When it comes to analyzing typical asset allocation ETFs I’m more often than not thoroughly unimpressed by what is being offered under the hood.

What you’ll typically find is the most vanilla of all-time arrangements featuring market-cap weighted equities handcuffed with aggregate bonds.

These funds typically brand themselves as being total portfolio solutions.

One click and done.

In fact, they’re even more popular in Canada, where I’m located as an investor, than they are in the US.

Up north we call these all-in-one ETFs.

At the end of the day you’re only getting exposure to one equity style (large caps), one equity strategy (market-cap weighted) and an aggregate collection of long-only bonds.

If you were of the opinion that your portfolio is diversified, robust and regime ready for all potential outcomes, 2022 has sure been a slap in the face, hasn’t it?

The truth is that long only stocks/bonds combinations work well in low inflation/low rate growth regimes but are taken to the wood-chipper when pesky and persistent inflation rears its ugly head.

If you have a perverse desire to watch your portfolio get sliced up like sashimi during stagflationary and deflationary bust regimes, I’ve got no words for you gentle kind soul.

But for those of you interested in creating more robust, resilient and regime ready portfolios, one of the latest ETF offerings from Simplify may pique your interest.

Enter the room Simplify Macro Strategy diversified multi-strategy asset allocation fund.

FIG ETF is an all-in-one fund offering a plethora of Simplify ETFs and other strategies/funds under its hood.

In order for us to unpack this fund will require a careful examination of each of its underlying components.

Quite frankly, just a few months ago, I don’t think I would have had the skillset to even attempt to understand some of the more sophisticated strategies being offered with this fund.

Yet, oddly enough, I’m bold enough to try right here right now.

I may very well melt my brain like a grilled cheese in the process, so if you don’t hear from me for a while after this please do understand.

I’ll be incapacitated.

All jokes aside, let’s try to discover what makes FIG ETF such an interesting and unique fund that separates itself from the pack of other insipid asset allocation ETFs.

source: Simplify Asset Management on YouTube

Review of the Simplify Macro Strategy Asset Allocation Fund: FIG ETF

Hey guys! Here is the part where I mention I’m a travel vlogger! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Simplify ETFs

Simplify, as a relatively new ETF fund provider, has been releasing some of the most interesting funds since the fall of 2020.

In a nutshell, they’ve been providing both retail investors and advisors access to options based strategies that used to only be available for high net worth individuals.

Initially, I wasn’t tempted by the equity and convexity combination products they offered.

Although I recognized the role these funds could play in a portfolio that is attempting to diversify its diversifiers, I’m at the point where if an ETF is going to make it into my crowded 12 fund portfolio, it has to offer a multi-strategy approach with a few more bells and whistles added to the mix.

Hence, when I reviewed SPD ETF several months ago, I was of the opinion that it was an interesting fund that could be the right fit for others, but not quite for me.

However, I’m more than willing to eat my words and a slice of humble pie because Simplify Macro ETF is everything I could possibly want and more given its multi-strategy fund of funds allocation.

It’s rare for me to jump on board the train of a fund without it at least having close to a year of performance under its belt.

However, FIG is a total exception to the rule.

What exactly makes this fund so interesting?

Let’s find out.

Simplify Macro Strategy (FIG ETF) Holdings and Info

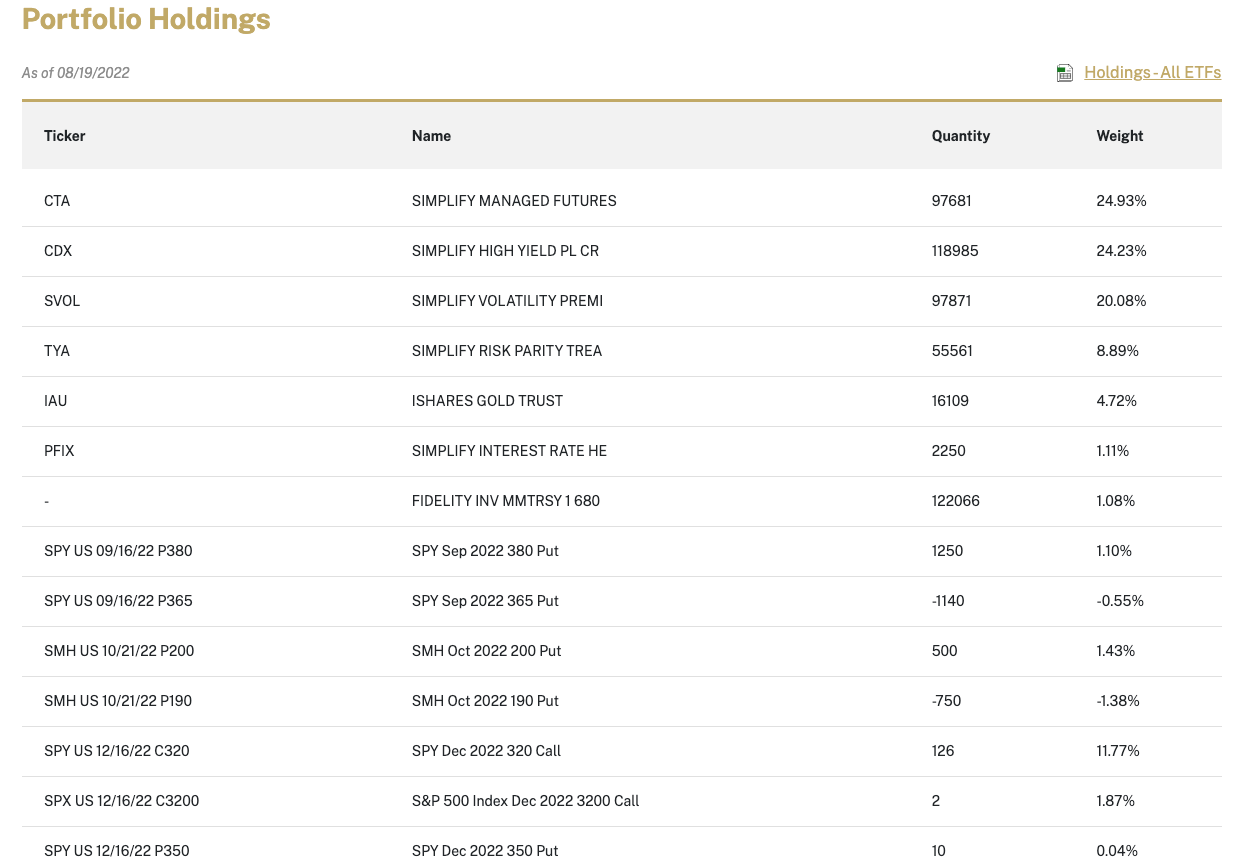

I thought the first place we could start with FIG ETF is to highlight its efficient use of capital for exposure to US equities, treasuries and gold.

Popping open the hood reveals that with just 25% of the funds resources it is getting approximate exposure to the following:

- 60% US equities exposure via an in-the-money call option on SPY = 12% allocation

- 27% Intermediate US Treasury via Simplify Risk Parity ETF TYA = 8.89% allocation

- 4.72% Gold via iShares Gold Trust = 4.72% allocation

- Put option as form of portfolio insurance = 1-2% allocation

Before we even begin to unpack the other 75% of what the Simplify Macro Strategy ETF has under the hood, I think it’s paramount to acknowledge that with just over 25% resources we’re getting a diversified asset allocation to equities, treasuries and alternatives (gold and put).

This in and of itself could be a fund that rivals other asset allocation funds.

In fact, it’s already considerably more diversified than most given it offers exposure to gold and put options versus merely just stocks and bonds.

Hence, what we consider moving forward is more or less an expanded canvas overlay of return stacking strategies that add further diversification and return streams.

FIG ETF Portfolio Holdings

Simplify Macro Strategy Portfolio Holdings

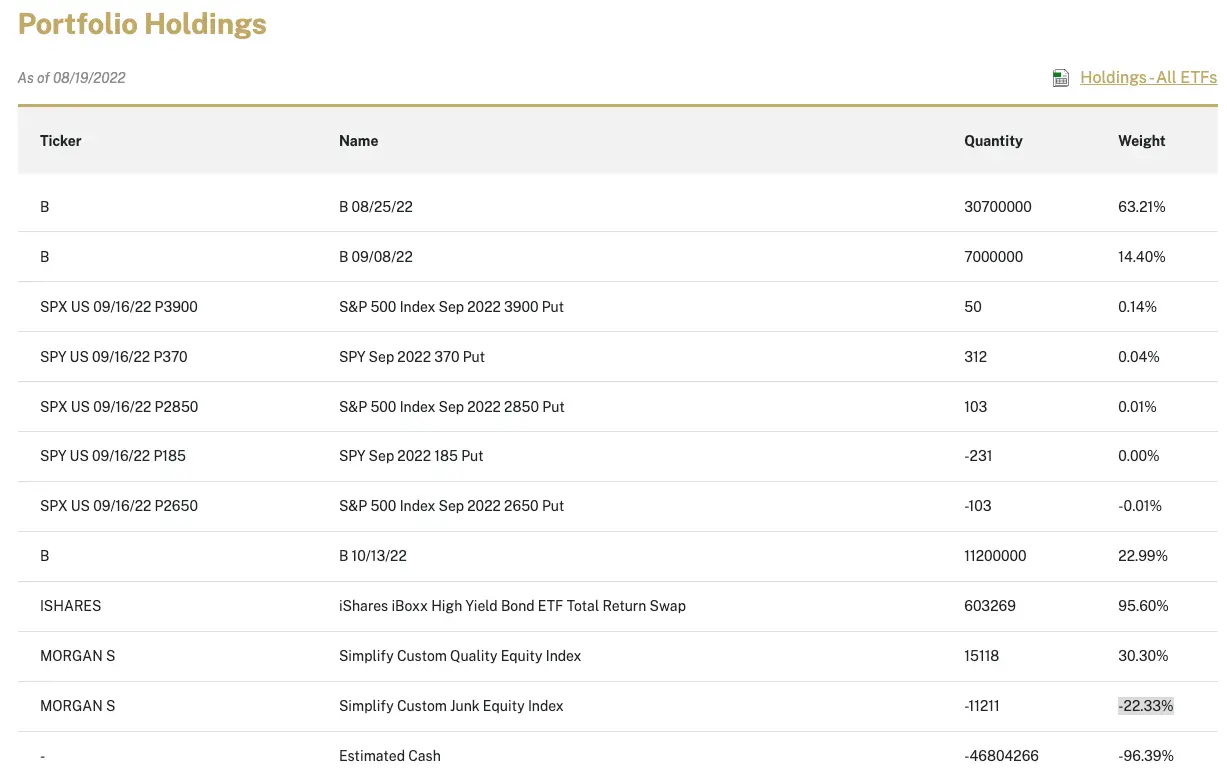

CDX Simplify High Yield plus Credit Hedge ETF

Let’s move on to CDX Simplify High Yield plus Credit Hedge ETF that accounts for 24.23% of FIG.

As possibly the most creative fund in the portfolio, the backbone of this fund consists of iShares iBoxx High Yield Bond ETF Total Return Swap taking up 95.60% space in the fund.

It provides exposure to a broad range of U.S. high yield corporate bonds for investors seeking higher income.

As part of the funds hedging strategy, an overlay of Simplify Custom Quality Equity Index at 30.30% while shorting Simplify Custom Junk Equity Index -22.33% provides a long-short equity component to the fund.

I would fully anticipate that this factor based equity strategy long-term will provide outsized returns in addition to the high yield corporate bonds.

The fund then utilizes a suite of put options at various strike prices as a form insurance policy to further hedge against its high yield bond exposure.

Overall, this is an expanded canvas ETF with a multi-strategy approach to diversification and hedging that is a most welcome diversifier within FIG.

Portfolio Holdings of CDX ETF

SVOL Simplify Volatility Premium ETF

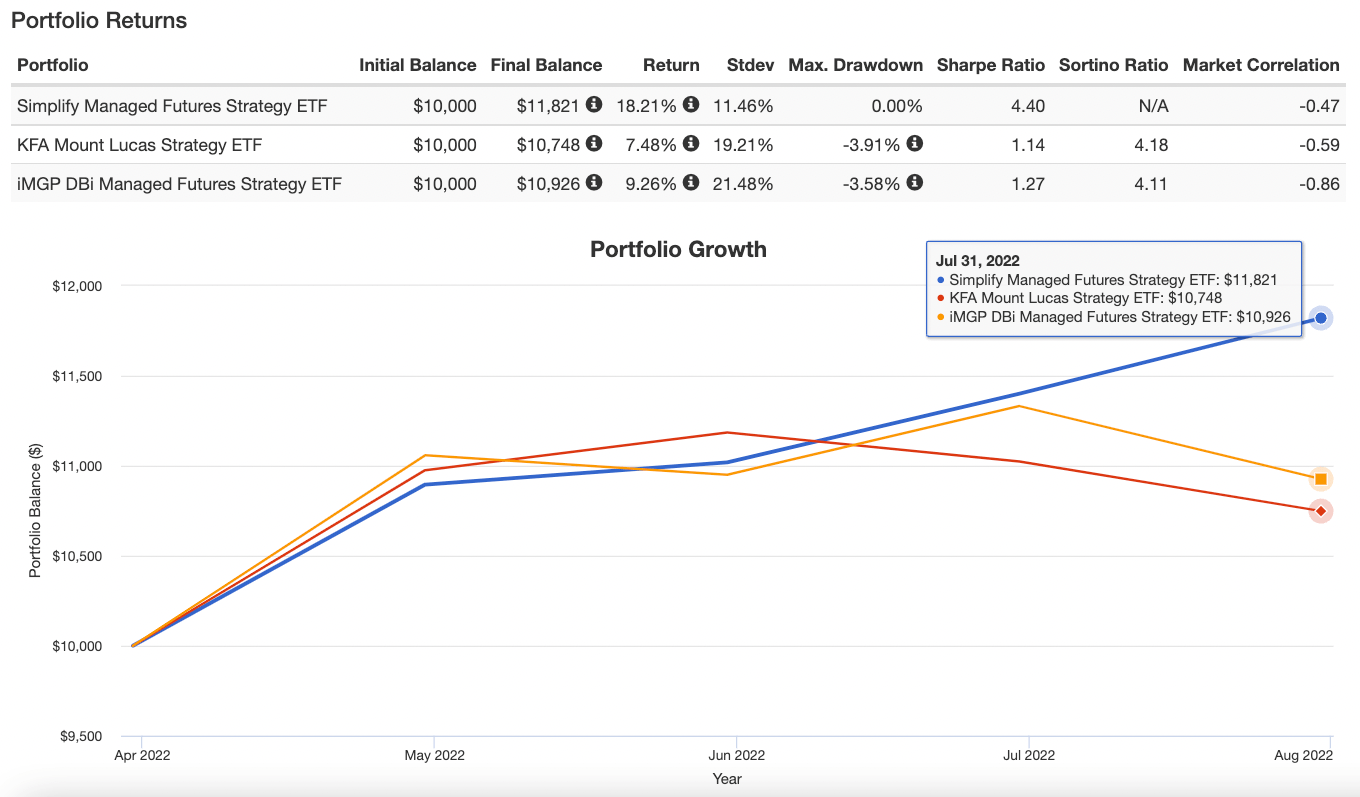

Last but certainly not least we’ve got Simplify Volatility Premium ETF SVOL to cover as a core holding taking up 20.08% of FIG ETF.

SVOL is an income strategy that sells volatility on CBOE Vix Futures targeting -0.2 to -0.3X the inverse performance of the S&P VIX short-term futures index.

Given that selling volatility can be risky the fund offers an option overlay budget of call options to protect against adverse moves in VIX.

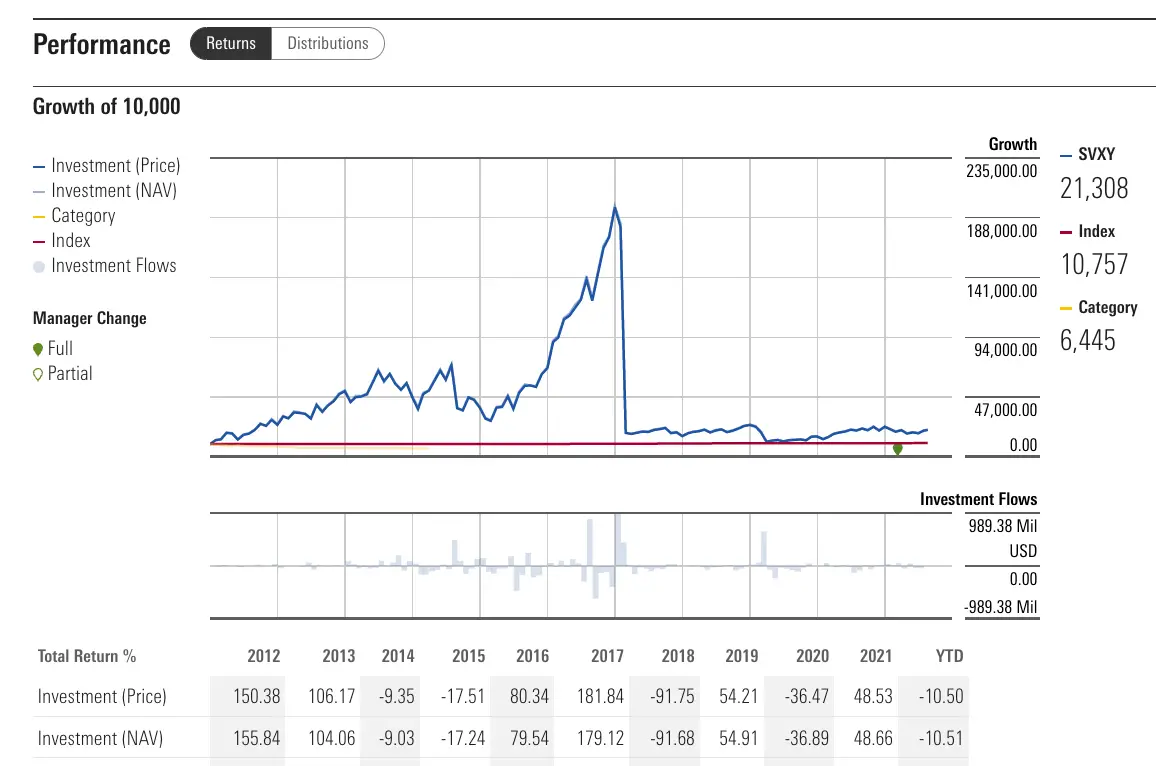

To get a taste of the potential returns of this strategy we can consult the annual performance of the more aggressive ETF SVXY.

Keep in mind this particular ETF is positioned at far more aggressive -0.5X and does not have a call options component to provide a ballast in case of adverse moves.

ETF SVXY Annual Performance via Morningstar

For those interested in learning more about SVOL here is video to watch from Simplify.

Source: Simplify on YouTube

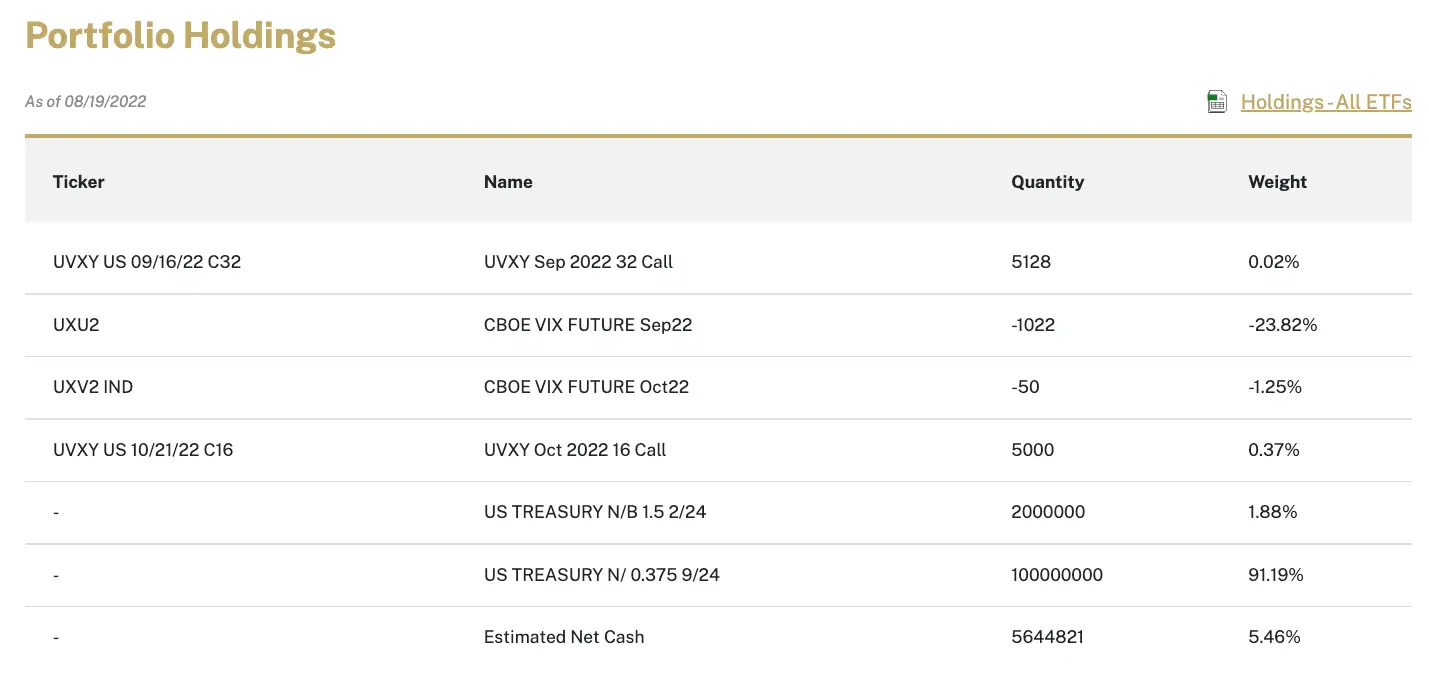

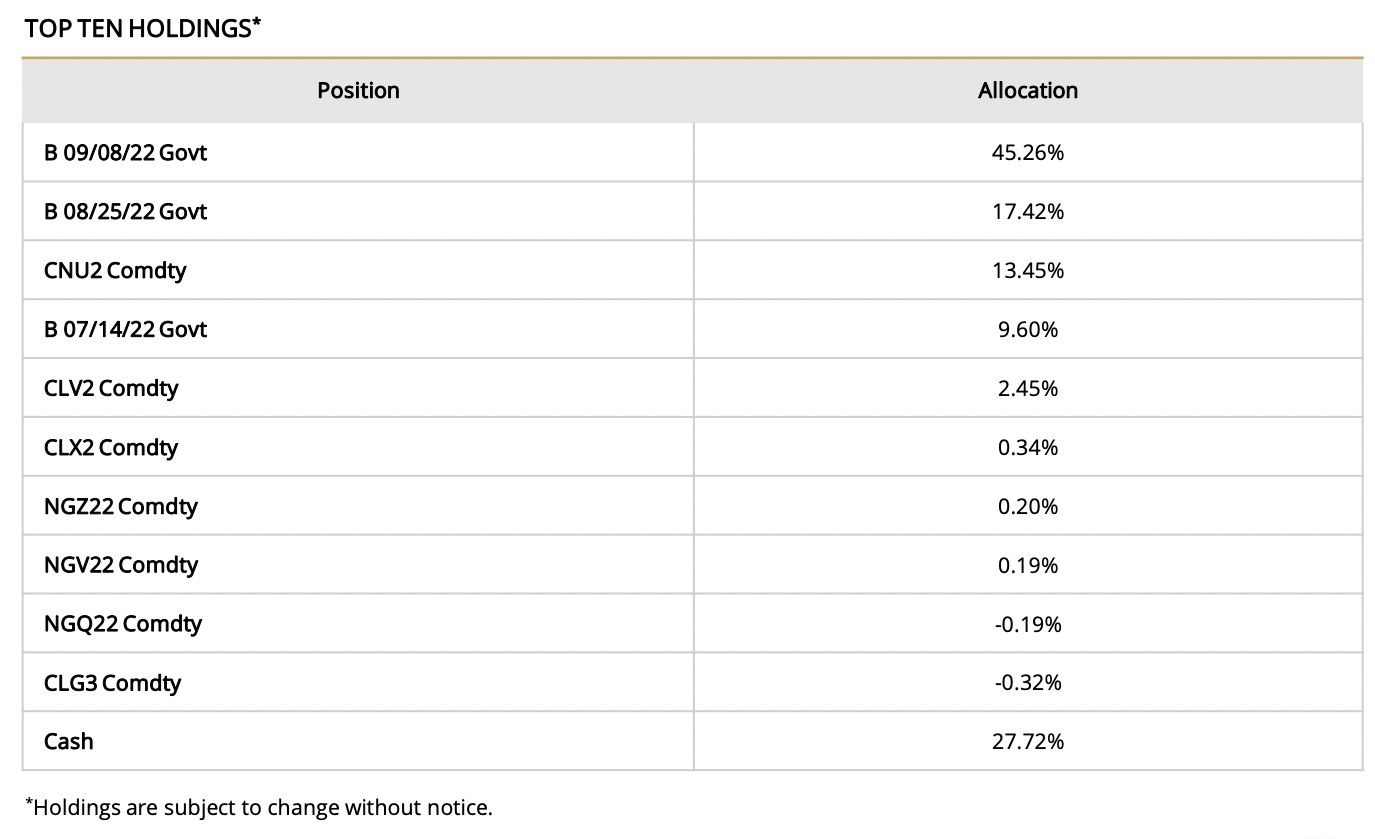

Here is what we’ve got under the hood for SVOL currently:

At current levels it appears to be -0.25X which is approximately the medium position of its intended -0.2X to -0.3X range.

TYA and PFIX ETF

We’ll just briefly touch upon the strategies of TYA at 8.89% and PFIX at 1.11%.

TYA, mentioned earlier, provides investors capital efficient intermediate term treasury exposure at roughly 2.5 to 3X.

Check out this video to learn more:

Source: TYA: Simplify Risk Parity Treasury ETF on YouTube via Simplify

The Simplify Interest Rate Hedge ETF (PFIX) attempts to hedge interest rate movements arising from rising long-term interest rates by holding large position in over-the-counter (OTC) interest rate options that is similar to owning a position a long-dated put options on 20-year US Treasury bonds.

Source: PFIX: Simplify Interest Rate Hedge ETF on YouTube via Simplify

FIG ETF: Whole Is Greater Than The Sum Of Its Parts

Well after going through all of the individual line items and funds that encompass FIG ETF what is the big picture when you put it all together?

The whole is greater than the sum of its parts.

To even attempt to individually cobble together a sophisticated multi-strategy approach to mirror FIG you’d need a smattering of different ETFs.

The truth is that many of these strategies don’t exist in the roster of other ETF providers.

It’s a distinct competitive edge to Simplify that they’re ahead of the game here.

To have this many sophisticated investing strategies under one hood is truly quite impressive.

It’s hard to imagine that such a fund could even exist as an ETF given what was available in the marketplace just a few years ago.

In total I’m counting no less than 10 distinct strategies under the hood of FIG ETF.

10 Distinct Strategies Offered By FIG ETF

- US equity exposure via in-the-money call options via FIG ETF directly

- Intermediate Treasury exposure via TYA ETF

- Gold exposure via IAU ETF

- Managed Futures multi-strategy (price trend, mean reversion, carry, and risk-off) long/short commodities and rates via CTA ETF

- US High Yield Corporate Bonds via HYG ETF via CDX ETF

- Long-Short Equity Quality minus Junk (custom Simplify indexes) via CDX ETF

- Selling volatility inverse VIX at -0.2X to -0.3X via SVOL

- (OTC) Interest Rate Options via PFIX ETF

- S&P Put Options via FIG ETF directly and CDX ETF

- UVXY Call Option via SVOL

FIG ETF: PROS vs CONS

Let’s examine the pros and cons of Simplify Macro Strategy ETF.

FIG ETF PROS

- 10+ strategies in 1 asset allocation that sets itself MILES apart from other vanilla all-in-one funds

- Capital efficient usage of leverage to expand the canvas of the portfolio to offer a number of different strategies without shaving down exposure to typical equity/bond allocations

- Non-traditional defensive strategies of managed futures and put that are often gaping holes in most retail investors portfolios

- Exposure to “diversified diversifiers” such as selling volatility, call options and OTC rates that are typically only available to high net worth individuals and institutions

- Equity factor exposure to quality minus junk to capture both sides of premium

- High yield corporate bond exposure that is often missing in most fixed income sleeves

- Exposure to Gold which in many regards is the original gangster alternative

- Absolute bargain all in encompassing management fee of 0.75 given that most fund of funds strategies are way over 100 basis points

- Attractive monthly yield of 3.33% for investors seeking income

- Chance to support one of the most creative boutique ETF providers in the business

FIG ETF CONS

- For the average DIY, retail investor or run of the mill advisor the sophistication of some of these strategies may be hard to grasp/explain (education likely required – myself included)

Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

This is always my favourite part of fund reviews.

How does the potential fund fit into the portfolio at large?

Let’s explore some creative ways FIG ETF might make it into your portfolio

FIG ETF: Total Portfolio Solution

Does Simplify Macro Strategy ETF have the potential to be a total portfolio solution?

In a word.

Yes.

It has so many moving parts under the hood along with a number of sophisticated strategies, hedging techniques and alternatives along with classic exposure to equities/bonds/gold that it kinda puts the milquetoast 60/40 portfolio to shame.

One and done FIG and chillax.

Yeah.

That’s possible.

100% FIG

FIG ETF: Core Portfolio Solution

I really like the potential combination of UPAR and FIG as a 50/50 ying/yang split.

On the one hand, UPAR may be the most complete long-only ETF with exposure to global equities (US, EAFE, EM), TIPs, Long-Term Treasury, Gold and Commodities.

On the other hand, FIG may be the most complete esoteric ETF with exposure to just about everything under the sun in the managed futures and options space across equities, treasury, credit, currency, commodities, etc.

Why not just pair them up together and enjoy whichever one does a little better in any given year by rebalancing?

50% FIG

50% UPAR

FIG ETF: Four Quadrant Portfolio Solution

If you want to have even more fun maybe consider FIG as part of a four quadrant portfolio.

We’ll call this the most diversified multi-strategy combination on planet earth:

25% FIG

25% UPAR

25% RDMIX

25% QSPIX

It’s got so much going on I’m not even going to try and unpack it here.

Just enjoy all of the diversification.

FIG ETF: Partial Portfolio Solution

FIG would be an interest partial portfolio solution for investors utilizing the 90/60 suite of NTSX, NTSI and NTSE funds.

At 67% these 3 funds give you a globally diversified 60/40 portfolio.

The remaining 33% could be filled by FIG as an add on for its diversification benefit.

30% NTSX

20% NTSI

17% NTSE

33% FIG

Nomadic Samuel Final Thoughts

If it seems as though I’ve been gushing over FIG ETF it’s because I absolutely love this fund.

I honestly can’t think of any ETF that has launched over the past couple of years that ties together so many unique strategies into one discrete bowtie.

If portfolio constructions is as much art as it is science, the way FIG has been thoughtfully assembled deserves to be acknowledged.

Apparently, it is brainchild of Michael Green better known as @profplum99 on Twitter.

Hats off to Michael and entire team at Simplify!

I mentioned earlier that it’s rare for a fund to make it into my portfolio without having touched ground for a while.

There have been exceptions.

UPAR is one of them.

As is PFAA.TO and now FIG.

My DIY Expanded Canvas Portfolio has no less than 12 funds; therefore, it’s not easy for a new ETF to weasel its way into the mix.

I’ve started off with a modest allocation of 5% to FIG but I fully anticipate it’ll increase its wingspan over time.

Twitter user @1WhiteTruck made the astute observation that FIG ETF offers a dragon-like fund exposure to stocks, bonds, managed futures (commodities), gold and long volatility.

To which I say indeed it does and then on top of that it offers even more strategies for good measure.

Regardless, being compared to the Dragon Portfolio may be one of the highest compliments a fund can receive in my humble opinion.

So I think we’ll leave things at that.

What do you think of FIG ETF?

Is it on your radar?

Let me know in the comments below.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

Hi Sam,

Cheers for the great article. When you talk about the diversification of this portfolio:

25% FIG

25% UPAR

25% RDMIX

25% QSPIX

Do you refer to diversification of management and administration of the different funds?

Because when I look into those 4 funds, they kind of try to do the same thing, and they seem similar in their way of contructing their overall ETF. So in that regard those 4 ETFs can be seen as not so diverse from one another.

Thank you again

Jesper

Nice products for diversification, however avg volume on FIG(~15k) and UPAR(~15k) are way to low for most portfolios unless just starting out. Hopefully volume will pick up in future.