Every once in a while I’ll come across a great fund that sort of flies under the radar.

For whatever reason it just doesn’t quite get the attention it deserves.

Passionate investors that I follow on Twitter will mention certain funds quite frequently that permeate my consciousness.

It creates a ripple effect where I’ll start thinking about those ones more often than I probably should be.

But that’s a good reminder for me to step back and do some of my own independent research more frequently.

With this in mind, I’d like to shine the spotlight upon a fascinating capital efficient mutual fund that combines a long US equity (50% exposure) and managed futures strategy (100% exposure).

The fund I’m referring to is none other than Abbey Capital Multi Asset Fund.

Ticker MAFIX (I), MAFAX (A) and MAFCX (C).

Unlike other expanded canvas products that are still wet behind the ears, Abbey Capital Multi Asset Fund has been compounding since 2018.

That always excites me because I have more data to play around with in terms of backtest scenarios.

Let’s check out how it has performed since inception.

Performance: Abbey Capital Multi Asset (MAFIX Mutual Fund)

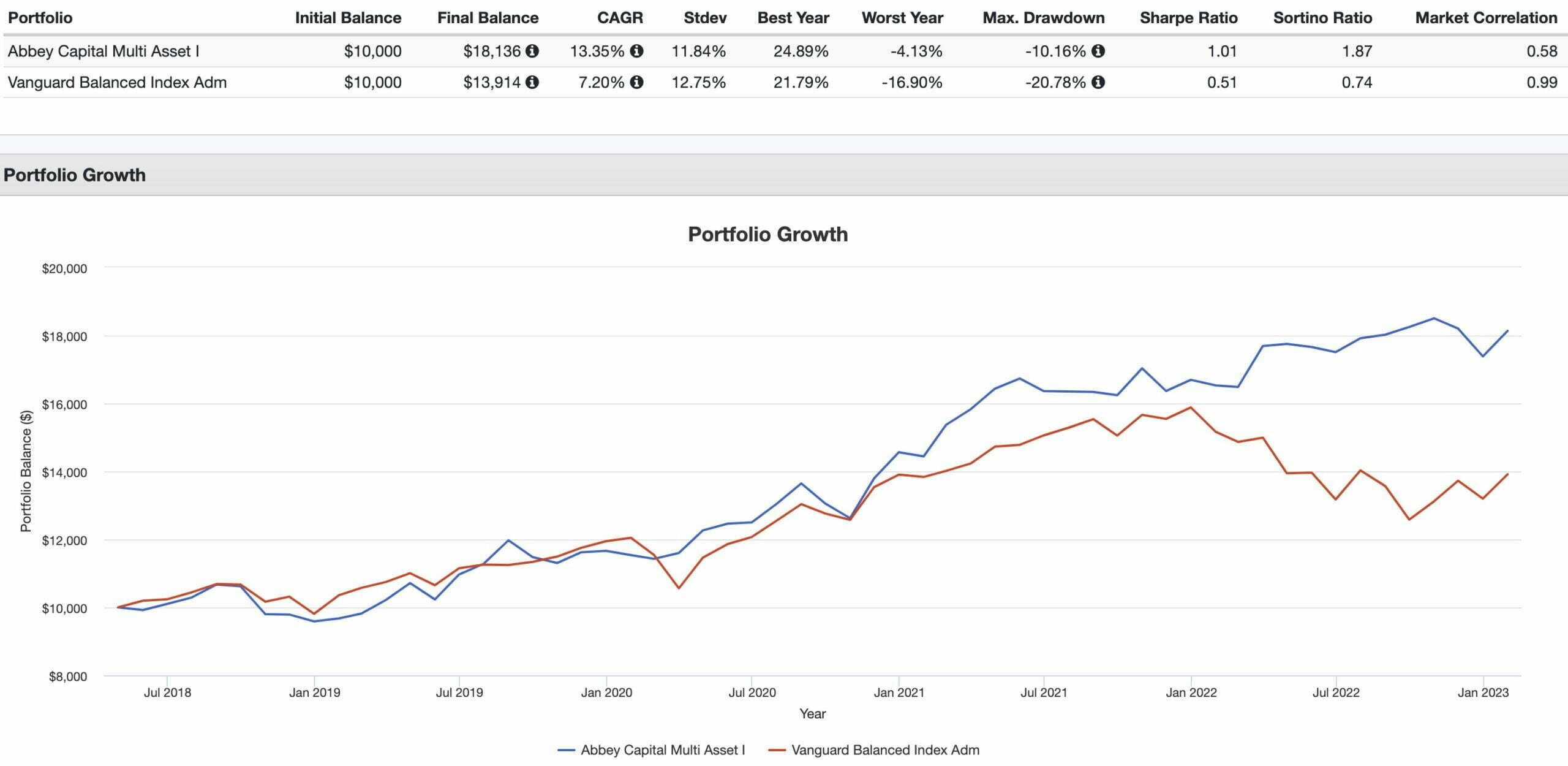

We’ll compare MAFIX (since its inception) directly with an industry standard 60/40 portfolio as best represented by VBIAX.

MAFIX vs VBIAX Performance Summary

CAGR: 13.35% vs 7.20%

RISK: 11.84% vs 12.75%

BEST YEAR: 24.89% vs 21.79%

WORST YEAR: -4.13% vs -16.90%

MAX DRAWDOWN: -10.16% vs -20.78%

SHARPE RATIO: 1.01 vs 0.51

SORTINO RATIO: 1.87 vs 0.74

MARKET CORRELATION: 0.58 vs 0.99

The Abbey Capital Multi Asset Fund has absolutely crushed a 60/40 portfolio from a returns meets risk standpoint since it was dropped into the frying pan.

Outstanding risk management with a worst year of only -4.13% versus -16.90% for the 60/40.

Its Sharpe Ratio, Sortino Ratio and overal Market Correlation are highly attractive as well.

It’s simply bonkers that a 60/40 portfolio is considered default when a more adaptive strategy (such as MAFIX) is prepared for more challenging economic regimes.

What’s fascinating for me especially is just how well the 50/100 equities/managed futures combination performs from 2018 until the end of 2021.

It already was outmuscling the 60/40.

And then 2022 reared its ugly head.

And MAFIX with its adaptive strategies didn’t skip a beat whereas the 60/40 was ravaged.

Let’s dig a little deeper under the hood.

MAFIX Fund Review | Alternative Mutual Fund: Abbey Capital Multi Asset Fund Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review and Mutual Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Abbey Capital: Managed Futures Specialists

Abbey Capital are managed futures and multi-strategy specialists based out of Dublin, Ireland!

When I noticed a few redheads in the photos on their homepage it kind of gave it away.

Who knows?

Maybe I can get a job!

I’ve at least got that going for me.

In all seriousness, they’re a firm with over 20 years of experience that now offer strategies to US investors.

Abbey Capital Multi Asset Fund Overview, Holdings and Info

The investment case for “Abbey Capital Multi Asset Fund” has been laid out succinctly by the folks over at Abbey Capital: (source: fund landing page)

“Abbey Capital Multi Asset Fund:

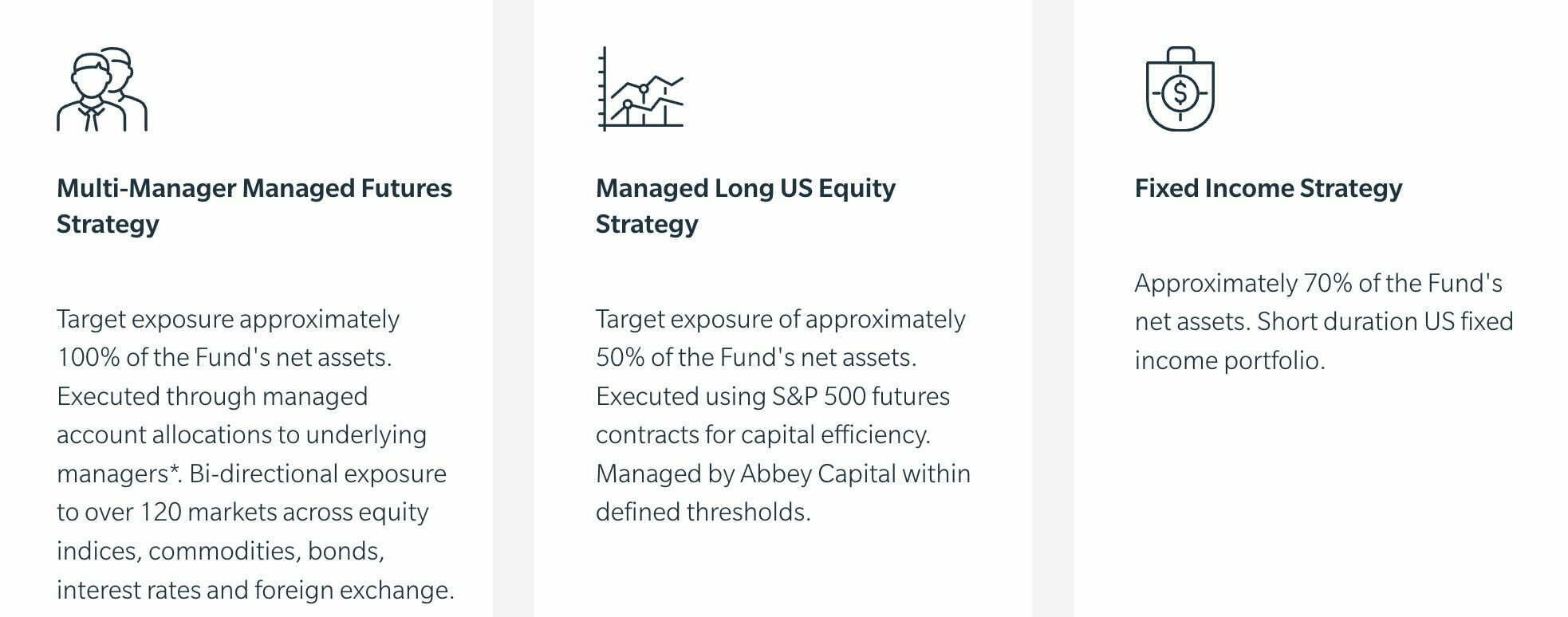

The Abbey Capital Multi Asset Fund (the “Fund”) combines an allocation to a multi-manager managed futures strategy with a managed long US equity strategy. The remaining cash is invested in a short-dated fixed income strategy.

Multi-Manager Managed Futures Strategy:

Target exposure approximately 100% of the Fund’s net assets. Executed through managed account allocations to underlying managers.

Bi-directional exposure to over 120 markets across equity indices, commodities, bonds, interest rates and foreign exchange.

Managed Long US Equity Strategy:

Target exposure of approximately 50% of the Fund’s net assets. Executed using S&P 500 futures contracts for capital efficiency. Managed by Abbey Capital within defined thresholds.

Fixed Income Strategy:

Approximately 70% of the Fund’s net assets. Short duration US fixed income portfolio.

Reasons to invest

Low Correlation:

Managed futures and equities are historically uncorrelated. Combining the two assets has the potential to deliver a higher risk-adjusted return than either of the two components on a standalone basis.

Capital efficiency:

The Fund will execute both the long US equity strategy and the managed futures strategy using futures for efficient use of cash, effectively generating leverage in the product.

Help to control behavioural biases:

Structuring this strategy in a single portfolio can help investors focus on the portfolio performance rather than the individual components.”

Abbey Capital Multi Asset Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve highlighted what I feel are the most salient parts and summarized the key points at the very bottom. (source: summary prospectus)

“Principal Investment Strategies:

The Fund seeks to achieve its investment objective by allocating its assets among a “Managed Futures” strategy, a “Long U.S. Equity” strategy and a “Fixed Income” strategy.

The Managed Futures strategy will be achieved by the Fund investing in managed futures investments, including (i) options, (ii) futures, (iii) forwards, (iv) spot contracts, or (v) swaps, including total return swaps, each of which may be tied to (i) commodities, (ii) financial indices and instruments, (iii) foreign currencies, or (iv) equity indices (the “Futures Portfolio”).

The Managed Futures strategy will be achieved by the Fund investing a portion of its assets in ACMAF Onshore Series LLC, a wholly-owned and controlled Delaware series limited liability company (the “Onshore Subsidiary”), and the Fund may invest up to 25% of its total assets in ACMAF Master Offshore Limited, a wholly-owned and controlled subsidiary of the Fund organized under the acts of the Cayman Islands (the “Cayman Subsidiary”).

The Cayman Subsidiary will in turn invest all or substantially all of its assets in segregated portfolios of ACMAF Offshore SPC (the “SPC” and, together with the Onshore Subsidiary and the Cayman Subsidiary, the “Subsidiaries”), a wholly-owned and controlled segregated portfolio company incorporated under the acts of the Cayman Islands.

The Cayman Subsidiary will serve solely as an intermediate entity through which the Fund will invest in the SPC.

The Cayman Subsidiary makes no independent investment decisions and has no 4 investment or other discretion over the Fund’s investable assets.

The Adviser may allocate assets of the SPC and the Onshore Subsidiary to multiple Managed Futures portfolios (the “Segregated Portfolios”) that include investment styles or sub-strategies such as (i) trend following, (ii) discretionary, fundamentals based investing with a focus on macroeconomic analysis, (iii) strategies that pursue both fundamental and technical trading approaches, (iv) other specialized approaches to specific or individual market sectors such as equities, interest rates, metals, agricultural and soft commodities, and (v) systematic trading strategies which incorporate technical and fundamental variables.

The Managed Futures strategy investments are designed to achieve capital appreciation in the financial and commodities futures markets.

The Adviser intends to allocate a portion of the assets of the SPC and the Onshore Subsidiary to one or more Trading Advisers to manage in percentages determined at the discretion of the Adviser.

Each Trading Adviser will manage one or more of its own Segregated Portfolios.

All commodities futures and commodities-related investments will be made in the Segregated Portfolios of the SPC.

Each current Trading Adviser is registered with the CFTC as a Commodity Trading Advisor (“CTA”).

Trading Advisers that are not registered with the SEC as investment advisers provide advice only regarding matters that do not involve securities.

The trading strategies employ several different trading styles using different research and trading methodologies, in a wide range of global financial and commodity markets operating over multiple time frames.

Trading Advisers may use discretionary approaches aimed at identifying value investments and turning points in trends.

The Fund invests in U.S. and non-U.S. markets and in developed and emerging markets.

The Long U.S. Equity strategy will be achieved by the Adviser targeting an allocation of approximately 50% of the Fund’s total assets in a portfolio of one or more U.S. equity index futures (the “Equity Portfolio”).

The Adviser will monitor the percentage of the Fund’s total assets that form the Equity Portfolio on a daily basis.

The Adviser will establish ‘rebalancing thresholds’ so that if at any time the percentage of the Fund’s total assets invested in the Equity Portfolio is above or below the target allocation of approximately 50% by a specific amount, then the Adviser will seek to rebalance the Equity Portfolio back towards its target allocation of approximately 50%.

Such rebalancing thresholds will be determined by the Adviser and may be subject to change from time to time.

As part of the Long U.S. Equity strategy, the Fund may invest in all types of equity and equity-related securities, including without limitation exchange-traded and over-the-counter common and preferred stocks, futures, warrants, options, rights, convertible securities, sponsored and unsponsored depositary receipts and shares, trust certificates, participatory notes, limited partnership interests, and shares of other investment companies (including exchanged-traded funds (“ETFs”)) and real estate investment trusts (“REITs”).

The Fund may also participate as a purchaser in initial public offerings of securities (“IPO”), a company’s first offering of stock to the public.

The Fund defines United States companies as companies (i) that are organized under the laws of the United States; (ii) whose principal trading market is in a the United States; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales, within the United States.

The Fixed Income strategy invests the Fund’s assets primarily in investment grade fixed income securities (of all durations and maturities) in order to generate interest income and capital appreciation, which may add diversification to the returns generated by the Fund’s Managed Futures and Long U.S. Equity strategies.

The level of the Fund’s assets invested in the Fixed Income Strategy will be managed and rebalanced pursuant to thresholds determined by the Adviser, which may be subject to change from time to time.

In line with these thresholds, any proceeds of maturing fixed income securities will be substantially reinvested into additional fixed income securities.

To achieve its investment objective, the Fund’s Adviser will target approximately 100% exposure of the Fund’s net assets to Managed Futures strategy investments and approximately 50% exposure of the Fund’s net assets to Long U.S. Equity strategy investments.

The Fund’s remaining net assets will be allocated to the Fixed Income strategy investments.

As much of the trading within the Fund is in futures markets, the Fund is likely to have cash balances surplus to margin requirements.

The cash portfolio will be invested on a short-term, highly liquid, basis, to meet margin calls on the futures positions.

The Fund is “non-diversified” for purposes of the Investment Company Act of 1940, as amended, (the “1940 Act”), which means that the Fund may invest in fewer securities at any one time than a diversified fund.

The Fund may not invest more than 15% of its net assets in illiquid investments.

The Fund’s investments in certain derivative instruments and its short selling activities involve the use of leverage.

Generally, the SPC invests primarily in commodity futures but it may also invest in financial futures, options, forwards, spot contracts and swap contracts, fixed income securities, pooled investment vehicles, including those that are not registered pursuant to the 1940 Act and other investments intended to serve as margin or collateral for the SPC’s derivative positions.

The Onshore Subsidiary only invests in financial futures, options, forwards, spot contracts and swap contracts, fixed income securities, pooled investment vehicles, including those that are not registered pursuant to the 1940 Act, and other investments intended to serve as margin or collateral for derivative positions.

The Fund invests in the SPC via the Cayman Subsidiary in order to gain exposure to the commodities markets within the limitations of the federal tax laws, rules and regulations that apply to regulated investment companies.

Unlike the Fund and the Onshore Subsidiary, the SPC may invest without limitation in commodity-linked derivatives.

The Fund complies with Section 8 and Section 18 of the 1940 Act, governing investment policies and capital structure and leverage, respectively, on an aggregate basis with the Subsidiaries.

The Subsidiaries also comply with Section 17 of the 1940 Act relating to affiliated transactions and custody.

In addition, to the extent applicable to the investment activities of the Subsidiaries, the Subsidiaries are subject to the same fundamental investment restrictions and will follow the same compliance policies and procedures as the Fund. Unlike the Fund, the Subsidiaries will not seek to qualify as a regulated investment company (“RIC”) under Subchapter M of Subtitle A, Chapter 1, of the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund is, directly or indirectly, the sole shareholder of each Subsidiary and does not expect shares of the Subsidiaries to be offered or sold to other investors.”

Abbey Capital Multi Asset Fund Investment Strategy Key Points

- Fund Objectives: Invests in a “Managed Futures” strategy, a “Long U.S. Equity” strategy and a “Fixed Income” strategy

- Managed Futures Strategy: Invests in options, futures, forwards, spot contracts, or swaps

- Managed Futures Universe: Commodities, financial indices and instruments, foreign currencies, or equity indices

- Managed Futures Investment Styles:

A) Trend following

B) Discretionary: Fundamentals based macro investing with a focus on macroeconomic analysis

C) Fundamental and technical trading approaches

D) Other specialized approaches

E) Systematic trading strategies - Global Universe: The Fund invests in U.S. and non-U.S. markets and in developed and emerging markets

- Long U.S. Equity Strategy: 50% of the Fund’s total assets in a portfolio of U.S. equity index futures

- Rebalancing Thresholds: Keep equity rebalanced to target of 50%

- Fixed Income Strategy: Investment grade fixed income (of all durations/maturities) to generate interest income and capital appreciation

- Target Allocation: 100% exposure to Managed Futures strategy and 50% exposure to U.S. Equity with remainder to Fixed Income

Abbey Capital Multi Asset Fund Info

Ticker: MAFIX (I), MAFAX (A), MAFCX (C)

Adjusted Expense Ratio: 1.79 (I)

AUM: 418.9 Million

Inception: 04/11/2018

Abbey Capital Multi Asset Fund Pros and Cons

Let’s move on to examine the potential pros and cons of Abbey Capital Multi Asset Fund (MAFIX).

MAFIX Pros

- Long US Equity (50%) and Managed Futures Strategy (100%) that has been an absolute winning combo in both strong and challenging markets since inception versus a 60/40 portfolio

- Multi-strategy plus multi-manager approach to its managed futures that eliminates single manager risk

- Capital efficient exposure with a 150% expanded canvas

- An adaptive strategy in managed futures that trades over 120 markets across equities, commodities, bonds, interest rates and foreign exchange

- A potential total portfolio solution or a tremendous building block that can be combined with other traditional asset classes and alternative diversifying strategies

- An all-weather or all-season alternative approach to asset allocation that flips conservative long-only asset allocation strategies upside down

- Chance to support a boutique provider versus typical ones

MAFIX Cons

- Long US-only equity means that investors will have to seek additional puzzle pieces to go global

- Management fee that is higher than what low cost indexers are used to paying

Abbey Capital Multi Asset Fund Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

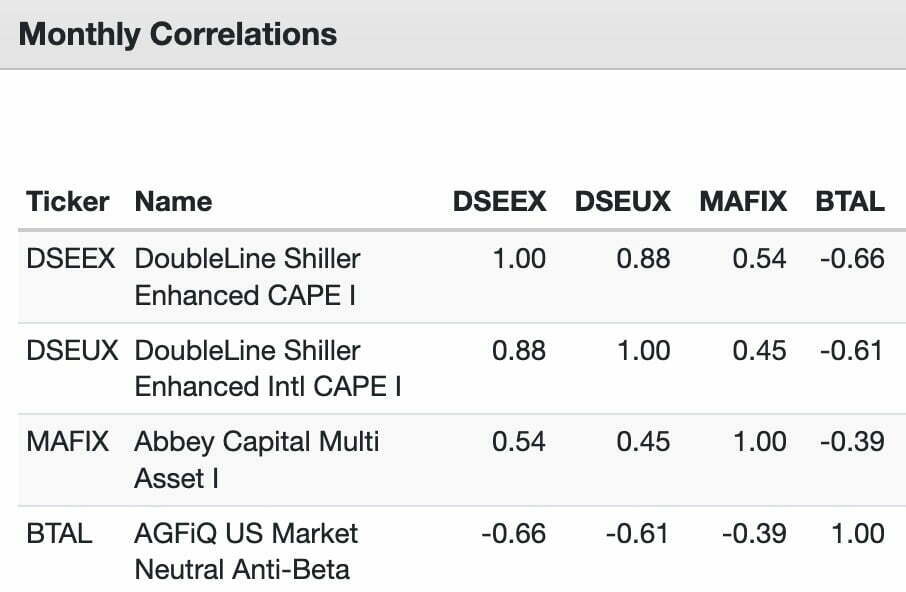

We’re able to assemble a nifty little four fund capital efficient portfolio with Abbey Capital Multi Asset Fund being the primary puzzle piece.

20% DSEEX – DoubleLine Shiller Enhanced CAPE

20% DSEUX – DoubleLine Shiller Enhanced Intl CAPE

50% MAFIX – Abbey Capital Multi Asset Fund

10% BTAL – AGF US Market Neutral Anti Beta Fund

Here we’re utilizing 100/100 long equity and bond DoubleLine Shiller Enhanced CAPE funds (both US and Europe) to efficiently increase our equity and bond positions.

We’ll plunk down MAFIX as the bedrock of this strategy to bring additional long-equity and a managed futures strategy into the equation.

Finally, we’ll diversify further by adding a market neutral anti-beta fund into the equation.

Our exposures are as follows:

65% Equities

40% Bonds

50% Managed Futures

10% Market-Neutral

Overall, we have a 165% Expanded Canvas portfolio.

Let’s see how it has performed versus a 60/40!

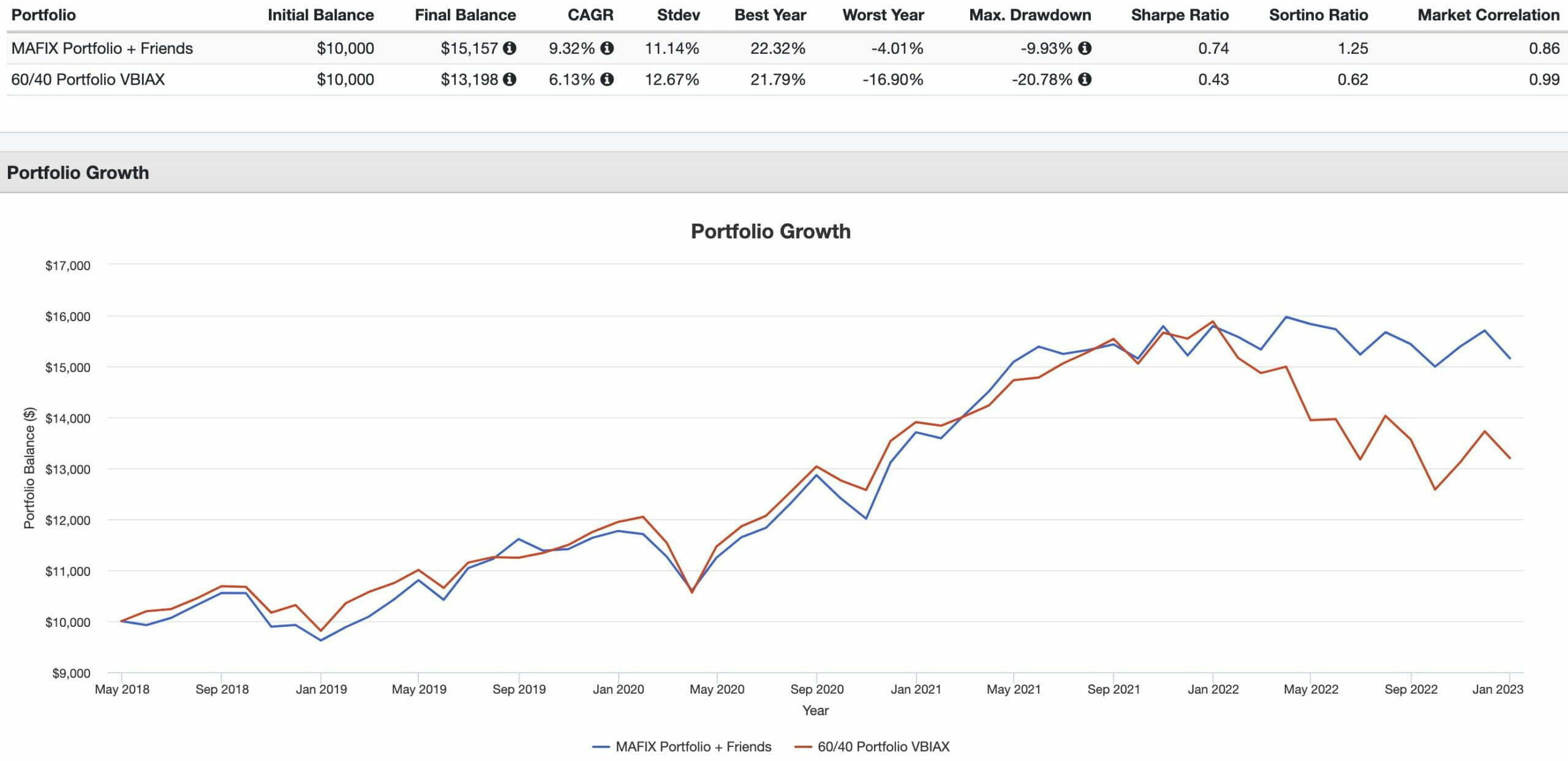

MAFIX + Friends Portfolio vs 60/40 Portfolio (VBIAX)

CAGR: 9.32% vs 6.13%

RISK: 11.14% vs 12.67%

BEST YEAR: 22.32% vs 21.79%

WORST YEAR: -4.01% vs -16.90%

MAX DRAWDOWN: -9.93% vs -20.78%

SHARPE RATIO: 0.74 vs 0.43

SORTINO RATIO: 1.25 vs 0.62

MARKET CORRELATION: 0.86 vs 0.99

Oh, it’s just a complete drubbing across the board!

We defeat the industry standard 60/40 in every way under the sun.

Diversification and capital efficiency for the win!

Here are the monthly correlations between all of the building blocks.

source: ReSolve Asset Management on YouTube

Nomadic Samuel Final Thoughts

Abbey Capital has created an incredible multi-strategy fund for investors to seriously consider.

I’ll take an expanded canvas long-equity strategy handcuffed to managed futures over a 60/40 portfolio any day, week, month or year!

The strategy has proven to be a winning formula since it was launched back in 2018.

Unfortunately, I’m unable to purchase US Mutual Funds as a Canadian!

Hence, I’ll have to wait patiently for an ETF to hopefully be developed sometime in the future offering that specific combination.

Anyhow, at this point it the review I’m interested in hearing from you!

What do you think of Abbey Capital Multi Asset Fund?

Is it on your radar?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Another MAFIX con is I couldn’t find a place that will allow me to buy it with less than a million dollar inital investment. I think etrade.com was finally a place I found that let you, but then you have to pay fees to them for investing in mutual funds so I ended up not putting in money into it. The have other versions of it with higher fees and lower minimum, but I couldn’t find a good place to buy it and contacting the company that runs the fund was actually not helpful at all. You’d think they’d be able to direct me where to get it. I additionally heard about MAFIX from the guy that runs BLNDX because their strategy is very close to the same (with only $25k minimum and I think it was $500 minimum at my broker), and they recommend MAFIX if you wanted it to diversify away from all managed by one company.