When it comes to online tools and resources that I’ve used as an investor, I’d put Portfolio Charts near the very top of the list.

Thus, I’m thrilled to welcome Tyler (the creator of Portfolio Charts and the Golden Butterfly Portfolio) to the “How I Invest” series.

When I think of the Golden Butterfly Portfolio and Portfolio Charts two words come to mind.

Big Picture.

Tyler’s portfolio and website help investors think/see/prepare for the “big picture” which is in stark contrast to the typical day to day noise found in the investment universe.

Risk Management.

Alternatives to stocks and bonds.

These are three crucial components to building a successful long-term portfolio that can weather every economic curveball thrown its way.

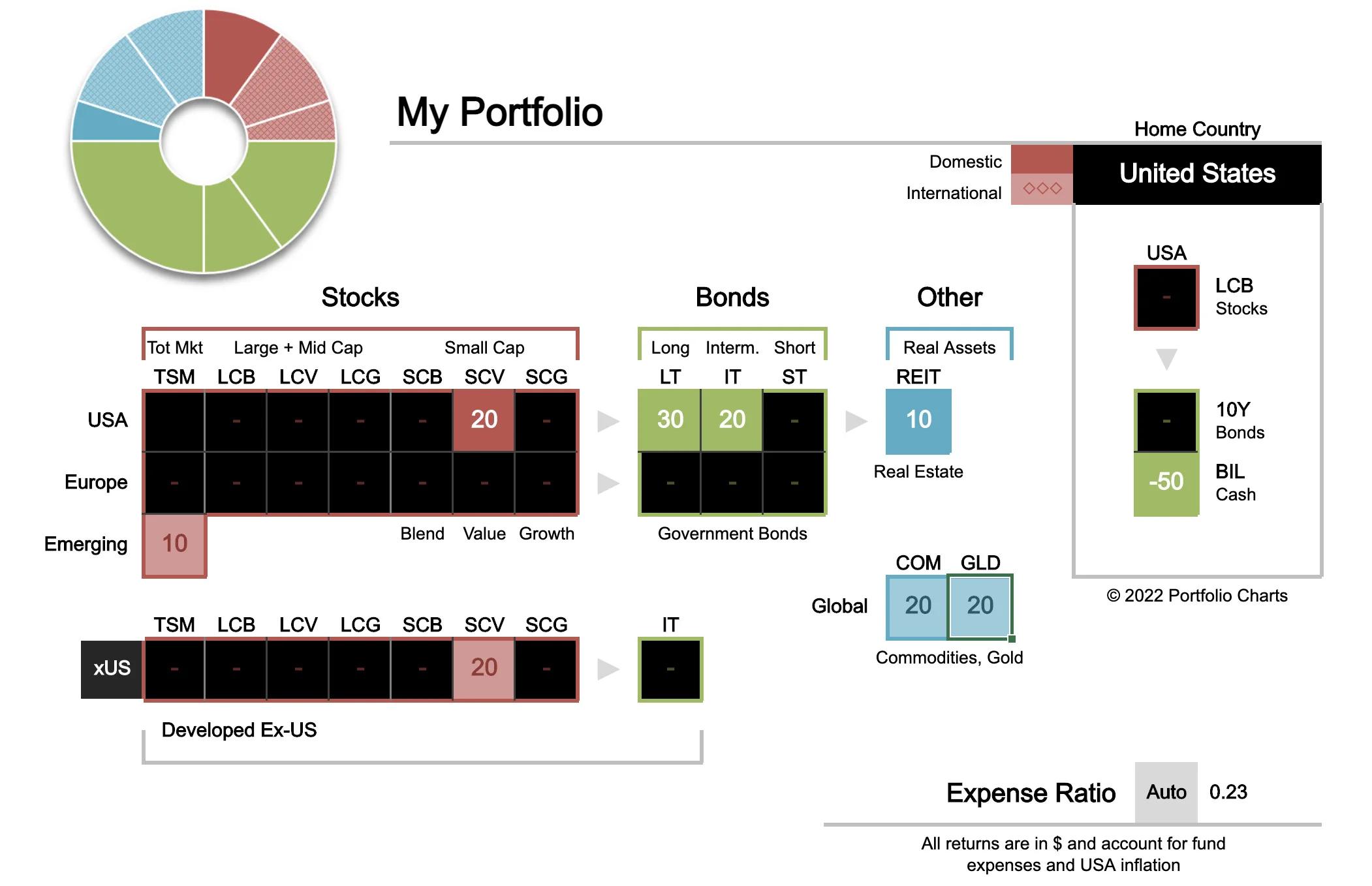

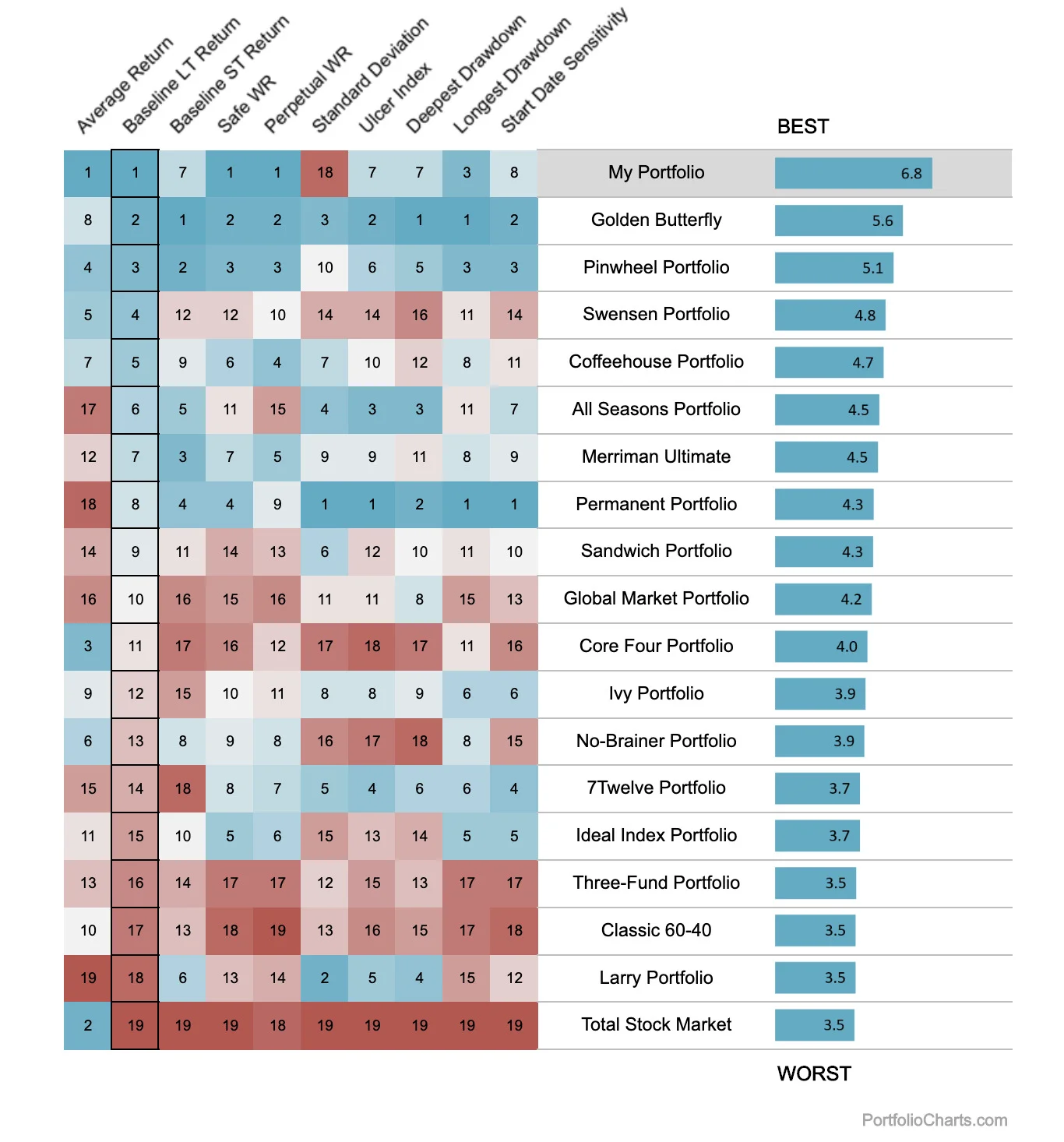

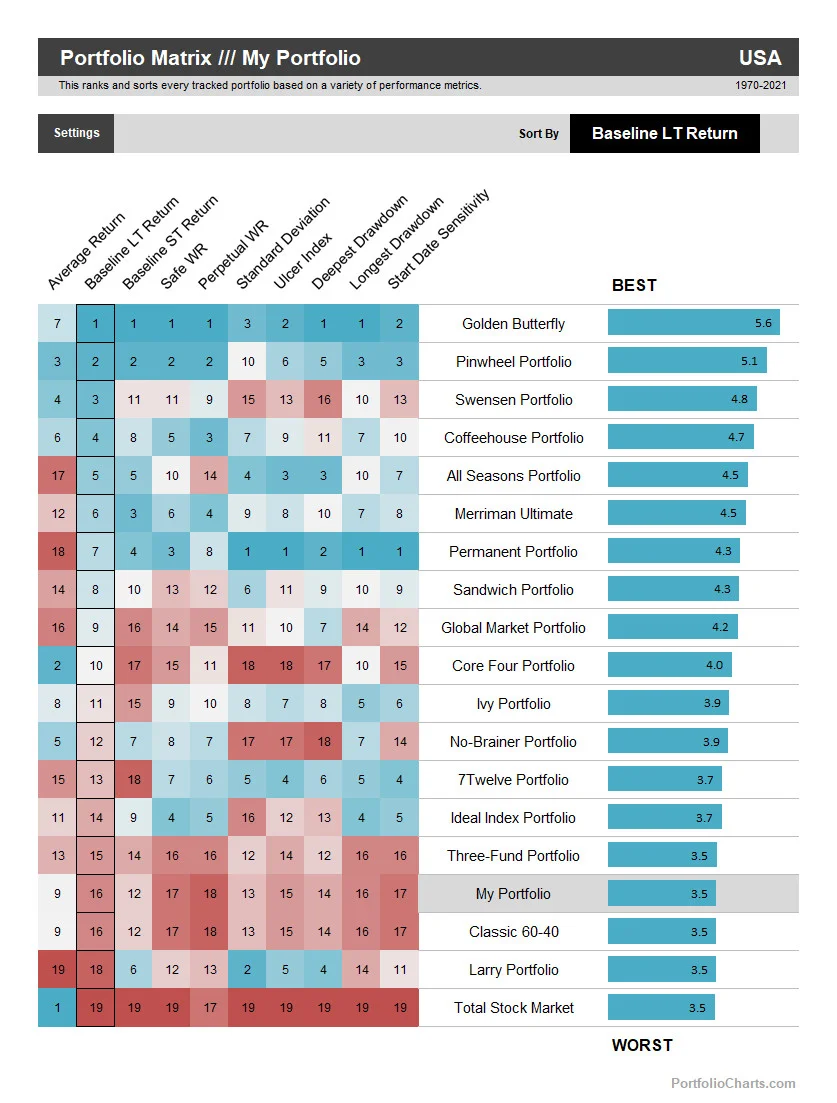

One of my personal favourite tools on Portfolio Charts is the Portfolio Matrix.

I’m an investor that favours a capital efficient portfolio, so I was curious to see how an equal parts equities, bonds and alternatives 150% expanded canvas portfolio would stack up versus other classic portfolios from a risk meets returns standpoint.

With Portfolio Charts I’m able to do just that.

Not too shabby at all.

I’m thrilled with the results as the portfolio clearly performs well historically.

However, I’m most interested in the risk management side of the equation since I’m stretching the boundaries of a 100% canvas portfolio.

I’m able to see that the portfolio does not let me down in the Ulcer Index, Deepest Drawdown and Longest Drawdown department.

I could honestly spend the whole afternoon on Portfolio Charts tinkering and testing out various portfolio combinations.

Anyhow, enough of my rambling.

Let’s turn things over to Tyler!

How I Invest with The Golden Butterfly Portfolio featuring Tyler of Portfolio Charts

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Tyler of Portfolio Charts | The Art and Science of Investing

About a decade into my product design career full of countless brainstorms and fast-paced development cycles, the core thought process balancing inputs, constraints, and new possibilities finally leaked over into my own life.

“I know this is the normal way to do it, but what if I did this instead?”

That eventually led to an interest in financial independence that not only set me on a path towards maximum life flexibility but also planted the seed of a new passion for investing.

Eventually reaching that goal was an exciting accomplishment, and it also cleared the deck of old responsibilities and habits to allow space for new ideas to surface.

With a detail-oriented mechanical engineering education, a highly creative design background, a newfound interest in portfolio theory, and the time and space to tinker, I was in a rather unique position to ponder the art and science of investing from interesting new perspectives.

One day when perusing old data sources much more diverse than your typical stocks and bonds, I had the bright idea of making an online tool that quickly models the historical performance of any portfolio you can think of and visualizes every investing timeframe simultaneously.

The result worked way better than I imagined and was a surprising hit among a few message boards I frequent.

Data is complicated, and a good chart just makes everything so much easier to understand.

Ever since then, I’ve poured my creative energy into Portfolio Charts – a website full of interactive tools and explanatory articles that strives to make modern portfolio concepts intuitive and approachable.

I don’t claim to have everything figured out, but I’m happy to share what I’ve learned.

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Inspired To Think Beyond The Career Treadmill

When I first started to really get into finance it was less about the mechanics of investing and more about the goal.

Pete Adeney (Mr. Money Mustache) and Jacob Lund Fisker (Early Retirement Extreme) were my early retirement heroes and had a huge effect on my life by inspiring me to think beyond the career treadmill.

In terms of investing strategy, the first writer that I truly connected with was Harry Browne for how he so clearly explained the idea of designing a portfolio that can grow and protect your money no matter what happens in the markets.

Fail Safe Investing is still the one book I recommend most to new investors.

One writer who probably had the biggest influence on me was Bob Clyatt.

He’s a business professional who similarly switched gears and became a successful artist, and his book Work Less, Live More just totally clicked with me.

In fact, his unique approach to modeling portfolio performance in Excel was the thing that inspired me to start doing it on my own.

It’s hard to do that whole story justice in a short space, but if you have some time to spare I talk about it in length here: A Meeting, A Book, A Portfolio, and A Better Life.

As for my views changing over time, that has mostly come through additional knowledge resulting from my continuous search for good data.

Instead of fixating on one “perfect” portfolio like most people in the financial space, I choose to study many different portfolios and offer a neutral platform so that others can similarly come to their own conclusions.

Basically, I have an open mind to new information and try to encourage that in others by providing the tools to study that information with ease.

Those tools have certainly helped refine my own understanding of investing over time, and I want to help others share that same journey.

It’s pretty much impossible to boil down one’s entire investing worldview into a single book or article, but for a quick sample of how my engineering mindset works with my financial aptitude this one is pretty good: A Faith Not Tested Cannot Be Trusted.

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

Investing Like An Endowment To Last A Lifetime

I suppose stepping away from full-time engineering work far before normal retirement age affected how I think about investing, as the standard mindset of maximizing returns while working for a living is quite a bit different than investing like an endowment to last a lifetime.

Once your investments are your primary source of income, risk is no longer just a standard deviation on a spreadsheet or a vague thing that you waive off with “I can recover in another 20 years”.

You’re a lot more thoughtful with each choice.

I also come from a lower-middle-class family where money was always tight and a major source of stress.

I was raised to never be wasteful with money, and that goes for risky investment schemes just as much as silly purchases.

As a result, I see value in conservative strategies that perhaps other more aggressive investors dismiss without a second thought.

And I think my neutral engineering mindset sets me apart from others with pure finance backgrounds.

Your fund has great results?

Cool.

Let me see the assumptions of your analysis so that I can compare it apples-to-apples to other options.

You say there’s no easy data source?

No worries!

I’ll research the fund methodologies and replicate the index manually.

And you looked at the last 10 years?

I mean that’s nice, but the real world is noisy and I’d rather look at every 10-year interval to make sure you weren’t just lucky.

Engineers are stubborn and driven to the truth, and I think that gives me an edge in fighting past entrenched biases and easy answers.

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

Wish I Had Access To Portfolio Charts At A Younger Age

Not everyone responds to lectures.

Especially me. : )

So rather than locking my younger self in a room and hoping to not bore him to death, I’d simply send him a link to Portfolio Charts to explore at his own pace.

I often think of it as the site I wish I had access to when I was first starting out, and my goal is to offer all kinds of resources so that investors at all stages can find something to connect with.

So no matter whether you’re a beginner looking for direction, a comparison shopper browsing portfolios, an analytical type tinkering with backtesting tools, or an advanced investor struggling to visualize and explain tricky concepts like bond convexity, there’s useful information for all types of people.

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

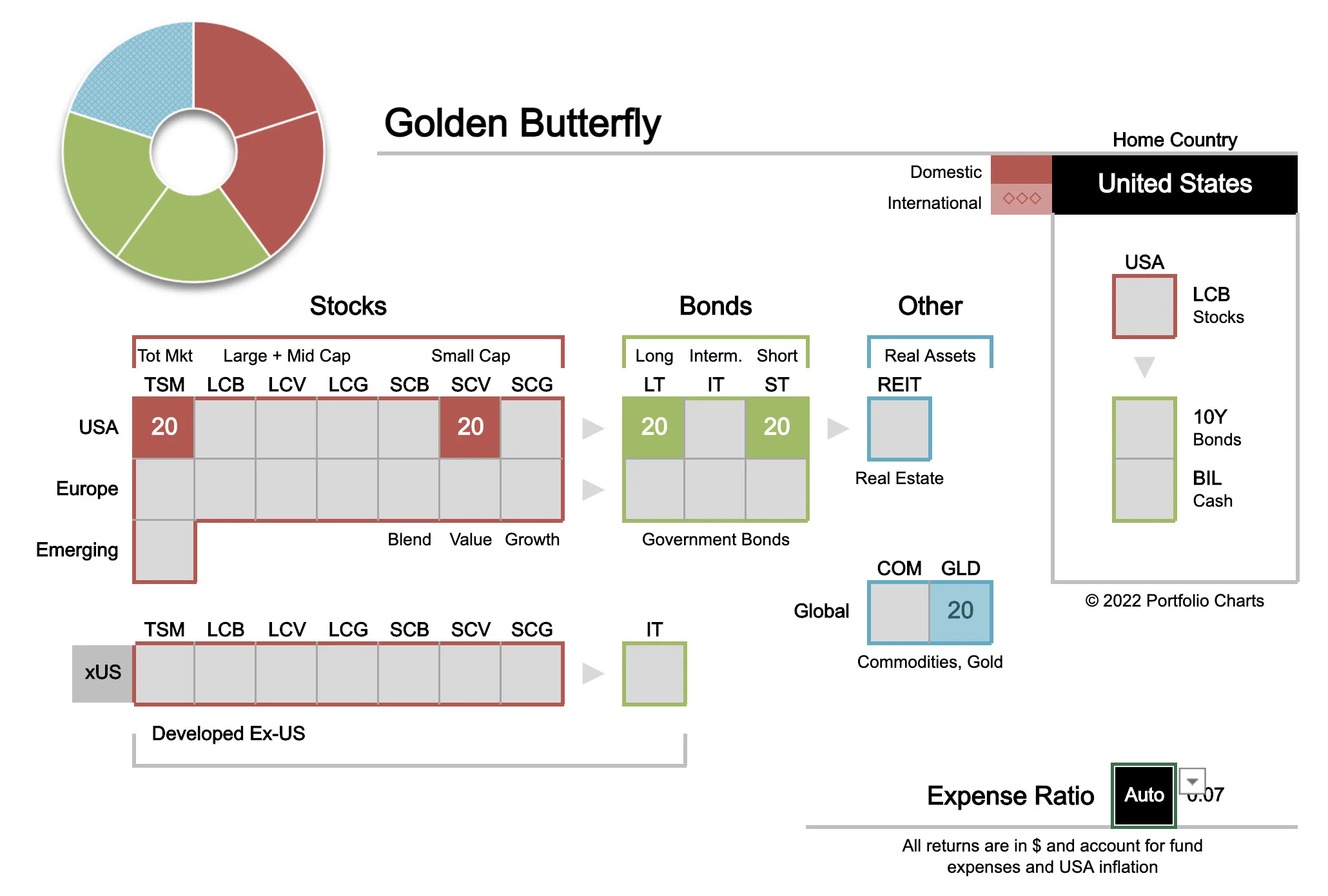

The Golden Butterfly Portfolio: Evolution of the Permanent Portfolio

My own portfolio is about 90% Golden Butterfly (my own evolution of the Permanent Portfolio) and 10% other stuff based on my personal situation.

So it’s mostly equal parts total US stock market, small cap value, long term treasuries, short term treasuries, and gold.

For more information on how those things work together, I talk about it in detail here: The Theory Behind the Golden Butterfly.

The distinguishing characteristic of the Golden Butterfly is its consistency.

Beyond just having nice long-term averages, it has been far more consistent than most other options at actually achieving those averages in your own investing timeframe.

Because of that dependability, it not only has experienced lower drawdowns than your typical stock/bond blends but also has sported some of the highest withdrawal rates of any portfolio you’ll find.

No matter what metric you value most, many people start to see the appeal when browsing the Portfolio Matrix.

That said, the important thing to remember about me is that unlike many others in the financial space I’m not a portfolio pusher.

Everyone is different, and there’s no one asset allocation suitable for all people.

That’s why I don’t make a big deal about my own investments, and why Portfolio Charts features dozens of different portfolio options.

It’s also why I offer flexible tools to study pretty much anything you can imagine from many different angles.

Find the right portfolio that you truly believe in and are comfortable holding even when times are tough, and investing gets a whole lot easier.

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

Low-Cost and Low-Key Indexing Investing Using Diversified Assets

Fundamentally, I’m a proponent of low-cost and low-key index investing using diversified assets.

But I do arguably go quite a bit deeper than your typical asset allocation fan by looking at many different types of assets and various modern portfolio theory concepts.

Not all stocks and bonds are created equal, and every portfolio is different.

The cool thing about my approach is that it can work for anyone, as you don’t have to be an investing fanatic to be successful and the only requirement is to look at your portfolio once a year to rebalance.

There are all types of portfolios suitable for different types of people, so the hard part is just finding the right one for you.

That said, there are a few types of investors that I’ve found struggle most with the concept.

People who love to stock pick generally reject the idea of sticking with a plan regardless of what happens in the markets.

Classic value investors in the Buffett or Graham mold often focus so much on individual asset valuations that they miss the big picture of the portfolio recipe.

And those predisposed to monitor their portfolios daily are inevitably tempted to sell the down assets out of fear rather than buying low by rebalancing into them.

So I would say that my particular approach appeals most to data-driven people who prioritize maximizing portfolio efficiency and consistency over taking incrementally greater investing risks.

Basically, normal people who want to invest wisely but would rather spend their lives doing something else they love rather than stressing about the markets.

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

source: Michael Jay Value Investing YouTube

A Higher and Lower Risk Golden Butterfly Portfolio?

The simplest iteration (although not necessarily watered down in terms of risk) is an easy stepping stone for all young investors – a basic total stock market portfolio using an ETF like VTI.

The nice thing about that asset in particular is that it’s a core component of almost any asset allocation you may grow into.

So it’s a great choice to get started in investing, and as you learn more you can easily supplement what you already own with other helpful ingredients to dial in the performance you want.

A more aggressive version would be one that leans even more heavily on highly volatile assets to capture rebalancing opportunities.

Things like emerging markets, commodities, and zero-coupon long-term treasuries can really ramp up volatility to levels that may work well together but could also be more difficult to stomach on their own.

Everyone has their limits, and it’s important to understand what you’re getting into before taking the plunge.

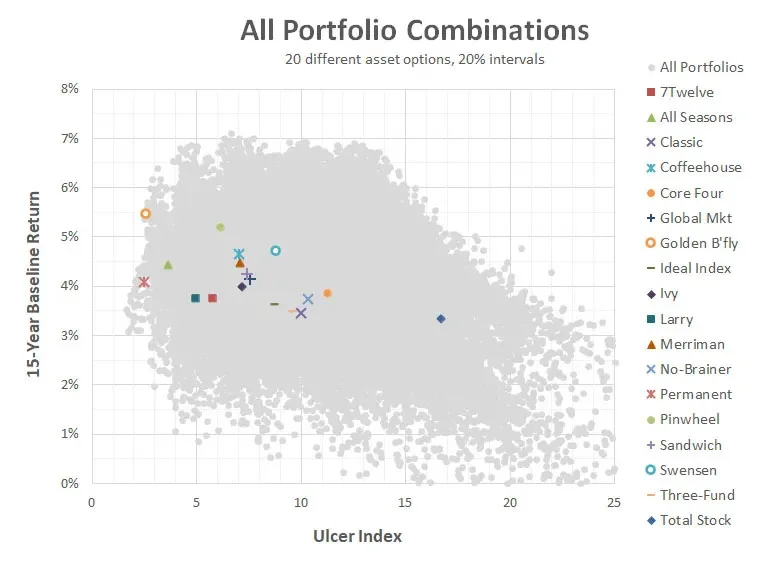

By the way, I also think that the old risk/reward mantra does investors a disservice by implying that the two things are linearly related.

But they’re really not.

Modern portfolio theory offers all kinds of opportunities to maximize the return for a certain amount of risk by making smart choices at the

portfolio level.

So the challenge as I see it is NOT to maximize the pain you’re willing to tolerate, but to find the sweet spot in terms of investing efficiency that consistently meets your financial needs with minimum stress.

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

Creative Use Of Data To Explore Investing Ideas

I think my biggest strength is my creative use of data to explore investing ideas that even other very sophisticated investing researchers never bother to study because of the work involved.

For example, while some people go deep into studying every angle of a single portfolio, I make charts like this that compare tens of thousands of them at a time.

Compared to other true financial professionals, my greatest weakness is probably my (in)ability to evaluate individual companies.

I admire those with that skillset and have no doubt that it can be profitable, but I invest the way that I do because I have no real interest in spending my time on this earth sitting in earnings calls and reading quarterly reports.

The good news is that, with the right portfolio, none of that is necessary to be a successful investor.

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

Big Fan Of Gold In A Portfolio

I’m a big fan of gold in a portfolio, which has a weird way of driving the investing community absolutely crazy.

People tend to either love it unconditionally or irrationally hate it with nothing in between.

But after studying asset allocation for years, I believe the data shows that gold is uniquely useful in the right percentages to maintain portfolio returns while smoothing the ride.

On the other hand, one pet peeve of mind is how the 4% rule is so ubiquitous in the investing community that it has become an article of faith with almost no understanding of how it was derived.

The number of people who apply the same 4% rule to ANY combination of stocks (beyond the S&P 500 that is used in almost every study you see) always hurts my heart a little.

Once you start looking beyond the very specific assumptions that were used to derive that number, you quickly learn that withdrawal rates are way more dynamic than most people realize.

Differences like that between “common knowledge” and measurable reality are why I think independent tools like my Withdrawal Rates calculator are so important.

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

Desire To Study Alternative Rebalancing Strategies

One thing I’ve been wanting to study in more detail is alternative rebalancing strategies such as dual momentum.

Beyond the good papers on the topic, I’m interested in modeling them for myself using my extensive asset database.

Those things just take time to develop.

I’m not exactly sure how that information would influence my portfolio, but that’s exactly why I’m interested in learning more.

I’m an engineer, not a salesman.

And every bit of new knowledge is one more tool in the toolbox.

What would be the ultimate anti-Tyler portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Someone Would Have To Hold A Gun To My Head To Day Trade

I think someone would have to hold a gun to my head to day trade.

I just can’t think of a less desirable strategy than being tied to a chair watching markets all day, researching companies constantly, stressing about my positions, and lying awake at night beating myself up over every choice.

If only I had held on longer or sold earlier!

That’s just not for me.

That said, for those with the personality, know-how, and drive to invest at that level of granularity, I see the appeal of chasing good opportunities.

And I’m also a fan of Harry Browne’s concept of investing the bulk of your money that you can’t afford to lose in a safe asset allocation while setting aside a smaller amount to invest in any way you like without worry.

So I’m definitely not against placing speculative bets.

I’m just for doing it responsibly.

Connect With Tyler: Portfolio Charts and The Golden Butterfly Portfolio

You can research portfolios, experiment with charts, and read my articles at PortfolioCharts.com.

I’m also on Twitter and Instagram, and my inbox is always open for good investing discussions.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.