I’m thrilled to have Roger Nusbaum as our first guest on the “How I Invest” series where he shares his investing style of simplicity hedged with complexity along with test-driving investments himself before potentially recommending them to clients.

“Roger Nusbaum has over 38 years of industry experience including time as a “stockbroker” at Lehman Brothers in the late 80’s/early 1990’s, an institutional trader at Charles Schwab for much of the 90’s and as a registered investment adviser since 2004.

In addition to his “day job” as an RIA, Roger has been blogging and writing prolifically over that same period.”

You can connect with Roger on Twitter @randomroger and read his blog Random Rogers Portfolio & Retirement Lab.

Let’s hear from Roger!

Hey guys! Here is the part where I mention I’m a travel vlogger! This “How I Invest” opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Roger’s Greatest Investing Influences

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Peter Lynch/Jimmy Rogers: I learned about simplicity from them. Lynch talked about being able to explain the thesis of a stock holding to a seven-year-old.

Rogers was always very theme-oriented when he was a more frequent guest on stock market TV and interviewed in print and the themes that interested him were always so easily explained.

James Stack: Stack wrote about the importance of the 200-day moving average in the old Smart Money Magazine maybe 30 years ago.

The 200 DMA has been an important cornerstone of my approach to portfolio management.

Nassim Taleb: Risk generally, capital efficiency (before it was called that), ergodicity, tail hedging and asymmetry.

Jack Myer: He was the CEO of Harvard Management Company. He held timberland in the endowment because of its diversification benefits. Although not a liquid alt, it influenced my process and opened me up to using alts in client portfolios before they started to become popular.

John Hussman: Does a great job framing the bear case. I don’t think he draws optimal investment conclusions based on the framing of the bear case but there is always a prevailing bear case and understanding it makes for better risk management.

An important part of how I do things is that I don’t mimic these people, I disagree with plenty, pretty sure I’d say no to lunch with Taleb, but I take bits of process from the above, and others to create my own process.

Real Life Events That Shaped Roger’s Outlook

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

My parents made some terrible personal financial decisions, and I was able to understand at least some of what was going on and I benefitted from their mistakes by learning and not repeating their mistakes.

I know people who’ve made their lives much more complicated than they needed to be because they were too smart for their own good or as someone quipped “too clever by half.”

Keep it simple.

Simple can be a relative term but I’ve tried to embrace the idea of simplicity and integrate into my life where possible.

Not sure where this comes from, but I’ve made a priority of happiness and independence over trying to maximize career success.

Someone in the investment industry does not strike it rich in Prescott, AZ but it doesn’t take much to make a good living and be financially independent at a young age.

Also, I take a very long-term view of things although I am not sure where that comes from.

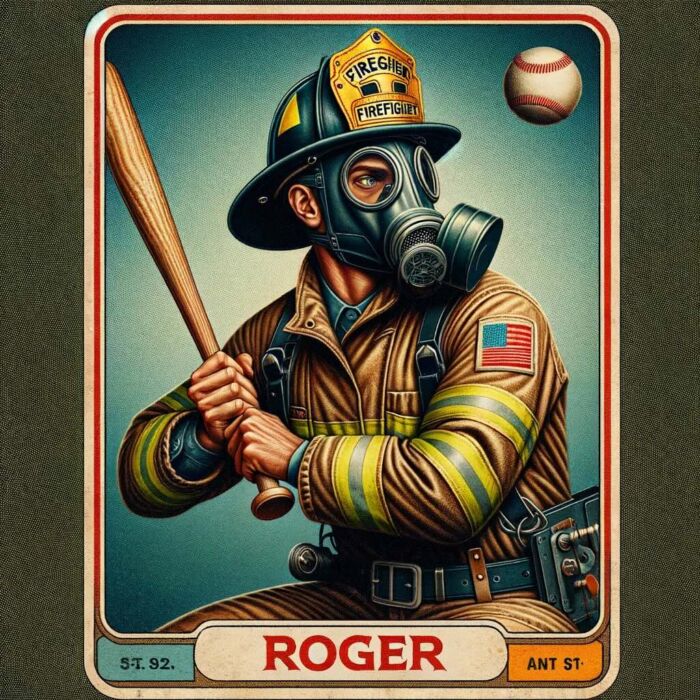

Weaving in real life stuff, I’m the chief of the Walker Fire Department, I live in Walker, AZ which is a community in the Prescott area.

I’ve been with the department since 2003 and the chief since 2012.

There’s crossover between my day job and the fire service on several fronts including risk taking.

There’s a saying “risk nothing to save nothing, risk a lot to save a lot.”

If there’s no one in a burning building, there’s probably no real reason to go in.

Investors frequently misunderstand risk and so don’t take it in appropriate size.

During every fad we always hear stories about people who lost it all on Comparator Systems, then Andrea Electronics, then Iomega, then internet stocks more broadly all the way through to people who’ve made catastrophic decisions allocating to cryptocurrency.

If Bitcoin is going to go to a bazillion, buy a little and let it go to a bazillion, you’re risking almost nothing with the potential for a huge payoff.

If it goes to zero, “oh well, no big deal.”

Conversation With Roger’s Younger Self

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

To the extent that this is about regrets or difficult lessons learned, I don’t think I would have any conversation along these lines.

We are all products of our mistakes and successes.

I wouldn’t change the outcome up to this point.

How Roger Invests: Pop Open The Portfolio

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

Our accounts have long been under invested.

My income being so levered to the stock market, it has always made sense to me that I shouldn’t busy trading my account or find out after some large decline that I was too heavy in something.

My allocation to equities and a few diversifiers is maybe 25%, 3-4% in crypto, it’s grown to the level, and the rest in cash or cash proxies.

At 56, I don’t see myself wanting to ever get out of the business and some clients are about my age, so it is plausible that I’ll have my RIA income for quite a while.

We have enough that if my hand were forced tomorrow, we could make it work but, in that scenario, I believe I could monetize my involvement with the volunteer fire department (I’ve blogged about that frequently).

I do use our accounts to test drive alts for possible use for client accounts.

This worked out with StandPoint Multi Asset (BLNDX) and AGFiQ US Market Neutral Anti-Beta (BTAL), have had some duds from Simplify and right now I’ve got a small position in Rational/Resolve Adaptive Asset Allocation Fund (RDMIX) which I am not sure about either way.

Client accounts are mostly plain vanilla simplicity with individual issues and narrower ETFs like for sectors, industries or themes.

There is no question for me that simplicity is by far the best way to go.

I will hedge client accounts with complexity, RDMIX would be an example of a complex hedge if I ever bought it the way BTAL is now.

Although RDMIX would be far more complex than what I’ve used.

I’ve owned tickers like Nike (NKE), Consumer Discretionary Sector SPDR (XLY) and Northrup Grumman (NOC) for clients for years as examples that have skyrocketed, I first bought NOC in 2004.

Letting something grow like that is an example of ergodicity, just letting the market do its thing for you.

Over the shorter term, they may lag for a bit but that’s ok, no holding can always be best. Johnson & Johnson (JNJ) and Novartis (NVS) would be examples of very long term holds that have done fine but not world beaters.

Other names like Scotia Bank (BNS) and GLD that haven’t done as well but they all play a role, they all bring attributes to the table.

I know you (Sam) like to use a lot of very sophisticated strategy funds; I hope that goes well but I want no part of that much complexity.

Stocks are the thing that goes up the most, most of the time and simple exposure to that in a proper weighting for volatility tolerance is the best way to go. I use alts to manage the “proper weighting” part.

Again, simplicity hedged with a little complexity.

When will client portfolios do best/worst?

Sort of not knowable but when people retire, their priority is to not have their portfolio income needs disrupted.

If you’re pulling $3000/mo, nothing better get in the way of that so I am trying to smooth out the ride a little bit.

If that is going well then I’d lag a little during big up years and be ahead a little during down years.

Skills Required To Be A Good Investor

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

I’ve been talking about this point for ages, saying it the same way and it applies to most people, not all but most, and many strategies, not all.

The barriers to entry really come down to an individual’s ability to devote time to the endeavor and to their interest level.

My style is very simple.

Look at the benchmark, make some overweights and underweights at the sector level and then have a strategy for when and how to add some defense.

Spend enough time and many people could do that.

I’m pretty good about not having emotional reactions like panicking on the way down to getting too greedy on the way up which I think comes with time in the industry.

I’ve also been able to avoid fads.

More Conservative and Aggressive Portfolio

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

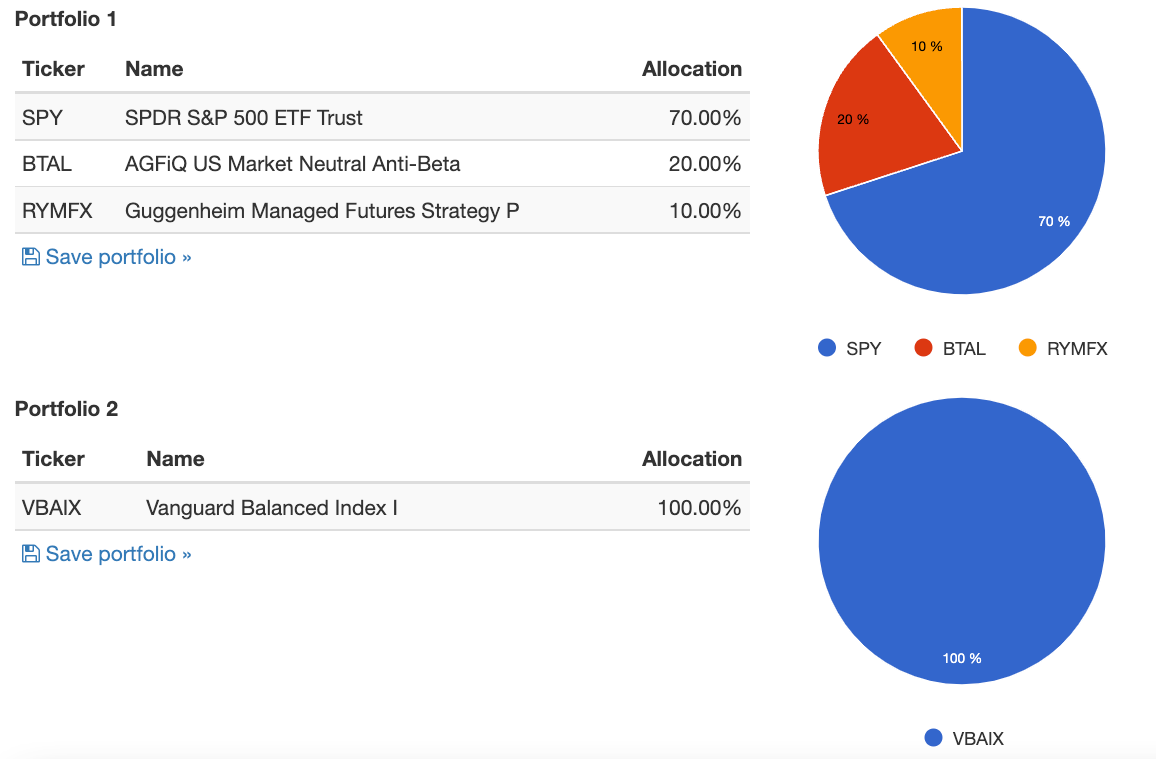

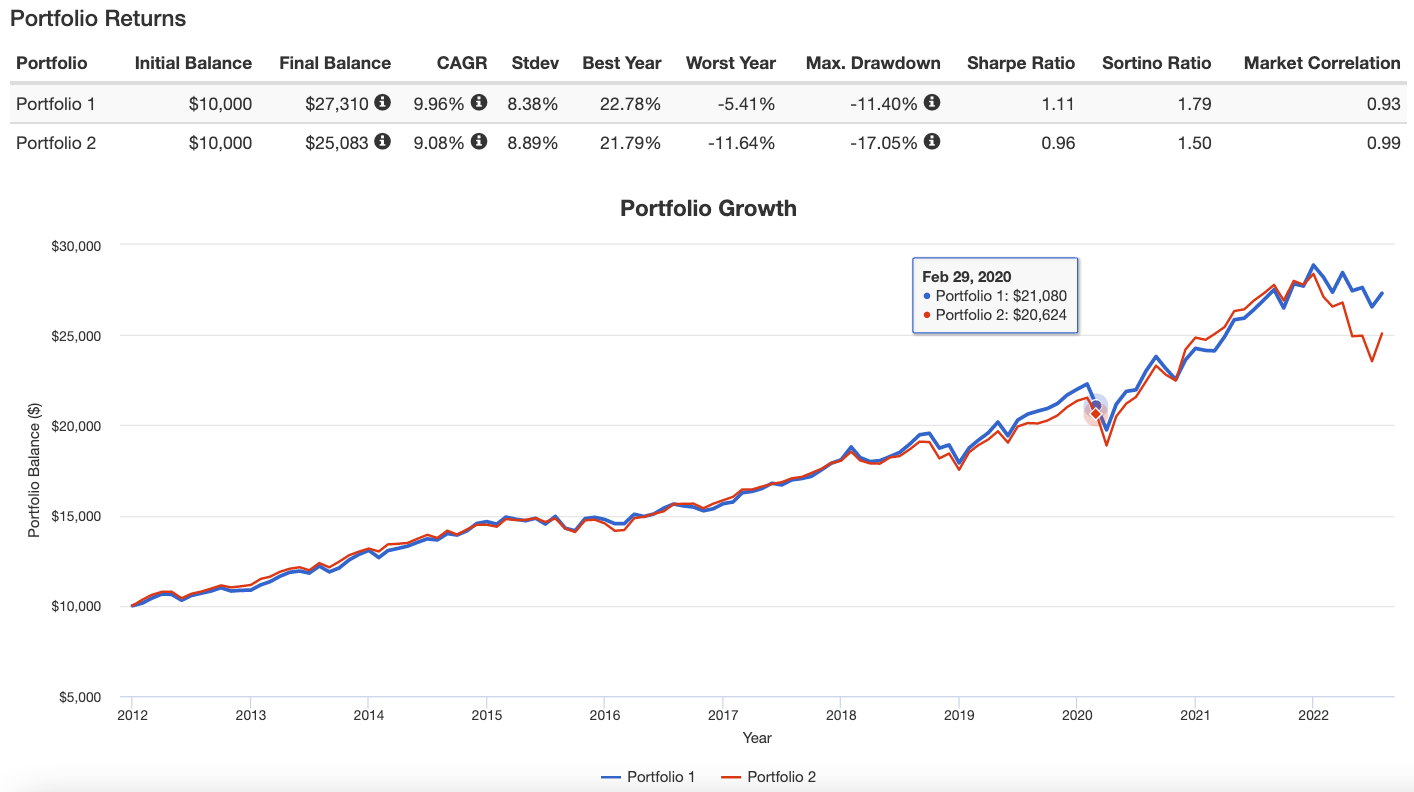

A simple MCW, broad based equity ETF, BTAL and maybe RYMFX.

I did a blog post recently where those funds weighted at 70/20/10 outperformed VBAIX and did so with a lower standard deviation according to Portfolio Visualizer.

You could split the 70% into a couple of factors or part MCW/part factor.

If you’re going to use a factor fund though, you need to be prepared to hold it for a long time.

The odds of a factor with a great back test hitting the market and immediately underperforming a pretty good.

If a factor will work, it will do so over a longer period.

The only way I can think of to dial it up would be a larger percentage in equities.

Roger’s Greatest Strengths and Weaknesses As An Investor

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

My greatest strength is probably my never-ending fascination with all aspect of capital markets which leads to my desire to learn more which hopefully yields a good result for clients.

I need to improve on having more conviction at inflection points.

I’m comfortable buying into panic, I’ve done it a few times but not every time.

The times I’ve done I should have gone heavier.

This is not about timing bottoms but buying something after it has fallen 25% is usually a good idea even if the next 20% after that is still down.

Peter Lynch had a quote along the lines that he doesn’t know where the next 25% will be but he knows where the next 100% will be and that is higher.

Things Roger Agrees and Disagrees With

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I’ve been avoiding interest rate risk and duration risk in the portfolio for many years.

Lending money to the government for 10 years and 3% never made a lick of sense to me.

Buying treasuries with low yields was a popular trade but I had no reason to think I’d be able to spare clients a great deal of pain whenever rates started to move back up.

Most investment professionals seem to fans of target date funds. I think they are an awful product.

Subject Roger Wants To Learn More About

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I always seek out new things to learn about.

Right now, I seem to be focusing on capital efficiency and crypto currency.

I’ve invested time into both but don’t feel a huge edge on crypto.

I know things but also realize I don’t know a lot.

I first heard about capital efficiency 20 years, but I don’t think that term existed yet.

The concept fascinates me.

Taleb wrote about it years ago too, maybe 15 years ago but again no mention of term.

I first heard “capital efficiency” only recently but it has long influenced the portfolio.

I expect more beta and return from certain names versus maybe yield with low volatility from other names or hedging attributes one way or another from yet different names in the portfolio.

Volatility as an asset class has long intrigued me, I’ve studied it and recently added it to most client portfolios.

This isn’t something I would necessarily tell someone to just jump into after reading one article or listening to one podcast.

This is absolutely learnable, but I think takes time, there’s a lot of bad ways to allocate to volatility.

I added Princeton Premium Fund (PPFAX or PPFIX) which sells weekly, out of the money put spreads on the S&P 500 seeking an absolute return result and maybe kick out a little income.

The chart looks like a horizontal line with a slight tilt upward.

I also added ProShares VIX Medium Term Futures ETF (VXIM).

It’s a completely different way to access volatility with a completely different objective.

If stocks are going down a lot, hopefully VIXM is going up a lot.

It’s not pure VIX exposure, which is ok, front month VIX ETPs have a tendency to go down 99% and then reverse split.

Anti-Roger Nusbaum Portfolio

What would be the ultimate anti-Roger Nusbaum portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

My anti-portfolio would be target date funds.

The tide went out on them in the GFC and the few I looked at on this go around didn’t do much better.

I would much rather take a more active hand the weightings between stocks and bonds and be able to avoid interest rate risk.

The argument for target date funds is that one fund could be a long-term solution.

Just put in your DCA amount every paycheck and check back in 30 years.

Nomadic Samuel Final Thoughts

I want to personally thank Roger for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.