Equity optimization strategies are a primary focus on this investing blog.

However, I’ve mostly spent time unpacking familiar ones such as factor focused quality, value, momentum, minimum volatility and shareholder yield.

Today we’re in for a real treat as we have an opportunity to learn about a unique approach.

Intangible Value.

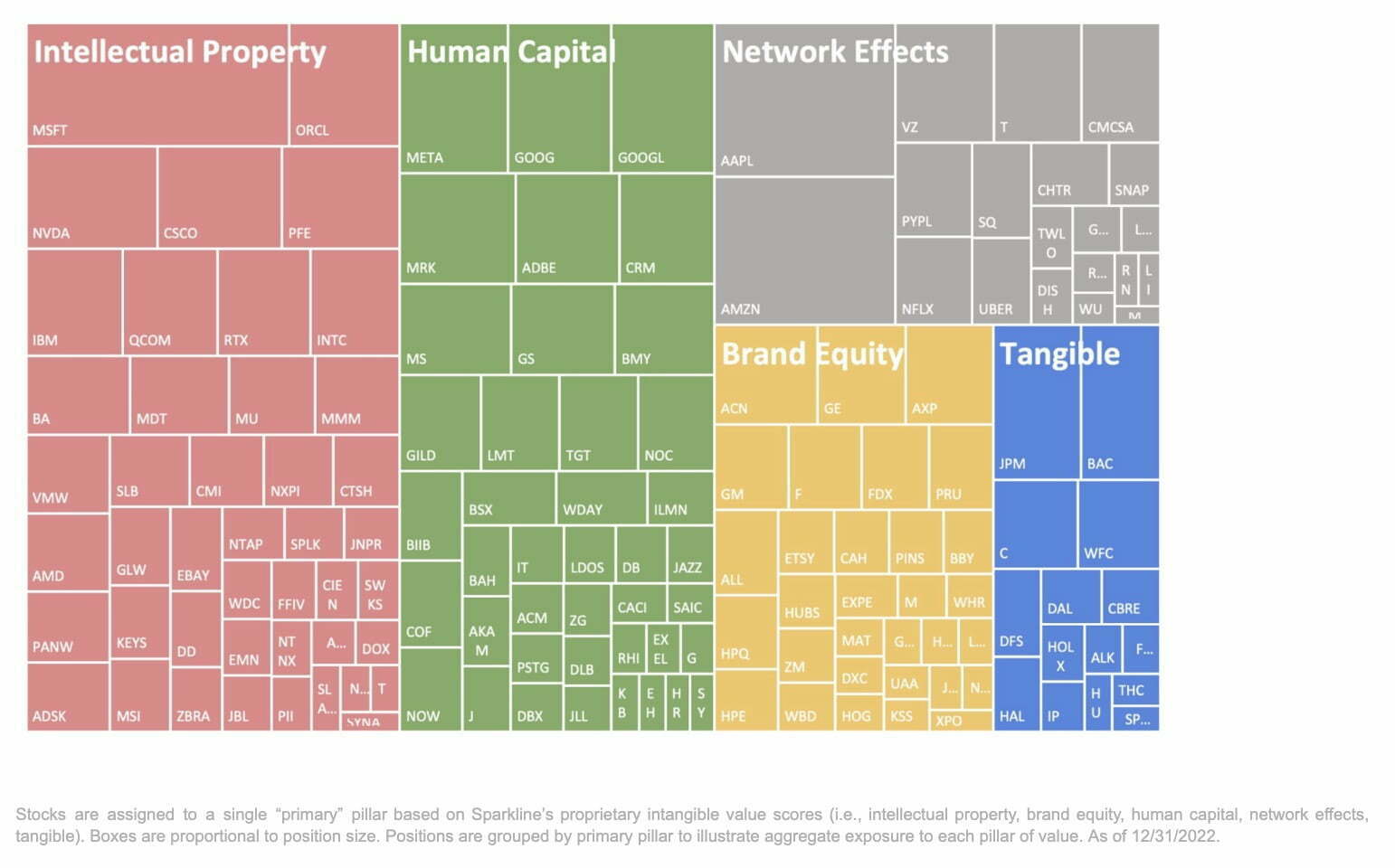

It specifically zeroes in on intangible assets including intellectual property, brand equity, human capital, and network effects.

With this in mind, I’m thrilled to welcome Kai Wu of Sparkline Capital to discuss Sparkline Intangible Value ETF (Ticker ITAN) as part of the “Strategy Behind The Fund” series.

Without further ado, let’s turn things over to Kai!

Meet Kai Wu of Sparkline Capital

My interest in financial markets began with my college economics thesis.

Against the backdrop of the 2008 Global Financial Crisis, I put together a study of hundreds of historical crises, showing how imbalances in asset prices and credit led to elevated crisis risk.

From there, I joined Grantham, Mayo, Van Otterloo (GMO), one of the pioneers of quantitative value investing and famous for its work on financial bubbles.

At GMO, I was fortunate to have the opportunity to travel the world, working with teams across asset classes in Sydney, London, San Francisco and Boston.

In 2014, I left GMO and found myself engaged in crypto trading.

These were the early days when arbitrages were plentiful but not scalable.

I ultimately decided to join a former GMO coworker, and we co-founded a quantitative hedge fund specializing in futures and options.

The firm was successful, growing to a few hundred million dollars in AUM.

In 2018, I left to found my own firm, Sparkline Capital.

Sparkline sets out to answer a trillion dollar question that has vexed me since I started my career: “What explains the last decade’s underperformance of value investment strategies?”

After many years working on this problem, we believe we finally have a solution in our “intangible value” strategy.

Reviewing The Strategy Behind ITAN ETF (Sparkline Intangible Value ETF) with its creator Kai Wu

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of ITAN ETF?

For those who aren’t necessarily familiar with an “intangible value” style of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Let’s start with the definition of value investing.

Value investors seek to buy low and sell high against some measure of fair value.

The style originated in the 1930s with Ben Graham, when the economy was primarily industrial, comprised of utilities, railroads and textile mills.

Of course, the economy has transformed over the past century.

Value today is increasingly driven not by physical capital, but intangible assets, such as intellectual property, brand equity, human capital, and network effects.

Today, most companies in the S&P 500 are intangible-intensive, such as Apple, Google, or Coca-Cola. And intangible investment is only increasing as a share of GDP, so it is unlikely that this trend will abate anytime soon.

The problem is that most investors rely on obsolete accounting data, which has failed to evolve with the rise of the intangible economy.

Accounting statements make only inconsistent and limited disclosure as to intangible assets.

Thus, it is no surprise that traditional value strategies based on metrics such as price / book that omit intangibles have struggled.

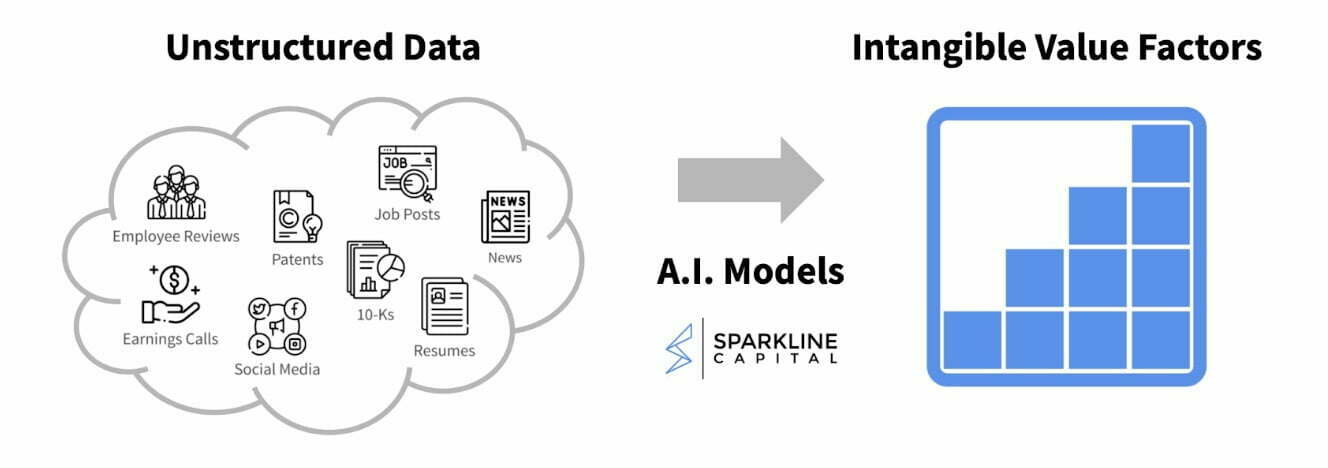

Fortunately, the rise of the digital economy has also led to an explosion of new alternative data sources.

Datasets such as patents, social media and job postings can provide insight into the various intangible pillars.

However, this data is unstructured, meaning it is not amenable to basic statistical analysis.

Thus, we have spent years building expertise in artificial intelligence tools, which allow us to process this natural language data (similar to ChatGPT).

To summarize, the “intangible value” style of investing is just value investing but where intrinsic value also includes intangible assets.

In our view, the principles of value investing are timeless, we just need the metrics to evolve.

Unique Features Of Sparkline Intangible Value ETF ITAN

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The Fund invests in large- and mid-cap U.S. equities.

Our models generate valuation scores for each of the 1,000 largest stocks in the U.S..

The portfolio is then composed of the 150 most attractive companies from this set.

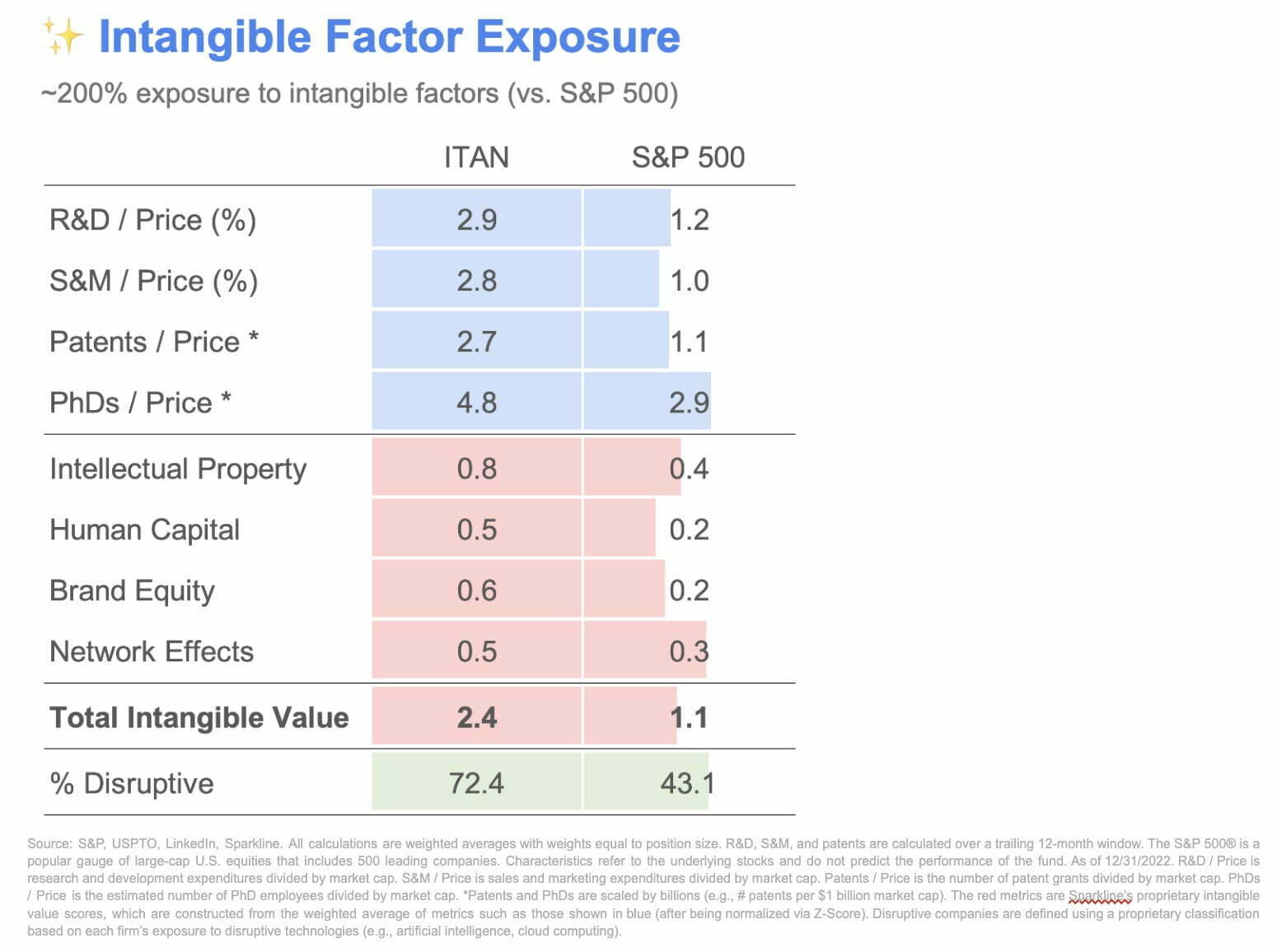

By design, the portfolio offers enhanced exposure to intangible value characteristics.

For example, the number of patents per dollar invested is around 2.5x that of the S&P 500.

We obtain similar advantages for PhDs, R&D, marketing expenditures, and other intangible metrics.

In other words, it invests in companies with stronger IP, brands, human capital and network effects per share.

The strategy is always ~100% invested in stocks, but the relative weightings are rebalanced on a roughly monthly basis in response to changes in prices and fundamentals (e.g., new patent grants, new hires, viral marketing).

While it is fully model driven, it is technically an active strategy (opposed to indexed).

This gives us the ability to upgrade the strategy as new research and datasets become available.

source: Excess Returns on YouTube

What Sets ITAN ETF Apart From Other Equity Funds?

How does your fund set itself apart from other “optimized equity” funds being offered in what is already a crowded marketplace?

What makes it unique?

We are the only ETF purely dedicated to intangible value.

While there are other funds focused on specific pillars, such as company culture, disruptive innovation, or brand, no other fund exists that puts all these ideas together in a consistent way.

Furthermore, our strategy builds in a valuation framework.

Thus, unlike many single-pillar thematic funds (e.g., disruptive innovation), we only own companies if we believe they are reasonably priced.

We are not wedded to any one pillar, but have the ability to rotate as valuations fluctuate.

As we recently saw with the rise and fall of disruptive innovation stocks, valuations matter!

Finally, while some other strategies utilize accounting data to estimate intangibles, our measures of intangible value incorporate unstructured data using natural language processing models.

There are few funds utilizing these cutting-edge techniques.

We believe this gives us a technical advantage over many of the others in the marketplace.

What Else Was Considered For ITAN ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We initially considered implementing the strategy industry-neutral.

This would ensure that we don’t deviate from the S&P 500 industry weightings.

However, we ultimately decided to let the industry-weights emerge bottoms-up based on fundamentals and valuations.

Ultimately, we concluded that the standard industry classifications are deeply flawed.

Most companies cannot be put in a single box.

For example, Amazon is both a retailer and (through AWS) an enterprise tech company.

Furthermore, tech is now a key part of the economy, so the definition of the IT sector is increasingly blurred.

We didn’t want to constrain our strategy based on an arbitrary, reductive classification scheme.

source: Flirting With Models on YouTube

When Will ITAN ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

One major challenge for investors today is that the market environment often shifts between “value and growth.”

For example, many investors rotated into energy and other value stocks last year, just to be whipsawed this month.

We believe factor timing is challenging and that valuation is the best way to navigate through these cycles.

Thus, part of our goal is for the portfolio to not have biases toward certain market conditions, at least over long periods of time.

Our hope is that investors can count on us for the long-term, without having to worry about what market condition we will do better or worse in. We are not a thematic fund suitable for trading.

That said, the Fund does currently have a relatively high exposure to technology companies and limited exposure to energy and materials stocks.

Thus, if energy prices surge again, the Fund will likely underperform.

And if rate hikes abate and tech stocks rip, we will outperform.

However, we view these sorts of macro shocks as mostly unpredictable (at least relative to what the market is already pricing in) over a short run.

And in the long run, they largely wash out in the cycle.

Furthermore, remember that the strategy is active and will rotate over time.

In our backtests, the strategy actually had basically the opposite positioning in the dot-com bubble.

This is because, at the time, tech valuations were extremely overextended against a relatively limited base of fundamental value (which has grown a lot over the past two decades).

source: CFA Institute on YouTube

Why Should Investors Consider Sparkline Intangible Value ITAN ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Low cost beta has an important place in a portfolio.

In equities, these tend to be market-cap weighted indexes following rigid quarterly rebalance rules.

Market cap weighting perversely tends to buy high and sell low, as it increases its weighting as stocks rise in price.

In the dot-com bubble, the S&P 500 increased its weight to the tech sector as the bubble inflated, leading to big losses in the bust.

We believe investors should instead have a value orientation, whereby they consider the price of each stock relative to its fundamentals.

As mentioned, our research shows that intangible assets tend to be frequently undervalued, providing ample opportunities for outperformance.

Replacing some (or all) of one’s index exposure with our Fund can help increase the portfolio’s overall exposure to firms with undervalued intangible assets, which we believe are well positioned to outperform the market.

source: Excess Returns on YouTube

How Does ITAN ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

Our clients use ITAN in a few different ways.

Some investors (such as myself) use it as a core allocation.

The strategy is well diversified (150 names), while providing a more sensible weighting scheme than market cap.

We have conviction that undervalued intangible assets will produce market-beating returns.

Other investors utilize the Fund as a satellite to their core portfolio.

They view ITAN as a way to tilt their portfolio toward stocks with more intangible value.

This gives them a lever to dial up their portfolio’s exposure to intangible value characteristics, but only up to their desired amount.

Importantly, we have found the intangible value factors to have low correlations to traditional style factors (e.g., P/B, momentum, size, quality).

Thus, for investors already using these other factors, mixing in ITAN could be helpful.

We have recently had several investors tell us they are funding ITAN from their “growth” allocation (e.g., QQQ, ARKK*).

Like many growth funds, ITAN owns innovative companies in industries such as software, semiconductors, and healthcare.

However, by paying great attention to valuation, it hopes to employ a more disciplined approach – disruption at a reasonable price, not at any price.

* Not a recommendation to buy or sell securities and positions are subject to change.

The Cons of ITAN ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

The biggest point of criticism is that the top 10 names in the fund look “boring,” as they tend to be companies like MSFT and GOOG*.

This is a function of our weighting scheme.

As mentioned, we select the top 150 from the 1000 largest U.S. stocks.

However, we also weight by both value score and size.

Thus, all else equal, we put more weight behind larger firms.

We considered equal-weighting the portfolio.

However, this would introduce a heavy bias toward the “small cap factor.”

For better or worse, most investors compare us against the S&P 500.

We did not want our relative performance to be driven so heavily by the performance of large vs. small stocks.

In addition, as a quantitative fund manager, we care about how aggregating many small advantages across a portfolio compounds into a big advantage.

While not every holding will be better in every way, the Fund has superior intangible value characteristics at the portfolio level.

In other words, it is less about any one company and more about how they fit together in a portfolio.

* Not a recommendation to buy or sell securities and positions are subject to change.

The Pros of ITAN ETF

On the other hand, what have others praised about your fund?

Our Fund appeals to sophisticated investors with an appreciation for data-driven research.

Over the past few years, we’ve published several papers on intangible investing.

For example, our last paper showed that firms that invest in influence (via lobbying or political donations) tend to outperform.

Other papers have used social media to identify strong brands, Glassdoor reviews for company culture, and Crunchbase to identify sectors of VC investment.

If applicable, our research insights go into the ITAN strategy.

Thus, to the extent investors find our insights around the intangible economy compelling, the Fund ends up being a good way for them to access this in an efficient and transparent vehicle.

source: Instituto Juan de Mariana on YouTube

Driven By Dedication Towards Independent and Innovative Investment Research

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

As mentioned, we are driven by a dedication toward independent and innovative investment research.

If investors are interested in learning more about the strategy, I would highly recommend checking out some of the research papers on our website.

The Intangible Value paper is probably the most relevant, but there several other papers focused on more specific intangible pillars.

Feel free to dive into whatever topic piques your interest!

In terms of current projects, we are currently writing a paper on the big tech layoffs and tech human capital more broadly.

If you’re interested in getting our research as it comes out, you can join our email list here.

Connect With Kai Wu of Sparkline Capital

Website: Sparkline Capital

Fund Page: Sparkline Intangible Value ETF ITAN

Twitter: @ckaiwu

LinkedIn: @ckaiwu

Nomadic Samuel Final Thoughts

I want to personally thank Kai for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.