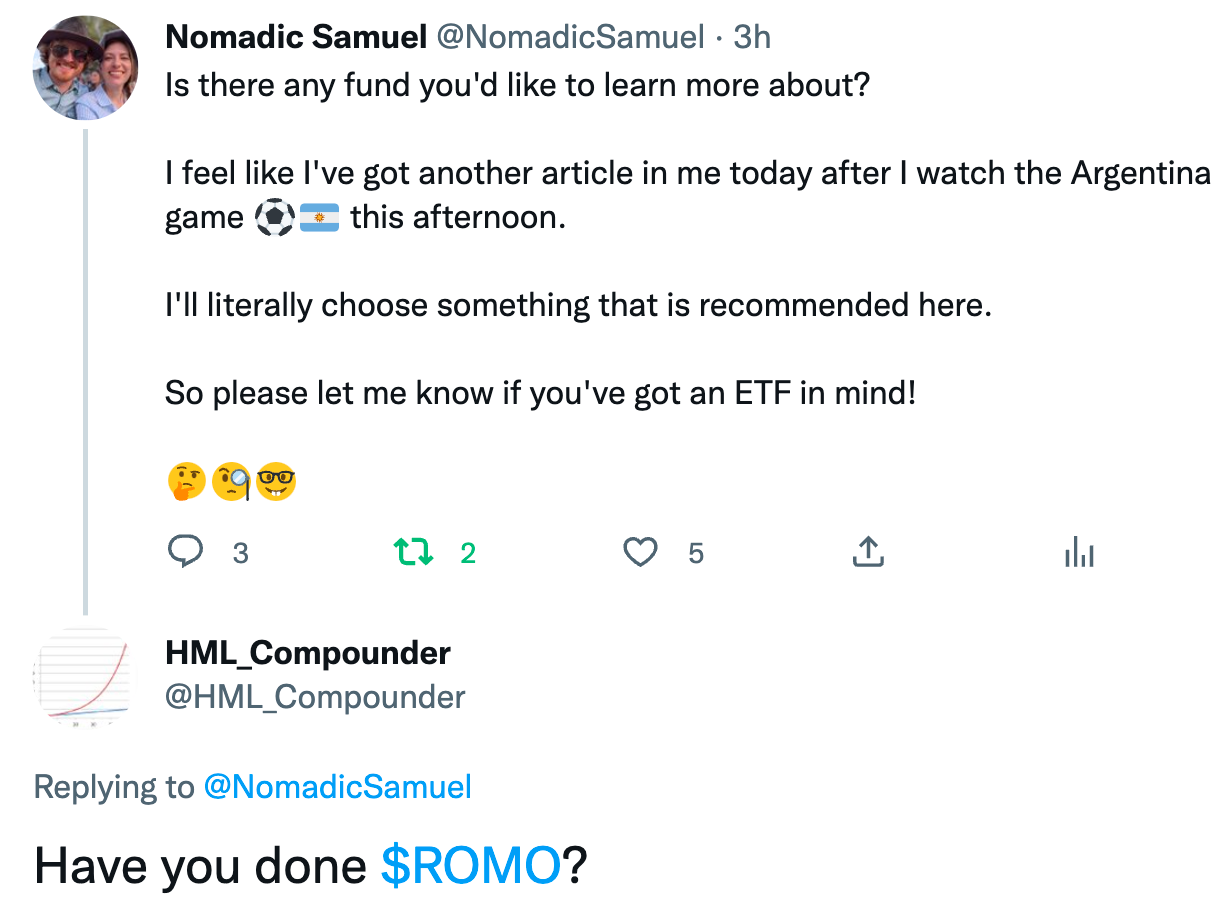

Some of the best suggestions I get for fund reviews come from friends I’ve made on Twitter.

Prior to watching Argentina defeat Poland to advance in the World Cup, I tweeted out the following:

Jolly crackin’ good times!

Alas, I received another splendid suggestion from @HML_Compounder who dropped by earlier this year to discuss Value Investing and Trend-Following as part of the “Investing Legends” series.

Undoubtedly, HML_Compounder did a great job of summarizing two of the most distinct features of ROMO ETF:

- Dual Momentum Strategy

- Distinct Dimmer Switch Approach

More on both of those key features later.

Strategy Shares Newfound/ReSolve Robust Momentum ETF is the full name of the fund we’re about to review today.

It’s a collaboration between Newfound Research and ReSolve Asset Management.

When these two asset management and research firms join forces it’s usually a force to be reckoned with whether it be to produce a white paper, podcast or in this case a fund that is available for retail investors and advisors.

And in many regards Strategy Shares seems like the perfect partner as the ETF provider with the following motto: “Pioneers in Non-Traditional Investment Solutions”

Over here at Picture Perfect Portfolios we’re also rarely enthused by vanilla offerings, so with that in mind let’s kick things off with this review of ROMO ETF!

Strategy Shares Newfound/ReSolve Robust Momentum ETF Review of ROMO

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Strategy Shares / Newfound Research / ReSolve Asset Management

Let’s discover a bit more about Strategy Shares, Newfound Research and ReSolve Asset Management before we examine ROMO ETF.

Strategy Shares seeks to provide innovative investment solutions to address unmet needs:

- Unique and innovative strategies

- Strategies managed by experienced institutional teams

- A non-traditional approach

They currently have a roster of 5 ETFs:

- FIVR – Strategy Shares Nasdaq 5HANDL™ Index ETF

- GLDB – Strategy Shares Gold Hedged Bond ETF

- HNDL – Strategy Shares Nasdaq 7HANDL™ Index ETF

- NZRO – Strategy Shares Halt Climate Change ETF

- ROMO – Strategy Shares Newfound/ReSolve Robust Momentum ETF

ReSolve Asset Management is a firm that specializes in systematic investment strategies and offers two of my favourite funds.

HRAA.TO and RDMIX.

Horizons ReSolve Adaptive Asset Allocation Fund is an ETF that has made its ways into my diversified DIY Quant Portfolio.

NewFound Research is a quantitative investment management and research firm that offers model portfolios and some fascinating funds such as Newfound Risk Managed U.S. Growth Fund that I reviewed a few months ago.

What is on my radar for 2023 is another alliance between Newfound Research and Resolve Asset Management to release two “Return Stacking” ETFs into the marketplace:

The Investment Case For Robust Momentum Tactical Strategy

The investment case for a “Robust Momentum Tactical Strategy” has been laid out succinctly by the folks over at Strategy Shares in tandem with Resolve Asset Management and Newfound Research: (view on the fund page)

source: ReSolve Asset Management

“Why invest in ROMO ETF?

The Newfound/ReSolve Robust Equity Momentum Index seeks to provide momentum-based exposure to global equity regions while simultaneously avoiding significant and prolonged drawdowns.

Strategy Description:

The Newfound/ReSolve Robust Equity Momentum Index uses a quantitative, rules-based methodology to provide exposure to broad U.S., international, and emerging equity indices to the extent that equity indices are exhibiting positive momentum relative to U.S. Treasury indices. The Index will include U.S. Treasury exposure when equities exhibit negative momentum and trend following characteristics versus the U.S. Treasury markets.

Index Description (Solactive):

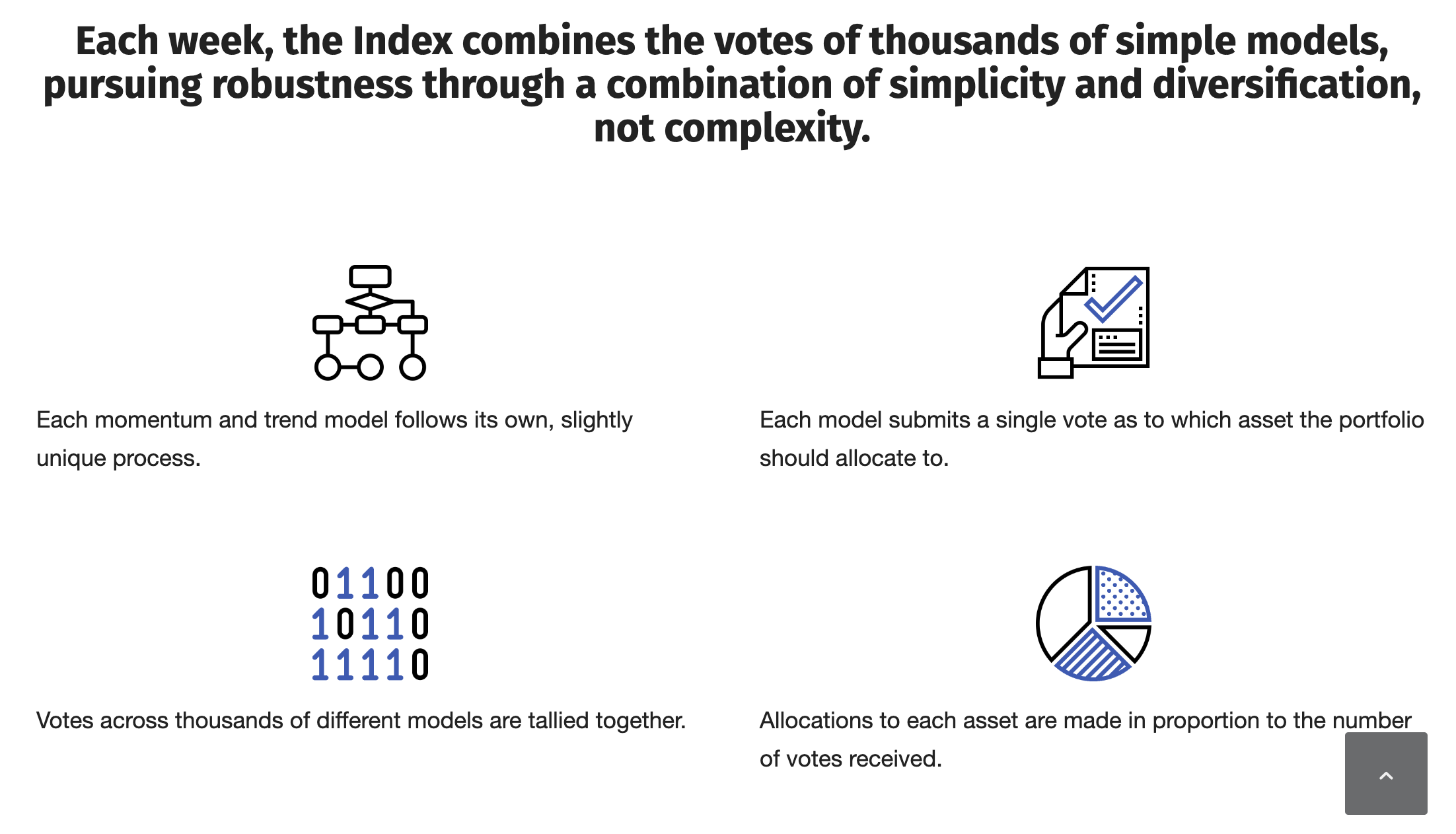

The Newfound / ReSolve Robust Equity Momentum Index attempts to provide dynamic exposure to broad U.S., international, and emerging equities while simultaneously seeking to avoid significant and prolonged drawdowns by tactically allocating to short- or intermediate-term U.S. Treasuries. Exposures to underlying indices are expressed through U.S. listed Exchange Traded Funds (”ETFs”). The Index rebalances weekly into the equity region exhibiting the strongest momentum (subject to constraints on maximum weights). A trend filter is applied, allocating into U.S. Treasuries when equities exhibit negative trends. The Index employs an ensemble approach where a large number of simple momentum and trend strategies ”vote” on which of the 5 possible ETFs should be held by the Index. The weight of each ETF in the portfolio at each rebalance is in proportion to the percentage of votes it receives.”

Okay.

So let’s attempt to boil this down into 5 key points.

ROMO ETF 5 Key Points

- Global Equities: exposure to US, International Developed and Emerging Markets Equities via ETFs

- Momentum: index rebalances “weekly” towards the equity region with the strongest momentum

- Trend: allocate to US Treasuries when equities exhibit negative trends

- Ensemble: large number of simple “momentum” and “trend” strategies “vote” on which of the 5 possible ETFs to hold

- Vote: weight of each ETF during rebalancing is determined in proportion to the percentage of votes it receives

Let’s put this altogether in one sentence.

ROMO ETF invests in global equities markets (US, International Developed and Emerging Markets) determined by which region has the strongest “momentum” with “trend” signals determining if/when to allocate to US treasuries (ex: when markets are trending downward) which is determined by an “ensemble” of total “votes” from simple momentum and trend strategies.

ROMO ETF: Hypothetical Examples

Let’s give some hypothetical examples to better understand the strategy.

If markets are strongly upward trending ROMO ETF has the capacity to be 100% equities and if Emerging Markets have the most relative momentum it’ll expand its presence in the portfolio.

If markets are downward trending ROMO ETF will increase its allocation to US Treasuries at the expense of its equity allocations.

If International Developed markets are now experiencing more relative momentum than Emerging Markets, ROMO ETF will adjust its weightings accordingly to reflect this reality.

The same would be true if US markets emerged with strong momentum relative to global markets.

Momentum + Trend

Dimmer Switch

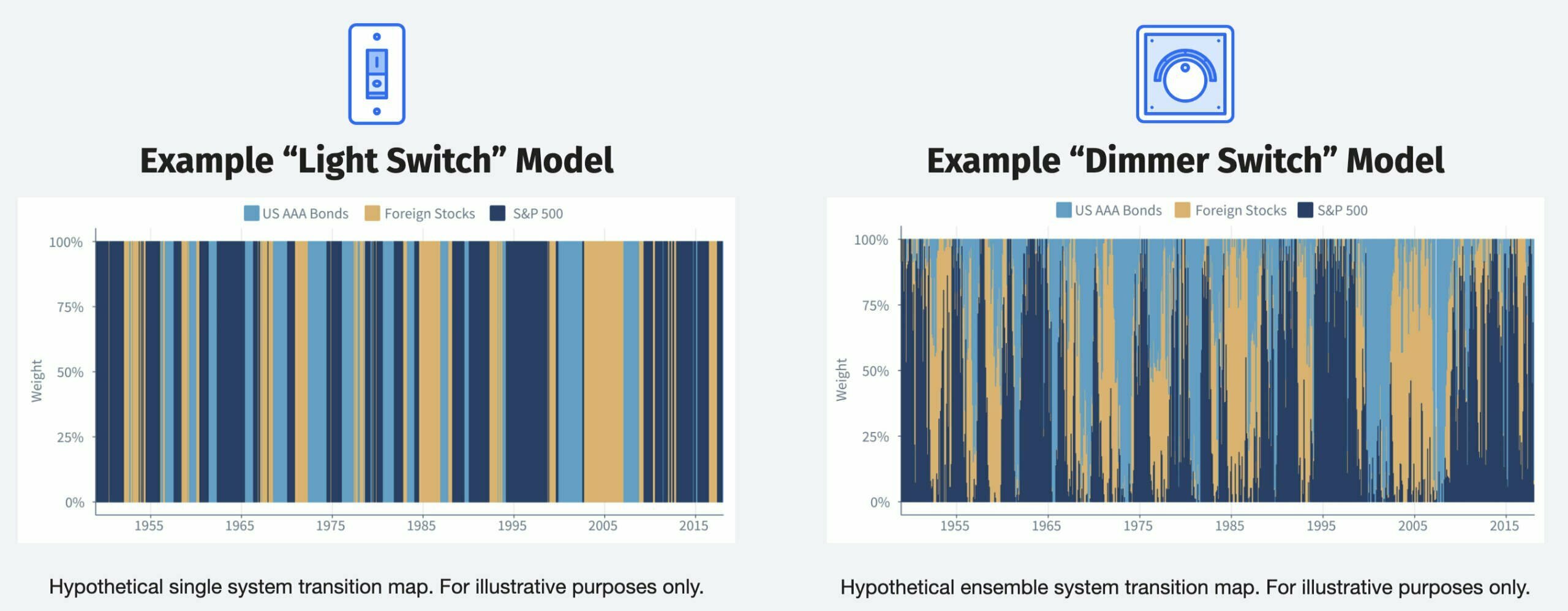

One of the key features of ROMO ETF that sets it apart from other tactical funds is that it utilizes a “Dimmer Switch” model as opposed to a “Light Switch” model.

Here is an explanation from the team:

“Despite the overwhelming empirical evidence supporting momentum and trend signals, our research suggests that overly simplified implementations can be surprisingly fragile.

Fortunately, many models that seek to capture momentum and trend are actually close mathematical cousins.

By combining thousands of simple – but slightly different – models together, we seek to benefit from process diversification and create a more robust investment result.”

It seems the ensemble voting system ensures that transitions are smooth as opposed to rigid “on” and “off” models.

You can read more about the strategy by checking out the ReSolve Asset Management PDF: “Global Equity Momentum”

Dynamic Historical Weightings

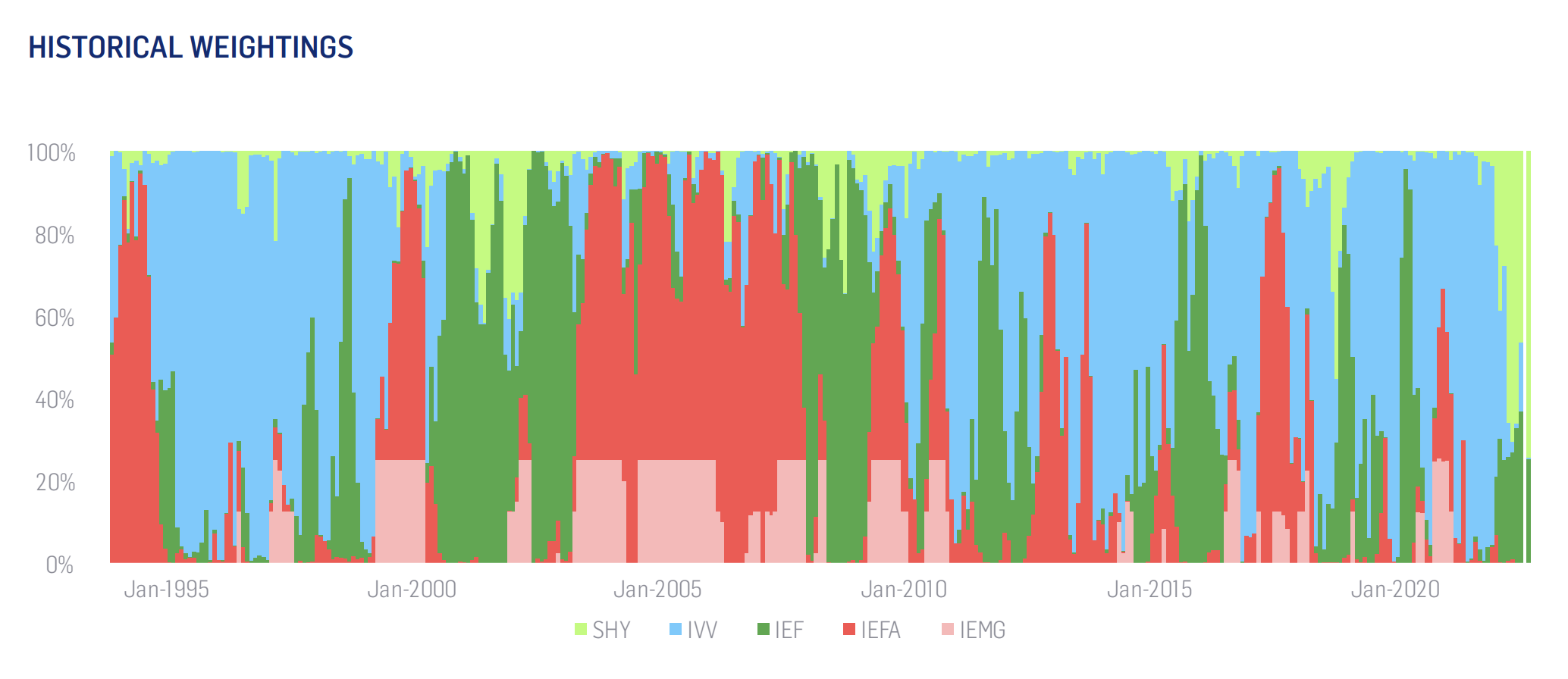

Sometimes a picture says a thousand words.

Above you’ll notice ROMO ETF as represented by its historical hypothetical weightings.

Notice how dynamic allocations are throughout the years.

US equities (IVV) dominated allocations in the 2010s when they were relatively outperforming Emerging Markets and International Developed equities.

Now check out the 2000s when International Developed (IEFA) and Emerging Markets (IEMG) equities reigned supreme.

The advantage of rotating into markets that are relatively strong is that you avoid holding US equities when they have a lost 2000s while you overweight them in the 2010s when relative momentum suggests an outsized allocation.

The same holds true for treasuries.

In the early 2000s, when global equities were struggling across the board the fund would have been dominated by 7-10 Intermediate Treasuries (IEF).

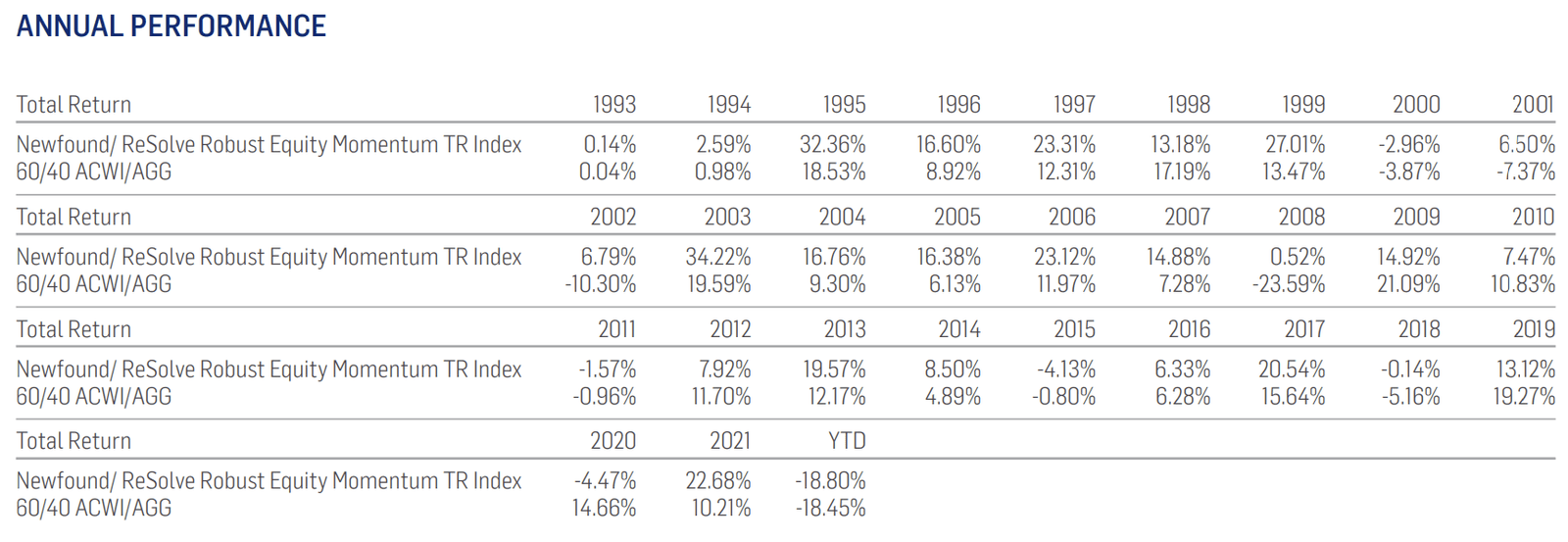

Hypothetical Historical Performance

Here we’re able to get a taste of ROMO ETF returns throughout the years through the lens of a hypothetical historical backtest.

Notice how the fund outperforms in the early 2000s and 2008 in particular.

In fact, it had a streak of outperformance annually from 1999 that doesn’t end until 2009.

Noteworthy, is that the strategy unsurprisingly has tracking error to the static 60/40 portfolio with years such as 2009, 2010 and 2012 as a clear example of it relatively underperforming.

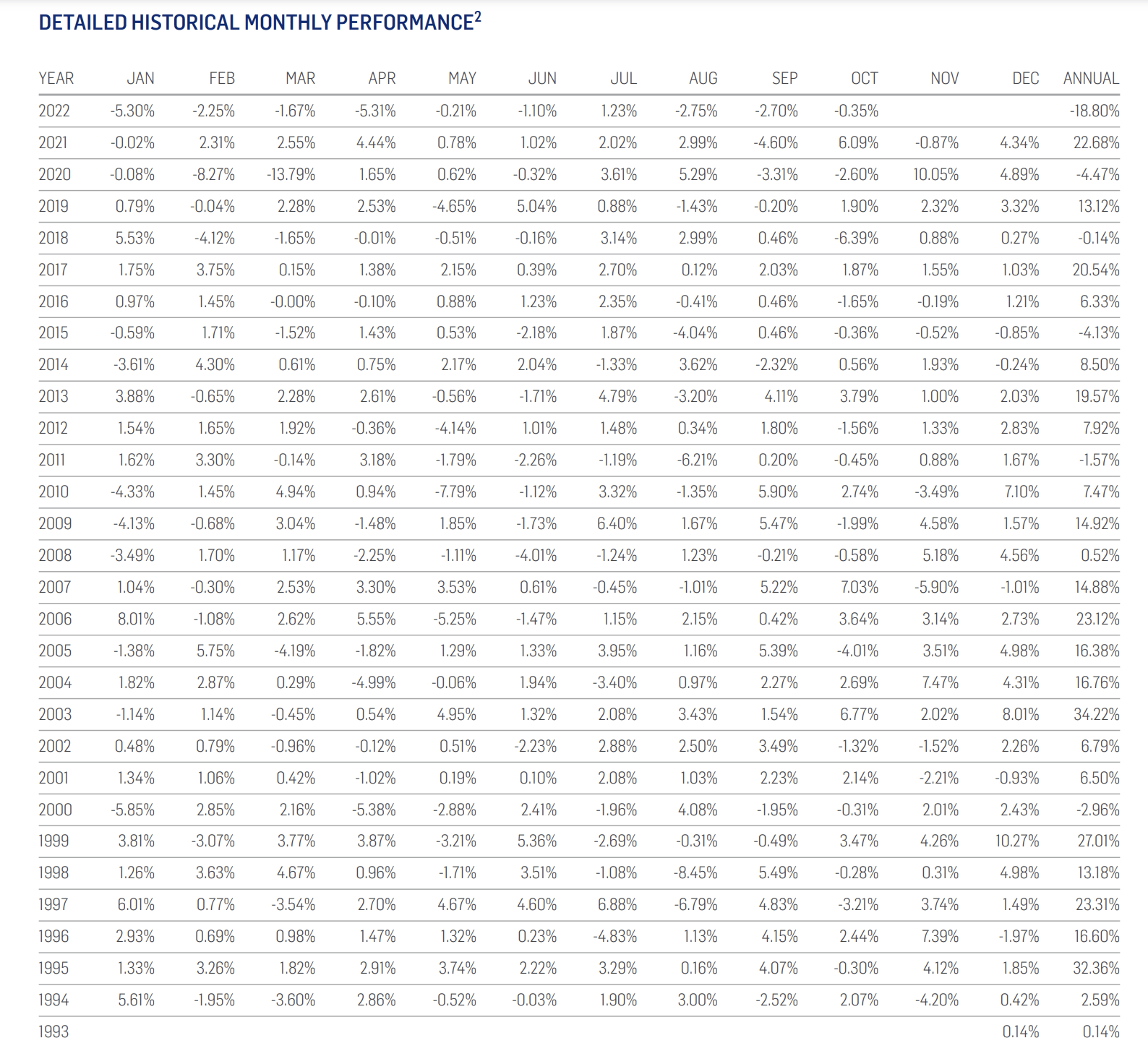

Here you get the full picture of annual returns as broken down by month going all the way back to 1993.

ROMO ETF Overview, Holdings and Info

Let’s pop open the hood of ROMO ETF to see what kind of goodies the fund has to offer investors!

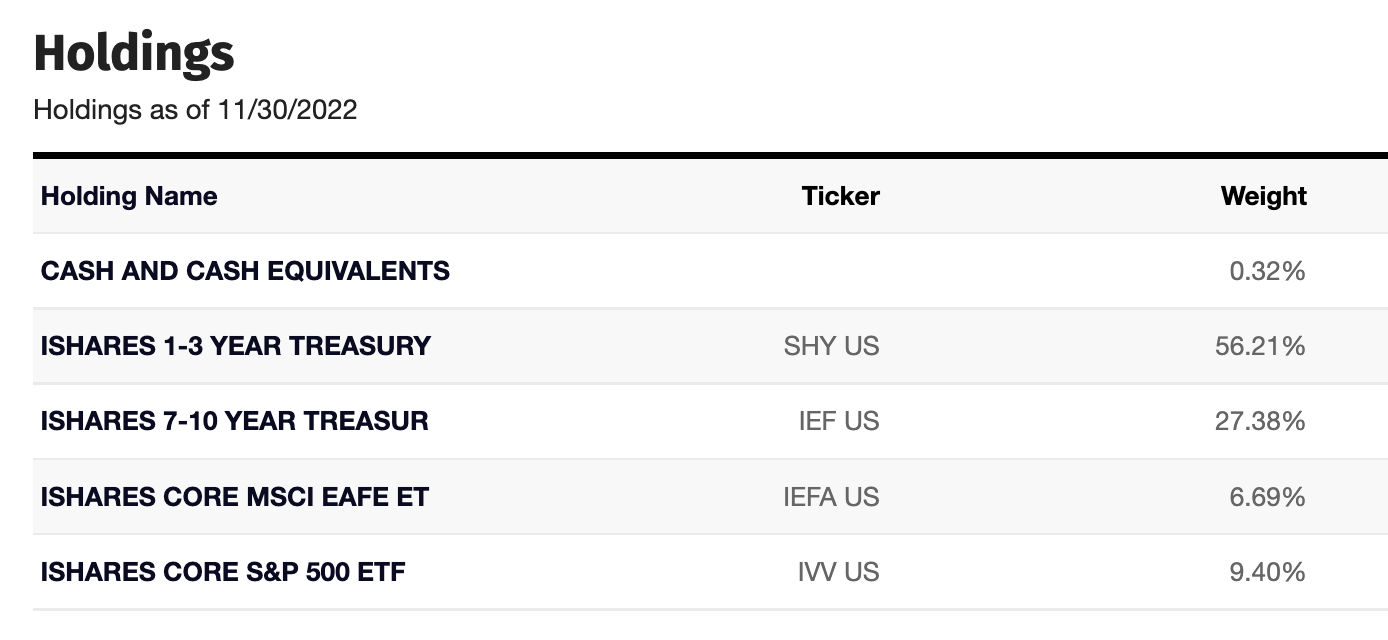

ROMO Holdings as of 11/30/2022

It should come as no surprise that current ROMO ETF holdings are heavily skewed towards short-term and intermediate treasuries given the tumultuous downtrending markets of 2022.

However, it is important to note this is just a snapshot and that the fund is dynamic in nature.

In fact, the fund can range from having 100% portfolio exposure to US equities or International developed equities.

And a maximum of 25% exposure to Emerging Markets.

In cases where there is negative equity momentum and strongly downward trending markets the fund may have 100% exposure to US Treasuries.

Overall Range: 100% Global Equities <—> 100% US Treasuries (Short/Int)

ROMO Info

Ticker: ROMO

Net Expense Ratio: 0.89

AUM: 51.1 Million

Inception: 11/01/2019

Strategy Shares Newfound/ReSolve Robust Momentum ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Newfound/ReSolve Robust Equity Momentum Index (the “Index”).

The Index is based on a proprietary methodology co-developed and co-owned by Newfound Research LLC and ReSolve Asset Management SEZC (Cayman) (the “Index Providers”).

The Index is calculated and maintained by Solactive AG.

The Fund will invest at least 80% of its assets in the component securities of the Index. The Index uses a quantitative, rules-based methodology to provide exposure to broad U.S. equity, international equity, and emerging market equity indices, to the extent that such equity indices are exhibiting positive momentum relative to U.S. Treasury market indices.

The Index generally consists of exchange-traded funds (“ETFs”) that track regional equity indices, representative of U.S. equities, developed international equities and emerging market equities (“Regional Equity ETFs”), as well as ETFs that track U.S. Treasury market indices, representative of shortterm (i.e., 1-2 year maturity) U.S. Treasury notes and intermediate-term (i.e., 7-10 year maturity) U.S. Treasury bonds (“U.S. Treasury ETFs”).

The Regional Equity ETFs that may be included in the Index invest in the equity securities, including common stock and American Depository Receipts (“ADRs”), of companies of any market capitalization that are traded on foreign or U.S. exchanges.

The Index typically includes between one and five ETFs.

Because the Index is comprised of securities issued by other investment companies, the Fund operates as a “fund of funds.”

The allocations to Regional Equity ETFs within the Index are determined by proprietary quantitative models that include momentum and trend following factors that are evaluated over various time horizons.

The weightings of Regional Equity ETFs within the Index are determined based on measures of the momentum of the global equity markets relative to the momentum of U.S. Treasury securities.

Regional Equity ETFs with the strongest momentum characteristics that also exhibit positive trend following characteristics receive greater weights.

The Fund may have 100% portfolio exposure to U.S. Regional Equity ETFs or developed international Regional Equity ETFs, and up to 25% portfolio exposure in emerging market Regional Equity ETFs.

The Index will include U.S. Treasury ETFs when Regional Equity ETFs exhibit negative momentum and trend following characteristics versus the U.S. Treasury markets.

The Fund may have 100% portfolio exposure to U.S. Treasury ETFs under such circumstances.

The Index is rebalanced weekly and is reconstituted annually in December.

The Fund generally will use a replication methodology, meaning it will seek to invest in all of the ETFs comprising the Index in proportion to the weightings in the Index.

However, under various circumstances, the Fund may use a representative sampling strategy, whereby the Fund would invest in what it believes to be a representative sample of the component securities of the Index.

To the extent the Fund uses a representative sampling strategy, it may not track the Index with the same degree of accuracy as would an investment vehicle replicating the entire Index.

The Fund will concentrate its investments in a particular industry or group of industries to the extent that the Index concentrates in an industry or group of industries. The Fund may engage in frequent trading of portfolio securities.”

ROMO ETF Pros and Cons

Let’s examine the pros and cons of Strategy Shares Newfound/ReSolve Robust Momentum ETF.

ROMO ETF Pros

- Tactical Fund of Funds exposure to global equity markets that include US, International Developed and Emerging Markets

- Bond exposure to US Short and Intermediate Term Treasuries

- The ability to be 100% allocated to equities or 100% allocated to US Treasury depending upon “momentum” and “trend” signals

- Its dynamic nature allows the fund to be defensive when markets are downtrending and offensive when they’re upward trending

- Its relative momentum strategy between US, International Developed and Emerging Markets prevents a scenario like the 2000s where US equities experienced a lost decade (fund would have allocated its resources to International Developed and Emerging Markets based upon relative momentum)

- Dimmer switch as opposed to light switch of an ensemble voting process between momentum and trend models

- Can potentially be a core holding or a satellite position in a portfolio depending upon the goals of the investor

- Reasonable fee for a tactical ETF (index funds keep costs lower)

- Support innovative boutique firms that are creating unique products for investors

ROMO ETF Cons

- A year like 2022 is challenging when US Treasuries aren’t providing as much of a hedge against Equity drawdowns

- The potential for tracking error versus a static 60/40 portfolio (you own a different product so you best expect different results)

ROMO ETF Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

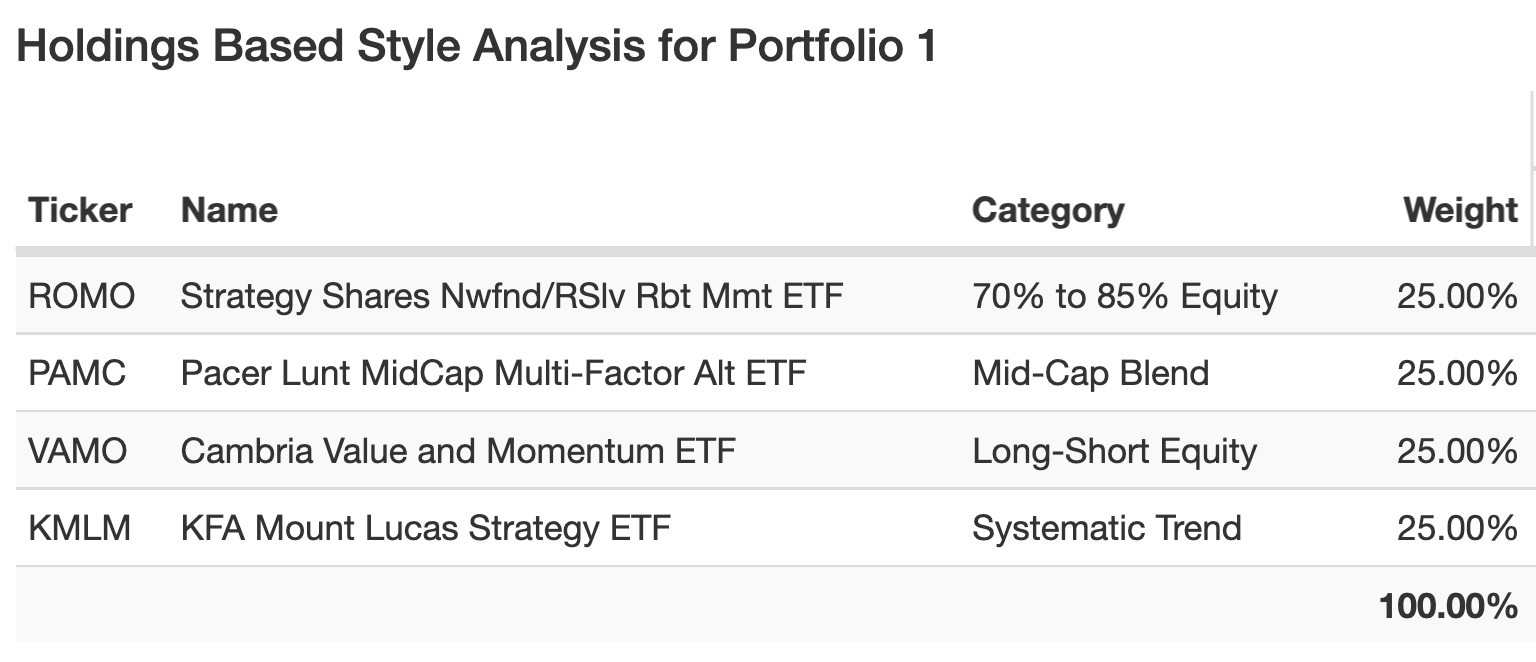

Since ROMO ETF is a dynamic fund, I thought it might make sense to create an entirely dynamic portfolio for it to be a part of.

25% ROMO

25% PAMC

25% VAMO

25% KMLM

Here we’d be pairing ROMO ETF (with its ability to dynamically allocate between 100% global equities and 100% US Treasuries) with three other funds.

Pacer Lunt MidCap Multi-Factor Alternator ETF (PAMC) rotates between factors (momentum, value, quality and volatility) selecting the 2 factors with the highest rank for every given month.

VAMO ETF offers value and momentum factor focused equities with the capacity to tactically hedge by shorting the S&P 500.

KMLM ETF offers trend-following across commodities, rates and currencies while excluding equities.

Overall, we’d cover all of our bases with MCW weighted equity exposure, mid-cap factor tilts and value and momentum.

Treasury exposure and trend-following managed futures rounds things out.

ROMO Portfolio vs 60/40 Portfolio

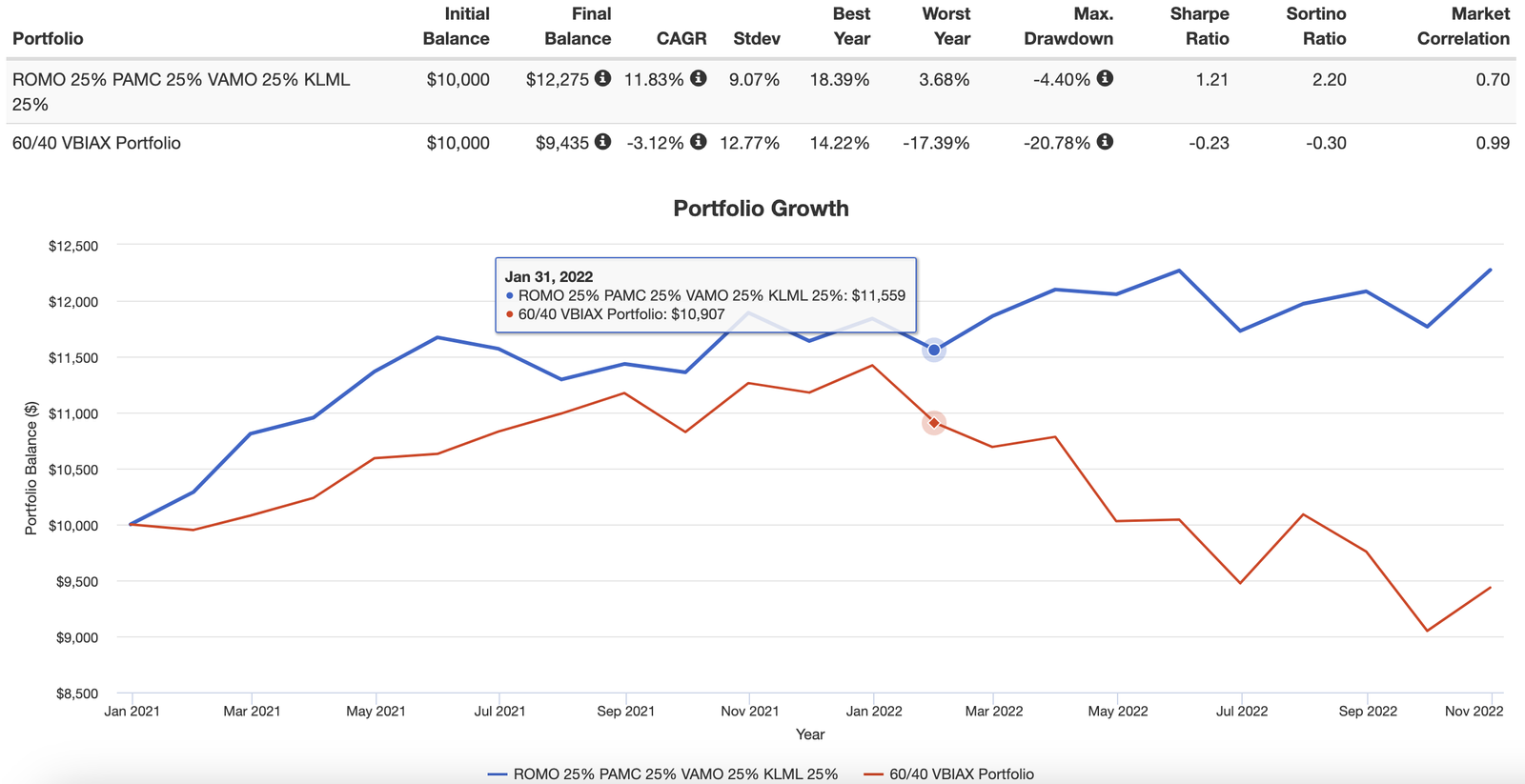

The ROMO ETF And Friends Portfolio kicks the tar out of a 60/40 Portfolio from as far back as we’re able to backtest it.

Notice how our CAGR of 11.83% is above RISK at 9.07%.

We add insult to injury by crushing the 60/40 portfolio in terms of Sharpe Ratio, Sortino Ratio, Max Drawdown and Worst Year.

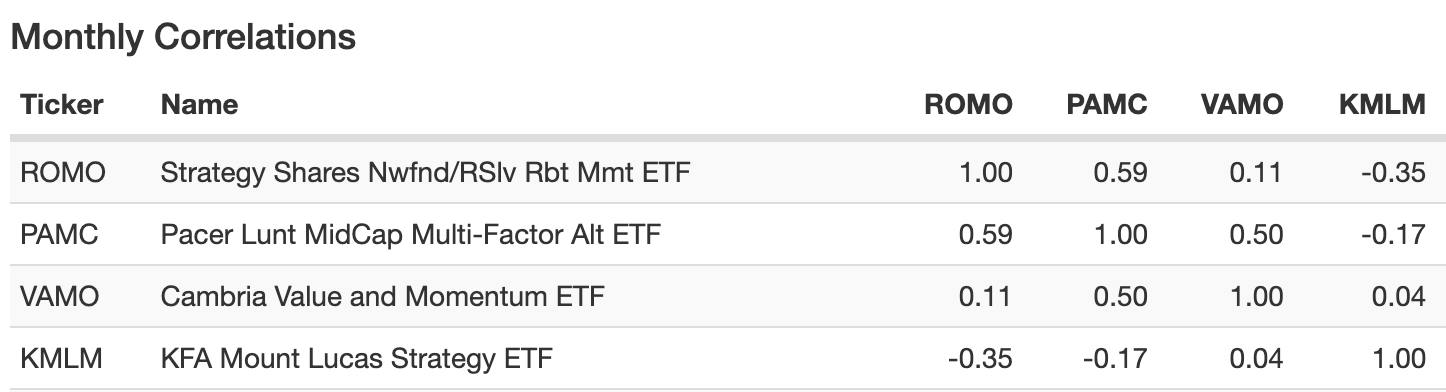

Finally, we’re able to see that monthly correlations are low between all strategies in the model portfolio.

That’s a feather in our diversified cap.

Nomadic Samuel Final Thoughts

Overall, I’m a fan of ROMO ETF.

I think it represents a step forward in an industry plagued by conservatism and groupthink.

Most innovation is coming from boutique level providers.

If we support them we’ll continue to be blessed with innovative new products.

If we don’t, we’ll have nothing but vanilla ice cream served by the Goliath providers.

I think that’s where we’ll end things off today.

What do you think of ROMO ETF?

Please let me know in the comments below.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.