I find many amateur investors are gung-ho about pursuing strategies offering potential excess returns, but are shortsighted when it comes to risk management. They’ll dial things up with leverage to the moon and back relying on past correlations to remain the same in the future. It’s refreshing to hear from those who take portfolio construction a bit more seriously from a risk management perspective. Our guest today does just that. He’s assembled an all weather portfolio that utilizes capital efficiency in a multi-strategy approach that attempts to cover all of the bases. With this in mind, let’s turn things over to Jack!

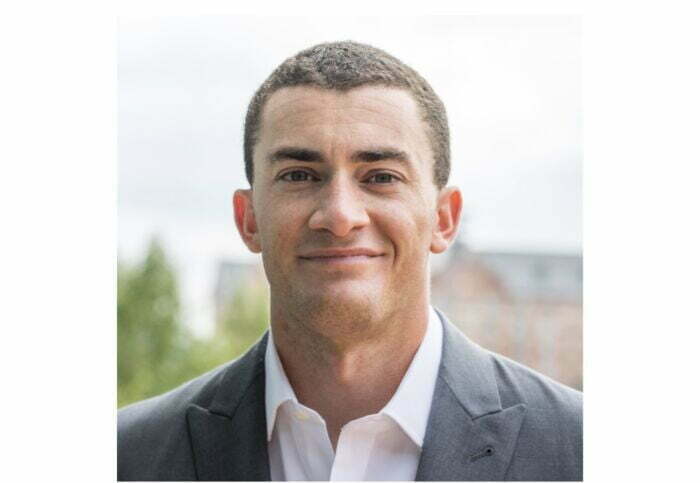

Meet Jack Burns: “Top Of Mind” on Substack

I grew up in New Milford, CT where my Mom routinely dropped my brother and I off in the town library and left us to our own devices. In high school I came across Jack Bogle’s book Common Sense on Mutual Funds and have been fascinated by investing ever since. I went to college at the U.S. Naval Academy and afterwards served seven years as an officer in the Marines, deploying twice. I left active duty in 2021 and I’m currently wrapping up my MBA studies at Georgetown University where I’ll graduate in May 2023. I love playing sports and I follow the markets closely.

How I Invest with Jack Burns: Capital Efficient All Weather Portfolio Strategy

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

I Was Incredibly Lucky To Learn About Investing From Legends

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

I was incredibly lucky to learn about investing from legends, and even luckier to have encountered them in the order in which I did. Coming across Jack Bogle first helped me build a strong foundation, and I encountered the others in roughly the order in which they’re listed below, along with my main takeaways from them.

Jack Bogle:

-Keep investing simple (index) and keep fees low (they erode returns).

Ray Dalio<span style=”font-weight: 400;”>:

-Asset prices reflect expectations of the future. Cash flows for assets and their discount rates are mostly determined by economic activity (growth) and the pricing of that activity (inflation).

-Understand how and why different assets perform the way they do in environments of rising/falling growth and rising/falling inflation. A well-diversified portfolio should be balanced based on the relationships of different assets to their environmental drivers.

And in no particular order……

Meb Faber, Eric Crittenden, Corey Hoffstein, Wes Gray, the Resolve Asset Management crew:

-Use your capital efficiently to diversify more effectively.

-Break away from market-cap weighting, valuation matters.

-Trend following strategies have been consistent and persistent across time and asset classes because of human bias.

The principles I’ve taken from these investors serve as the foundation of my investing philosophy. I’ve evolved from a pure Boglehead investor to one that embraces other core concepts in a way that makes my portfolio more durable.

My view on portfolio construction is simple – stocks are the engine of returns over the long run (20+ years), but they are prone to wealth destroying drawdowns driven by long term debt cycles, human behavior, and inflation – so I need to diversify against that. Assets and strategies that are as volatile as stocks but with low, no, or negative correlation to stocks are the best diversifiers. Ideally these assets also have a resume of performing well during periods of high/rising inflation or during negative growth shocks. Importantly, don’t get too fancy. Fancy is expensive.

I recommend the following books:

Common Sense on Mutual Funds – Jack Bogle

Risk Parity: How to Invest for All Market Environments – Alex Shahidi

DIY Financial Advisor – Wes Gray

Investing Amid Low Expected Returns – Antti Ilmanen

The Psychology of Money – Morgan Housel

Building A More Robust Portfolio: Lessons Learned From Reading & Podcasts

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I began investing in a meaningful way in 2011. I only invested in VOO for my first eight years investing. What a run it was and how lucky was I? But I was fascinated by markets and had a sinking feeling that returns couldn’t be this good, all the time, year after year. I began reading about Ray Dalio and the concept of Risk Parity in early 2018. Around that time I also fell deep down the podcast rabbit hole and haven’t looked back.

In absence of personal experience in turbulent markets, I relied on the lessons I learned from reading and podcasts to build a more robust portfolio over time. The 2020 COVID sell-off was my first time living through a real panic in the markets. It was a short lived but meaningful experience because the diversifying assets I had allocated to and read about worked as advertised. The inflationary shock of last year was the next ‘real’ experience that further reinforced the necessity for truly diversifying assets and strategies.

Beyond the minutiae of investing, my Mom always encouraged me and my siblings to be diligent savers and to live within our means. This, more than anything in this post, is what’s important.

Read Broadly + Get Engaged With Finance Twitter

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

It would be a quick conversation – read broadly and get engaged with finance Twitter.

Clear Investing Goal: Outperform Global Equities With Less Risk Over Time

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

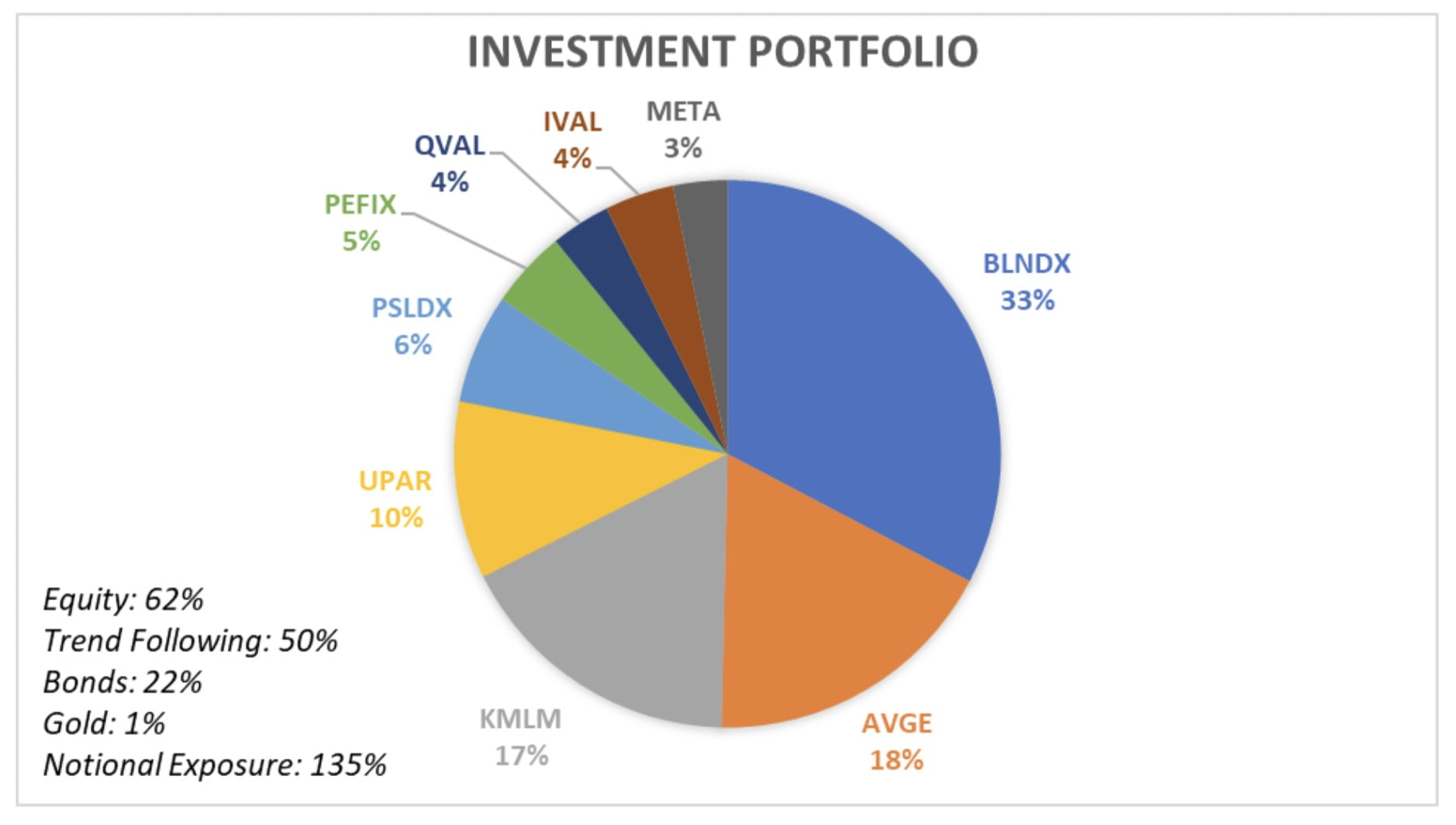

Here it is.

Portfolio construction is about combining uncorrelated assets (and strategies) that are uniquely biased to perform well during periods of high/low growth and high/low inflation – envision the Bridgewater 4-quadrant model.

Since I have a very long time horizon I want to buy and hold an equity biased portfolio tilted towards the value factor. From my research, trend-following is the best diversifying strategy to pair with equities. It has low-to-no correlation to equities, strong absolute performance, and has historically done well during inflationary periods. So I added trend alongside the equities. That’s pretty much it. I have some more commentary below discussing my rationale for the particular funds. The portfolio is capital efficient, reasonably priced relative to the notional exposure, and globally diversified. I’m sure it could be better, and I know it could be worse. It works for me.

Lastly, I also want to invest in a way that doesn’t destroy me on taxes, so BLNDX, PSLDX, and PEFIX are in tax-advantaged accounts.

BLNDX: Global equities + Trend following for ~150% notional exposure. This is the combination of an asset class and a strategy that I’m most convinced of for the long run. The fund has worked exactly as you’d expect since its inception. I may have listened to every Eric Crittenden podcast or piece of content out there. If I had to give all my money to one manager it would be him (I’ve thought about it). The fund emphasizes simplicity, durability, global diversification, and is capital efficient. Exactly what I’m looking for.

AVGE: Global equities with a value tilt. I wanted a one stop shop for global equity exposure, ideally tilted to value. I was going to use different Avantis funds to piece this together myself, but when this fund came out last year it was what I was looking for.

KMLM: Simple, volatile, pure price trend following. Has performed exactly as expected since inception. Pairing this alongside AVGE in roughly equal proportion cleanly ~replicates the return profile of BLNDX which is what I’m looking to create.

UPAR: Risk Parity. This fund provides 168% notional exposure to stocks and bonds with equal risk contribution. It’s thoughtfully constructed, capital efficient, and I believe it will outperform equities over time as a standalone investment while also diversifying the whole portfolio.

QVAL & IVAL: Concentrated, global, cheap, high quality value stocks. Alpha Architect is my favorite ETF shop and I wanted to have skin in the game with them.

PSLDX & PEFIX: Stocks (U.S & EM) + Bonds. PIMCO is a pioneer of capital efficient products for retail investors. They have a long history of performance. I’m mostly invested in these funds for the leverage they provide and the fair pricing relative to the notional exposure (200%). Last year was an absolute bloodbath for PSLDX, it happens.

META: I follow the market closely and I love investing, so when I see things that I think are obviously incorrect I try to put a bet in. I generally limit these bets to one at a time and to ~1-2% of the portfolio at entry to limit my downside. Something obviously incorrect happened last year when it became fashionable for everyone to dunk on Mark Zuckerberg. In my opinion he’s closer to being a genius than the idiot that everyone was making him out to be. For a pretty extended period META traded like deep value trash, getting down to $90 at one point from $336 at the beginning of the year, all while the core business kept printing cash. Anecdotally, boomers are addicted to Facebook where they get mad about politics and fall into conspiracy theories, 20-40 year olds are addicted to Instagram so they can obsess over the ‘perfect lives’ of people they’ve never met, and the whole world uses WhatsApp. It’s still a great advertising platform. I don’t see any of this changing anytime soon, and I figure that politicians will continue distrusting TikTok. I bought META at $100 and I reupped at $120. I’ve done a bit better than 2x my investment so far. I’ll continue monitoring performance, but I think the wind is at Zuck’s back.

In conclusion, I expect this portfolio to exceed the performance of global equities with less risk over time. The asset class/strategic exposure I have now – ~60% stocks, ~50% trend, ~20% bonds – is roughly where I want to be long term and I’ll keep adding cash to my existing positions over time.

I’m Not Afraid To Invest Differently: I’ll Adapt As The Evidence Presents Itself

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

Psychology, primarily. I’m not afraid to invest differently. There’s no skill involved outside of the small amounts I’m putting to work in bets on individual positions.

I’m convinced that combining equities + trend following is the way to invest, but I’ll continue learning and adapt as the evidence presents itself.

VT To Tone It Down / Hedgefundie To Ramp It Up

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

I could probably tone things down by putting all my money outside of the allocations to BLNDX and KMLM into VT. It would be less expensive and more consolidated, but inferior. I enjoy the fact that I have skin in the game with investors that I admire (Wes Gray, Alex Shahidi, PIMCO). Even simpler would be to put all my money into BLNDX.

The one portfolio I’ve always kept track of is Hedgefundie’s excellent adventure. I think I could juice my portfolio using some of the popular leveraged ETFs, and I have used them to put bets on in the past, but I don’t trust them and wouldn’t ever use them as real allocations.

Commitment To The Process = Investing Success

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

I feel confident in my discipline and ability to stick with a plan, even when it’s not what ‘everyone else’ is doing. Over time it’s this commitment to the process that leads to investing success.

On weaknesses, I’m a pretty skeptical person and I think this leads me to over-discount certain ideas at times. There’s also so much more for me to learn.

Embracing Fringe Beliefs: Trend Following Approach

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I believe in and invest in trend following which is a fairly fringe belief. If I recall correctly, Meb Faber put out a Twitter poll asking about trend allocations and the results were very low (even from his audience).

I also think many (most?) investors believe that gold or commodities don’t deserve a meaningful place in a portfolio. I strongly disagree with that. They provide great diversification benefits, are biased to perform well during inflationary periods, and have had strong absolute performance throughout history, 4.4% annualized since 1870. Trend following commodities using a fund like COM would be a great allocation for most 60/40 type investors.

Becoming More Aware Of The Two Certainties In Life: Death & Taxes

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I’m focused on learning more about taxes and estate planning. They have a huge impact on investing and financial planning broadly. Death and taxes are the only certainties in life, so it makes sense to me to be aware of both.

What Makes Me Cringe: Overly Complex + Expensive + No Tether To Value

What would be the ultimate anti-Jack Burns portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Portfolios that are overly complex, expensive, or have no tether to value make me cringe. There are many investments that check these boxes that have gained popularity recently. I think that most of the flows into these funds are driven by behavioral hype cycles and they’ll ultimately be fleeting.

While people love to dunk on the 60-40, it’s simple and cheap to implement, even though it’s not the portfolio for me, it checks two important boxes.

Connect With Jack Burns

I’m on Twitter @jack_burns25

LinkedIn: https://www.linkedin.com/in/jack-burns025/

and I also post on Substack at Top of Mind, twice a week.

Nomadic Samuel Final Thoughts

I want to personally thank Jack for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.