Once in a blue moon a generational talent in baseball will rise through the ranks of the minor league system with a meteoric big show debut announcing that not only do they belong but they’re the future of the franchise.

CTA Simplify Managed Futures Strategy ETF has arrived in the ETF marketplace in the midst of tumultuous market conditions and shown that not only is it a welcome addition to the managed futures space but that it may very well be the Top Gun.

2022 has proven to be a challenging year for most investors committed to traditional long-only asset allocation.

Investors savvy enough to carve out space for managed futures strategies in the alternative sleeve of their portfolio have been rewarded with “something” that has conspired in their favour.

The truth is that most amateur portfolios, committed to the typical narrow script of market-cap weighted stocks and aggregate bond only allocations, have had their portfolio flambéed, deep-fried and violently mashed together in a manner that is hardly palatable.

Fortunately, a number of maverick ETF providers (such as Simplify) have brought to market products that can thrive, adapt, hedge and/or insure a portfolio from absolute carnage when equity and fixed income correlations converge.

In this fund review we’ll highlight what makes CTA Simplify Managed Futures ETF a strong contender for “Rookie Of The Year” honours given that since its debut it has provided robust returns and stellar volatility management amidst choppy market waters.

CTA Simplify Managed Futures Strategy ETF | CTA ETF Review

Hey guys! Here is the part where I mention I’m a travel content creator! This investing opinion blog post ETF Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Simplify ETFs: Bringing Institutional Investment Strategies To The Marketplace

When it comes to fund providers innovating and creating products that did not exist in the marketplace until recently, it’s impossible not to shine the spotlight upon Simplify.

With a dual mandate of democratizing access to better portfolios whilst also bringing institutional investment strategies to ETFs, Simplify has delivered in spades with a roster that has now expanded to 22 funds.

It’s quite remarkable how they’ve been able to bring forth the concept of “creative alternative fund ideas” into actual investable ETFs in record time as building blocks for informed DIY investors and in-the-know advisors.

Strategies range from total portfolio solution products (FIG Simplify Macro Strategy ETF), credit hedges, capital efficient treasury exposure, tail risk and bitcoin to name just a few.

CTA marks a significant entry into what is still quite an uncrowded managed futures space in the ETF marketplace.

Why Should Investors Consider Managed Futures ETFs?

There are a plethora of reasons why investors should consider managed futures strategies as part of their overall portfolios.

However, let’s get the most obvious one out of the way right from the get go.

In 2022, they’ve provided stellar returns in what has otherwise been an abysmal year for just about every traditional asset allocation and strategy under the sun.

However, if we’re to take the strategy seriously long-term let’s not succumb to recency bias but instead highlight the most important aspect managed futures offers allocators summarized succinctly by a single word:

Uncorrelated.

They’re uncorrelated with equities and bonds.

Hence, the diversification benefit of adding an uncorrelated alternative investment strategy to the mix offers investors the potential to assemble more robust, resilient and regime-ready portfolios.

Moreover, they have the capacity to adapt like a chameleon by not fighting reality with an ability to go long/short.

When fixed income is trending downward it’ll exclaim “indeed” and capture the moment by going short.

When that same asset class has recovered and the moving day average suggests positive upward momentum it’ll declare “absolutely” by taking a long position.

If long-only equities and bonds are like a fair-weather friend that raises their glass of wine to celebrate only when times are good, a managed futures strategy is a trusty companion that is often there to offer solace when times aren’t as rosy.

The problem most investors face is that they fall in love with managed futures when they’re providing “crisis alpha” returns and become disinterested quickly when a 2010s-scenario presents itself with roaring markets and trends that aren’t as plentiful.

The “sweet spot” for managed futures strategies is with a permanent proportional allocation that provides long-term diversification benefits.

CTA ETF Overview, Holdings and Info

CTA Simplify Managed Futures ETF sets itself apart from its competition by providing 4 distinct long-short managed futures strategies under one ETF wrapper (trend, carry, mean reversion and risk-off) along with keying in specifically on commodity and financial futures while excluding equity and currency indexes.

Moreover, its systematic models and overall strategy has been designed by Altis Partners.

CTA ETF is “new” in the sense it has only been in the ETF marketplace for a few months but has the backing of a CTA management firm that has over 20 years of experience.

Simplify Managed Futures ETF brings a multi-strategy managed futures approach geared towards absolute returns with the potential to thrive under any market regime.

CTA Simplify Managed Futures Strategy ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The adviser seeks to achieve the Fund’s investment objective by investing in various types of futures contracts.

The adviser delegates selection of futures contracts for the Fund’s portfolio to a futures adviser, Altis Partners (Jersey) Limited (the “Futures Adviser”).

Under normal market conditions, the Fund invests in a portfolio of equity, U.S. Treasury, commodity, and foreign exchange futures contracts (collectively, “Futures Contracts”).

The Fund attempts to capture the economic benefit derived from rising trends based on the price changes of these Futures Contracts.

Each month, each Futures Contract will generally be positioned long if it is experiencing a positive price trend.

The Fund may take short positions if the Futures contract is experiencing a negative price trend.

This positioning is based on a comparison of the recent returns of each Futures Contract and the Futures Adviser’s models that analyze various inputs including measures of relative and absolute momentum signals (prices trending higher or lower over various look back periods).

The Fund will also hold short-term U.S. Treasury securities or other high credit quality, short-term fixed-income or similar securities (such as

shares of money market funds and collateralized repurchase agreements) for direct investment or as collateral for Futures Contracts.

The Fund may also invest up to 100% of its assets in any short-term U.S. Treasury securities or other high credit quality, short-term fixed-income or similar securities (such as shares of money market funds and collateralized repurchase agreements).

Reverse repurchase agreements are contracts in which a seller of securities, usually U.S. government securities or other money market instruments, agrees to buy the securities back at a specified time and price. Repurchase agreements are primarily used by the Fund as an indirect means of borrowing.

Typically, the Fund will not invest directly in commodity futures contracts.

The Fund expects to gain exposure to these investments by investing up to 25% of its assets in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”).

The Subsidiary is advised by Simplify Asset Management Inc. and the Fund’s investment advisor.

Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to commodity markets in accordance with applicable rules and regulations.”

Let’s pop open the hood to see what kind of goodies we’ve got inside.

CTA Simplify Managed Futures ETF Portfolio Asset Class Exposure

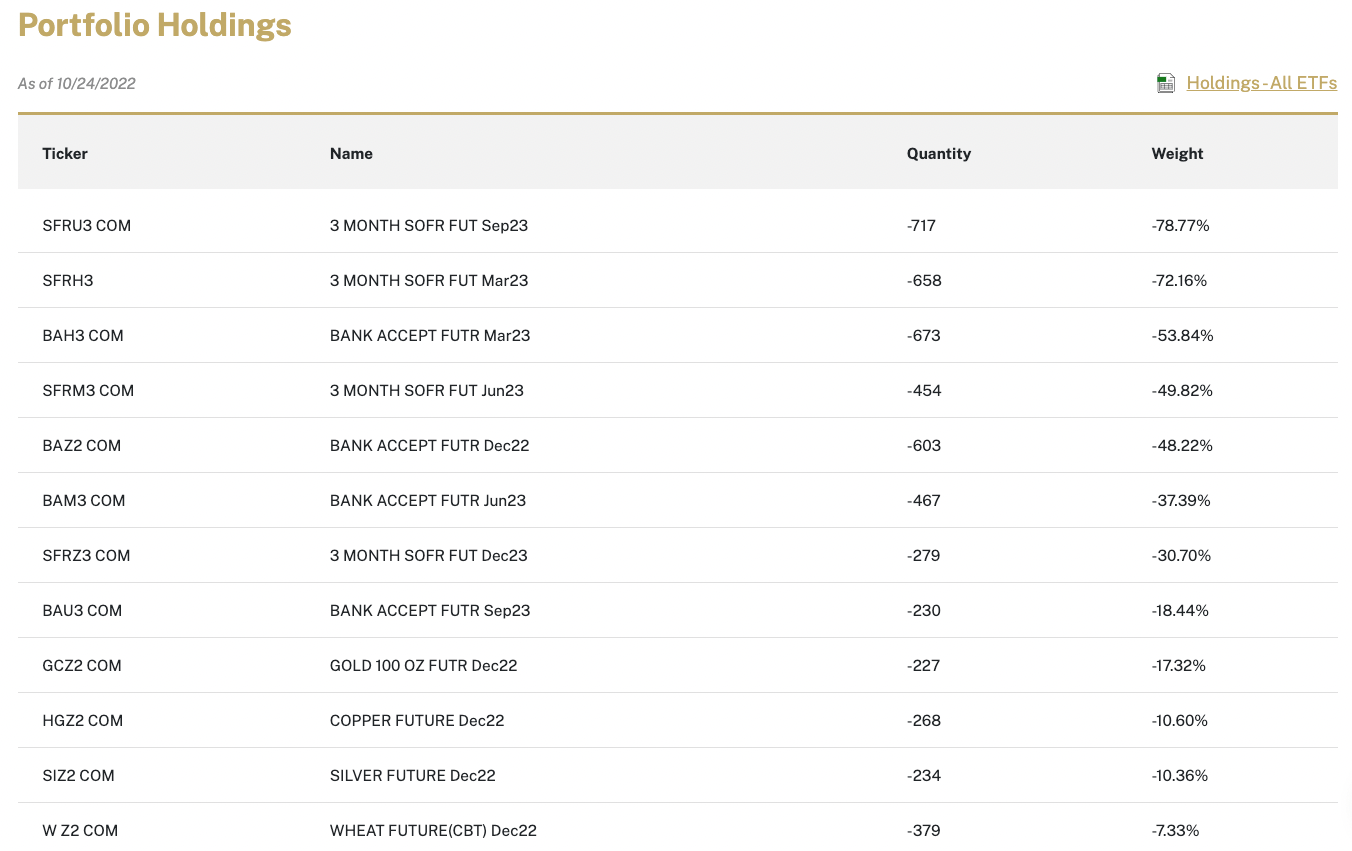

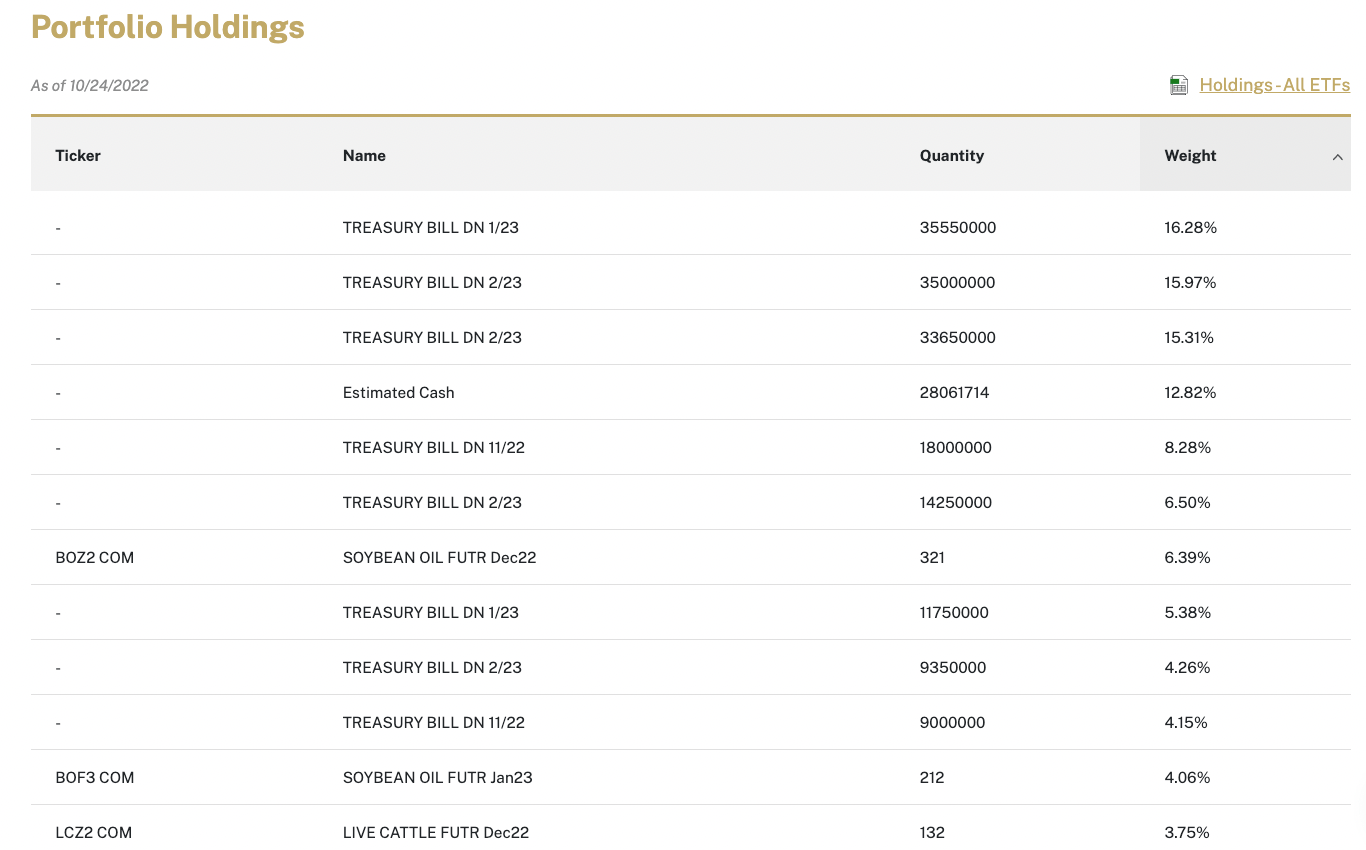

Here we get a taste of some of the top “short” and “long” positions CTA Simplify Managed Futures ETF is taking as of 10/24/2022.

Now it’s crucial to remember this is a “current snapshot” of how the fund is positioned and that if you’re reading this in the future the fund will have adapted and/or changed based on the four managed futures strategies it deploys.

Here you’ll notice high conviction “short” positions ranging from -78.77% to -7.33% with gold, copper, silver and wheat futures rounding things out at the bottom.

The long-side of the equation features a range of 16.28% to 3.75% with Treasury Bills, Soybean Oil and Live Cattle futures reigning supreme.

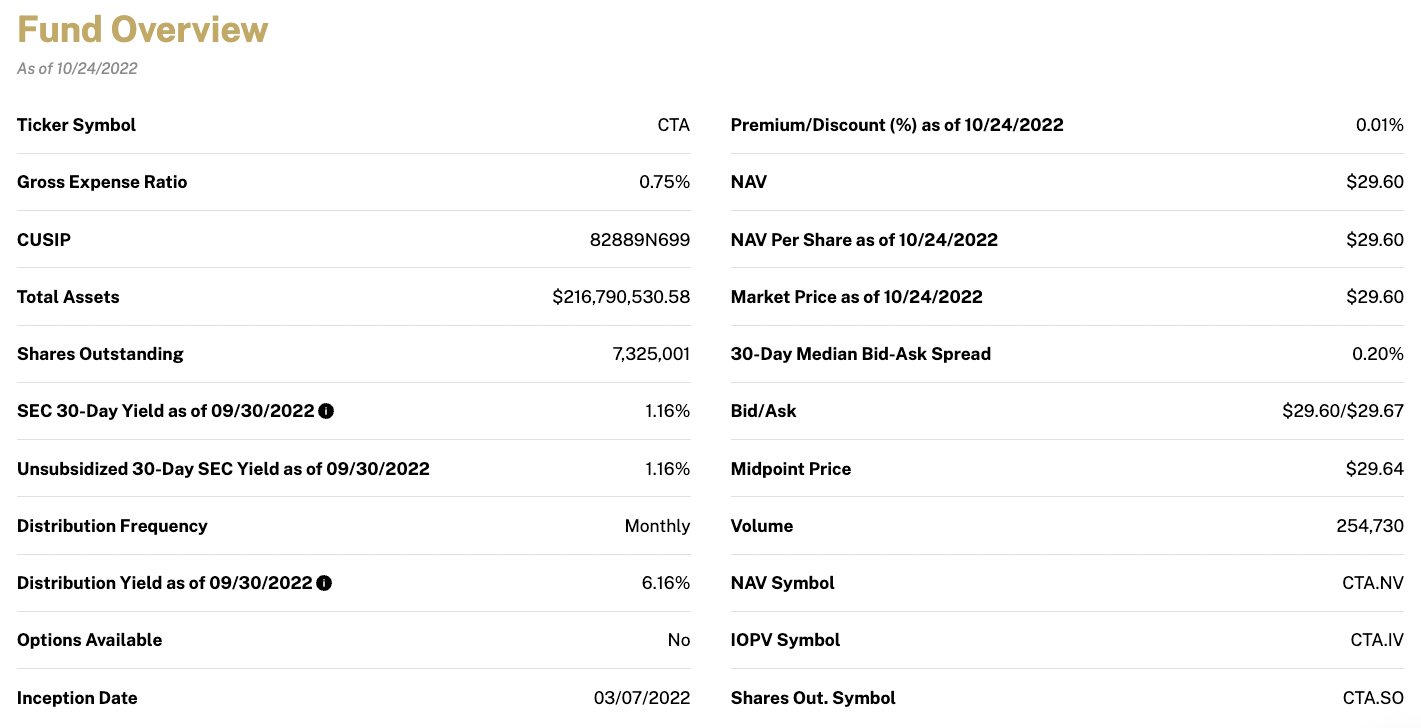

CTA ETF INFO

Ticker: CTA

Net Assets: $216,790,530

Expense Ratio: 0.75%

The AUM CTA ETF has been able to accumulate in merely a few months is most impressive coming in at over 216 Million.

Noteworthy is that the fund brings an “institutional mandate” at affordable prices for investors with an all-in-cost of only 0.75%.

To put this into perspective we’re talking about double digit basis point fees for what is typically a triple digit basis point domain.

Not only is the Gross Expense Ratio impressive but when compared to rival funds it’s the lowest in class that I’ve noticed.

It’s also an ETF that provides monthly distributions for those seeking income from their managed futures sleeve of the portfolio.

There is plenty to be impressed with so far but how has the CTA ETF performed?

source: Simplify Asset Management on YouTube

CTA Simplify Managed Futures Strategy ETF Performance

When I first became aware of the launch of CTA ETF I wanted to track two specific things.

Firstly, I wanted to see how it performed against the industry standard 60/40 portfolio.

Secondly, I was keen to see how it stacked up relative to the returns from managed futures stalwarts DBMF ETF and KMLM ETF.

Let’s explore each of those scenarios in more detail.

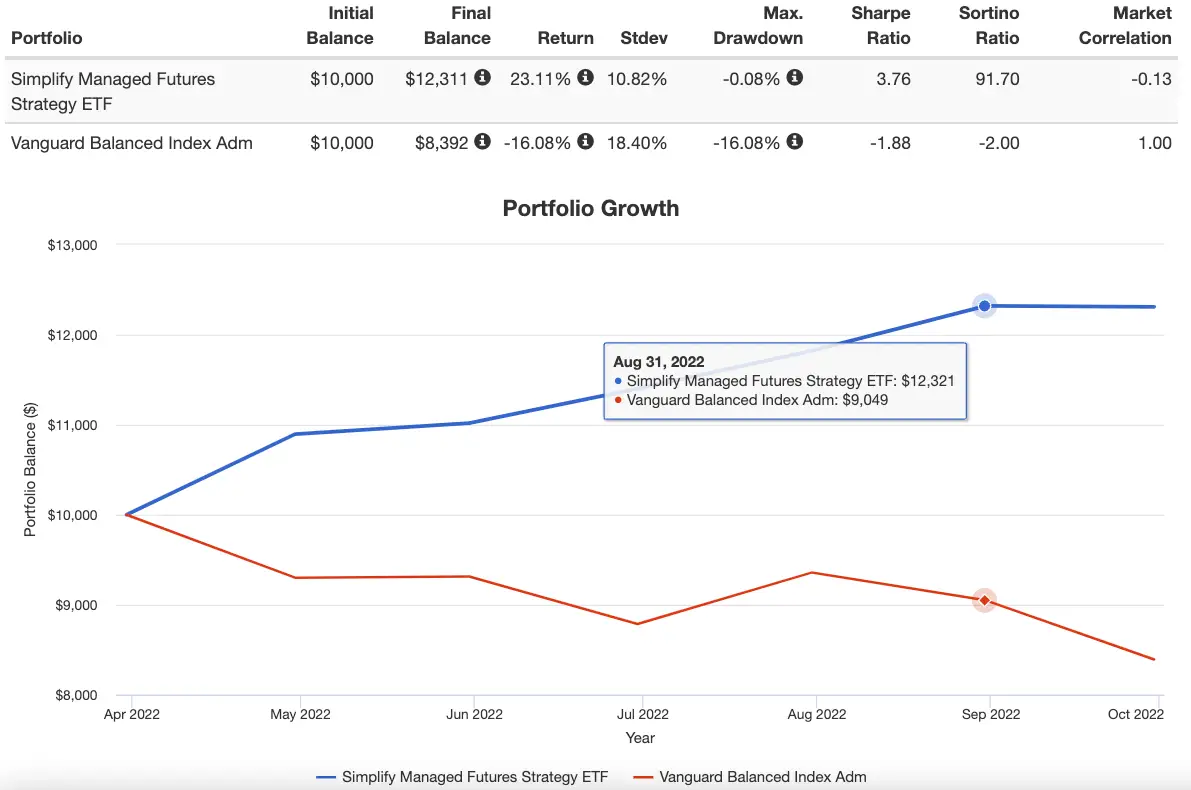

CTA ETF vs Global 60/40 Portfolio

It’s safe to say over a small sample size that CTA Simplify Managed Futures Strategy ETF has kicked up dirt in the face of a balanced 60/40 portfolio while darting-off in dramatic fashion.

Notice the -0.13 correlation to the market and outstanding 23.11% CAGR compared to -16.08% for the industry standard 60/40 portfolio.

In recent months, one fund has been a saviour whilst the other has been a wealth destroyer.

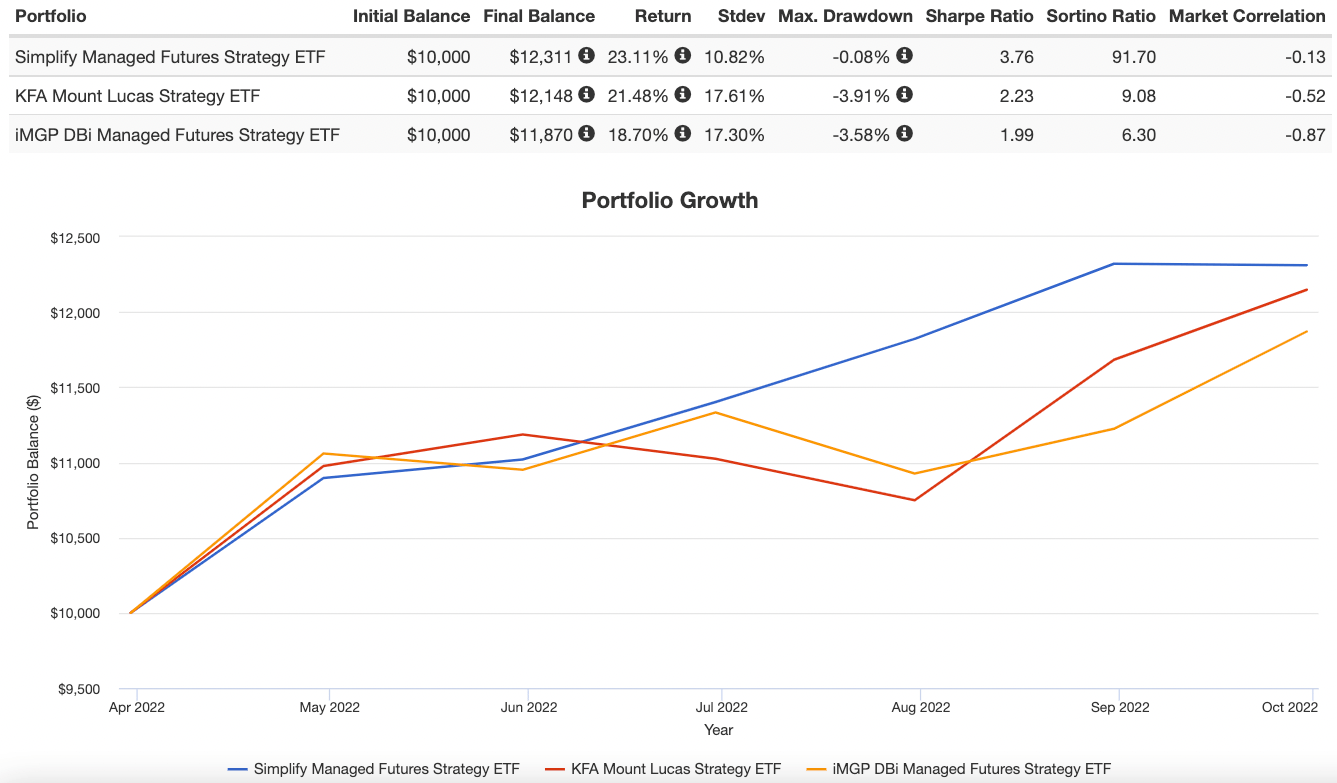

CTA ETF vs DBMF ETF and KMLM ETF

Beating the tar out of the industry standard 60/40 portfolio has been a cinch for most managed futures strategies in 2022 but how has CTA ETF compared to managed futures heavyweights KMLM ETF and DBMF ETF?

It’s not only been able to hang with those ETFs but it has actually relatively outperformed the two of them.

Appealing to the Sortino Ratio Deity with an otherworldly 91.70 indicator it’s provided returns and volatility management that are simply best in class since its inception.

Not only can it hang with the likes of DBMF and KMLM but it’s also making a case for being the new Sheriff in town.

And that’s not to steal any of the thunder of those two funds that have been bastions of stability and powerhouse positive return generators this year as well.

It’s certainly clear that the managed futures space now has a trio of thoroughbreds for investors to consider and that’s damn exciting in my opinion.

CTA Simplify Managed Futures Strategy ETF PROS AND CONS

Let’s summarize the pros and cons of CTA Simplified Managed Futures Strategy ETF.

CTA ETF PROS

- A multi-strategy Managed Future ETF that brings trend, carry, mean reversion and risk-off to the dinner table all under one hood

- An absolute return long-short strategy that is uncorrelated with both traditional long-only equities and bonds

- Performance out of the gate (albeit with a small sample size) that is beyond impressive and highlights the fund’s capacity to provide “crisis alpha” amidst a challenging market environment

- An all-in expense ratio of 0.75 that is best in class for retail investors

- Providing institutional level strategies that typically have been at arms length for retail investors

- Altis Partners brings expertise and a winning strategy with over 20 years of experience

- An adaptable part of your portfolio that provides overall diversification benefits while having the potential to thrive under all economic regimes

- Chance to support Simplify, an innovative alternative ETF provider, that is bringing unique strategies to the ETF marketplace

CTA ETF CONS

- Even best in class fees is often not enough to tempt hardcore indexers who are used to single digit basis points for market-cap weighted equities (excluding themselves from alternative strategies)

- Diversification is “awesome” when managed futures are outperforming traditional asset classes but poses a behavioural challenge for investors during regimes where it is a drag on their portfolio

CTA Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

I’m always excited when I reach this part of the ETF review because it means I’m almost finished the article and it’s time to consider how the fund can integrate into a portfolio at large.

CTA ETF Total Portfolio Solution

Investors may consider a one-click and chill ETF solution for their portfolio by allocating to my favorite asset allocation fund $FIG.

Simplify Macro Strategy ETF packs no less than 10 strategies under its hood as a super fund of funds asset allocation masterpiece with approximately 25% coverage to $CTA.

You can check out my comprehensive ETF Review of FIG Simplify Macro Strategy ETF if you’re keen on a learning more.

100% FIG

CTA ETF Factor Focused Quant Portfolio

For investors drooling over research supported factor-focused strategies you’ll find CTA ETF slots in nicely.

50% AVGE

30% CTA

10% TYA

5% BTAL

5% CYA

By utilizing capital efficient TYA for treasury exposure (3X greater than its portfolio weighting), you create ample space for global core equity AVGE ETF (with factor tilts) while having plenty of room for CTA.

Market Neutral BTAL and CYA provide further diversification and defensive benefits.

CTA ETF Expanded Canvas Portfolio

Expanded canvas investors, hardwired to build the most capital efficient portfolio under the sun, may consider the following allocation:

10% $GDE

10% $SPBC

10% $NTSI

10% $NTSE

10% $AVGE

30% $CTA

6% $TYA

4% $CYA

2.5% $DBEH

2.5% $BTAL

2.5% $PFIX

2.5% $ARB

For those capable of juggling a 12 ETF roster you’re globally diversified, factor focused and capital efficiently allocating to Gold, Bitcoin, Merger Arbitrage, Credit Hedges, Market Neutral, Long Volatility and Hedge Fund diversifiers.

Plus you’re still covered with long only equities, bonds and ample space for managed futures.

CTA ETF Standard Milquetoast Portfolio

For those of you committed to impaling yourself upon the sword of the industry standard 60/40 portfolio (but open minded enough to add an alternative sleeve) we’ve got you covered too.

80% $AOR

20% CTA

You’ve got your globally diversified 60/40 ETF $AOR augmented by alternative sleeve CTA to form a 50/30/20 portfolio.

Nomadic Samuel Final Thoughts

CTA Simplify Managed Futures ETF has burst onto the ETF marketplace scene and made a name for itself in record time.

It’s already stockpiling impressive AUM and it goes to show that a product that performs like a thoroughbred out of the gate can make a splash in what is otherwise known as the ruthless ETF Terrordome.

Do I personally invest in CTA ETF?

I do.

But I’ve decided to gain exposure via FIG Simplify Macro Strategy ETF.

For those interested, you can check out my DIY Quant Portfolio.

I’m “simply” a fan of Simplify and the products they’ve brought to market in recent months.

It’s exciting to see what they’ll come up with next!

What do you think of CTA Simplify Managed Futures ETF?

Is it on your shortlist of funds to consider adding to your portfolio?

Let me know in the comments below.

That’s all I’ve got for now.

Ciao.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.