Expanded canvas products have lured investors seeking capital efficiency and maximum diversification where the potential for enhanced risk management and returns collide.

However, hardcore value investors have found it challenging to stomach market cap weighted equities as part of the equation.

In fact, it’s usually a dealbreaker.

What many don’t realize is that a fascinating value-tilted capital efficient fund already exists that doesn’t get nearly the same attention as other sensibly leveraged products.

The alternative mutual fund I’m referring to is DSEEX.

It’s better known as the DoubleLine Shiller Enhanced CAPE.

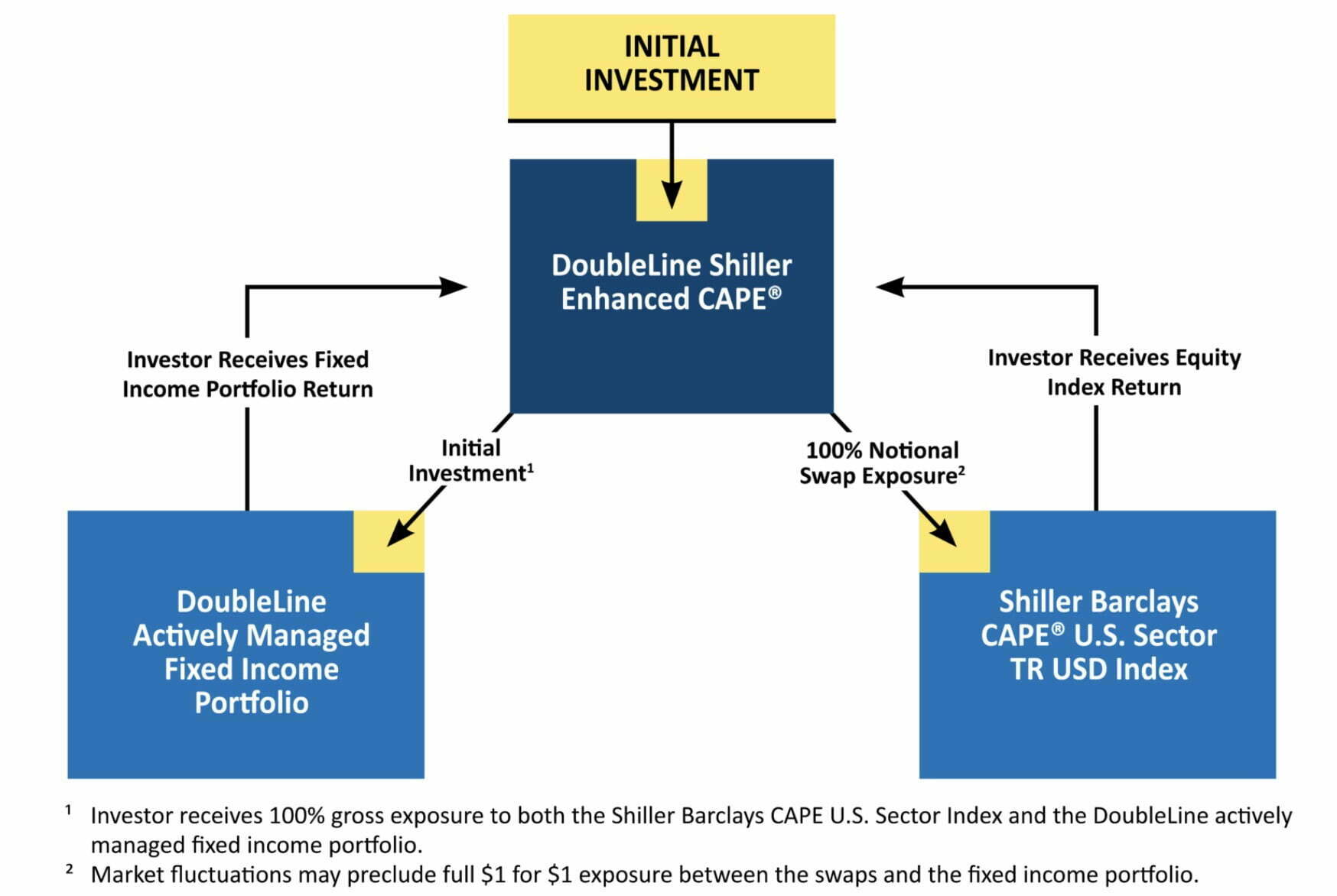

For every $1 dollar spent on the fund you get exposure to $1 of equities via swaps and $1 of fixed income actively managed by DoubleLine.

However, as we alluded to earlier, it breaks the link between products that only offer market cap weighted equities with its unique Shiller Enhanced CAPE strategy.

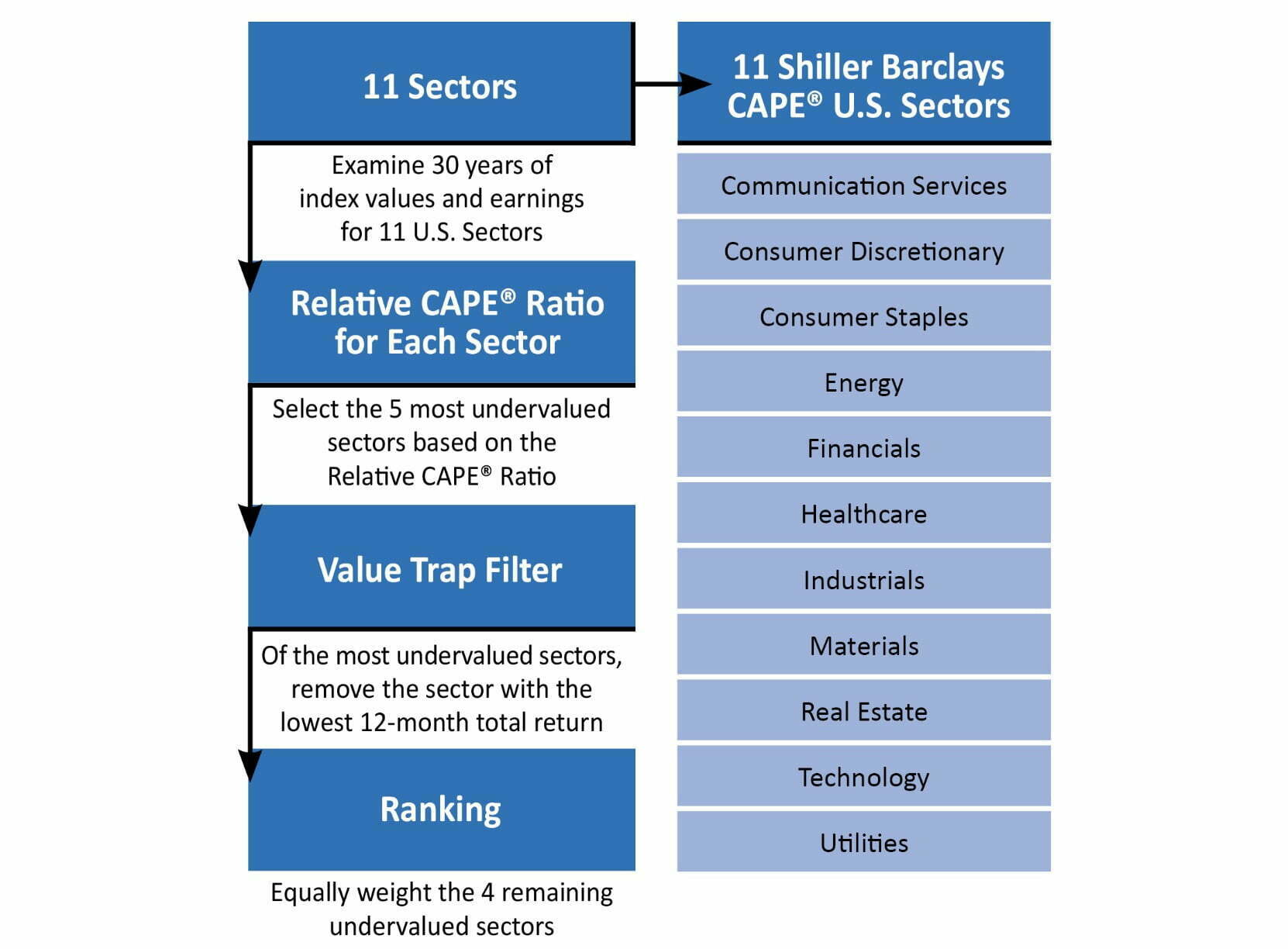

Instead it divides the US large cap equity market into sector slices and uses a rules based process to scan for the top 5 undervalued sectors based on the Shiller Enhanced Cape Ratio.

It punts out what is considered to be the “value trap” (the sector with the worst 12 month price momentum) and then equally weights the remaining four sectors.

We’ll dive a bit deeper into this process later on in the review.

For the fixed income sleeve of the portfolio it’s all about tapping into DoubleLine’s wheelhouse of expertise:

“The Bond King!”

Overall, you’re getting capital efficient exposure to value tilted equities and an active bond management strategy that has the potential to outperform a similar duration passive bond index.

What Is The Shiller Enhanced CAPE Index?

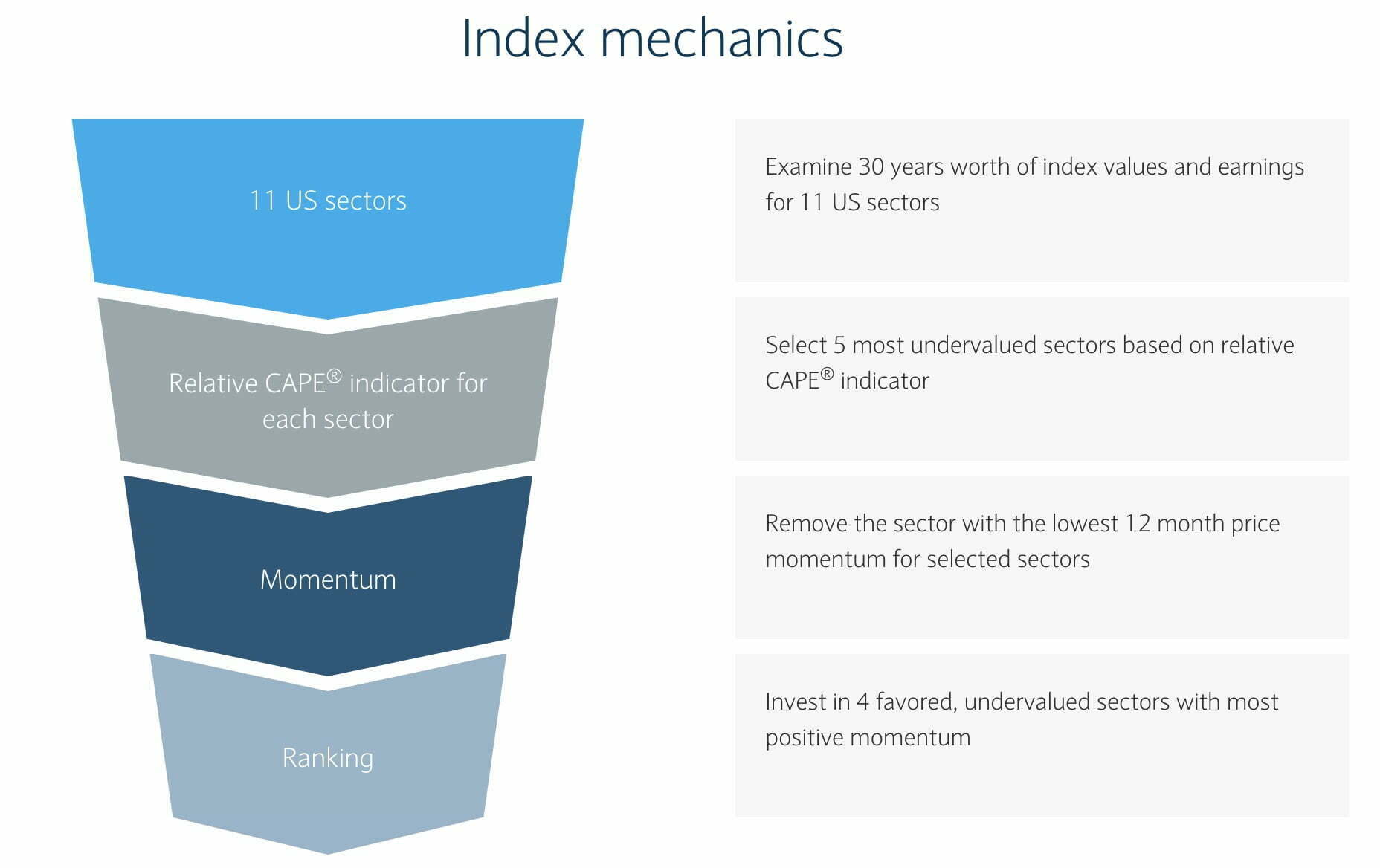

Let’s learn more about the index mechanics.

The index examines the 11 US sectors to determine the 5 most undervalued sectors based on relative CAPE indicator.

It then punts out the sector with the lowest 12 month price momentum.

It’ll then invest equally in the 4 undervalued sectors.

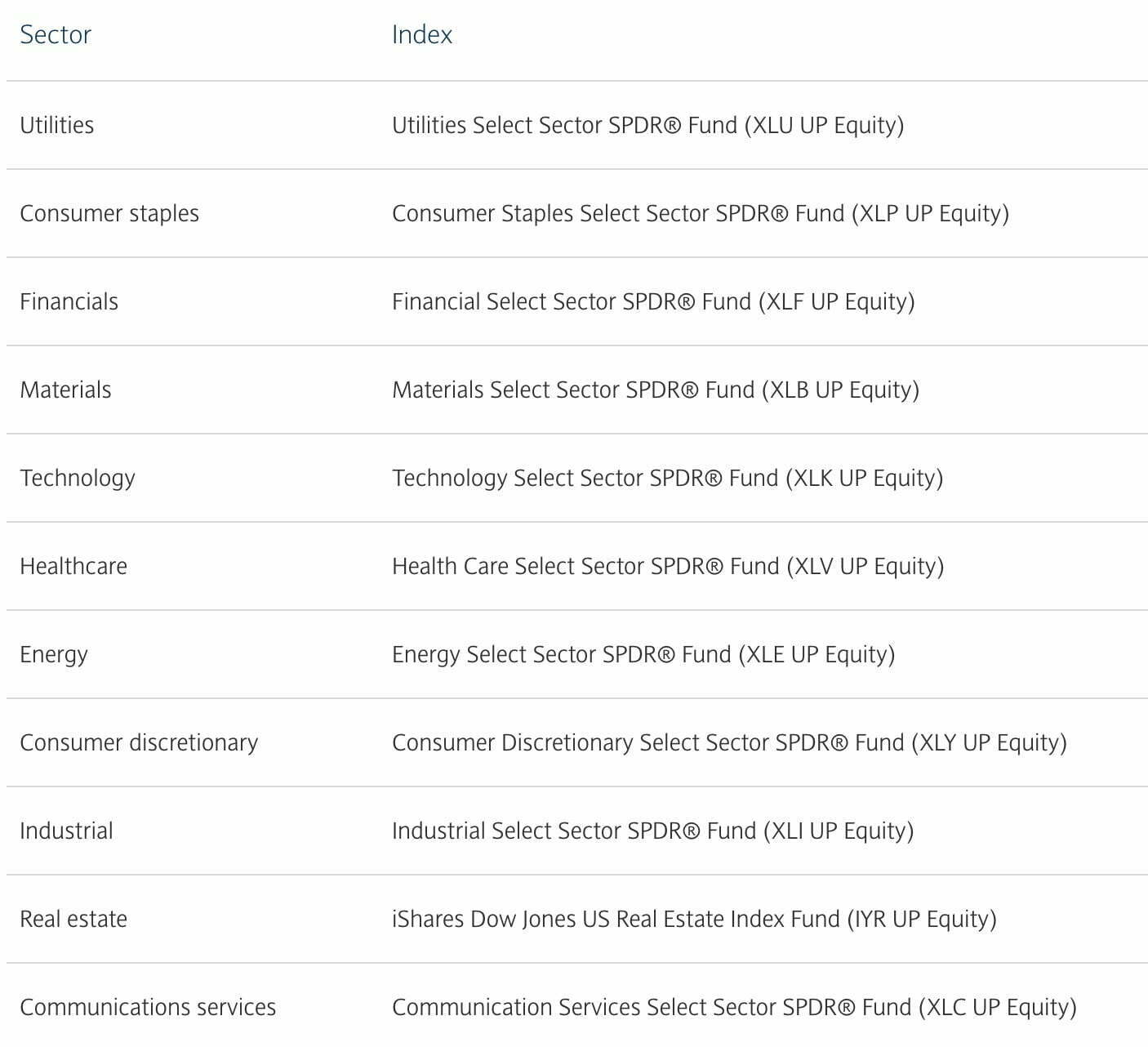

- Utilities: Utilities Select Sector SPDR® Fund (XLU UP Equity)

- Consumer Staples: Consumer Staples Select Sector SPDR® Fund (XLP UP Equity)

- Financials: Financial Select Sector SPDR® Fund (XLF UP Equity)

- Materials: Materials Select Sector SPDR® Fund (XLB UP Equity)

- Technology: Technology Select Sector SPDR® Fund (XLK UP Equity)

- Healthcare: Health Care Select Sector SPDR® Fund (XLV UP Equity)

- Energy: Energy Select Sector SPDR® Fund (XLE UP Equity)

- Consumer: Discretionary Consumer Discretionary Select Sector SPDR® Fund (XLY UP Equity)

- Industrial: Industrial Select Sector SPDR® Fund (XLI UP Equity)

- Real Estate: iShares Dow Jones US Real Estate Index Fund (IYR UP Equity)

- Communications Services: Communication Services Select Sector SPDR® Fund (XLC UP Equity)

What does CAPE mean?

Cyclically adjusted price-to-earnings ratio.

What is the CAPE Ratio?

Price / 10 Year Inflation Adjusted Earnings

What is the Relative CAPE?

Sector’s Current CAPE / 20-year average of Sector’s CAPE Ratio

Hence, the fund is seeking exposure to the top 4 sectors with earnings that are relatively cheap compared with dollars of historical earnings.

DoubleLine Actively Managed Fixed Income Sleeve

Let’s zero in on the DoubleLine actively managed fixed income sleeve of the portfolio.

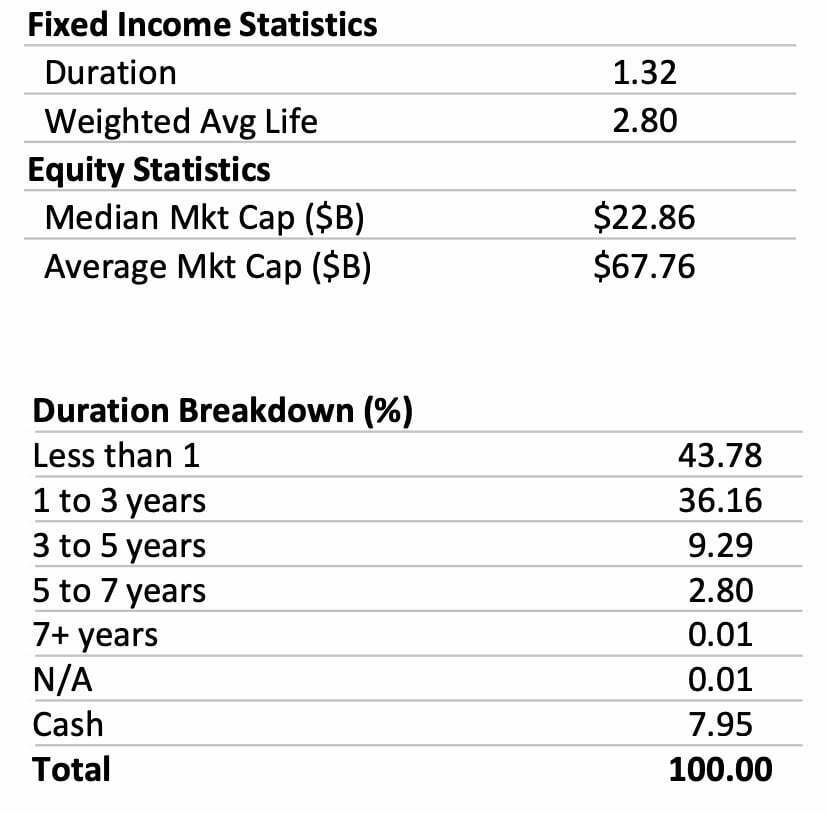

We’re able to clearly see the duration levels of the actively managed fixed income strategy:

- Duration: 1.32

- Weighted Average Life: 2.80

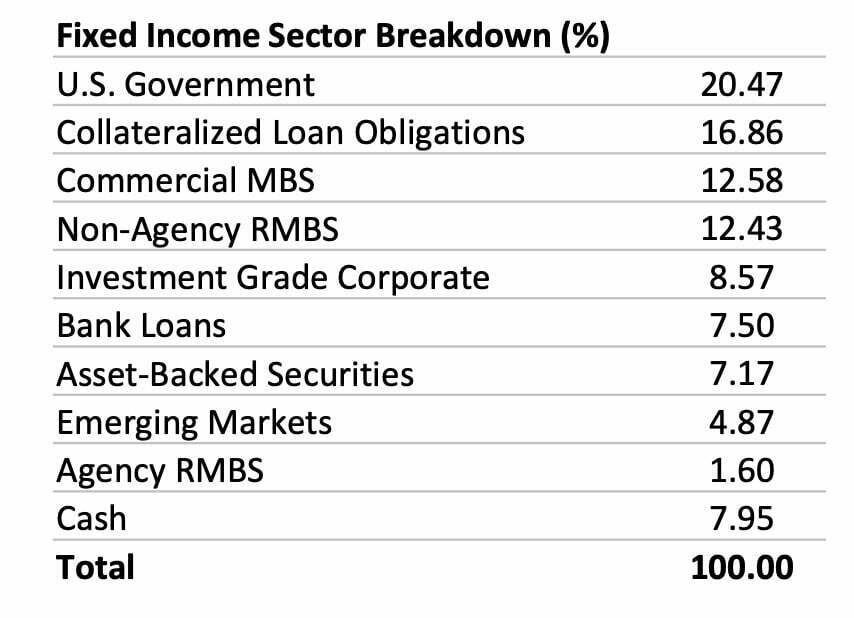

Here is the Fixed Income Sector Breakdown:

- US Government = 20.47%

- Collateralized Loans Obligations = 16.86%

- Commercial MBS = 12.58%

- Non-Agency RMBS = 12.43%

- Investment Grade Corporate = 8.57%

- Bank Loans = 7.5%

- Asset-Backed Securities = 7.17%

- Emerging Markets = 4.87%

- Agency RMBS = 1.60%

- Cash = 7.95%

What stands out to me in particular is the diverse range of fixed income instruments ranging from US Government to MBS and from Investment Grade Corporates to Emerging Markets.

Fixed income is a DoubleLine area of specialized knowledge and investing expertise.

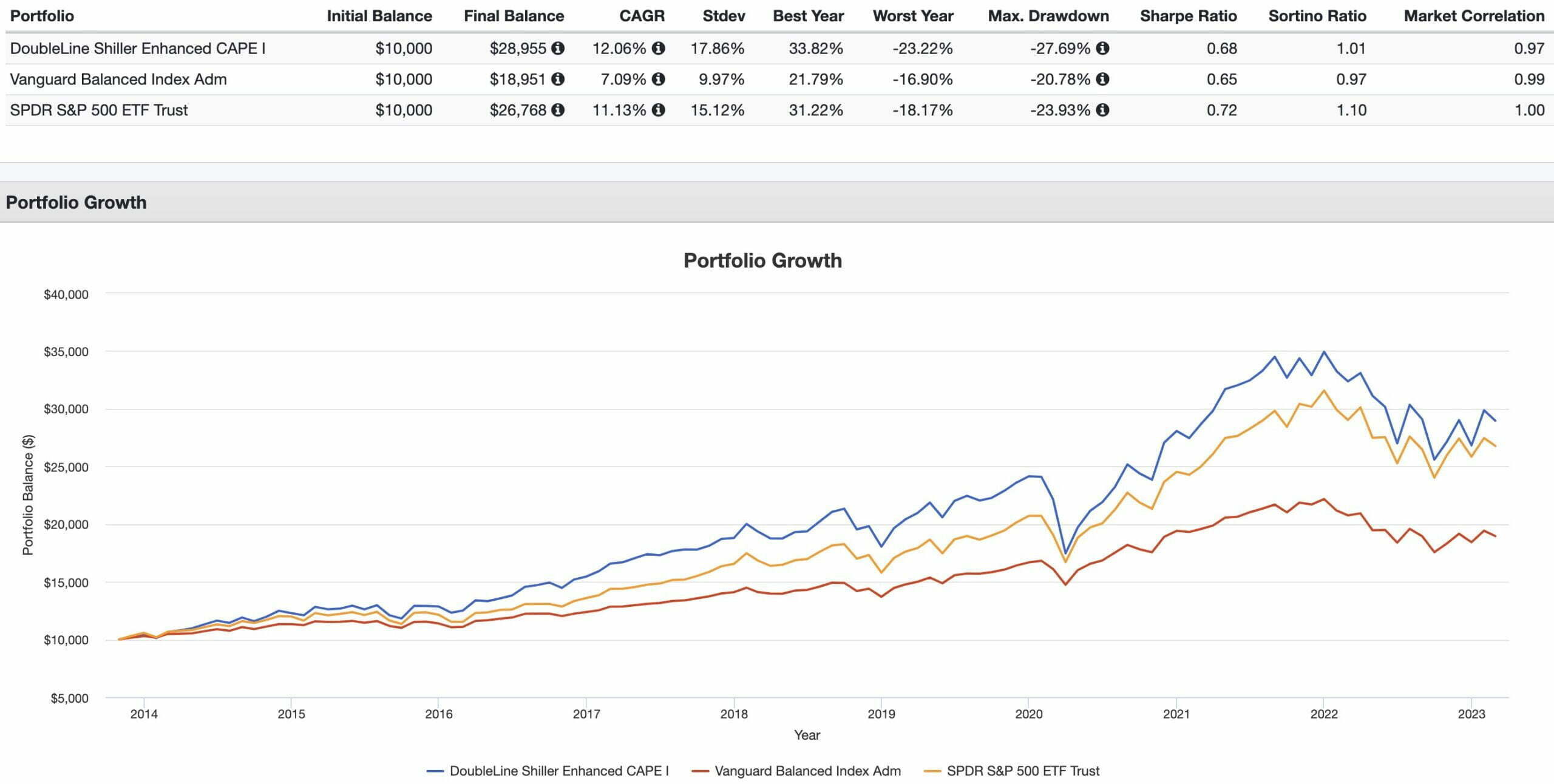

DoubleLine Shiller Enhanced CAPE Fund Performance

Let’s check out the performance of DoubleLine Shiller Enhanced CAPE Fund since its inception.

CAGR: 12.06% vs 7.09% vs 11.13%

RISK: 17.86% vs 9.97% vs 15.12%

BEST YEAR: 33.82% vs 21.79% vs 31.22%

WORST YEAR: -23.22% vs -16.90% vs -18.17%

MAX DRAWDOWN: -27.69% vs -20.78% vs -23.93%

SHARPE RATIO: 0.68 vs 0.65 vs 0.72

SORTINO RATIO: 1.01 vs 0.97 vs 1.10

MARKET CORRELATION: 0.97 vs 0.99 vs 1.00

It should come as no surprise that DoubleLine Shiller Enhanced Cape Fund has soundly defeated both the S&P 500 and a balanced 60/40 from a performance standpoint since it launched.

However, that does come with added volatility while testing the capacity for investors to endure bigger drawdowns and worse potential years.

DSEEX Alternative Mutual Fund Review | DoubleLine Shiller Enhanced CAPE Fund Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review and Mutual Funds Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

source: DoubleLine Capital on YouTube

DoubleLine: Independent & Employee-Owned Money Management Firm

DoubleLine is known for its expertise in fixed income strategies and multi-asset fund mandates offerings investors mutual funds, ETFs and closed-end funds.

DoubleLine Roster Of Funds: Shiller CAPE

Mutual Funds:

$DSEEX (I) & $DSENX (N) – DoubleLine Shiller Enhanced CAPE®

$DSEUX (I) & $DLEUX (N) – DoubleLine Shiller Enhanced International CAPE®

ETFs:

$CAPE – DoubleLine Shiller CAPE® U.S. Equities ETF

DoubleLine Shiller Enhanced CAPE Fund Overview, Holdings and Info

The investment case for “Shiller Enhanced CAPE Fund” has been laid out succinctly by the folks over at DoubleLine Funds: (source: fund landing page)

Investment Objective:

“The Fund’s investment objective is to seek total return which exceeds the total return of its benchmark index over a full market cycle.”

Investment Philosophy:

“Maintain a core portfolio of debt instruments that focuses on global fixed income sector rotation while simultaneously obtaining exposure to U.S. equity sector rotation strategy via the Index.

The Index aims to identify undervalued sectors based on a modified CAPE® ratio, and then uses a momentum factor to seek to mitigate the effects of potential value traps.

The Fund’s goal is to outperform the Benchmark by obtaining 100% notional exposure to the Index and 100% exposure to the underlying fixed income collateral portfolio.

Historically, the Fund’s beta has been similar to that of the U.S. equity market.

This capital efficiency is one of the key components of the Fund.

DoubleLine Shiller Enhanced CAPE Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom. (source: summary prospectus)

Principal Investment Strategies:

“The Fund seeks total return (capital appreciation and current income) in excess of the benchmark index, currently the S&P 500® Index, over a full market cycle.

The Fund will seek to use derivatives, or a combination of derivatives and direct investments, to provide a return (before fees and expenses) that approximates the performance of the Shiller Barclays CAPE® US Sector TR USD Index (the “Index”).

The Fund will also invest in a portfolio of debt securities to seek to provide additional total return over the long term.

The Fund uses investment leverage as part of its principal investment strategies.

The Fund expects normally to invest an amount approximately equal to its net assets directly in a portfolio of debt securities while also maintaining notional exposure to the Index providing the Fund with economic exposure to the Index in an amount up to the value of the Fund’s net assets.

As a result, the Fund’s total investment exposure (direct investments in debt securities plus notional exposure to the Index) will typically be equal to approximately 200% of the Fund’s net asset value (“NAV”).

It is possible that the Fund could lose money on both its investments in debt securities and its exposure to the Index at the same time.

The Fund will normally use derivatives in an attempt to create an investment return that approximates (before fees and expenses) the Index’s return.

For example, the Fund might enter into swap transactions or futures transactions designed to provide the Fund a return before fees and expenses approximating the Index’s return, including swap transactions or futures transactions where the reference asset is the Index or a modified version of the Index, one or more components of the Index, or an unrelated index or basket of securities.

The transaction pricing of any swap transaction will reflect a number of factors that will cause the return on the swap transaction to underperform the Index.

The Fund expects to use only a small percentage of its assets to attain the desired exposure to the Index because of the structure of the derivatives the Fund expects to use.

As a result, use of those derivatives along with the Fund’s investments in a portfolio of debt securities will create investment leverage

in the Fund’s portfolio.

In certain cases, derivatives based on the Index or that use the Index as the reference asset might be unavailable or the pricing of those derivatives might be unfavorable; in those cases, the Fund might attempt to approximate the Index’s return by purchasing some or all of the securities comprising the Index, or portions of the Index, at the time.

If the Fund at any time invests directly in the securities comprising the Index, the assets so invested will be unavailable for investment in debt instruments, and the Fund’s ability to pursue its investment strategy fully and achieve its investment objective may be limited.

To the extent use of the above-described derivatives strategy leaves a substantial portion of the Fund’s assets available for other investment by the Fund, the Fund expects to invest those assets in a portfolio of debt instruments managed by DoubleLine Capital to seek to provide additional total return over the long term.

References to the “Adviser” in this section and in “Principal Risks” below shall refer to DoubleLine Alternatives, the Fund’s investment adviser, except in the case of the discussion of the Fund’s principal investment strategies and principal risks that relate to investing directly in debt securities, in which cases “Adviser” shall refer to DoubleLine Capital, the sub-adviser to the Fund and the entity primarily

responsible for the day-to-day management of the Fund’s fixed income portfolio.”

The Shiller Barclays CAPE® US Sector TR USD Index:

“The Index incorporates the principles of long-term investing distilled by Dr. Robert Shiller and expressed through the CAPE® (Cyclically Adjusted Price Earnings) ratio (the “CAPE® Ratio”).

The classic CAPE® Ratio assesses equity market valuations and averages ten years of inflation adjusted earnings to account for earnings and market cycles.

Traditional valuation measures, such as the price-earnings (PE) ratio, by contrast, typically rely on earnings information from only the past year.

The Index uses a relative version of the classic CAPE® Ratio to identify undervalued sectors while also seeking to exclude a sector that may appear undervalued, but which may have also had recent relative price underperformance due to fundamental issues with the sector that may

negatively affect the sector’s long-term total return.

There can be no assurance that the Index will provide a better measure of value than more traditional measures, over any period or over the long term.

The Index’s composition is determined monthly. Each month, the Index’s methodology ranks eleven US sectors based on a modified CAPE® Ratio (a “value” factor) and a twelve-month price momentum factor (a “momentum” factor).

Each US sector is represented by a sector exchange-traded fund (“ETF”) that tracks a sector index, which is an ETF in the family of

Select Sector SPDR Funds or, in the case of the real estate sector, the iShares Dow Jones U.S. Real Estate Index Fund.

The Index methodology selects the five US sectors with the lowest modified CAPE® Ratio — the sectors that are the most undervalued according to the CAPE® Ratio.

Only four of these five sectors, however, end up in the Index for a given month, as the sector with the worst 12-month price momentum among the five selected sectors is eliminated.

The Index methodology allocates an equally weighted long (i.e., investment) exposure to the four remaining US sectors.

As of the date of this Prospectus, the eleven sectors that may be selected by the Index methodology include Communication Services,

Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Materials, Technology, Utilities and Real Estate.

The Select Sector SPDR Funds are typically comprised of issuers represented in the S&P 500 Index.

As of June 30, 2022, the issuers represented in the S&P 500 Index had market capitalizations ranging from $3.135 billion to $2.213 trillion.

Through the Fund’s investments related to the Index, the Fund will have focused exposures to the sectors making up the Index at any given time.

As a result, the Fund’s NAV may be affected to a greater degree by factors affecting those sectors or industries than a fund that invests more broadly.

If derivatives designed to provide the Fund a return approximating the Index’s return become unavailable or for other reasons, DoubleLine Alternatives may seek investment exposure to the sectors comprising the Index by investing directly in some or all of the sector ETFs or securities that correspond to those sectors, or by utilizing derivatives that are designed to provide long exposure to either the sector ETFs themselves or the indices that the sector ETFs seek to track.

DoubleLine Alternatives or the Fund’s Board of Trustees may in their sole discretion and without advance notice to shareholders select, in place of the Index, another index (such as the S&P 500® Index) or a basket of investments.

The Fund may gain exposure to any substitute index or basket of investments in any manner DoubleLine Alternatives determines appropriate, including those described above with respect to how the Fund may obtain exposure to the Index.

Although a portion of the Fund’s assets may be invested in instruments the performance of which is based on an index, the Fund’s overall portfolio includes other investments.

Therefore, the Fund is not designed to replicate the performance of any index.

The Fund’s performance will deviate, potentially significantly, from the performance of any index used by the Fund.

During the Fund’s most recent fiscal year, the Fund entered into swap transactions related to the Index with a limited number of counterparties.

The Fund will likely enter into swap transactions related to the Index with a limited number of counterparties for the foreseeable future.

In selecting swap counterparties for the Fund, DoubleLine Alternatives will normally consider a variety of factors, including, without limitation: cost; the quality, reliability, and responsiveness of a counterparty; the operational compatibility between a counterparty and DoubleLine Alternatives; and a counterparty’s creditworthiness.”

The Fund’s Investments in Debt Instruments:

“Under normal circumstances, to the extent use of the above-described derivatives strategy leaves a substantial portion of the Fund’s assets available for other investment by the Fund, the Fund intends to invest those assets in a portfolio of debt instruments managed by DoubleLine Capital to seek to provide additional total return over the long term.

The Fund may invest directly in debt instruments; alternatively, DoubleLine Capital may choose to invest all or a portion of the Fund’s assets in one or more fixed income funds advised by DoubleLine Capital or a related party of DoubleLine Capital.

Debt instruments in which the Fund may invest include, by way of example, (i) securities or other income-producing instruments issued or guaranteed by the U.S. Government, its agencies, instrumentalities or sponsored corporations (including inflation-protected securities); (ii) corporate obligations; (iii) mortgage-backed securities (including commercial and residential mortgage-backed securities) and other assetbacked securities, collateralized mortgage obligations, government mortgage pass-through securities, multiclass passthrough securities, private mortgage pass-through securities, stripped mortgage securities (e.g., interest-only and principal-only securities), and inverse floaters; (iv) collateralized debt obligations (“CDOs”), including collateralized loan obligations (“CLOs”); (v) foreign securities (corporate and government, including foreign hybrid securities), including emerging market securities; (vi) fixed and floating rate loans of any kind (including, among others, bank loans, assignments, participations, senior loans, second lien or other subordinated or unsecured fixed or floating rate loans, debtor-in-possession loans, exit facilities, delayed funding loans and revolving credit facilities), which may take the form of lloans that contain fewer or less restrictive constraints on the borrower than certain other types of loans (“covenant-lite” loans); (vii) municipal securities and other debt obligations issued by states, local governments, and governmentsponsored entities, including their agencies, authorities, and instrumentalities; (viii) inflation-indexed bonds; (ix) convertible securities; (x) preferred securities; (xi) real estate investment trust (“REIT”) securities; (xii) payment-in-kind bonds; (xiii) zero-coupon bonds; (xiv) custodial receipts, cash and cash equivalents; (xv) short-term, high quality investments, including, for example, commercial paper, bankers’ acceptances, certificates of deposit, bank time deposits, repurchase agreements, and investments in money market mutual funds or similar pooled investments; and (xvi) other instruments bearing fixed, floating, or variable interest rates of any maturity.

The Fund may invest in any level of the capital structure of an issuer of mortgage-backed or asset-backed securities, but does not intend to invest in the equity or “first loss” tranche of such investments.

In managing the Fund’s portfolio of debt instruments, under normal market conditions, the portfolio managers intend to seek to construct an investment portfolio with an overall dollar-weighted average effective duration of between one year and three years.

Duration is a measure of the expected life of a fixed income instrument that is used to determine the sensitivity of a security’s price to changes in interest rates. Effective duration is a measure of the Fund’s portfolio duration adjusted for the anticipated effect of interest rate changes on bond and mortgage prepayment rates as determined by DoubleLine Capital.

The longer a portfolio’s effective duration, the more sensitive it will be to changes in interest rates.

The effective duration of the Fund’s portfolio of debt instruments may vary materially from its target range, from time to time, and there is no assurance that the effective duration of the portfolio will always be within its target range.

DoubleLine Capital monitors the effective duration of the Fund’s portfolio of debt instruments to seek to assess and, in its discretion,

adjust the Fund’s exposure to interest rate risk.

The Fund may invest in debt instruments of any credit quality, which may include securities that are at the time of investment unrated or rated BB+ or lower by S&P Global Ratings or Ba1 or lower by Moody’s Investors Service, Inc. or the equivalent by any other nationally recognized statistical rating organization or unrated securities judged by DoubleLine Capital to be of comparable quality.

Corporate bonds and certain other fixed income instruments rated below investment grade, or such instruments that are unrated and determined by DoubleLine Capital to be of comparable quality, are high yield, high risk bonds, commonly known as “junk bonds”.

Generally, lower-rated debt securities offer a higher yield than higher-rated debt securities of similar maturity but are subject to greater risk of loss of principal and interest than higherrated securities of similar maturity.

The Fund may invest up to 33 1/3% of its net assets in junk bonds, bank loans and assignments rated below investment grade or unrated but determined by DoubleLine Capital to be of comparable quality, and credit default swaps of companies in the high yield universe.

DoubleLine Capital does not consider the term “junk bonds” to include any mortgage-backed securities or any other asset-backed securities, regardless of their credit rating or credit quality, and accordingly may invest without limit in such investments.

The Fund may invest a portion of its assets in inverse floater securities and interest-only and principal-only securities.

An inverse floater is a type of instrument, which may be backed by or related to a mortgage-backed security, that bears a floating or variable interest rate that moves in the opposite direction to movements in interest rates generally or the interest rate on another security or index.

Because an inverse floater inherently carries financial leverage in its coupon rate, it can change very substantially in value in response to changes in interest rates. Interest-only and principal-only securities may also be backed by or related to a mortgage-backed security.

Holders of interest-only securities are entitled to receive only the interest on the underlying obligations but none of the principal, while holders of principal-only securities are entitled to receive all of the principal but none of the interest on the underlying obligations.

As a result, they are highly sensitive to actual or anticipated changes in prepayment rates on the underlying securities.

The Fund may invest a portion of its assets in debt instruments (including hybrid securities) issued or guaranteed by companies, financial institutions and government entities in emerging market countries.

An “emerging market country” is a country that, at the time the Fund invests in the related fixed income instruments, is classified as an emerging or developing economy by any supranational organization such as an institution in the World Bank Group or the United

Nations, or an agency thereof, or is considered an emerging market country for purposes of constructing a major emerging market securities index.

The Fund may pursue its investment objective and obtain exposures to some or all of the asset classes described above by investing in other investment companies, including, for example, other open-end or closed-end investment companies and ETFs, including those sponsored or managed by DoubleLine Capital or its related parties.

The Fund may engage in short sales or take short positions, either to earn additional return or to hedge existing investments.

In managing the Fund’s debt instruments, the portfolio managers typically use a controlled risk approach. The techniques of this approach attempt to control the principal risk components of the fixed income markets and may include, among other factors, consideration of DoubleLine Capital’s view of the following: the potential relative performance of various market sectors, security selection available within a given sector, the risk/reward equation for different asset classes, liquidity conditions in various market sectors, the shape of the yield curve and projections for changes in the yield curve, potential fluctuations in the overall level of interest rates, and current fiscal policy.

The portfolio managers utilize active asset allocation in managing the Fund’s investments in debt instruments.

Portfolio securities may be sold at any time. By way of example, sales may occur when the Fund’s portfolio managers determine to take advantage of what the portfolio managers consider to be a better investment opportunity, when the portfolio managers believe the portfolio securities no longer represent relatively attractive investment opportunities, when the portfolio managers perceive deterioration in the credit fundamentals of the issuer, or when the individual security has reached the portfolio managers’ sell target.”

DoubleLine Shiller Enhanced CAPE Fund Investment Strategy Key Points

- Seeks excess returns over its benchmark index the S&P 500

- 200% Expanded Canvas Portfolio seeking an equal 100% exposure to equities and fixed income

- The equity sleeve tracks The Shiller Barclays CAPE® US Sector TR USD Index with monthly sector rebalancing

- Each month, the Index’s methodology ranks eleven US sectors based on a modified CAPE® Ratio (a “value” factor) and a twelve-month price momentum factor (a “momentum” factor).

- Selects the five US sectors with the lowest modified CAPE® Ratio (punting out the sector with the worst 12-month price momentum) and then equally weights the remaining 4 US sectors

- Typically utilizes “swap transactions” to efficiently gain exposure to the sector equities

- Invests in a diversified variety of debt instruments

- Under normal market conditions the fund weighted average effective duration is between one year and three years

- May invest up to 33.3% of its fixed income in “junk bonds” or instruments rated below investment grade

- Has the potential to invest in Emerging Markets fixed income instruments

- Can take short sales or take short positions, either to earn additional returns or to hedge existing investments

DoubeLine Shiller Enhanced CAPE Fund Info

Ticker: DSEEX (I), DSENX (N)

Adjusted Expense Ratio: 0.54 (I)

AUM: 4.3 Billion

Inception: 10/31/2013

DoubleLine Shiller Enhanced CAPE Fund Pros and Cons

Let’s move on to examine the potential pros and cons of DoubleLine Shiller Enhanced CAPE Fund (DSEEX).

DSEEX Pros

- Capital efficient exposure to US Equities and Fixed Income with $1 invested providing 100% equities and 100% bonds

- Unique Enhanced CAPE strategy tilts equities towards “value” and breaks the link between Market Cap Weighted capital efficient strategies

- Has lived up to its mandate of outperforming the S&P 500 and crushing a 60/40 portfolio since its inception

- A capital efficient building block that can stretch the canvas of your portfolio to make room for other diversifying alternative strategies

- The ability to pair this fund with its International Developed sibling fund for global equity coverage

- Very reasonable management fee for a capital efficient product

- Utilizing the in-house expertise of DoubleLine for its fixed income capabilities that have the potential for better risk adjusted rates of returns versus passive bond indexes

DSEEX Cons

- The potential for tracking error versus MCW equity strategies and for correlations between stocks and bonds to have a year like 2022 where both are clearly down with leverage amplifying things

- Likely a strategy more suited for tax-advantaged accounts with its exposure to equity swaps (but I am not an expert on this by any stretch of the imagination so do your own due diligence)

DoubleLine Shiller Enhanced CAPE Fund Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Given the tremendous capital efficiency of the DoubleLine Shiller Enhanced CAPE (US and International-Developed) funds, we’re able to easily squeeze in a 60/40 portfolio allocation with plenty of room to add uncorrelated managed futures and market neutral anti-beta strategies.

25% DSEEX – DoubleLine Shiller Enhanced CAPE®

15% DSEUX – DoubleLine Shiller Enhanced International CAPE®

40% MAFIX – Abbey Capital Multi Asset Fund

20% BTAL – AGF US Market Neutral Anti Beta Fund

Expanded Canvas Portfolio: 160%

Overall, we have the following exposures to four distinct strategies:

60% Global Equities

40% Diversified Fixed Income

40% Managed Futures

20% Market Neutral Anti-Beta

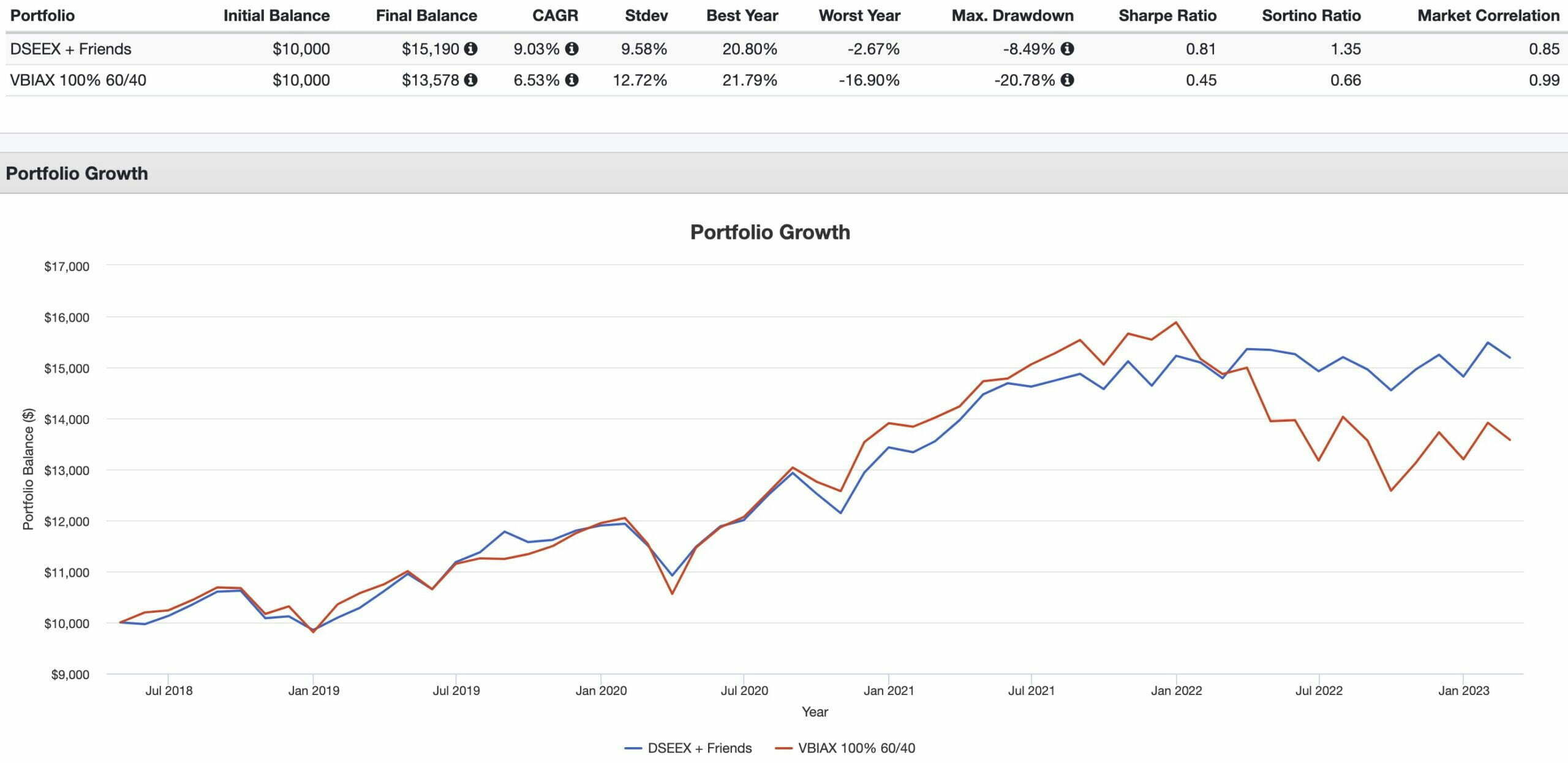

DSEEX Fund + Friends Portfolio vs 60/40 Portfolio (VBIAX)

CAGR: 9.03% vs 6.53%

RISK: 9.58% vs 12.72%

BEST YEAR: 20.80% vs 21.79%

WORST YEAR: -2.67% vs -16.90%

MAX DRAWDOWN: -8.49% vs -20.78%

SHARPE RATIO: 0.81 vs 0.45

SORTINO RATIO: 1.35 vs 0.66

MARKET CORRELATION: 0.85 vs 0.99

The DSEEX and friends portfolio obliterates a 100% VBIAX allocation in every way under the sun.

More defensive?

You betcha!

It has offered investors vastly superior standard deviation, worst year and maximum drawdown results.

Higher risk adjusted rates of returns?

Indeed!

Check our the massive upgrade in Sharpe Ratio and Sortino Ratio.

Outperformance?

Oh yeah!

We’ve got 250 basis points of that thrown in for good measure.

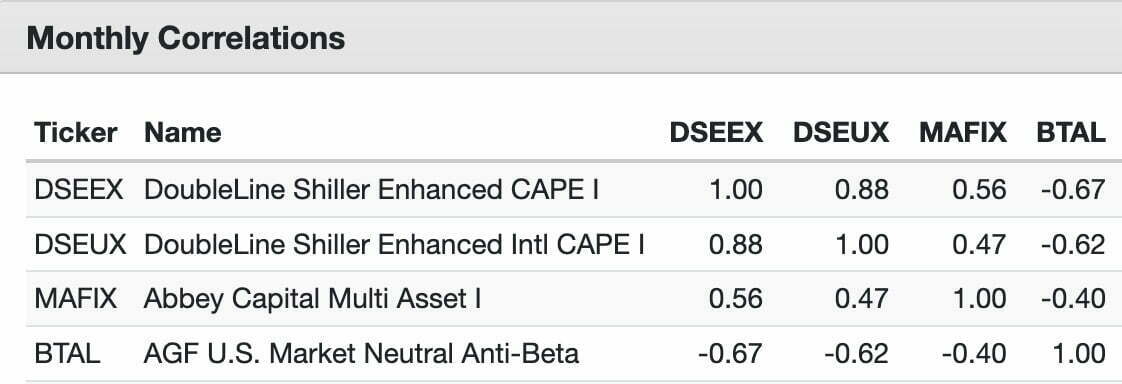

Finally, let’s move on to monthly correlations which you can see below.

Nomadic Samuel Final Thoughts

It still baffles me why DoubeLine Shiller Enhanced Cape fund doesn’t get more attention from investors on social media.

It’s a fund that deviates from the typical script of capital efficient market cap weighted equities and aggregate bonds.

For value investors seeking capital efficient US exposure to equities and bonds it’s an absolute game changer.

The potential to utilize this fund with other capital efficient building blocks is in my opinion its greatest appeal.

Additionally, it feels as though the fund’s best days may be ahead of it with a potential change of regimes rotating from growth to value strategies ruling the roost.

But at this point in the review I’m more interested in what you’ve got to say.

Are you a capital efficient investor seeking value titled products?

Is the DoubleLine Shiller Enhanced CAPE Ratio fund on your radar?

Please let me know in the comments below.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.