Momentum is easily one of the most fascinating equity optimization strategies for investors to consider!

However, it is also one of the most underrated (and under-allocated strategies) relative to factors such as value and minimum volatility.

With this in mind, we’ll be learning more about a high conviction quantitative momentum equity strategy from Alpha Architect.

They’re without a doubt one of the most respected fund providers/researchers renowned for evidence based factor focused equity strategies.

We’re in for a real treat as Ryan Patrick Kirlin has generously taken the time to unpack QMOM ETF as part of the “Strategy Behind The Fund” series.

Better known as Alpha Architect U.S. Quantitative Momentum ETF!

Without further ado, let’s turn things over to Ryan!

Reviewing The Strategy Behind QMOM ETF (Alpha Architect U.S. Quantitative Momentum Fund)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of QMOM ETF?

For those who aren’t necessarily familiar with a “quantitative momentum” style of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

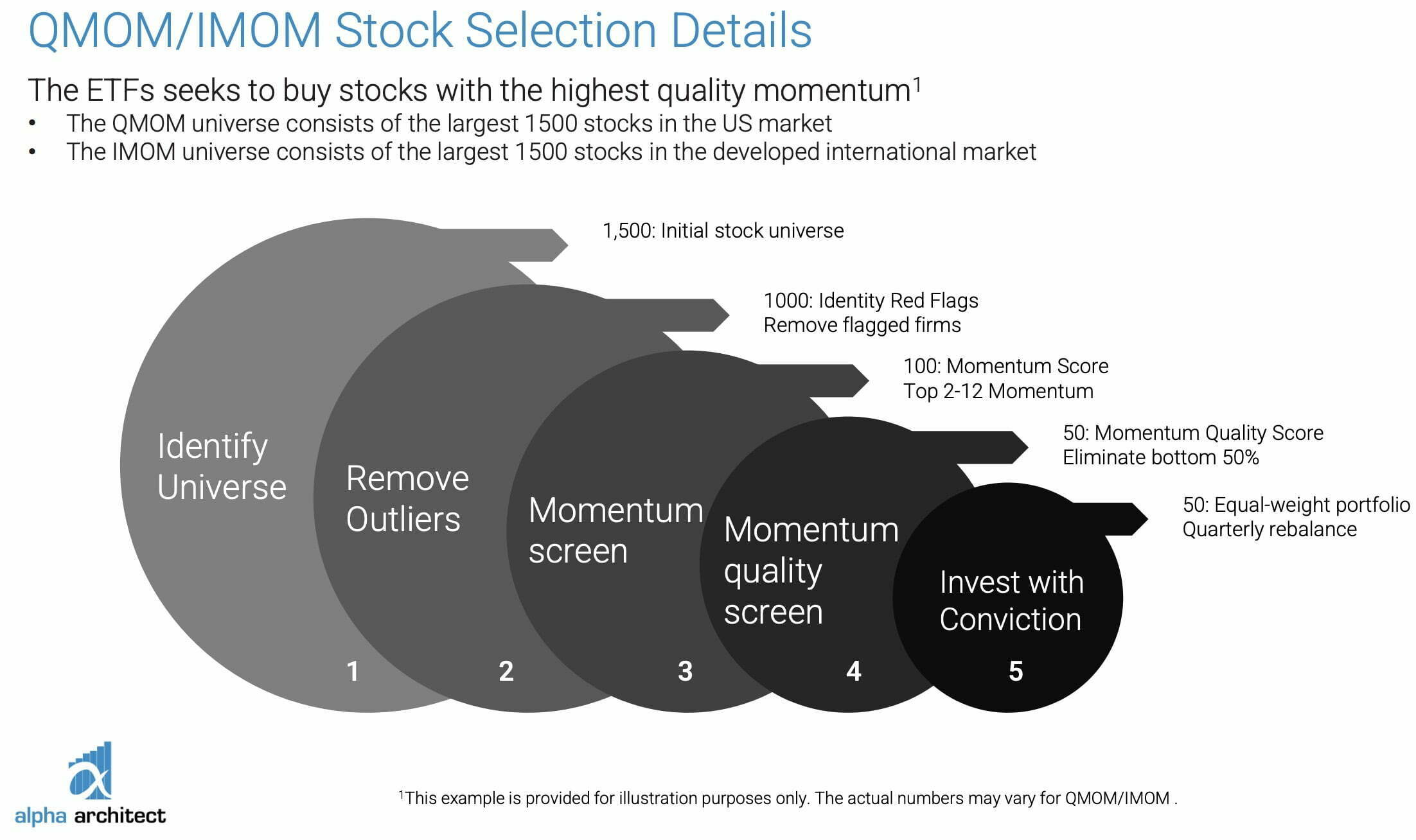

Quantitative Momentum boils down to buying the 50 strongest stocks in the US stock markets each quarter.

We do that by using research that was extensively tested by leading academics.

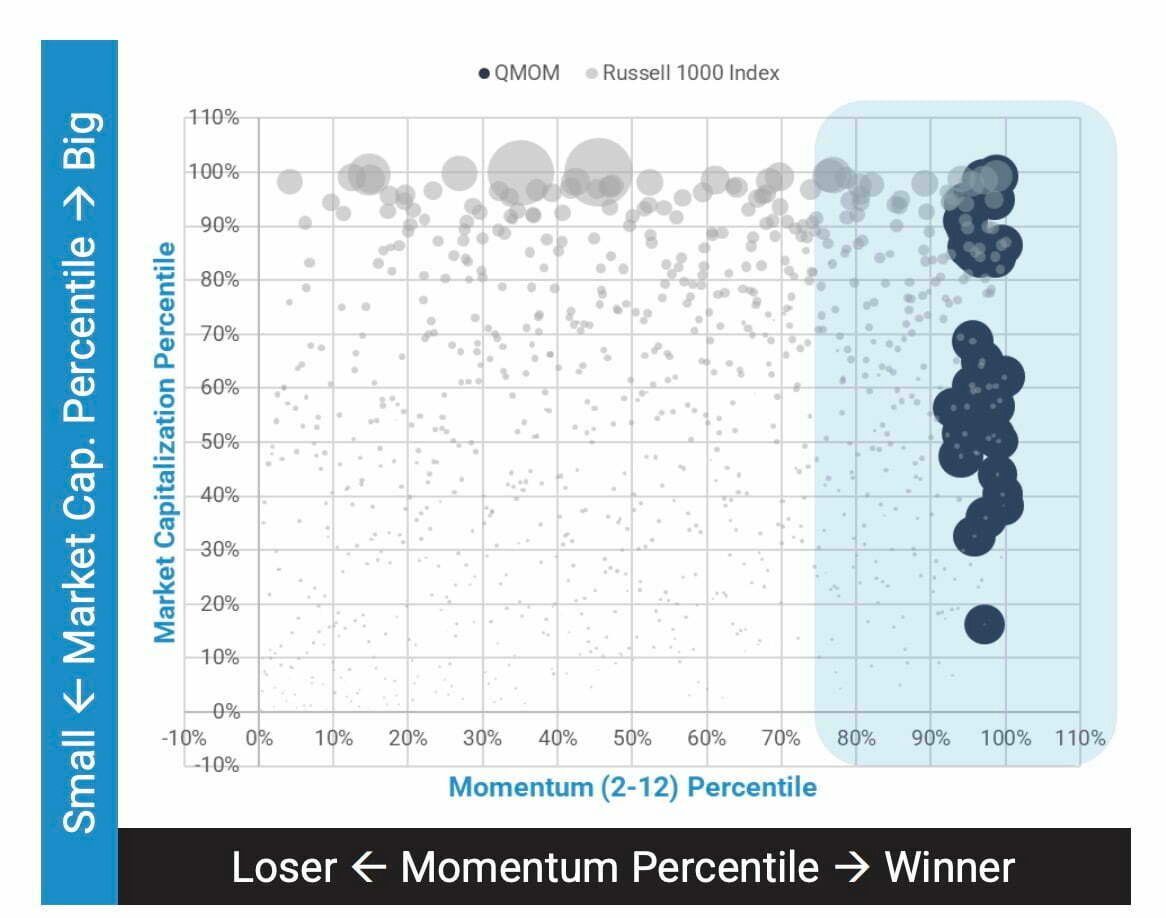

The primary piece of research is using 2-12 momentum to select the “strongest” stocks.

2-12 momentum is looking at what stocks have performed the best over the last “12” months, while leaving out the most recent month.

So it’s only month 2 through 12.

You leave out the most recent month because there are academic findings that show stocks tend to mean revert over a 1-month time period. i.e., the worst stocks have a short dead cat bounce.

Let me provide you a simple example, consider stock A, which is up 50% over the past year (but skipping the nearest month), and stock B, which is up 35% over the past year.

Our systems would prefer stock A over stock B.

An important side note is that our process is a bit more sophisticated than what is outlined above, for example, we do a lot of negative screens up front and we also look at the quality of the momentum via the “Frog-in-the-Pan” algorithm, which essentially tries to identify “smoother” past momentum versus “jumpy” past momentum.

But we’ll leave that discussion for another time.

A detailed discussion of our process can be found here.

Unique Features Of U.S. Quantitative Momentum QMOM ETF

Let’s go over all the unique features your momentum fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

Dynamic is the perfect word to use to describe our momentum strategy.

And rather than explain it in terms of active or passive, the better term would be systematic.

We give you dynamic, systematic, exposure to the 50 strongest stocks in the US stock market.

Our objective is to capture the so-called momentum factor in what we believe is the purest form possible for a long-only portfolio.

There is no leverage.

The current fee is 39bps.

What Sets QMOM ETF Apart From Other Factor Funds?

How does your fund set itself apart from other “factor focused equity” funds being offered in what is already a crowded marketplace?

What makes it unique?

Of the most popular factors offered to investors in the ETF wrapper, momentum is probably the least popular in terms of total assets allocated towards it.

(The other more popular factors would probably be value, low volatility, and size.)

Momentum isn’t as popular probably because it is the most misunderstood.

Investors often believe momentum is related to investing in a growth strategy, but that is not the case.

Growth strategies buy companies that have the highest growth in some metric, such as revenue.

These strategies often lead to buying companies that are expensive.

Momentum is buying the stocks that have performed the best relative to other stocks.

These could be growth stocks, value stocks (as they largely are currently the high momentum stocks), or any other type of stock.

What sets our fund apart from other momentum funds largely comes down to three things:

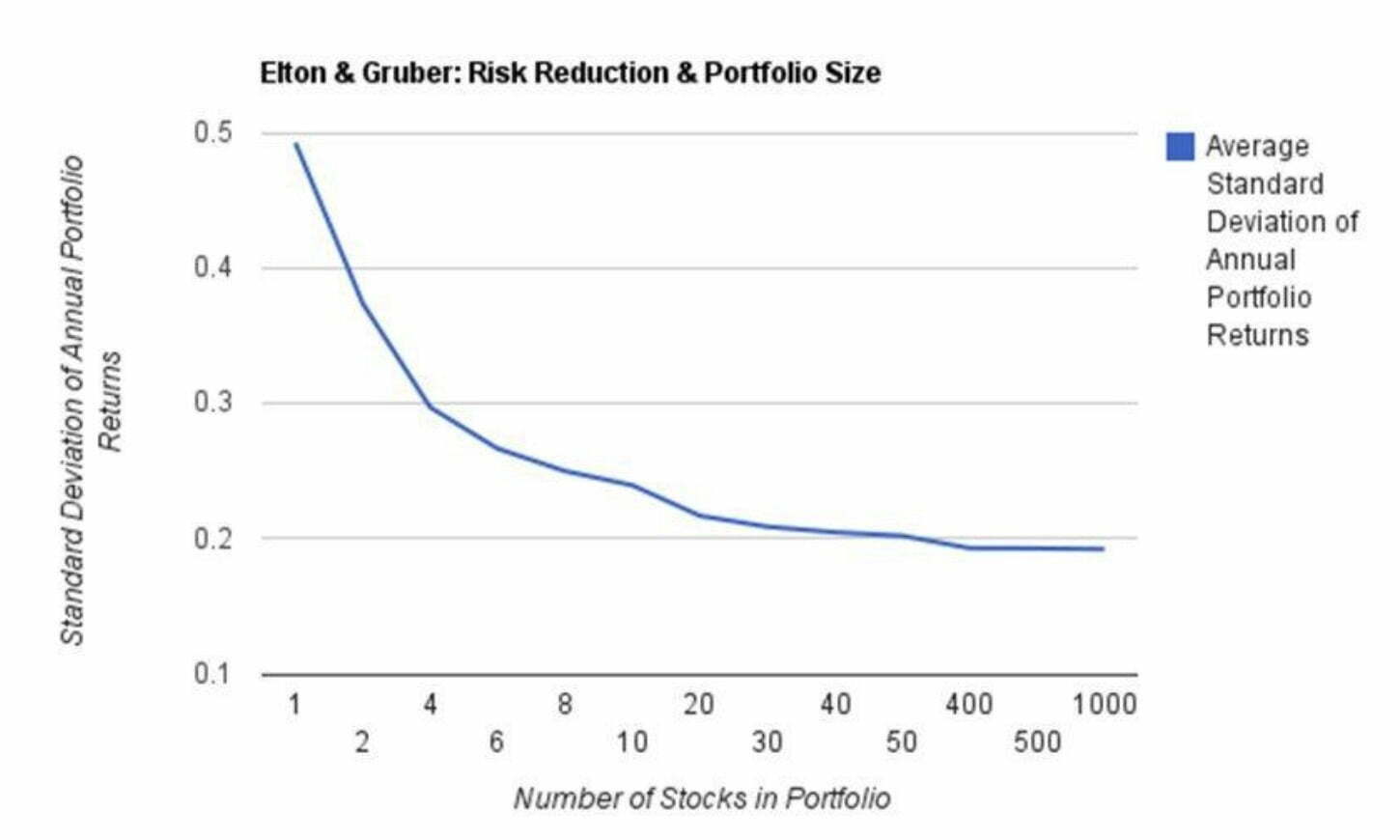

1: Number of holdings: We hold 50 stocks. The reason is because once you get to 50 stocks, you seemingly receive most of the benefits of diversification. And we don’t want to own more than that because for each stock we add, we are adding a stock with lower momentum than the one before it. If we believe momentum “works,” we want to own the highest momentum stocks and no more.

2) Weighting: We equal weight our 50 stocks. This is because we just want exposure to the momentum factor and don’t care to be exposed more or less to an individual company. I.e., if momentum stocks in general are doing well, we do well (and vice versa).

3) Rebalance Frequency: We rebalance our fund quarterly. Historically, for momentum investing in general, it seems the more frequently you rebalance, the higher the compound annual growth rate (CAGR).

What Else Was Considered For QMOM ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We have strongly considered (and continue to strongly consider) increasing our rebalance frequency to monthly vs quarterly.

The reason we haven’t done it is some combination of operational costs and trading costs.

We are actively researching the cost/benefits of higher frequency and might increase this in the future.

source: AAII on YouTube

When Will QMOM ETF Perform At Its Best/Worst?

Let’s explore when your momentum fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

The best times for the strategy are when there’s a strong trend for a particular sector.

So strong that it actually becomes difficult to hold because you’re wondering to yourself how it can keep going.

The covid bubble is a good example.

We owned Zoom, Peloton, Tesla, Docusign, and a bunch of other “stay at home” stocks that were going to the moon.

I remember saying to Wes and Jack when QMOM had gone from about $22 to $32 per share in a few short months that we had to be nearing the top.

I wasn’t even close.

QMOM didn’t top out until around $70 per share.

We weren’t even halfway there yet!

This is why systems are so important – they allow you to follow a process and avoid gut instincts that are often wrong.

The worst time for long only momentum strategies (as opposed to long short) comes after big shifts in the market.

Those “stay at home” stocks turned down hard after outpacing the market.

However, our momentum algorithm is fast moving and adapted quickly: we were able to rotate out of covid winning stocks and into the new trendy stocks like energy stocks.

For our clients who owned momentum throughout the whole thing, many told us it was a great experience.

It gave them something that scratched that itch of owning the hottest stocks in a hot time but gave them a systematic way to get out when the party was over.

Why Should Investors Consider US Quantitative Momentum QMOM ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

As I alluded to for the last question, a common reason some investors come to us is in search of that little something extra.

We build our strategies to attempt to give scalable, sustainable, performance.

QMOM gives you exposure to whatever the current hot thing in the market is.

And momentum historically delivers solid performance.

Behaviorally then, it can be a nice add alongside the more vanilla low-cost beta ETFs, while still keeping you in an academically sound investment that we believe has a chance to outperform over the long haul.

How Does QMOM ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

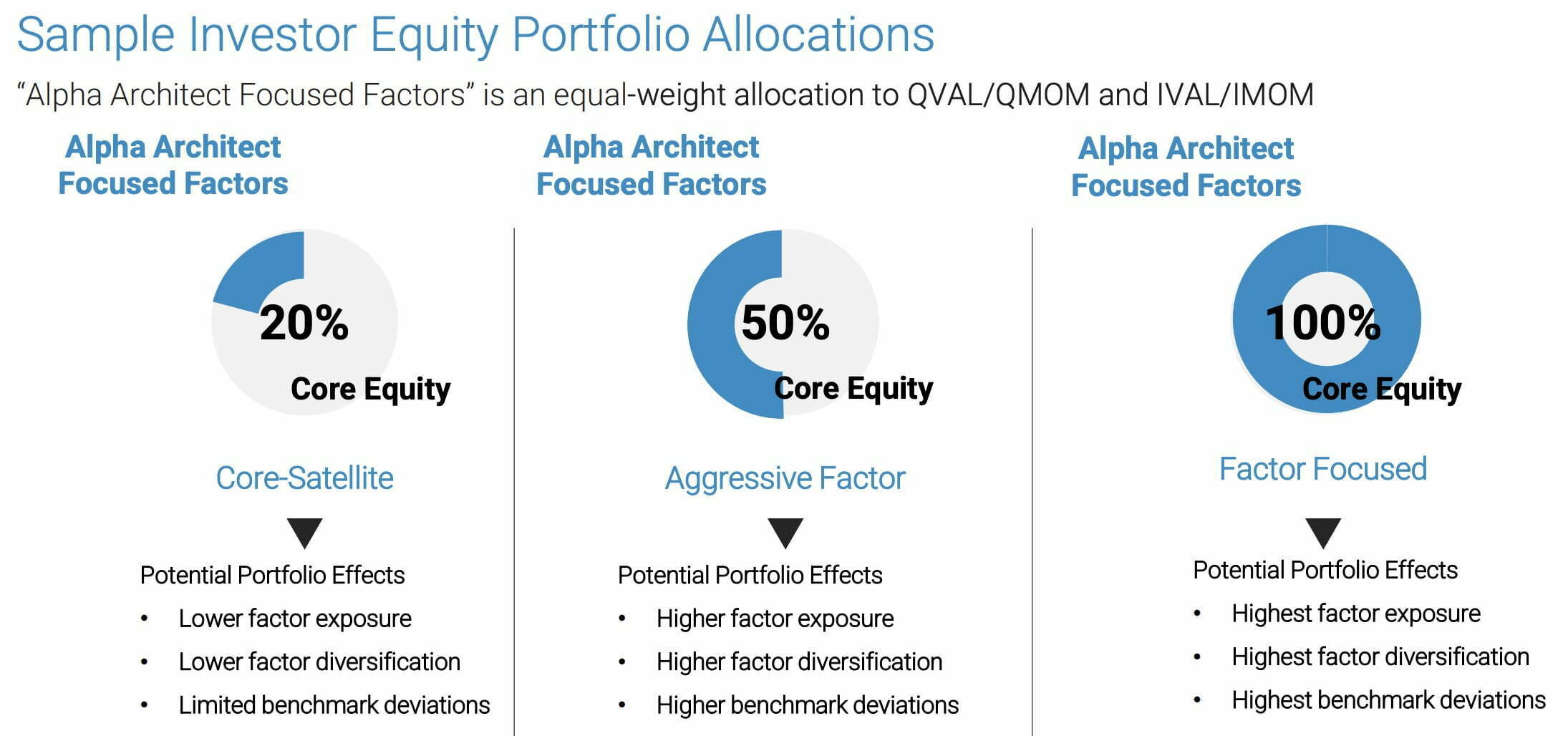

For most, it’s a satellite diversifier.

For those who already have a full portfolio allocated to value type strategies, it can be a great addition at about 20% of your equity portfolio and can serve as a yin to your value’s yang, as the two tend to perform differently.

If you have a market portfolio already, it can be good at a 15% weighting with our concentrated value ETF (QVAL) alongside it equally.

There are those who are OK making it 50%, or more, of their equity portfolio, but it depends.

The people who use our funds at a higher percentage of their portfolio are generally individual investors managing their own money, as opposed to financial advisors managing on behalf of others.

Why is that the case?

The biggest challenge with QMOM, and really all of our ETFs, is the fact we are so different from the market, which means we have a lot of tracking error.

So intermediaries need to use our strategies as satellite positions versus core positions, when career risk concerns are at a peak.

source: Raise Your Average on YouTube

The Cons of QMOM ETF

What’s the biggest point of constructive criticism you’ve received about your quantitative momentum fund since it has launched?

The typical criticism is that the fees are too high relative to other momentum funds.

And we’ve been as responsive as possible on that criticism by bringing down the fees of our funds as we’ve gained additional AUM to pass cost savings along to our clients.

But we also spend a lot of time educating investors on the differentiation between QMOM and the other so-called momentum ETFs in the market.

And the reason the other ETFs are a bit lower cost is because they are often mega-cap closet index funds in drag.

We are not.

We are a pure-play momentum fund with limited scalability and the strategy requires a lot of work behind the scenes.

We feel confident that our value proposition is very strong, but everyone always wants lower fees – which we understand!

source: Financial Advisor TV on YouTube

The Pros of QMOM ETF

On the other hand, what have others praised about your quantitative momentum fund?

Sticking to the research.

It can be challenging to stick to the research when we’re operating on a 30-year time horizon in building strategies to compound with, but the world generally operates on a 1 year horizon.

Our investors though have been loyal and embrace the suck that is inevitable at times and have praised us for not changing things to be more like others.

Democratize Quant Conference + Recently Launched New ETFs!

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

We have our Democratize Quant Conference on May 18th.

Anyone can attend that digitally and we are working on putting together some good deep geek content.

Beyond that, we’ve recently launched some new ETFs that we are excited about.

And we are constantly working to build up the education library on those (and on our existing too).

Connect With Ryan Patrick Kirlin of Alpha Architect

Website: Alpha Architect

Fund Page: QMOM U.S. Quantitative Momentum ETF

Entire Roster Of Funds (Alpha Architect + Others): ETF Architect

Twitter: @RyanPKirlin (Ryan) / @alphaarchitect (Wes) / @jvogs02 (Jack)

Nomadic Samuel Final Thoughts

I want to personally thank Ryan for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

Ryan was also a guest for the “Investing Legends” series (Quantitative Momentum Investing Strategy With Ryan Patrick Kirlin) which I recommend checking out.

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.