How do you spend your final conscious moments before you drift off to sleep?

I think most people count sheep, review their day, say affirmations/prayers or are consumed by anxiety about tomorrow.

I, on the other hand, am often thinking about how to enhance my expanded canvas portfolio.

If I shave down a bit of gold and add some more market-neutral anti-beta, will I improve the risk adjusted rate of returns of the portfolio at large?

Yeah.

Nerd alert.

It’s totally weird.

Indulging My Strange Obsessions With Asset Allocation

But I found some affinity in my madness after watching the Netflix series “The Queen’s Gambit” where the protagonist is simulating chess matches in her head prior to drifting off.

Last year I spent most of my time on a self-taught journey of discovering more about alternative investments.

Specifically, how alternative investments can enhance portfolio returns whilst better managing risk.

More importantly, I’ve been sharpening my skills finding alternative portfolio puzzle pieces that are low or negatively correlated with traditional asset classes.

In an ideal scenario you’re assembling a portfolio where enhanced risk and returns collide.

Most investors, when they become aware of the diversification benefit of alternatives, face deciding whether or not to shave down their equity or fixed income in order to create space for an alternative sleeve.

With an expanded canvas portfolio you don’t have to shave down anything.

It’s about expanding the sandbox boundaries and stretching the canvas beyond its 100% confines to create space for them in a capital efficient manner.

That’s left me pondering what exactly is “My Dream Expanded Canvas Portfolio”?

Well, folks that’s what we’re going to explore here today.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Building The Ultimate Expanded Canvas Capital Efficient Portfolio

Expanded Canvas: Portfolio Size

What exactly is an expanded canvas portfolio?

It’s a portfolio that doesn’t play by the traditional rules and boundaries of a 60/40 portfolio.

It features more strategies and asset classes than merely equities and bonds.

It’s the equivalent of an artist requiring a larger canvas to paint a more detailed picture.

It’s upgrading your tiny high definition television to a supersized 4K screen.

It’s all about being bigger and better.

The formula involves some semblance of traditional long-only asset classes (equities, bonds, real assets, gold, etc) and a mixture of alternative strategies (managed futures, long-short equity, market-neutral, arbitrage, etc).

It’s not just about dialling up sequence of return risk toys (2X to 3X equity products) and slapping them alongside leveraged bonds.

If a “Hedgefundie” inspired portfolio is your North Star you’re being disavowed from using “expanded canvas” as a way of describing your portfolio.

In the same manner that far-right and far-left fringes are excluded from both sides of the political aisle, I think it’s important to distinguish between thoughtful applications of leverage versus risk ignoramus allocations.

Sorry, Hedgefundie, it’s nothing personal but managing risk is more important when it comes to expanded canvas portfolios than adding Mount Everest sized scoops of equities and bonds to the equation.

If levering equities and bonds to the moon and back is all that tickles your fancy, please take your sequence of return risk toys and setup shop somewhere else on beach.

I’d be thrilled to have others use “Expanded Canvas Portfolios” with or without credit as I’m just an amateur hoping to spearhead awareness and kickstart product innovation, so that retail investors have all of the puzzle pieces they desire to create a unique masterpiece of a personalized portfolio.

Expanded canvas refers to the “how much” or the “size” of the portfolio.

What’s your canvas?

130%.

Gotcha.

But it fails somewhat in its ability to describe the “ingredients” or “components” of the portfolio.

In that regard, I’m most impressed with “return stacking“.

source: ReSolve Riffs on YouTube

Return Stacking: The Ingredients Of The Portfolio

Return Stacking is the creative genius of Rodrigo Gordillo and Corey Hoffstein.

When you describe portfolios utilizing thoughtful applications of leverage as “return stacking” I think it’s important to give credit to these two fine gentlemen.

Not only did they create the term but they’re building a product suite around “return stacking” and “return stacked” as their trademarked branding.

What I love about “return stacking” is that it refers specifically to the ingredients of the portfolio.

What are you stacking?

Equities, bonds, managed futures and gold.

Gotcha.

I’ve learned a lot from their research and I would highly encourage you to check out their groundbreaking paper:

“Return Stacking Strategies For Overcoming A Low Return Environment” (Invest ReSolve)

“Return Stacking: Additional Resources” (NewFound Research)

With “expanded canvas” and “return stacking” we can effortlessly discuss capital efficient portfolios without hurling around geek speak “portable beta” or “efficient core” types of terminology.

source: Comedy Bites on YouTube

Expanded Canvas and Return Stacking At The Office Water Cooler

Here’s a riveting conversation between Bob and Sally at the water cooler discussing Expanded Canvas Portfolios and Return Stacking.

Scene: Sally and Bob converge at the office water cooler.🚰

Sally: Heyya, Bob.

Bob: Hi, Sally.

Sally: Did ya watch the game last night?

Bob: No. I shared a tuna melt 🥫🧀🥪 with my cat. 😼

Sally: Oh.

Awkward 10 seconds of silence.

Sally: How’s your portfolio these days?

Bob: Great. I’m Return Stacking. 🥞

Sally: Ah, Return Stacking! How big is you Canvas?

Bob: 180%.

Sally: Whatcha Stacking?

Bob: Stocks. Bond. Managed Futures. 60% each.

Sally: Oh my!

Awkward 20 seconds of silence.

Sally: Well, I better get back to work.

Bob: Same.

Proof That Expanded Canvas Portfolios Are Better Than A 60/40 Portfolio

All of this talk about expanded canvas portfolios but does it pass the litmus test?

Can we confidently combine traditional assets and alternative in a capital efficient manner that enhances returns whilst better managing portfolio risk?

Can we send a milquetoast 60/40 portfolio to saunter off in shame with its tail in-between its legs?

Yes.

Yes, we can.

And here is the proof.

The following portfolio is NOT the most capital efficient by today’s standards (better puzzle pieces available now) but it does allow us to rewind the clock back to 2014 giving us a long-range 9 year backtest.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

60/40 Portfolio Slayer

40% PSLDX – PIMCO StocksPLUS Long Duration

30% PQTIX – PIMCO TRENDS Managed Futures Strategy

10% QLEIX – AQR Long-Short Equity

5% GLD – SPDR Gold Shares

5% BTAL – AGFiQ US Market Neutral Anti-Beta

5% ADAIX – AQR Diversified Arbitrage

5% QSPIX – AQR Style Premia Alternative

Our 60/40 Portfolio Slayer features PSLDX as the capital efficient backbone offering us 100/100 equity/fixed income exposure.

Hence, with 40% of our portfolio resources we’re able to gain 40% exposure to equities and 40% exposure to fixed income.

Now we’re able to key in on the alternative sleeve of our portfolio.

We’ve assemble an alternative motley crew of managed futures, long-short equity, gold, anti-beta market neutral, arbitrage and style premia to the mix.

This is the oddball team we’ve cobbled together to slay both the US-only and Globally diversified 60/40 portfolios.

US-Only 60/40 Portfolio

100% VBIAX – Vanguard Balanced Index Admiral Shares

Here’s the Vanguard US-only 60% equities and 40% bonds portfolio.

It’s the industry standard and it succumbs hard to home country bias.

Global 60/40 Portfolio

100% AOR – iShares Core Growth Allocation ETF

This iShares product is a more broadly diversified 60/40 portfolio all-in-one asset allocation ETF.

It has the following underlying tickers:

EQUITIES:

IVV – ISHARES CORE S&P 500 ETF

IDEV – ISHARES CORE MSCI INT DEVEL ETF

IEMG – ISHARES CORE MSCI EMERGING MARKETS

IJH – ISHARES CORE S&P MID-CAP ETF

IJR – ISHARES CORE S&P SMALL-CAP ETF

BONDS:

IUSB – ISHARES CORE TOTAL USD BOND MARKET

IAGG – ISHARES CORE INTL AGGREGATE BOND

Both VBIAX and AOR are low cost market-beta exposure ETFs that lure investors in the same way grocery stores feature cheap junk food at the checkout counters.

It’s time to slay-away!

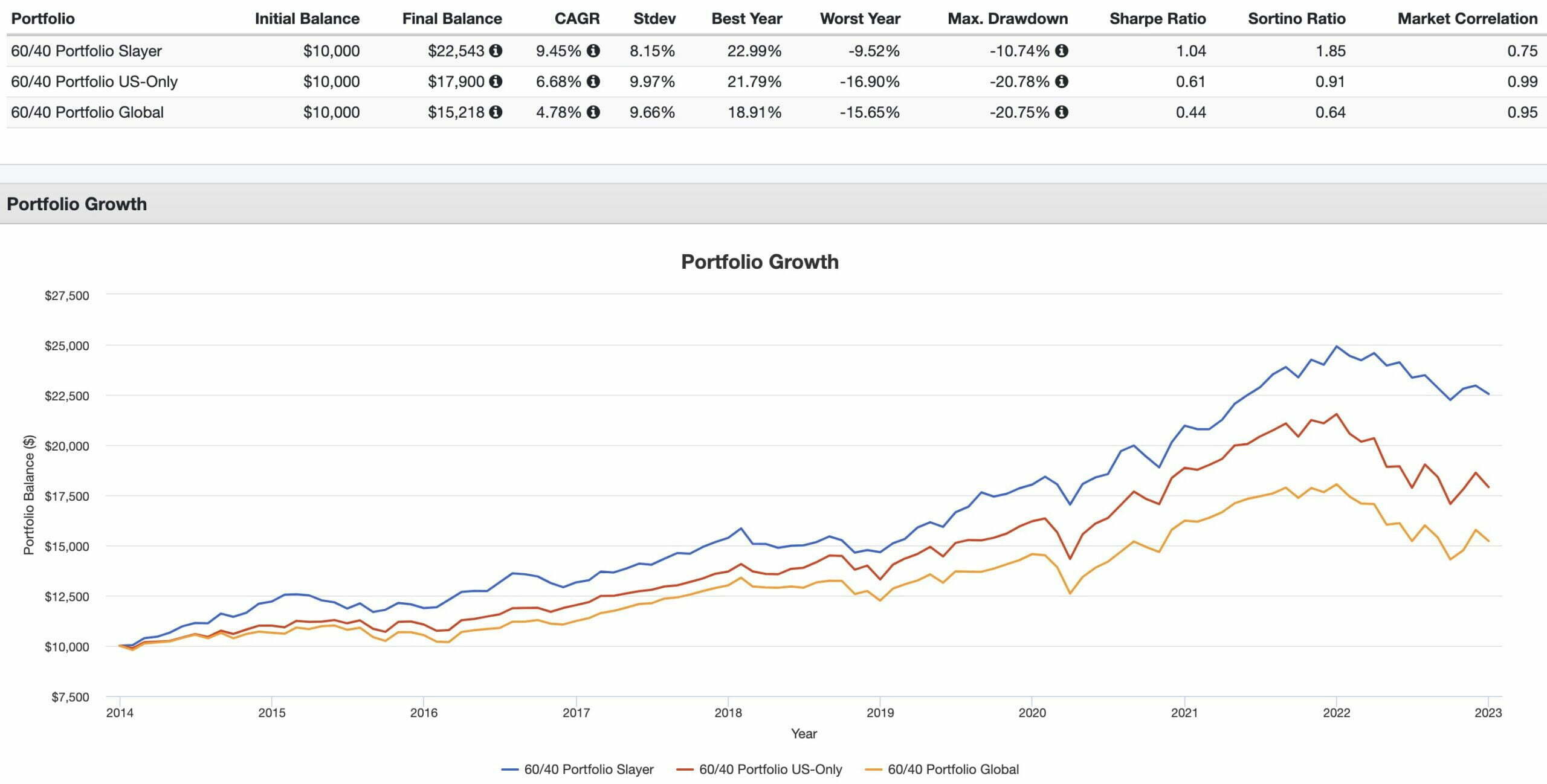

60/40 Portfolio Slayer Summary Performance vs Industry Standard 60/40 Portfolios

CAGR: Slayer: 9.45% / US: 6.68% / Global: 4.78%

RISK: Slayer: 8.15% / US: 9.97% / Global: 9.66%

BEST YEAR: Slayer: 22.99% / US: 21.79% / Global: 18.91%

WORST YEAR: Slayer: -9.52% / US: -16.90% / Global: -15.65%

MAX DRAWDOWN: Slayer: -10.74% / US: -20.78% / Global: -20.75%

SHARPE RATIO: Slayer: 1.04 / US: 0.61 / Global: 0.44

SORTINO RATIO: Slayer: 1.85 / US: 0.91 / Global: 0.64

MARKET CORRELATION: Slayer: 0.75 / US: 0.99 / Global: 0.95

Would it be a stretch to say that the 60/40 Slayer Portfolio explodes out of the gate and kicks dirt back in the faces of the two milquetoast industry standard 60/40 portfolios?

At no point does the 60/40 Slayer Portfolio fall behind or trail in terms of its performance.

And it does all of this while also better managing volatility and risk.

It’s just an across the board sweep in terms of CAGR, Stdev, Best Year, Worst Year, Max Drawdown, Sharpe Ratio, Sortino Ratio and Market Correlation.

Total domination.

I don’t know what else to say.

If you insist on compounding with a traditional 60/40 portfolio you miss out on enhanced performance from a risk meets returns standpoint.

You just flat out lose.

That’s the bottom line.

The Name Of The Game: Capital Efficiency & Correlations

The key to putting together a portfolio where returns exceed risk comes down to your ability to combine capital efficient products that have low correlations with one another.

The 60/40 Portfolio Slayer is comprised of flawed individual line items.

But when they combine together they form a regime ready, robust and resilient juggernaut.

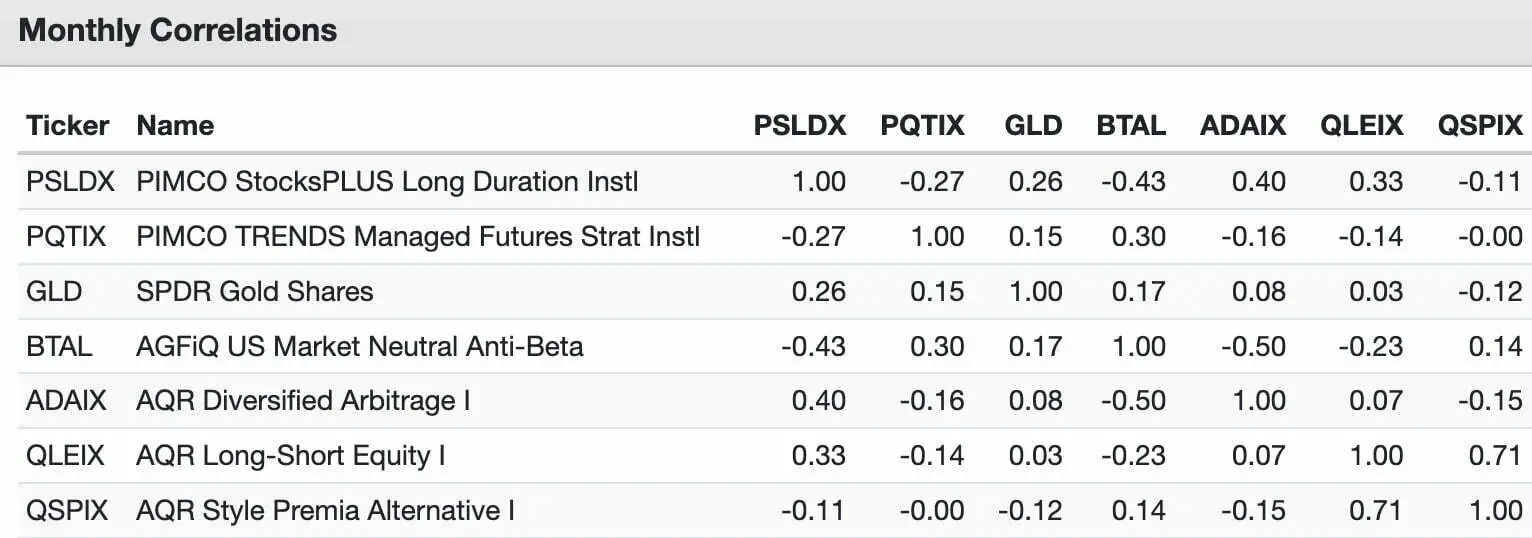

60/40 Portfolio Slayer Assets

CAGR: (1.48% to 12.02) vs 60/40 Slayer: 9.45%

RISK: (6.14% to 20.72%) vs 60/40 Slayer: 8.15%

MAX DRAWDOWN: (-12.19% to -47.45%) vs 60/40 Slayer: -10.74%

SHARPE RATIO: (0.12 to 0.64) vs 60/40 Slayer: 1.04

SORTINO RATIO: (0.16 to 1.04) vs 60/40 Slayer: 1.85

The magic or secret sauce of diversification is really just to combine as many uncorrelated asset classes together as possible.

Notice how you have individual line-items as volatile as 20.72% but you achieve an overall 8.15% standard deviation when they’re assembled.

Nothing is impressive left to its own devices from a Sharpe/Sortino standpoint (0.64 and 1.04 is the highest for long/short equity) but as an ensemble you get a 1.04 Sharpe Ratio and 1.85 Sortino Ratio.

We’ve discussed correlations quite a bit, so let’s finally take a look at the big picture.

60/40 Portfolio Slayer Correlations

Notice the low to negative correlations between the various asset classes and strategies that galvanize to form the 60/40 Portfolio Slayer.

This is where the magic is at folks.

This is how you construct the most efficient portfolio possible.

My Dream Expanded Canvas Portfolio: Ultimate Wishlist

My dream is to someday be able to assemble an expanded canvas portfolio that ticks off all the boxes.

Don’t get me wrong.

I’m close to being able to do so right now and I really appreciate all of the capital efficient building blocks that I have at my current disposal.

But I’m not quite there just yet.

So let’s explore what my dream expanded canvas portfolio would look like.

My Dream Expanded Canvas Portfolio: 200% Allocation

Here is what my dream expanded portfolio looks like from an allocation standpoint.

60% Global Equities (20% Offensive / 20% Defensive / 20% Long-Short)

60% Managed Futures (40% Trend-Following / 20% Other Strategies: Defensive, Carry, Seasonality, etc)

40% Fixed Income (30%^ Short-Term to Long-Term equal weight Treasury Ladder + 10% TIPs)

40% Alternative Other (10% Gold, 10% Arbitrage, 10% Market Neutral, 7.5% Options, 2.5% Bitcoin)

The framework of the portfolio is a 200% Expanded Canvas and I’d be return stacking Global Equities, Managed Futures, Fixed Income and Other “diversifying” Alternatives.

Products That Represent My Dream Expanded Canvas Portfolio

Here are the associated products that best represent each component of my dream portfolio.

20% Offensive Global Equities: AVGE ETF or ACWF ETF

20% Defensive Global Equities: ACWV ETF

20% Long-Short Global Equities: QLEIX Mutual Fund

40% Managed Futures Trend-Following: KMLM ETF

20% Managed Futures Multi-Strategies: CTA ETF

30% Laddered Treasuries: PLW ETF

10% TIPs: TIP ETF

10% Gold: GLD ETF

10% Arbitrage: ADAIX Mutual Fund

10% Market-Neutral: BTAL ETF

7.5% Options: TAIL ETF

2.5% Bitcoin: BITO ETF

That would be my set it and forget it line-up.

However, with what I’m able to cobble together today this is my best attempt.

Capital Efficient Expanded Canvas Portfolio

All of the products mentioned above are by and large not capital efficient ETFs or Mutual Funds.

Here is what I believe is the most capital efficient and strategically diverse expanded canvas portfolio that can be assembled today.

20% DSEEX – DoubleLine Shiller Enhanced CAPE

20% DSEUX – DoubleLine Shiller Enhanced International CAPE

40% BLNDX – Standpoint Multi-Asset Fund

5% RDMIX – Rational/ReSolve Adaptive Asset Allocation Fund

5% GDE – WisdomTree Efficient Gold Plus Equity Strategy

5% FSMSX – FS Multi-Strategy Alternatives

2.5% BTAL – AGFiQ US Market Neutral Anti-Beta Fund

1.25% PFIX – Simplify Interest Rate Hedge ETF

1.25% TAIL – Cambria Tail Risk ETF

With this arrangement I’m not able to add long-short equity, defensive equity, bitcoin and other strategies to the equation.

I’m also not able to reach a 200% Expanded Canvas Portfolio but I’ve got the following strategies conspiring in my favour.

- Capital Efficient Global Stocks and Bonds (DSEEX + DSEUX)

- Capital Efficient Global Stocks and Managed Futures (BLNDX)

- Capital Efficient US Stocks and Gold (GDE)

- Multi-Strategy Alternatives (RDMIX + FSMSX)

- Return Smoothers (BTAL + PFIX + TAIL)

Now the truth is that this is not my exact portfolio.

I’m not able to buy US Mutual Funds as a Canadian but I can purchase US-listed ETFs.

But it would look something like this if I could.

I would also find a way to include some of AQR’s alternative mutual funds but they’re out of reach for most retails investors with a 5 million minimum requirement.

Building a Dream Expanded-Canvas, Capital-Efficient Portfolio (Q&A)

1) What do you mean by an “expanded canvas” portfolio?

An expanded canvas portfolio goes beyond the 100% “space” of a traditional 60/40 by thoughtfully using capital-efficient building blocks so you can hold more (and more varied) exposures at once. The aim isn’t to lever stocks and bonds to the moon—it’s to create room for uncorrelated strategies while keeping core equity and bond exposures intact.

2) How is “return stacking” different from just using leverage?

Return stacking is about what you’re stacking—e.g., equities + bonds + managed futures + gold—so multiple independent return streams share the same dollar of capital. It’s a deliberate ingredient list, not simply turning up the volume on a single sleeve. Leverage is the tool; stacking diversified drivers is the recipe.

3) Why not just run a classic 60/40?

A plain 60/40 concentrates your fate in two risk drivers. By contrast, an expanded canvas can combine equities, duration, commodities/gold, and alternatives (trend, market-neutral, L/S equity, arbitrage, style premia) to raise Sharpe/Sortino, soften drawdowns, and reduce sequence-of-returns risk—historically outclassing 60/40 on both return and resilience.

4) What’s the proof that a stacked approach can beat 60/40?

A representative “60/40 Slayer” mix (PSLDX + managed futures + L/S equity + gold + anti-beta + arbitrage + style premia) historically showed higher CAGR, lower stdev, shallower max drawdown, and stronger Sharpe/Sortino than U.S. and global 60/40 proxies over the test window. The win comes from low/negative correlations among sleeves, not any single superstar.

5) What drives the risk/return improvement—alpha or correlations?

Correlations. Individual sleeves can look “meh” in isolation, but combined they mutually hedge each other’s weak spots. That’s the “secret sauce”: stack many distinct risk premia so the portfolio’s total variability drops while the blended return stays elevated.

6) What is your dream target mix and canvas size?

A 200% expanded canvas that stacks:

• 60% Global Equities (20% offensive, 20% defensive/min-vol, 20% L/S equity)

• 60% Managed Futures (40% trend, 20% other macro: carry/seasonality/defensive)

• 40% Fixed Income (30% laddered Treasuries, 10% TIPS)

• 40% “Other Alts” (10% gold, 10% arbitrage, 10% market-neutral, 7.5% options, 2.5% bitcoin)

7) Which products best map to that dream mix?

Illustratively: AVGE/ACWF (offensive), ACWV (defensive), QLEIX (L/S), KMLM (trend), CTA (multi-strategy MF), PLW (Treasury ladder), TIP (TIPS), GLD (gold), ADAIX (arbitrage), BTAL (market-neutral anti-beta), TAIL (options/tail-risk), BITO (bitcoin). These are conceptual placeholders for the sleeves, not endorsements.

8) What’s the most capital-efficient version you can build today?

A practical, efficiency-first lineup might look like: DSEEX + DSEUX (equities with bond overlay), BLNDX (equities + managed futures), plus RDMIX (adaptive global macro), GDE (equity + gold), FSMSX (multi-strategy alts), and return smoothers BTAL, PFIX, TAIL. It’s not 200% canvas, but it stacks multiple diversifiers without sacrificing core exposure.

9) Why include managed futures and market-neutral in size?

They’re uncorrelated, adaptive shock absorbers. Trend-following historically shines in inflationary or crisis regimes when long-only stocks/bonds struggle; market-neutral anti-beta can buffer equity beta shocks. Both improve the portfolio’s regime-readiness and smooth the ride.

10) Where do gold and a small bitcoin sleeve fit?

Gold offers a long-run diversifier with crisis and inflation hedging traits. A small, sized-right bitcoin sleeve can act as a high-octane diversifier, but it demands strict sizing and (optionally) pairing with hedges/return-smoothers to tame volatility and protect behavior.

11) What innovations do you still want to see?

More ETF-format capital-efficient pairings, e.g., long-equity plus managed futures (currently best accessed in certain mutual funds), and factor-tilted 90/60s (value/momentum/min-vol instead of market-cap). A completion ETF that efficiently stacks gold + bitcoin would also be handy.

12) What’s the first step for investors exploring this path?

Define your canvas size (how much efficiency/leverage you can truly handle), then pick stacking ingredients with low correlations: equities, bonds, managed futures, and a measured set of alts (gold, L/S, market-neutral, arbitrage, style premia). Build gradually, size prudently, and prioritize behavior you can stick with through full cycles.

Nomadic Samuel Final Thoughts

This was honestly one of the most fun posts I’ve ever written on Picture Perfect Portfolios.

It encapsulates everything I’m passionate about right now as an investor.

The good news is that new and innovative capital efficient products are rapidly coming to market.

Last year I was thrilled to see the likes of UPAR, GDE, FIG, PFAA.TO and ACAA.TO hit the marketplace.

They’re all in my expanded canvas DIY quant portfolio.

And I’m excited beyond belief to see what is coming next.

What’s currently missing in the ETF marketplace specifically?

A capital efficient long-equities plus managed futures ETF.

That’s only available as mutual funds such as BLNDX and MAFIX right now.

Also, factor thirsty investors are craving capital efficient factor focused equities and treasury combinations.

Right now you have some great funds like NTSX, NTSI and NTSE but they’re all MCW equity strategies.

Another one I’d love to see is an expanded canvas portfolio completion fund.

Something along the lines of gold and bitcoin stacked together efficiently.

Wouldn’t that be just awesome?

But for the time being I’ll be waiting patiently and building my dream expanded canvas portfolio inside of my head as I drift off to sleep.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.