When it comes to investing, surviving is all that matters.

For whatever reason, alternative investment strategies are not given as much leash to thrive as more mainstream funds.

It’s a strange double standard.

They’ll sweep under the rug a lost decade for US Equities (2000s) but skewer alternatives (2010s) when they’re relatively underperforming.

However, we’re in for a real treat today because we’ll be shining the spotlight on a long-short equity fund that’s been in existence since the late 90s.

Not only has it survived; it’s thrived!

It’s none other than BPLSX Mutual Fund.

It’s better known as Boston Partners Long/Short Equity Fund.

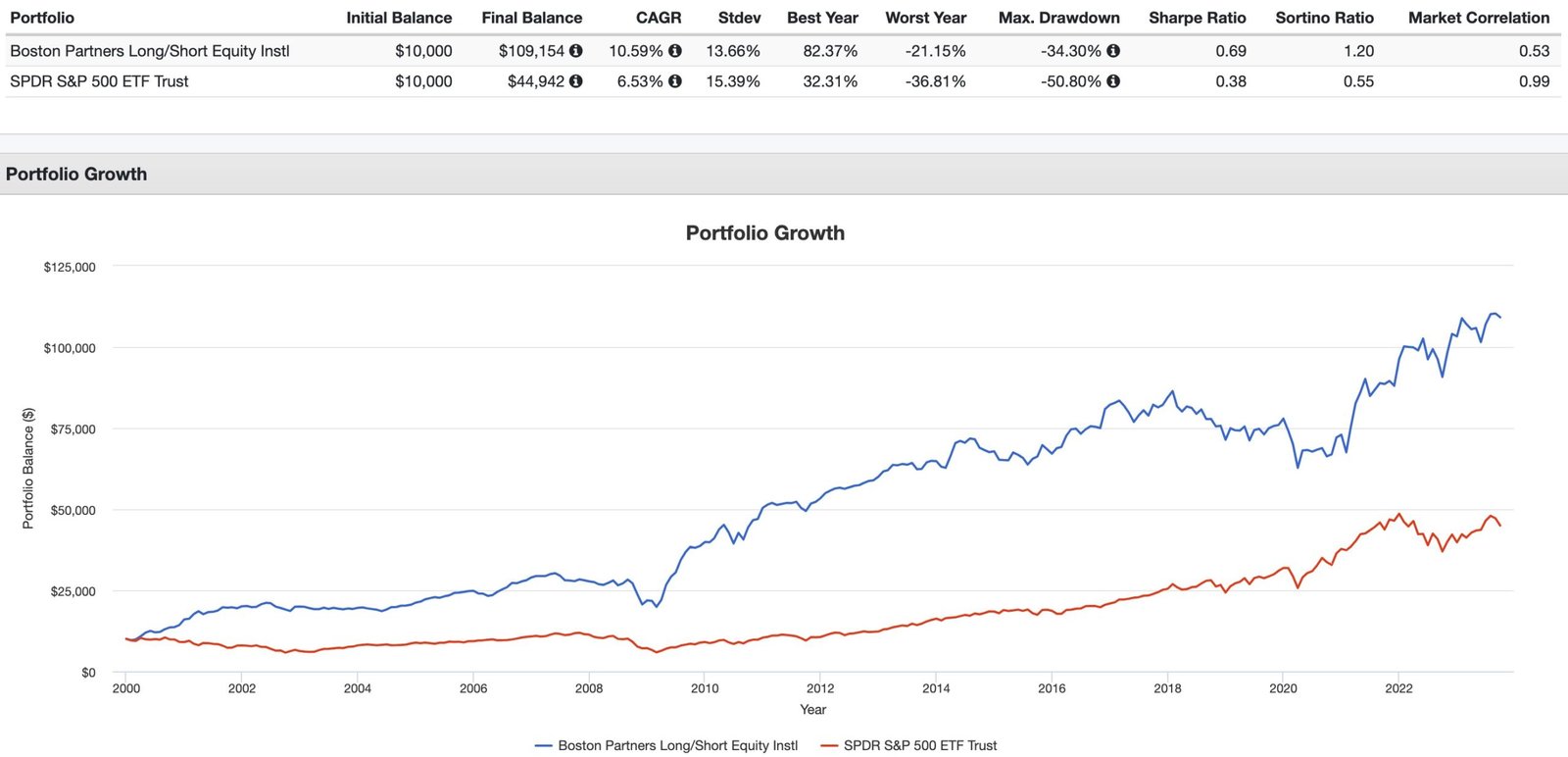

When you compare it head to head with the S&P 500 it has accomplished the following this century:

- Higher Returns

- Higher Risk Adjusted Returns.

- Superior Risk Management.

- Sortino Ratio that puts SPY to shame.

CAGR: 10.59% vs 6.53%

Stdev: 13.66% vs 15.39%

Max DD: -34.30% vs -50.80%

Sharpe Ratio: 0.69 vs 0.38

Sortino Ratio: 1.20 vs 0.55

Market Correlation: 0.53 vs 0.99

It ticks off all the criteria you’d want from a long-short equity mandate over a long enough time horizon.

Without further ado, let’s turn things over to Boston Partners to find out more!

Meet Boston Partners

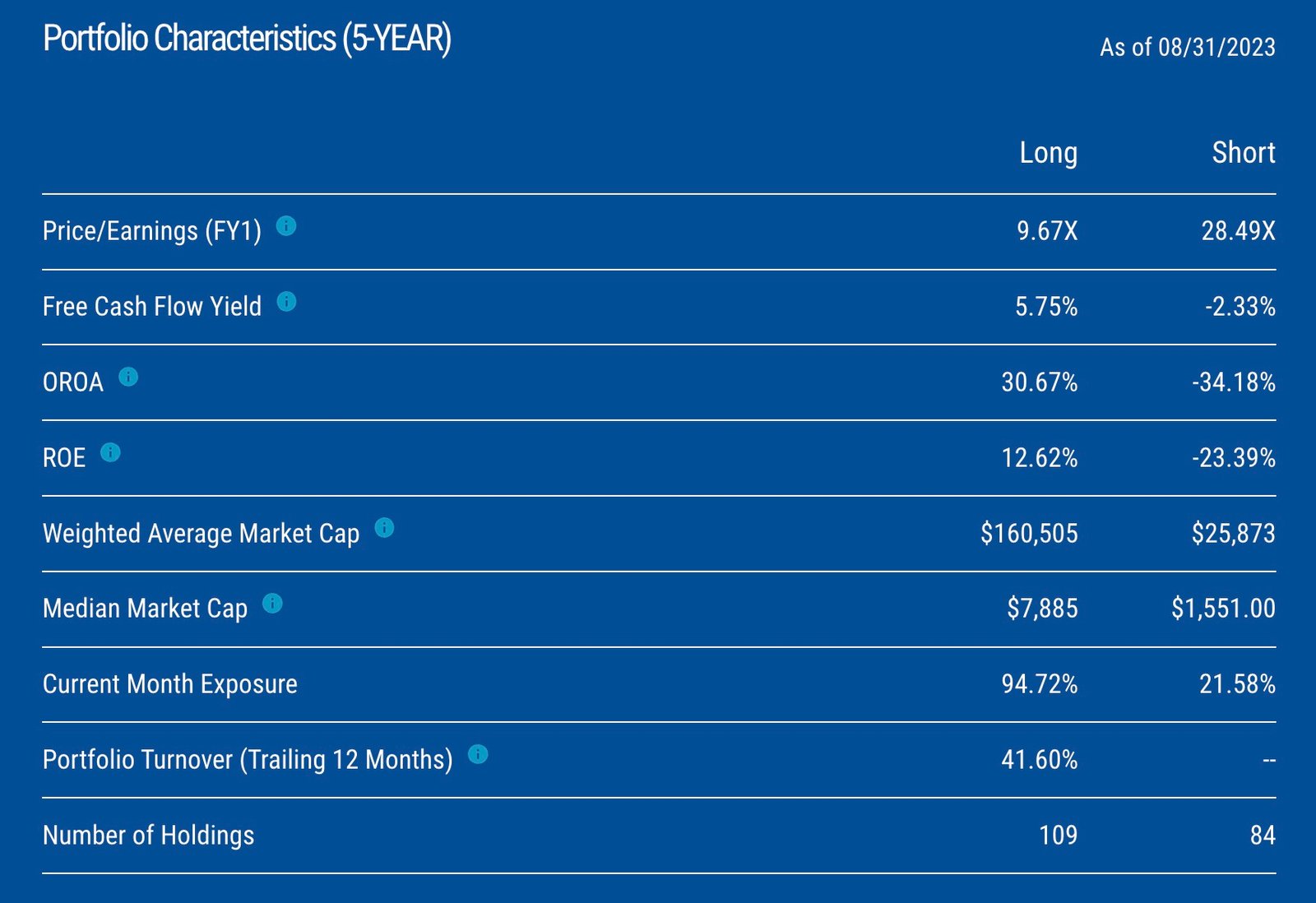

Boston Partners Long/Short Equity Fund (Ticker: BPLSX) is a value focused long/short fund with a bias towards smaller underfollowed companies. Our long portfolio is fully invested while our short exposure is variable depending on the number of short opportunities available.

Given the historic valuation spread between “Growth” and “Value” investment styles over the past 15 years, coupled with the global rise in interest rates and the beginning of quantitative tightening, we believe our fund is ideally positioned for the years ahead.

Reviewing The Strategy Behind BPLSX Mutual Fund (Boston Partners Long/Short Equity Fund)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of BPLSX Mutual Fund?

For those who aren’t necessarily familiar with a “‘long-short equity” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

It is best to think of long/short equity as two different funds rolled up into one portfolio. The two funds include a long only equity portfolio that remains fully invested and, in our case, a variable short equity portfolio whose market exposure varies depending on the number of attractive short candidates we can find.

Our long/short investment philosophy is grounded in certain “fundamental truths” to investing, that have worked over meaningful periods of time and in a variety of market environments, including:

- Valuation – low valuation stocks outperform high valuation stocks.

- Momentum – stocks with positive business momentum, e.g., rising earnings estimates, outperform stocks with negative business momentum.

- Fundamentals – stocks with strong fundaments, e.g., high sustainable returns on invested capital, outperform companies with weak fundamentals.

We invest our long portfolio in companies meeting these fundamental truths or “three circles” criteria.

Our short portfolio invests in extreme overvalued situations where there is at least 50% downside to what we think is fair value. The short portfolio is comprised of three types of shorts:

- Concept stocks – no business today, the company is simply selling a concept.

- Melting ice cubes – companies with deteriorating fundamentals that are ceding market share to industry disruptors.

- Poor/average business experiencing a transient spike in profitability – companies with temporary increases in profits that we view as unsustainable.

We do not short companies that are likely to earn above their cost of capital over time as they will likely be long-run value creators.

Unique Features Of Boston Partners Long/Short Equity Fund BPLSX

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

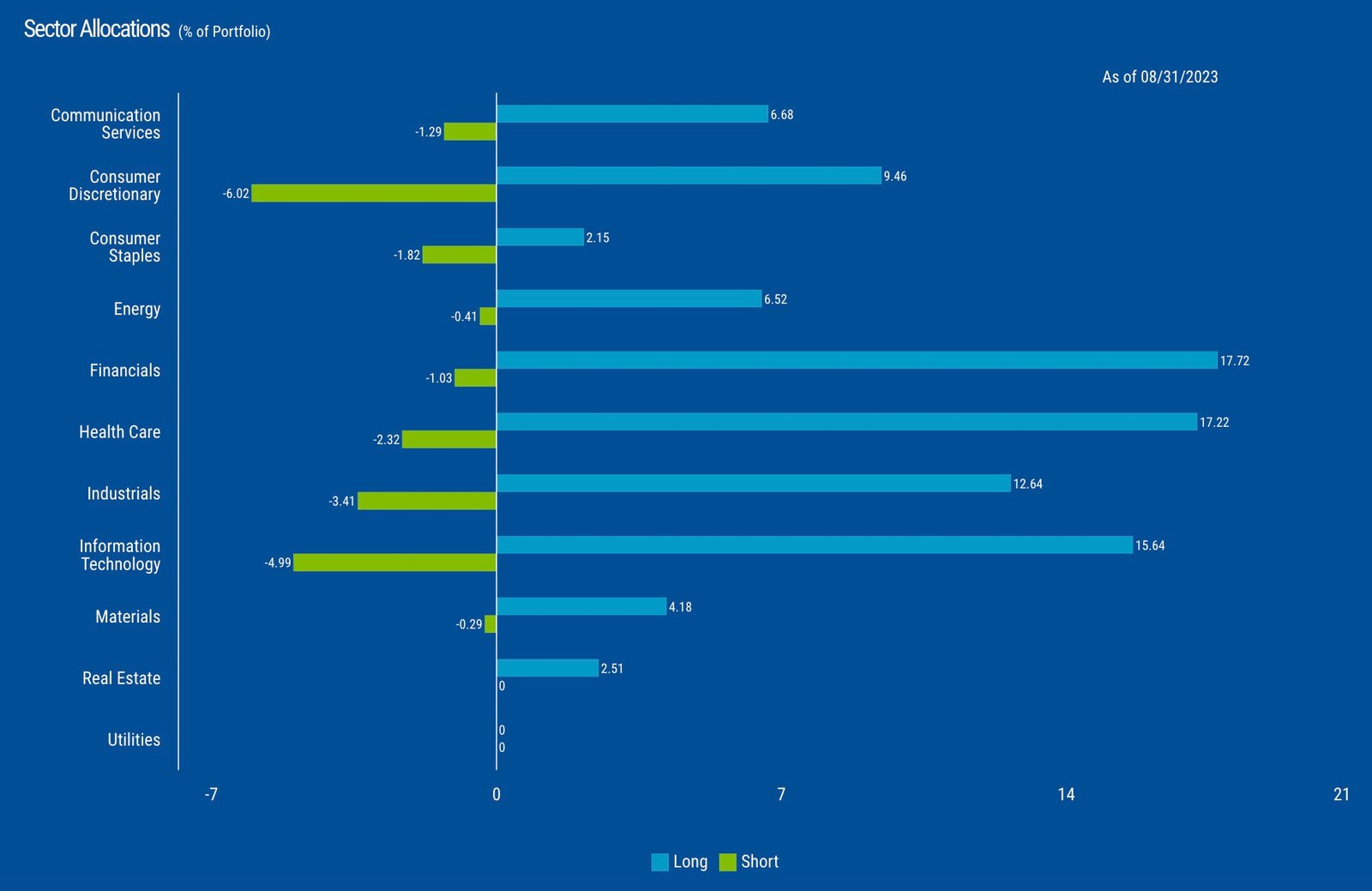

Our fund is an active, value focused, long/short investment vehicle designed to outperform the US equity market (S&P 500) through a full market cycle, all while maintaining lower levels of volatility.

A proprietary quantitative system lies at the core of our investment process and helps us selectively narrow down the investment universe for both our long and short positions. Our quantitative model ranks all publicly traded stocks across >25 factors encompassing valuation, momentum, and business fundamental characteristics.

A rigorous fundamental research process is layered onto our quantitative system to construct a diversified portfolio capturing our targeted investment criteria. On the long side, we strategically invest in “top ranking” companies that exhibit a rare combination of value, quality, and positive business momentum. Conversely, our short positions target “poor ranking” companies with flawed business models, questionable accounting practices, or unproven business concepts. Typically, our long portfolio ranges from 90-100% invested while our short book ranges from 10-70% resulting in a range for gross exposure of 100%-170%.

What Sets BPLSX Mutual Fund Apart From Other Alternative Funds?

How does your fund set itself apart from other “long-short equity” funds being offered in the ETF marketplace? What makes it unique?

We are a value focused long/short fund with no market capitalization or sector constraints. This grants us the freedom to explore thousands of opportunities across the entire equity market. Throughout our fund’s history, we have implemented fund closures during different periods to ensure that we maintain a manageable and nimble fund size. This approach enables us to invest in small to micro-cap companies for both long and short positions, which are often overlooked by larger funds due to liquidity constraints. By limiting our fund’s size, we can actively trade in these smaller names that provide unique investment potential.

We also invest only in individual securities. We do not invest in ETFs. This is true in both our long and short portfolios. Each position has its own investment thesis and target price. We do not short securities to provide a hedge against our long portfolio. Each short position is expected to generate its own positive absolute return.

Furthermore, we employ a prudent utilization of the swap and options markets to effectively manage tax liabilities and avoid incurring excessive rebates on short positions. These tools allow us to optimize our tax efficiency and enhance overall returns.

What Else Was Considered For BPLSX Mutual Fund?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

We spend every day trying to make our fund as “picture perfect” as possible within our three-circle investment philosophy. To do this, we review hundreds of names every week that do not make it into our fund.

To harness the full predictive powers of our quantitative system and to ensure the full benefits of portfolio diversification, our long portfolio typically carries 100-125 individual securities.

Conversely, the number of positions in our short portfolio is entirely dependent on the opportunity set presented by the market.

If we cannot identify attractive short candidates, we will not hold any short positions.

source: Managed Funds Association on YouTube

When Will BPLSX Fund Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

We expect our fund to perform well in most market environments, including those with an upward bias that are broadly based and balanced in terms of style. In periods marked by a correction from prior market imbalances (e.g., 2011, 2022) or recovery from profound valuation dislocations (e.g., 2013, 2021), the portfolio has tended to perform particularly well.

The most challenging market environment for our investment discipline would be a highly speculative one in which valuation and fundamental investment principles are disregarded and when “low quality” is rewarded. In 2020, artificially low interest rates, excess liquidity and the “meme stock craze” resulted in valuation and fundamental analysis being ignored leading to strong stock performance in unprofitable concept stocks which caused the portfolio to underperform relative to its benchmark. In 2009, the market recovered driven by a significant low-quality rally and the portfolio underperformed.

Our investment philosophy is rooted in a sensible set of principles and has not changed, but rather been affirmed, over various market cycles by the long-term performance of our products. You can expect that we will consistently have a long portfolio filled with inexpensive stocks, that have improving business trends and exhibit high quality fundamentals, while the characteristics of the short portfolio will exhibit the opposite.

Why Should Investors Consider Boston Partners Long/Short Equity Fund BPLSX?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

We believe this is the ideal time to invest in our fund. Over the past fifteen years, “growth” stocks have significantly outperformed “value” stocks; the valuation discrepancy between these two investment styles is now at historic spread. This is the direct result of unprecedented global quantitative easing programs, used to combat two world crises.

Theses governmental programs are now reserving, which should set the stage for a very different investment environment over the coming years and one that benefits our investment style. Over the past year, interest rates have jumped higher, which improves the economic prospects for short selling (investors are now paid to short through a positive rebate rate).

Moreover, today’s market is particularly “top heavy” with five mega-cap growth stocks in the S&P 500 now accounting for more than 25% of the Index’s total weight. The valuations of these mega-cap darlings are full on most reasonable quantitative metrics and suggests that the risk/reward profile for this bellwether group is poor.

We believe there are much more attractive investment opportunities further down the capitalization spectrum, and that value stocks will regain their outperformance tendency as global liquidity is drained from the system and valuations become paramount again.

In sum, we believe a value focused long/short fund with a bias toward smaller capitalized companies will be the ideal place to invest over the coming years.

How Does BPLSX Mutual Fund Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

Our fund is well-suited for a wide range of investors contemplating their broader investment portfolios. With 100-125 positions in our long portfolio, covering all market capitalizations and most industry sectors, our fund provides the prudent benefits of diversification and meets all core holding requirements.

Moreover, in a richly valued market with a murky outlook, such as the one we find ourselves in today, investors will get the added benefit of an active short portfolio that will provide an added layer of downside protection. We believe our long portfolio, with a bias toward underfollowed and smaller capitalized names, will outperform the S&P 500 Index over a complete market cycle.

Couple this with a variable short portfolio that can scale when prices disconnect from underlying fundamentals, and we believe our strategy is structured to work in both bull and bear markets and can serve as an excellent satellite diversifier for broader portfolios.

Learn More About BPLSX Mutual Fund

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

Boston Partners Long/Short Equity Fund (Ticker: BPLSX) initiated its current variable long/short strategy in 2004. The fund is currently managed by Pat Regan, who has served as lead portfolio manager since 2019.

The fund is supported by fundamental analyst Jack Antone and the broader Boston Partners complex, which manages over $90 billion in assets, spread across 12 different strategies, and serviced by over 20 fundamental sector analysts and 8 quantitative specialists.

Please visit www.boston-partners.com to learn more about our fund and other Boston Partners strategies that may interest you.

Nomadic Samuel Final Thoughts

I want to personally thank Boston Partners for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.