Long-only asset allocation is what most investors seek when it comes to stock and bond exposure.

But if you shine the spotlight on commodities it becomes a different ballgame.

The ability to adapt is crucial as holding tight in certain markets can leave you with your pants down.

Jaw-dropping drawdowns and prolonged underperformance is often part of the equation.

One way to gain the diversification benefits of commodities whilst managing risk and driving absolute returns is with a long-short strategy.

Today I’m thrilled to welcome back Eric McArdle of Simplify to discuss a fund that does just that.

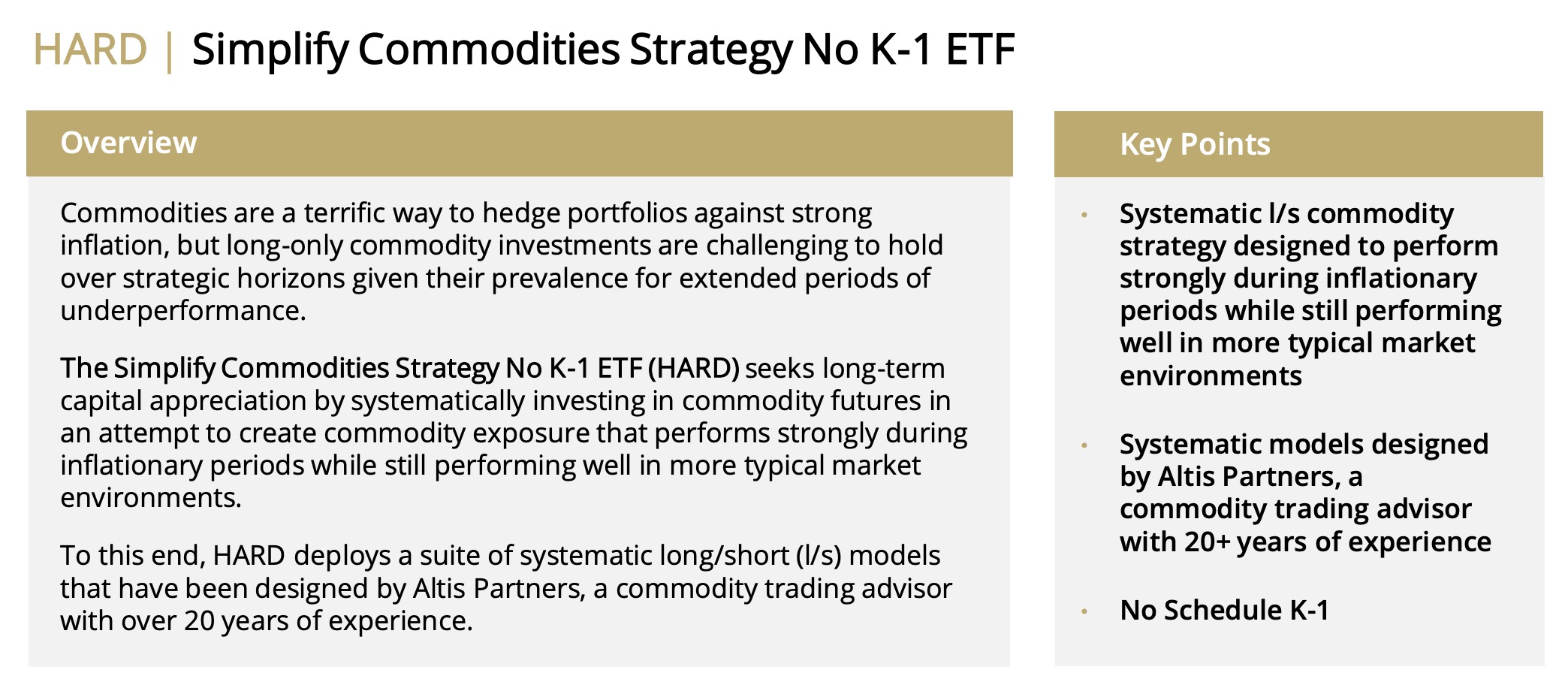

HARD ETF.

It’s better known as Simplify Commodities Strategy No K-1 ETF.

Without further ado, let’s turn things over to Eric!

Meet Eric McArdle of Simplify

Eric McArdle – Managing Director, Advisor Solutions

Eric has over 10 years of investment research, asset management, and client servicing experience. He is passionate about helping financial advisors, asset allocators, and individual investors solve and simplify complex investment problems.

Before joining Simplify at the firm’s inception in 2020, Eric was a research analyst at Nasdaq Dorsey Wright (NDW), a technical-analysis-focused investment firm in Richmond, Virginia. While there, he specialized in client communications pertaining to market research, including authoring a daily column for advisor clients as well as hosting the firm’s weekly podcast and video discussions.

Eric also led workshops around the country for financial professionals seeking to understand and implement the NDW methodology and ETF models into their practices. Prior to NDW, Eric served as one of two financial advisors for C&F Wealth Management’s Richmond-metro team, an LPL affiliate branch that managed and advised $450 million in assets under management.

Reviewing The Strategy Behind HARD ETF (Simplify Commodities Strategy No K-1 ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of HARD ETF?

For those who aren’t necessarily familiar with an “‘adaptable long-short commodity” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

An adaptable long-short commodity allocation uses trend following to go long when a commodity market is rallying and go short when it is going down. This solves the key challenge of long-only commodity investing where the investment looks great during the bull part of the commodity cycle and then gives up pretty much all those gains in the bear part of the commodity cycle.

Adaptable long-short strategies can generate returns in both parts of the cycle, giving you the inflation protection you want in inflationary environments without the pain when the commodity rally reverses.

Unique Features Of Simplify Commodities Strategy No K-1 Fund HARD ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

HARD was designed by our research partner, Altis Partners, to offer investors a better way to invest in the most liquid commodity futures markets using trend-following to deliver long-short allocations in the respective markets. HARD’s trend model also assumes a positive expected return for the commodity asset class as a whole, which results in a net-long bias while maintaining the ability to go short.

This results in a dynamic exposure that is quite different from the typical long-only broad basket commodity funds, which in our opinion are not built to capture the inherent booms and busts that are associated with the asset class. The fund is fully systematic and relies upon two models: trend and fundamental reversion. HARD has an expense ratio of 0.75%.

What Sets HARD ETF Apart From Other Commodity Funds?

How does your fund set itself apart from other “commodity” funds being offered in what is already a crowded marketplace? What makes it unique?

Unlike most broad-based commodity funds, HARD can go long or short. To our knowledge, it is one of, if not the only, ETF in its space to have long-short capabilities. The fund can also trade as often as daily, which is important for its secondary algorithm, fundamental reversion.

Fundamental Reversion detects when markets have moved too far from fair value based on a cross-sectional macro model, seeking to deliver returns during periods of lower/falling volatility.

What Else Was Considered For HARD ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

Some investors have asked if we would consider adding crash (tail) protection to our trend strategies, but we ultimately decided against it as we prefer to provide proprietary trend model exposures without embedded hedging.

When Will HARD ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

We would expect our strategy to perform well when commodities trend (i.e. price movements are well-defined) or are volatile. The advantage of having long-short capabilities allow for the potential capture of both positive and negative trend movements. We would expect the strategy to struggle during periods of chopiness in the market or low volatility.

Why Should Investors Consider Simplify Commodities Strategy No K-1 Fund HARD ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Commodities, and more specifically, commodity trend strategies, can offer investors with meaningful diversification benefits during periods where traditional risk premia offered from stocks and bonds may struggle. This is especially true in inflationary environments. However, long-only commodity indexes have had poor returns over the long term.

For example, the S&P GSCI Index has had a total return of -30% over the past dozen years. That’s why we believe that commodities are best held in an actively managed strategy like HARD. We would expect this strategy to have a low to neutral correlation to equities and a neutral to negative correlation to bonds during a long-term holding period.

How Does HARD ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

HARD is meant to be an alternative holding that complements traditional portfolio risk assets like stocks and bonds. A 5-10% portfolio allocation is typical for this exposure.

The Cons of HARD ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

While our ETFs are fully transparent, interpreting the positioning in a complex strategy like HARD can be difficult. We are constantly working to improve analytics and reporting around HARD and other strategies.

One such improvement is a Portfolio Risk Profile that aggregates all invested contracts across the term structure and displays them in a “contribution to volatility” framework table.

This report is accessible above the “Holdings” section of the fund’s detail page.

The Pros of HARD ETF

On the other hand, what have others praised about your fund?

HARD has been well-received in a period where inflation remains top of mind but disinflation/deflation is also becoming a serious concern. We’re excited for the opportunity to navigate what should be an interesting end of the year and 2024 for commodities.

Learn More About HARD ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

One last thing I’ll mention that we haven’t touched on is that many of our competitors offer roll-yield optimized long-only products, and this is a smart feature when investing in commodity markets, given that commodities have forward curves with dynamic shapes.

In our product we naturally account for curve shapes within our trend forecasting models, so you still get all the benefits of being roll yield optimized within HARD, but with all the trend benefits we have previously laid out.

To learn more about Simplify or to speak with a Simplify representative, please go to simplify.us. You can also follow us on YouTube at https://www.youtube.com/@SimplifyAssetManagement

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: HARD ETF

Nomadic Samuel Final Thoughts

I want to personally thank Eric McArdle at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

You may want to check out LCSIX as another long/short commodity option. It’s a mutual fund, but it’s been around since 2013 with an impressive track record and low market correlation.