, a request to boil things down to just one fund makes a lot of sense.

A global small-cap value fund.

A global momentum ETF.

A global small-cap multi-factor ETF.

There seems to be considerable demand for these types of products.

The other issue is a serious lack of product availability outside of the US.

European investors (and other global investors) are especially keen to see some of the latest “factor” strategies become available as UCIT ETFs.

Hopefully certain providers will eventually seize upon that opportunity/demand to provide those types of products.

“Avantis global small cap value that follows US/DM/EM weights.” @Luke_Swanson_

- “Global Equities Momentum

- Composite Momentum

- Global Small Cap Value

And…World ex-US…yap does not exists in UCITS (UE).” @MaciejWasek

“The UCITS market lacks good SCV ETFs more generally, sure, there is one US and one Europe one from State Street ETFs, but wonder why Avantis and Dimensional haven’t launched UCITS ETFS yet.” @QuantOfAsia

“I would love to have US ETFs available for EU retail investors, just that.” @NProtasoni

“Global portfolio that doesn’t pay out dividends for taxable accounts.” @DeathStripMall

Leveraged ETFs

Leveraged ETFs were another big theme for further product development in the 1.25X, 2X and 3X categories.

As of now it is possible to get access to 3X S&P or Nasdaq and a few other equity indexes but “factor products” at the 2X to 3X level don’t currently exist.

Small-cap value and Global Minimum Volatility are especially interesting suggestions that came up more than once.

From studying minimum volatility returns, I’ve noticed it can at times be 1000 basis points more defensive during brutal bear markets.

Small-cap value on the other hand has had less sequence of return risk roll periods than some major market indexes in the past 50 years.

Thus, they’re certainly interesting puzzle piece proposals.

Also, further development with managed futures and dual momentum products were suggestions that came up more than once.

“Hmmm…good question:

- 3X Leveraged Small Cap Value (US only and Global versions). UPRO meets VIOV and value tilted VSS.

- 3X Leveraged global min vol fund (h/t @pansareV)

- Simply more low-cost CTA ETFs following different approaches.” @rp_chronicles

“3x levered low vol!” @EMcArdleInvest

“A couple of ideas I’d love to see:

- 2X and 3X Global Min Vol

- Dual Momentum as developed by Gary Antonacci, or more preferably, levered dual momentum applied to a wider set of uncorrelated assets + one additional lookback period + holding top 3 assets instead of 1.” @pansareV

“Dream isn’t how I think of these but as the conversation about portfolio construction evolves, a 1.1X or 1.2x levered SPX for modest return stacking, an ETF of publicly traded exchanges (stock, commodity etc), sport bitcoin (purer access to asymmetry).” @randomroger

Multi-Asset Class/Strategy and Total Portfolio Solutions

Some of my personal favourite ETF ideas from others would likely best be described as multi-asset class and/or multi-strategy solutions with a few even representing total portfolio solutions.

Factor equity and trend-following combinations were some of the key contributions.

Another interesting proposal would be a capital efficient bond plus managed futures fund that would create space for equity exposure.

The Risk Parity Portfolio, Dragon Portfolio and Cockroach Portfolio all receive notable mentions.

Unfortunately, there are some restrictions still in place that make implementing some of those ideas tricky from a regulations standpoint.

“An ETF version of BLDX that replaced the MCW equity exposure with a strong factor tilted global portfolio that accounted for factor momentum.” @FactorDork

“Would love to stuff what we do into an ETF…but regulations prevent it.” @JasonMutiny

“$UPAR Ultra Risk Parity ETF is quite close to a dream portfolio exhibiting global diversification, decent leverage & robustness to inflation/growth regimes.

Alex Shahidi’s approach to Risk Parity is very similar to David Swenson’s approach with built-in contrarian rebalancing rules.”

“I spent a couple of years dreaming of a Dragon-like fund: stocks, bonds, commodities, gold and long vol.

Then Simplify ETFs invented it: $FIG macro strategy.” @1WhiteTruck

“Do you know of any that are effectively QMOM + IMOM overlayed by a VMOT / KMLM type strategy?

Personally I have grown skeptical of long-only bonds.

While good for protecting downside at times it seems that Trend and MF can do that just as well.

And could bonds be over-relied on?”@DominantPort

“World Concentrated Momentum quarterly rebalance with an overlay of Trend Following/MFs (think VMOT + KMLM) meant to catch drawdowns but with an add-on:

Also adds in quantitative management of the Reinsurance asset class that is so hard to access by most investors today.

Further diversification.” @DominantPort

“You put in $100 and effectively get $100 of $TYA plus $100 of $DBMF or $KMLM.

Static bonds could come partly from futures that will net out if the trend is short, plus some direct bond holdings to keep costs low.

Basically a one-stop diversifier for an equity portfolio.” @HML_Compounder

“Could think of all sorts of all-in-one type funds that include my equity preference (multi-factor or just value) plus some futures overlays, but if one still wants better control of the equity side, I think a managed-futures (trend) plus static-bonds fund would be neat.” @HML_Compounder

Other New ETF Ideas

And to round things out we received some other creative suggestions.

“An active ETF positively correlated with VIX with a non negative expected long term return and convexity during crisis.” @milesdividendmd

“two ideas:

ETN that tracks the price of uranium hexafluoride

ETN that tracks the price of separative work units

(preferably without some ridiculous self-defeating ponzi-like structure *ehem cough cough*)” @UraniumFarmer

Nomadic Samuel Final Thoughts

Firstly, a special thanks for all of the ETF wish-list contributions from everyone on #FinTwit!

Absolute legends!

Since we’re already over 3000+ words I’m going to keep this short and sweet.

I feel, as I mentioned at the beginning of the article, that we’ve already entered a golden age for DIY investors.

The ability to cobble together a DIY portfolio that tickles your every fancy has never been easier or more accessible.

Yet, many of us are still dreaming about funds we’d love to have in our portfolios someday in the future.

What an exciting time to be an investor!

Now over to you.

What ETF would you like to see created that doesn’t exist?

Please let us know in the comments section below.

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.