No investing strategy has captured my attention more in recent months than Return Stacking!

When I first heard of the concept, a term coined by @RodGordilloP and @choffstein, I immediately thought it was brilliant from both an investing and branding standpoint.

I’ve consumed hours of content related to Return Stacking and witnessed how hard the Newfound Research and ReSolve Asset Management team have worked to transform an idea into an investable product.

We’ve now got RSBT ETF in the marketplace as a potential puzzle piece for rip roarin’ return stackers, capital efficient aficionados and expanded canvas mavens to consider.

It’s better know as Return Stacked Bonds & Managed Futures ETF.

And we’re in for a real treat because we have its founder Corey Hoffstein joining us to take part in the “Strategy Behind The Fund” series to unpack all of its unique features.

I’m drop dead serious when I admit that I could go on all day rambling about “return stacking” but let’s turn things over to Corey!

Corey Hoffstein: CIO of Newfound Research

Corey Hoffstein is co-founder and Chief Investment Officer of Newfound Research, a quantitative investment firm offering alternative investment strategies and capital efficient solutions.

At Newfound, Corey oversees quantitative research and overall corporate strategy.

A passionate researcher and educator, Corey is best known for his writing on liquidity cascades, his journal-published papers on rebalance timing luck, and being the host of the quantitative investment podcast Flirting with Models.

Corey holds a B.S. in Computer Science from Cornell University and a M.S. in Computational Finance from Carnegie Mellon University.

Reviewing The Strategy Behind RSBT ETF (Return Stacked Bonds & Managed Futures) with its creator Corey Hoffstein

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of RSBT ETF?

For those who aren’t necessarily familiar with a capital efficient “return stacking” asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

For many investors looking to incorporate diversifying alternatives into their portfolio, a common question emerges: “how do I make room?”

Often, the answer is selling core stock and bond positions, which can be difficult to stick with during periods like the 2010s when alternatives struggled.

For decades, sophisticated institutions have solved this problem through the thoughtful application of leverage, allowing them to include diversifying alternatives without diluting their core stock and bond allocation.

They are effectively able to stack the alternatives on top of their core, strategic asset allocation.

In practice, however, this often requires managing derivative positions like futures and swaps, which we believe has precluded many investors from adopting the approach.

That is where Return Stacked™ ETFs come in: our aim is to allow all investors the opportunity to implement this concept.

As a concrete example, consider the Return Stacked™ Bonds & Managed Futures ETF (RSBT).

The ETF seeks to provide long-term capital appreciation by investing in two complementary investment strategies: a bond strategy and a managed futures strategy.

For every $1 invested, the ETF seeks to provide $1 of exposure to its bond strategy and $1 of exposure to its managed futures strategy.

source: ReSolve Asset Management on YouTube

Unique Features Of Return Stacked Bonds & Managed Futures ETF RSBT

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The Return Stacked™Bonds & Managed Futures ETF (RSBT) seeks to provide long-term capital appreciation by investing in two complementary investment strategies: a bond strategy and a managed futures strategy.

For every $1 invested, the ETF seeks to provide $1 of exposure to its bond strategy and $1 of exposure to its managed futures strategy.

Breaking that down further, the bond strategy seeks to capture the total return of the broad U.S. fixed income market by investing in U.S. Treasury securities, broad-based bond ETFs, and U.S. Treasury futures.

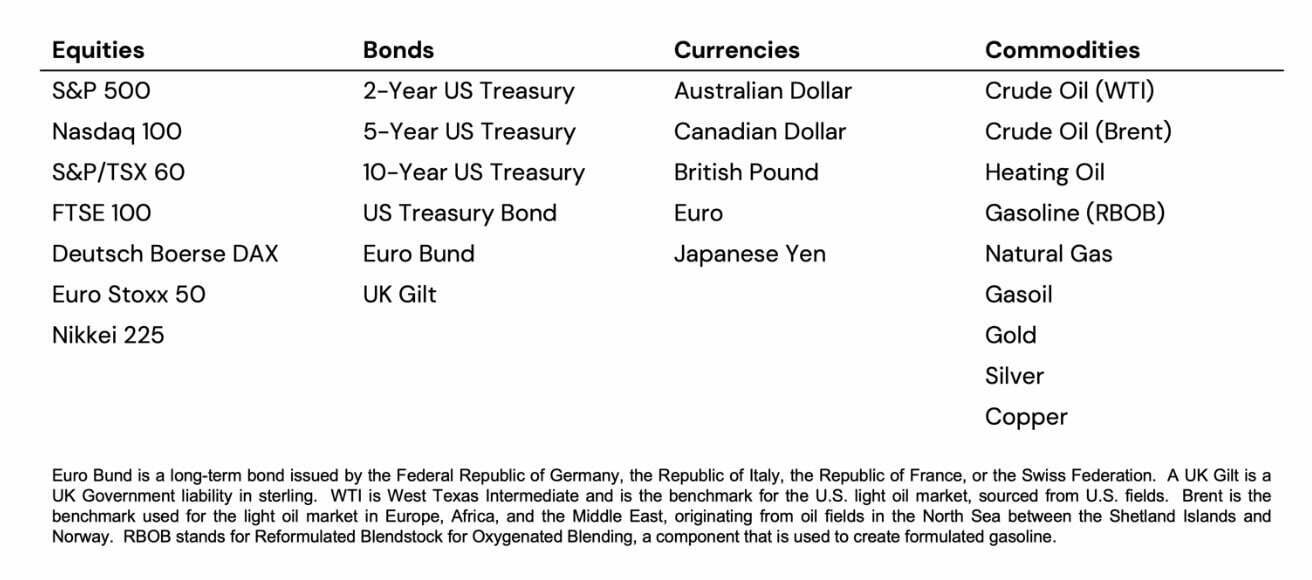

The managed futures strategy invests across commodities, currencies, bonds, and equities via futures contracts using a systematic and quantitative process (managed by ReSolve Asset Management SECZ) that seeks to replicate the Société Générale Trend Index (“NEIXCTAT”) gross of underlying manager fees.

RSBT ETF: Managed Futures Asset Classes

The strategy is quantitative and pursues this objective using sophisticated machine learning techniques, blending two distinct and diversifying approaches.

The expense ratio of the ETF is 0.97%.

source: Portfolio Designer on YouTube

What Sets RSBT ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other “alternative funds” being offered in what is already a crowded marketplace?

What makes it unique?

The key differentiator of the ETF is the embedded capital efficiency.

By seeking to provide $1 of exposure to a bond strategy and $1 of exposure to a managed futures strategy for every $1 invested, we believe that investors can more thoughtfully incorporate alternatives into their portfolios and unlock the benefits of diversification without sacrificing their core exposures.

source: The Meb Faber Show on YouTube

What Else Was Considered For RSBT ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

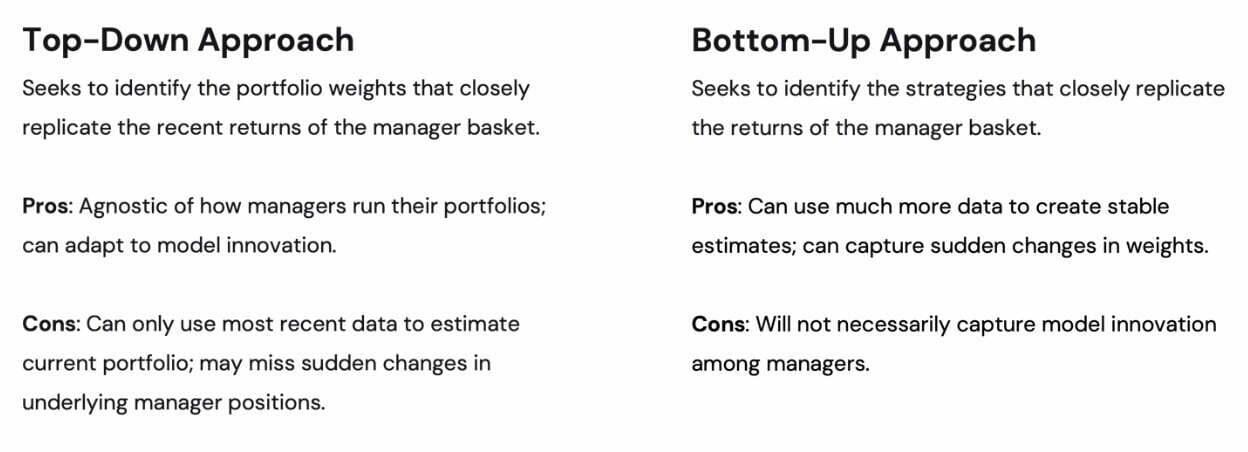

One of the big, initial design questions was, “how do we want to implement a managed futures strategy?”

There are many, many ways a managed futures strategy can be implemented (e.g. what markets, what type of signals, what speed, portfolio construction, et cetera), which ultimately leads to significant dispersion returns across managers.

What we knew is that we wanted to reduce single-manager risk as much as possible.

Initially, this meant taking an ensemble approach, constructing a large set of different implementations and blending their weights together (almost like a virtual fund-of-funds).

At the end of the day, however, we recognized that what most investors want is just the category benchmark.

So, ultimately, we decided that the best approach would be to develop a strategy that could try to track the benchmark closely.

source: Return Stacked® Portfolio Solutions on YouTube

When Will RSBT ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

We cannot emphasize enough that the purpose of this ETF is as a portfolio building block.

Evaluating its performance in isolation largely defeats the purpose.

Obviously, as a combination of bonds and managed futures, it will do well when both do well and poorly when both do poorly.

However, if an investor sells bonds to buy this ETF, then the bond component is just replacing the bonds the investor already had in their portfolio; the only new component is the managed futures strategy.

Historically – and somewhat tautologically – trend following strategies have done poorly during periods during which there have not been meaningful, sustained trends.

The 2010s are a standout example of this type of period.

Conversely, favorable periods have been those in which sustained trends have emerged.

For example, sustained trends in both the U.S. dollar and interest rates created a tailwind for trend following strategies in 2022.

source: Simplify Asset Management on YouTube

Why Should Investors Consider Return Stacked Bonds & Managed Futures RSBT ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

One of our core goals with our Return Stacked™ ETFs is to provide core beta exposure (like stocks and bonds) as cheaply as we can while charging competitively for the alternative beta (all while ensuring that the fund is commercially viable and sustainable).

In the case of RSBT, that means pricing the total portfolio to be cost competitive with other managed futures strategies in the market.

source: Return Stacked® Portfolio Solutions on YouTube

How Does RSBT ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

The Return Stacked™ Bonds & Managed Futures ETF (RSBT) is designed to be a component of a larger portfolio.

In fact, we believe that evaluating its returns on a stand-alone basis largely defeats the purpose of the strategy (other than, of course, to determine whether it is actually tracking its mandate).

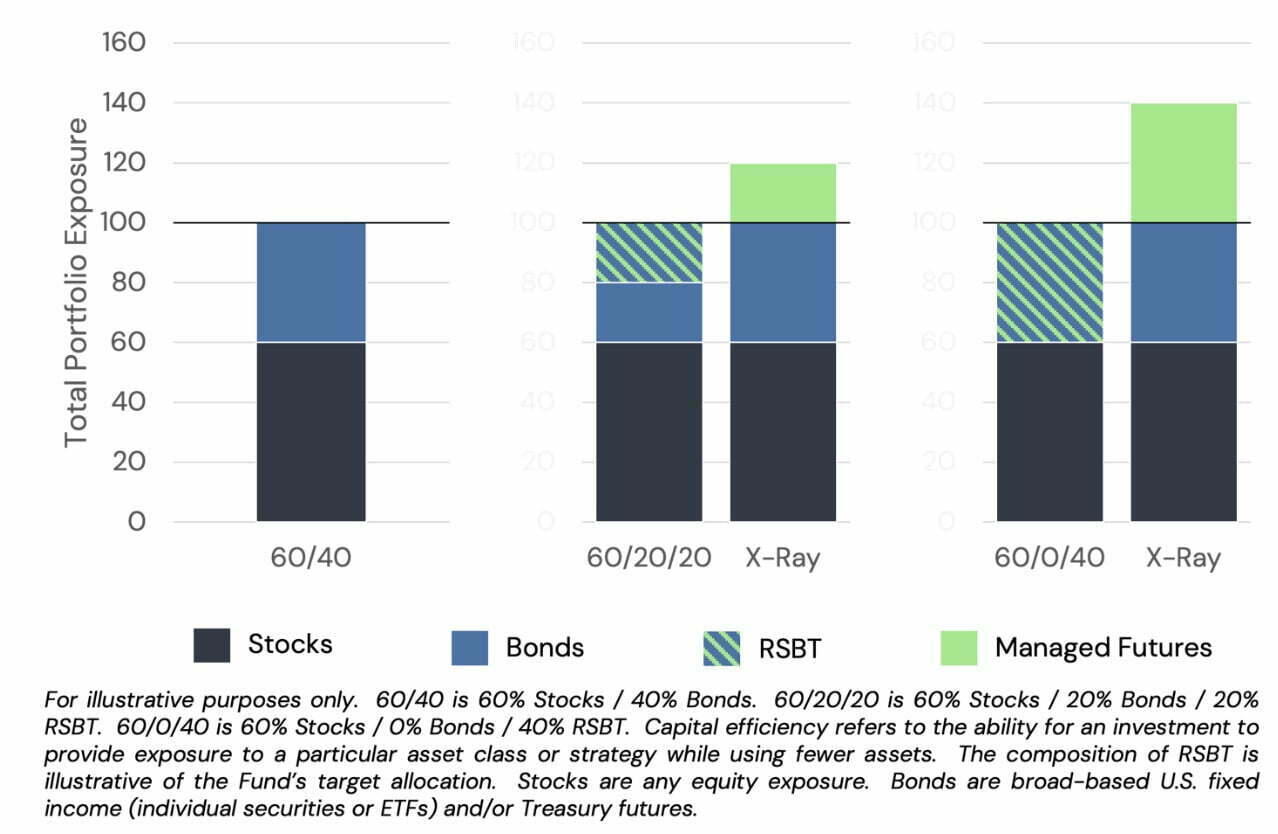

Rather, as a capital efficient solution, we believe its best use is as a replacement for core U.S. fixed income, allowing investors to maintain their bond exposure while introducing managed futures on top.

For example, if an investor holds 60% stocks and 40% bonds, they could sell 20% of their bonds and buy RSBT, resulting in a portfolio that seeks to provide 60% stocks / 40% bonds / 20% managed futures.

Return Stacking: Total Portfolio Exposure X-Ray

Future Ambitions: Suite Of Return Stacking Building Blocks For Investors

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

Our grand ambition with return stacking™ solutions is to provide a suite of building blocks so that all investors can more thoughtfully express their investment views and construct portfolios like institutions have for decades.

We expect you’ll be seeing several new funds being launched by us over the next few years.

source: Flirting With Models on YouTube

Connect With Corey Hoffstein of Newfound Research

Investors can learn more about the ETF at www.returnstackedetfs.com, can find me on Twitter @choffstein, and can find my podcast at www.flirtingwithmodels.com.

Sam speaking: I’ve also really benefited from reading Corey’s Newfound Research Blog and listening weekly to the Pirates of Finance show on YouTube with co-host Jason Buck over @jasoncbuck.

Return Stacking Further Reading

If you’re interested to learn more about “Return Stacking” I’d recommend the following resources:

- Return Stacking™ (Newfound Research)

- Return Stacking™: Strategies For Overcoming a Low Return Environment (ReSolve Asset Management)

- Return Stacking on Advisor Perspectives (Newfound & ReSolve)

- Return Stacked Managed Futures & Bonds ETF RSBT Review (my review)

- Preparing Portfolios For Inflation And Return Stacking With Rodrigo Gordillo (interview on my site with @RodGordilloP)

- Adaptive Asset Allocation, Risk Parity And Return Stacking With Adam Butler (interview on my site with @GestaltU)

- Return Stacking Investing Strategy (my initial thoughts shortly after discovering “RS” from Newfound/ReSolve)

Nomadic Samuel Final Thoughts

I want to personally thank Corey for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.