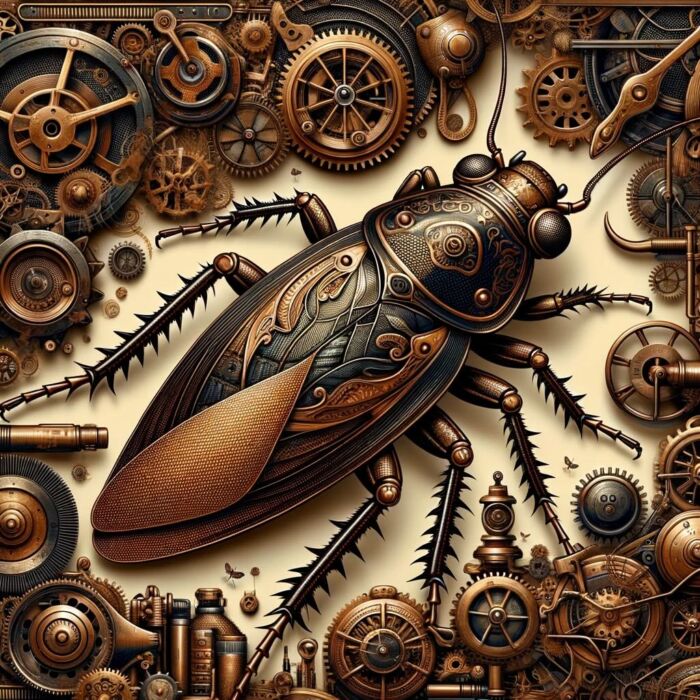

The Cockroach portfolio is a four quadrant portfolio that combines the best of traditional long-only asset classes with derivatives to create a diversified masterpiece prepared for all economic regimes.

I once waged a war against cockroaches inside of my illegal housing structure (basically a shack on top of a roof) in South Korea and lost badly.

I felt defeated at the time by this relentless pest.

How could it be that such a small creature could continuously reappear, despite my best efforts to set traps, over and over again?

Those little buggers.

Well, clearly I didn’t respect my opponent enough.

Did you know that cockroaches can withstand up to 900 times their body weight?

Hard to squish.

Not easy to stomp on.

Plus their flexible exoskeleton allows them to fit into tight spaces.

If you can imagine the most apocalyptic scenario you and I may not still be here but they likely are.

So if you were to conjure up a creature you’d most want to represent a portfolio that can endure all economic regimes that is thrown its way, I’m pretty sure a cockroach would make the shortlist.

Fortunately, we’re already there.

Jason Buck, the co-founder of Mutiny Funds (along with Taylor Pearson) created the Cockroach Portfolio.

We’re thrilled to have Jason as our next guest of the “investing legends” series.

This is a portfolio that can play both offence and defence, during all four economic regimes, in a way that a typical 60/40 is woefully unprepared for.

The inspiration for The Cockroach Portfolio is a modern “best ideas” reinterpretation of the Harry Browne Permanent Portfolio.

Many, industry wide, wax nostalgic or giddy up with glee over the Risk Parity Portfolio and Ray Dalio All Weather Portfolio.

But it was the Permanent Portfolio that came first and in many ways it doesn’t get the due credit it deserves.

As always, I’m rambling on; let’s hear from Jason.

Hey guys! Here is the part where I mention I’m a travel vlogger! This “Investing Legends” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

The Cockroach Portfolio

Harry Browne Permanent Portfolio | 4 Quadrant Diversification

Thanks for joining us today Jason!

Before we take a deep-dive into the nitty gritty of the Cockroach Portfolio, I thought we could first lay the foundation for your portfolio by examining its inspiration – The Permanent Portfolio created by Harry Browne.

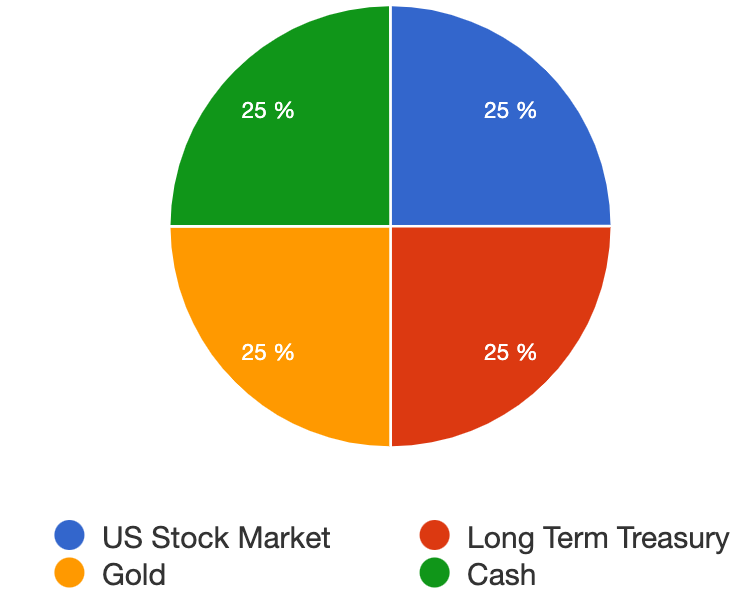

With its design simplicity (of four equal quadrants) and its regime readiness (by factoring in asset classes that are prepared for stagflation and deflationary bust) it is considered by many to be the first serious attempt by a portfolio to diversify in such a way that it can thrive in all economic environments.

For those not familiar, the Harry Browne Permanent Portfolio is as follows:

25% Stocks

25% Bonds

25% Gold

25% Cash

What is it about the Harry Browne Permanent Portfolio that you find most attractive?

And why do you think it doesn’t get the credit that the Ray Dalio All-Weather and Risk Parity portfolios receive today?

First, thank you for having me, I appreciate it.

Second, nothing I say is investment advice, please seek out your own investment professional.

What I find most attractive about Harry Browne’s Permanent Portfolio is that he wasn’t trying to predict the future.

He was acknowledging that he doesn’t have a crystal ball and no one else does either.

When you build a portfolio for your savings, the premise should start with I don’t know what the future holds. Browne’s four quadrant model takes into account the 4 primary return drivers in a rough global macro sense.

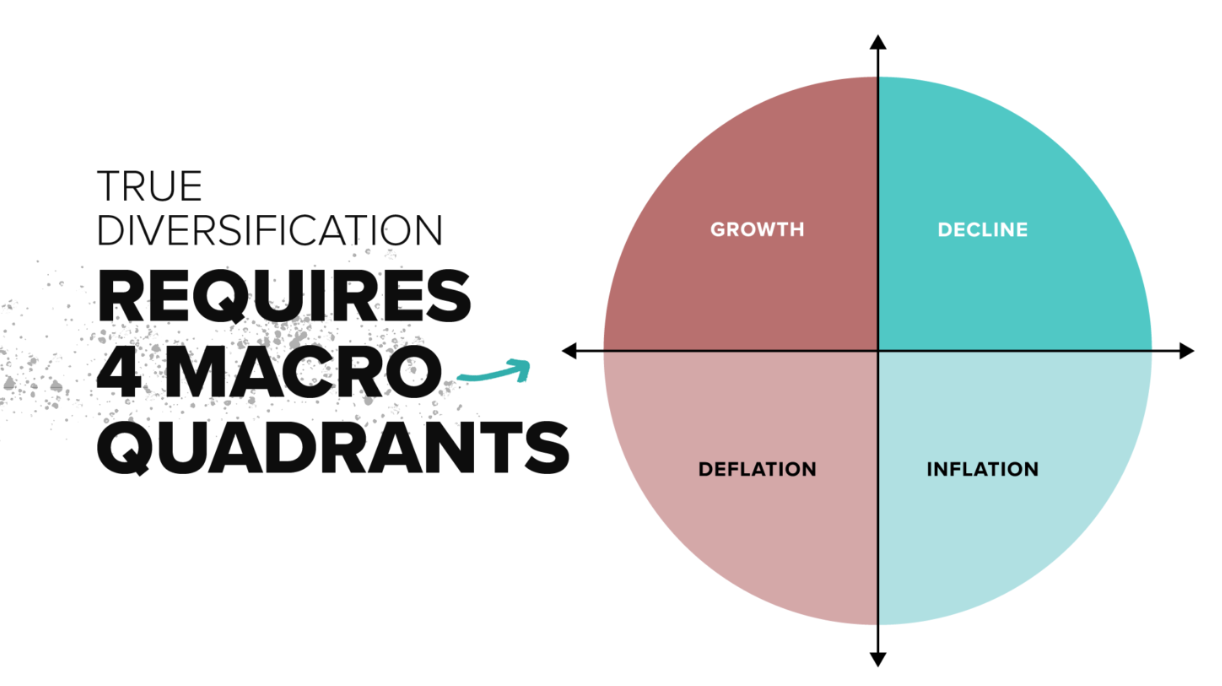

4 Macro Quadrants – Diversification

We are always dealing with the axis of growth and inflation.

We have either a growing economy or a shrinking one.

We have either inflation or deflation in the monetary base.

Obviously, these things overlap like a Venn diagram and no regime is just one of these quadrants.

The other point is a properly diversified portfolio is always going to have one or more of the asset classes in drawdown and this is painful for people to handle.

Yet, you need this diversification if you cannot predict the future.

The point of the portfolio is that it muddles along no matter what macro environment we are in.

It protects your savings and grows it over the long term even after inflation.

Most importantly the portfolio helps protect you from making any behavioral errors due to panic, greed and fear, which is what affects compounding even more than the asset class mix.

I think the simple answer of why Risk Parity is better known than Permanent Portfolio is that Ray Dalio runs one of the largest hedge funds in the world.

In our world, financial success is a proxy for genius.

I find that there is a general lack of historical awareness in the financial industry and managers tend to not give credit to the people that came before them.

Ray Dalio simply levered up the ideas from Permanent Portfolio based on the individual asset classes historical volatilities.

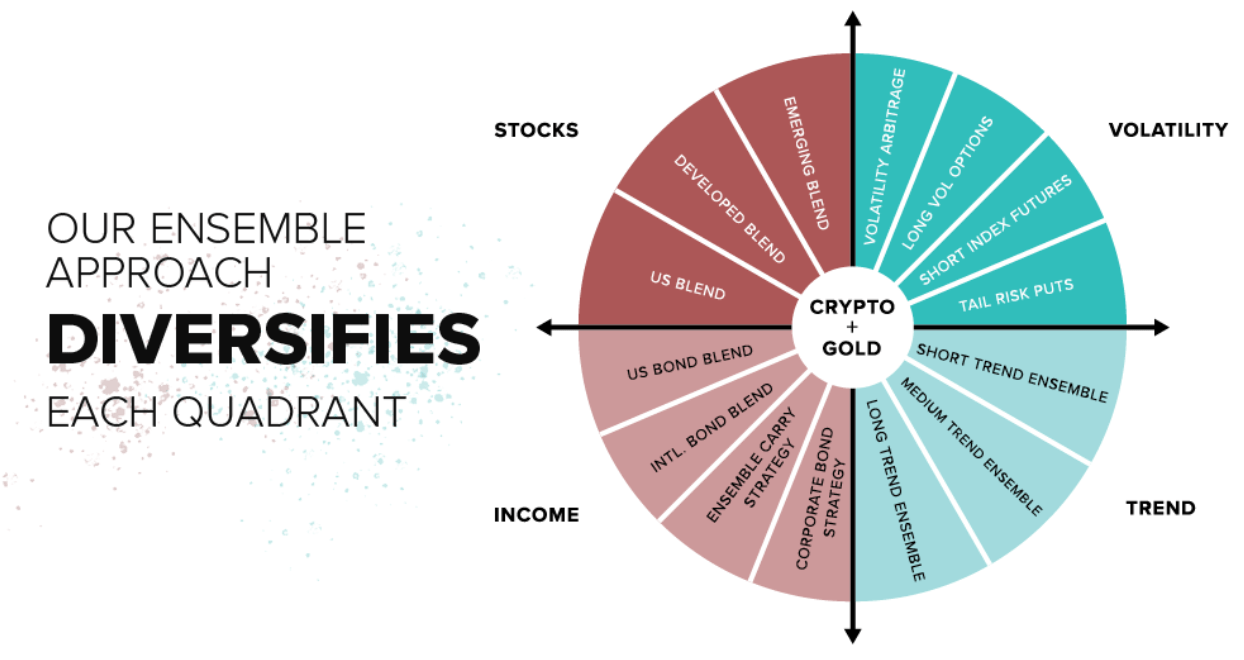

Ensemble Approach: Diversifies Each Quadrant

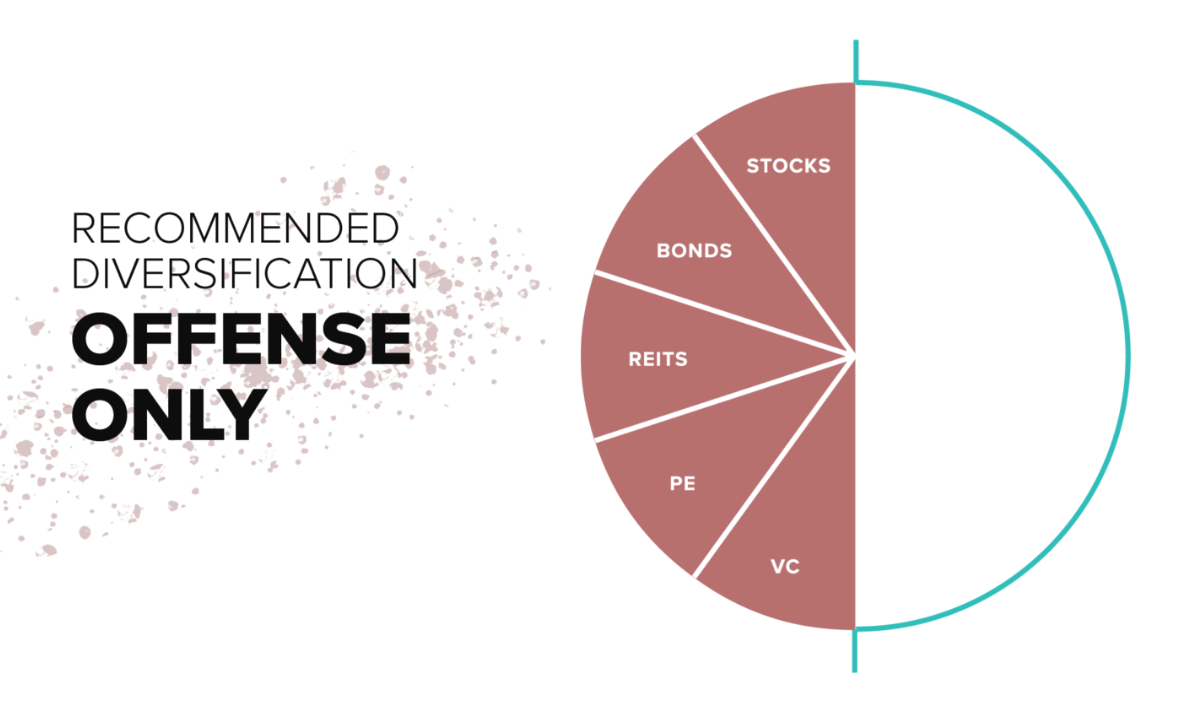

The Cockroach Portfolio: Asset Allocation

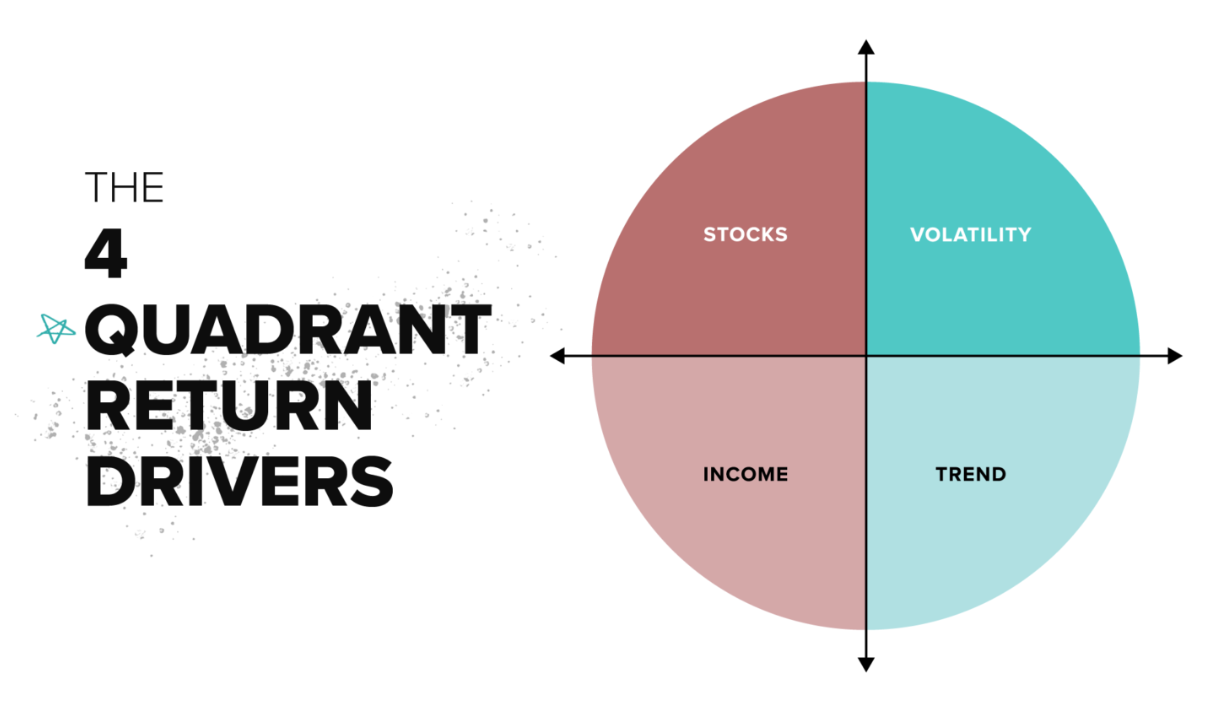

4 Quadrant Return Drivers

Offensive Assets

We believe there are essentially two ways to make returns over a Risk On economic cycle: equity and debt.

This is your Offense.

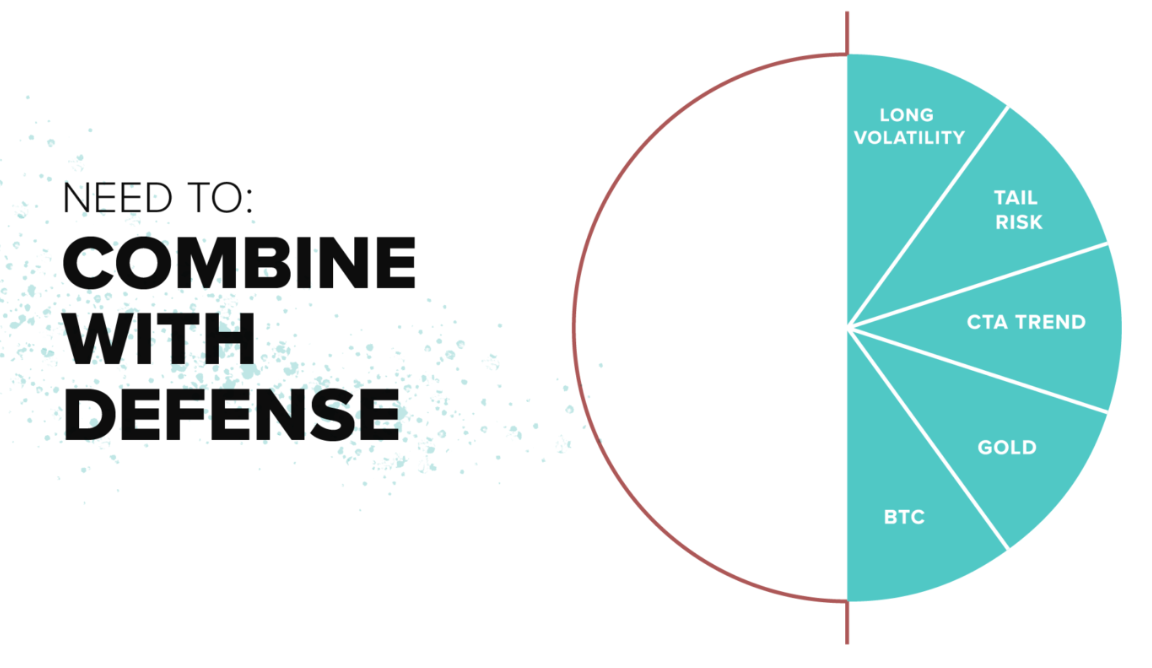

Defensive Assets

In a Risk Off environment you want to be hedging those equity and debt positions.

This is your Defense.

During periods of economic growth, stocks (equity) tends to do well.

We use a combination of Global Equity indexes because we want that broad diversification and do not want to fall victim to home country bias.

During periods of deflation or disinflation, Income (debt) from bonds, or bond like income, tend to do well.

We us a combination of Global government bonds and other active Bond/Income strategies for broad diversification.

When stock markets sell off in a Risk Off environment we have an ensemble of Long Volatility and Tail Hedges that hopefully ballast the sell off in the stock market.

When inflation starts to run and the Bond/Income bucket is likely to sustain losses, we have a Commodity Trend ensemble that can hopefully capture that inflationary move via the commodity markets.

source: Flirting With Models on YouTube

Investment Strategy vs Branding

I also think there is an interesting cultural divide in our industry when it comes to creativity in marketing and branding.

Millennials and Gen Z skew towards transparency, authenticity, and prefer the irreverence of showing your human side.

While the older generations seem to skew towards opacity and pretending to be an infallible, robot wizard behind the curtain.

Source: The Derivative by RCM Alternatives on YouTube

Portfolio Construction: Offence and Defence

Correlations are a tricky thing.

If we look back over the past 20 years or even 40 years, stocks and bonds have been mostly negatively correlated.

So, we were able to use a 60/40 portfolio where the bonds hedged the stock position.

When we widen our historic scope to 100+ years, our research suggests to us that stocks and bonds are mildly correlated the majority of the time.

This is why we don’t believe in bonds as a defensive hedge.

We have lived through an unprecedented 40 year bull market in bonds.

I also say correlations are tricky because they depend on the time frame we use and they are in constant flux.

When a major market correction happens like March 2020, correlation go to 1 meaning almost all asset classes sell off together as everyone is trying to raise some cash in a liquidity crisis.

This is why we prefer long volatility strategies such as buying puts on the S&P 500 index, which we feel are more structurally negatively correlated as an example.

The negative correlation is built into the hedge, so we are less concerned about correlations being conditional.

Our friend Chris Cole of Artemis Capital Management wrote a great essay on Dennis Rodman of the Chicago Bulls during their multiple NBA championships run.

The essence of the essay is that Rodman’s ability to rebound and play defense raised the team’s ensemble average of putting up more points than the other team.

Even if Rodman could have scored negative points, his rebounding ability allowed Michael Jordan to take more shots, leading to a higher positive expectancy for the team.

A more modern version would be Draymond Green and the Golden State Warriors.

I played soccer most of my life, so I would prefer to use the Liverpool Football Club in the English premiership.

They were a great offensive team, but they didn’t start winning championships until they added Alisson as a goalie and Van Dijk as a sweeper (last defender).

The two of them are such outliers at preventing other teams from scoring that Liverpool can play their all out, “heavy metal” style of offense and completely overwhelm other teams.

One can use analogies from almost any sport in that we need offense and defense as well as the transitional players in between.

Source: Mutiny Fund on YouTube

Equity Allocation

Let’s start exploring each of the 25% slabs of pie we’ve got in the Cockroach Portfolio.

source: Excess Returns on YouTube

Fixed Income Allocation

One thing that sets apart both the Cockroach Portfolio and Permanent Portfolio apart from the Ray Dalio All Weather Portfolio and long-only Risk Parity Portfolio is a 25% sleeve towards fixed income to combat deflation.

The bond units in Dalio’s Risk Parity can actually fluctuate to a lot more that just 2 to 1.

Risk Parity is based on using a look back to determine the volatility of each asset and then leveraging or deleveraging to make them equally weighted to volatility.

We don’t believe volatility is a great proxy for risk, we are more concerned about drawdowns.

Our research suggests that in the 1930’s a 60/40 portfolio would have experience a -60% plus drawdown.

Risk parity may have done better or worse depending on their market timing and reduction of bond leverage, but that is hard to know for certain.

To be fair, classic risk parity uses other asset classes besides stocks and bonds.

We tend to think about the emergent properties of a portfolio in aggregate.

We start with balancing our exposures to Offense and Defense, or Short Volatility and Long Volatility.

Through this lens we believe that Stock and Bonds thrive in low volatility/short volatility environments.

Meaning they are harmed by volatility, so they are both part of our offensive portfolio.

After Offense and Defense, we then think about the four quadrant model, we use the lens of return drivers and weighting more towards long term drawdowns than to short term volatility correlations.

Then within each bucket we prefer to diversify those concentration risks further.

Using a longer term perspective, we feel the 25% allocation to bonds is more appropriate.

We tend to call our Bond allocation “Income” because the general idea is in a deflationary environment one prefers a steady income.

As I said above, we believe in broad diversification.

If one position sizes each strategy or instrument appropriately you are reducing the risk of any one element disproportionately hurting the portfolio returns.

The Carry strategy, that we allocate to Resolve Asset Management, uses the broad markets exposure available in the futures space to harness term structure carry as an income across dozens of instruments.

Put simply, if an instrument has a term structure in contango, meaning the future months are consecutively higher than the front month, one could go short and ride the term structure down.

And vice versa when the term structure is in backwardation, where the front month is higher than the consecutive months, one could go long and ride up the curve.

This is a very simplistic example and the nuance is in the details.

It is a differentiated form of an income trade offering us more diversification within that sleeve.

Source: Rocket Dollar on YouTube

Trend Following Allocation

I’ve been delaying gratification over here waiting to ask you about the trend-following 25% slice of your portfolio that is geared towards fighting inflation.

We are told to buy low and sell high.

Trend Following seeks to buy high and sells higher, and sells low and buys lower.

The buy low and sell high is actually a mean reversion strategy, while Trend Following is a break out strategy.

When a market breaks out of its mean reversion channel, Trend managers will either go long or short based on the extension of the trend in either direction.

The strategy is agnostic to direction. It’s not as well know because they also implement their trades in the futures markets.

In these markets one can trade 100s of instruments across: commodities, currencies, and financials.

Trend followers are taking advantage of herd mentality in markets and for trends to persist in either direction.

A benefit is they are agnostic to market direction and happy to follow the trend either long or short.

At any given time they will be both long and short many different market instruments.

I’ve previously discussed that we start our portfolio from an Offense and Defense perspective.

Then we look at the four quadrant model of return drivers.

The third element is correlation.

We believe that there are only 3 correlations: correlated, uncorrelated, and negatively correlated.

In a liquidity shock all offensive assets go to a correlation of 1 with equities.

One can hedge with negatively correlated assets like long volatility or tail risk put options which should be more negatively correlated in a sharp sell off.

Trend Following, by its bi-directional nature, is an Uncorrelated strategy.

Even though people will talk about 16 uncorrelated return streams, we feel all assets or strategies fall within the 3 broad correlations, especially under stress.

Inflation is an incredibly pernicious problem and we can only try our best to maintain our purchase power parity through broad diversification.

We feel our best bet on capturing a return from inflation is by having a broad diversification to commodity markets via Trend Following strategies.

We search out managers that have at least a 40% exposure to commodity markets and we tranche them by look back periods of short, medium, and long.

Every Trend Follower is going to have a speed or duration to their model based on look back period to determine a trend.

There is a large dispersion of returns when it comes to these strategies.

We are not trying to pick the best manager because that changes year to year, we are trying to get broad exposure or create a beta return from the entire space.

We start with look back periods because different ones will do better at different times.

Long term managers did well in 2008’s protracted recession and short term didn’t do as well.

In March 2020, short term managers did well and long term did poorly.

Many medium term managers were whip sawed in the first half of 2020.

Meaning they were long going into the sell off and then were under positioned for the rebound, this happens often in Trend Following.

Within the look back sleeves we also diversify by trading styles (moving averages, regressions, breakouts) and monetization heuristics (vol targeted, trailing stop, tranching).

This diversification on several levels is attempting to smooth out the equity curve and create a generalized beta return from the asset class.

Volatility Allocation

Volatility is the most difficult space in investing to understand.

We firmly believe that Trend and Volatility are the last bastions of active management.

Especially in Volatility, you get what you pay for.

Tail Risk Puts– this is the classic hedge.

The general idea is you buy puts on the S&P index to truncate your losses beyond a certain attachment point.

So, if you want to prevent any losses beyond a -20% drawdown in the S&P you buy the equivalent amount of puts around the -20% strike that will cover the losses 1 for 1 beyond that point.

You are willing to take a -20% loss, but no further loss beyond that point.

This sounds easy, but is super tricky in which strikes you buy, how much you spend on premium, and when do you roll them or monetize them.

Long Vol Options– this is a way to lessen the bleed of constantly paying the premium of rolling tail risk puts.

Managers opportunistically buy puts or calls based on their internal metrics and algorithms for when they think a “forest fire may spark into a contagion”.

They are trying to time the market for an expansion in volatility.

Volatility Arbitrage– also known as volatility relative value, is a form of pairs trade.

They are trading S&P versus VIX or trading within the term structure of VIX futures.

The idea is to combine negatively correlated assets in the right ratios so you can garner an income from this market neutral pair.

Another way to look at is, they are isolating the term structure roll of VIX futures to have a market neutral way of earning the roll yield.

Short Index Futures– this is a form of intra-day trend following on the market indexes around the world.

As an individual stock market sells off they will follow that move down during market hours, but can do similar trades around the globe on a 24 hour basis.

The idea is that as markets sell off then implied volatility expands on options pricing, which lowers the convexity on a payout.

As you roll those put options you now need to pay a higher premium.

When you are just going short intra-day with futures you do not need to pay that premium, it is simply a directional bet.

The reason we like all four of these in concert is because there are so many path dependencies to a market sell off and we want to try to capture that move as best as we can and not rely on an individual path dependency, an individual strategy, or an individual manager.

We look at all these strategies through the triangle of trade offs between: carry, certainty, and convexity.

If you chose one or two of these, you are losing the others.

As a rough example: Tail Risk Puts have a lot of certainty and convexity, but a negative carry.

With Long Vol Options you are reducing the carry, but lessening the certainty.

At a simplistic level we can look at the portfolio in 3 phases: during risk on times the Tail Risk and Long Vol options are going to have a negative carry or bleed.

We use the pairs trade style income to make up for this bleed.

In a sell off, the options pay out with convexity, but now the premium or cost is much higher to re-establish the position, so we like the delta-1 directional play of the Short Index Futures.

We like the ensemble of being in three distinct markets with different personalities: VIX, Options, and Index Futures.

Crypto In The Portfolio

I love the fact that the Cockroach Portfolio has a small bullseye with space for both gold and crypto.

20% of our Cockroach Portfolio is allocated to Fiat Hedges.

It’s 16% Gold and 4% Crypto.

The crypto is weighted to market cap and we only use the futures.

So, currently that is about 2.5% BTC and 1.5% ETH.

As we are focused on a portfolio that manages our client’s savings through multiple business cycle and multiple decades, we also worry about multiple generations.

It’s not necessarily the asset classes that people invest in that hurts them over longer time horizons, it’s the dislocations that happen due to things like war, confiscation, and diasporas.

We think about our Fiat Hedge for those once in a lifetime event risks.

At the same time we are rebalancing frequently so they do add to our portfolio diversification and are simultaneously thought of as trading instruments.

Our main focus is always on position sizing.

We try to appropriately position size our gold in case of one of these once in a generation events.

The crypto positions are also based on what if the proponents are correct and BTC is a form of digital gold?

No one can know in advance what would be the exact amount of exponential return from either of these asset classes, yet we feel our allocation size is broadly appropriate given an unknown, unknowns scenario.

We found the responses to holding crypto futures are highly dependent on the individual.

BTC is by far the most polarizing asset and people are either evangelical or absolutely appalled by it.

We feel that this is not binary, so we take an appropriate position size with an open mind about the future.

Once again, we believe in diversifying our diversifiers.

And proper diversification means you, and financial media, will always hate at least one of the asset classes you currently hold.

Living Abroad: Investing + Life Lessons

How did living/traveling overseas impact you as an investor and more importantly as an individual?

I’ve done many different things while abroad from: teaching english, selling Turkish rugs on the streets of Istanbul, living at a soccer academy in Bolivia, running online businesses, to selling condos in Mexico.

I will not be the first to point this out but travel brings out resiliency and open mindedness.

If you are open minded to how life operates in different ways there is often an opportunity to incorporate a better model.

When you are traveling and living in developed countries you learn how to go with the flow when you can’t count on your electricity or water to work every time or the mind numbing bureaucracy when you need to get something official done.

I would be remiss if I also didn’t point out the other side.

People exalt things like being a traveler over a tourist.

Living abroad is seen only as a net benefit.

I think about the obvious, I have only had my own subjective experience.

Even though I lived in Brazil for a long time, I cannot tell you anything about Brazil, I can only tell you about my subjective experience while in Brazil.

After traveling to emerging countries one does feel incredibly grateful, but it has always amazed my how quickly that wears off when we rejoin the hedonic treadmill.

A lot of people travel as an escape, where they may possibly find more verdant, unknown landscapes within their own psyche, just by “sitting alone in a room quietly”.

Connect with Jason Buck

How can people find you across the myriad of platforms you’re creating content on these days?

Sam, I just want to thank you for the opportunity!

Especially because I am a fan of the courage you and Audrey display via all of the content you produce.

You can find us at MutinyFund.com and I am @JasonMutiny on Twitter.

(Sam speaking here. Jason is one of the most prolific content creators on YouTube where he effortlessly slips between the roles of host, co-host and guest on a number of shows.

Source: Mutiny Fund Podcast on YouTube

Be sure to check out Mutiny Funds Podcast.

The Pirates of Finance on Blockworks Macro on YouTube

And the weekly show Pirates of Finance on Blockworks Macro.

Source: The Derivative by RCM Alternatives on YouTube

Also, Jason is frequently a guest/host on The Derivative by RCM Alternatives and Real Vision Finance.)

Source: Real Vision On YouTube

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Hi Sam,

I found the interview with Jason and Tyler regarding the Cockroach portfolio very interesting. I’ve been aware of Mutiny Funds for some time now, but this All-weather approach is somewhat new. What is a little confusing is the allocation percentages with respect to the Gold/Crypto fiat protection. If each quadrant is allocated 25% each, how do they incorporate 20% additionally in Gold/Crypto? Is there some leverage involved or is the Trend bucket less than 25%? Or, are all quadrants equal but less than 25%, making room for the gold/crypto allocation? Also, I suspect that the nature of this strategy would make creating a Cockroach ETF quite complicated with respect to some of the quadrants. Still, I wonder if they have considered this? Many thanks for providing such interesting content and any clarification of the portfolio as you understand it.

This blog brilliantly explains the concept of the Cockroach Portfolio, showcasing its resilience and diversification strategies that prepare investors to navigate various economic scenarios with confidence and stability.

This blog offers a unique perspective on the resilience of cockroaches, drawing an interesting parallel to investment portfolios. A clever metaphor for navigating all economic conditions truly a thought-provoking read!