I honestly couldn’t imagine my portfolio without a significant allocation towards a managed futures investment strategy.

That’s quite a bold statement coming from somebody who didn’t even know what “managed futures” were a couple of years ago.

Managed futures specifically have the adaptive capacity to go long/short a globally diverse range of asset classes providing a tremendous diversification benefit for traditional long-only portfolios.

They’re historically uncorrelated with both stocks and bonds.

As a strategy they typically provide “crisis alpha” in scenarios like 2022, 2008 and the early 2000s.

Furthermore, managed futures offer attractive long-term positive returns.

What’s not to like?

Honestly, that’s the conclusion I’ve come to recently.

However, we’re in for a real treat today on Picture Perfect Portfolios, as we have a chance to interview the folks over at Mount Lucas.

They have the expertise and experience of running managed futures investing strategies since the 1980s!

For this the “Strategy Behind The Fund” interview we’ll be shining the spotlight on KMLM ETF.

Better known as KFA Mount Lucas Managed Futures Index Strategy ETF.

It’s one of my personal favourite ETFs, so I’m thrilled to have the opportunity to learn more about the fund.

I hope you feel exactly the same way!

Let’s turn things over to the Mount Lucas team.

Meet Mount Lucas

As you know, Mount Lucas has been managing trend following strategies since its inception in 1986 and created the first passive alternative beta index, the MLM Index, in 1988.

We began replicating this Index in 1993, FedEx Pension Plan was our initial investor.

Review Of The Strategy Behind KMLM ETF (KFA Mount Lucas Managed Futures Index Strategy ETF) with Mount Lucas

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of KMLM ETF?

For those who aren’t necessarily familiar with “managed futures” investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Managed Futures is an alternative investment strategy where an asset manager invests in a portfolio of futures contracts using a combination of commodity, currency, fixed income, and equity futures.

There is a real economic premium that trend following captures, this is what makes trend following returns durable over time, and it is the nature of that premium that makes this strategy diversifying to traditional assets.

Futures markets were created over 150 years ago with the simple premise, to transfer price risk away from commercial interests to investors willing to own that price risk for a premium.

Returns to futures market investors are best during periodic bursts of price volatility, when hedgers desire to transfer price risk to investors.

Owning this risk premium is predominantly achieved by investors through trend following.

The MLM Index was created in 1988 as a benchmark for capturing the returns to investors who take on these price risks.

Many investors look at Managed Futures through a lens of absolute returns over economic cycles, uncorrelated to stock and bond markets.

This lens looks at the broader range of markets available in Managed Futures markets – currencies and commodities typically – and both the long side and short side of return distributions available such that one isn’t reliant on prices always going up to generate positive returns.

Either up or down is fine, as long as prices trend.

Choppy sideways is bad.

Other investors look for Managed Futures as ‘Crisis Risk Offset’ strategies that they expect to generate returns during equity market declines and recessions, somewhat akin to put options or highly rated government bonds.

This lens sees Managed Futures as capitalizing on flows that recessions and panics tend to coincide with – equity markets down, commodity markets down, flight to quality dynamics in currencies and fixed income.

Unique Features Of KFA Mount Lucas Managed Futures Index Strategy ETF KMLM

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The KFA Mount Lucas Managed Futures Index Strategy ETF (KMLM) seeks to replicate a passive index, the KFA MLM Index, which employs the same methodology as the MLM Index as published over time but is produced by a third party calculation agent for additional transparency.

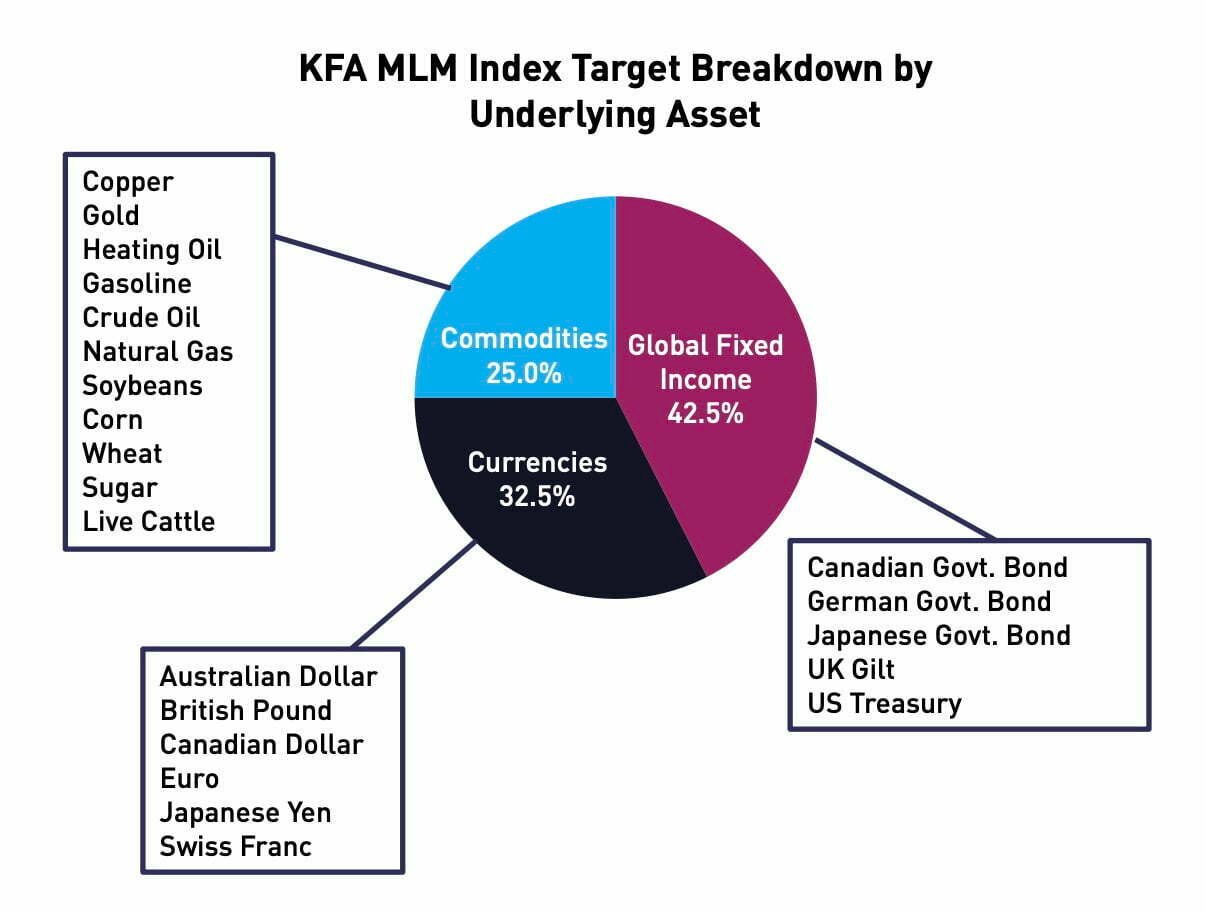

The KFA MLM Index consists of a portfolio of twenty-two liquid futures contracts traded on U.S. and foreign exchanges.

The Index consists of futures contracts on 11 commodities, 6 currencies and 5 global bond markets.

These three baskets are weighted by their relative historical volatility.

Within each basket, the constituent markets are equal dollar weighted.

The KFA MLM Index represents a pure trend beta approach to capturing the risk premium available to investors in the futures markets.

The markets and weightings are static and reviewed annually by the Index committee.

The strategy utilizes the leverage that is inherent in futures markets.

Total gross market exposure can range up to 300% for the portfolio depending on strength of the proprietary trend signals.

This leverage results in an expected annual standard deviation of 15% over time, slightly less than the S&P 500.

These target allocations are rebalanced monthly.

Implementation typically requires less than 15% of invested assets to be deposited with the futures broker, earning interest.

The remaining funds are held in short term US government securities.

The strategy does not involve any discretionary inputs.

The net expense ratio of KMLM is 0.92%.

What Sets KMLM ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other alternative funds being offered in what is already a crowded marketplace?

What makes it unique?

The key differences between the KFA MLM Index and other Managed Futures funds are:

Passive:

The KFA MLM Index represents a pure trend beta approach to capturing the risk premium available to investors in the futures markets.

Volatility Adjusting:

Typical Managed Futures managers use a vol targeting approach, both at the portfolio level and the individual market level.

Basically, increasing market exposure when volatility is low and reducing exposure when volatility is high.

This approach creates a better Sharpe ratio, but the cost is giving up the far right tail (positive skew) in periods of market stress.

Yet, as a diversifying element in an investor portfolio, it is just that far right tail that provides the most benefit to the client when it is needed most.

The KFA MLM Index approach is to use constant allocations to each sector, and equal weight the markets under each sector.

The overall volatility of the Index is expected over a market cycle, not targeted daily, and allows market volatility to run.

This gives the investor full access to the right tail events, as positions aren’t cut in the face of volatility.

Ultimately, we believe this to be more beneficial to the end client portfolio and prioritizes their diversification needs and their Sharpe ratio.

Why no equities:

Given most investors use Managed Futures as a diversifying element to their equity and credit led investment portfolio, why add more equity?

In a portfolio context, you count on the trend following diversification to provide a return in times of instability when the rest of the portfolio is getting hurt.

Adding more of what you are trying to diversify away from muddies the water.

The real juice comes from capturing the flows on the other side, as instability drives commercial prices in currency, fixed income and commodity markets in times of stress.

Additionally, the combination of equity trend following and volatility adjusting positions creates an equity bull bias in the managed futures portfolio.

As equities go up, their volatility drops and managers then increase exposure.

What Else Was Considered For KMLM ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We have received a lot of a questions about whether the index would include cryptocurrency futures.

The crypto futures markets need to mature more before they can be added.

Investors can earn a premium in the futures markets when commercial entities face real price risks that they need to transfer to investors.

Presently, cryptocurrencies need to be more heavily used by companies and commercial entities so that they feel compelled to hedge their exposure to the price of bitcoin as they would heating oil or other traditional commodities.

If crypto becomes a more integral part of the economy with more widespread business applications, it could be eligible for inclusion in the KFA MLM Index.

When Will KMLM ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

Trend following requires patience and an understanding of the market environment.

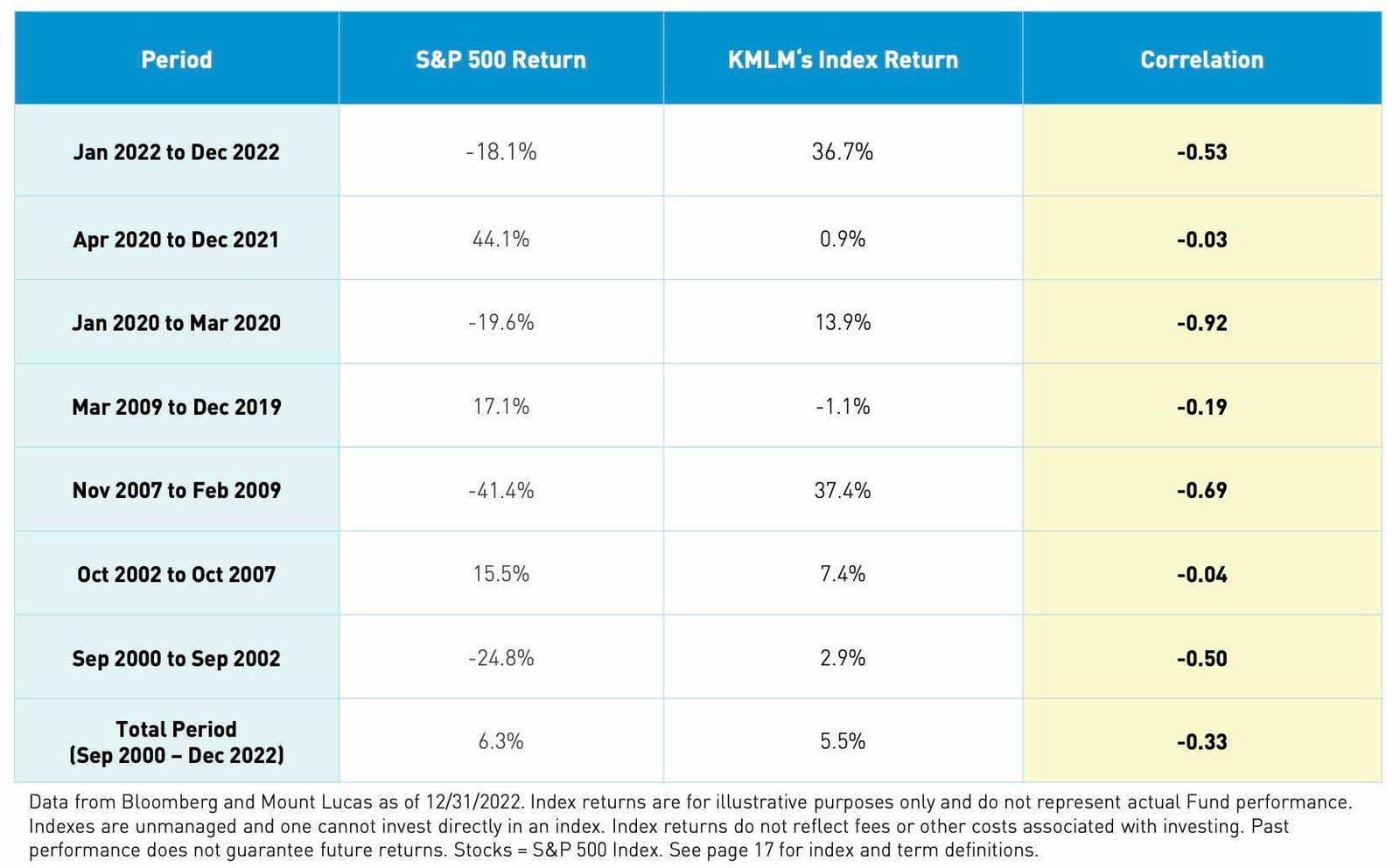

There are environments where it thrives (uncertainty, volatility, tail-events), and there are environments where it lags (certainty, low-volatility, range bound).

Many “active” trend following managers spend a lot of time optimizing their models to squeeze basis points out of this latter environment.

These methodologies ultimately come at a cost, and that cost is lower participation in the good trend following environments.

We view this as trying to source outsized returns from an environment where there are inherently low returns to the underlying risk premia.

The KFA MLM Index is designed to capture the “wind behind the sails”, or the economic premium in the futures markets.

That premium is paid in the tail events.

As a passive investment, the strategy maintains 100% exposure to both the low performing range-bound periods and to the high performing tail periods.

This is important – trend following is used as a tool in investment portfolios to provide diversification in crisis events, where full exposure to trend is demanded.

Why Should Investors Consider KFA Mount Lucas Managed Futures Index Strategy ETF KMLM?

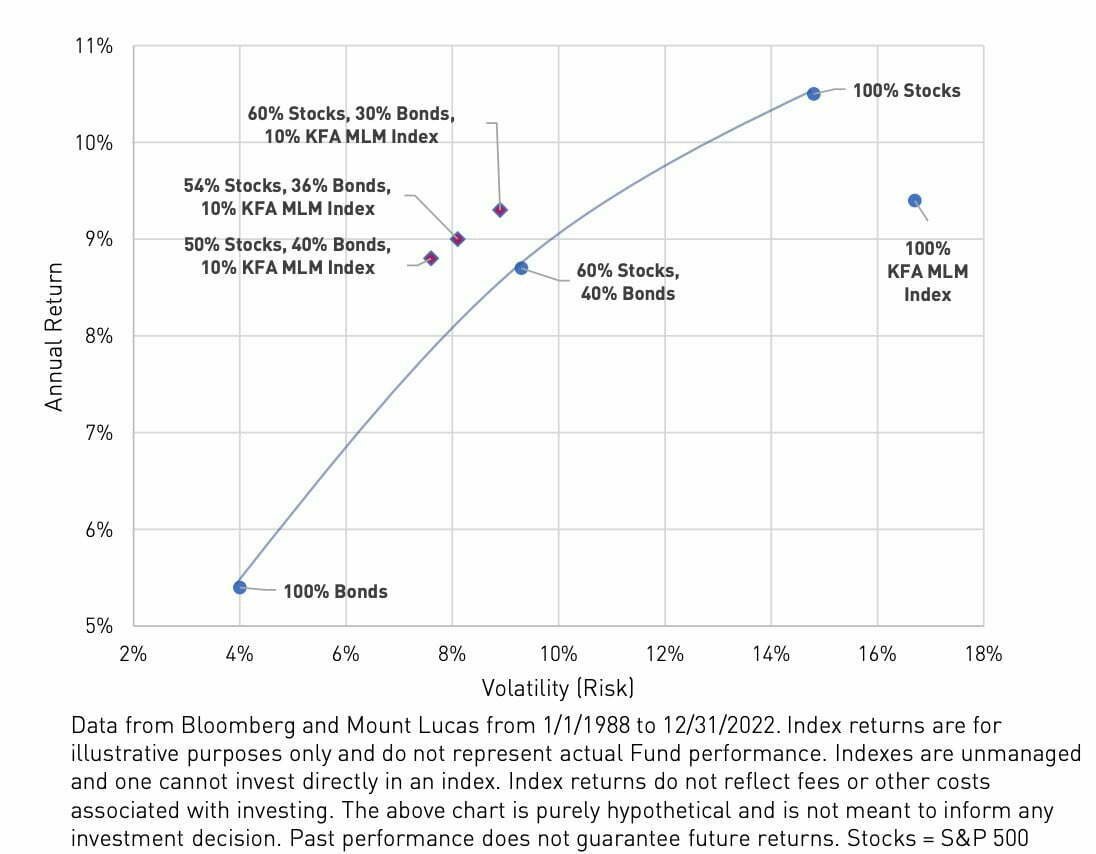

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Decades of complacency have left portfolios underexposed to investments that have historically done well in times of price uncertainty and volatility, and ill-equipped to handle the current market environment.

This makes perfect sense given the way monetary policy has operated over the last twenty-five years, counter cyclical policy is very effective in periods of low and stable inflation.

When equity markets start to become concerned about recessions ahead, earnings expectations reduce and valuation multiples contract.

Stock prices fall.

Bond markets typically would then anticipate the increased chance of the standard monetary policy response; cutting interest rates to spur economic growth.

Bond prices rise.

The dual mandate was really a single mandate on unemployment, as the inflation side of the mandate was not biting.

On the other hand, periods of higher inflation have historically resulted in positive correlation between stocks and bonds.

During periods of higher inflation, you tend to see rising interest rates, knocking bond prices down and putting pressure on equity multiples.

It is much harder for monetary policy to operate in higher inflation environments to combat slowdowns, as the option of cutting interest rates is less easy.

The two sides of the dual mandate are in conflict.

Sounds a bit like 2022.

While the long side of the return distribution has dominated since 1998, a return to higher inflation expectations, as seen from 1970 to 1998, requires the investor to consider the other side of the distribution when considering diversifying strategies.

Managed Futures strategies have more tools available given they can take both long and short positions.

If bonds trend downwards, short positions can capture it and produce returns to diversify stocks.

They also provide access to other asset classes, from both the long and the short side, in commodities and currencies.

In 2022, access to additional return distributions were strong contributors to the positive Managed Futures returns that diversified equity and credit markets.

It stands to reason why – in times of rising inflation and rising interest rates, getting direct exposure to commodity prices and currency moves gets directly to the issues facing equity investors.

In 2022, short bonds, long commodities, long the USD was right.

In 2008, long bonds, short commodities, long the USD was right.

The combination of this adaptability and broader toolset is what makes Managed Futures so compelling as a diversifying strategy to us.

Why rely on just bonds going up to diversify, when so many other things, both long and short can also fulfil the role.

How Does KMLM ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

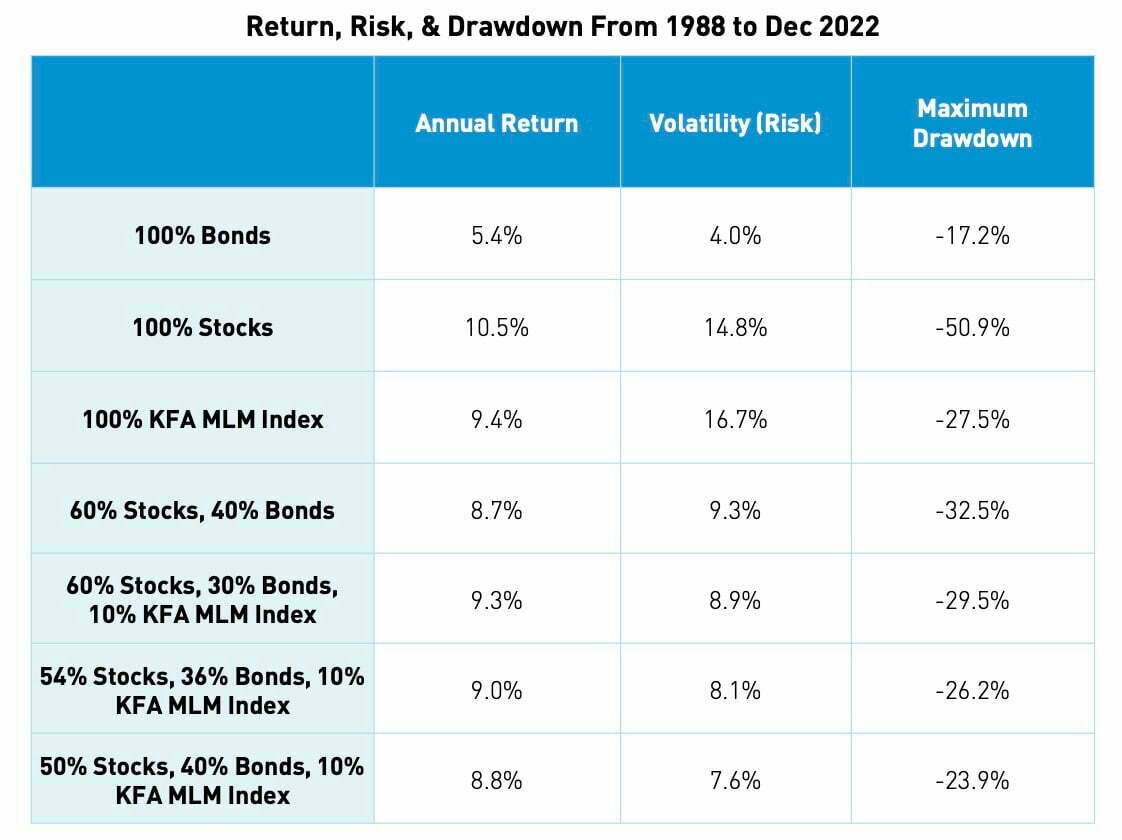

KMLM is not meant to be a total portfolio solution, but we do consider it a core holding and an inexpensive passive option for a permanent strategic allocation to managed futures.

Best usage scenarios should really be made at the individual level but in broad terms an allocation sized to diversify meaningfully in an equity drawdown is important.

The end goal for the client is the ability to hold their asset allocation in the worst bear markets.

Then, rebalance regularly and during those times of stress.

The Cons of KMLM ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

In 2022, the fund trailed the performance of the underlying index primarily due to the performance on excess cash.

The fund invested excess cash in a short term treasury ETF while the index assumes a 30 day T-Bill.

Normally, the short term treasury ETF would have a better yield with average duration of about 2 years, but in 2022 that duration was detrimental as bond prices fell.

In Q4 of last year, the fund sold the short term treasury ETF and invested in a laddered T-Bill portfolio to better track the underlying index going forward.

The Pros of KMLM ETF

On the other hand, what have others praised about your fund?

The primary selling points of the fund are: passive, pure trend, maximum positive skew in stress periods, and no equities to muddy investor’s existing asset allocations.

Additionally investors are able to analyze extensive historical data form KMLM’s benchmark, the MLM Index, to make determination of suitability for an investment portfolio.

For More Managed Futures Research Check Out The Mount Lucas Blog

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

Thank you for your time. This was a pretty thorough overview with great questions.

We are constantly researching various topics related to managed futures and macro themes, a great place to keep up with us and access our historical research on managed futures would be at blog.mtlucas.com.

Connect With Mount Lucas

Investors can connect with the folks over at Mount Lucas on the following platforms:

Blog: https://blog.mtlucas.com

Website: https://www.mtlucas.com

Twitter: @MountLucasMgmt

Nomadic Samuel Final Thoughts

I want to personally thank Mount Lucas for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Is KMLM suitable to hold in a taxable account? I can find little to no information on tax efficiency.