The research paper “The Allegory of the Hawk and Serpent” serves as a critical foundation for understanding the innovative investment strategy known as the Dragon Portfolio. This paper, steeped in a detailed analysis of economic patterns and market behaviors over a century, offers a paradigm shift in asset allocation and investment thinking. Its primary purpose is to challenge the traditional notions of portfolio management, which often fall short in the face of dynamic economic changes.

The Cyclical Nature of Markets

The research underscores the cyclical nature of markets, driven by an interplay of various factors like demographics, technological advancements, and geopolitical shifts. These cycles have historically shown significant impacts on investment returns, leading to the realization that traditional investment strategies might not be as effective in navigating these ever-changing economic waters.

Limitations of Traditional Portfolio Management

One of the key highlights of the paper (written by Chris Cole of Artemis Capital Management) is its critique of conventional portfolio management strategies. It points out that these traditional approaches, often heavily reliant on a static stock-bond mix, are not equipped to handle the complexities and variabilities of different economic regimes. This leads to an increased risk of underperformance, especially during unexpected market downturns or periods of high volatility.

Introduction to the Dragon Portfolio Concept

The Dragon Portfolio emerges as an answer to these limitations. Named after the mythical creature symbolizing power and adaptability, the Dragon Portfolio is designed to withstand and prosper through various economic climates. It proposes a diversified mix of assets, balancing growth-oriented investments like equities with protective assets such as commodities and trend-following instruments. This mix aims to provide stability and growth across different market conditions, from bull markets to recessions.

source: Real Vision on YouTube

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Objective of the Dragon Portfolio

The overarching objective of the Dragon Portfolio is to deliver sustainable growth and wealth preservation over the long term. By diversifying across different asset classes that respond uniquely to various economic phases, the portfolio aims to reduce risk and enhance returns, irrespective of the prevailing market environment.

In essence, the Dragon Portfolio presents a comprehensive and adaptable investment strategy, geared towards navigating the complex and cyclical nature of markets. Its approach transcends traditional investment methodologies, offering a more dynamic and resilient way of asset allocation that is especially pertinent in today’s rapidly evolving financial world. The strategy not only promises to safeguard investments but also to harness growth opportunities across diverse economic scenarios.

Who Created The Dragon Portfolio?

The Dragon Portfolio is a concept that was popularized and developed by Chris Cole, the Chief Investment Officer (CIO) and founder of Artemis Capital Management. Chris is a recognized figure in the world of finance and investment, particularly known for his research and work on volatility, risk management, and alternative investment strategies. He introduced the Dragon Portfolio as an innovative approach to all-weather asset allocation and risk mitigation in investment portfolios.

Conceptual Foundation of the Dragon Portfolio

The Allegory of the Hawk and Serpent: Philosophical Underpinnings

The Dragon Portfolio’s conceptual roots are deeply embedded in the allegory of the hawk and serpent, a powerful metaphor representing the perpetual struggle between risk and return in the investment world. This allegory, at the heart of the research paper, symbolizes the dynamic and often adversarial relationship between aggressive secular growth (serpent) and defensive preservation during secular change (hawk) strategies in investment management. It underscores the need for a balanced approach that recognizes and adapts to the inherent dualities in financial markets.

- The Serpent: This typically represents more traditional, liquid investments like stocks and bonds. These assets are characterized by their responsiveness to economic growth and are generally more familiar to most investors.

- The Hawk: This represents assets that are designed to perform well during periods of economic stress or market volatility. This could include investments like gold, long volatility strategies, and perhaps even certain types of trending commodities.

The idea is that by balancing these two types of investments (the Serpent and the Hawk), the Dragon Portfolio aims to achieve long-term growth while also being resilient during times of economic turbulence. The portfolio is designed to “breathe fire” in both good and bad economic times, much like a mythical dragon.

Philosophical Significance in Investment Strategy

The allegory serves as more than a symbolic representation; it provides a philosophical framework for understanding the complexities of market behavior. By personifying the elements of risk and safety, the allegory encourages investors to embrace a holistic view of asset allocation. This perspective is critical in developing a portfolio that can navigate the delicate balance between seeking growth and protecting capital.

The Cyclical Nature of Wealth: Creation, Destruction, and Rebirth

Central to the Dragon Portfolio is the concept of the economic cycle, which involves phases of wealth creation, destruction, and rebirth. This cyclical view acknowledges that economic environments are not static; they evolve through periods of expansion, peak, contraction, and trough. The paper illustrates how different asset classes perform variably across these cycles, highlighting the importance of a diversified portfolio that can adapt to these changes.

Wealth Creation and Growth Phase

In the growth phase of the cycle, characterized by economic expansion and bullish markets, growth assets like equities tend to perform well. However, relying solely on such assets can be precarious, as they are vulnerable to market downturns.

Wealth Destruction and Defensive Strategy

Conversely, during downturns and recessions, defensive assets like bonds and commodities typically offer better protection. This phase underscores the importance of including assets in the portfolio that can counterbalance the volatility of growth-oriented investments.

Rebirth and Dynamic Adaptation

The rebirth phase is about adapting to the new economic realities post-recession. This involves rebalancing the portfolio to align with the emerging economic environment, ensuring that it remains resilient and poised for growth.

In essence, the Dragon Portfolio, through its philosophical grounding in the allegory of the hawk and serpent, provides a sophisticated approach to investment strategy. It emphasizes the need for a dynamic, adaptable asset allocation that can thrive across the cyclical nature of wealth creation, destruction, and rebirth. This approach not only helps in mitigating risks associated with economic fluctuations but also capitalizes on growth opportunities presented by these cycles.

Secular Growth and Decline: Understanding the Market Cycles

Analyzing Past Market Trends and Cycles

A critical aspect of the Dragon Portfolio is its deep dive into the historical patterns of market trends and cycles. This analysis spans over a century, providing a comprehensive view of how markets have evolved through various economic phases. The research paper meticulously examines these patterns, identifying recurring themes and shifts that have shaped the financial landscape.

The Role of Demographics in Market Trends

Demographics play a pivotal role in shaping market trends. Changes in population dynamics, such as aging populations or shifts in workforce demographics, directly influence economic growth and consumer behavior. The Dragon Portfolio takes into account these demographic trends, understanding that they can significantly impact investment outcomes, particularly in long-term strategies.

source: RCM Alternatives on YouTube

Technological Advancements and Their Impact

Technology is another critical factor influencing market cycles. Innovations and technological breakthroughs can drive economic growth and create new investment opportunities. However, they can also disrupt existing industries and render traditional business models obsolete. The Dragon Portfolio considers these technological shifts, recognizing their potential to both enhance and disrupt market dynamics.

Economic Factors Shaping Market Trends

Economic policies, interest rates, inflation, and global trade are among the key economic factors that influence market cycles. The Dragon Portfolio incorporates an understanding of these elements, recognizing how they can create environments of prosperity or adversity for different asset classes.

Integration of Market Cycle Analysis in the Dragon Portfolio

The Dragon Portfolio utilizes this detailed analysis of past market trends, demographics, technology, and economic factors to formulate a strategy that is not only reactive but also anticipatory of future market movements. This approach allows for a dynamic asset allocation that adjusts to the secular trends of growth and decline, aiming to capitalize on opportunities while mitigating risks.

The Dragon Portfolio’s approach to understanding and utilizing market cycles is comprehensive and multifaceted. By analyzing historical trends and considering the impact of demographics, technology, and economic factors, the strategy seeks to navigate through the complexities of secular growth and decline. This deep understanding of market dynamics is crucial in developing an investment strategy that is resilient and adaptable to the ever-changing financial landscape.

Challenges in Traditional Portfolio Management

The Paradigm of Traditional Investing Assumptions

Traditional portfolio management is predicated on a set of long-standing assumptions that have shaped mainstream investment practices. Central to these is the belief in the infallibility of equities for long-term growth, often overlooking the possibility of extended market downturns. Similarly, fixed-income instruments like bonds are traditionally viewed as havens of stability, yet they falter in environments of low interest rates or inflation, leading to the erosion of real returns.

The Equity Dominance Fallacy

In the realm of traditional investing, there’s a pervasive overconfidence in equities as the cornerstone of growth, especially over long periods. This belief, however, is frequently challenged during bear markets, where equity-heavy portfolios can experience substantial value erosion. Such scenarios starkly contrast with the conventional wisdom that equities are invariably safe in the long-term horizon.

Fixed Income in Low-Yield Contexts

The role of fixed income in portfolio stability is another cornerstone of traditional strategies. However, in eras of low interest rates, the yield on these instruments can be insufficient, failing to keep pace with inflation, and thus offering negative real returns. This challenge is particularly pronounced in stagnant or deflationary economic climates.

Misconceptions Around Diversification

A common trope in traditional portfolio management is the reliance on diversification as a risk mitigation tool. However, the assumption that asset classes remain non-correlated in all market conditions is often disproved during times of financial crises, where increased correlations can lead to simultaneous losses across diversified assets.

Reliance on Historical Performance

Many traditional investment strategies are built on the edifice of historical performance data, assuming that past patterns will predict future market behaviors. This backward-looking approach, however, can be myopic, particularly in the face of unprecedented market disruptions or paradigm shifts in the global economy.

Inflation Risks and Portfolio Erosion

Another critical oversight in traditional portfolio management is underestimating the impact of inflation, particularly in portfolios with a heavy emphasis on fixed-income assets. Over time, inflation can significantly diminish the purchasing power of returns, eroding the real value of the portfolio.

The Imperative for a Dynamic Investment Approach

These various challenges underscore the imperative for a more dynamic and nuanced approach to portfolio management. Traditional models, with their static assumptions and reliance on historical trends, are often ill-equipped to navigate the complexities and volatilities of modern financial markets.

Summary: Pitfalls in Different Market Regimes

- Equity-Dominated Portfolios in Bear Markets: In bear markets, portfolios heavily weighted in equities can suffer significant losses. This is contrary to the common assumption of equities being safe for long-term investment.

- Fixed Income in Low-Yield Environments: The traditional safe haven of bonds and other fixed-income securities becomes problematic in low-yield environments, particularly when inflation is factored in, leading to negative real returns.

- Diversification Misconceptions: Traditional diversification strategies often assume a lack of correlation between asset classes. However, in extreme market conditions, this correlation can increase, leading to simultaneous losses across supposedly diversified portfolios.

- Overreliance on Historical Performance: Many traditional strategies rely heavily on back-tested data and historical performance, which may not accurately predict future market behavior, especially in unprecedented scenarios.

- Inflation Risk: Traditional portfolios, especially those heavy in fixed-income assets, can be vulnerable to inflation, eroding the real value of returns.

The Dragon Portfolio, through its innovative approach, addresses the shortcomings of traditional portfolio management by advocating for an adaptive, forward-looking strategy. This approach recognizes the limitations of conventional wisdom and historical patterns, emphasizing the need for a portfolio that is resilient and responsive to the multifaceted and ever-evolving nature of global financial markets.

The Dragon Portfolio: A Comprehensive Century-Long Approach

The Dragon Portfolio presents a revolutionary approach to asset allocation, designed to navigate the multifaceted landscape of financial markets over an extended period, typically spanning a century. It breaks away from traditional investment strategies, offering a diversified and balanced allocation of assets that strategically adapts to varying market conditions. This portfolio strategy is not merely a collection of different asset types; it is a sophisticated, methodical approach that responds to the intricate dynamics of global economic and market cycles.

Philosophical Underpinning of the Dragon Portfolio

The foundation of the Dragon Portfolio lies in understanding the cyclical nature of markets and economies. It is premised on the idea that financial markets are not linear or predictable in the long term but are instead characterized by phases of growth, stagnation, and decline. The portfolio is structured to not only survive but also thrive in each of these phases.

source: Mutiny Funds on YouTube

Diversification Beyond Traditional Norms

Diversification in the Dragon Portfolio extends beyond the conventional stock and bond mix. This diversification is not arbitrary; it is a deliberate strategy to ensure that different components of the portfolio respond differently to various market conditions, thereby reducing overall risk.

Incorporating Counter-Cyclical Assets

A distinctive feature of the Dragon Portfolio is its emphasis on counter-cyclical assets. These are assets that tend to perform inversely to the general market trends. For instance, certain commodities or alternative assets may rise in value when traditional markets decline, providing a hedge against downturns. This counter-cyclical approach is crucial in stabilizing the portfolio during periods of market volatility and economic downturns.

The Importance of Adaptability and Rebalancing

The Dragon Portfolio is dynamic, not static. It requires regular rebalancing to adjust to changing market conditions. This adaptability is key to its long-term success. It involves periodically reviewing and adjusting the asset mix to ensure that the portfolio remains aligned with the overarching strategy of balancing growth potential with risk mitigation.

The Dragon Portfolio is a sophisticated, forward-thinking investment strategy designed for longevity and resilience. Its multi-faceted approach to diversification, inclusion of counter-cyclical assets, and emphasis on adaptability make it a unique and compelling choice for investors looking for sustainable growth and wealth preservation over an extended time horizon. In a world where financial markets are increasingly complex and unpredictable, the Dragon Portfolio offers a blueprint for navigating these challenges with confidence and foresight.

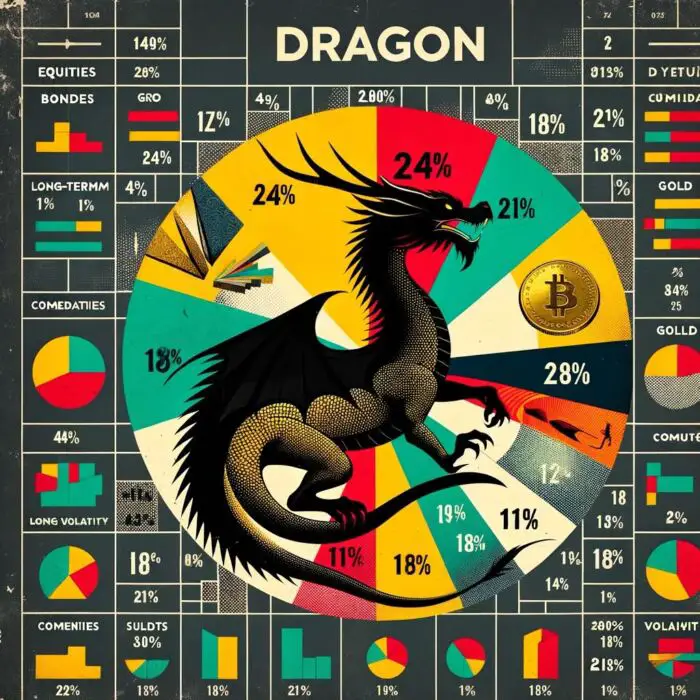

Composition of the Dragon Portfolio

In the realm of investment strategies, the Dragon Portfolio emerges as a quintessential model of diversification and risk management. At its core, this portfolio is meticulously engineered to withstand economic vicissitudes, ensuring robust performance across various market scenarios. The composition of the Dragon Portfolio is a tapestry of diverse asset classes, each serving a strategic role in balancing the risk-reward equation.

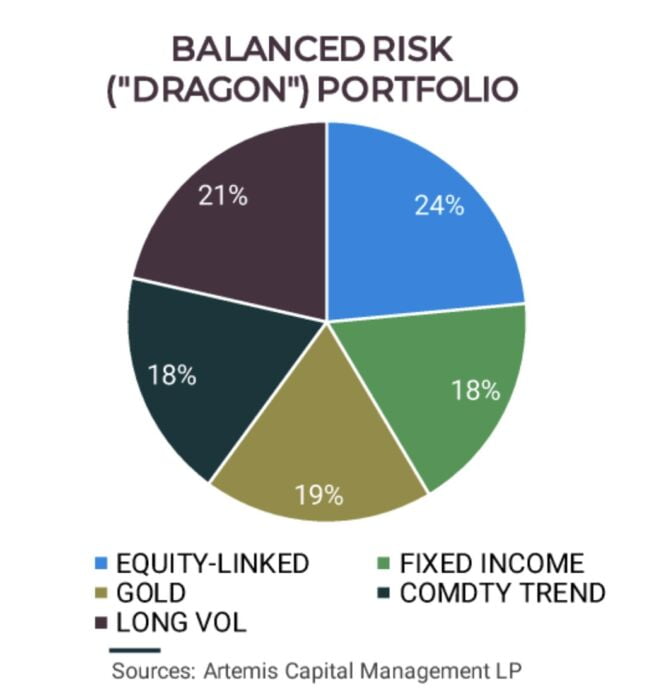

Dragon Portfolio: Asset Classes and Their Allocation

- Equities (24% Allocation): Equities form a vital segment of the Dragon Portfolio, constituting approximately 24% of the total allocation. This segment primarily includes stocks from a broad spectrum of sectors and geographies, offering growth potential and a hedge against inflation. Equities are pivotal for capital appreciation, especially in bullish market phases.

- Long-Term Bonds (18% Allocation): A similar proportion is allocated to long-term bonds, typically government securities with extended maturities. These instruments provide a stabilizing counterbalance to the portfolio, offering predictable income and preservation of capital. In periods of declining interest rates, these bonds can deliver substantial capital gains, thereby cushioning the portfolio against equity market downturns.

- Gold (19% Allocation): The Dragon Portfolio allocates around 18% to gold, a time-honored bulwark against inflation and currency devaluation. Gold’s intrinsic value and its negative correlation with traditional financial assets make it an indispensable component for hedging against systemic risks and financial crises.

- Commodities (18% Allocation): Another 18% is vested in a basket of commodities, including energy, agriculture, and metals. Commodities provide an essential hedge against inflation and serve as a counterweight to equities and bonds in different economic cycles. Their prices are often driven by supply-demand dynamics, independent of financial markets, thus adding another layer of diversification.

- Long Volatility (21% Allocation): The most distinctive feature of the Dragon Portfolio is its 21% allocation to long volatility strategies. These strategies thrive on market volatility, providing substantial gains during periods of market stress and downturns. They act as a critical defensive mechanism within the portfolio, offsetting losses from other asset classes during turbulent times.

Rationale Behind the Asset Allocation

The strategic allocation in the Dragon Portfolio is underpinned by a deep understanding of economic cycles and their impact on different asset classes. The portfolio is designed to achieve a state of equilibrium, where each asset class complements and balances the others.

- Equities and Bonds Synergy: The juxtaposition of equities and long-term bonds leverages the often inverse relationship between stock and bond markets. While equities offer growth in a thriving economy, bonds provide a safety net during recessions.

- Inflation Hedges: Both gold and commodities serve as potent hedges against inflation. Their inclusion is pivotal in protecting the portfolio’s purchasing power, especially in times of loose monetary policies and currency devaluation.

- Volatility as an Asset Class: The allocation to long volatility is a strategic masterstroke. This component is primed to benefit from market dislocations and spikes in uncertainty, a feature often overlooked in traditional portfolios.

The Dragon Portfolio is a paradigm of strategic asset allocation, designed to weather various economic storms. Its diversified approach not only seeks to capitalize on growth opportunities but also provides a robust defense against market downturns and inflationary pressures. This balanced and dynamic allocation is the cornerstone of its resilience, making it a compelling choice for investors seeking long-term stability and growth.

The All-Weather Approach

The All-Weather investment strategy, a paradigm of modern portfolio theory, is a meticulously crafted approach designed to endure across diverse economic climates. This strategy transcends traditional investment methodologies by emphasizing a balanced allocation that is responsive to the vicissitudes of economic cycles, inflationary trends, and market volatility. The quintessence of this approach lies in its ability to adapt and thrive in both favorable and adverse market conditions, thereby offering a consistent and resilient investment trajectory.

All-Weather vs. Traditional Portfolio Strategies

- Diversification Beyond Conventional Asset Classes: Traditional portfolio strategies often revolve around a simplified allocation between stocks and bonds, typically adhering to a fixed ratio like 60/40. The All-Weather approach, in contrast, advocates for a more expansive diversification. It encompasses a broader range of asset classes, including commodities and volatility instruments, which are not customarily present in standard portfolios.

- Responsive Asset Allocation: Unlike traditional strategies that maintain a static asset mix, the All-Weather strategy dynamically adjusts its allocation in response to shifting economic conditions. This proactive reallocation is predicated on an astute analysis of economic indicators and market trends, thereby aligning the portfolio to capitalize on emerging opportunities while mitigating risks.

- Risk Parity Principle: Traditional portfolios often inadvertently skew towards higher risk in equities. The All-Weather approach, conversely, employs the risk parity principle, ensuring that each asset class contributes equally to the overall risk profile of the portfolio. This methodology fosters a more balanced and stable portfolio, reducing the dependence on any single asset class’s performance.

Benefits of the All-Weather Approach in Volatile Markets

- Enhanced Stability and Reduced Volatility: The All-Weather strategy’s diversified and balanced nature inherently reduces volatility and buffers the portfolio against market upheavals. By not being overly reliant on the performance of equities, the strategy provides a steadier investment experience, especially critical during times of heightened market turbulence.

- Adaptability to Different Economic Scenarios: Whether it’s a booming economy, a deflationary spiral, or an inflationary period, the All-Weather portfolio is structured to adapt and perform. This versatility is pivotal in navigating complex and unpredictable economic landscapes, offering a strategic advantage over traditional portfolios that may falter under specific conditions.

- Consistent Long-Term Performance: By aiming to generate steady returns across various market conditions, the All-Weather approach aligns well with long-term investment goals. Its design to mitigate extreme losses in downturns and capture gains in upturns contributes to a more consistent compounding effect over time.

- Strategic Risk Management: The focus on risk parity and inclusion of assets like commodities and volatility instruments provides a sophisticated risk management framework. This framework is key in preserving capital during market downturns, a critical aspect often overlooked in traditional strategies focused predominantly on growth.

Paradigm Shift In Portfolio Management

The All-Weather investment strategy represents a paradigm shift in portfolio management. Its holistic and dynamic approach to asset allocation, underpinned by the principles of diversification, adaptability, and risk parity, offers a robust framework for navigating the complexities of modern financial markets. In an era characterized by unpredictable economic cycles and market volatility, the All-Weather strategy stands as a beacon of stability, offering investors a prudent path to achieving their long-term financial objectives.

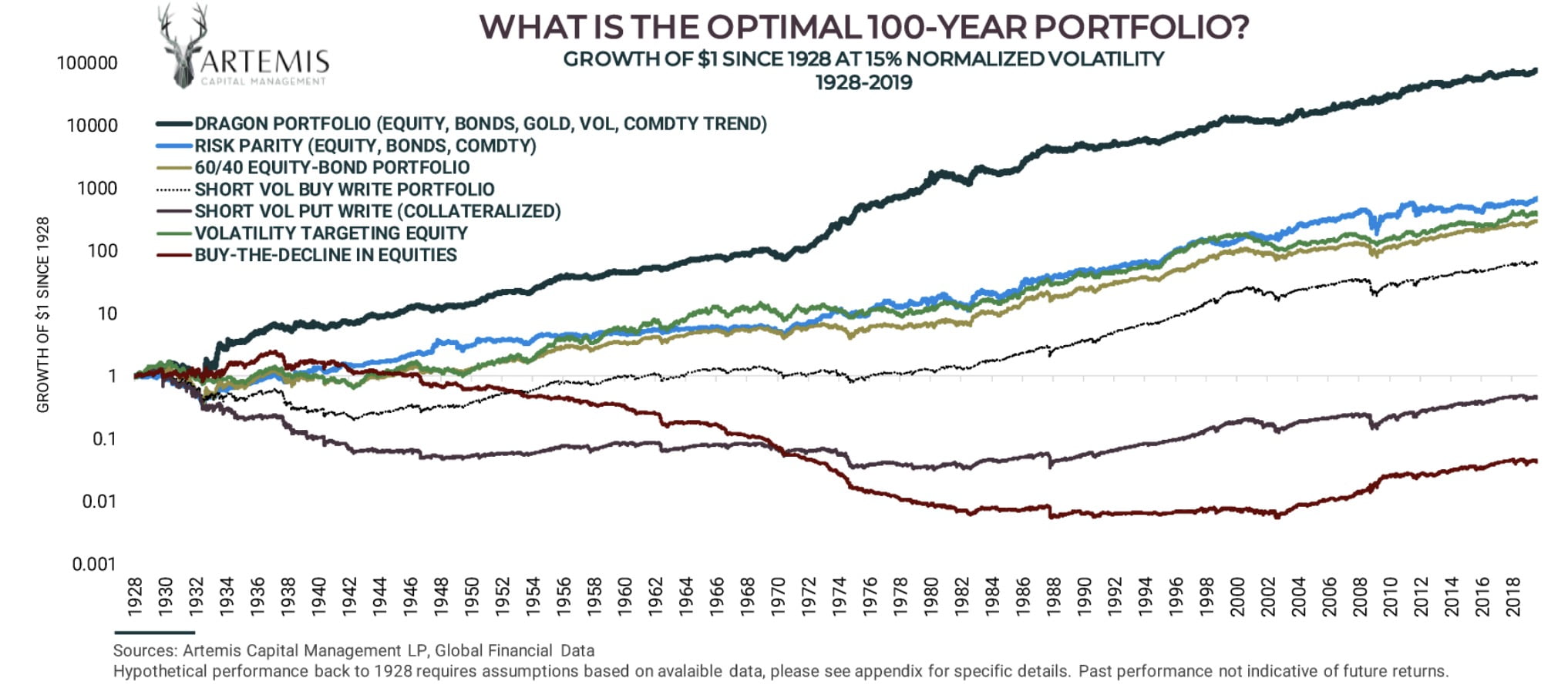

Performance Analysis of the Dragon Portfolio

The Dragon Portfolio, a paradigm of all-weather investment strategies, stands as a testament to sophisticated asset allocation and risk management. Its historical performance is not just a mere reflection of past successes but a tapestry woven through various economic cycles, presenting a compelling case for its efficacy. To contextualize the portfolio’s performance, one must delve into its historical data, examining how it has fared across different market epochs.

Comparative Analysis with Benchmark Indices and Traditional Portfolios

- Outperforming in Diverse Market Conditions: A critical aspect of the Dragon Portfolio’s performance is its ability to outpace traditional benchmarks, including the S&P 500 and other global indices. This outperformance is particularly pronounced during periods of market tumult and economic distress, where traditional portfolios, often heavily reliant on equities, tend to falter.

- Stability during Market Volatility: The portfolio’s allocation to long volatility and commodities, unique in its class, provides a strategic advantage in hedging against market downturns. This allocation has consistently mitigated losses during periods of heightened volatility, a feat rarely achieved by portfolios adhering to a conventional stock-bond dichotomy.

- Balanced Performance across Economic Cycles: The Dragon Portfolio’s diversified nature enables it to adapt and perform across various economic phases, be it inflationary periods, recessions, or growth phases. This balanced performance starkly contrasts with traditional portfolios, which may exhibit pronounced weaknesses in certain economic scenarios, such as high inflation or stagflation.

Analysis of Performance in Varied Market Conditions

- Bull Markets: In bullish markets, characterized by economic growth and rising stock prices, the equity component of the Dragon Portfolio captures substantial gains. However, its diversified nature may lead to a relatively moderated performance compared to pure equity portfolios, albeit with significantly lower volatility.

- Bear Markets and Recessions: During bear markets and recessions, the Dragon Portfolio’s allocation to long-term bonds, gold, and long volatility strategies come to the fore. These assets typically perform well in downturns, offering a counterbalance to the equity segment, and often result in the portfolio outperforming traditional equity-focused investments.

- Inflationary Periods: The inclusion of commodities and gold, assets that historically perform well during inflationary times, ensures that the Dragon Portfolio is well-positioned to withstand eroding purchasing power. This feature starkly contrasts with traditional portfolios, which may struggle in inflationary environments due to the adverse impact on equities and fixed-income instruments.

- Deflationary Environments: In deflationary periods, the portfolio’s bond allocation is particularly beneficial. Bonds tend to perform well as interest rates fall, providing a cushion against deflationary pressures that can adversely affect other asset classes.

Risks and Considerations of the Dragon Portfolio

The Dragon Portfolio, a paragon of diversified investment strategies, is not impervious to risks. Understanding these risks is essential for investors seeking a balanced and informed approach. While the portfolio is engineered to mitigate various market risks, certain inherent vulnerabilities and external economic factors could influence its performance.

Potential Risks Associated with the Dragon Portfolio

- Complexity and Execution Risk: The sophisticated nature of the Dragon Portfolio demands nuanced understanding and precise execution. Missteps in allocating assets, particularly in the more complex segments like long volatility strategies, can lead to suboptimal performance or heightened risk exposure.

- Liquidity Risk in Alternative Assets: Some components of the portfolio, especially those involving commodities or specific volatility strategies, may suffer from liquidity constraints. This risk becomes pronounced during market crises when liquidity is paramount.

- Correlation Risk: Although the portfolio is designed to minimize correlation between assets, unprecedented market events can lead to a temporary increase in correlation. This scenario could diminish the diversification benefits and expose the portfolio to amplified losses.

- Underperformance in Rapid Growth Markets: In rapidly ascending markets, especially those driven by a strong equity bull run, the Dragon Portfolio might lag behind pure equity portfolios. Its diversified nature, while beneficial for risk management, could temper its ability to fully capture the gains of a surging stock market.

Market Scenarios Where the Portfolio Might Underperform

- Extended Bull Markets: In prolonged bull markets, where equities consistently outperform other asset classes, the portfolio’s diversified approach may result in underperformance relative to equity-centric portfolios.

- Low Volatility Environments: The allocation to long volatility strategies, while advantageous during turbulent times, can be a drag on performance in stable, low-volatility market conditions.

- Sudden Shifts in Asset Class Correlations: Unforeseen events that lead to a temporary alignment in the behavior of typically uncorrelated assets can adversely impact the portfolio. This risk is particularly relevant in global crises where market movements tend to synchronize across asset classes.

Diversification and Risk Management Strategies

- Dynamic Asset Rebalancing: Regular rebalancing of the portfolio to align with the intended asset allocation is crucial. This practice helps in maintaining the desired risk profile and capitalizing on the rebalancing bonus.

- Continuous Monitoring of Correlations: Keeping a vigilant eye on the correlations between different assets allows for timely adjustments. This strategy is pivotal in maintaining the diversification benefits that are core to the portfolio’s resilience.

- Risk Parity Approach: Adhering to a risk parity approach, where the risk contribution of each asset class is balanced, enhances the portfolio’s stability. This method ensures that no single asset class disproportionately influences the portfolio’s risk profile.

- Utilizing Derivatives for Hedging: Implementing derivative strategies, such as options or futures, can be an effective way to hedge against specific risks. This tactic is particularly useful in managing exposure to volatile assets.

Robust Framework

While the Dragon Portfolio offers a robust framework for long-term investing, navigating its complexities and inherent risks is crucial. Investors must remain cognizant of the potential for underperformance in certain market scenarios and employ astute risk management strategies. Through careful planning and execution, the potential pitfalls can be mitigated, harnessing the portfolio’s full potential to achieve diversified, resilient growth.

Implementing the Dragon Portfolio

Embarking on the journey to construct a Dragon Portfolio requires meticulous planning and execution. This segment provides a detailed roadmap for investors seeking to replicate this sophisticated investment strategy.

Crafting the Blueprint: A Step-by-Step Guide to Building the Dragon Portfolio

- Assess Your Financial Goals and Risk Tolerance: Begin by evaluating your investment objectives, time horizon, and risk appetite. The Dragon Portfolio is designed for long-term growth with risk mitigation, making it suitable for investors with a balanced risk profile and a long-term perspective.

- Understand the Asset Allocation: Familiarize yourself with the core components of the Dragon Portfolio: equities, long-term bonds, gold, commodities, and long volatility strategies. Each of these asset classes plays a vital role in the portfolio’s overall performance and risk management.

- Determine the Allocation Percentages: Allocate your capital according to the prescribed percentages: 24% in equities, 18% in long-term bonds, 19% in gold, 18% in commodities (trend following), and 21% in long volatility strategies. This allocation should align with your risk tolerance and investment goals.

- Select the Individual Investments: Within each asset class, choose specific investments that align with the Dragon Portfolio’s philosophy. This could include a mix of index funds, ETFs, individual stocks, government bonds, commodity futures, and options for volatility strategies.

Leveraging Tools and Platforms for Portfolio Construction

- Online Brokerage Accounts: Utilize reputable online brokerage platforms that offer a wide range of investment options across different asset classes. These platforms should provide access to equities, bonds, ETFs, and derivatives needed to build the portfolio.

- Portfolio Management Software: Employ portfolio management tools that offer real-time analytics, asset allocation tracking, and performance metrics. These tools are invaluable for monitoring your portfolio’s adherence to the Dragon Portfolio structure.

- Financial Advisory Services: Consider consulting with a financial advisor, especially for guidance on implementing long volatility strategies, which can be complex and require specialized knowledge.

Tips for Portfolio Rebalancing and Maintenance

- Regular Rebalancing: Implement a disciplined rebalancing strategy to maintain the original asset allocation. This might involve quarterly or annual adjustments, depending on market movements and portfolio drift.

- Monitor Market Conditions: Stay informed about economic indicators and market trends. This awareness is crucial for making informed decisions about when to rebalance and how to adjust your portfolio in response to changing market dynamics.

- Diversification Within Asset Classes: Within each asset class, ensure diversification to spread risk further. For instance, within equities, diversify across different sectors and geographies.

- Manage Transaction Costs and Taxes: Be mindful of transaction costs and tax implications when rebalancing. Employ strategies such as tax-loss harvesting to optimize the tax efficiency of your portfolio.

Strategic Planning

Implementing the Dragon Portfolio is a journey that combines strategic planning with ongoing diligence. By understanding the portfolio’s framework, leveraging the right tools and platforms, and adhering to disciplined rebalancing and maintenance practices, investors can effectively replicate this sophisticated strategy. The Dragon Portfolio offers a holistic approach to investing, balancing risk and reward in pursuit of long-term financial growth and stability.

Conclusion: Reflections on the Dragon Portfolio’s Effectiveness

As we conclude our exploration of the Dragon Portfolio, it is imperative to encapsulate its distinctive qualities and assess its place in the investment landscape. This innovative strategy, a fusion of diversification, adaptability, and risk management, stands as a testament to its creator’s foresight in navigating the complexities of the financial markets. Its multidimensional approach, encompassing equities, long-term bonds, gold, commodities, and long volatility strategies, positions it as a vanguard of all-weather asset allocation.

Assessing Who Should Adopt the Dragon Portfolio

- Long-Term Investors Seeking Diversification: The Dragon Portfolio is particularly suited for investors with a long-term horizon who are seeking a balanced approach to wealth accumulation. Its diversified nature spreads risk across various asset classes, mitigating the impact of market downturns and economic cycles.

- Sophisticated Investors with Risk Management Focus: Investors who have a sophisticated understanding of the market dynamics and are focused on risk management would find the Dragon Portfolio aligns well with their strategy. Its inclusion of long volatility and commodities offers a level of downside protection rarely found in traditional portfolios.

- Those Seeking a Hedge Against Inflation and Market Volatility: For investors concerned about inflation and market volatility, the Dragon Portfolio offers a compelling solution. Its allocation to gold and commodities serves as an effective hedge against inflation, while its long volatility component provides a cushion during market upheavals.

Evaluating the Future Outlook for All-Weather Asset Allocation Strategies

- Increasing Relevance in a Volatile World: In an era marked by economic uncertainties and heightened market volatility, all-weather asset allocation strategies like the Dragon Portfolio are poised to gain more prominence. Their ability to withstand various market conditions makes them increasingly relevant for modern investors.

- Adaptation to Evolving Market Conditions: The future of all-weather strategies lies in their ability to adapt to the evolving financial landscape. This might involve integrating emerging asset classes, like digital assets, or employing more dynamic asset allocation models that respond in real-time to market changes.

- Broadening Accessibility for Retail Investors: As the investment world becomes more democratized, there is a growing opportunity to make sophisticated strategies like the Dragon Portfolio more accessible to retail investors. This could be achieved through simplified investment products that emulate the portfolio’s principles without requiring extensive financial expertise.

Long-Term Perspective

The Dragon Portfolio, in its essence, is a beacon for investors navigating the tumultuous seas of the financial markets. Its all-weather approach, grounded in deep diversification and strategic risk management, offers a comprehensive blueprint for enduring success. While it demands a sophisticated understanding and a long-term perspective, its principles are universally applicable, offering valuable lessons for investors of all calibers. As the financial landscape continues to evolve, the principles underpinning the Dragon Portfolio and similar all-weather strategies will remain pivotal in guiding investors towards prudent, resilient investment decisions.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.