Simplify seems to have an uncanny ability to create and release funds that hit the marketplace with high investor demand.

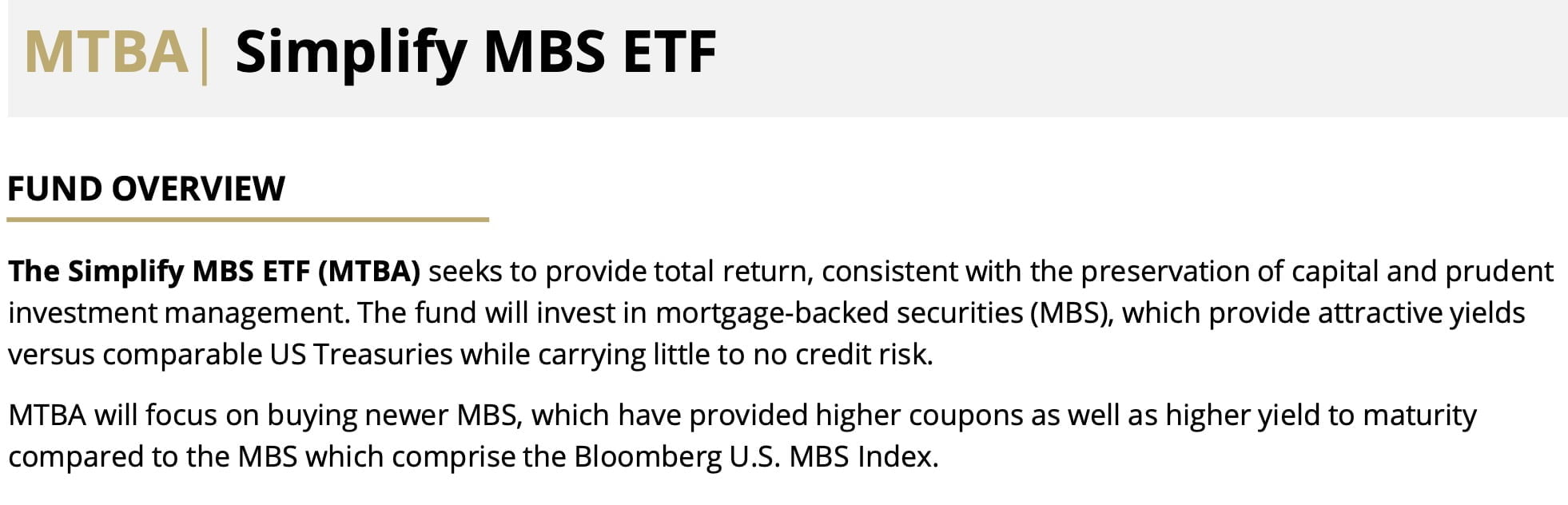

One of their latest offerings to accumulate impressive AUM is MTBA ETF (Simplify MBS ETF).

It distinguishes itself from the crowd by seeking exposure to newer, higher coupon MBS with a higher distribution yield and yield to maturity than a typical MBS index.

Hence, it attempts to earn higher yields than treasuries with minimal extra credit risk.

Let’s learn more about it!

Meet Eric McArdle – Managing Director, Advisor Solutions

Eric has over 10 years of investment research, asset management, and client servicing experience.

He is passionate about helping financial advisors, asset allocators, and individual investors solve and simplify complex investment problems.

Before joining Simplify at the firm’s inception in 2020, Eric was a research analyst at Nasdaq Dorsey Wright (NDW), a technical-analysis-focused investment firm in Richmond, Virginia.

While there, he specialized in client communications pertaining to market research, including authoring a daily column for advisor clients as well as hosting the firm’s weekly podcast and video discussions.

Eric also led workshops around the country for financial professionals seeking to understand and implement the NDW methodology and ETF models into their practices.

Prior to NDW, Eric served as one of two financial advisors for C&F Wealth Management’s Richmond-metro team, an LPL affiliate branch that managed and advised $450 million in assets under management.

Reviewing The Strategy Behind MTBA ETF (Simplify MBS ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of MTBA ETF?

For those who aren’t necessarily familiar with a “mortgage-backed securities (MBS)” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Mortgage-backed securities (MBS) are a type of asset-backed security that is secured by a collection or pool of mortgages. Most MBS issued today are agency-backed, which means that they are issued by government-sponsored entities such as Fannie Mae, Freddie Mac, and/or Ginnae Mae. This point is important as it denotes that agency MBS do not have credit risk.

Mortgages are a huge part of the fixed income market and are the second largest exposure in the Bloomberg Aggregate Bond Index behind U.S. Treasuries. They are highly liquid and typically offer higher yields than their maturity-equivalent counterparts, as a mortgage bond is effectively short an out of the money call option (whereas a borrowing homeowner is long the option and has the ability to refinance/prepay their loan).

source: Simplify Asset Management

Unique Features Of Simplify MBS Fund MTBA ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

MTBA offers investors access to newly-issued MBS that were issued during the Fed’s recent hiking cycle. These pools of bonds offer higher coupons (interest payments), lower duration (sensitivity to changes in interest rates), and typically higher yield to maturities than legacy, benchmark MBS exposures.

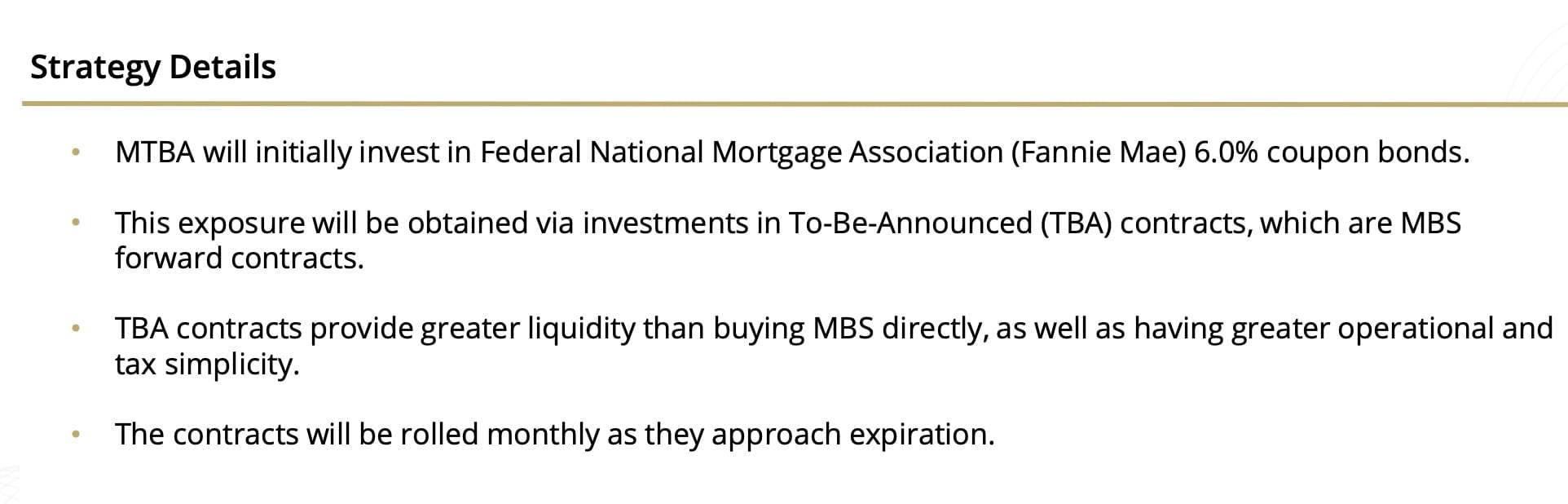

The strategy will typically buy pools of MBS that are trading just below par value ($100). Our exposure to MBS is obtained via TBA contracts, which are forward contracts on pools of mortgages. These contracts are incredibly liquid – in fact, more so than underlying individual mortgage bonds – and are rolled monthly to maintain exposure to the pool that meets our investment criteria.

The fund does not employ leverage and while it is technically listed as an active ETF, the typical selection process will focus on bonds issued just below par at say, $99, as mentioned before.

MTBA has a gross expense ratio of 0.25% with a net expense ratio of 0.15% after fee waivers.

What Sets MTBA ETF Apart From Other MBS Funds?

How does your fund set itself apart from other “MBS” funds being offered in the marketplace? What makes it unique?

Most MBS strategies, especially the large benchmark exposures that are offered to investors, tend to invest in bonds or pools of bonds that were issued before the Fed began hiking rates.

The Bloomberg US MBS Index is worth referencing here, as it has a weighted average coupon of 3.11, an average yield to maturity of 5.11%, and an effective duration of 5.75 as of 2/20/2024.

The Fannie 5.5% March TBA pool, of which MTBA owns and the portfolio exposure centers around at the moment, has a coupon of 5.5%, a yield to maturity of 5.74%, and a duration of 4.34 as of 2/20/2024.

Higher coupons, higher YTM, lower duration.

What Else Was Considered For MTBA ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

Harley Bassman (aka The Convexity Maven), who designed the product, wanted to give investors a simple way to access newly-issued MBS. In his words “I couldn’t believe that no one else had beat us to market with this.” (sic)

Some investors have asked why we didn’t employ leverage in the strategy. Our view is that the relative advantage to unlevered MBS was compelling enough as-is, especially given the large role that unlevered MBS can play in an investor’s fixed income allocation.

When Will MTBA ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

This strategy is made more attractive by the vast difference in characteristics between legacy MBS and newly-issued MBS. In fact, ~72% of the mortgage bonds that are held in the Bloomberg U.S. MBS Index were issued pre Fed hiking cycle. So backtesting a strategy like this is not really possible.

That said, using the data from Q3, all else equal, if rates were to stay the same, fall modestly, or go up, an investor would likely prefer to own the Fannie 5.5% pool (or MTBA). If rates were to fall sharply, investors would likely prefer to own the benchmark MBS index, as the higher duration would likely result in higher returns.

Why Should Investors Consider Simplify MBS Fund MTBA ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

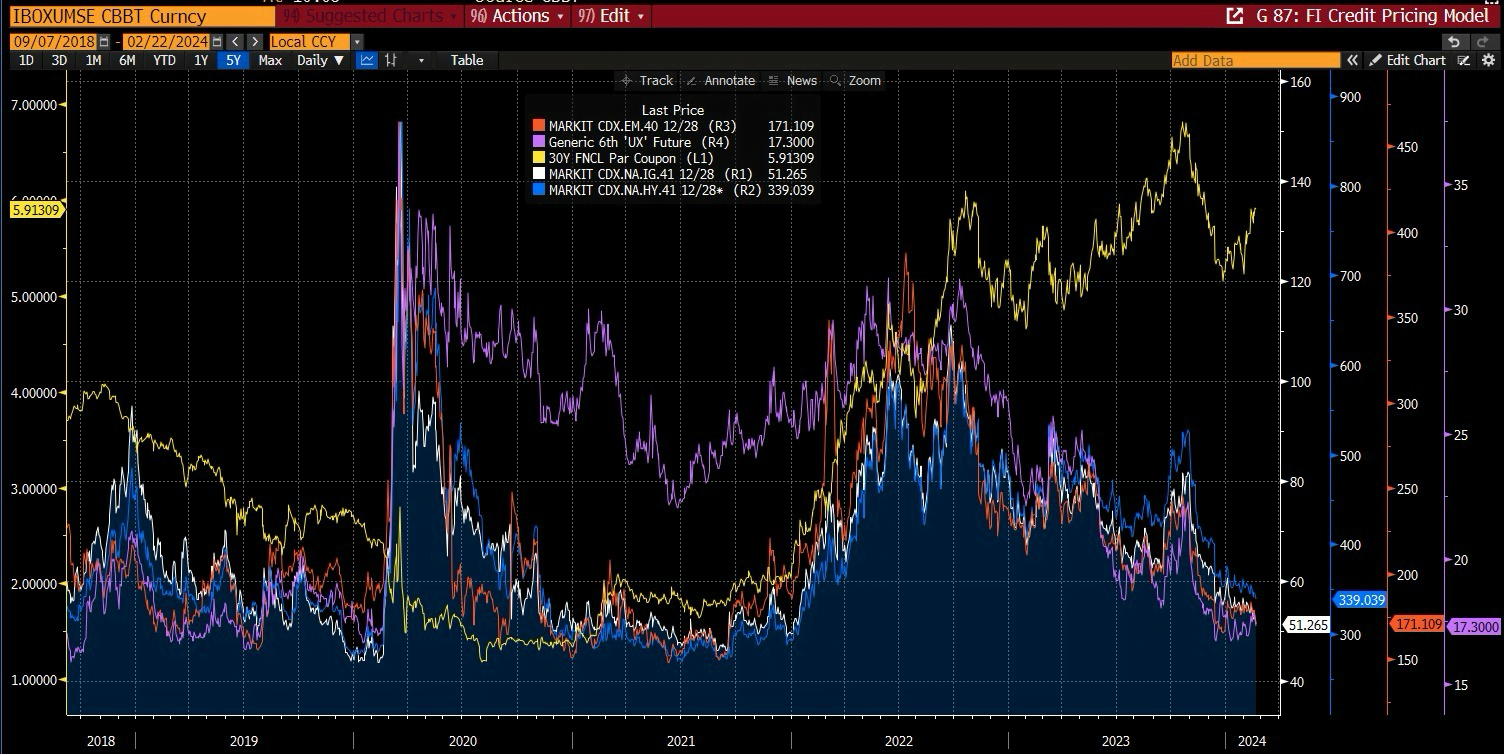

Investors seeking higher yield in fixed income typically have to take on added duration or credit risk. MBS, and particularly newly-issued MBS held within MTBA, offer investors a way to benefit from abnormally high MBS spreads to Treasuries in an environment where duration remains volatile and credit is priced richly.

MTBA’s low cost and relative advantages in most market environments vs. its benchmark makes for a compelling alternative to traditional MBS and/or a complement to duration and credit exposure.

How Does MTBA ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

MTBA is meant to be a core holding as a replacement for traditional MBS exposure, or as a complement to duration and credit exposures.

It can also be used as a satellite to overweight MBS from a core bond position if investors think that a wide MBS spread, as is currently the case, is worth seizing upon.

The Cons of MTBA ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Rates have come down somewhat aggressively since launching the fund in early November of 2023, which is the least ideal outcome for MTBA relative to its benchmark.

That said, the fund has sported positive absolute returns during the period and is narrowing the gap against the benchmark as rates have risen in recent weeks.

The Pros of MTBA ETF

On the other hand, what have others praised about your fund?

The idea is novel but incredibly simple.

Investors appreciate the yield differential opportunity relative to the benchmark and Treasuries, as well as the low duration and avoidance of credit exposure.

While the fund has grown to about $335M in 4 months, the liquidity is quite robust given the depth of the underlying holdings.

And the expense ratio is competitive!

Learn More About MTBA ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

You can learn more about MTBA from our fund website https://www.simplify.us/etfs/mtba-simplify-mbs-etf. We have also released a Deep Dive Video on the strategy, which is found on the top of the fund’s detail page.

We are always cooking up new products and research. If you have any questions or would like to speak with our team, please visit simplify.us and click the “Contact Us” button.

And for a deeper dive on MBS and all things fixed income, follow Harley Bassman’s work at convexitymaven.com.

Connect With Simplify ETFs & Eric McArdle

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Eric’s Twitter: @EMcArdleInvest

Fund Page: MTBA ETF

Nomadic Samuel Final Thoughts

I want to personally thank Eric McArdle for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.