Ticker $GDE is WisdomTree’s latest efficient core ETF offering greater than 100% portfolio exposure between two different asset classes (gold plus equity).

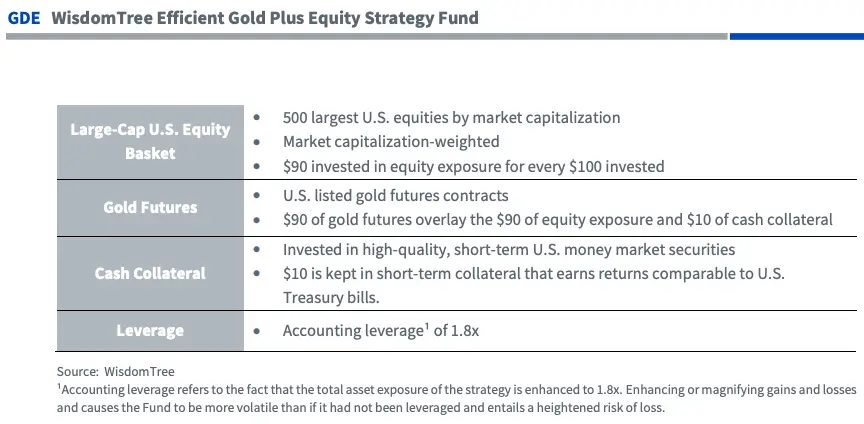

Specifically $GDE is comprised of 90% US large-cap equity securities and 90% gold futures contracts leveraged for an effective coverage of 180%.

What is so exciting about the latest addition to the roster of efficient core WisdomTree products is that it is the first to break the link between stocks/bonds 90/60 combinations while instead offering an enticing stock and gold duo of 90/90.

The best of the S&P 500 and gold?

For investors looking to beef up their alternative asset class exposure to gold without having to shave down equities this may be a fund on your radar.

I’ve done a number of back-tests related to leveraged stock/bond/gold combinations with impressive results throughout the decades.

However, this was my first time to backtest for merely a stock/gold only combination. I had no ideas what the results would be like (teaser: they’re pretty darn impressive).

But for the time being let’s get into the nitty gritty details of the fund.

WisdomTree Efficient Gold Plus Equity Fund | GDE ETF Review

Hey guys! Here is the part where I mention I’m a freakin’ travel blogger! This ETF review is entirely for entertainment purposes only. Do your own due diligence and research while consulting with a financial advisor before considering securities mentioned on this site. Seriously, I’m a travel blogger not a financial professional, so take what I say with a grain of salt; okay? Cheers! 😉

$GDE ETF OVERVIEW

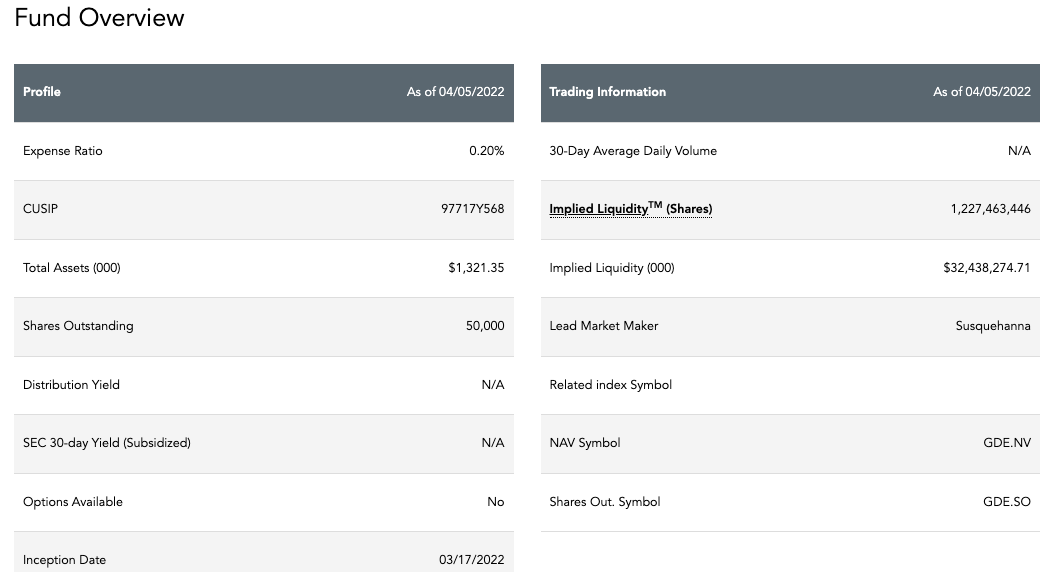

The first thing you’ll notice from the above fund overview is just how brand spanking new it is!

Launched on March 17, 2022 it is newly minted and just getting started from an AUM standpoint.

For such an intriguing fund, and puzzle piece in a return enhanced portfolio, my hope is that it attracts assets promptly.

However, a few things really stand out.

Firstly, the impressive 0.20% expense ratio firmly puts this fund in a class of its own compared to other leveraged funds in the ETF universe that can however around 30 to 75+ basis points higher.

WisdomTree is renowned for keeping its funds low cost and tax efficient. These are huge bonuses as many other leveraged funds do exactly the opposite.

WisdomTree Efficient Gold Plus Equity Strategy Fund Overview, Holdings and Info

The investment case for “WisdomTree Efficient Gold Plus Equity Strategy Fund” has been laid out succinctly by the folks over at WisdomTree: (source: fund landing page)

The WisdomTree Efficient Gold Plus Equity Strategy Fund seeks total return by investing, either directly or through a wholly-owned subsidiary, in a portfolio comprised of U.S.-listed gold futures contracts and U.S. large-cap equity securities.”

Why GDE?

- Gain capital efficient exposure to large-cap U.S. equities and gold through leveraged futures contracts”

- “Use as substitute for large cap U.S. equity, multi-asset, or alternative strategies”

- Use to enhance portfolio diversification with gold futures as a potential inflation hedge”

WisdomTree Efficient Gold Plus Equity Strategy Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom. (source: summary prospectus)

Principal Investment Strategies of the Fund

The Fund is actively managed using a models-based approach.

The Fund seeks to achieve its investment objective by investing, either directly or through a wholly-owned subsidiary, in a portfolio comprised of (i) U.S.-listed gold futures contracts and (ii) U.S. equity securities. The Fund uses U.S.-listed gold futures contracts to enhance the capital efficiency of the Fund. Capital efficiency is the ability for an investment to gain exposure to a particular market while using fewer assets.

The Fund will invest in a representative basket of U.S. equity securities of large-capitalization companies generally weighted by market capitalization.

Under normal circumstances, the Fund will have approximately equal exposure to U.S.-listed gold futures contracts and U.S. equity securities.

To the extent exposure of the Fund deviates from the targeted allocation by 5% or greater, it is anticipated that the Fund will be rebalanced to more closely align with the original target allocations.

The Fund may invest in U.S. Treasury securities and other liquid short-term investments as collateral for its U.S.-listed gold futures contracts.

The Fund will not invest directly in physical commodities.

The Fund seeks to gain exposure to the commodity market for gold, in whole or in part, through investments in a subsidiary organized in the Cayman Islands (the “WisdomTree Subsidiary”). To provide such exposure, the WisdomTree Subsidiary will invest primarily in U.S.-listed gold futures contracts.

The WisdomTree Subsidiary is wholly owned and controlled by the Fund. The Fund’s investment in the WisdomTree Subsidiary may not exceed 25% of the Fund’s total assets at each quarter-end of the Fund’s fiscal year.

The Fund’s investment in the WisdomTree Subsidiary is intended to provide the Fund with exposure to the investment returns of gold while

enabling the Fund to satisfy source-of-income requirements that apply to regulated investment companies (“RICs”) under the Internal Revenue Code of 1986, as amended (the “Code”).

Except as noted, references to the investment strategies and risks of the Fund include the investment strategies and risks of the WisdomTree Subsidiary.

WHY GOLD PLUS EQUITY IN ONE FUND?

With 60/40 equities/bonds being the orthodox milquetoast portfolio of the day why would any investor deviate to a 90/90 stock/gold combo?

Well, we’re about to find out: (bring on the return stacking back-tests!)

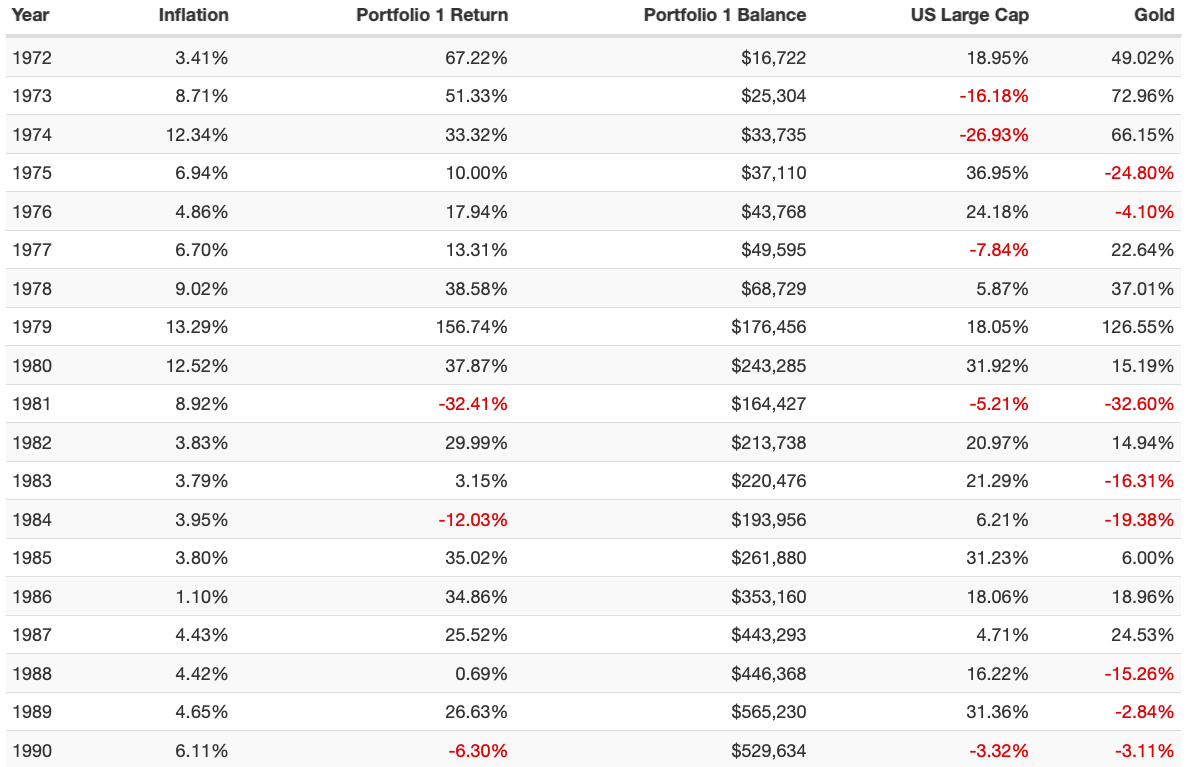

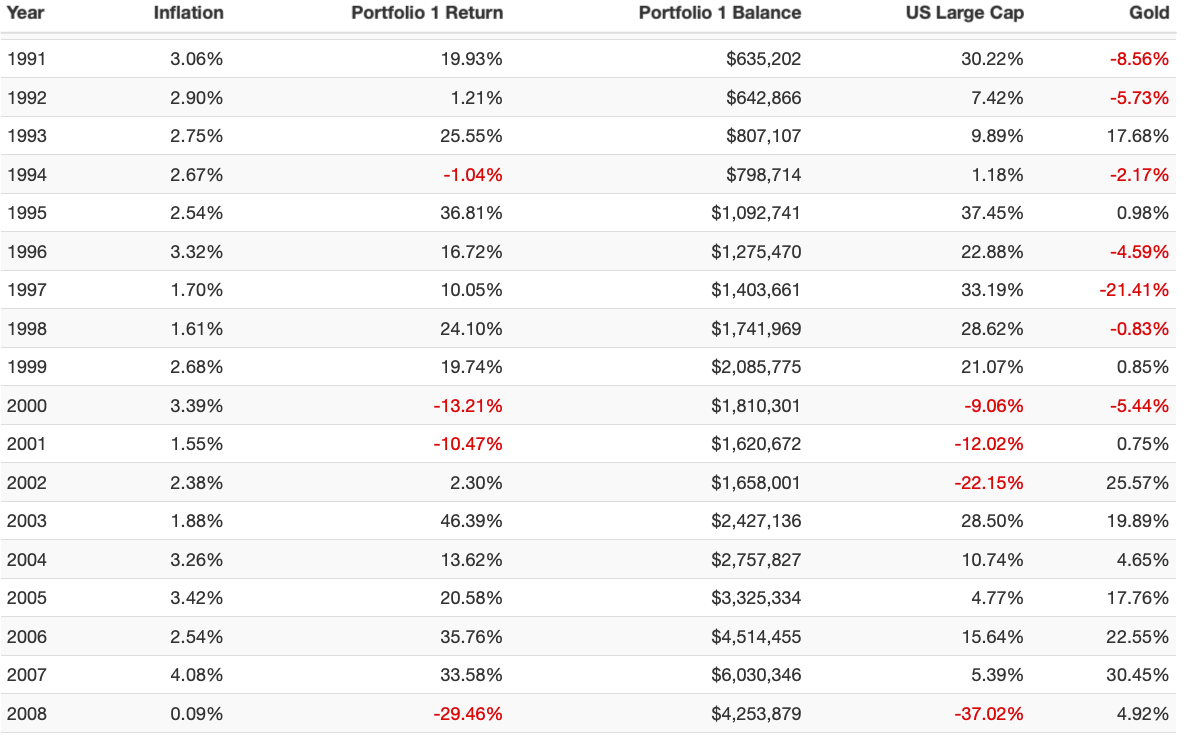

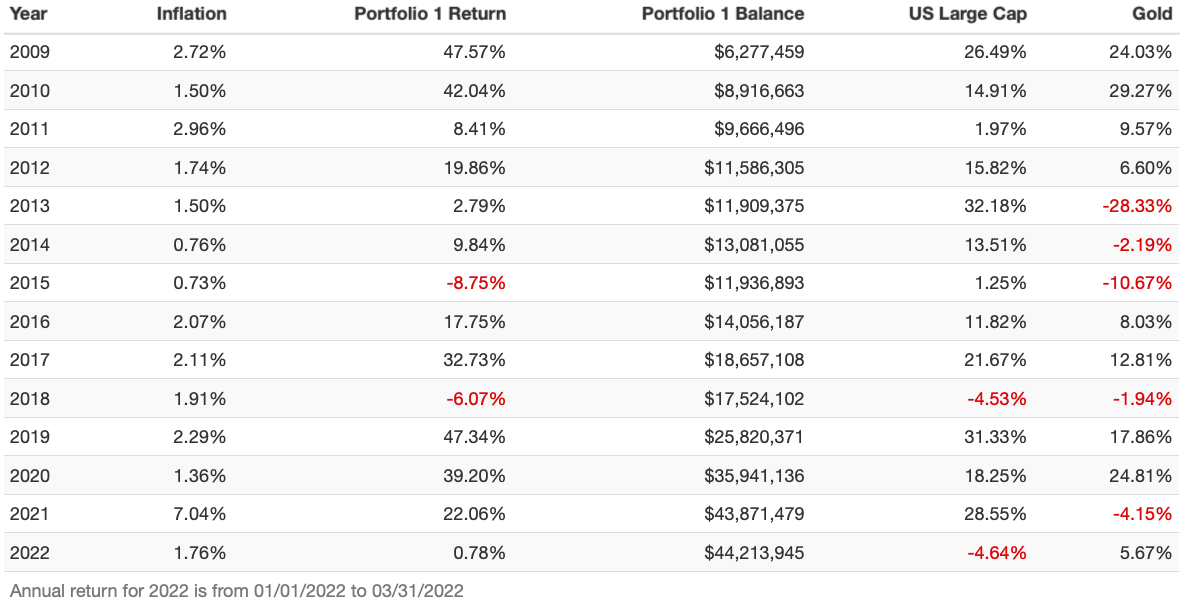

Here are the results of a simulated backtest of 90% US Large Cap Equities and 90% Gold from the 21st century from 2000 to 2022.

Anything stand out to you?

How about the insane 14.71% CAGR and relatively stable 20.25% Stdev.

What’s more impressive is that the dynamic duo outperformed the S&P 500 in the years 2001, 2002 and 2008 when times were rough.

Hands up for those who knew that gold has outperformed the S&P since 2000 until 2022?

Yeah, I don’t see too many from over here 😉

With a CAGR of 8.54% and low market correlation of 0.05 it proves to be a worthy ally.

Basically, the hypothetical fund given its twin engines approach has always been there to prompt up the struggling co-pilot and vice versa.

For instance, when the US large cap equities struggled in the 70s and 2000s gold picked up the tab.

Conversely, the S&P 500 would have been a better bet in the 80s, 90s and 2010s.

Who knows what the future holds but at least over the past 50 years they’ve been reliable partners when one is struggling over the other.

1972 to 2022 Backtest: US Large Cap and Gold

This is where I’m sold on the perpetual Batman and Robin relationship between US large cap stocks and gold.

From 1972 until 2022 the dynamic duo has only both been down together annually on 4 occasions!

1981. 1990. 2000. 2018.

That’s it.

Either one engine in the black or two every other year.

Let’s compare the US large cap 2 of the worst years vs the hypothetical 90/90 stock/gold fund.

The toughest years would have corresponded to the S&P also getting pounded. 1981 and 2008.

Overall the 90/90 stock/bond superduo only had 9 negative years of which 4 were single digit, 3 in the low teens and two super ouch -30+.

Keep in mind this fund would be frustrating from a tracking error perspective on certain years even when numbers are net positive.

For instance, take 2013 when US stocks delivered a mighty 32.18% while gold dragged things down by -28.33%.

How Does This Fund Potentially Fit Into A Portfolio?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

I think it is fair to suggest the 90/90 stock/gold $GDE ETF is not meant to be a total portfolio solution.

That is unless you’re an investor that is 100% S&P long only and feel okay with home country bias.

In that case this fund along with $NTSX 90/60 stocks/bonds would provide a worthy bond and gold allocation to your portfolio assuming you’re willing to trim you equities by 10%.

What is a more likely scenario is that investors may be attracted to this fund as one of many efficient core building blocks to build a portfolio of globally diversified equities, bonds and alternatives (such as gold).

If that is the case sticking within the WisdomTree family of efficient core products provides for some stellar combinations. One to consider may be as follows:

30% $GDE (90 US Equities / 90 Gold)

30% $NTSX (90 US Equities / 60 Bonds)

20% $NTSI (90 INT DEV Equities / 60 Bonds)

20% $NTSE (90 EM Equities / 60 Bonds)

This 4 fund portfolio would be easy to manage and offers globally diversified equities while offering substantial allocations to both gold and bonds. The overall coverage would be as follows:

US Equities = 54%

INT DEV Equities = 18%

EM Equities = 18%

US Bonds = 42%

Gold = 27%

For a portfolio that isn’t pursuing total capital efficiency or leverage strategies another option would be for this fund to swap out your S&P core holding.

Both $GDE and $NTSX offer attractive solutions for investors hoping to add gold and/or bonds in that scenario.

GDE ETF Pros and Cons

PROS

- Impressive double digit CAGR throughout every decade I back-tested. In fact, no lost decades and particularly good performance in 70s and 2000s when US equities struggled

- 90/90 exposure is definitely an alpha strategy that should add overall returns to the portfolio in a significant manner

- Tax Efficient and Low Cost

- Brings an alternative asset class (gold) into 60/40 portfolios that are lacking alternatives

- Is a great diversifier for return stacking portfolios that are already heavy in bonds

- Combines great with other diversifying alternative strategies as it tends to be uncorrelated with traditional asset classes and alts

- Ability to add gold into your portfolio without having to shave down your equity sleeve

- Support a fund provider in WisdomTree that provides great capital efficient solutions

CONS

- Leverage in a portfolio does bring about associated risks that need to be carefully considered by investors. Investors prone to loss aversion and recency bias should stay far away

- Tracking error during certain years where one asset (either stocks or gold) is performing well when the other isn’t. Especially the case when the S&P is strong and gold is potentially dragging it down

- The potential for the two asset classes to be down significantly in the same year. Although unlikely it is possible

GDE ETF FINAL THOUGHTS (GOLD PLUS EQUITY)

I feel like $GDE compared to $NTSX has flown under the radar a bit since initially hitting the market.

To me that’s a shame and it is a reflection that most investors still don’t see the value in carving out an alternative sleeve into the portfolio to add further diversification.

I’ll admit here that I’m long $GDE for its gold plus equity and it is one of my favourite new funds in the ETF marketplace.

I have to give WisdomTree a lot of credit for embracing the efficient core strategies and sensible use of leverage concept more than other providers out there.

My hope would be that this fund thrives and attracts an AUM that keeps it robust and viable for years to come. All hail gold plus equity!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Fantastic article. This is a goldmine of information. Thanks very much!!

A couple of questions.

1)What has your performance been since you started this portfolio?

2)Is there a danger that there is a lot of marketing hype behind these ETFs, just trying to gather AUM?

3) Would it not be better for these ETFs to have slightly longer performance records. Some of the ones you have chosen have virtually no history.

4) For funds that use leverage, am I right in thinking there s volatility decay (as in some of the leveraged ETFs)

Again, thanks again for this.

I love pairing this with RSBT. I just wish that instead of being an S&P 500 equity position it’d invest 90% into a heavily factored ETF like a Dimensional/Avantis ETF.