When it comes to the question of how do I invest my own money, I’ve shifted in the past year from being a 100% equity factor based investor to building a diversified DIY Portfolio keying in on a myriad of quantitative investing strategies spread out over numerous asset classes.

Why change from a stocks for the long run strategy?

Aren’t stocks the best game in town?

If you can handle the expected volatility and drawdowns of markets, with a long enough time horizon, doesn’t it make sense to be 100% in equities and then dial things down closer to retirement?

I thought so.

However, I no longer believe this is the best way to invest at any given stage of the life cycle of an investor.

Why?

Because diversification is your only free lunch in investing.

How Do I Invest My Money As A DIY Investor?

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Nomadic Samuel’s Diversified DIY Quantitative Portfolio

Diversification Is Your Only Free Lunch

When you combine uncorrelated (or lowly correlated and negatively correlated) asset classes and strategies with a modest amount of leverage you can outperform equity only mandates, manage risk and reduce sequence of returns risk.

Does this all sound too good to be true?

It did to me for a while.

But over the past year, I’ve been obsessed with studying portfolios such as the Ray Dalio All Weather Portfolio, the Harry Browne Permanent Portfolio and the Risk Parity Portfolio along with modern interpretations such as the Adaptive Asset Allocation, the Dragon Portfolio and the Cockroach Portfolio to see how these portfolios perform under all economic regimes and whether or not they can handle modest leverage to boost returns.

I even created a battle of the leveraged portfolios series of blog posts, using 10 different model portfolios, dating back to returns from 1978 to test how, when and why portfolios fall apart under certain economic conditions.

Rejection of a 100% Equity Portfolio

How about 100% stock only portfolios?

They do fantastic long-term but a portfolio featuring a 100% US Total Stock Market faced a sequence of returns risk of being underwater for an entire decade!

10 years of absolute pain!

And what about the Ray Dalio All Weather Portfolio, Harry Browne Permanent Portfolio and Risk Parity Portfolio?

The negative year roll period was only 1 year for each and every one of those portfolios.

In other words, with over 45 years worth of annual returns, these portfolios never experienced a negative 3, 5, 7 or 10 year roll period.

This was true whether we applied modest leverage at 2X or aggressive leverage at 3X to 4X.

Furthermore, these diversified portfolios featuring stocks, bonds and alternatives never had a negative year that even came close to being as bad as a 100% equity only portfolio.

What’s most exciting about all of this information is that these portfolios are classic long-only asset classes of stocks, bonds, gold and cash.

They’re not employing more sophisticated modern investing strategies of diversification that include long/short managed futures, trend-following, global systematic macro, long-short equity, market neutral, merger arbitrage, long volatility tail risk, cryptocurrencies and/or credit hedges that can make a portfolio even more efficient and overall diversified.

Now there is the potential to build a DIY Portfolio that provides returns equal to (or better) than equities, while managing risk (volatility) and negative annual return roll periods.

Expanded Canvas Portfolios

An artist needs a bigger canvas to create a masterpiece.

A television that expands from HD to 4K provides a massive upgrade for viewers watching movies at home.

In order for my DIY portfolio to reach its full returns potential I need a canvas bigger than 100%.

The idea isn’t to dial up the risk profile of my portfolio by leveraging stocks and bonds to the moon.

It is to create more space in my DIY portfolio for additional strategies, asset classes and alternative investments that will provide unique return streams.

Efficient core.

Portable Beta.

Expanded Canvas Portfolios.

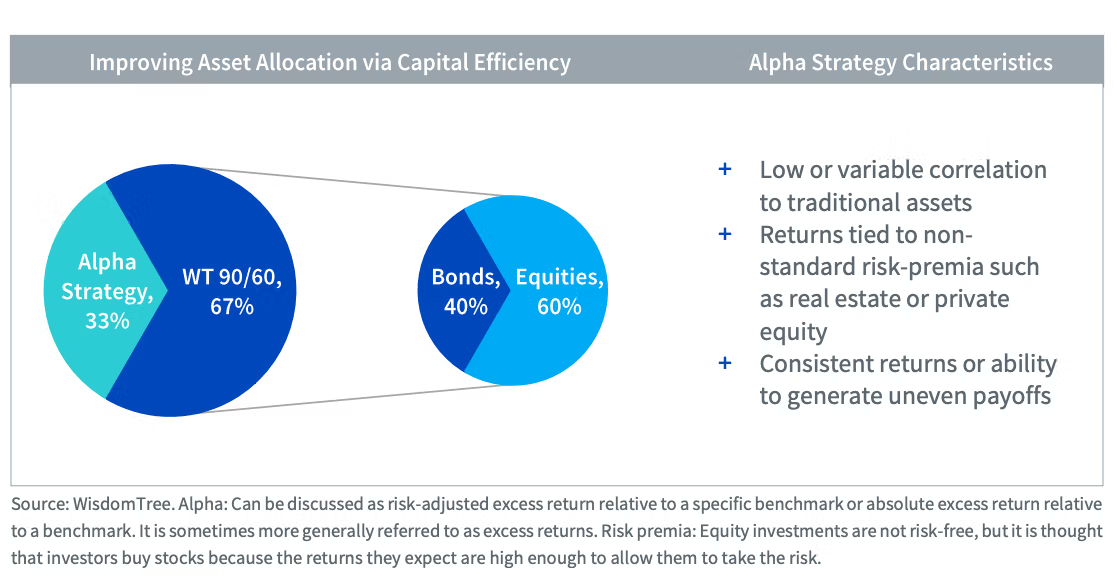

Out of all the possible ways to describe what I’m attempting as a DIY investor I prefer the framework of “return stacking” coined by legendary investor Rodrigo Gordillo and “expanded canvas” minted by yours truly as preferred frameworks for describing the process.

Return stacking is taking the template of a successful historical portfolio, such as the 60/40, while using portable beta strategies such as leverage to create space to stack on additional uncorrelated return streams.

For instance, utilizing a fund such as $NTSX 90/60 requires only 67% portfolio space to achieve a 60/40 portfolio mandate while creating 33% room for additional strategies.

The idea is not to add more stocks/bonds but to consider alternatives.

Expanded canvas portfolios are an unconstrained approach to utilizing leverage.

There are no rules or template to follow.

Screw benchmarks, convention or orthodoxy.

This is a chance to create your own masterpiece of a portfolio from a bottoms-up approach with the cookie cutter template thrown in the trash bin.

In other words, how you decide to mix and match stocks, bonds and alternatives is entirely up to you.

You get to build a DIY Portfolio that matches your own uniquely quirky personality profile, life experiences and overall investment goals.

If this isn’t exciting, I don’t know what is!

I just asked my wife Audrey if she found it as exciting as I do.

I received an epic eye-roll.

How Do I Invest My Money?

The way I currently invest my money, as a DIY investor, is a reflection of my best attempt to understand myself (self-awareness), my career and my investing goals.

I’ve lived an unconstrained and unconventional lifestyle which has involved working abroad, creating a business from scratch overseas and meeting my wife while living in a foreign country.

It should come as no surprise that I’m an unconstrained investor.

It makes me cringe to think I need to use a template as the backbone of my portfolio, such as the 60/40.

I want more diversification and strategies in my portfolio aside from a token alternative sleeve.

The small resource based town I grew up in (Gold River), with a pulp and paper mill that went bust in the 1990s, didn’t diversify its local economy.

It went from a boom (one of the highest per capita income small-towns in Canada) to bust almost overnight.

My day job in travel media, was threatened by the pandemic lockdowns which culled our industry to a fraction of what it was just a few years ago.

Who survived?

Those who diversified and had multiple sources of income streams.

Who didn’t?

The all eggs in one basket crowd which included those who exclusively only ran tours, did paid campaigns or affiliate/advertising models only.

Thus, given that I’ve chosen a volatile career, I’m seeking a portfolio that manages risk while providing excellent returns.

My Investing Goals: A Targeted Approach

I have very specific investing goals.

They are as follows:

10 DIY Investing Goals

- Build a DIY portfolio that can compete with (or outperform) equity only mandates

- To build a maximum Sharpe Ratio and Sortino Ratio portfolio where my returns exceed the level of risk (standard deviation) that is prepared for every economic regime

- To be focused more on the long-term “portfolio strategy” as opposed to the “portfolio results” with the patience to stick with a sensible plan even when certain sleeves are inevitably underperforming in the short-term

- Utilize a modest amount of leverage to create space in my portfolio to add as many unique uncorrelated alternative return streams as possible

- Create a portfolio that is globally diversified and avoids home country bias at all costs by investing in International Developed and Emerging Markets

- To pursue “short” strategies to capture factor, style and risk premia as much as “long” only strategies

- Use a systematic quantitative approach to assembling a portfolio that involves both “passive” and “active” management

- To not be so obsessed with “fees” that it excludes me from pursuing specific strategies that cost more to implement

- To review my portfolio annually to potentially upgrade it (not tinker with for just the sake of it) if I have expanded my knowledge and/or certain products have been created that would be an upgrade over what I currently own

- To never stop learning about investing and to remain a curious investor my entire life throughout this journey

If my portfolio looks the same in 3 years time I would consider that a total failure.

Not because I haven’t stuck with a sensible plan but because I haven’t learned anything new to improve its overall diversification and/or that I haven’t paid close enough attention to new funds that better represent the goals and strategies I’m currently pursuing.

I also firmly want to maintain a “sponge investor” approach where I’m not a part of a team or tribe that succumbs to confirmation bias.

My Limitations For Pursuing the Picture Perfect Portfolio

The biggest limitation I face as a DIY investor at the moment is a lack of funds that represent the strategies I’m most interested in pursuing.

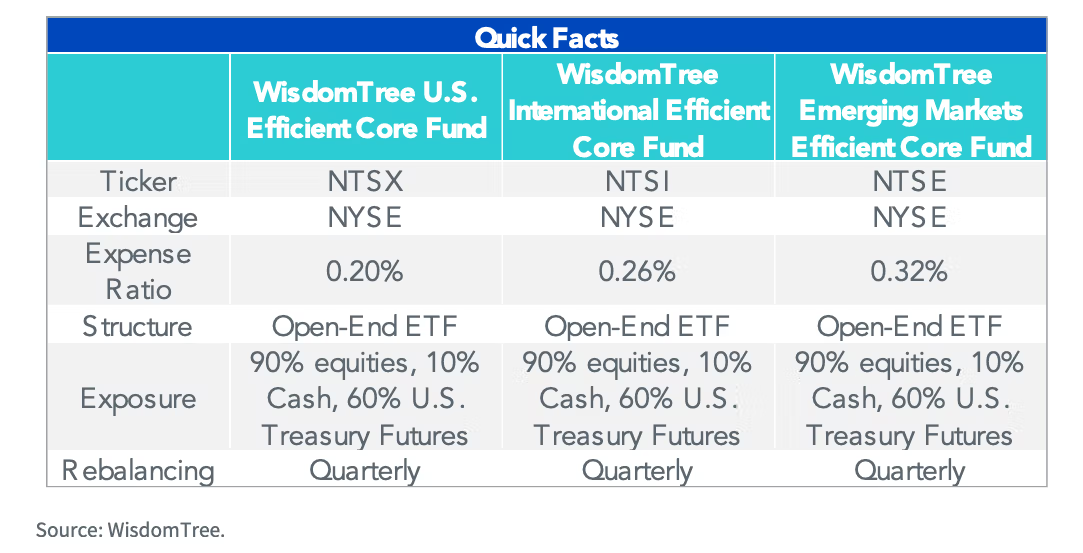

As an example, I absolutely love the 90/60 funds created by WisdomTree including $NTSX, $NTSI and $NTSE but I would in a heartbeat switch to a 90/60 fund that instead deployed a minimum volatility, momentum and/or value strategy as the backbone of the equity sleeve.

It’s not current available and so I’ve got considerably less equity factor exposure than I would like to have.

Also, as a Canadian investor, I’m not able to purchase US Mutual funds (I can buy US ETFs) so I’m left peering through the storefront with a drool bucket firmly in hand at funds such as StandPoint Multi-Asset Fund $BLNDX which I’d love to add to my portfolio.

There are also strategies that are being floated around and discussed such as the “Return Stacked 60/40 Absolute Return Index” that I’m interested in integrating into my portfolio that I hope become available in the near future.

I could go on and on with a wishlist of investing in the Cockroach Portfolio and the Dragon Portfolio along with portfolios I’ve created such as the Picture Perfect Portfolio and Nomadic Samuel Portfolio.

It’s exciting to think what the future holds in terms of potential funds and strategies.

Diversified DIY Quantitative Portfolio

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

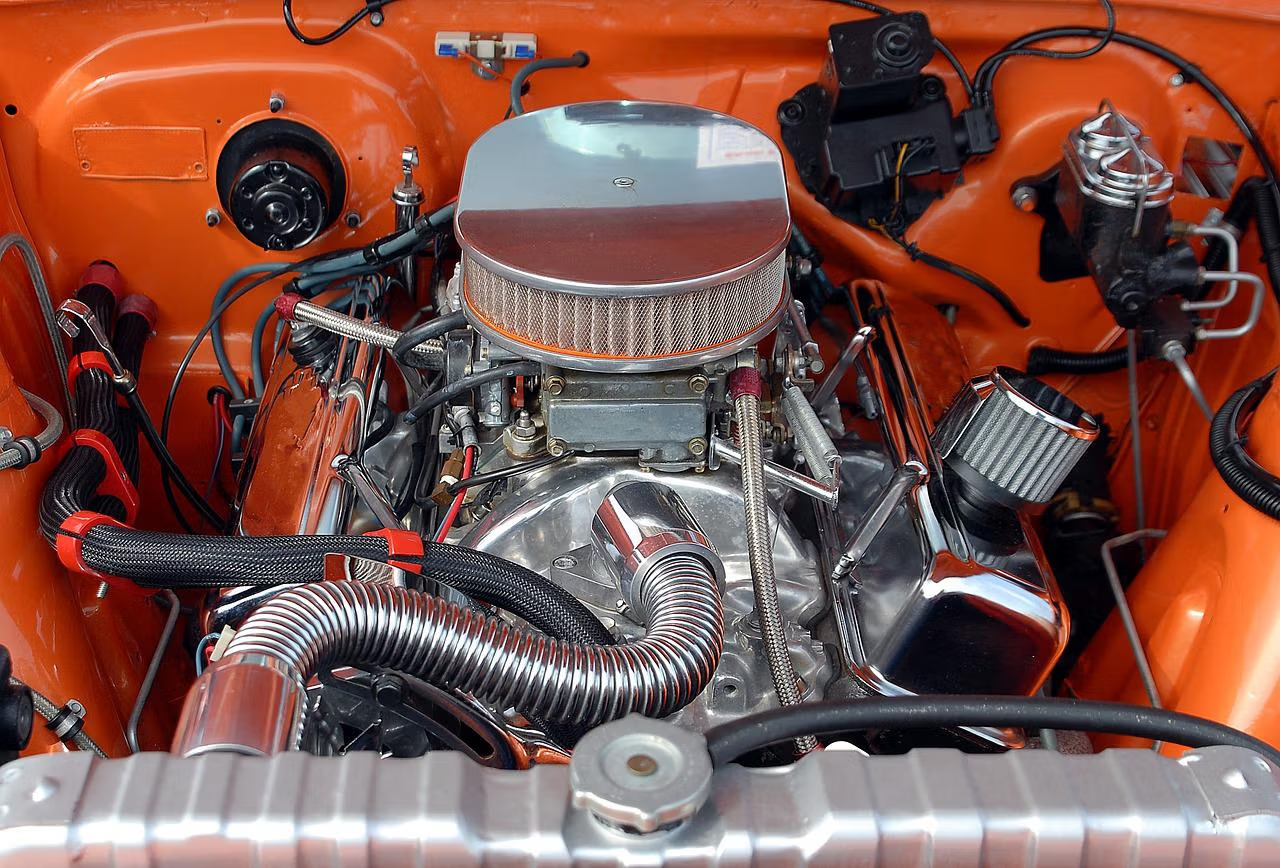

I apologize for what might be considered by some to be a long-winded rant leading up to what is actually under the hood of my portfolio.

However, I felt it necessary to clearly outline my process, goals and limitations clearly before jumping into the nitty gritty.

Without further ado let’s pop this baby open!

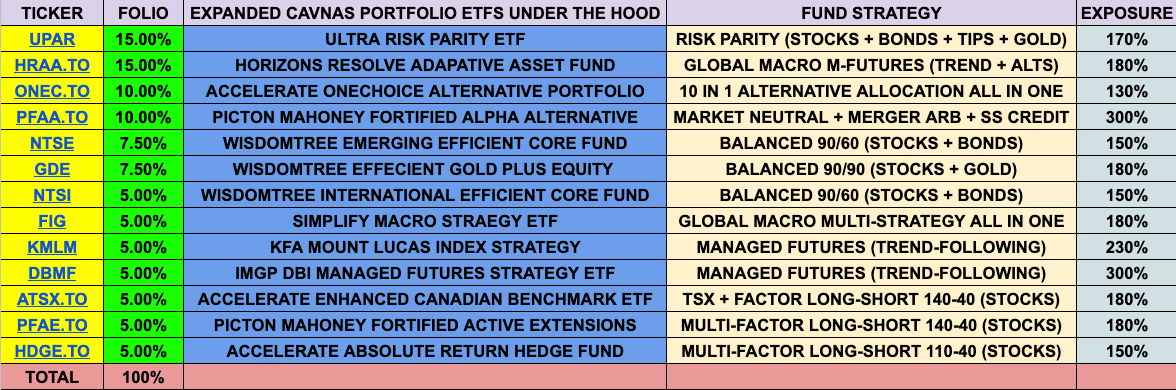

Nomadic Samuel Portfolio

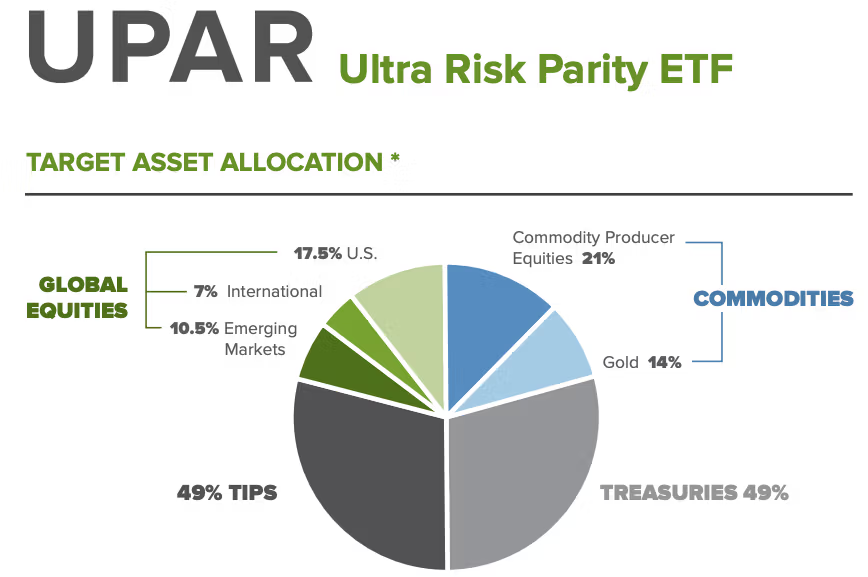

| UPAR | 15.00% | ULTRA RISK PARITY ETF |

| HRAA.TO | 15.00% | HORIZONS RESOLVE ADAPTIVE ASSET FUND |

| ONEC.TO | 10.00% | ACCELERATE ONECHOICE ALTERNATIVE PORTFOLIO |

| PFAA.TO | 10.00% | PICTON MAHONEY FORTIFIED ABSOLUTE ALPHA ALTERNATIVE |

| NTSE | 7.50% | WISDOMTREE EMERGING EFFICIENT CORE FUND |

| GDE | 7.50% | WISDOMTREE EFFICIENT GOLD PLUS EQUITY |

| NTSI | 5.00% | WISDOMTREE INTERNATIONAL EFFICIENT CORE FUND |

| FIG | 5.00% | SIMPLIFY MACRO STRATEGY ETF |

| KMLM | 5.00% | KFA MOUNT LUCAS INDEX STRATEGY |

| DBMF | 5.00% | IMGP DBI MANAGED FUTURES STRATEGY ETF |

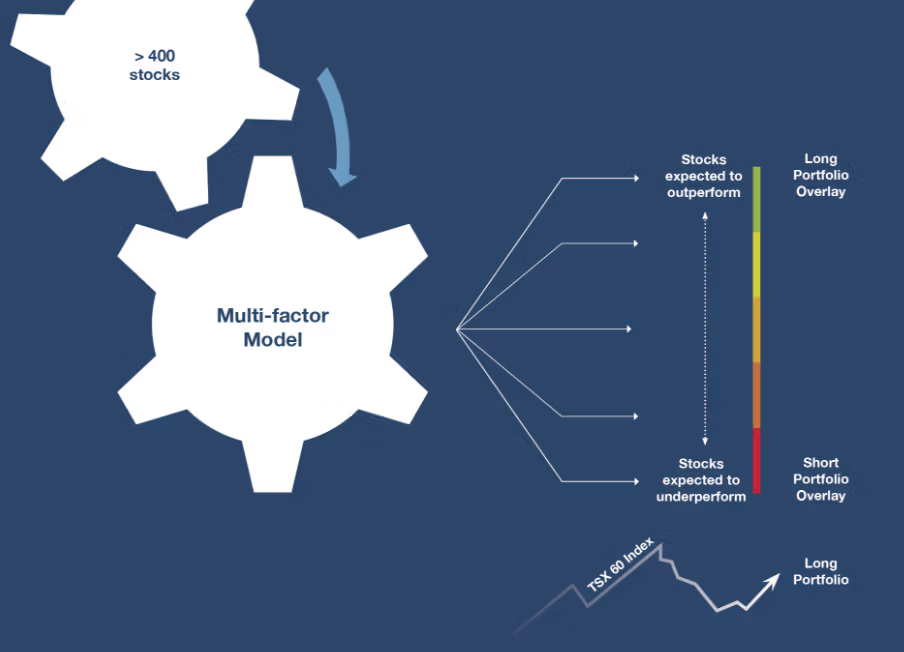

| ATSX.TO | 5.00% | ACCELERATE ENHANCED CANADIAN BENCHMARK ETF |

| PFAE.TO | 5.00% | PICTON MAHONEY FORTIFIED ACTIVE EXTENSIONS |

| HDGE.TO | 5.00% | ACCELERATE ABSOLUTE RETURN HEDGE FUND |

What exactly is the Nomadic Samuel Portfolio as of 2022?

13 ETFS.

7 US listed.

6 Canadian listed.

50% exposure to US funds.

50% exposure to Canadian funds.

The ticker represents the specific ETF followed by the % the fund takes up in the overall portfolio.

Next we’ve got the official fund name and a short description of the overall fund strategy.

Lastly, the last column represents the rough gross exposure each fund has (many are long/short) but not the overall net exposure.

As a quick example, an equity fund that is long (140) and short (40) would have a gross (180) exposure but only net (100) exposure.

Finally, every single fund is either multi-asset class or multi-strategy.

There is no long only equity or long only bond funds.

For example, ONEC.TO is a fund of funds whereas PFAE.TO is equity only but is multi-strategy in the sense that is goes both long/short.

ETF Funds Under The Hood

Let’s examine each of the funds to understand what each fund offers from a strategic point of view.

The two biggest positions in my portfolio are risk-parity portfolio funds that offer multi-asset class and multi-strategy exposure to my portfolio in an expanded canvas format.

UPAR = 15%

$UPAR is a long-only risk parity 168% canvas portfolio that is bond-centric in nature with TIPS and Long-Term Treasury making up 98% of the fund (49% each) with global equities (US + Int-Dev + EM) taking up a 35% allocation and Gold/Commodities forming the alternative sleeve at 35%.

The fund owns each sleeve based on the historical overall risk-level (standard deviation of each sleeve).

Thus, the bonds take up larger portions of the portfolio given they have lower standard deviation whereas stocks and gold/commodities are more volatile and thus receive a smaller allocation.

I expect the fund to offer better than equity returns with a smoother ride.

I wrote blog post where I reviewed UPAR Ultra Risk Parity ETF in detail.

$UPAR could easily be a total portfolio solution.

A one and done ETF approach.

But I’m a fan of what has been mentioned by influential quants on FinTwit of diversifying my diversifiers.

So a long-only one and done asset allocation approach is not for me.

HRAA.TO = 15%

$HRAA.TO is a risk parity adaptive asset allocation fund from some of my favourite quant folks in the industry over at ReSolve Asset Management.

Unlike $UPAR, $HRAA.TO takes advantage of a global systematic macro approach deploying various long-short managed futures strategies in a bespoke ensemble approach including (but not limited to) trend following.

It truly covers all of the bases including equity indexes, fixed income, tradeable real estate, currencies and commodities.

Getting back to the bespoke ensemble of managed futures strategies aside from just trend-following, Horizon Resolve Adaptive Asset Allocation ETF fund offers investors exposure to carry, value, momentum, seasonality, mean reversion and tail-risk.

This fund offers more uncorrelated asset classes and strategies than any other fund I’ve got under the hood.

If I could only invest in one fund for the rest of my life it might be something like this one.

With the funds ability to go long/short in an adaptive manner it offers an advantage strategically from a risk management perspective compared to long-only mandates.

Moreover, US investors can gain access to this strategy from ReSolve by utilizing $RDMIX.

It’s a Morningstar Five Star Fund and has received Lipper Awards as well.

I anticipate equity-like returns with volatility management that puts stock only portfolios to shame.

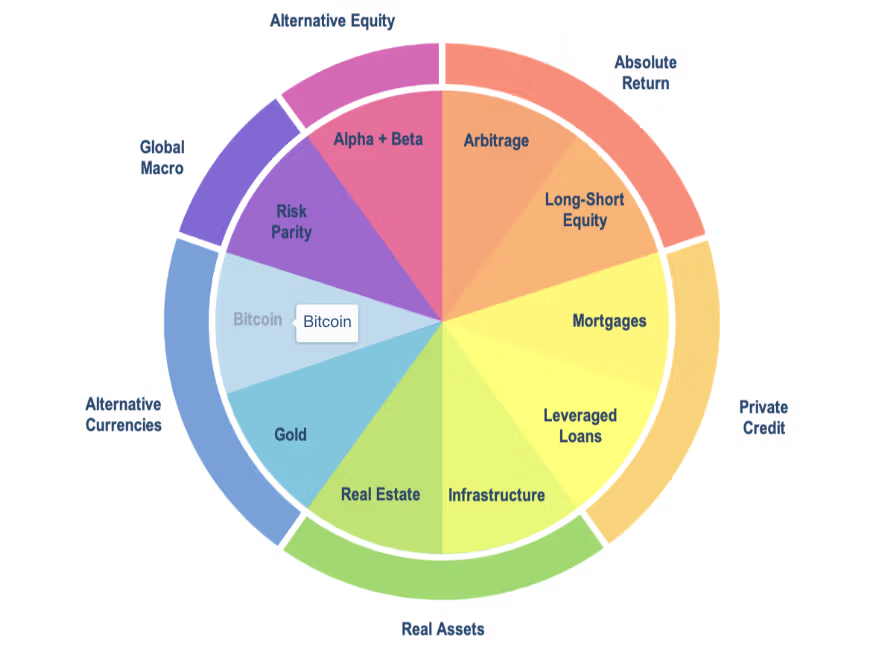

ONEC.TO = 10%

ONEC.TO is my favourite fund of funds ETF in my portfolio.

It just offers so much and allows me to break the shackles of some of the market-beta equity and bond exposure I have in other funds.

What is included?

| iShares Global Real Estate Index ETF | 10.0% |

| RPAR Risk Parity ETF | 9.9% |

| SPDR® Gold Shares | 10.5% |

| Accelerate Enhanced Canadian Benchmark Fund | 10.2% |

| SPDR® Blackstone / GSO Senior Loan ETF | 10.4% |

| Accelerate Arbitrage Fund | 10.7% |

| Accelerate Absolute Return Hedge Fund | 10.0% |

| Accelerate Carbon-Negative Bitcoin ETF | 7.0% |

| BMO Global Infrastructure Index ETF | 4.9% |

| FlexShares STOXX® Global Broad Infra Index Fund | 5.0% |

| iShares MBS ETF | 5.3% |

| BMO Canadian MBS Index ETF | 5.3% |

I’m gaining exposure to long-only equity diversifiers such as Global REIT and Global Infrastructure stocks while also enjoying long-short active extensions and factor-based hedging funds.

Gold and Bitcoin are part of the package as well allowing me to dip my toes into less than 1% cryptocurrency.

Mortgaged Backed Securities and Senior Loans provide further diversification to the portfolio as these are strategies not present in any other fund.

ONEC.TO is just one of three funds that I have in my portfolio created by Julian Klymochko of Accelerate.

If you’re interested in learning more about the fund I covered it in a review of Accelerate OneChoice Alternative ETF.

I’m expecting equity like returns with this fund with lower volatility.

PFAA.TO = 10%

Picton Mahoney Fortified Alpha Alternative ETF is one of the most interesting funds I have in my portfolio.

It takes three of the quantitative firms in house specialties (merger arbitrage, market neutral and special situation credit) as the primary strategy and layers secondary strategies of carry, value, momentum and tail-risk protection to round out the fund.

It utilizes aggressive leverage in a long/short capacity close to 300% gross exposure.

What I’m most excited about is how the sum of the parts have an incredible track record as individual funds where returns have easily outpaced risk.

These guys eat Sharpe Ratios for breakfast.

I’ve reviewed Picton Mahoney Fortified Absolute Alpha fund in detail for those interested in learning more.

I’m anticipating equity-like returns with this fund with only 1/3 to 1/2 the volatility.

NTSE = 7.5%

NTSE is the first of three WisdomTree funds that feature efficient core exposure stretching the canvas of the portfolio beyond 100%.

I utilize these funds to create space in my portfolio for other alternative strategies.

NTSE in particular is a 90/60 Emerging Markets equities and Treasury combination that provides 1.5X 60/40 portfolio exposure.

I’m firmly a believer in global diversification when it comes to equity allocation, so I’m thrilled that this fund boosts my Emerging markets exposure more than others.

I’m expecting the fund to outperform equity only mandates while offering similar volatility levels but less sequence of return risk. .

GDE = 7.5%

GDE is where I deviate from the NTS(?) series of funds from WisdomTree.

Instead of going for NTSX (90/60 US/Treasury exposure) I’ve opted for the 90/90 US/Gold combination to boost my allocation to gold as opposed to bonds.

I’ve got a lot of bond exposure in my portfolio – long and short.

Thus, I’m thrilled to add gold without really having to sacrifice equities in the process.

Wondering how a US stock + Gold tandem performs over a 50 year period?

You can check out my GDE ETF review here for that.

But the TL;DR version is that this duo pairs extremely well given they’re uncorrelated asset classes.

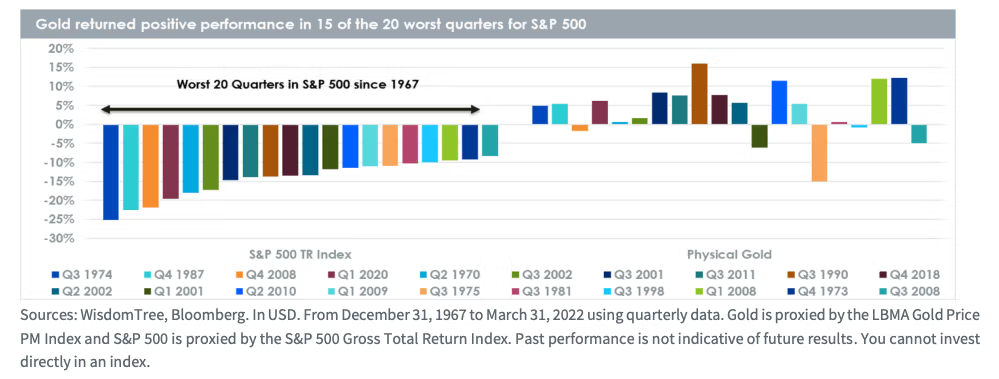

Gold protected against US equity lost decades of the 1970s and 2000s whereas equities picked up the tab in the 80s, 90s and 2010s.

In fact, this combination delivered double digit CAGR returns for each decade.

I firmly expect this combination to firmly crush equity only exposure to the US stock market.

NTSI = 5%

I’ll make this short and sweet.

NTSI is the equivalent of NTSE but with International Developed Markets as opposed to Emerging Markets.

Boosting the International-Developed exposure to equities in my portfolio is clearly a priority.

FIG = 5%

I’m really a big fan of what Simplify has been doing as an ETF provider over the past couple of years but for a while I couldn’t quite find a specific fit where a product they’ve released integrated well into my portfolio.

Well, that entirely changed with FIG ETF.

Simplify Macro Strategy ETF is a masterpiece fund of funds total portfolio solution with a plethora of goodies under the hood.

| CTA | SIMPLIFY MANAGED FUTURES | 72280 | 26.24% |

| CDX | SIMPLIFY HIGH YIELD PL CREDIT HEDGE | 86801 | 24.84% |

| SVOL | SIMPLIFY VOLATILITY PREMIUM | 71812 | 20.34% |

| TYA | SIMPLIFY RISK PARITY TREASURY | 27560 | 6.37% |

| IAU | ISHARES GOLD TRUST | 11549 | 4.64% |

| – | FIDELITY INV MMTRSY 1 680 | 201161 | 2.47% |

| SPY US 12/16/22 C320 | SPY Dec 2022 320 Call | 110 | 11.16% |

| SPX US 12/16/22 C3200 | S&P 500 Index Dec 2022 3200 Call | 2 | 2.04% |

| SPY US 12/16/22 P350 | SPY Dec 2022 350 Put | 7 | 0.08% |

It offers a diversified set of risk drivers including exposure to equity, credit, duration and volatility.

I almost forgot to mention gold.

It’s a fund that deserves its own review on this site at some point.

The fund utilizes leverage in certain cases and put/call strategies to maximum returns and minimize downside risk.

Out of all the funds I own it has more exposure to long-volatility than any other.

In fact, I wouldn’t be surprised if I boost the allocation to FIG closer to 10% at some point.

I’m anticipating this fund will provide equity like returns while managing risk like a defensive all-star.

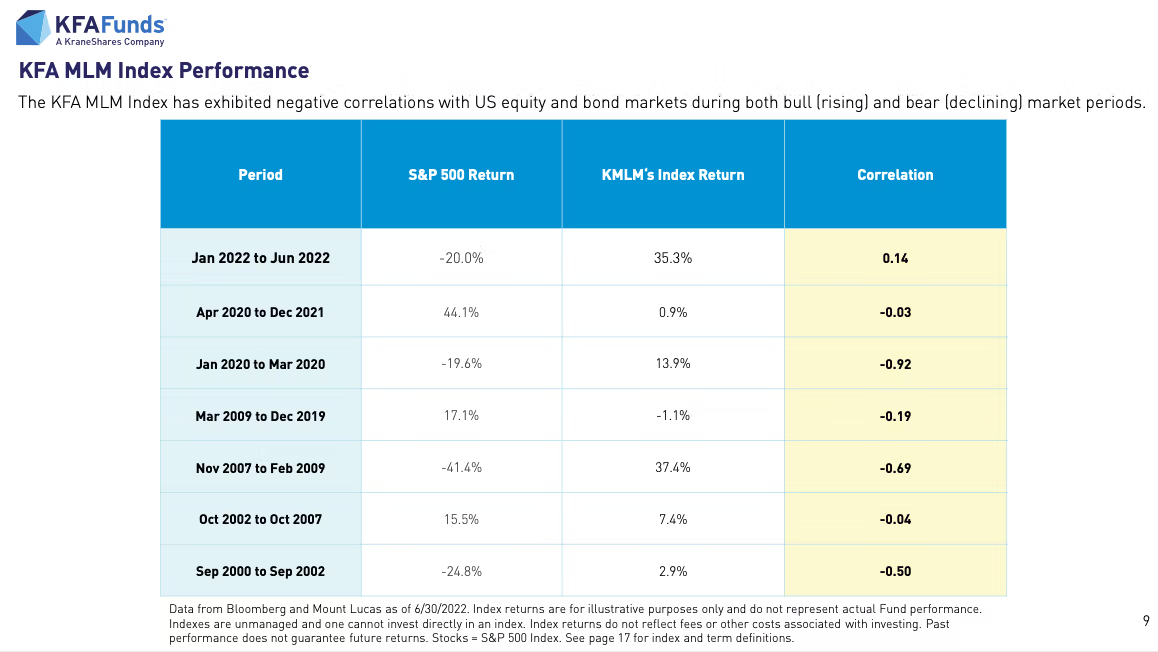

KMLM = 5%

KMLM is a managed futures long/short fund I’m truly excited about.

With an incredible track-record dating back decades I’m thrilled about having it in my portfolio as an uncorrelated strategy to long-only stocks/bonds/commodities funds.

It’s had a monster year in 2022 so far providing the type of crisis alpha investors seek when long only stocks/bonds are being skewered at the exact same time.

It’s the ultimate hedge for long-only equity, bond and commodity risk.

What’s interesting about this fund in particular is that it offers diversified exposure to commodities, currencies and bonds but forgoes equity index coverage.

There is a fantastic long-term track-record as well.

When it comes to managed futures strategies you can anticipate equity like returns long-term with 1/2 the risk.

DBMF = 5%

DBMF is a managed futures fund with a bit of a twist.

It seeks hedge fund like performance without hedge fund like fees by tracking the performance of a diversified pool of managed futures managers.

It’s a strategy uncorrelated with long equities/bonds and has delivered goliath positive returns this year while most traditional portfolios are tanking.

Given its all-weather capabilities and diversified long-short exposure to equity, bond, currency and commodity indexes it has significantly outperformed its benchmark SG CTA Index since inception.

I love this ETF.

I’m anticipating equity like performance meets stellar volatility management.

ATSX.TO = 5%

ATSX.TO is the first of three long-short equity funds that I’ve got in my portfolio.

It takes 100% of the TSX index as a future contract and then overlays a 50 long / 50 short combination of factor based strategies minus junk.

The fund has no management fees.

Only a performance fee when it outperforms the TSX as its benchmark.

I love this approach where the fund manager takes the same hit if/when the fund relatively underperforms and shares in the success when it does well.

I fully anticipate this fund to crush its benchmark and deliver better than equity like returns.

This is an outperformance strategy clear and simple.

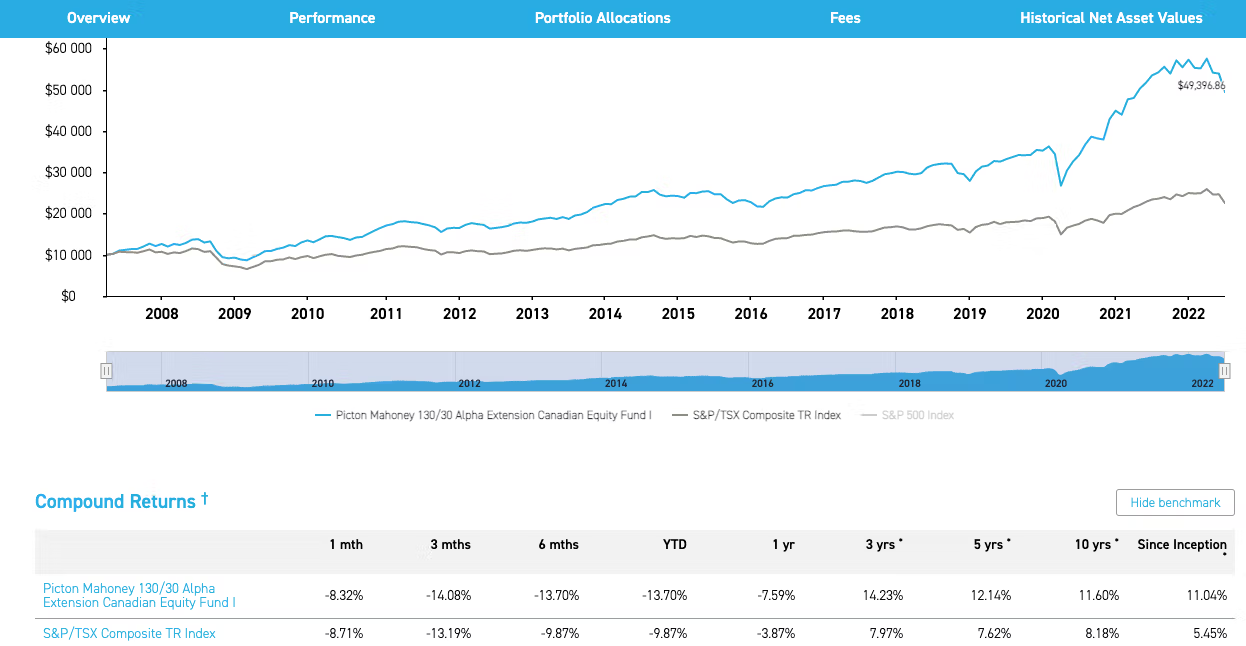

PFAE.TO = 5%

Picton Mahoney Fortified Active Extensions fund is a 140-40 long/short equity fund with a track record that is beyond impressive.

The ETF version of this fund takes after its hedged mutual fund sibling.

With a track record dating back over a decade it has absolutely crushed its benchmark TSX by over 500 basis points while delivering a much higher Sharpe Ratio.

It uses a multi-factor quantitative approach to selecting attractive long stocks while shoring those with unattractive fundamentals.

I expect this fund to continue to significantly outperform equity only mandates as it has in the past.

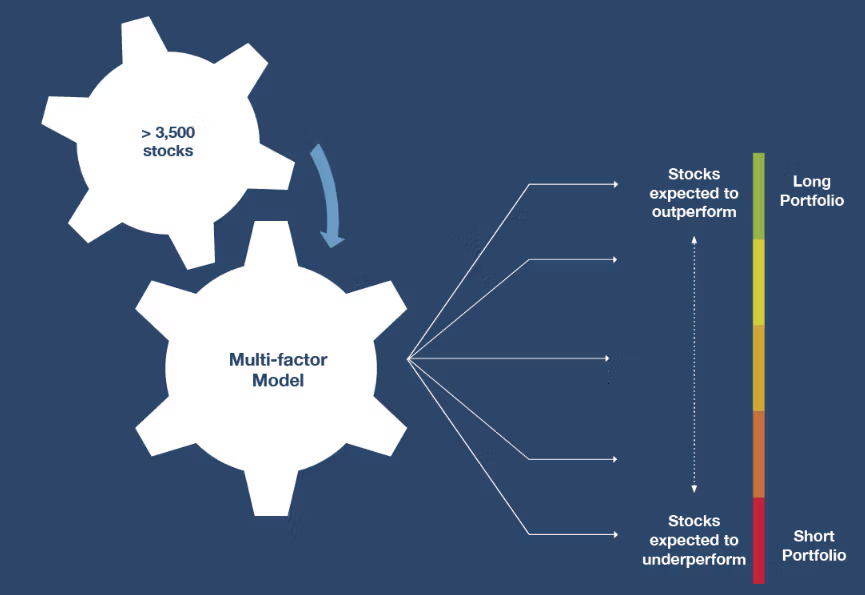

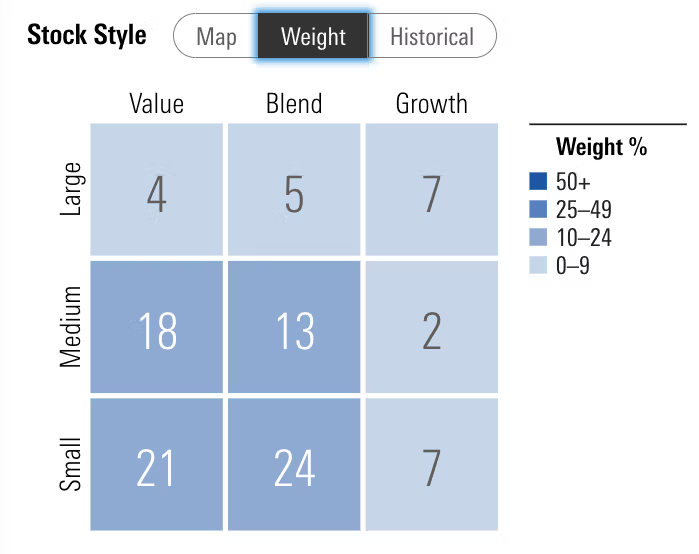

HDGE.TO = 5%

Last but not least is Accelerate Absolute Return Hedge Fund.

Unlike its sibling ATSX.TO this fund does not follow a benchmark and instead offers multi-factor exposure to long 110 attractive stocks minus 40 junk.

Given my desire for significant equity factor exposure in my portfolio this fund provides it in spades.

Check out the delicious Morningstar Style Box below.

I’m anticipating this fund will long-term outperform index based equity funds while offering hedging protection those long only mandates lack.

FAQ: How Do I Invest My Money? Diversified DIY Quantitative Portfolio (by Nomadic Samuel)

1) Why did you shift away from a 100% equity, factor-tilted approach?

Because diversification is the only free lunch. A stocks-only mandate can suffer lost decades and gut-wrenching drawdowns. By combining uncorrelated (or low-correlated) assets and strategies, you can pursue equity-like (or better) returns with smoother volatility and fewer multi-year negative roll periods.

2) What exactly is a “Diversified DIY Quantitative Portfolio” in your case?

It’s a rules-driven, multi-asset, multi-strategy mix that blends risk parity, efficient-core equity/treasury or equity/gold sleeves, managed futures / systematic macro, long–short and market-neutral equities, and select alternative premia—implemented with ETFs (US and Canadian) and modest leverage to expand the “canvas.”

3) What do you mean by “expanded canvas,” “efficient core,” and “return stacking”?

“Expanded canvas” = notional exposure above 100% to make room for more diversifiers. “Efficient core” funds (e.g., 90/60 or 90/90) deliver core beta while freeing space. “Return stacking” layers additional, uncorrelated return streams (trend, long–short, gold, arbitrage, vol premia) on top of core exposures without simply levering one risky sleeve.

4) How do you use leverage without “swinging for the fences”?

I don’t lever one asset (like equities) to the moon. I apply modest leverage primarily via capital-efficient funds to add breadth—managed futures, gold, credit/vol overlays, and long–short—so diversification does the heavy lifting while keeping total portfolio risk in check.

5) What’s under the hood right now?

A representative mix includes: Risk parity (UPAR, HRAA.TO), efficient core (GDE, NTSE, NTSI), alternatives/systematic macro & CTAs (FIG, DBMF, KMLM, ONEC.TO, PFAA.TO), and long–short / market-neutral equities (PFAE.TO, ATSX.TO, HDGE.TO). US and Canadian tickers split roughly 50/50.

6) Why not stick with a classic 60/40 or 100% equities if they “work over time”?

Both can work long-term, but they concentrate risks (equity beta, duration, inflation). My aim is a portfolio that’s prepared for multiple regimes (growth up/down, inflation up/down) and reduces sequence-of-returns risk, especially important for real lives and cash-flow needs.

7) How does this approach handle drawdowns and “lost decades” risk?

By spreading risk across independent engines—trend/managed futures, long–short/market-neutral, gold/commodities, and global equities/treasuries—so when one sleeve struggles, others can offset. The objective is shallower max drawdowns, fewer multi-year negatives, and steadier compounding.

8) How do you rebalance and make changes without performance-chasing?

I use a calendar cadence (e.g., quarterly/semiannual) or tolerance bands to rebalance. I review annually for genuine upgrades (new products, better implementations) but avoid tinkering for tinkering’s sake. Patience > perfection.

9) What if a specific fund isn’t available to me?

Think in exposures, not tickers. Map required sleeves—risk parity, efficient core equity/treasury or equity/gold, managed futures, market-neutral/long–short, arbitrage/alt premia, vol strategies—to closest accessible substitutes in your market, prioritizing correlation diversity and cost/liquidity.

10) What limitations or wishlist items do you have?

Access. As a Canadian investor I can’t buy US mutual funds (e.g., BLNDX). I’d love factor-based efficient-core (90/60) variants (min-vol, value, momentum) and broad return-stacked absolute-return indices in ETF form. Product availability shapes implementation.

11) Who is this style for—and who should avoid it?

For investors who value breadth, process, and tracking-error tolerance—and who can commit to a quant, rules-based approach. It’s not for those wedded to single benchmarks, uncomfortable with capital-efficiency, or likely to bail when a sleeve underperforms.

12) Is this investment advice?

No. This is educational, entertainment-only content reflecting my personal portfolio and preferences. Do your own research and consider consulting a qualified advisor who understands your objectives, constraints, and risk tolerance.

Nomadic Samuel Final Thoughts

I thought it would be a bit presumptuous for me to write a pros and cons list, like I normally do for fund reviews, for my own portfolio given how biased it would be.

Quite frankly this isn’t a model portfolio I’m suggesting for anyone else.

It suits my quirky personality/character, unique life circumstances and my overall current knowledge as an investor.

As an attempt to think objectively for a moment I’ve come to conclusion that this is the anti-Bogleheads portfolio.

It’s not simple.

I’m not obsessed with fees.

The portfolio is not a long only market beta equity/bond combination.

I have much greater exposure to alternative asset classes and strategies than most other DIY investors.

The funds I’ve selected utilize a modest amount of leverage.

I have more long/short multi-strategy combinations than I do long-only.

That’s my favourite part by far.

This is one heck of a behemoth of a blog post.

4000+ words!

Jeez, Louise.

Sorry about that!

I had zero plans to write a post this long but I felt I needed the space to explain things thoroughly.

If you’ve made it this far, thank you!

I think it’s time to wrap things up.

But before I do that I want to hear from you.

What do you have under the hood of your portfolio?

How have you changed as an investor over the years? (if you have at all)

What do you think of my portfolio?

Please, feel free to poke holes in it as I’m very much open to constructive criticism.

Also, I’m curious to know what kinds of strategies do you seek that aren’t currently represented in an investable fund?

Are there are any portfolio ideas you’ve thought of that you’d like to see come to life someday?

That’s all I’ve got for now.

Happy investing and pursuing your own picture perfect portfolio that suits your every need.

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Hey Sam,

Thanks for sharing all the details on your portfolio! I love posts like this.

I was curious if you had any suggested alternatives to explore for the Accelerate and Picton Mahoney ETF’s for US based investors.

Thanks!

Thanks so much for your detailed post! Just wondering if you had US ETF alternatives for the canadian-only funds that you mentioned. I know we have RDMIX, but are there anything else for the other ones? Thanks!

Oop, posted my questions in the wrong place.

In the GDE ETF review, I posted a bunch of questions for you.

Hey Sam,

I love your stuff. I’m an RIA and have been constructing all-weather type portfolios for 20-plus years. We should talk. If interested, please email me so we can set something up.

Thanks,

Scott

You website is nothing but a myriad of ads and covers 2/3 of screen on an iOS device. Top and bottom. Not worth trying to read and is not user friendly. WTH! Clean this thing up and you would get more trades I sure. You may have some good info but for the love of Rae up on the ads.

Scott

Thanks for sharing your thoughts!

Thank you so much for posting. I must say that I learned a lot from your post on how to invest in this turbulent times. You website is a goldmine of knowledge for individual investors.