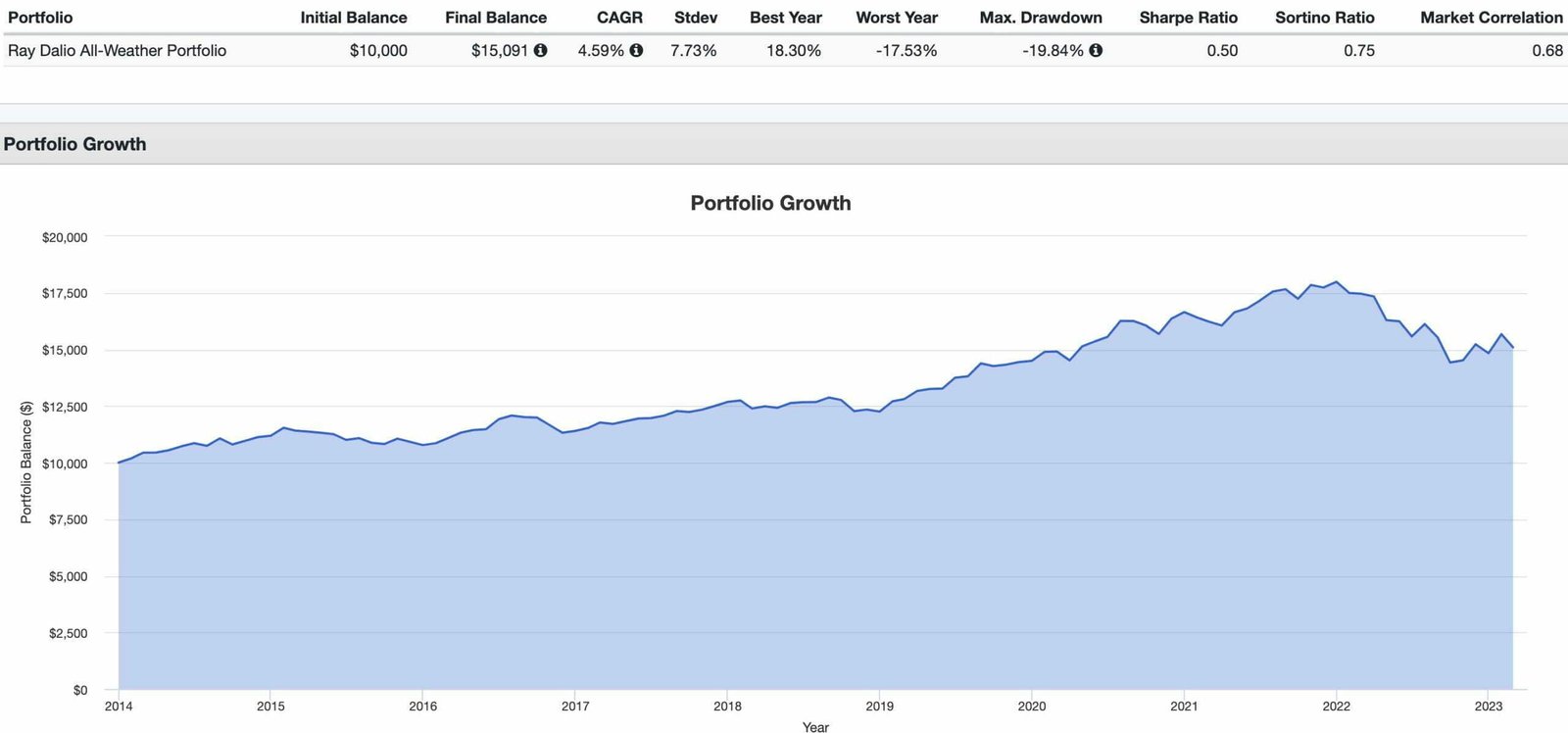

The Ray Dalio All Weather Portfolio is considered by many to be one of the most defensive and diversified long-only portfolios for investors to consider.

The Tony Robbins’ “Simple Simon” version is what most investors are familiar with.

Ray Dalio All Weather Portfolio

30% US Total Stock Market

40% Long-Term Treasury

15% Intermediate-Term Treasury

7.5% Gold

7.5% Commodities

When the book debuted many years ago it was during a time when alternative investments, capital efficient funds and maximum diversification strategies were mostly available only to institutional and accredited investors.

At the retail level, a lack of product availability and knowledge of the subject matter (lack of educators/influencers) were huge obstacles for investors considering diversifiers outside of say Gold, REITs and Commodities.

source: Investopedia on YouTube

New Era Of Democratized Access To Sophisticated Investing Products

But that’s all changed in recent years.

Regulations that once stifled the creation of capital efficient products and alternative investments have been softened.

The era of democratized access to sophisticated investing strategies is now upon us.

And a crop of in-the-know savvy professional investors and asset managers have released podcasts, blog posts and white papers on the subject.

We’re now able to assemble the Ray Dalio All Weather Portfolio with capital efficient ease.

This leaves us with room to add defensive upgrades in the form of diversifying uncorrelated asset classes/strategies and optimization of existing sleeves of the portfolio.

What exactly do I mean by this?

We’re able to utilize capital efficient building blocks such as PSLDX (100 Equities / 100 Long-Duration Bonds) to create space in our portfolio to add diversifying defensive strategies such as a return smoother BTAL ETF (anti-beta market neutral).

We can repeat this step with a fund like recently minted RSBT ETF (100% AGG / 100% Managed Futures Trend-Following) to fulfil our fixed income mandate while adding a “return stack” of defensive managed futures to our portfolio mix.

That is specifically what I mean in terms of adding diversifying strategies that are uncorrelated with what we’ve already got in our portfolio.

But how about optimization?

A concrete example of this would be upgrading our equity strategy from “market cap weighted” to the more defensive “minimum volatility”.

Historically, this has provided 100s of basis points of enhanced volatility management when it comes to standard deviation.

We can go one step further by examining the most volatile asset class in the Ray Dalio All Weather Portfolio: commodities.

Instead of having a long-only allocation to commodities we can replace that with a long-short or long-flat approach which better manages upside/downside performance.

Building A More Defensive Ray Dalio All Weather Portfolio

Firstly, we should acknowledge that the Ray Dalio All Weather Portfolio is a solid portfolio solution in and of itself.

Here are clear ways in which it is more defensive and balanced than the industry standard 60/40 portfolio:

- Less Aggressive Equity Allocation (30% vs 60%)

- More Bonds (Historically less volatile from a standard deviation perspective)

- More Diversified And Prepared For All Economic Regimes (Adding uncorrelated asset classes: Gold/Commodities)

Here’s the portfolio once again:

Ray Dalio All Weather Portfolio

30% US Total Stock Market

40% Long-Term Treasury

15% Intermediate-Term Treasury

7.5% Gold

7.5% Commodities

Why not be thrilled with its current configurations?

Because over here at Picture Perfect Portfolios we’re not satisfied with the status quo.

As a contrarian investing blog we like to obsessively tinker around in the toolshed to see if we can possibly enhance what is already considered good.

We’re in the business of turning “good” into “great”.

And with this in mind let’s explore how we can transform the Ray Dalio All Weather Portfolio into a defensively upgraded enhanced version of itself.

Our Enhanced Ray Dalio All Weather Portfolio Defensive Mandate

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Here’s our specific mandate.

We’re going to keep the current configurations of the Ray Dalio Portfolio.

In other words, we need to have the following allocations when all is said and done:

30% US Equities

55% Bonds

7.5% Commodities

7.5% Gold

We’re committed to not deviating from the backbone of the Ray Dalio All Weather strategy from its core components.

We’ll give ourselves a tiny bit of wiggle room to not adhere strictly to the 40% Long-Term Treasury and 15% Intermediate Treasury allocations but we’re firmly committed to ensuring an overall diversified fixed income allocation of 55% overall.

Our goal for performance and risk management is clear and concise:

- Outperform both a 60/40 Portfolio and the Ray Dalio All Weather Portfolio

- Ensure that we’re also MORE DEFENSIVE in the process by having higher risk adjusted rates of returns

- Let’s go one step further by insisting that we have enhanced maximum drawdown, worst year, Sortino ratio and Sharpe ratio too in a long-range backtest

So we’ve got plenty of work to do!

Let’s get crackin’ to see what we can accomplish over here!

How To Improve The Ray Dalio All Weather Portfolio To Make It More Defensive

Hey guys! Here is the part where I mention I’m a travel content creator as my day job! This investing opinion blog post is entirely for entertainment purposes only. Most investors should not use leverage in any way, shape or form. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Step One: Expand The Canvas Of Our Portfolio To Create Space For Diversifiers

Our first step is to expand the canvas of our portfolio to create space for diversifiers.

We’re specifically seeking to add uncorrelated asset classes and strategies to the backbone of our portfolio to make it more defensive.

Enhanced returns would be a bonus but we’re laser focused on making things more defensive first and foremost.

To achieve our target and reap the rewards of adding diversifying strategies we’ll specifically utilize two products.

- PSLDX – PIMCO StocksPLUS Long Duration Fund

- RSBT – Return Stacked Bonds & Managed Futures

With PSLDX we’ll allocate 15% of our portfolio resources to gain access to 100% US Equities and 100% Long Duration Fixed Income.

Instantly, we’ve added 15% real-estate space for something else (diversifying strategy) which we’ll reveal later on in the article.

Next we’ll lay down a significant slab of RSBT ETF at 40%.

We’re now over and done with our fixed income sleeve of the Defensively Enhanced Ray Dalio All Weather Portfolio.

Yee-Haw!

Bonds are kinda boring anyways and that means we can zero in on something else!

Oops.

I almost forgot to mention we just added a massive heap of Managed Futures to the mix.

We’ve added in a capital efficient manner 40% Aggregate Bonds and 40% Managed Futures.

The Case For Adding Managed Futures To The Mix

Why add such a significant amount of managed futures to our portfolio?

Four main reason:

- Adaptive Asset Allocation

- Uncorrelated With Stocks, Bonds, Gold

- Historically Consistent Crisis Alpha

- A Capital Efficient Way To Add A Diversifying Strategy To Our Portfolio

A trend-following managed futures strategy has the capacity to go long-short equity, fixed incomes, commodities, currencies and precious metals.

In instances where long-only asset allocation is rigidly static and exposed to unfavourable economic conditions, managed futures offers the exact opposite approach.

It can adapt.

It has the capacity to “go with the flow” and not fight reality by saying “yes” to whatever is going on.

Yes to stocks being down by going short equity indexes.

Yes to bonds being down by going short bond indexes.

Yes to commodities trending upwards by going long certain commodities.

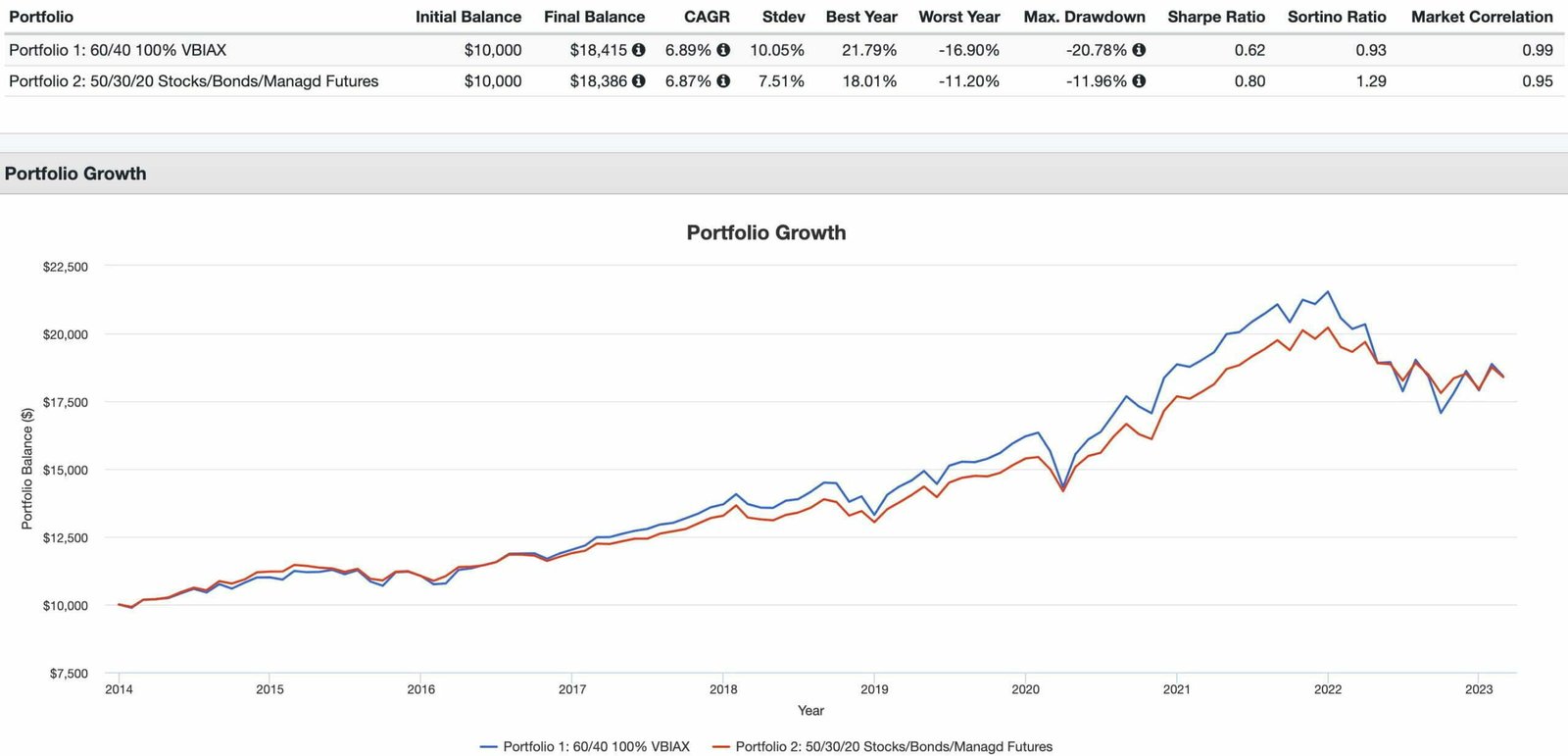

Check out what adding a 20% slab does to improve the risk adjusted rate of returns of a 60/40 portfolio.

100% VBIAX vs 80% VBIAX + 20% PQTIX.

60/40 Portfolio vs 50/30/20 with Managed Futures

What a difference adding an uncorrelated asset class to the mix from a defensive perspective!

Our standard deviation is significantly upgraded (7.51% vs 10.05%) by 254 basis points!

Our worst year is now only -11.29% versus -16.90%.

We notice the biggest upgrade of all when it comes to maximum drawdown defensive upgrades (-11.96% vs -20.78%).

And let’s take a victory lap with enhanced risk adjusted rates of return as best represented by improved Sortino ratio and Sharpe ratio.

And our returns are only 2 bps lower.

However, we’re not shaving down equities or bonds with our portfolio!

We’re just layering this bad boy (managed futures) on top of it!

Step Two: Optimize Our Equities and Commodities

We’ve completed step one!

It’s time to focus on step two which involves optimization as opposed to capital efficiency.

Two of the most volatile components of the Ray Dalio All Weather Portfolio are the equity and commodity sleeve.

Historically US stocks are around 16% standard deviation and Commodities can reach well over 20%!

Can we tame these two beasts while not muting returns?

Yep.

We sure can.

Let’s focus first on the equity side of the equation.

US Minimum Volatility Equities vs US Market Cap Weighted

Historically, Minimum Volatility equity strategies have provided investors with a significant defensive upgrade over market cap weighted strategies.

The so-called boring factor (min vol) offers investors lower lows and lower highs.

It wins by losing less.

Does that sounds exciting?

I didn’t think so!

However, you may be surprised to learn that it typically means enhanced returns as well.

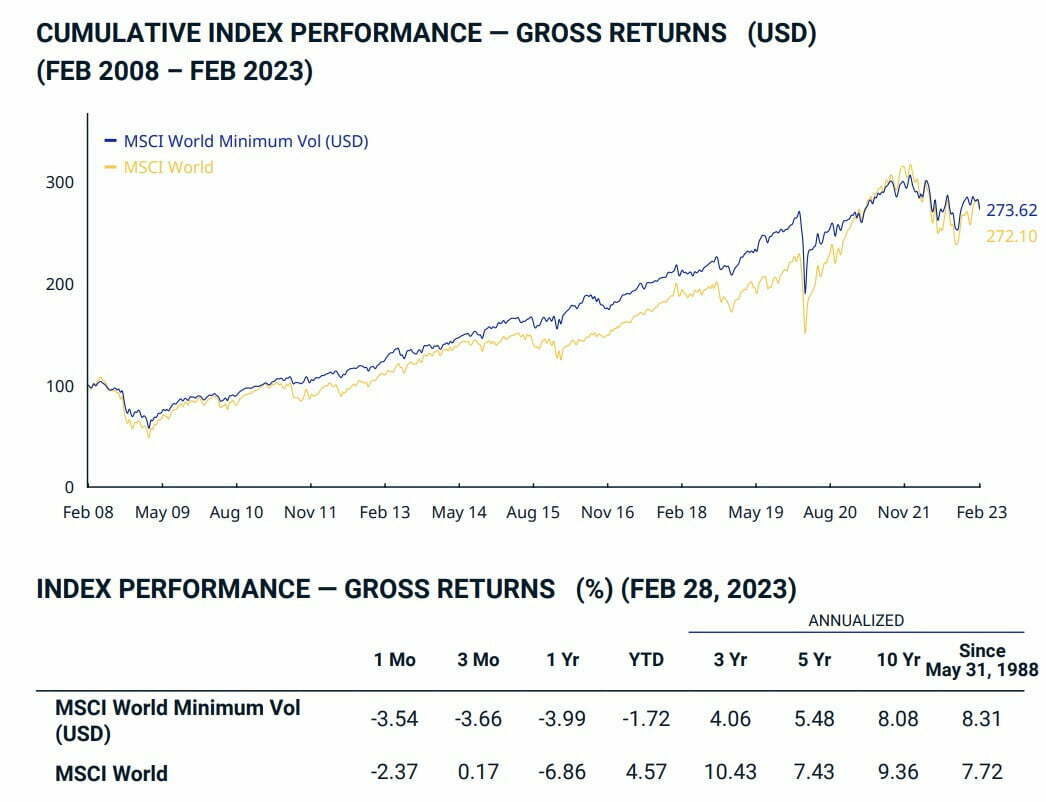

MSCI World Minimum Volatility Index vs Parent MSCI World Index

Since its inception (May 31, 1988) the Global Minimum Volatility Index has outperformed its parent index by 59 basis points!

And we haven’t even considered its defensive acumen which we’ll do now.

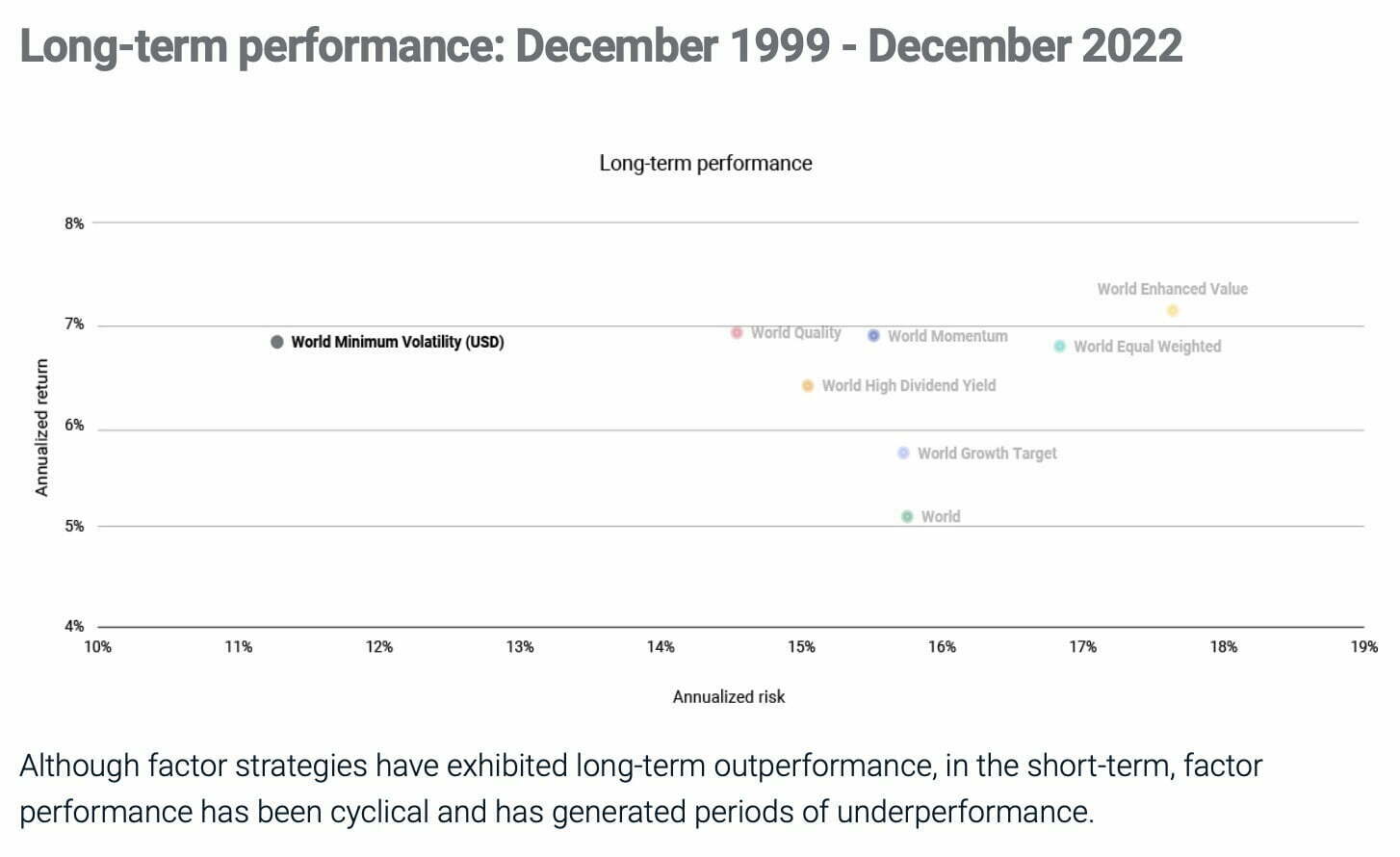

World Minimum Volatility Index vs Other Equity Strategies Annualized Risk

Min Vol is hanging out on a lonely island when it comes to risk management!

And we’re thrilled about that!

Compared to other equity strategies (which have historical long-range volatility of 14-18% standard deviation) we’re hovering around 11% with minimum volatility.

That’s anywhere between 300 to 650 basis points more defensive!

So we’ll fulfill our 30% Ray Dalio All Weather Portfolio equity mandate by replacing a MCW strategy with 15% of USMV ETF.

Better know as iShares MSCI USA Min Vol Factor ETF.

We’re looking to defensively enhance our Ray Dalio All Weather Portfolio and with this optimization upgrade we’ve clearly accomplished our goal.

Now our equity and fixed income sleeves are complete.

Let’s see what we can do to improve our commodity sleeve.

Buyer Beware: Long-Only Commodity Strategies

Unless you’ve got a cast-iron stomach and are a sucker for pain it’s best not to go long-only when it comes to commodities.

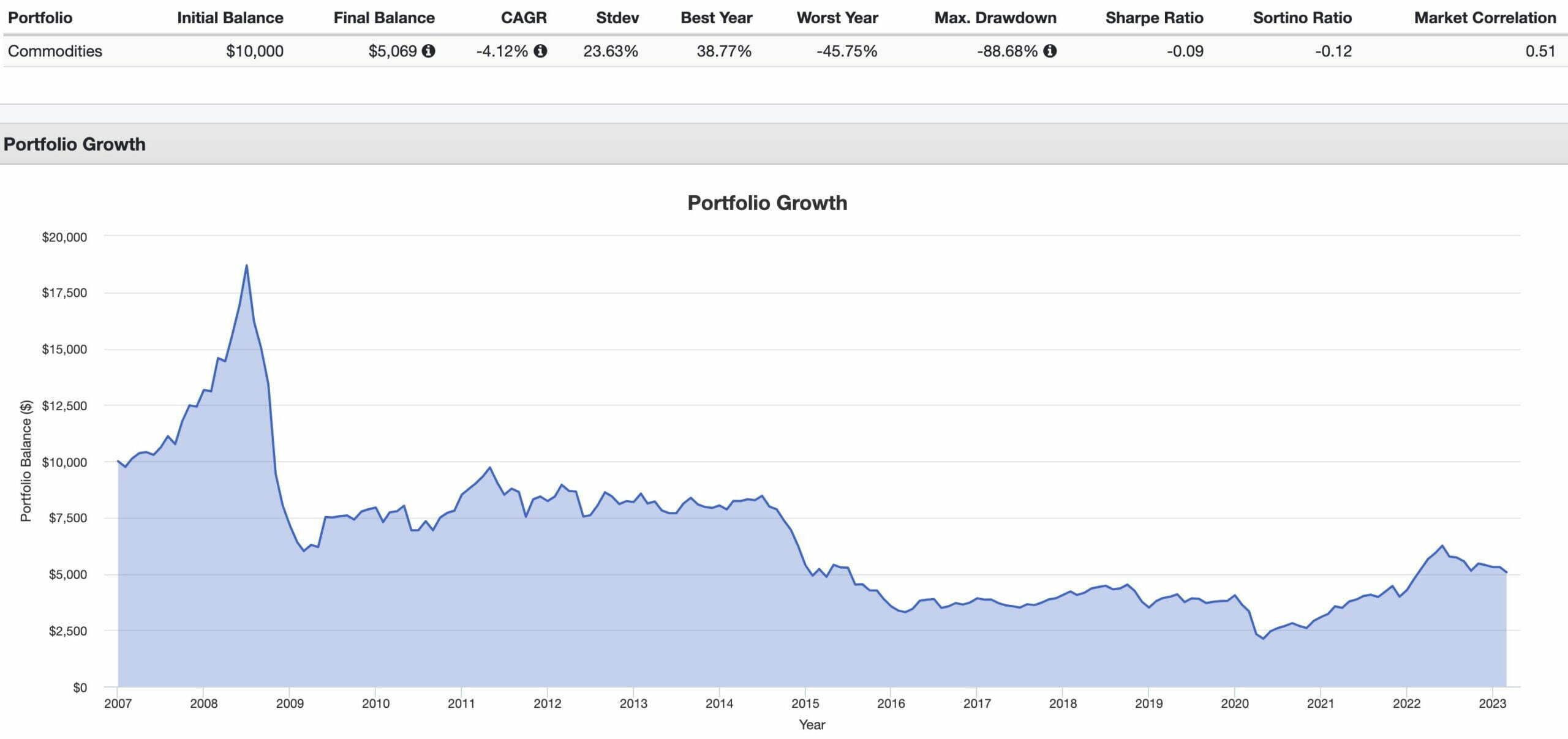

Consider the results of a long-only commodity allocation as far back as we can back-test it on portfolio visualizer.

Suffering succotash!

Long-only commodities have been a terrible investment since 2007.

-4.12 CAGR handcuffed to a 23.63% RISK!

Get me outta here!

Is there a way to allocate towards commodities where you avoid the rollercoaster ride, bad returns and overall malaise?

Indeed.

You can go long-short or long-flat commodities.

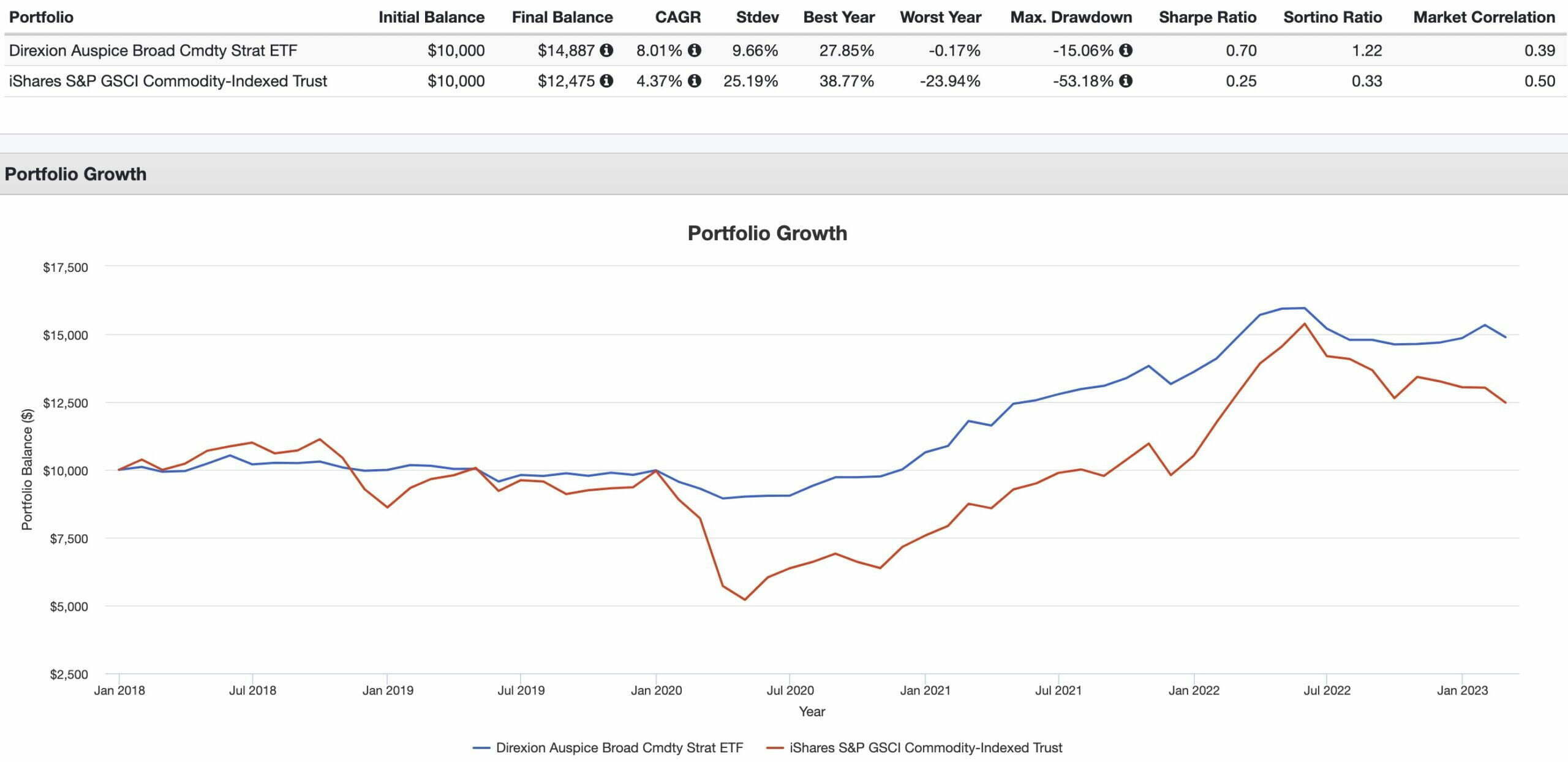

Let’s consider a fund such as COM ETF versus a broad commodity fund.

Auspice Broad Commodity Strategy ETF vs iShares GSCI Commodity Index

Having a long-flat commodity solution (the ability to get out of losing situations) is a massive upgrade versus a long-only allocation.

Returns, risk management and market correlation all improve.

The worst year is only -0.17% versus -23.94%.

And most significant of all is a reduction of volatility from 25.19% standard deviation to 9.66%.

This may be the lowest of low hanging fruit upgrades and we’ll grab it with glee.

So for our 7.5% commodity sleeve we’re allocating to COM ETF.’

Step Three: Add A Return Smoother

Remember a while back when we added 15% PSLDX?

Well, that created 15% real-estate space in our portfolio.

We’re going to use that wisely by adding a return smoother to our portfolio mix.

We’ll hunker down with a 15% slice of BTAL ETF.

Better known as AGF US Market Neutral Anti Beta Fund.

It provides us with a defensive market neutral position by going long “low volatility stocks” while shorting “high beta stocks”.

When caca hits the fan it’s a reliable partner in crime.

For instance, in a scenario where all stocks are down more defensive stocks might be -10% whereas high beta could be -25%.

In that scenario we’d be plus 15%!

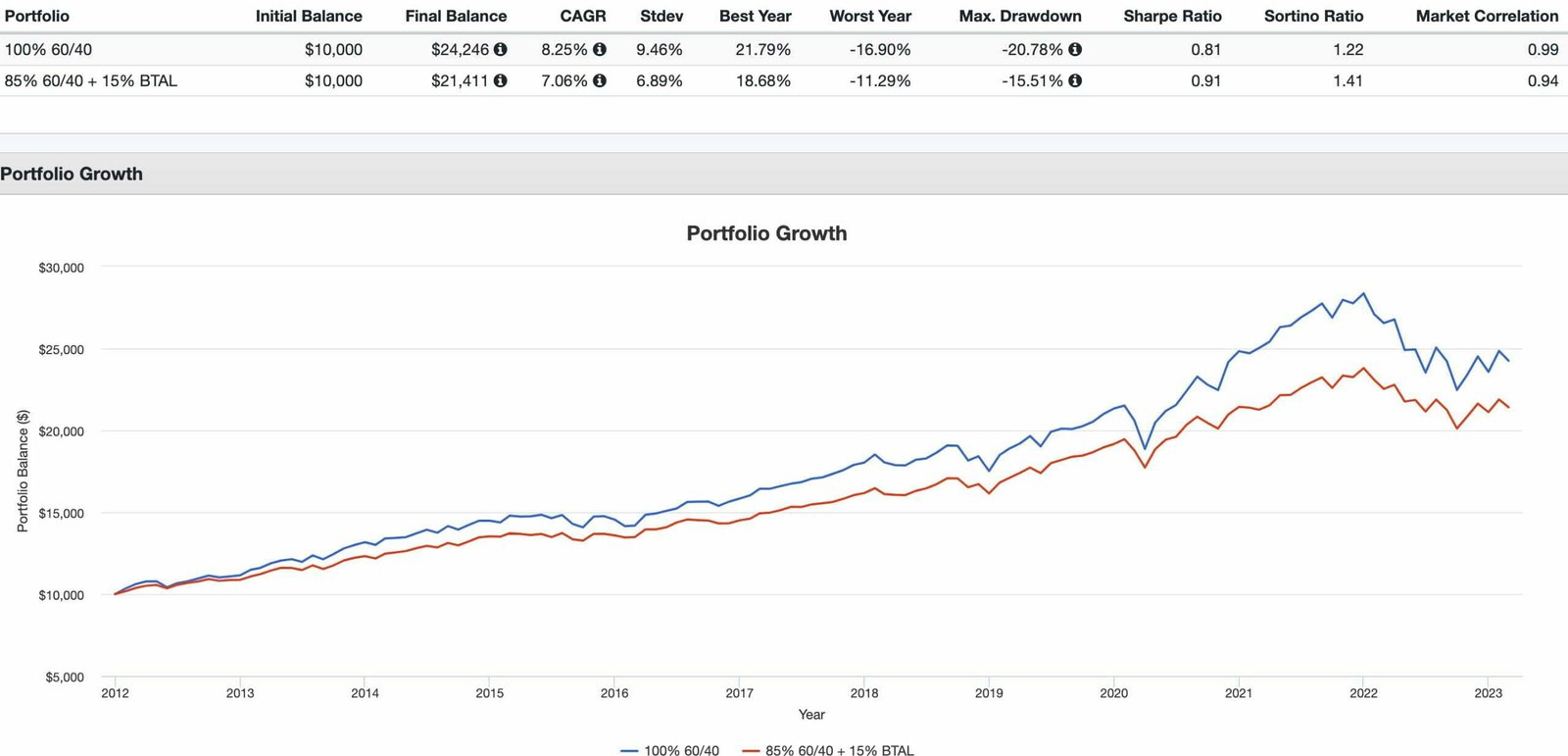

Check out how plugging a 15% slice into a 60/40 Portfolio smooths out returns.

60/40 Portfolio vs 60/40 + BTAL

With just a 15% slice of BTAL ETF we enhance our RISK by 257 basis points while also upgrading our risk adjusted rates of returns with improved SHARPE/SORTINO.

Adding this slice of BTAL ETF at 15% and just regular old Gold GLD ETF at 7.5% is how we’ll round out our portfolio.

Let’s examine things in earnest.

Enhanced Defensive Ray Dalio Portfolio

So we’re finally at the stage where we’re ready to assemble it all.

Here is the complete portfolio.

40% RSBT – Return Stacked Bonds & Managed Futures

15% PSLDX – PIMCO StocksPLUS Long Duration Fund

15% USMV – iShares MSCI USA Min Vol Factor ETF

15% BTAL – AGF US Market Neutral Anti Beta Fund

7.5% COM – Direxion Auspice Broad Commodity Strategy ETF

7.5% GLD – SPDR Gold Shares ETF

And with that we’ve got the following exposures.

30% US Stocks (15% MCW + 15% Min Vol)

55% Bonds (Long-Duration + Aggregate)

7.5% Gold

7.5% Commodities Long-Flat

40% Managed Futures

15% Anti-Beta Market Neutral

Expanded Canvas Portfolio: 155%

Let’s back-test the results to see if we’re able to achieve our mandate.

In order to do this we’ll need to use a couple of different tickers as RSBT ETF and COM ETF were not available.

Hence, we’ll use PQTIX (managed futures) and LCSIX (long-short commodities) as imperfect replacements.

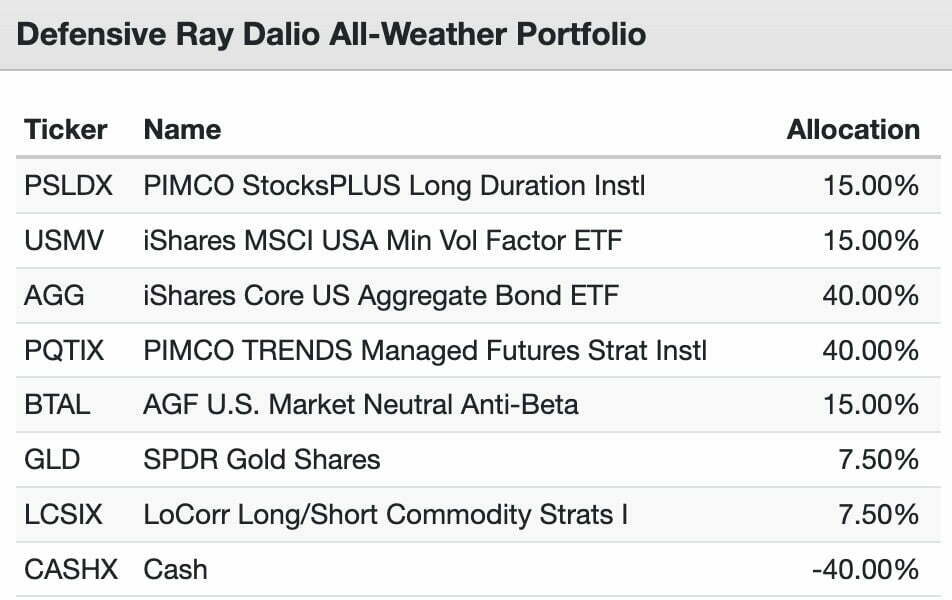

15% PSLDX – PIMCO StocksPLUS Long Duration

15% USMV – iShares MSCI USA Min Vol Factor ETF

40% AGG – iShares Core US Aggregate Bond ETF

40% PQTIX – PIMCO TRENDS Managed Futures

15% BTAL – AGF U.S. Market Neutral Anti-Beta

7.50% GLD – SPDR Gold Shares

7.50% LCSIX – LoCorr Long/Short Commodity

-40% CASHX – Cash

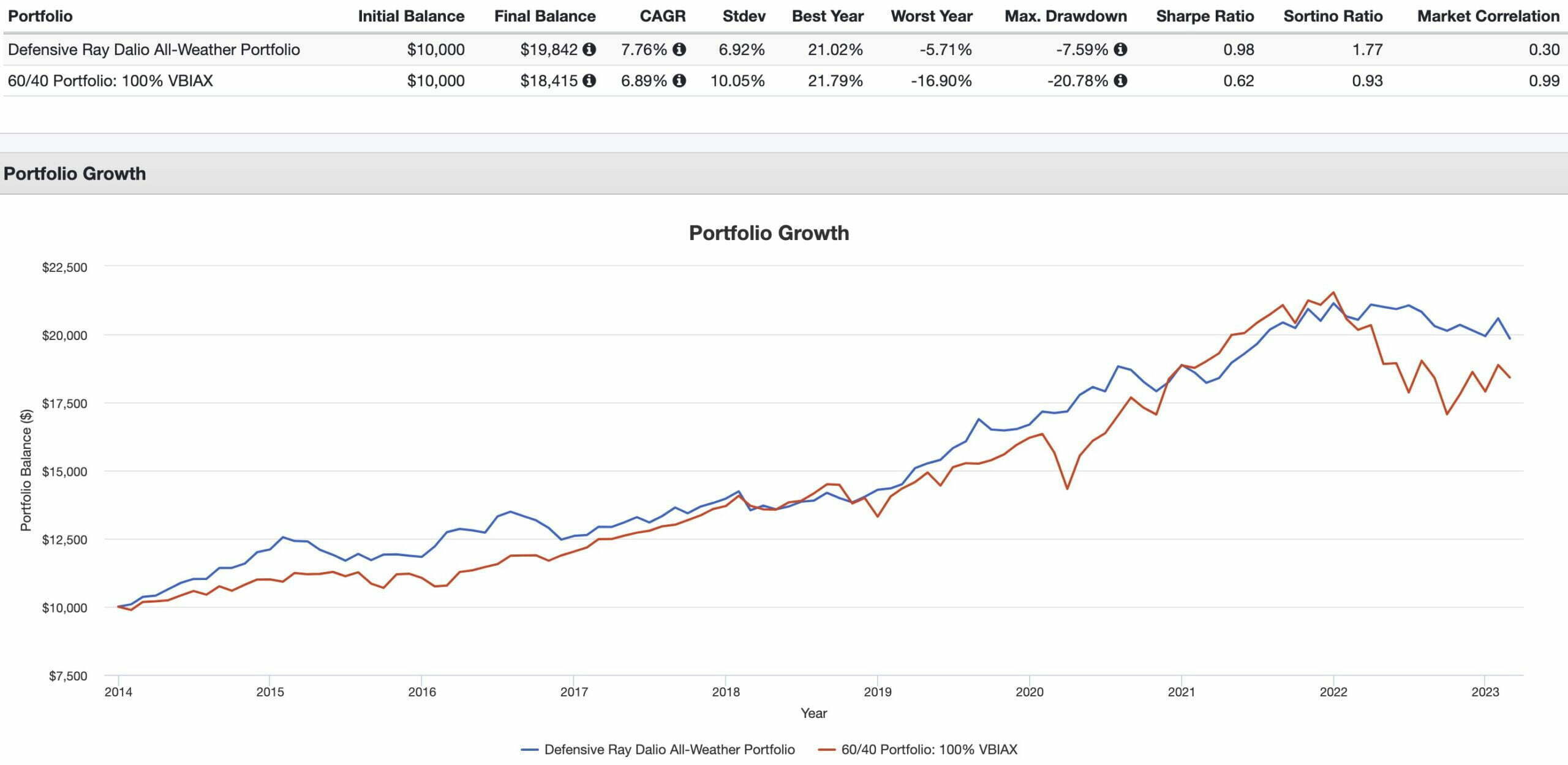

Defensive Ray Dalio All Weather Portfolio vs 60/40 Portfolio

CAGR: 7.76% vs 6.89% vs 4.59%

RISK: 6.92% vs 10.05% vs 7.73%

BEST YEAR: 21.02% vs 21.79% vs 18.30%

WORST YEAR: -5.71% vs -16.90% vs -17.53%

MAX DRAWDOWN: -7.59% vs -20.78% vs -19.84%

SHARPE RATIO: 0.98 vs 0.62 vs 0.50

SORTINO RATIO: 1.77 vs 0.93 vs 0.75

MARKET CORRELATION: 0.30 vs 0.97 vs 0.68

Mission accomplished!

We’ve managed to build the most defensive portfolio out of the three.

Our risk management is superior (6.92% vs 7.73% vs 10.05%) and we crush the 60/40 and static Ray Dalio in terms of enhanced Worst Year Performance (-5.71% vs -16.90% vs -17.53%).

When it comes to Max Drawdown, Sharpe Ratio, Sortino Ratio and Market Correlation it is a sweep across the board.

And last but certainly not least we win the CAGR race as well (7.76% vs 6.89% vs 4.59%).

We’ve built ourselves a nifty returns/risk defensive powerhouse that can defend better than the two classic portfolios whilst offering greater offensive prowess.

Nomadic Samuel Final Thoughts

Long-only asset allocation and simple solution portfolios aren’t terrible investments by any stretch of the imagination.

For patient investors committed to allocating to a 60/40 Portfolio or Ray Dalio All Weather Portfolio you’re likely miles ahead of other short-term thinking amateur investors who regularly jump in and out of investments at the worst possible times.

But if you’re a curious and open minded investor you can improve upon these portfolios by using some of the newer sophisticated investing products available at your disposal.

These allow you to expand the canvas of your portfolio, add diversifying sources of return streams with the goal of enhancing returns and better managing volatility and drawdowns.

I’ve shown you how you can create a more Defensive Ray Dalio All Weather Portfolio.

I promise you that this won’t be my last time to explore potential enhancements to the Ray Dalio All Weather Portfolio.

I’ll also continue this series with other classic portfolios.

But at this point in the article I’m more interested in what you’ve got to say.

What do you think of the classic Ray Dalio All Weather Portfolio?

Do you have an thoughts (praise or constructive criticism) on the way I’ve put together a modified defensive approach?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Love this article and the methods you used to smooth the ride and increase returns. I’ve recently become a disciple of risk parity portfolio construction and have been considering a modified All Weather Portfolio for accumulation. I know your post was focused on enhancing the AWP compared to a classic 60/40 but what are your thoughts on a leveraged AWP for someone in accumulation? Maybe there’s a balance between what you’ve created here and a 3x leveraged AWP using funds like UPRO, TMF, and UGL.

Pretty awesome. Have u heard of HGER, looks like effectively long flat commodities w nice looking backtest

I have recently discovered your site and have enjoyed browsing the portfolios. I have been establishing positions in RPAR and BLNDX over the last year and was glad to see them reviewed here. I am wondering if you see the all-weather portfolios as all-weather for all ages. I am retired and in my seventies and would be interested in your thoughts about tweaking as one gets older. Thanks for your work!

Any thoughts on how to implement this in M1Finance? A number of the funds aren’t currently available.