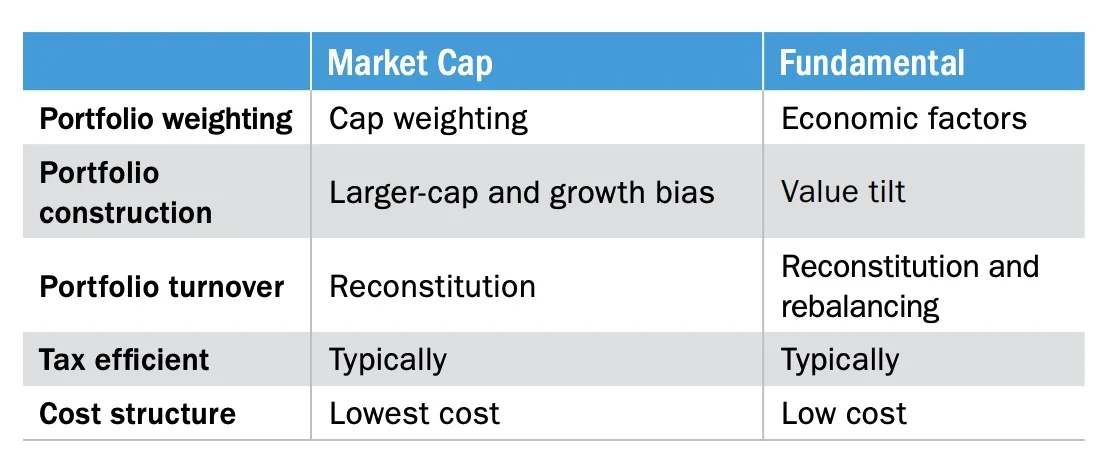

A fundamental index is a type of stock market index that is based on fundamental financial data of the underlying companies, such as their sales, earnings, dividends, book value, and cash flow. Unlike traditional market capitalization-weighted indices, which assign weights to individual stocks based on their market capitalization (i.e., the total value of their outstanding shares), fundamental indices use other factors to weight the stocks.

The idea behind a fundamental index is that it is designed to capture the true economic value of the underlying companies, rather than simply reflecting the prices at which their shares are trading. By using fundamental factors to weight the stocks, the index aims to provide a more accurate representation of the underlying companies’ financial health and prospects.

Fundamental indices are often used as a benchmark or investment strategy by investors who believe that the market capitalization-weighted indices may be subject to certain biases, such as overweighting overvalued stocks or underweighting undervalued stocks.

Fundamental Indexing: A Brief History Of The Investing Strategy

The idea of fundamental indexing emerged in the early 2000s as a response to perceived weaknesses in traditional market capitalization-weighted indices. Critics of these indices argued that they overweighted overvalued stocks and underweighted undervalued stocks, leading to suboptimal performance and increased risk for investors.

To address these issues, researchers began exploring alternative ways to construct indices that would better capture the true economic value of the underlying companies. One of the earliest attempts to create a fundamental index was made by Robert D. Arnott and his colleagues at Research Affiliates in 2002. They proposed the concept of “fundamental weighting,” which used factors such as sales, earnings, and book value to weight stocks in an index, rather than their market capitalization.

The idea gained traction, and other researchers and index providers began developing their own versions of fundamental indices. In 2005, Standard & Poor’s launched the S&P 500 Equal Weight Index, which weighted each stock in the index equally, rather than by market capitalization. In 2006, Research Affiliates partnered with FTSE to launch the FTSE RAFI Index Series, which used fundamental factors to weight the stocks in the index.

Since then, many other index providers have launched their own fundamental indices, and the approach has gained popularity among investors who are looking for an alternative to traditional market capitalization-weighted indices.

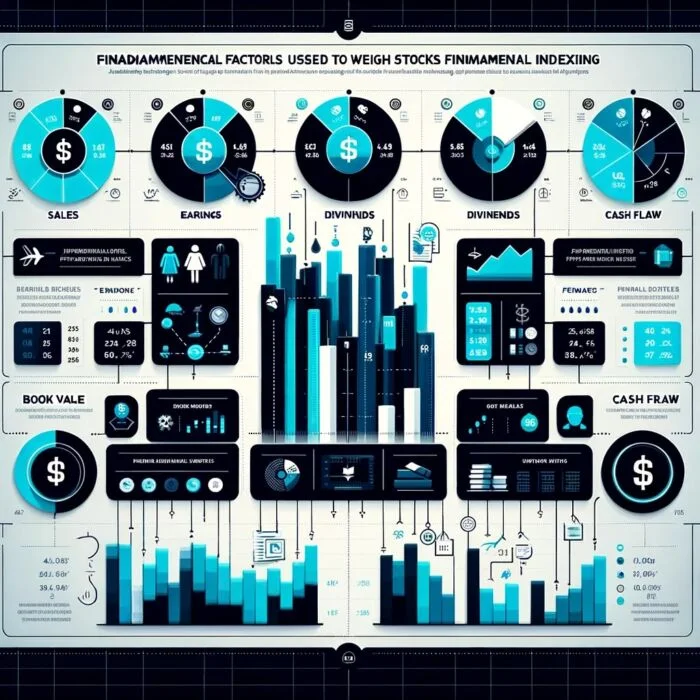

Fundamental Index Factors To Weight Stocks

Fundamental indices use a range of fundamental factors to weight the stocks in an index. Some of the most commonly used factors include:

- Sales: This factor measures the total revenue generated by a company. Companies with higher sales are given a higher weighting in the index.

- Earnings: This factor measures a company’s profitability. Companies with higher earnings are given a higher weighting in the index.

- Dividends: This factor measures the amount of money a company pays out to shareholders in the form of dividends. Companies with higher dividend yields are given a higher weighting in the index.

- Book value: This factor measures the value of a company’s assets, minus its liabilities. Companies with higher book values are given a higher weighting in the index.

- Cash flow: This factor measures the amount of cash a company generates from its operations. Companies with higher cash flows are given a higher weighting in the index.

The specific factors used to weight the stocks in a fundamental index may vary depending on the index provider and the specific index being constructed. For example, the FTSE RAFI Index Series uses four factors to weight the stocks in its indices: book value, cash flow, sales, and dividends.

Once the factors have been selected, they are combined to determine the overall weighting of each stock in the index. This is typically done using a formula that assigns a score to each stock based on its performance on each of the selected factors. The stocks are then ranked based on their scores, and the top-ranked stocks are given the highest weightings in the index.

For example, consider the construction of a hypothetical fundamental index, which uses the four factors mentioned above to weight the stocks in the index. The formula used to calculate the overall weighting of each stock in the index is:

Weight = (Book Value x 0.3) + (Cash Flow x 0.3) + (Sales x 0.3) + (Dividends x 0.1)

Using this formula, a higher weighting would be assigned to a stock that had a high book value, cash flow, and sales, and a relatively high dividend yield.

source: ETF_com on YouTube

Bizarre Real Life Applications Of Fundamental Indexing

Here are a few wacky examples of how fundamental indices work in real life:

- The “Burger Index”: Imagine you are trying to create a fundamental index of fast-food chains. You might use factors such as total sales, number of restaurants, and the quality of the food to weight the stocks. However, one additional factor you could use is the “Burger Index,” which measures how many burgers a chain sells each year. After all, if people are buying lots of burgers, it’s a sign that the chain is doing something right (or wrong, depending on your perspective!).

- The “Athlete’s Foot Index”: Let’s say you’re creating a fundamental index of athletic footwear companies. In addition to factors such as sales, earnings, and cash flow, you might include a factor called the “Athlete’s Foot Index,” which measures how many athletes are wearing the company’s shoes. This could be a good indication of the quality and popularity of the company’s products.

- The “Lipstick Index”: This is a real-life example of a fundamental index that has been used by some economists. The “Lipstick Index” measures the sales of cosmetics during times of economic hardship. The idea is that during tough times, people are less likely to spend money on big-ticket items, but they may still indulge in small luxuries such as lipstick. So, if you were creating a fundamental index of cosmetics companies, you might use the Lipstick Index as one of your factors.

While these examples are a bit tongue-in-cheek, they illustrate the idea that fundamental indices can be constructed using a wide range of factors, depending on the industry and the specific stocks being included. By using these factors to weight the stocks, fundamental indices aim to provide a more accurate picture of the underlying companies’ economic value, rather than simply reflecting the market’s current pricing of their shares.

Pros Of Fundamental Indexing: Major Advantages

There are several advantages of fundamental indexing over traditional market capitalization-weighted indices. Here are a few of the key advantages:

- Less reliance on market sentiment: Market capitalization-weighted indices are heavily influenced by the market’s current pricing of a company’s shares. This means that stocks that are popular or in favor with investors at a given time will be given a higher weighting in the index, regardless of their underlying economic value. In contrast, fundamental indices are constructed using a range of fundamental factors that are more closely tied to the underlying economic value of a company. This can provide a more accurate picture of the company’s long-term prospects and reduce the impact of short-term market sentiment.

- Diversification: Fundamental indices are typically constructed using a broad range of stocks from a given market or industry. This can help to reduce risk and increase diversification, as investors are not overly reliant on a few individual stocks.

- Potential for higher returns: Some studies have suggested that fundamental indices can outperform market capitalization-weighted indices over the long term. This is because fundamental indices are constructed using factors that are more closely tied to a company’s economic value and long-term prospects. Additionally, by reducing reliance on short-term market sentiment, fundamental indices may be less prone to market bubbles or crashes.

- Transparency: The construction of fundamental indices is typically more transparent than market capitalization-weighted indices. This is because the factors used to weight the stocks in the index are clearly defined and publicly available, making it easier for investors to understand how the index is constructed and how it is likely to perform over time.

Hence, fundamental indexing offers a number of potential advantages over traditional market capitalization-weighted indices. While it is not a guaranteed path to success, it is a valuable tool for investors seeking to reduce risk, increase diversification, and potentially achieve higher long-term returns.

source: Stansberry Research on YouTube

Cons Of Fundamental Indexing: Key Criticisms

While fundamental indexing has gained popularity in recent years, it is not without its criticisms. Here are a few of the key criticisms:

- Higher costs: Constructing a fundamental index requires more analysis and research than a market capitalization-weighted index. This can lead to higher costs, both in terms of time and resources. Additionally, some fundamental indices may require more frequent rebalancing, which can lead to higher trading costs.

- Potential for subjectivity: The factors used to weight stocks in a fundamental index are not always clear-cut. Different investors may use different factors or weight them differently, which can lead to differences in performance. Additionally, some fundamental factors may be more subjective than others. For example, how do you measure the “quality” of a company’s management team?

- Backtesting bias: Many fundamental indices have been constructed using backtesting, which involves testing the index’s performance against historical data. However, this can lead to a bias towards factors that have performed well in the past, rather than factors that are likely to perform well in the future. Additionally, changes in market conditions or economic factors may make historical data less relevant.

- Limited availability: While some fundamental indices are widely available, others may be less accessible to individual investors. This can limit the potential benefits of using fundamental indexing for some investors.

While fundamental indexing has its benefits, it is important to consider the potential drawbacks as well. Investors should carefully weigh the costs and benefits of using a fundamental index and consider whether it is appropriate for their investment goals and risk tolerance.

source: Wealth Revealed on YouTube

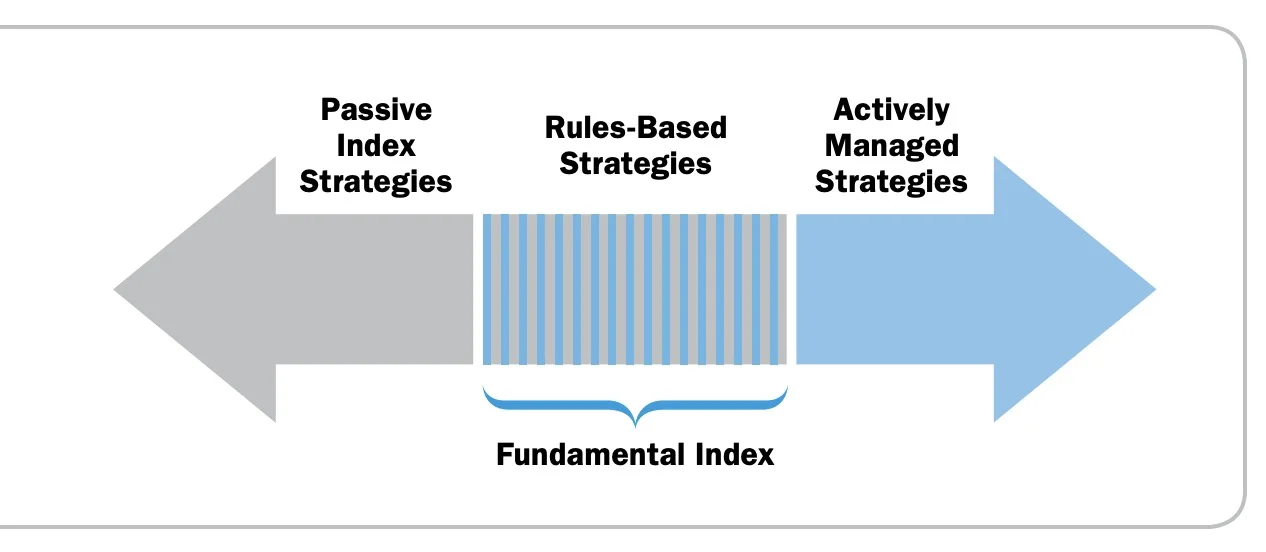

Alternative Indexing Strategies

When it comes to investing, there is no one-size-fits-all approach. While fundamental indexing has gained popularity in recent years, it is not the only indexing strategy available to investors. In this context, it’s worth exploring some of the alternatives to fundamental indexing that investors can consider.

- Market Capitalization-weighted Indexing: This is the traditional approach to indexing, where the weight of each stock in the index is determined by its market capitalization. This means that the largest companies in the index have the highest weighting, regardless of their fundamental factors. This approach is widely used and is often the benchmark against which other indexing strategies are measured.

Market capitalization-weighted indexing is a popular approach because it is simple and easy to understand. It can provide a diversified exposure to the overall market, and the weightings naturally adjust over time as the market cap of individual stocks changes. However, it can also result in a concentration of the index in a few large companies, which may not always be desirable.

- Equal Weighting: In an equal-weighted index, each stock in the index is given the same weight, regardless of its market capitalization or other fundamental factors. This can lead to greater diversification and reduce the impact of a few individual stocks on the overall performance of the index.

Equal-weighted indexing can provide a more balanced exposure to the overall market, and it can help mitigate the risk of being overly concentrated in a few large companies. However, it may also result in a higher turnover and transaction costs, as the index needs to be rebalanced frequently to maintain the equal-weighted allocation.

- Factor-based Indexing: Factor-based indexing involves constructing an index using a range of specific factors, such as value, momentum, or quality. The weight of each stock in the index is determined by its exposure to these factors, rather than its market capitalization or other fundamental factors. This approach can provide a more targeted exposure to specific market factors and may be more suitable for investors with specific investment goals.

Factor-based indexing can provide a more nuanced exposure to the overall market by focusing on specific factors that are expected to drive returns. For example, a value-based index may overweight stocks that are considered undervalued, while a momentum-based index may overweight stocks that are exhibiting strong price momentum. However, factor-based indexes can also be more complex to understand and implement, and they may require more frequent rebalancing to maintain the targeted factor exposure.

- Smart Beta: Smart Beta is a catch-all term for a range of indexing strategies that seek to capture specific market factors or achieve specific investment goals. Smart Beta strategies can include elements of fundamental indexing, factor-based indexing, and other approaches. These strategies often use quantitative models or algorithms to construct the index and can provide a more targeted approach to investing.

Smart Beta strategies can provide a more tailored approach to investing by focusing on specific market factors or investment goals. For example, a smart beta strategy may overweight stocks with strong environmental, social, and governance (ESG) ratings, or it may focus on stocks with high dividends. However, smart beta strategies can also be more complex to understand and implement, and they may have higher costs than traditional indexing approaches.

In summary, there are several alternatives to fundamental indexing that investors can consider. Each indexing approach has its own strengths and weaknesses, and the choice will depend on the investor’s investment goals and risk tolerance. By understanding the different options available, investors can select the approach that is best suited to their needs and preferences.

source: VettaFi on YouTube

Popular Fundamental Index ETFs

There are several exchange-traded funds (ETFs) that track fundamental indexes, and they have gained popularity in recent years as investors seek alternative ways to invest in the stock market. Here are some of the most popular fundamental index ETFs:

- Invesco FTSE RAFI US 1000 ETF (PRF): This ETF tracks the FTSE RAFI US 1000 Index, which is a fundamental index that selects the largest 1,000 US stocks based on four fundamental factors: book value, cash flow, sales, and dividends. The index then weights the stocks based on their fundamental scores, rather than their market capitalization.

- Invesco FTSE RAFI Developed Markets ex-U.S. ETF (PXF): This ETF tracks the FTSE RAFI Developed ex-US Index, which is a fundamental index that selects the largest stocks in developed markets outside the US based on four fundamental factors: book value, cash flow, sales, and dividends. The index then weights the stocks based on their fundamental scores, rather than their market capitalization.

- WisdomTree U.S. LargeCap Dividend Fund (DLN): This ETF tracks the WisdomTree US LargeCap Dividend Index, which is a fundamental index that selects the largest 300 US stocks with the highest dividend yields. The index then weights the stocks based on their dividend yield, rather than their market capitalization.

- Oppenheimer Russell 1000 Dynamic Multifactor ETF (OMFL): This ETF tracks the Russell 1000 Dynamic Multifactor Index, which is a fundamental index that selects the largest 1,000 US stocks based on five fundamental factors: value, momentum, quality, low volatility, and size. The index then weights the stocks based on their fundamental scores, rather than their market capitalization.

- Schwab Fundamental U.S. Broad Market Index ETF (FNDB): This ETF tracks the Russell RAFI US Broad Market Index, which is a fundamental index that selects US stocks based on four fundamental factors: book value, cash flow, sales, and dividends. The index then weights the stocks based on their fundamental scores, rather than their market capitalization.

These ETFs provide investors with exposure to different fundamental indexing strategies, and they can be a useful way to diversify their portfolios and potentially achieve better risk-adjusted returns. However, investors should always conduct their own research and carefully consider the risks and potential benefits of any investment before making a decision.

source: etf_com on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

Common Applications Of Fundamental Indexing

Fundamental indexing can be applied in various investment strategies and has several applications in the financial industry. Here are some of the most common applications of fundamental indexing:

- Diversification: Fundamental indexing can provide diversification benefits to investors by investing in a broader range of stocks compared to traditional market capitalization-weighted indices. By selecting stocks based on fundamental factors such as sales, cash flow, and dividends, fundamental index ETFs can provide exposure to different sectors and industries that may not be adequately represented in market capitalization-weighted indices.

- Value Investing: Fundamental indexing can be used as a value investing strategy, where investors seek undervalued companies with strong fundamentals. By selecting stocks based on fundamental factors such as book value, earnings, and dividends, fundamental index ETFs can identify companies with attractive valuations and high potential for future growth.

- Income Generation: Some fundamental index ETFs focus on selecting stocks with high dividend yields, providing investors with a steady stream of income. This strategy is particularly attractive to investors looking for regular income, such as retirees.

- Risk Management: Fundamental indexing can be used as a risk management strategy, where investors seek to minimize the impact of market downturns on their portfolio. By selecting stocks based on fundamental factors such as low volatility, fundamental index ETFs can provide a more stable investment compared to traditional market capitalization-weighted indices.

- Sector Rotation: Fundamental indexing can be used for sector rotation strategies, where investors seek to take advantage of market trends by rotating their investments among different sectors. By selecting stocks based on fundamental factors such as sales growth and earnings, fundamental index ETFs can identify sectors with high potential for future growth and rotate investments accordingly.

Fundamental indexing provides investors with a versatile tool that can be used in various investment strategies, providing exposure to different sectors and industries and potentially generating better risk-adjusted returns.

source: Research Affiliates on YouTube

Fundamental Indexing Final Thoughts

In summary, fundamental indexing is a popular investment strategy that uses fundamental factors such as earnings, dividends, cash flow, and book value to select and weight stocks in an index. This approach differs from traditional market capitalization-weighted indices, which weight stocks based on their market value.

Fundamental indexing has several advantages, including diversification, value investing, income generation, risk management, and sector rotation. By providing exposure to different sectors and industries, fundamental index ETFs can potentially generate better risk-adjusted returns and provide a more stable investment compared to traditional market capitalization-weighted indices.

However, fundamental indexing also has some criticisms, including the potential for higher transaction costs and tracking error, and the possibility that the fundamental factors used in the selection and weighting process may not always predict future stock performance.

Overall, fundamental indexing can be a useful tool for investors looking to diversify their portfolios and potentially achieve better risk-adjusted returns. As with any investment strategy, investors should conduct their own research, carefully consider the risks and potential benefits, and consult with a financial advisor before making investment decisions.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.