Before the arrival of Harry Markowitz on the financial scene, the world of investment was akin to uncharted waters. Without the tools and understanding to navigate its complexities, many investors made decisions based on whims, gut feelings, or the seductive allure of historical returns. There was a glaring absence of systematic approaches, and the realm of investing often seemed more like gambling than a science. The concept of risk was understood in a nebulous manner, more felt than quantified. Investors were often at the mercy of market fluctuations, with little to no understanding of how to buffer their portfolios against the inherent uncertainties of the market.

The Genius of Harry Markowitz: A Beacon in Financial Darkness

Dr. Harry Markowitz, born into an era recovering from the aftermath of the Great Depression, was not just a spectator but a pioneering force in the world of finance. He observed the financial tumults and the volatile nature of markets, and these observations fueled a quest for a more systematic, mathematical approach to investment. In a realm dominated by intuition and guesswork, Markowitz introduced logic, math, and a profound understanding of risk and reward.

![]()

The Nobel Prize: A Testament to Revolutionary Thought

Markowitz’s groundbreaking work didn’t go unnoticed. The world recognized the magnitude of his contributions when in 1990, he was awarded the Nobel Prize in Economic Sciences. This wasn’t just a ceremonial recognition; it signified a paradigm shift in how finance was perceived and practiced. The award was not just for Markowitz the theorist but for Markowitz the visionary, whose ideas found resonance in the bustling world of Wall Street, the strategic meetings in investment banks, and the analytical tools of hedge funds.

Modern Portfolio Theory: A Brief Insight

At the heart of Markowitz’s revolutionary thinking was the Modern Portfolio Theory (MPT). For the first time in financial history, there was a systematic way to evaluate and construct portfolios, taking into account both the potential returns and the associated risks. Markowitz introduced the world to the idea that risk could be quantified, and that through diversification, one could optimize returns. This wasn’t just about picking the best stocks but understanding how different stocks (or assets) interacted with each other.

The Lasting Impact: Markowitz’s Eternal Imprint on Finance

Today, decades after Markowitz first introduced his theories, they remain foundational in the world of finance. Modern Portfolio Theory is not just a topic discussed in B-schools; it’s a practical tool wielded by financial professionals globally. Every time an investor diversifies their portfolio, or a robo-advisor suggests an asset allocation, the guiding principles can be traced back to Markowitz.

As we journey further into the intricate world of Harry Markowitz, we’ll explore the depths of his theories, the brilliance of his insights, and the unparalleled impact of his work. For in understanding Markowitz, we gain a clearer understanding of the modern world of finance and investment.

Early Life and Education

From the Streets of Chicago: The Making of a Financial Luminary

Harry Max Markowitz was born on August 24, 1927, in Chicago, Illinois. The environment of his early years was still reeling from the aftermath of the Great Depression. These were formative times, where the highs and lows of the financial world were not just headline news but dinner-table discussions. Growing up in such an environment, it’s conceivable that the seeds of financial curiosity were sown early in young Harry’s mind.

His family, like many others, discussed the economic hardships, market crashes, and the nuances of financial security. These conversations, combined with the ambient economic milieu, undoubtedly played a role in shaping Markowitz’s early interest in finance. But it wasn’t just the external environment; his intrinsic penchant for mathematics and logic ensured that he did not approach finance as just another topic of interest, but as a discipline waiting to be understood, decoded, and reinvented.

The Academic Odyssey: Charting a Course in Economics and Mathematics

Markowitz’s academic journey began at the local schools of Chicago, where his acumen for numbers and analytical thinking quickly became apparent. He exhibited an innate ability to simplify complex problems, a trait that would later become the cornerstone of his groundbreaking theories.

As he transitioned to higher education, Markowitz attended the University of Chicago, a decision that would prove pivotal for his future. The University of Chicago was not just any educational institution; it was a hub of economic thought, home to some of the most brilliant minds in the field. Here, he was exposed to a rigorous academic culture that nurtured independent thinking, questioning of established norms, and the relentless pursuit of knowledge.

It was during his years at the University of Chicago that Markowitz truly immersed himself in the confluence of mathematics and economics. He pursued a Bachelor’s degree in Economics, followed by a Master’s degree. But he didn’t stop there. His insatiable thirst for knowledge led him to pursue a Ph.D., where he wrote his seminal dissertation on portfolio selection, a work that would later become the bedrock of Modern Portfolio Theory.

At the University of Chicago, Markowitz was fortunate to study under esteemed economists like Milton Friedman and Jacob Marschak. These interactions, combined with his academic endeavors, molded Markowitz’s understanding of economics and finance. They provided him with the tools, perspectives, and confidence to challenge prevailing investment paradigms and propose theories that were both groundbreaking and practical.

source: QuantPy on YouTube

Introduction to Modern Portfolio Theory (MPT)

A New Dawn in Financial Thinking: The Birth of MPT

For decades, the investment landscape was riddled with ambiguities. How does one choose the right investment? Is it purely about returns, or is there more to the puzzle? These were questions that perplexed investors and scholars alike. And then came Modern Portfolio Theory (MPT), a beacon of clarity in the often murky waters of finance, fundamentally altering the very DNA of investment thinking.

At its core, Modern Portfolio Theory proposed a revolutionary idea: the process of investment isn’t just about individual asset selection based on returns; it’s about how these assets work together within the larger framework of a portfolio. MPT introduced the concept of looking at investments not in isolation but in cohesion, emphasizing the relationships between assets and how they interacted in terms of risk and return.

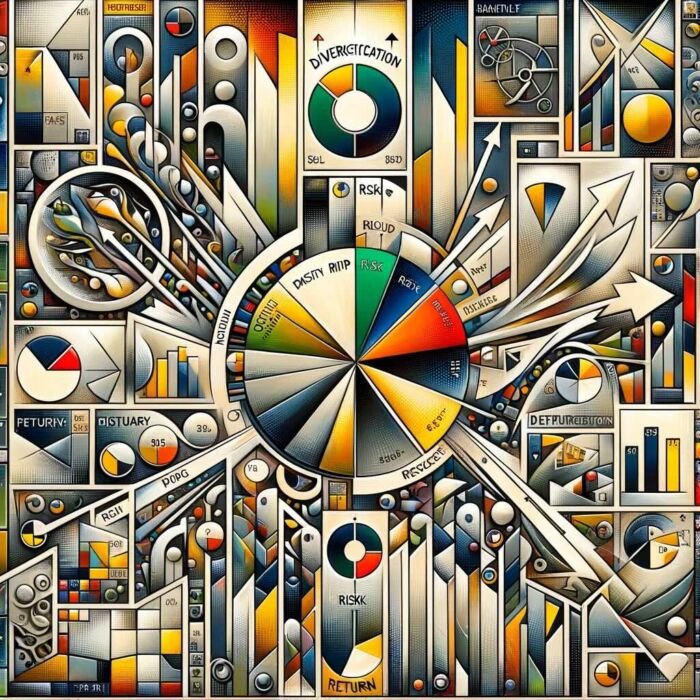

The Pillars of MPT: Risk, Return, and Diversification

- Risk and Return: Before Markowitz’s MPT, risk was a loosely understood term. With MPT, risk became quantifiable. It wasn’t just a vague fear of losing money; it was the statistical measure of how much an investment’s returns could vary over a period. Alongside, MPT stressed that returns were not standalone enticements but were inextricably linked with risk. Essentially, to achieve higher returns, one had to be prepared to shoulder higher risks.

- Diversification: Often touted as the only “free lunch in finance,” diversification became a central tenet of MPT. It wasn’t just about holding different assets; it was about holding assets that behaved differently from one another. By doing so, the overall risk of the portfolio could be reduced without necessarily compromising on expected returns. The genius of MPT was in demonstrating that the whole (the portfolio) was often less risky than the sum of its parts (individual assets), thanks to the magic of diversification.

Why MPT was a Watershed Moment in Finance

- Quantifying the Intangible: Before MPT, risk was a shadowy concept, lurking in the background but rarely addressed head-on. Markowitz gave it form and substance. By introducing variance or standard deviation as measures of risk, he allowed investors to approach portfolio construction with eyes wide open, fully aware of the potential pitfalls and rewards.

- Optimal Portfolio Construction: The Efficient Frontier, a concept birthed from MPT, depicted all possible portfolios that offer the maximum expected return for a given level of risk. For the first time, investors had a roadmap to construct portfolios that aligned with their risk appetites, ensuring they weren’t taking on undue risk for the potential returns they sought.

- Holistic View of Investment: Prior to MPT, investment decisions often revolved around individual asset merits. MPT broadened the lens, urging investors to consider how assets complemented and counterbalanced each other. An asset might be volatile on its own but could be invaluable in stabilizing a portfolio when paired with other, differently behaving assets.

- Empirical Validation: MPT wasn’t just a theoretical marvel; it was empirically testable and, over time, proved robust in a variety of market conditions. It laid the foundation for countless investment strategies and analytical tools that professionals rely on today.

Modern Portfolio Theory wasn’t merely a new chapter in finance; it was a new book altogether. In casting aside age-old beliefs and introducing rigor, quantifiability, and a holistic perspective to portfolio construction, Harry Markowitz didn’t just propose a theory; he heralded a paradigm shift, reshaping the very fabric of investment philosophy and practice.

source: PensionCraft on YouTube

The Fundamental Principles of MPT

Risk and Return: The Dual Heartbeats of Investment

Every investor, whether consciously or subconsciously, grapples with two primary concerns: the potential return on an investment and the risk associated with achieving that return. While many investment theories have touched upon these two elements separately, Modern Portfolio Theory (MPT) was groundbreaking in its attempt to marry these twin pillars, presenting them as two sides of the same coin.

Defining Risk and Return

- Return: In the simplest terms, return is the gain or loss made from an investment over a specific period. It’s often expressed as a percentage of the investment’s initial cost. While the past returns of an investment provide historical data, MPT is more concerned with expected future returns. This distinction is vital, as MPT seeks to create a portfolio based on projected performance, rather than merely reflecting on past achievements.

- Risk: In the context of MPT, risk refers to the potential variability of returns on an investment. It represents the uncertainty regarding the expected outcome. While there are many types of risks in finance, MPT focuses primarily on the standard deviation of returns, making it quantifiable. In layman’s terms, it is a measure of how spread out the returns of an investment are likely to be. The higher the standard deviation, the greater the risk, as returns could vary significantly from the expected average.

The Inextricable Link Between Risk and Return

The genius of MPT lies in its assertion that risk and return are not independent entities but are deeply interconnected. According to MPT:

- Higher Potential Returns Demand Higher Risks: Assets with the potential for higher returns are generally accompanied by higher volatility, meaning they have a wider range of possible outcomes. Think of it as the price an investor pays for the allure of elevated gains. For example, stocks, which have historically shown higher returns than bonds, also exhibit more volatility.

- Lower Risk Usually Means Lower Expected Returns: On the flip side, assets that pose less risk are often associated with lower returns. Government bonds, for instance, are often seen as less risky than stocks, especially in stable economies. Correspondingly, they usually offer lower potential returns.

No Free Lunch in the Investment World

This relationship between risk and return leads to an essential principle of MPT: there is no additional reward without additional risk. Investors seeking higher potential returns must be prepared to accept a higher degree of uncertainty in those returns. In other words, there’s no “free lunch.” If one hopes to feast on the riches of high returns, they must be ready for the indigestion of potential downturns.

It’s akin to a seesaw: as potential returns rise, so does potential risk, and vice versa. For investors, the challenge (and the art) lies in balancing their appetite for risk with their desire for returns, ensuring they aren’t unwittingly leaning too heavily on one side of the seesaw.

Modern Portfolio Theory’s exploration of the risk-return trade-off is both profound and pragmatic. It steers investors away from the simplistic chase of returns, urging them to consider the risks lurking behind those potential rewards. By doing so, MPT doesn’t just shed light on the complexities of investment; it equips investors with the knowledge to navigate them. In recognizing that risk and return are inseparable dance partners in the financial ballet, MPT provides the choreography for a more harmonious, informed, and potentially rewarding investment journey.

source: Yahoo Finance on YouTube

Diversification: The Art of Spreading Wealth and Minimizing Risk

The Age-Old Wisdom of Diversification

There’s a timeless piece of advice that has been passed down through generations and across cultures: “Don’t put all your eggs in one basket.” This ancient wisdom is not just a life lesson but a fundamental principle of investing, encapsulated beautifully in the concept of diversification.

Understanding Diversification in the Investment Context

At its heart, diversification is the strategy of spreading investments across various assets or asset classes to reduce exposure to any single asset or risk. By not overly relying on a singular investment or asset class, investors aim to mitigate the negative impact of a poor-performing investment on the overall portfolio. In essence, it’s a risk management technique that blends a wide variety of investments within a portfolio.

Why Diversification Matters

- The Unpredictability of Markets: Markets, by nature, are dynamic and unpredictable. While historical data provides some insights, it doesn’t offer surefire predictions. Certain sectors or assets may perform exceedingly well in one period and then underperform in another. By diversifying, investors cushion themselves against the inherent volatility and unpredictability of specific sectors or assets.

- Correlation and Risk Reduction: Different assets often respond differently to macroeconomic events. For example, during economic downturns, while stocks might decline, certain bonds or commodities might remain stable or even appreciate. Assets that don’t move in tandem have a low or negative correlation. By combining assets with low correlations, diversification ensures that even if one or more assets underperform, others in the portfolio can counterbalance the losses, stabilizing the overall returns.

Diversification: Reducing Risk Without Compromising Returns

The magic of diversification is its ability to lower risk without proportionally lowering expected returns. Here’s why:

- Collective Strength Over Individual Vulnerability: While individual assets come with their unique risk profiles, a diversified portfolio’s risk is often lower than the weighted average risk of its individual components. This counterintuitive result arises because individual asset volatilities often offset one another, leading to a smoothing out of fluctuations.

- Maximizing the Power of Compounding: A diversified portfolio reduces the chances of significant losses. By minimizing large downturns, the portfolio can better harness the power of compounding, where returns are earned not only on the original investment but also on the accumulated returns.

- Access to a Broader Investment Landscape: Diversification doesn’t limit itself to different asset classes in one country. It encompasses global diversification, allowing investors to tap into opportunities in various countries and regions. This not only provides more avenues for potential returns but also ensures that the portfolio isn’t overly exposed to the economic conditions of a single country.

Crafting a Diversified Portfolio

Diversification is not about blindly accumulating a variety of assets. It’s a strategic exercise. Here are some considerations:

- Asset Allocation: This refers to how an investment portfolio is divided among different asset classes (e.g., stocks, bonds, real estate). The right allocation depends on various factors including the investor’s financial goals, risk tolerance, and investment horizon.

- Rebalancing: Over time, due to differing returns from various assets, the portfolio might drift from its original asset allocation. Regular rebalancing ensures that the portfolio remains aligned with the investor’s objectives.

Diversification, in its essence, is a manifestation of the wisdom of collective strength. By spreading investments, not only does an investor safeguard against the unpredictable nature of markets, but they also harness the combined power of multiple assets, optimizing returns while judiciously managing risks. In the symphony of investing, diversification ensures that no single note’s discord affects the entire melody, allowing for harmony even amidst volatility.

source: Investopedia on YouTube

Efficient Frontier: Charting the Path to Optimal Investment

Grasping the Efficient Frontier

The financial world is riddled with complexities, and one of the most potent tools that has emerged to navigate this maze is the concept of the Efficient Frontier. The Efficient Frontier isn’t just a theoretical construct; it’s a graphical revelation, a roadmap to the highest possible return an investor can expect for a given level of risk.

Understanding the Graphical Representation

The Efficient Frontier is represented as a curve on a graph where the x-axis measures risk (typically represented by the standard deviation of returns) and the y-axis measures expected returns. The curve showcases the maximum expected return for each level of risk. Any portfolio that lies on this curve is deemed “efficient” because it provides the highest return for its level of risk.

Points below the curve are considered “inefficient” because for the same level of risk, a higher return can be achieved by a portfolio on the Efficient Frontier. Similarly, for any given level of expected return, portfolios on the curve have the lowest possible risk.

Significance of the Efficient Frontier in Investment Decisions

- Guiding Asset Allocation: The Efficient Frontier serves as a lighthouse for investors, guiding them towards portfolios that maximize returns for their risk appetite. By identifying where on the frontier their comfort level lies, investors can determine the optimal asset allocation for their specific risk tolerance.

- A Benchmark for Performance: By defining what’s possible in the risk-return space, the Efficient Frontier provides a benchmark against which actual portfolio performance can be measured. If a portfolio is not on the frontier, there might be room for improvement either by increasing returns, reducing risk, or both.

- Risk Management: The curve provides a clear visual representation of the trade-offs between risk and reward. This can help investors understand the implications of their choices, encouraging more informed risk management.

Driving Optimal Asset Allocation

One of the cardinal contributions of the Efficient Frontier is its role in asset allocation. By demonstrating the relationship between risk and return for different portfolios, it allows for:

- Tailored Investment Strategies: Investors have varied risk appetites. Some are risk-averse, preferring to stay in the lower risk, lower return portion of the curve, while others might be more risk-tolerant, gravitating towards the higher risk, higher return end. By identifying their position on the Efficient Frontier, investors can tailor their asset allocation accordingly.

- Diversification Insights: The curve often highlights the benefits of diversification. A mix of assets can often achieve a higher return for a given level of risk (or a lower risk for a given return) than any single asset. This underpins the importance of holding a diversified portfolio.

- Continuous Re-evaluation: The Efficient Frontier is not static. As market conditions change, asset correlations shift, and new investment opportunities arise, the curve can evolve. Regularly revisiting the Efficient Frontier ensures that asset allocation remains optimal.

In the vast universe of finance, where infinite possibilities and permutations of portfolios exist, the Efficient Frontier serves as a North Star. It doesn’t just depict a theoretical ideal; it provides tangible guidance, aiding investors in making decisions that align with their financial goals and risk tolerances. In a world of uncertainties, the Efficient Frontier offers a semblance of clarity, showcasing the path to optimal investment, one where every risk taken is adequately rewarded.

source: Finance Explained on YouTube

Impact and Applications of Modern Portfolio Theory (MPT)

Revolutionizing Asset Allocation and Investment Strategies

The arrival of Modern Portfolio Theory (MPT) marked a paradigm shift in the financial world’s approach to investments. Prior to its introduction, individual asset analysis largely dictated investment strategies, focusing on separate securities’ intrinsic value. MPT, however, introduced a holistic perspective, emphasizing the importance of portfolios’ overall composition and the interrelations between individual assets.

- Risk-Return Optimization: Before MPT, the focus was primarily on maximizing returns. MPT introduced the dual objectives of achieving desired returns while managing risk, challenging investors to think about both simultaneously. This shifted the spotlight from individual assets to the overall portfolio construction, driving home the idea that the combined performance of various assets is more crucial than the standalone performance of each.

- Strategic Diversification: MPT mathematically formalized the age-old wisdom of not putting all eggs in one basket. Investors became more enlightened about the benefits of diversification, not just as a safety mechanism, but as a strategic tool to optimize the risk-return trade-off.

The Rise of Passive Investment Strategies: A Testament to MPT’s Influence

- Genesis of Index Funds: MPT’s principles sowed the seeds for passive investment strategies. Recognizing that achieving consistent outperformance was challenging and that market risk couldn’t be diversified away, index funds emerged as a product that mirrored market performance. Rather than attempting to “beat” the market, these funds aimed to “be” the market. By simply mirroring market indices, index funds offer diversification across the market segment they track, aligning perfectly with MPT’s teachings.

- Cost Efficiency: MPT highlighted that higher returns weren’t always a product of active stock picking. Sometimes, simply minimizing costs could lead to better net returns. Passive strategies, with their lower turnover and reduced active management costs, exemplified this insight, often outperforming their actively managed counterparts on a net-of-fees basis.

Robo-Advisors: MPT Meets Technology

The digital age brought with it a new player in the investment arena: robo-advisors. These digital platforms, driven by algorithms, provide automated, personalized investment advice. At the heart of many such platforms is MPT.

- Personalized Portfolio Recommendations: Robo-advisors typically begin by gauging an investor’s risk tolerance and financial goals. Armed with this information, and grounded in MPT principles, they construct a diversified portfolio tailored to optimize the risk-return profile for the individual investor.

- Efficient Frontier in Action: Many robo-advisors leverage the concept of the Efficient Frontier, suggesting portfolios that lie on this curve. The user’s risk tolerance determines their position on this frontier, guiding the asset allocation algorithm.

- Periodic Rebalancing: MPT emphasizes the importance of maintaining a portfolio’s desired asset allocation. Recognizing this, robo-advisors often include automatic rebalancing features, ensuring that portfolios remain aligned with the investor’s objectives even as market dynamics cause drifts in asset weights.

- Democratizing Investment Management: Before robo-advisors, personalized investment advice was largely reserved for the wealthy. The marriage of MPT with technology democratized this, making optimized investment strategies available to the masses at a fraction of traditional advisory costs.

Modern Portfolio Theory’s influence is profound, reshaping the investment landscape in manifold ways. From redefining asset allocation strategies to being the philosophical backbone behind index funds and robo-advisors, MPT’s principles have found applications that continue to shape and democratize the world of finance. As investors embrace both the wisdom of MPT and the tools of the modern age, they’re better equipped than ever to navigate the complexities of the financial world.

source: Bridger Pennington on YouTube

Critics and Limitations of Modern Portfolio Theory (MPT)

The Foundations of MPT’s Criticism

While Modern Portfolio Theory (MPT) has revolutionized the investment landscape and stands as a pivotal theory in finance, it is not without its critics. The theory, grounded in several assumptions about markets and investor behavior, has been challenged on multiple fronts, especially in light of evolving understandings of human behavior and unprecedented financial events.

Behavioral Finance: Challenging the Rational Investor Assumption

One of MPT’s cornerstone assumptions is that investors are rational beings, always acting in a manner to maximize their utility. However, behavioral finance, an interdisciplinary field merging psychology with finance, begs to differ.

- Irrational Exuberance and Panic: Behavioral finance posits that emotions often drive investor decisions. Periods of “irrational exuberance” can lead to market bubbles, while widespread panic can result in sharp market crashes. These emotional responses are stark deviations from the cold, calculated decisions of the “rational” investor MPT presupposes.

- Heuristics and Biases: Humans often rely on heuristics – mental shortcuts – that can lead to systematic errors or biases. Confirmation bias, loss aversion, and overconfidence are just a few examples of behavioral tendencies that can skew investment decisions, challenging the notion of the always rational investor.

- Herd Behavior: Investors, rather than making independent decisions based on objective analyses, sometimes tend to follow the crowd, leading to herding effects in markets. This behavior can exacerbate market volatility and result in mispricings, further straying from MPT’s rational investor model.

The Financial Crisis of 2008: An Empirical Challenge to MPT

The global financial crisis that unfolded in 2008 raised eyebrows about many traditional financial theories, including MPT.

- Correlation Breakdown: One of MPT’s principles is the benefit of diversification, especially when assets aren’t perfectly correlated. However, during the 2008 crisis, asset correlations converged, with diverse portfolios experiencing simultaneous declines, challenging the protective premise of diversification.

- Risk Underestimation: The financial models grounded in MPT often relied on historical data to estimate risks. The extreme events of 2008, often termed “black swans,” were not adequately captured by these models, leading to a significant underestimation of risk.

Efficient Market Hypothesis (EMH) and Its Detractors

A key pillar supporting MPT is the Efficient Market Hypothesis (EMH), which asserts that markets are efficient, and current prices reflect all available information. However, this hypothesis, and by extension MPT, has its skeptics.

- Market Anomalies: There have been documented instances of market anomalies, like the small-cap effect or the January effect, that seem inconsistent with the EMH. If markets were truly efficient, such consistent anomalies would be hard to justify.

- Active Management: The very existence and persistence of successful active fund managers challenge the EMH. If all information is already priced in, consistently outperforming the market should be near impossible, yet some managers achieve this feat.

- Information Asymmetry: While EMH assumes all investors have access to all information, in reality, information asymmetry exists. Some investors, especially institutional ones, might have access to better, faster information, giving them an edge, thereby challenging the notion of universally efficient markets.

Modern Portfolio Theory, while transformative, isn’t immune to criticism. The ever-evolving landscape of financial markets, combined with deeper insights into human psychology, has led to rigorous debates about MPT’s assumptions and applicability. While it remains a foundational theory in finance, these critiques underscore the importance of adaptive thinking and the continual evolution of financial models to capture the multifaceted nature of markets and investors.

source: MIT Laboratory for Financial Engineering on YouTube

Markowitz’s Other Contributions and Later Life

Pioneering Operational Research

Beyond the realm of finance, Harry Markowitz’s intellectual pursuits spanned into operational research, a field focused on optimizing complex processes and systems. His mathematical acumen played a pivotal role in bridging economics and computational methodologies.

- Simulating Real-World Systems: Markowitz was instrumental in utilizing computers for simulating real-world scenarios. This proved invaluable for businesses looking to optimize operations without resorting to trial and error in real-world conditions.

- Optimization in Business Operations: His knack for applying mathematical models extended to optimizing business operations. Whether it was streamlining supply chain processes or enhancing production lines, Markowitz’s insights have left a mark on various facets of operational research.

The “Markowitz Bullet” Concept

Beyond Modern Portfolio Theory, Markowitz’s name is often associated with the concept of the “Markowitz bullet.” This term refers to the shape of the graph illustrating the Efficient Frontier in the risk-return space.

- Visualizing Optimal Portfolios: The Markowitz bullet provides a visual representation of the trade-off between risk and return. This bullet-shaped curve demonstrates that beyond a certain point, the only way to achieve higher returns is to accept higher levels of risk.

- Highlighting Inefficiencies: The space below the bullet represents portfolios that are sub-optimal. These portfolios either take on unnecessary risk for a given level of expected return or fail to provide the return that could be achieved for a certain level of risk. The bullet, therefore, doesn’t just point to what’s optimal; it also illuminates what’s not.

A Storied Career Beyond MPT

After introducing the world to Modern Portfolio Theory, Markowitz’s career trajectory was marked by a blend of academia, research, and consultancy.

- Academic Tenure: Markowitz took on roles in prominent institutions, enriching young minds with his vast knowledge. His academic stints include serving on the faculties of the University of California, Los Angeles (UCLA), and The City University of New York (CUNY).

- Consultancy and Research Roles: Markowitz’s expertise was highly sought after in both public and private sectors. He consulted for major corporations and was associated with renowned research entities, applying his theories to real-world financial challenges.

- Published Works: Beyond his seminal paper on portfolio selection, Markowitz penned numerous articles and books. These works spanned topics from portfolio theory to the intricacies of operational research.

- Recognition and Awards: Over the years, Markowitz received numerous accolades for his contributions to economics and finance. The pinnacle of these recognitions was the Nobel Prize in Economic Sciences in 1990, which he shared with Merton Miller and William Sharpe.

Later Life and Enduring Legacy

In his later years, Markowitz continued to contribute to the field, remaining an active participant in debates, discussions, and developments related to finance and operational research. His intellectual curiosity remained undiminished, and he continued to engage with evolving theories and methodologies.

His legacy, encapsulated not just in the Modern Portfolio Theory but in his broader contributions, remains foundational in both finance and operational research. As scholars, practitioners, and students grapple with the complexities of decision-making, risk, and optimization, the shadow of Markowitz’s insights continues to loom large, guiding and influencing in equal measure.

source: Research Affiliates on YouTube

Legacy and Recognition of Harry Markowitz

The Nobel Acclamation: A Testament to Genius

In 1990, the Royal Swedish Academy of Sciences awarded Harry Markowitz the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. This coveted recognition was not just a personal accolade for Markowitz but also an institutional validation of the profound impact of Modern Portfolio Theory on the field of economics.

- Shared Distinction: The prize was a collective recognition of the pioneering work done in the realm of financial economics. Markowitz shared this honor with Merton Miller, whose work illuminated corporate finance’s nuances, and William Sharpe, who refined and expanded upon Markowitz’s insights to develop the Capital Asset Pricing Model (CAPM).

- Nobel Motivation: The Academy, in its official statement, recognized them “for their pioneering work in the theory of financial economics,” with Markowitz specifically lauded for his groundbreaking article on portfolio theory.

Enduring Impact on the World of Finance

- Investment Paradigm Shift: Markowitz’s Modern Portfolio Theory introduced a seismic shift in how investors perceived risk and return. Rather than focusing on individual securities, the emphasis moved to the overall portfolio, revolutionizing asset allocation and diversification strategies.

- Foundational Financial Education: Today, any curriculum in finance, be it undergraduate or postgraduate, includes the tenets of Modern Portfolio Theory. Markowitz’s principles are as fundamental to financial education as Newton’s laws are to physics.

- Financial Software and Tools: Markowitz’s work has transcended theoretical discourse and found practical applications in countless financial software tools. Robo-advisors, portfolio optimization algorithms, and risk assessment tools often embed MPT principles, offering tailored advice to individual and institutional investors.

Praises from Financial Luminaries

Over the years, numerous financial experts, both academic and practitioners, have sung praises of Markowitz and his pioneering contributions.

- Warren Buffett: While Buffett, known for his value investing approach, might operate differently from the diversification principles of MPT, he has acknowledged the foundational role Markowitz’s theories play in the broader investment landscape.

- Eugene Fama: The father of the Efficient Market Hypothesis, Fama has often credited Markowitz for laying the groundwork that spurred further research into market efficiencies and their implications on investment strategies.

- Paul Samuelson: The acclaimed economist, in various writings and interviews, has alluded to the transformative impact of Markowitz’s work, likening its importance to that of other monumental theories in economics.

- Robert Merton: A fellow Nobel laureate, Merton’s work on continuous-time finance built on the bedrock laid by pioneers like Markowitz. Merton has often lauded Markowitz for introducing rigorous mathematical frameworks into finance.

A Legacy Beyond Measure

Harry Markowitz’s imprint on the financial world is indelible. From academic corridors to the bustling trading floors of Wall Street, his principles resonate, guiding decisions and shaping strategies. The Nobel Prize, while a significant recognition, is just one of the many testaments to his enduring legacy. Markowitz’s real achievement lies in the countless portfolios optimized, risks managed, and returns maximized, all thanks to his visionary insights.

Conclusion: The Timeless Legacy of Harry Markowitz and Modern Portfolio Theory

A Beacon in the Annals of Finance

The realm of finance, much like other fields of study, is marked by epoch-making ideas and figures that redefine its contours, shifting paradigms and molding future trajectories. Among these, Harry Markowitz stands tall, not merely as a thought leader but as a revolutionary who transformed how we understand risk, return, and the very essence of investment.

Markowitz’s journey in finance commenced with a seemingly simple yet profound question: How should one invest when faced with a multitude of choices and the omnipresent shadow of uncertainty? The answers he provided were not just an academic exercise but a reimagining of financial wisdom that had prevailed for decades. By centering the portfolio over individual assets and elucidating the synergies between diversification and risk management, Markowitz birthed a new era of investment philosophy.

Enduring Relevance Amidst an Evolving Financial Landscape

The financial world has witnessed tectonic shifts since the mid-20th century. The rise of algorithmic trading, the globalization of markets, and the democratization of investment through technology have all drastically altered the investment terrain. Yet, amidst this flux, the principles of Modern Portfolio Theory (MPT) remain as pertinent as ever.

- Foundational Pedagogy: From the classrooms of Ivy League institutions to online courses democratizing education, Markowitz’s MPT is a staple. It’s the bedrock on which new finance students build their understanding, and seasoned professionals revisit for refinement.

- Guiding Investment Decisions: Whether it’s the individual investor curating a retirement portfolio or a hedge fund manager overseeing billions, the tenets of diversification and the trade-off between risk and return continue to guide decisions. In an age of information overload, MPT offers a structured approach to navigate the investment maze.

- Influence on Financial Innovations: The burgeoning world of robo-advisors, with their algorithm-driven investment strategies, owe a debt to Markowitz. Their algorithms, though sophisticated, often hinge on MPT principles, optimizing portfolios in line with an individual’s risk appetite and return expectations.

Markowitz: Beyond MPT to a Philosophical Shift

While the mathematical rigor and empirical validity of MPT are commendable, Markowitz’s real contribution lies deeper. It’s a philosophical shift. He moved the conversation from the myopic view of isolated gains to a holistic understanding of harmony within a portfolio. In doing so, he taught the financial world a valuable lesson: success isn’t just about individual victories; it’s about orchestrating a symphony where each element, while valuable on its own, achieves its true potential in concert with others.

As we stand in the third decade of the 21st century, looking back at the tapestry of financial thought, Harry Markowitz’s Modern Portfolio Theory gleams brightly, a testament to the timeless nature of true genius. The world of finance, in its ceaseless evolution, will continue to birth new ideas and paradigms, but the edifice built by Markowitz will forever remain its foundational stone.

Further Reading

Books and Journal Articles:

- Markowitz, H. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91.

- Markowitz, H. (1959). Portfolio Selection: Efficient Diversification of Investments. New York: John Wiley & Sons.

- Elton, E. J., Gruber, M. J., Brown, S. J., & Goetzmann, W. N. (2009). Modern Portfolio Theory and Investment Analysis. John Wiley & Sons.

Biographical Insights:

- Nobelprize.org. (1990). The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1990. [Nobel Prize Biography of Harry Markowitz]. Retrieved from the official Nobel Prize website.

- Bernstein, P. L. (1992). Capital Ideas: The Improbable Origins of Modern Wall Street. Free Press.

Critical Analysis and Further Readings:

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425-442.

- Fama, E. F., & French, K. R. (1992). The Cross‐Section of Expected Stock Returns. The Journal of Finance, 47(2), 427-465.

- Statman, M. (2004). The Diversification Puzzle. Financial Analysts Journal, 60(4), 44-53.

Historical Context and Broader Implications:

- Goetzmann, W. N., & Rouwenhorst, K. G. (Eds.). (2005). The Origins of Value: The Financial Innovations that Created Modern Capital Markets. Oxford University Press.

- Malkiel, B. G. (2007). A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing. W. W. Norton & Company.

Contemporary Applications and Evolutions:

- Bodie, Z., Kane, A., & Marcus, A. J. (2013). Investments. McGraw-Hill/Irwin.

- Ritter, J. R. (2011). The History of IPOs. Handbook of Empirical Corporate Finance, 2, 3-40.

Interviews and Personal Accounts:

- Markowitz, H. (2007). Harry Markowitz: Selected Topics in Investment. CFA Institute Conference Proceedings Quarterly, 24(2), 15-24.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

A great post without any doubt.

Thank you for sharing indeed great looking !

Nice i really enjoyed reading your blogs. Keep on posting. Thanks

Nice i really enjoyed reading your blogs. Keep on posting. Thanks

Thank you for sharing indeed great looking !