Seeking less crowded spaces is one of my ultimate goals as an investor.

One particular equity optimization strategy that is most alluring to me is micro-cap investing.

This involves selecting stocks based on a particular market capitalization size ranging from $50 to $300 million.

Most investors hang-out exclusively in large cap territory; some venture further down the ladder to capture mid and small-caps.

Yet, I don’t know many microcap investors.

Additionally, I’m the first to admit I’m anything but an expert on the subject.

Thus, I’m thrilled to welcome Ryan Telford to the “How I Invest” series to discuss all things related to micro-cap stocks.

It’s honestly one of the most fascinating interviews we’ve run on Picture Perfect Portfolios.

With that mind, let’s turn things over to Ryan!

How I Invest with Ryan Telford: Factor Focused Quantitative Microcap Investor

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Ryan Telford

I am an engineer by education, and this is the focus of my daytime career at the moment.

I am not trained formally in finance, however with my quantitative background I relate well to many elements of finance.

As a working adult, I started off investing very passively, first with my financial planner managing investments through mutual funds, and through my employers’ “off the shelf” plans.

Some years later, a close family member passed away, and I received a modest sum from the estate.

My family worked hard to build their assets, so I felt it my responsibility to better understand my options for best putting these funds to work for myself and in turn, my family.

Over time in tandem, I was slowly building up my assets through regular contributions to retirement and savings accounts.

At around this time, I realized that my financial planner’s mutual funds and my employers’ plans were just not cutting it.

I started looking at several other options, from investing on my own in mutual funds, precious metals (physical), becoming a small business owner, and real estate (which I’ve written about on Seeking Alpha, see here for Part 1: https://seekingalpha.com/article/4058151-age-old-investment-question-stocks-real-estate-part-i-asset-class-overview-and-real-estate of a multi-part series).

I eventually landed on stocks, particularly value investing.

I absorbed everything I could on Buffett at the time and started investing on my own in his type of high quality, moat bearing, compounding businesses.

Using Morningstar stock reports as my source of research, I selected those companies I thought were of the highest quality and the most discounted to fair value.

The investing bug hit me, and it became a mild obsession (and is now maybe more than just a mild obsession).

Quantitative Microcap Investor: Where Larger Investors And Institutions Can’t Swim

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

When I started out, I had the benefit of being able to read Fosback’s Stock Market Logic, Marty Zweig’s Winning on Wall Street, Yale Hirsch’s Stock Market Almanac and Peter Lynch’s One Up on Wall Street.

Once I committed to stocks as my primary investment vehicle, I read everything I could on Buffett and Graham at the time, and started investing on my own in Buffett’s “wonderful businesses at fair prices”.

While I enjoyed this process, in hindsight I was going about it very haphazardly, using discretion to choose companies I felt would be good bets.

I was only loosely tracking my performance overall, so I really didn’t know if I was making good choices compared to the market or not.

That said, over the few years that I was investing this way, from what I could tell I was achieving average returns.

I stumbled upon Joel Greenblatt’s “The Little Book that Beats the Market”, and everything changed.

This book describes Greenblatt’s “Magic Formula” strategy, which is a purely quantitative strategy designed to find Buffett style “wonderful” businesses (high quality), but also at “wonderful” prices (cheap).

As an engineer, using a purely quantitative approach really appealed to me; this style of investing became an obsession and led me down the rabbit hole of factor investing.

I have written about the Magic Formula extensively:

1) https://seekingalpha.com/article/4027533-greenblatt-wizardry-quantitative-look-magic-formula

2) https://seekingalpha.com/article/4346121-magic-formula-underperformance-cracking-code-part-i

Another book that has shaped my way of thinking is Jim O’Shaughnessy’s “What Works on Wall Street”.

This looked at the various quant factors presented in academia from Fama and French, but from a practitioner’s point of view (hence the title) with several more factors than just covered in academia.

I use many of the factors and backtest analysis from the book in some of my strategies today.

Around the same time, I was also exploring “behavioural finance”, the best book on the subject in my opinion being Daniel Kahneman’s “Thinking Fast & Slow”.

This classic covers the now well-known System 1 and System 2 thinking, from his “prospect theory” and other research that he developed with the late Amos Tversky.

My conclusion from this book was that humans have many ingrained habits and instincts that do not necessarily fit well with finance and successful investing.

To have any sort of edge in investing, it was clear from Kahneman’s research (and others) that one must find ways to remove or minimize

these biases.

For me, and also a key point of O’Shaughnessy’s, was that using data and automated strategies can be a great tool to help us from getting in our own way in investing.

It was shortly thereafter that I discovered a quantitative research platform called Portfolio123, which allows users to test various investing factors.

P123 also allows you to devise your own quantitative models and screens for your own investing, with backtesting back to 1999. I use P123 exclusively today.

I was immediately hooked on quant and factor investing, and spent the next 7 years designing my own investing strategies, learning many valuable (maybe “painful and expensive” would be more accurate) lessons along the way.

It was my early work in quant/factor investing that I discovered my interest in small and microcap stocks.

From designing and testing strategies, I found that it was smaller stocks that typically performed the best with many quant factors.

This is a relatively inefficient space, where larger investors and institutions can’t swim.

Typically, microcaps’ business models and accounting are relatively straightforward, which also screens well from a quantitative point of view.

All of this led me to where I am today, a quantitative microcap investor.

To further describe my approach, it may be helpful to identify those types of things that I don’t do:

What I Don’t Do As A Quantitative Microcap Investor

- I don’t read 10-K’s or 10-Q’s – the strategies I use extract data directly from all financial statements (point-in-time), so there is no need to dig into individual quarterly and annual reports. Where many reports provide further commentary from management on the reported numbers, I find just looking at the numbers provides a more objective picture. My approach is such that I usually have around 100 positions between strategies at any given time, so I also don’t have the time to look at each company’s statements anyway.

- I don’t forecast or calculate DCF – I have gone down the rabbit hole of discounted cash flow models to try and come up with a fair valuation for a business, but I’ve found this process is more an exercise in assumptions, and even slight variations in the discount rate can provide very different values. For this reason, I prefer to use relative valuation techniques and ratios in my strategies.

- I don’t interview company management – many investors do this, however I have found that quant strategies work particularly well for microcaps and provide a very objective view of the business. There are many quant factors that can be used as a proxy for the quality of

management as well. - I don’t fall in love with my stocks, nor do I require to hold them “forever” – Microcaps in particular can experience bumps, which can either be “growing pains” or “permanent setbacks”, and knowing which one in the moment is difficult. Holding on to laggards also has an opportunity cost – time spent waiting for a stock to find its way (which it may or may not be able to do) is time lost on other potentially better opportunities.

Data Provides An Edge To Differentiate Between The Narrative And The Facts

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I’ve always been a “numbers guy”, I suppose this is why I’m an engineer. For this same reason, I don’t easily accept a claim unless I see some sort of back up or empirical data.

I’m not from Missouri, but I confess that I do feel like a distant relative to the “Show-Me” state!

From my perspective, data provides an edge to differentiate between the narrative and the facts.

In finance, there are “narratives” everywhere.

Some are backed up by facts and research, others are great stories that “feel right” but with little to back them up.

In my background of science and engineering, there are no narratives without a theory based on scientific first principles, or even better, based on tested, empirical evidence.

A Seeking Alpha reader went so far as to refer to me as an ‘intellectual avenging angel’ this may sum up my approach quite succinctly.

Working in industry, I’ve had several scenarios where clients have made project decisions purely on qualitative assessments or “gut feelings”.

As their consultant, it’s our job to make sure they’re doing the right thing; in some of these scenarios, taking a closer look and deeper investigation allowed for a more informed decision, and potentially avoided disaster.

I do feel quite strongly about an “evidence” based approach, and I’ve been taught firsthand the value of “show me”.

Of my largest mistakes in investing, either in stocks or other asset classes, all errors could be traced back to that fact that I did not demand sufficient evidence to understand the risks.

Even worse, in some of these situations I took on a disproportionate amount of risk (i.e. leverage), which in one case exacerbated the problem.

I am still weary of using leverage in investing, which can be a good thing, but at times may also be a limiting factor.

Granted, for some uniquely new opportunities, where there is no data, my approach can be limited.

That said, there’s a reason why they call the leading edge the “bleeding edge”, so this approach keeps me away from those potential pitfalls as well.

As noted above, my background is in engineering, and not finance. I have learned a great deal about finance and investing on my own and from others, but not taking the traditional approach in some ways makes me an outsider.

This is both an advantage and disadvantage.

I may not fully understand some of the key mechanisms in finance, but it also allows me to ask those questions that may be taken for granted by those in the field.

The Market Will Eventually Find A Way To Prove You Wrong

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

First, coming from an engineering background, I recall starting my journey in investing with the notion that the stock market obeys laws, just like in physics and other hard sciences.

Early in my quant journey, I remember performing a few backtests of strategies with good past long-term performance, and assumed that to be a guarantee of how the given strategy would perform in the future.

I truly thought that I had struck gold.

How wrong I was!

Where hard science is comprised of atoms, elements and electrons, finance is a man-made construct, driven by humans, who tend to be very irrational at times.

Rather, the market is what Jim O’Shaughnessy refers to as a “complex adaptive system”.

As much as I want to find an equation to model the entire stock market to, the truth is that such an equation would only apply for only an instant in time.

Knowing this at day one would have been helpful!

Second, I would remind myself to keep an open mind.

Starting out, I related well to value investing and Buffett style investing, but to a point where I believed all other investing/trading styles were inferior.

In reality, there are countless ways to invest, some of which will outperform value over extended periods.

The same goes for “investing” vs “trading”; there seems to be an unspoken superiority of investing vs trading, but in reality, they can both produce very good returns, they are just two very different approaches.

Third, and perhaps most importantly, is that no matter how smart you think you are, or how robust you feel your strategies are, the market will eventually find a way to prove you wrong.

In other words, always keep your guard up, especially after some success.

And fourth, perhaps a more general point, is to get exposed to markets as soon as possible.

Other than the benefit of compounding:

The sooner you start, the sooner you get a feel for your unique investing personality, risk tolerance, strengths & weaknesses.

Regardless of when you start, you will make mistakes in finding your way.

The sooner you do this, with less capital, the better!

Reality Of Factor Investing: Not All Factors Work All The Time

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

I use factor investing in my strategies, usually considering most of the major factor groups such as value, growth, quality, sentiment etc. simultaneously.

These factors are then assembled into a ranking system.

I take the entire stock universe meeting minimum liquidity rules, and rank all stocks so they have a final rank score.

The top 25 ranked stocks are selected.

All stocks are then re-ranked (rebalanced) after the week, and any new positions making it into the top 25 stocks are updated.

Where classic factor investing strategies are often long/short, I typically take high ranking long positions only.

I continue this rebalancing process each week (Monday mornings); some weeks there may be 2 or 3 position changes, or there could be several weeks in a row where no changes are made.

The most frequent turnover is during earnings season, when new financial data is released.

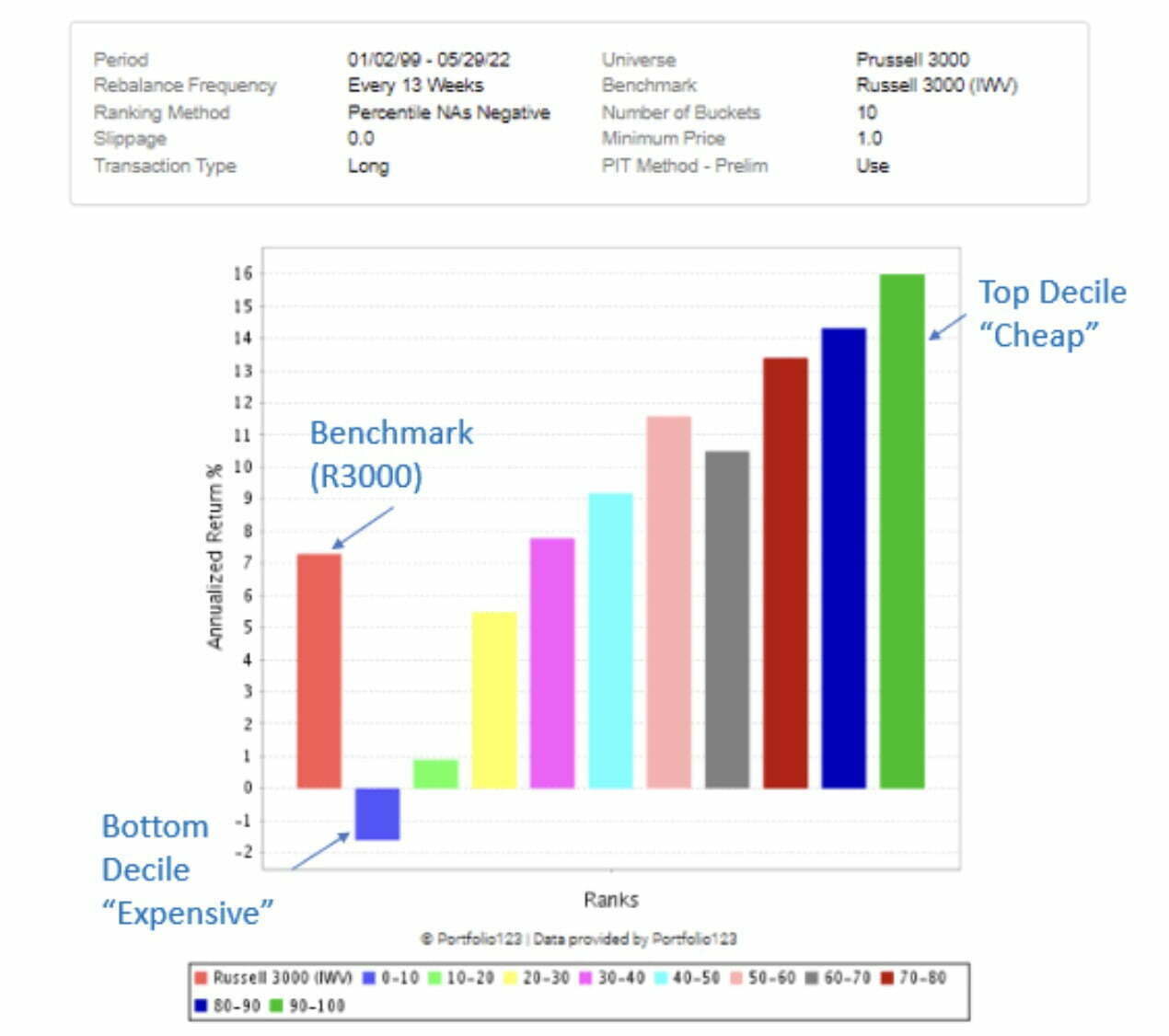

An effective way of looking at factor past performance is through rank charts.

Over a given period, all stocks are ranked, and grouped into ten (10) groups, or deciles.

The highest decile contains the 10% highest ranking stocks for the factor, the bottom decile the lowest 10% ranking stocks, with the remaining deciles in between.

At time of rebalance (say 1 month, or 3 months, 1 year), stocks are re-ranked in their respective deciles.

Over the full test period, the aggregate return of the various deciles are then calculated.

The rank chart below shows the returns of deciles for a value factor ranking system since 1999:

Value Factor Ranking System

Generally the greater the spread between the top and bottom deciles (with relatively smooth increase in deciles from bottom to top), the better. Chances are the factor(s) have been successful at finding winning (and losing) stocks.

One of my main “evergreen” strategies uses a ranking system of over 50 individual factors, broken down into the major factor groups (and weighting) as follows:

Major Factor Groups

- Value, 22% – cheaper, the better

- Growth, 19% – higher the growth rate (sales, EPS), the better

- Quality, 9% – profitability and financial health metrics, higher the better

- Sentiment, 15% – short interest, analyst recommendations

- Technical, 16% – the “when” – volume, price action, momentum

- Size (smaller the better), 19%

Much of the emphasis is on growth, which is important for stock returns in microcaps.

At the same time, you don’t want to pay top dollar for growth, so a 22% value weight is included as well.

This sort of strategy is somewhere between “investing” and “trading”.

With weekly rebalance, the strategy has an average annual turnover of 300%, with typical holding times of individual stocks anywhere from 3 to 12 months.

With microcaps, it is not uncommon to buy a high-ranking stock, only to see it drop in rank, for example after it misses earnings (assuming there are any estimates, many microcaps have little to no analyst coverage).

If a position falls out of the top 25, then it would be sold.

If things improve in the future, the same stock may rank more positively and can be re-bought.

Not all factors work all the time, so the strategy includes many different types as an attempt to be “evergreen”.

It is comprised of both fundamental and technical factors – they are intended to complement each other, sometimes in the market one is preferred over the other.

From the weightings above, the strategy relies more on fundamentals than technical; when the market is more interested in technical, or “story” stocks, then this strategy could suffer.

The strategy is mostly “sector agnostic”, however it does give credit when there is underlying strength in a particular sector.

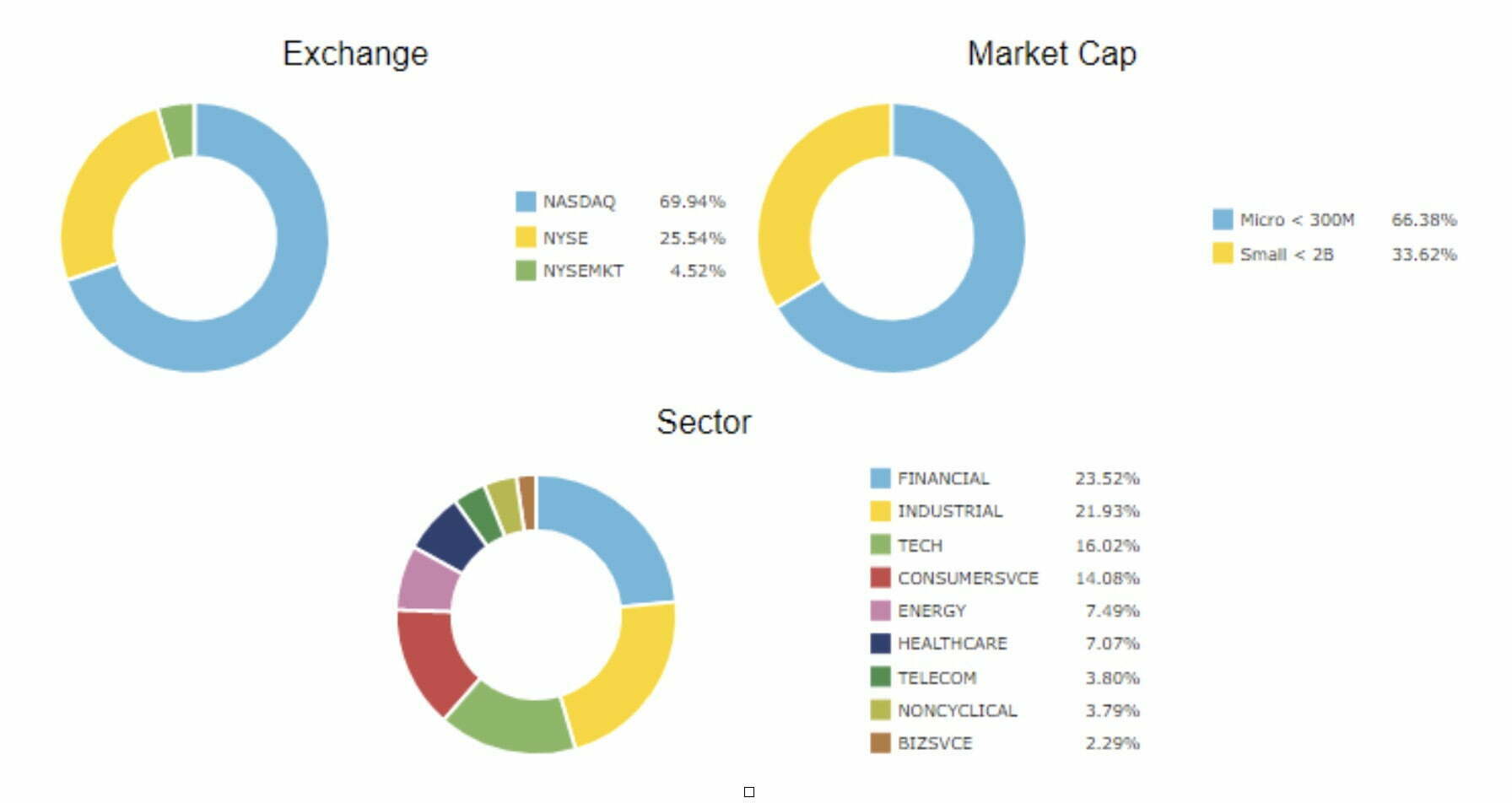

Here’s a graphical summary of the holdings in the strategy currently:

Current Holdings: Microcap Strategy

The Market Is A “Complex Adaptive System”

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

Perhaps an obvious point, but being numerate is a requirement for quant investing.

Most factors are numerical based, and you can use and devise different types of mathematical formulas to create your own factors.

The software I use (Portfolio123) is relatively user friendly, but there is some coding required in specialized, custom formulas, i.e. if/when statements.

Having some familiarity in these would help, but can be learned.

Building a strategy is one thing, interpreting a simulation or backtest is another.

With each backtest you can analyze the results through an array of statistical methods, some more reliable than others.

Having an understanding of statistics definitely helps to ensure any simulated performance is “statistically significant”.

That said, if we accept that the market is a “complex adaptive system”, then even we have the most statistically significant backtest, this is still only backward looking.

How the strategy will perform out-out-sample is still not guaranteed.

After generating multiple simulations and trading them in real-time, you start to learn how simulations trade into real results, under what market conditions, etc.

Assume you have a new strategy, it looks robust, and are confident it will perform out of sample.

Once we get it into live trading, there is going to be volatility (particularly for microcaps).

Being able to stick with the strategy is one of the most important skills in successful quant investing.

Again, provided the strategy is expected to do well in the current market conditions, then hold on.

If something has fundamentally changed in the market that doesn’t align with your strategy, then you may consider putting it out of service.

It is also important to remember that any factor-based approach is focused on the overall strategy, not necessarily the underlying names.

While the goal is to find a reasonable number of winners at an above rate of return, there will also be a share of losers, where -50% is not uncommon (and potentially as much as -30% in a day after a poor earnings report for microcaps).

For this reason, we usually include multiple stocks in the portfolio (say 25 stocks), so a single move will not sink the strategy.

Chances are there are other winners to come along to make up these losses (and then some), so you try not to fixate on these larger downside moves.

That said, if the idea of seeing a single position lose 50% makes you queasy, this strategy may not be for you.

This approach requires some trading – this could be a pro or con, depending on the person.

You don’t need to remain glued to your screen all day, but if you are looking to stay active, there isn’t enough trading to keep you occupied all day.

Ensure You’re Getting The Factor Exposure You’re Looking For

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

In terms of factor investing, there are several factor-based ETFs in the marketplace.

Many are single factor (i.e. value, or growth, or small/microcap), others are combined with size (small cap value, $IJS), or combined with industry (small cap tech stocks, $PCST).

One aspect of factor ETFs that I’ve written about on Twitter, is that several of the microcap ETFs (but not all) can have oddly distributed holdings, which don’t necessarily align with “microcap” (market cap of $300 million or less).

It is important to understand the underlying themes and factors to ensure you’re getting the exposure you’re looking for.

A more aggressive version of the strategy would be one with a higher concentration, i.e. less positions, say 10-15 (instead of 25).

With more concentration, comes more volatility (both on the upside and downside).

I have tried strategies with 5 positions; when they work, the returns are phenomenal, however an earnings miss from one stock can sink the entire strategy.

Another important consideration with fewer positions is during the design and testing of the strategy.

The fewer holdings the strategy uses during simulation and backtests, the smaller the sample size and risk that the strategy is “overfitted” to the data.

This increases the probability that the strategy will not work out of sample.

Your Strength Is Your Edge As An Investor

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

For any investor trying to maximize their performance, I believe their strength is in their edge.

I believe my edge is derived from the combination of three strengths, or characteristics: curiosity (trying new things, exploring new ideas), skepticism (not taking anything at face value), and persistence (stick with the plan and ride thru volatility).

In terms of curiosity, the advantage of using data and the “evidence based” approach is that ideas can be tested, instead of just assuming that a particular strategy should work.

This allows me to be on the lookout for other ways to run strategies in the market, and even challenge my own ideas.

Skepticism can be a double-edged sword.

I am a “show me” investor, so I need to see some robust, empirical evidence that a given strategy has potential, not just a narrative or story.

That said, this can also be a weakness, as some of the greatest disruptors do not have a reference, or a story that can be compared to.

I may miss out on some of these opportunities, but at the same time I do believe there are ample opportunities within quantitative microcap strategies, where there is plenty of data available.

Persistence mainly has to do with sticking with the plan.

Investing, particularly my style of microcap investing, can be very volatile.

Being able to hold on through extended periods is difficult, but I do what I can to do so, provided I believe the strategy is still suitable.

source: FundCalibre – independent research for investors on YouTube

Microcaps Are Misunderstood By The Broader Investment Community

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

Generally, microcaps are misunderstood by the broader investment community.

They are usually associated with being “risky”, “frauds” or “junk”.

These descriptions may fit many microcaps, but there are several out there that are legitimate businesses that can provide an investor with reasonable return, if s/he is so inclined to find them.

On the flipside, these smaller companies have an advantage as they have the most potential growth runway ahead of them; a microcap growing from 1x to 10x is not unheard of (or more); finding that scale of growth in a large cap is rare.

As a factor-based investor with nearly 100 individual holdings, I primarily see these stocks as tickers (almost as a trader would).

Warren Buffett investors insist that you hold businesses, not stocks.

My main focus is the overall strategy, i.e. the collection of the 25 stocks in each strategy.

I use many individual quantitative factors that evaluate the performance of the business, but I do not look much further than that.

With this approach, there are many other types of “business” related beliefs that I do not necessarily follow, that are widely held in the investing world.

As I mentioned earlier, I do not read 10Ks or 10Qs, nor do I perform any sort of absolute valuation exercise or DCF on individual names.

Common sense, in any discipline or endeavour, is helpful guidance that will help one avoid mistakes (think “System 1” thinking in Kahneman’s prospect theory, see Question #1).

Common sense is also just that, “common”, and generally results in a “common” outcome.

To achieve outperformance, I believe you need to think deeper and act different than just common sayings and witty phrases.

As an example, one of Warren Buffett’s famous quotes is “our favorite holding time is forever” (from Berkshire’s 1988 shareholder letter).

This particular line is taken quite to heart by many; in fact, there is much more context to this statement (something I’m planning to cover in a future piece).

This sort of approach is popularized with the “coffee can” portfolio as well; buy some stocks, put their certificates (when they were certificates) in a coffee can and hold for decades, in hopes that 1 or 2 are bound to be 10x or 100x.

Some investors may do well using this approach.

For my preferred arena of microcaps, I have found holding positions for shorter periods thru a major transitions or growth period, and repeating over and over with multiple stocks, to be a very viable and profitable strategy.

Similarly, common advice is to find moat bearing, high quality businesses at a good price.

In my experience, high quality businesses may be good businesses, but not necessarily good investments for price appreciation, as the “quality” aspect can already be priced in.

I prefer those businesses that are in the midst of growth, improving their quality, and are being recognized by the market.

Again, these characteristics are usually found in microcaps.

Mild Obsession With The Idea Of Market Timing

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I have a mild obsession with the idea of market timing.

One of the most difficult aspects of my type of investing is holding through volatility.

Generally I look for evergreen microcap stocks, those best suited to be held through most market conditions.

The ranking system is intended to capture the best stocks in the universe based on the factors, but it doesn’t give any credit for the overarching market conditions or regime.

When volatility hits, my only real option is to “grin and bear it”.

The idea of insulating my holdings from volatility is very appealing, however it is notoriously difficult, if not impossible.

And to capture any alpha when timing, you have to be correct on two counts – 1) exit (before volatility/correction starts), and 2) re-entry (usually investors wait too long and miss the start of the recovery).

Each market correction or phase is uniquely different, so finding a reputable signal from past data is almost impossible.

Still, it’s a challenge I’ve been working on, and hope to keep plugging away to find at least some sort of new factor or signal.

If I knew more about market timing, I would potentially look at higher risk, higher beta stocks during risk-on regimes, and lower risk during risk-off.

I also find biotech very interesting, which typically offer high rewards, but with high risk.

These stocks (particularly in the microcap stage) are driven mostly by research trial progress and FDA rulings, not just fundamental data.

Not particularly easy to select based on a quant factor approach, but worth a shot.

FANGAM Stocks Go Against Many Of The Factors I Look For

What would be the ultimate anti-Ryan Telford portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

As good as the FANGAM stocks may be, they go against many of the factors I look for.

Yes, they may be high quality with strong balance sheets, but they are just so massive that I really struggle to see how much more growth (and corresponding future returns) they can achieve.

What I truly love about microcaps is that they are often undiscovered, like hidden treasure.

Like that music group that you discovered on your own, or that little obscure restaurant that has the best burgers in the city, but very few know about.

Investing in something that everyone else has already found has little appeal to me, and I don’t believe I have much edge there, if any.

Now to “Steel Man” FANGAM to the flipside – not having an edge, or needing an edge, is perfect if you don’t want to spend the time finding the next big thing.

The FANGAM stocks are (or were) already the next big things.

Plus, if you want to “fit in” and buy what many other people own, then this could be appealing.

Plus, these are all household names, their businesses are mostly visible to many, and you can “use what you already know” as per Peter Lynch.

Chances are you use Google to search daily on your laptop that runs Microsoft Windows, then catch up with friends on Facebook, and use Amazon to buy a new Apple iPad to watch your favorite Netflix show.

Connect With Ryan Telford

SeekingAlpha – I write frequently on SeekingAlpha, feel free to browse my longer form analysis pieces

https://seekingalpha.com/author/ryan-telford

Twitter – I’m on there often, posting shorter facts or commentary on microcaps and quant investing

https://twitter.com/RTelford_invest

Porfolio123 – My strategy design and simulation platform of choice – try the link below for a free trial

https://www.portfolio123.com/app/dashboard?apc=RYANT

Nomadic Samuel Final Thoughts

I want to personally thank Ryan for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.