There are a plethora of value funds vying for your consideration in the ETF marketplace, but few offer the overall “deep value” exposure, quality and return on assets that The Acquirers Fund (ZIG) has on tap.

It honestly took me a while to realize that concentrated value is very different than what run-of-the-mill value funds offer with typically large number of positions and overall reduced exposure.

Aside from that, the issue of screening for additional factors such as quality/profitability are paramount in preventing investors from owning low quality cheap junk in their portfolio.

I mean sometimes companies are darn cheap for a very good reason.

They’re “fill-in-the-blank” awful and possibly on the way down the slippery slide to total irreverence and eventual extinction.

Fortunately, there are quantitative methods and fundamental screening processes to ensure the value stocks you own as an overall basket aren’t full of rotten apples.

Enter the room The Acquirers Fund – ZIG ETF.

Tobias Carlisle, the founder of ZIG and DEEP, laid out the process of “Deep Value Investing” in his Investing Legends interview:

“We first want stocks that can survive–a healthy balance sheet, positive cash flows and a business model that doesn’t pick up pennies in front of steamrollers.

The outcome is a high score on value and quality factors, but the process is old-school, bottoms-up fundamental analysis.”

In this fund review we’ll discover what sets ZIG ETF apart from the crowded “value” space while highlighting its core strengths and potential weaknesses.

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

source: The Investor’s Podcast on YouTube

The Acquirers Funds: Tobias Carlisle

Tobias Carlisle is the founder of deep-value investing firm Acquirers Funds and author of the Acquirer’s Multiple (also now a website).

He’s also the creator of the ETF ZIG (the fund we’re reviewing today) and DEEP ETF (a fund I’ll review at some point in the future).

In recent months I’ve become a fan of his weekly “Value After Hours” podcast where he along with co-hosts Jake Taylor and Bill Brewster riff on a variety of different topics including value investing.

The Acquirer’s Multiple is specifically defined as, “Enterprise value divided by Operating Earnings”.

Let’s unpack that a little.

Enterprise Value (EV) is the measure of a company’s total value as the sum of all claims by creditors and shareholders.

Operating Earnings are best described as profits earned after subtracting from revenues.

Hence, the Acquirers Fund ETF is specifically keying in on companies that offer the best bang for your buck whereas EV/OE is concerned.

Deep Value: The Case For Concentrated Value Exposure

What’s the case for concentrated value exposure?

Why on Earth would you want deep value with fewer positions (companies) when you can have the horn of plenty (with many companies)?

Well, my friends, it’s the same reason you’d want concentrated anything in any other sphere of your day to day existence.

Let’s use the analogy of a decent Scotch Whisky.

High quality Scotch is awfully good when served neat.

Drop an ice cube into the wee dram and you’re watering things down a little.

Perversely, add enough coke (or any other soda that tickles your fancy) and you’re drowning out the quality altogether.

The same holds true when it comes to value investing or factor investing of any angle.

Analogies aside, we’ll discover later why the concentration matters when we examine ZIG relative to other value funds.

ZIG Process For Identifying Undervalued Stocks

Something I really appreciate is a clear and transparent process from the fund provider in terms of how it screens, analyzes and ultimately selects stocks.

ZIG certainly doesn’t disappoint in this regard and directly from the Acquirers Fund we know the following:

- Invests in US Companies that it believes are undervalued but have strong fundamentals

- Selects approximately 30 stocks from the largest 25% of all stocks (Market capitalization greater than 2 billion)

- Examines and ranks stocks by: assets, earnings, and cash flows

- Evaluates stocks using statistical measures of fraud, earnings manipulation, and financial distress.

- Each holding examined for a margin of safety in 3 ways:

A) a wide discount to a conservative valuation

B) a strong, liquid balance sheet

C) a robust business capable of generating free cash flows - Finally, a forensic-accounting due diligence review (financial statements, notes and management’s discussion and analysis)

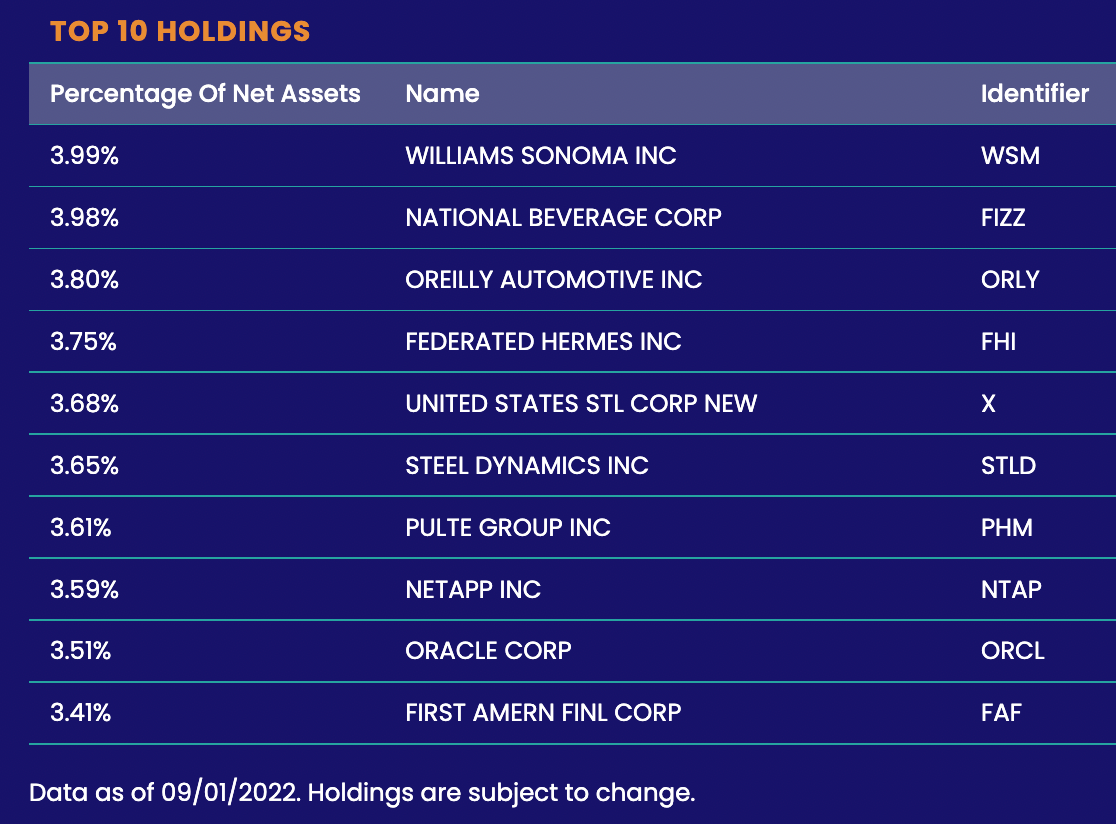

The Acquirers Fund (ZIG ETF) Holdings and Info

Let’s pop open the hood of ZIG to see what kind of goodies we have inside.

Below you’ll notice the top 10 holdings ranging from 3.99% to 3.41%.

ZIG – Top 10 Holdings

And here is the complete listing of all 30 stocks.

The Acquirers Fund | |

| % of Net Assets | Name |

| 3.99% | WILLIAMS SONOMA INC |

| 3.98% | NATIONAL BEVERAGE CORP |

| 3.80% | OREILLY AUTOMOTIVE INC |

| 3.75% | FEDERATED HERMES INC |

| 3.68% | UNITED STATES STL CORP NEW |

| 3.65% | STEEL DYNAMICS INC |

| 3.61% | PULTE GROUP INC |

| 3.59% | NETAPP INC |

| 3.51% | ORACLE CORP |

| 3.41% | FIRST AMERN FINL CORP |

| 3.40% | COLGATE PALMOLIVE CO |

| 3.36% | SEI INVTS CO |

| 3.31% | UNITED THERAPEUTICS CORP DEL COM |

| 3.30% | AMGEN INC |

| 3.28% | MICRON TECHNOLOGY INC |

| 3.26% | YUM BRANDS INC |

| 3.22% | BEST BUY INC |

| 3.21% | ALLSTATE CORP |

| 3.21% | LOUISIANA PAC CORP |

| 3.20% | HOLOGIC INC |

| 3.20% | LABORATORY CORP AMER HLDGS |

| 3.20% | META PLATFORMS INC |

| 3.17% | JANUS HENDERSON GROUP PLC |

| 3.17% | EVERCORE INC |

| 3.15% | DOMINOS PIZZA INC |

| 3.08% | WARRIOR MET COAL INC |

| 2.79% | INTEL CORP |

| 2.75% | HP INC |

| 2.73% | SOUTHERN COPPER CORP |

| 2.51% | GRAFTECH INTL LTD |

| 0.54% | Cash & Other |

source: acquirersfund.com/ (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

The first thing that comes to mind is the nearly even distribution of weightings between the 30 stocks that encompass the fund ranging from a high of 3.99% to a low of 2.51%.

Given the fund offers deep value exposure of 30 positions, I’m thrilled that the fund is spread out and not concentrated heavily around several companies.

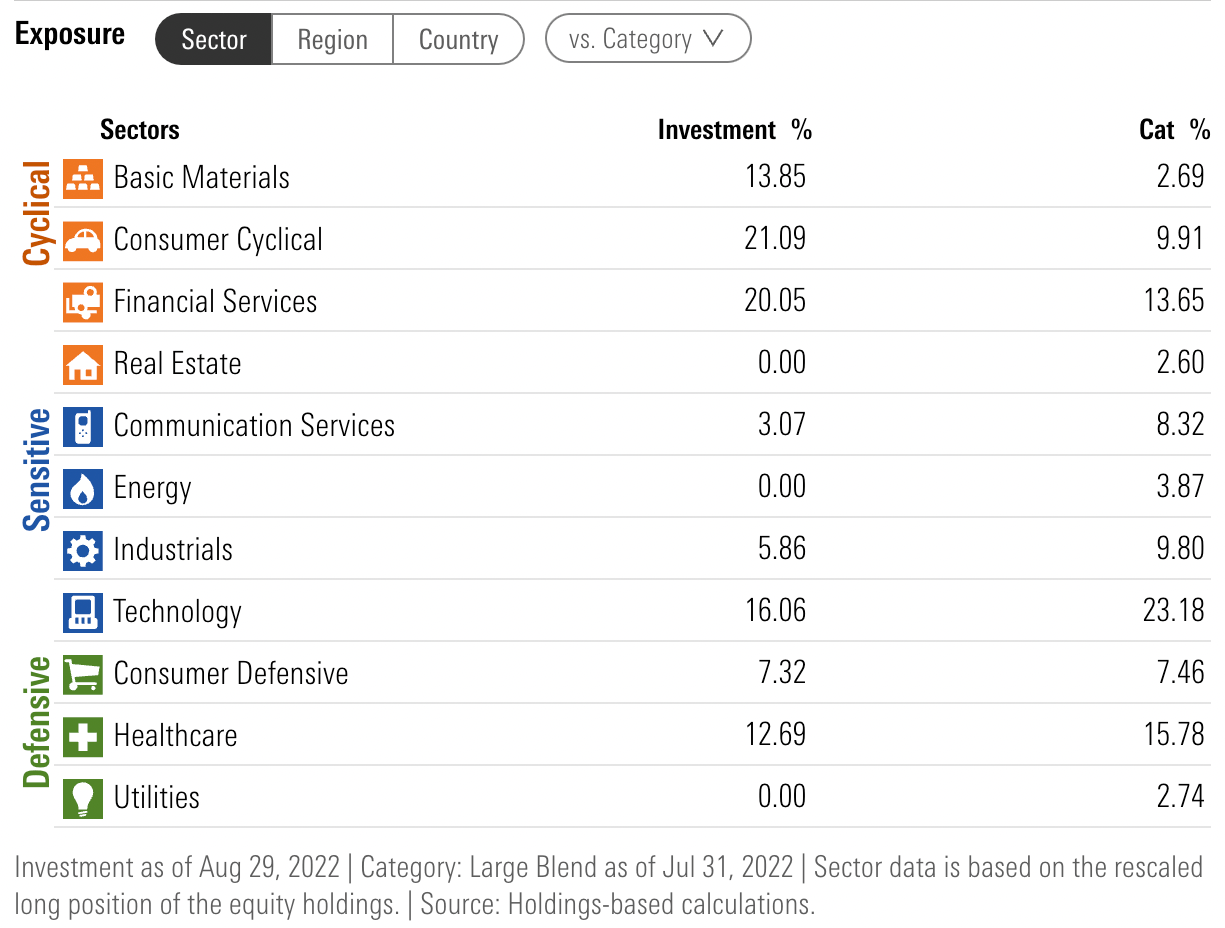

ZIG ETF – Sector Exposure

Let’s examine the Acquirers Fund sector exposure.

ZIG ETF is relatively overweight its category averages in cyclical sectors including basic materials at 13.85%, consumer cyclical at 21.09% and financial services at 20.05%.

Communication services (3.07%), Industrials (5.85%), Healthcare (12.69%) and Technology (16.06%) are slightly underweight whereas there is no exposure to Utilities, Energy or Real Estate.

For investors seeking to tilt and diversify away from typical market-cap weighted sector exposure, ZIG ETF offers something different in that regard.

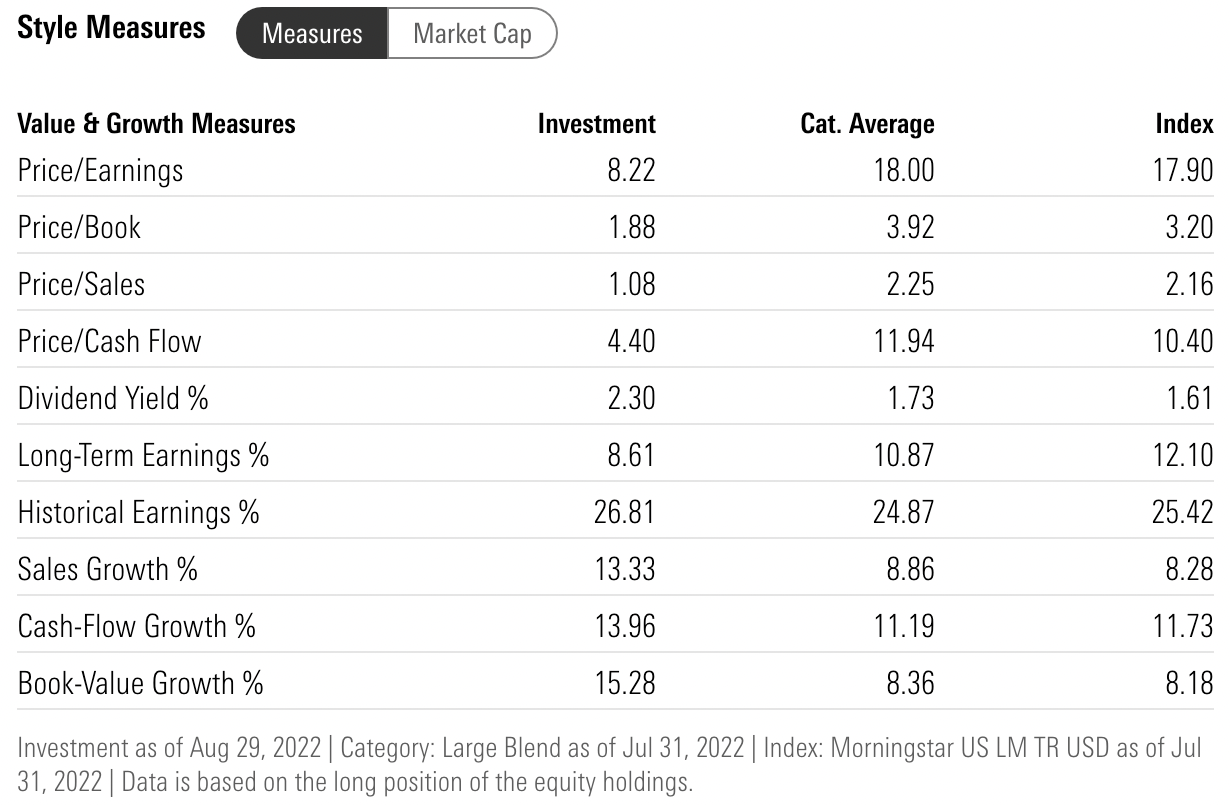

ZIG ETF – Style Measures

Let’s move on to analyze the Acquirers Fund styles measures according to third party screener Morningstar.

What is immediately apparent is the attractive single digit Price/Earnings of 8.22 versus the category average of 18.00.

Furthermore, ZIG ETF offers relatively attractive Price/Book, Price/Sales and Price/Cash Flow while providing a Higher Dividend Yield percentage.

Although US large cap market-cap weighted indexes are no longer outrageously expensive they’re far from cheap; whereas value is looking awfully attractive these days from a style measures perspective.

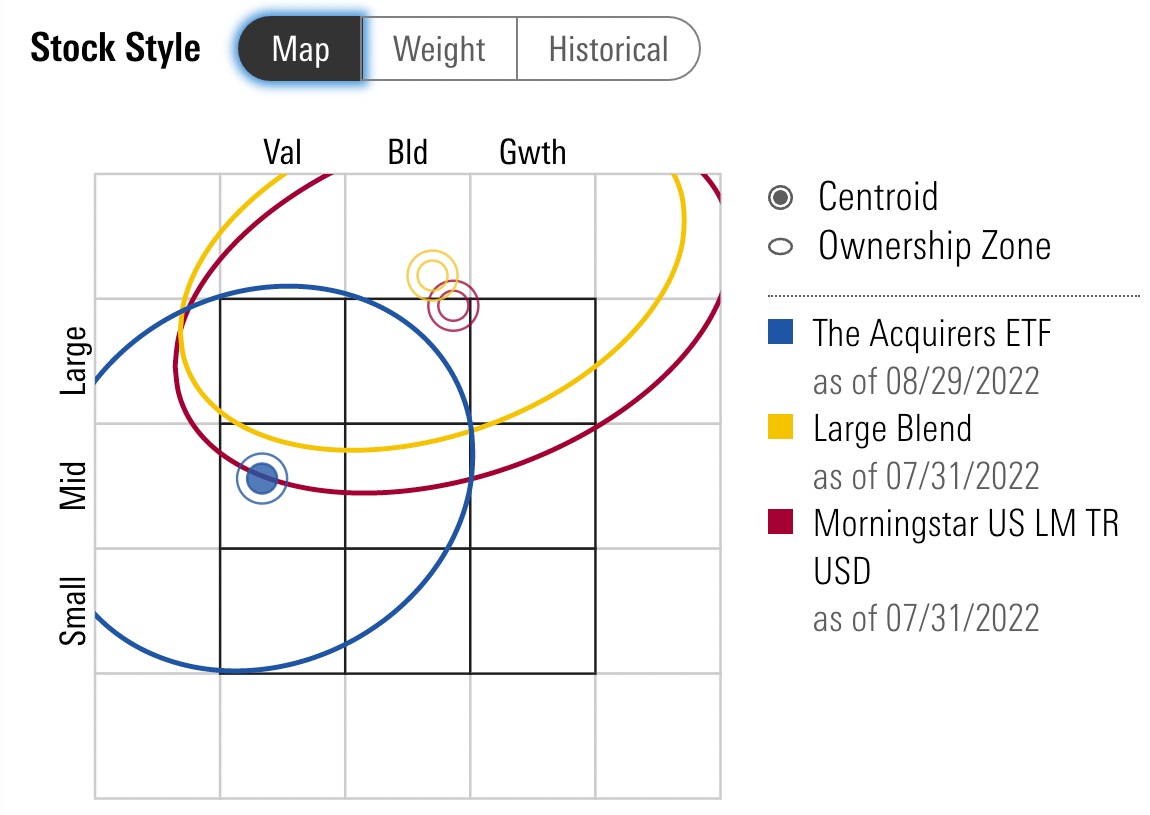

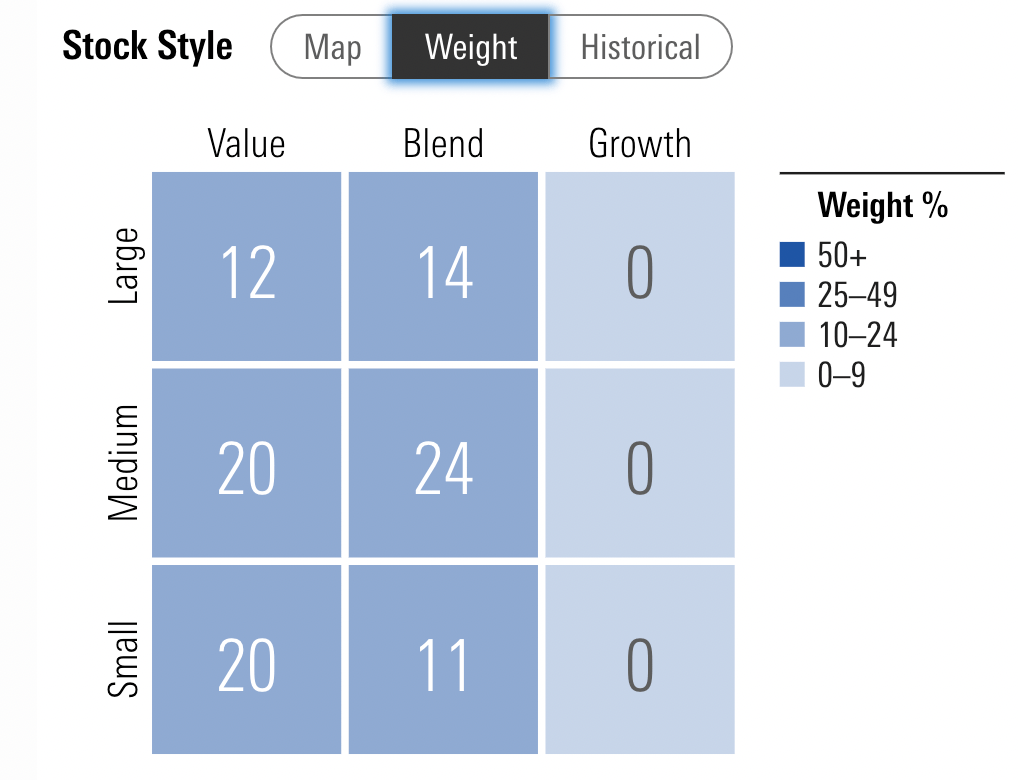

ZIG ETF – Stock Style

Let’s move on to check out ZIG ETF from a stock style perspective via Morningstar once again.

The sweet mid-cap value bullseye has historically been the most attractive place to hang-out from a returns meets risk perspective.

Less volatile than small-cap value and micro-cap territory yet with a similar return profile and the stability of large-cap equities.

I love how the fund is overall 26% large cap, 44% mid-cap and 31% small-cap to capture the entire range of weightings.

You’ll also notice the big fat zeroes in the growth columns with value and blend accounting for 100% of the Acquirers Fund’s coverage.

I’m ecstatic that the fund is proportionally balanced between large, medium and small-cap exposure as it offers an all-in-one value solution as opposed to having to cobble together several funds.

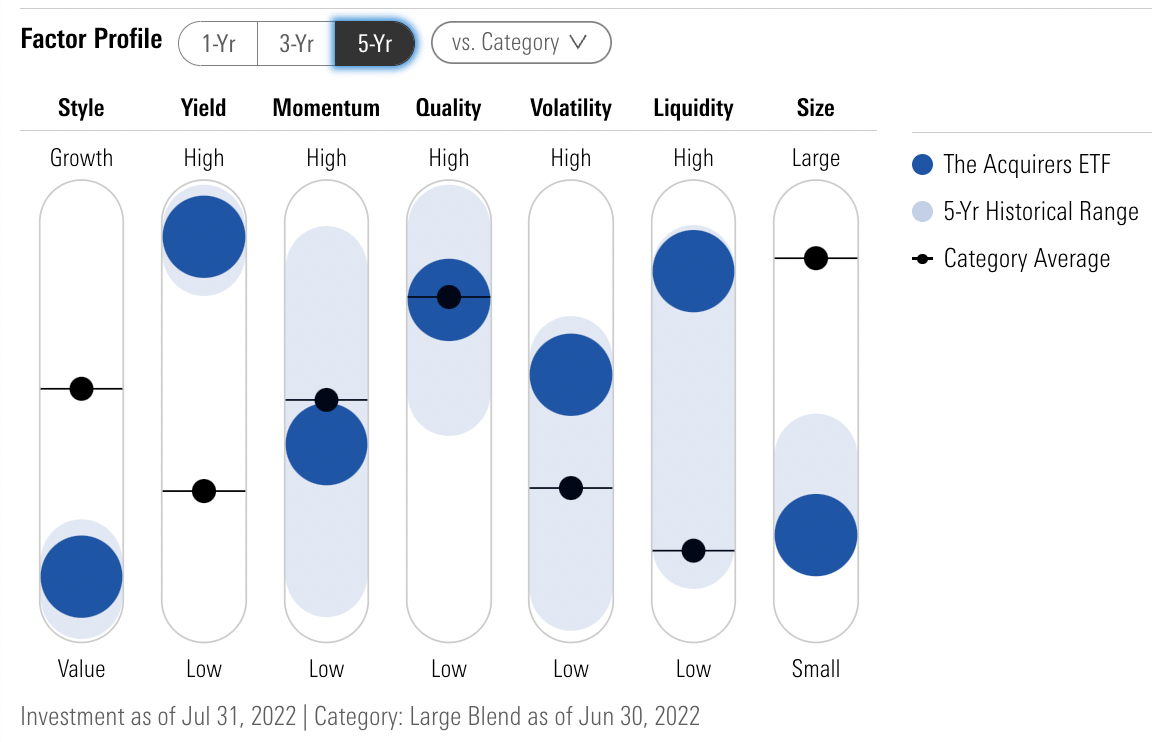

ZIG ETF – Factor Profile

Let’s see what kind of factor profile lever pulls ZIG ETF has to offer investors.

The deep-value ETF absolutely nails value, yield, quality and size for an impressive multi-factor ensemble.

Instead of being merely a one-trick pony and slave to “value” the fund provides tremendous secondary and tertiary exposure to research supported factors that are known to drive excess returns.

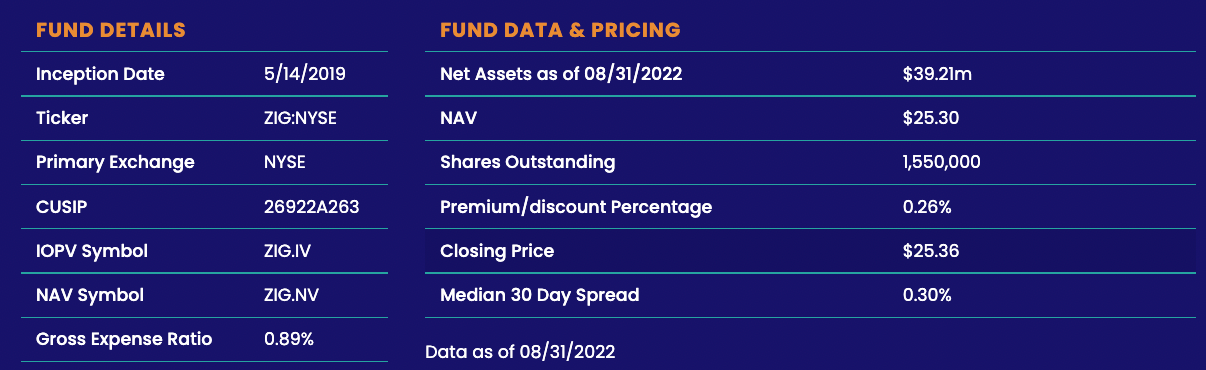

ZIG ETF – Details, Data and Pricing

To round things out let’s check out details, data and pricing for ZIG ETF.

Here we notice the inception date of the fund (5/14/2019), NAV of 25.30, Net Assets at 39.31 million and Gross Expense Ratio of 0.89%.

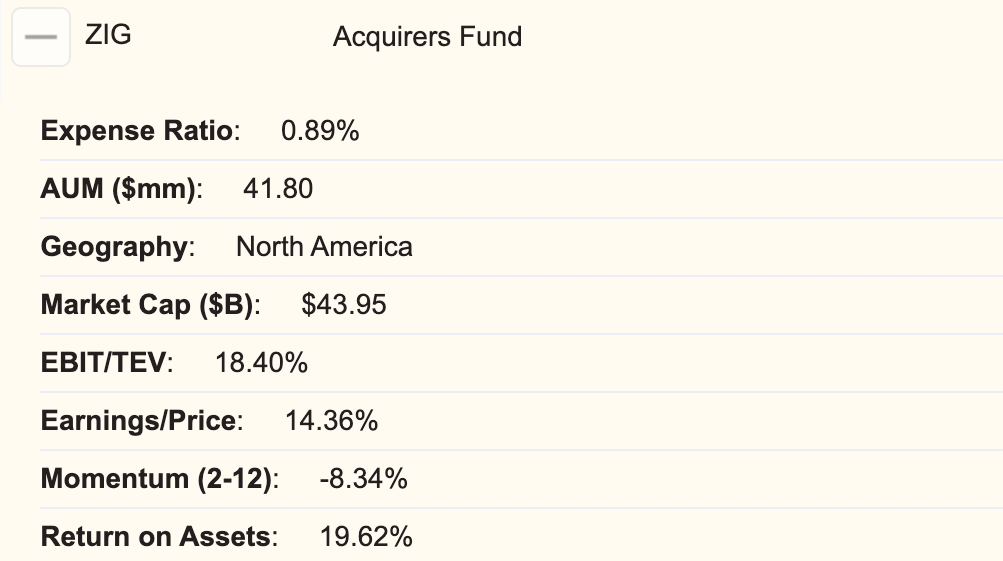

The Acquirers Fund (ZIG ETF) Alpha Architect Screening

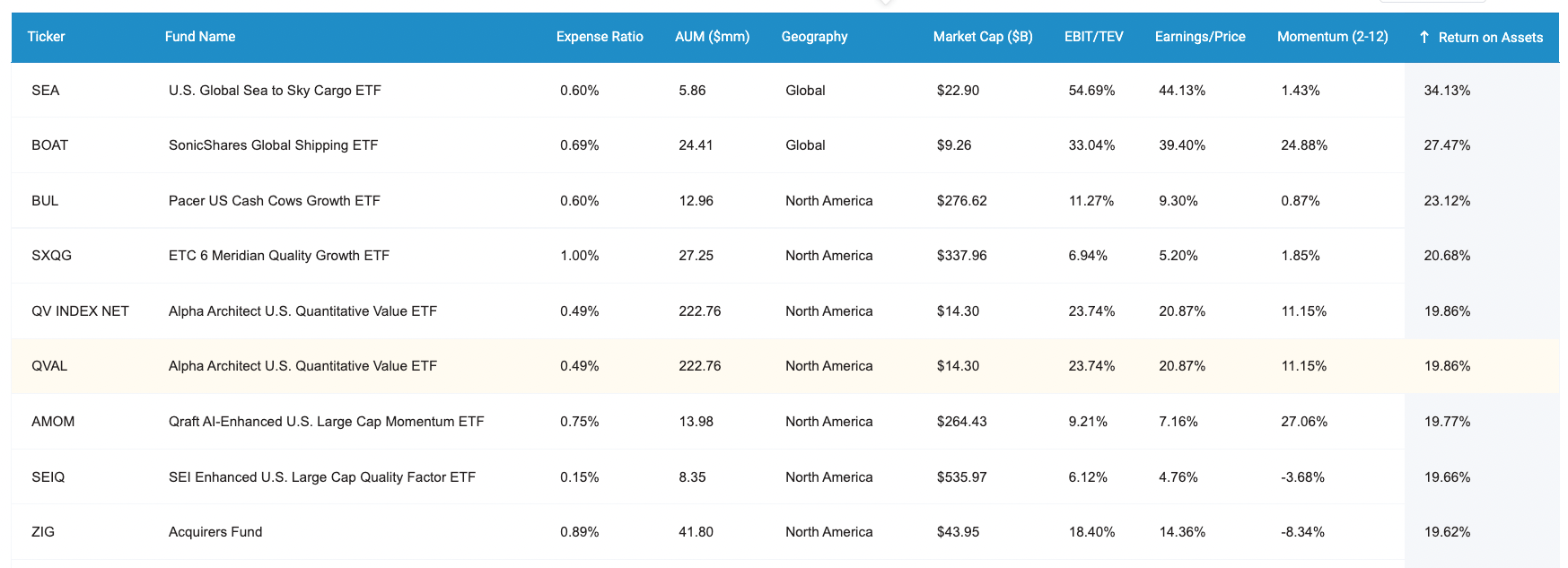

For our final x-ray of the Acquirers Fund we’ll utilize the invaluable Alpha Architect Fund Screener to examine EBIT/TEV, Earnings/Price, Momentum (2-12) and Return on Assets.

EBIT/TEV: 18.40%

Earnings/Price: 14.36%

Momentum (2-12): -8.34%

Return on Assets: 19.62%

ZIG ETF knocks it out of the park with tremendous across the board scores for EBIT/TEV, Earnings/Price and Return on Assets.

Here is where concentrated deep value funds peacock versus vanilla value ETFs with loads of positions.

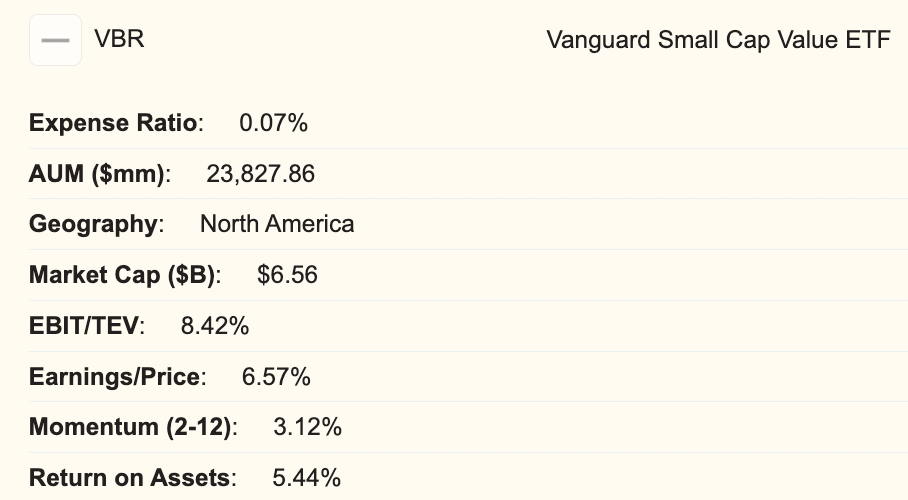

Let’s compare this to Vanguard Small-Cap Value Index Fund ETF VBR.

EBIT/TEV: ZIG 18.40% vs VBR 8.42%

Earnings/Price: ZIG 14.36% vs VBR 6.57%

Return on Assets: ZIG 19.62% vs VBR 5.44%

It’s just across the board slaughter in terms of ZIG outpacing VBR with its watered down 892 holdings.

ZIG ETF – Return on Assets

The spotlight shines ever so bright upon ZIG ETF in terms of one particular metric.

Return on Assets.

Out of a universe of 1923 available funds it is ranked number 9.

9 out of 1923.

That’s absolute elite territory.

The Acquirers Fund (ZIG ETF) Pros and Cons

Let’s move on to the pros and cons for the Acquirers Fund ZIG ETF.

ZIG Pros

- Concentrated deep value exposure to “value” and other factors such as quality, yield and size making it a true multi-factor fund

- 30 position exposure versus watered down value funds that can reach as many as 800 to 900 positions

- Return on Assets that puts the fund in elite territory (9 out of 1923)

- EBIT/TEV and Earnings/Price scores that are above and beyond most other value funds

- Sector tilts away from market-cap weighted indexes with significant exposure to cyclicals

- Sweet mid-cap bullseye with exposure to large and small-cap creating a balanced fund

- Single digit P/E indicating higher expected returns moving forward

- A higher level of due diligence examining companies from a variety of different angles

- Chance to support boutique level creativity

ZIG Cons

- Management fee higher than larger fund providers

- Concentrated value means higher expected volatility and tracking error relative to major market indexes. Not so much a con but something investors need to fully anticipate and be prepared for

ZIG Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Now that we’ve taken a thorough look at ZIG let’s see how it can potentially fit into a portfolio at large.

Deep Value 100% Equity

For investors seeking to assemble a globally diversified “deep value” 100% equity only portfolio a three fund solution could look something along the line of this:

50% ZIG

30% IVAL

20% EDOG

All three funds offer multi-factor exposure with US ZIG at 30 positions, International Developed IVAL at 50 holdings and Emerging Markets EDOG at 55 stocks.

You’d obviously need a cast iron stomach to hold a concentrated global value portfolio with no bonds or alternatives but some out there can do just that while not batting an eye even when markets are down.

Balanced Value Portfolio

If you’re seeking a concentrated value portfolio with multi-factor exposure along with bonds and alternatives the following portfolio is worth considering:

30% ZIG

20% FDTS

10% FEMS

25% KMLM

10% TYA

5% CYA

ZIG provides you with your US exposure to equities while First Trust small-cap alphadex funds give you value-tilted multi-factor coverage for both EAFE and EM.

KMLM offers you trend-following as an uncorrelated alternative strategy whereas CYA provides long-volatility portfolio insurance for when market-drawdowns are rapidly vicious.

TYA offers capital efficient treasury exposure at roughly 2.5 to 3X coverage.

Token Value Diversifier Portfolio

For investors with a market-cap weighted portfolio you could consider adding ZIG as a diversifier in your equity sleeve.

90% AOM

10% ZIG

Here you’d get a slight value tilt if you’re curious about adding it to your portfolio but not ready for a high conviction allocation.

Nomadic Samuel Final Thoughts

Overall, I’m more than impressed with the Acquirers Fund.

Unlike other value funds that have a lot of junk and low quality holdings that are further watered down by sheer volume, ZIG has assembled a concentrated mix of positions that offers investors an impressive multi-factor solution including exposure to quality, yield and size.

The funds relative Return On Asset alone versus the entire ETF universe along catapults it into elite all-star territory.

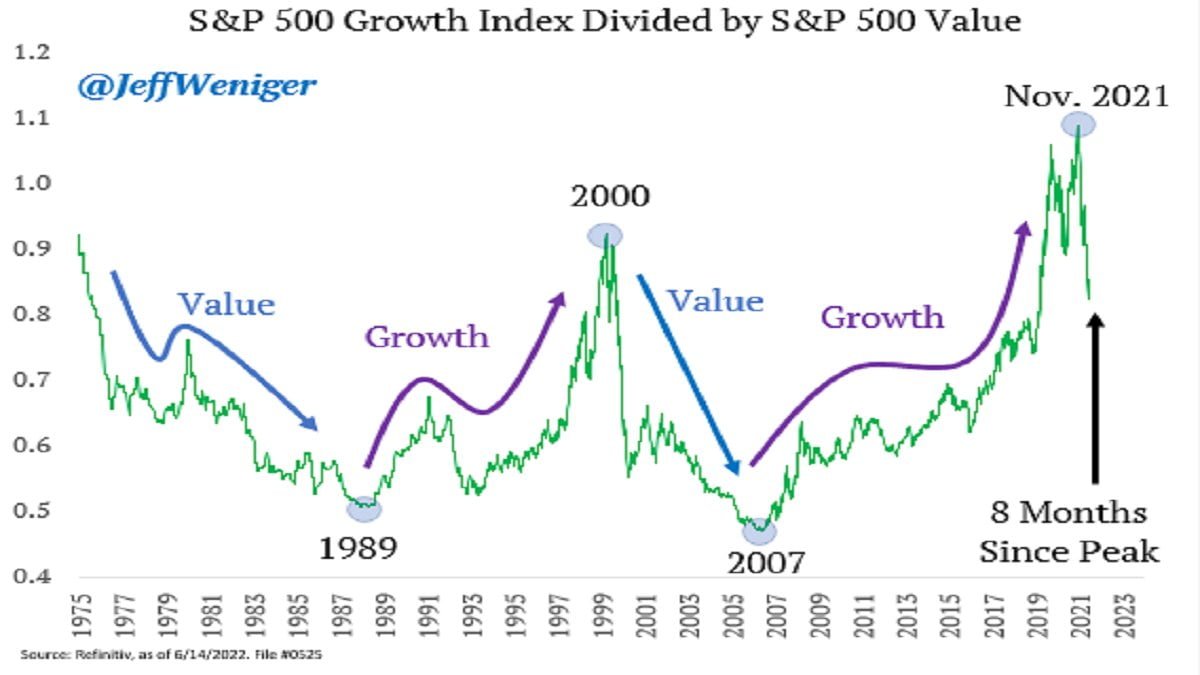

Furthermore, it appears value strategies in general may be primed for an impressive run given how growth has dominated for over a decade plus.

Thanks to Jeff Weniger of WisdomTree (be sure follow on Twitter) for an excellent visual of the value/growth cycles since 1975.

It’ll sure be interesting to see how things unfold.

That’s all I’ve got for now.

Ciao.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

Great post Samuel, hadn’t heard much about Zig, I’m pretty much a Vanguard guy, but this is quite intriguing. Great deep dive into this fund, I learned a lot from this post, and will continue to do some research! Safe travels, I’ll bet Germany is beautiful, always wanted to go there!