I’ve yet to witness the meteoric rise of a fund greater than iMGP DBi Managed Futures Strategy ETF DBMF.

In a year where most stock and bond allocations have had investors pulling their collective hair out, DBMF ETF has offered rip-roaring robust returns as a counterpoint.

Ah, the power of adding uncorrelated asset classes and strategies to your mix of long only equities and fixed income has been on full display in 2022.

Yet, it wasn’t always like this.

The 2010s were a particularly challenging decade for most Managed Futures strategies while efforts to diversify portfolios beyond large cap US growth stocks proved relatively futile.

Oh, how times have changed.

Hey guys! Here is the part where I mention I’m a travel content creator! This investing opinion blog post ETF Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

iMGP Global Partner Funds and DBi Dynamic Beta investments Partnership

DBMF ETF is a partnership between iMGP (iM Global Partner Funds) and DBi (Dynamic Beta investments).

Andrew Beer and Mathias Mamou-Mani head The New-York based team of Dynamic Beta investments with decades of experience in the alternative hedge fund space.

iMGP DBi Managed Futures Strategy ETF is the fund garnering all of the spotlight at the moment but an equally intriguing alternative ETF (DBEH) is a fascinating long-short equity hedge fund that Andrew and Mathias have also created.

We’ll focus most of our attention upon DBMF but we’ll also touch upon DBEH later on in the review.

The Case For Managed Futures Strategies In Your Portfolio

The forever swinging pendulum that rewards one particular strategy (at the expense of others) will at some point mean revert as a new economic regime emerges.

In this current high inflation regime, traditional long-only equity and fixed income strategies have revealed their Achilles’ heel whereas adaptive strategies with the capacity to go long and short equity, bond, currency, commodity and precious metal indexes have thrived.

Why?

Because of strong trends.

With equity and bond markets clearly down trend-following managed futures systematic style of investing has gracefully captured the short side of the equation.

On the other hand, strong upward trends across a broad set of certain commodities futures reveal the strategies dual capacity to also go long.

Being able to adapt to the current economic environment while not fighting reality is its greatest feature and certainly not in any way, shape or form a bug.

Hence, if the moving day average of the Managed Futures trend-following system is moving upwards it’ll go long.

If it’s moving downwards it’ll go short.

This system works brilliantly when trends are strong and falters when they’re not.

When do trends tend to be the strongest?

Specifically, they’re often strong in market regimes like the one we’re witnessing in 2022, where it’s clear certain things are downward trending (most equity, bond and currency indexes) whereas many commodities have been upward trending.

With the capacity to go both long and short across a globally diversified wide selection of indexes, DBMF ETF has been able to capture both sides of the coin.

It says “yes” to everything whereas long-only investments suffer when they’re on the wrong side of the current economic environment.

More importantly, Managed Futures Trend-Following strategies are uncorrelated with both stocks and bonds providing a tremendous diversification benefit for investors that carve out ample enough space for them in the alternative sleeve of their portfolios.

It’s easy to get excited and overly giddy about a needle in a haystack when it is performing outstandingly compared to just about everything else under the sun.

However, investors have typically jumped in and out of managed futures strategies (often at the worst of times) piling in like a Wildebeest herd after it’s performed well and bailing on it in droves in subsequent years when inevitable rough patches arise.

Savvy investors don’t view managed futures as a single line item but rather as an uncorrelated strategy (to long-only equities and bonds) that is worthy of a permanent asset allocation whereas “weak hands” investors will take a more fair-weather approach.

source: The Market Huddle on YouTube

DBMF ETF Overview, Holdings and Info

DBMF ETF sets itself apart from its competition by minimizing “single manager” risk by instead attempting to replicate the pre-fee performance of leading managed futures hedge funds without the exorbitant fees.

Hence, bringing institutional level hedge fund strategies to retail investors at an affordable cost well below industry standard.

It has the capacity to go both long and short Global equity, bond, commodity and currency indexes via futures contracts and forward contracts.

iMGP DBi MANAGED FUTURES STRATEGY ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund is a non-diversified, actively-managed exchange-traded fund (“ETF”) that seeks to achieve its objective by:

(i) investing its assets pursuant to a managed futures strategy (described below); (ii) allocating up to 20% of its total assets in its wholly-owned subsidiary (the “Subsidiary”), which is organized under the laws of the Cayman Islands, is advised by the Sub-Advisor (as defined herein), and will comply with the Fund’s investment objective and investment policies; and (iii) investing directly in select debt instruments for cash management and other purposes.

The Fund’s managed futures strategy employs long and short positions in derivatives, primarily futures contracts and forward contracts, across the broad asset classes of equities, fixed income, currencies and, through the Subsidiary, commodities.

Fund positions in those contracts are determined based on a proprietary, quantitative model – the Dynamic Beta Engine – that seeks to identify the main drivers of performance by approximating the current asset allocation of a selected pool of the largest commodity trading advisor hedge funds (“CTA hedge funds”), which are hedge funds that use futures or forward contracts to achieve their investment objectives.

The Dynamic Beta Engine analyzes recent (i.e., trailing 60-day) performance of CTA hedge funds in order to identify a portfolio of liquid financial instruments that closely reflects the estimated current asset allocation of the selected pool of CTA hedge funds, with the goal of simulating the performance, but not the underlying positions, of those funds.

Based on this analysis, the Fund will invest in an optimized portfolio of long and short positions in domestically-traded, liquid derivative contracts.

The Dynamic Beta Engine uses data sourced from (1) publicly available U.S. futures market data obtained and cross-checked through multiple common subscription pricing sources, and (2) public CTA hedge fund indexes obtained through common subscription services and cross checked with publicly available index information.

The Sub-Advisor relies exclusively on the Dynamic Beta Engine and does not have discretion to override the model-determined asset allocation or portfolio weights.

The Sub-Advisor will periodically review whether instruments should be added to or removed from the model in order to improve the model’s efficiency.

The model’s asset allocation is limited to asset classes that are traded on U.S.-based exchanges.

Based on this analysis, the Fund will invest in an optimized portfolio of long and short positions in domestically-traded, liquid derivative

contracts selected from a pool of the most liquid derivative contracts, as determined by the Sub-Advisor.

Futures contracts and forward contracts are contractual agreements to buy or sell a particular currency, commodity or financial instrument at a pre-determined price in the future.

The Fund takes long positions in derivative contracts that provide exposure to various asset classes, sectors and/or markets that the Fund expects to rise in value, and takes short positions in asset classes, sectors and/or markets that the Fund expects to fall in value.

The Fund expects to limit its investments to highly-liquid, domestically-traded contracts that the Sub-Advisor believes exhibit the highest correlation to what the Sub-Advisor perceives to be the core positions of the target hedge funds.

Such core positions are generally long and short positions in domestically-traded derivative contracts viewed as highly liquid by the Sub-Advisor.

Agreeing to buy the underlying instrument is called buying a futures contract or taking a long position in the contract.

Likewise, agreeing to sell the underlying instrument is called selling a futures contract or taking a short position in the contract.

The Fund may have gross notional exposure, which is defined as the sum of the notional exposure of both long and short derivative positions across the Fund, that approximates the current asset allocation and matches the risk profile of a diversified pool of the largest CTAs.

The Investment Company Act of 1940, as amended (the “1940 Act”), and the rules and interpretations thereunder, impose certain limitations on the Fund’s ability to use leverage.

Under normal market conditions, the Sub-Advisor will seek to achieve Fund volatility of 8-10% on an annual basis, which refers to the approximate maximum amount of expected gains or losses during a given year expressed as a percentage of value.

The Sub-Advisor will, in an effort to reduce certain risks (e.g., volatility of returns), limit the Fund’s gross notional exposure on certain futures contracts whose returns are expected to be particularly volatile.

In addition to these specific exposure limits, the Sub-Advisor will use quantitative methods to assess the level of risk for the Fund.

The Fund intends to gain exposure to commodities through its investments in the Subsidiary and may invest up to 20% of its total assets in the Subsidiary. Generally, the Subsidiary will invest primarily in commodity futures, but it may also invest in financial futures, fixed income securities, pooled investment vehicles, including those that are not registered with the SEC under the 1940 Act, and other investments intended to serve as margin or collateral for the Subsidiary’s derivative positions.

Unlike the Fund, the Subsidiary may invest without limitation in commodity-linked derivative instruments; however, the Subsidiary complies with the same 1940 Act asset coverage requirements with respect to its investments in commodity-linked derivatives that are applicable to the Fund’s transactions in derivatives. In addition, to the extent applicable to the investment activities of the Subsidiary, the Subsidiary will be subject to the same fundamental investment restrictions and will follow the same compliance policies and procedures as the Fund.

Unlike the Fund, the Subsidiary will not seek to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund is the sole investor in the Subsidiary and does not expect shares of the Subsidiary to be offered or sold to other investors.

In addition to its use of futures and investment in the Subsidiary, the Fund expects, under normal circumstances, to invest a large portion of the portfolio in debt securities in order to collateralize its derivative investments, for liquidity purposes, or to enhance yield.

The Fund may hold fixed income instruments of varying maturities, but that have an average duration of less than one year.

In particular, the Fund may hold government money market instruments, such as U.S. Treasury securities and U.S. government agency discount notes and bonds with maturities of two years or less.

The Fund will not invest in cryptocurrency or digital assets or cryptocurrency or digital asset derivatives.

Since the Fund is non-diversified, it may invest a greater percentage of its assets in a particular investment or issuer than a diversified fund.”

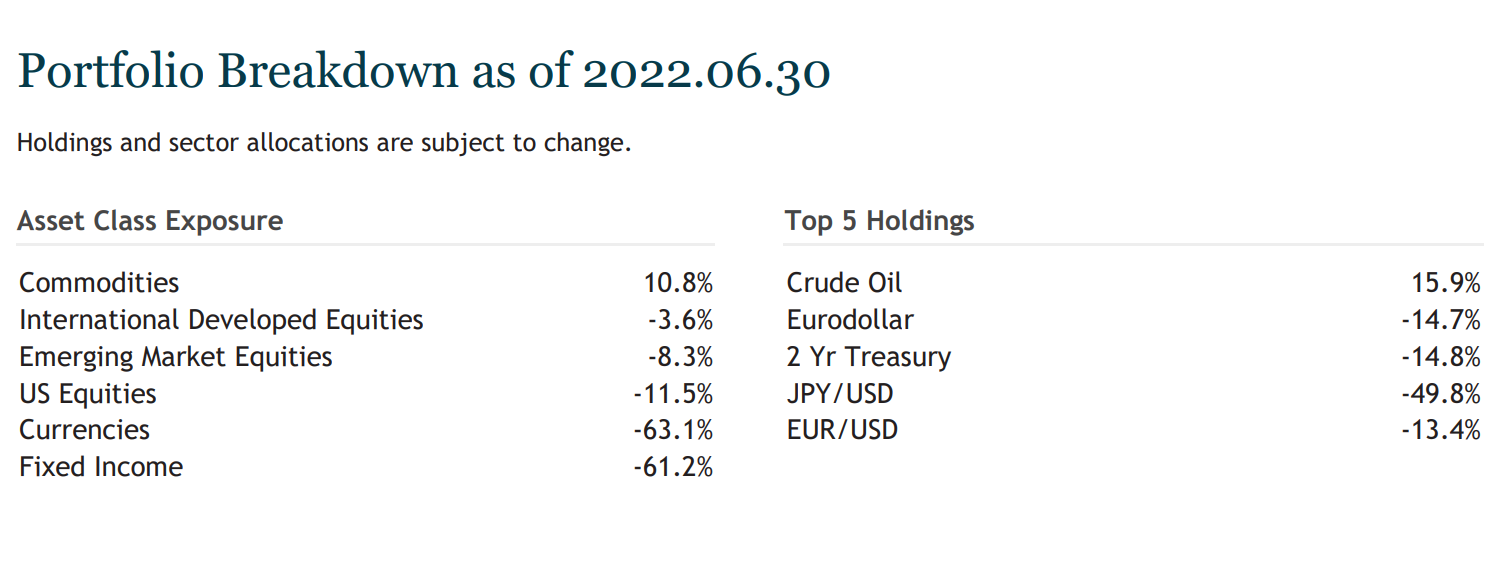

DBMF ETF Portfolio Asset Class Exposure

What’s immediately apparent is that the fund is predominantly taking short positions across the board with Global Equities, Currencies and Fixed Income with the lone long shining star of Commodities.

It’s important to keep in mind that these are dynamic and not static positions.

If you’re reading this article several months (or even a year later) you’ll likely notice a radically different outcome.

source: Raise Your Average on YouTube

DBMF ETF INFO

Ticker: DBMF

Net Assets: $1,046,521,137

Expense Ratio: 0.95%

With an all-in expense ratio of 0.95% iMGP DBi Managed Futures Strategy ETF can parade around the square with a victory lap because it has managed to bring double digit basis points fees to what is almost exclusively a triple digit basis point domain.

The fund has accumulated assets like there is no tomorrow seeing its biggest flows in 2022.

That’s all fine and dandy but how about the funds performance?

iMGP DBi Managed Futures Strategy ETF Performance

It’s one thing to talk about a fund’s strategy but it’s another to see how it has performed over the past couple of years.

What’s the best way to describe DMBF ETF returns versus the industry standard 60/40 portfolio?

Rocket-ship to the moon!

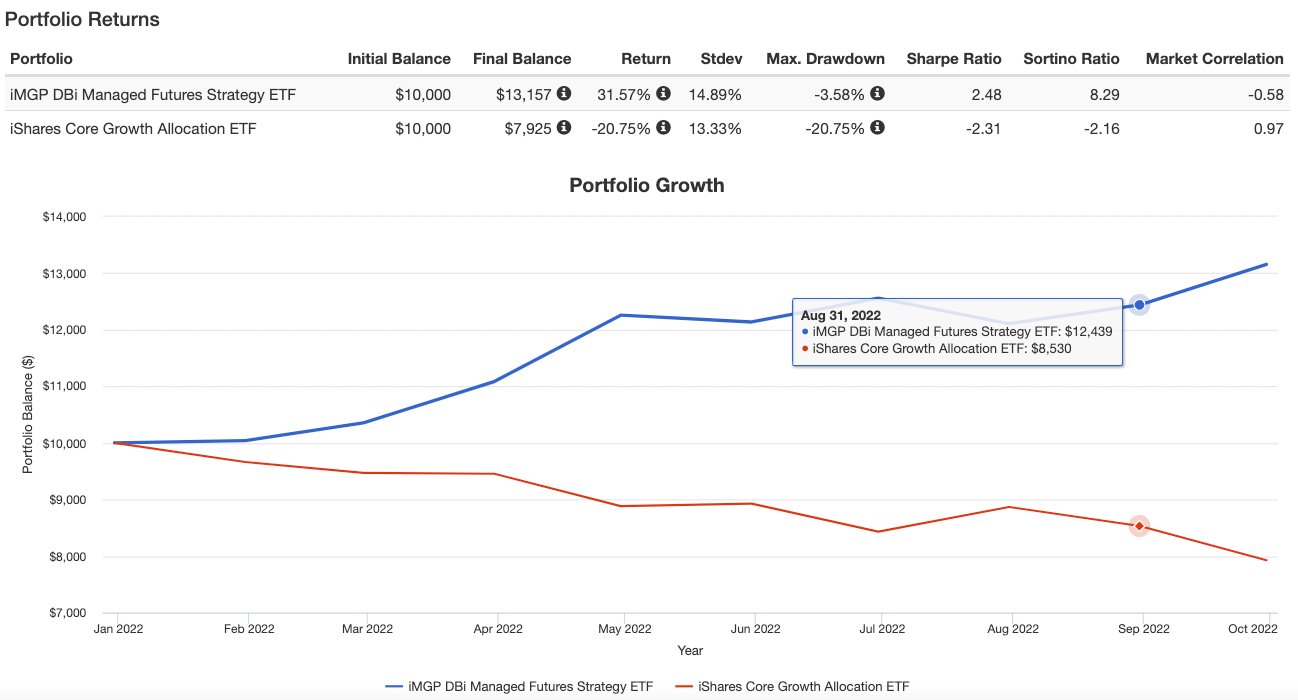

DBMF vs Global 60/40 Portfolio

While DBMF has been compounding annually at 15.65% like a cool-cucumber since January 2020 poor little 60/40 has been choking at -0.67%.

Now while it’s fun to poke the bear (industry standard 60/40) at its expenses from time to time, how many investors out there are 100% committed to a Managed Futures strategy?

I’m guessing not too many.

But the case for carving out a considerable “alternative sleeve” to fit managed futures into the overall portfolio equation is indeed growing stronger when you consider how poorly a 60/40 portfolio has navigated the 2020s so far.

Let’s zoom-in a little to examine a couple of different time periods specifically.

DBMF ETF Performance: March 2020

iMGP DBi Managed Futures Strategy ETF collected a few feathers for its caps in March 2020 relative to a globally diversified 60/40 portfolio by holding a steady defensive posture while the industry standard portfolio was rocked with a considerable drawdown.

From January 2020 until the end of March 2020 DBMF ETF was above water with a 0.09% return versus iShares Core Growth Allocation ETF (60/40 Portfolio) being down -13.50%.

DBMF ETF Returns 2022

For those militant industry diehards who just can’t help themselves from continuing to trot out the 60/40 portfolio as the best game in town, the counterpoint to that argument has been the performance of DBMF ETF.

A long-only globally diversified 60/40 portfolio has been brutally bludgeoned in 2022 with a return of -20.75% whereas iMGP DBi Managed Futures Strategy ETF has had its moment in the spotlight with +31.57%.

The overall results between the two when compared directly are jaw-dropping to say the least.

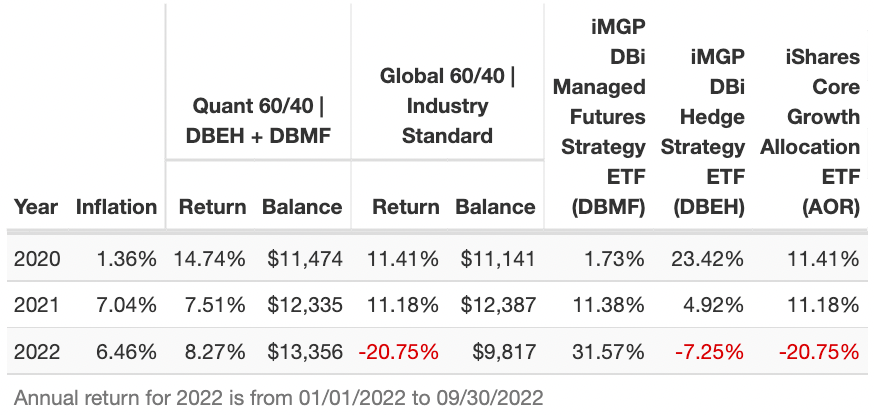

DBEH + DBMF 60/40 vs Industry Standard 60/40

Let’s circle back to DBEH ETF as a potential replacement for the “60” of a long-only equity portfolio.

iMGP DBi Hedge Strategy ETF specifically “seeks to replicate the pre-fee returns of forty leading equity long/short hedge funds to deliver equity-like returns over time with less risk” and we’ll gladly count that as our equity alternative.

Now for the “40” part of the equation we’ll say goodbye to long-only bonds and hello to DBMF ETF.

We can think of this as the Quant 60/40 portfolio vs the Industry Standard 60/40.

Quant 60/40 Portfolio vs Industry Standard 60/40

I wanted to first highlight the annual returns of DBMF ETF and DBEH ETF as individual line items to showcase that it hasn’t been iMGP DBi Managed Futures Strategy pulling all of the weight.

If you rewind back to 2020 it was DBEH that picked up the tab with a return of 23.42%.

Let’s look at the bigger picture.

If returns meets risk management is your primary investing goal, the results of a DBEH 60% / DBMF 40% portfolio since 2020 are most impressive with a CAGR of 11.10% and RISK of 8.83%.

Poor ‘ole 60/40 hobbles across the finish line below water with a CAGR of -0.67% and RISK of 13.34%.

That’s a lot of volatility for one to endure for such awful results.

Noteworthy is that the combined DBEH 60% / DBMF 40% has double digit returns with only single digit standard deviation.

source: VettaFi on YouTube

DBMF ETF PROS AND CONS

Let’s keep things rolling by summing up the pros and cons of DBMF ETF.

DBMF ETF PROS

- Tremendous uncorrelated “diversification puzzle piece” for long-only equity and bond investors to add in the alternative sleeve of the portfolio

- The ability for the fund to go both long and short across global equity, bond, commodity and currency indexes.

- An all in management fee of 0.95 bringing double digit basis points affordability for what has historically been a high triple digit fee strategy (both trades and manager performance incentives)

- Retail investors now have access to a strategy that has typically been reserved for high net worth individuals and institutions

- Crisis alpha performance during both March 2020 and all of 2022 up until October

- The ability for you to support boutique level creativity and ingenuity from Andrew and Mathias over at Dynamic Beta investments

DBMF ETF CONS

- Although we mentioned the fees being reasonable for this type of strategy you’ll still find investors not willing to pay that much for a fund these days

- Investors not realizing tracking error also refers to when times are not so rosy such as the 2010s when managed futures strategies struggled

DBMF Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Let’s consider a number of different ways DBMF ETF can slot into a portfolio at large.

Factor Focused Quant Portfolio

For DIY investors seeking an easy to put together globally diversified factor focused portfolio with an alternative sleeve as a feature (and not a bug) let’s check out the following:

40% $AVGE

20% $DBEH

30% $DBMF

10% $TYA

Here we’ve got long-short equity DBEH as a “satellite” puzzle piece as opposed to being a total equity replacement with newly released AVGE providing global core equity with factor tilts.

DBMF takes care of our alternative sleeve and we’re making a bit of room for fixed income with capital efficient TYA providing 3X intermediate treasury coverage.

Overall, we’re globally and strategically diversified with this model portfolio 4 fund combo.

Expanded Canvas Portfolio

For investors seeking capital efficiency and an overall expanded canvas portfolio as the end-game let’s consider the following:

20% $GDE

10% $NTSI

10% $NTSE

20% $DBEH

30% $DBMF

6% $TYA

4% $CYA

We keep our allocations to DBEH and DBMF exactly the same while making room in the portfolio to add “Gold” and “Long Volatility” as additional ingredients to the pancake mix.

This portfolio covers the bases nicely IMO.

Standard Milquetoast Portfolio

For those that are willing to die on the 60/40 hill we’ve got you covered too.

80% AOM

20% DBMF

Look at you in your fancy pants!

With merely a satellite allocation to DBMF ETF you’ve now turned your 60/40 portfolio into a 50/30/20 configuration.

Nomadic Samuel Final Thoughts

DBMF is a thoroughbred product that deserves every bit of the spotlight it has been receiving of late.

Hanging out in Managed Futures territory was a lonely island back in the 2010s when anything other than US growth stocks handcuffed to Aggregate bonds was the norm.

Oh, how the tables have turned.

Investors, especially those without 2008 scars, are learning first hand that the “so called” stable 60/40 portfolio of long-only equities and bonds is more like the Titanic than they had previously considered.

It can sink.

Fortunately, there are options to diversify beyond just stocks and fixed income.

You’ve got alternatives now available as ETFs that you can easily integrate into your portfolio.

Whether you shave down equity and bond allocations to make room or you build an expanded canvas portfolio from the ground up utilizing capital efficient products is entirely up to you.

But the days of just equities, bonds and chill seem to be over.

And if they’re not, maybe more lessons will be delivered harshly in the coming years for those who are rigid and fixed in their ways.

That’s all I’ve got for today.

What do you think of DBMF ETF?

DBMF has made it into the mix of ETFs in my DIY portfolio.

Let me know in the comments below.

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

I think you can take the performance of the SocGen Trend Index (which DBMF tracks pretty well if I understand it right) all the way back to the 2000’s, which further illustrate it’s fit for a reasonably diversified portfolio.

That’s a great point Kellan! I often refer to that index as well to get a taste of what returns would be like during different scenarios throughout the years.

Interesting article! Much appreciated!

Thanks Milan!

Thank you for putting the spotlight on Managed Futures and Trend Following and I agree Andrew deserves a lot of credit for what they have achieved with their ETF and for being a great promoter of the benefits of including Trend Following/Managed Futures in a portfolio. But as I discussed with Andrew in our recent podcast episode, there are other risks in replicating quant models, trading just once a week that we have not seen yet that investors should be aware of. The worst thing that could happen to our industry is that we see a massive inflow to these strategies (which has already happened) and that investors get a negative surprise from these type of products as we have seen before, when cheap solutions tries to compete with the decades of experience from established managers. Let’s hope this time really is different.

Is DBEH really worth it? I think a 60/40 VTI/DBMF would be an illuminating comparison. Returns are pretty similar over the short time period DBEH has been available, although the DBEH 60/40 is less volatile. In general I would trust Mr Market over any actively managed equity fund.

It’s also worth mentioning that KMLM employs a similar strategy and has also had a great year. It tracks very closely with ASFYX (much cheaper ER though) which itself has about a decade of history to give you some feel of how these investments work. KMLM has a higher target volatility so it doesn’t need to take up as much portfolio space to provide the same diversification benefit.

Buyer beware: none of these ETFs are suitable for a taxable brokerage account.

Nice article!

But it is strange that DBMF does not report full holdings on their website.

I look at the holdings table downloadable from the DBMF website here https://imgpfunds.com/im-dbi-managed-futures-strategy-etf/

About 15% of the collateral is missing. (85% is in the T-bills).

Any idea why that is?

For an ETF like this that doesn’t always have the best liquidity, will I still get a fair price if I let the brokerage reinvest dividends for me, or could that actually hurt me?